Key Insights

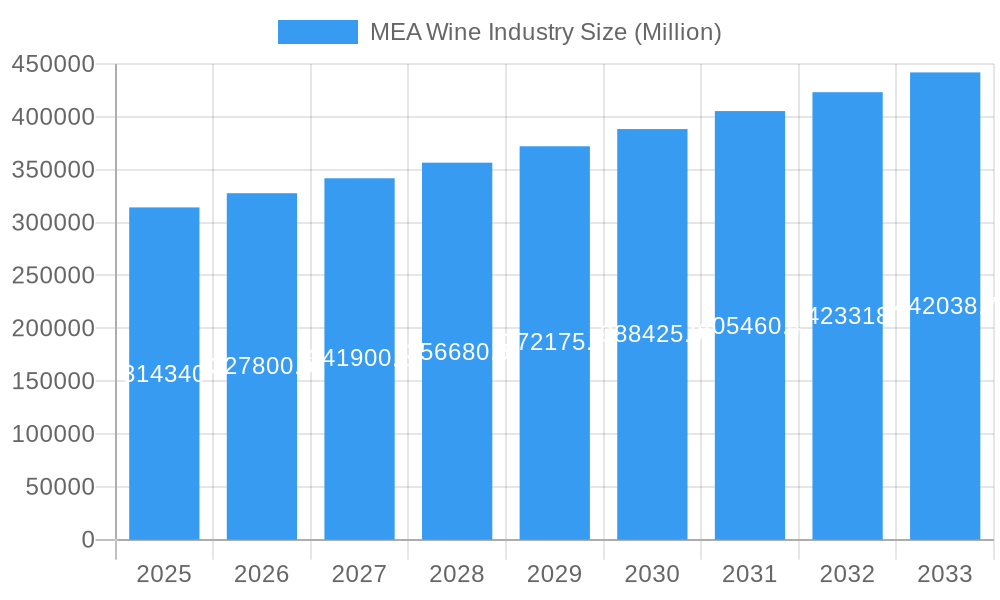

The Middle East & Africa (MEA) wine market is poised for significant expansion, projected to reach an estimated USD 314.34 billion in 2025 and exhibiting a healthy Compound Annual Growth Rate (CAGR) of 4.3% through 2033. This robust growth is primarily fueled by evolving consumer preferences, a rising disposable income in key markets like the GCC and select African nations, and an increasing adoption of wine as a social beverage. The On-Trade channel, encompassing restaurants, hotels, and bars, is expected to be a major contributor, driven by the booming tourism and hospitality sectors across the region. Furthermore, the growing presence of international wine brands and the emergence of local producers are diversifying the market, catering to a wider range of tastes and price points. Opportunities lie in tapping into the burgeoning demand for premium and specialized wine categories, such as sparkling and dessert wines, as consumer sophistication increases.

MEA Wine Industry Market Size (In Billion)

However, the MEA wine market also faces certain restraints. Cultural and religious norms in some parts of the region present a significant barrier to widespread consumption, influencing distribution and marketing strategies. Stringent regulations regarding alcohol sales and advertising in several countries also pose challenges. Despite these hurdles, the underlying economic development and a growing expatriate population in key hubs are creating a sustainable demand. The market’s segmentation by type, including still wine, sparkling wine, dessert wine, and fortified wine, indicates a broad spectrum of consumer interest, with still wines likely to dominate due to their versatility and wider appeal. Distribution channels like supermarkets, hypermarkets, and specialty stores are crucial for reaching the off-trade segment, which is also expected to witness steady growth as consumers increasingly seek convenient access to wines for home consumption.

MEA Wine Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the MEA Wine Industry, designed for immediate use without modification:

MEA Wine Industry Market Structure & Competitive Landscape

The Middle East and Africa (MEA) wine industry is characterized by a moderately concentrated market, with a growing number of innovative players and evolving regulatory frameworks. Key companies like E & J Gallo Winery, Suntory Holdings Limited, Constellation Brands Inc., Treasury Wine Estates, and Accolade Wines exert significant influence, though smaller, specialized producers such as Birthmark of Africa Wines and Davide Campari-Milano N.V. are increasingly carving out niche markets. The competitive landscape is shaped by innovation drivers including the introduction of new varietals, premiumization trends, and the development of sustainable production practices. Regulatory impacts vary across the diverse MEA region, with some countries implementing stringent import duties while others foster growth through supportive policies. Product substitutes, primarily beer and spirits, remain a constant competitive pressure. End-user segmentation is broadly divided between on-trade and off-trade channels, with significant growth observed in off-trade, particularly supermarkets and hypermarkets. Mergers and acquisitions (M&A) trends indicate a strategic consolidation by larger entities seeking to expand their regional footprint and diversify their portfolios. The M&A volume is projected to reach xx billion USD over the forecast period. Concentration ratios for the top five players are estimated to be around xx%.

MEA Wine Industry Market Trends & Opportunities

The MEA wine industry is poised for substantial growth, with an estimated market size expected to reach over 500 billion USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is fueled by a confluence of evolving consumer preferences, technological advancements, and shifting distribution dynamics. A key trend is the rising disposable income and a growing middle class across several MEA nations, leading to increased demand for premium and imported wines. Consumer preferences are leaning towards drier, more complex wines, with a notable surge in interest for sparkling and rosé varieties. Technological shifts are manifesting in improved vineyard management techniques, advanced winemaking processes, and the adoption of digital platforms for direct-to-consumer sales and marketing. The e-commerce segment within the off-trade distribution channel is experiencing exponential growth, driven by the convenience it offers, especially in urban centers. Furthermore, the growing awareness of health benefits associated with moderate wine consumption and the influence of global lifestyle trends are contributing to market penetration rates, which are projected to climb from xx% in 2024 to xx% by 2033. The competitive dynamics are intensifying, with both established global players and emerging regional wineries vying for market share. Opportunities lie in tapping into the nascent yet rapidly developing markets within Africa, catering to the demand for culturally relevant wine offerings, and leveraging digital channels to reach a broader consumer base. The focus on sustainability and ethically sourced wines is also emerging as a significant differentiator.

Dominant Markets & Segments in MEA Wine Industry

The MEA wine industry's dominance is currently concentrated in specific regions and segments, with key growth drivers including burgeoning tourism, supportive government initiatives, and increasing urbanization. South Africa and the UAE stand out as the leading markets, driven by established wine-producing heritage and significant consumer spending power, respectively. Within the product type segment, Still Wine commands the largest market share, accounting for an estimated xx billion USD in 2025, due to its widespread appeal and diverse varietal offerings. However, Sparkling Wine is experiencing the highest CAGR, projected at xx%, driven by celebrations and an increasing adoption of premium lifestyle trends. Dessert and Fortified Wines, while niche, also present steady growth opportunities, particularly in regions with established traditions. The distribution channel landscape reveals a strong preference for Off-Trade, with Supermarkets/Hypermarkets leading the segment with a market value of xx billion USD in 2025. This dominance is attributed to accessibility, bulk purchasing opportunities, and the increasing presence of international brands. Specialty Stores are also crucial for premium wine sales, offering curated selections and expert advice. The On-Trade channel, encompassing hotels, restaurants, and bars, remains a vital segment, especially in tourist destinations and major cities, contributing xx billion USD in 2025, and is expected to see robust recovery and growth post-pandemic. Key growth drivers in dominant markets include infrastructure development, enabling better logistics and distribution networks, and evolving policies that encourage wine tourism and domestic production. For instance, government incentives for agri-tourism in South Africa continue to bolster its wine sector. In the UAE, a more liberal approach to alcohol sales in recent years has significantly boosted the wine market. The expansion of premium retail outlets and the growing sophistication of consumer palates further fuel the dominance of these segments.

MEA Wine Industry Product Analysis

Product innovations in the MEA wine industry are increasingly focused on meeting diverse consumer demands and enhancing market appeal. Technological advancements are driving the development of wines with specific flavor profiles, longer shelf lives, and reduced alcohol content. Applications span from everyday consumption to premium gifting and hospitality. Competitive advantages are being built through unique varietal expressions, such as the introduction of indigenous grape varietals in North Africa, and Méthode Cap Classique in South Africa, alongside the adoption of sustainable viticulture practices and eco-friendly packaging. The market fit is enhanced by tailoring offerings to local tastes and occasions, such as the Nigerian market's introduction of French-produced wines like Princi Pinal, Princi Merlot, and Princi Cabernet Sauvignon.

Key Drivers, Barriers & Challenges in MEA Wine Industry

Key drivers propelling the MEA wine industry include increasing disposable incomes and a burgeoning middle class, leading to greater demand for premium beverages. Economic growth in key markets like South Africa and North African nations fosters increased consumer spending. Technological advancements in viticulture and winemaking enhance product quality and diversity. Furthermore, supportive government policies in some countries, such as tax incentives and tourism promotion, act as significant catalysts. The growing influence of global lifestyle trends and increased exposure to international wine cultures through travel and media also contribute positively.

However, significant barriers and challenges impede growth. Regulatory complexities, including stringent import regulations, high tariffs, and varying licensing requirements across different MEA countries, create market entry hurdles. Supply chain issues, such as underdeveloped logistics infrastructure and high transportation costs, particularly in landlocked African regions, inflate prices and affect product availability. Competitive pressures from established global players and the strong presence of substitute beverages like beer and spirits remain a constant restraint. Additionally, fluctuating currency exchange rates and economic instability in some markets can impact consumer purchasing power. The estimated impact of regulatory hurdles on market entry is xx billion USD annually.

Growth Drivers in the MEA Wine Industry Market

The growth drivers in the MEA wine industry market are multifaceted. Economically, rising disposable incomes and the expansion of the middle class in nations like Nigeria and Kenya are fueling demand for premium and imported wines. Technologically, advancements in irrigation, pest control, and fermentation techniques are leading to higher quality and more consistent wine production, making wines more accessible and appealing. Regulatory factors play a crucial role; for example, the liberalization of alcohol sales in certain Middle Eastern countries has directly stimulated market growth. The increasing popularity of wine tourism, particularly in South Africa, also acts as a significant economic and cultural driver, raising brand awareness and encouraging domestic consumption.

Challenges Impacting MEA Wine Industry Growth

Challenges impacting MEA wine industry growth are predominantly rooted in regulatory complexities, supply chain inefficiencies, and intense competitive pressures. For instance, varying excise duties and import restrictions across different MEA nations create a fragmented market and hinder cross-border trade, impacting the overall market size by an estimated xx billion USD annually. Supply chain issues, including underdeveloped cold chain logistics and inadequate transportation networks, especially in sub-Saharan Africa, result in higher costs and potential product spoilage, affecting the accessibility and price competitiveness of wines. Competitive pressures from established global brands and the strong preference for locally produced beer and spirits in many markets present a significant restraint. Furthermore, economic volatility and currency fluctuations in key markets can dampen consumer spending on discretionary items like wine, adding another layer of challenge for industry expansion.

Key Players Shaping the MEA Wine Industry Market

- E & J Gallo Winery

- Birthmark of Africa Wines

- Compagnia del Vino

- Suntory Holdings Limited

- Constellation Brands Inc.

- Treasury Wine Estates

- Accolade Wines

- The Wine Group

- Davide Campari-Milano N V

- Pernod Ricard

Significant MEA Wine Industry Industry Milestones

- December 2021: Nigerian pharmacists launched new wine brands, partnering with French winemakers to produce Princi wines like Princi Pinal, Princi Merlot, and Princi Cabernet Sauvignon for the Nigerian market, signifying localized product development and international collaboration.

- April 2021: South Africa's Birthmark of Africa Wines launched its new collection, including Brut Chardonnay MCC, Heritage Premium Red Blend, Heritage Premium White Blend, and other premium varietals, highlighting innovation in premium sparkling and still wines and expanding product portfolios.

- April 2020: Spinneys Liquor, part of the MMI group, launched its own home delivery service for wine, beer, and spirits in Abu Dhabi, demonstrating a pivot towards e-commerce and direct-to-consumer channels in response to changing consumer behavior and market conditions.

Future Outlook for MEA Wine Industry Market

The future outlook for the MEA wine industry is highly optimistic, driven by several growth catalysts. The increasing affluence and evolving lifestyle preferences across the region will continue to fuel demand for premium and diversified wine offerings. Strategic opportunities lie in the expansion of direct-to-consumer (DTC) models, leveraging digital platforms to overcome traditional distribution challenges and reach a wider audience. The growing interest in sustainable and ethically produced wines presents a significant market potential for brands that can align with these values. Furthermore, the development of localized wine tourism initiatives and the introduction of wine education programs will foster a deeper appreciation for wine, thereby driving market penetration and long-term growth across the diverse MEA landscape. The market is projected to witness sustained growth, with an estimated xx% increase in market value by 2033.

MEA Wine Industry Segmentation

-

1. Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Dessert Wine

- 1.4. Fortified Wine

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Specialty Stores

- 2.2.3. Other Distribution Channels

MEA Wine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

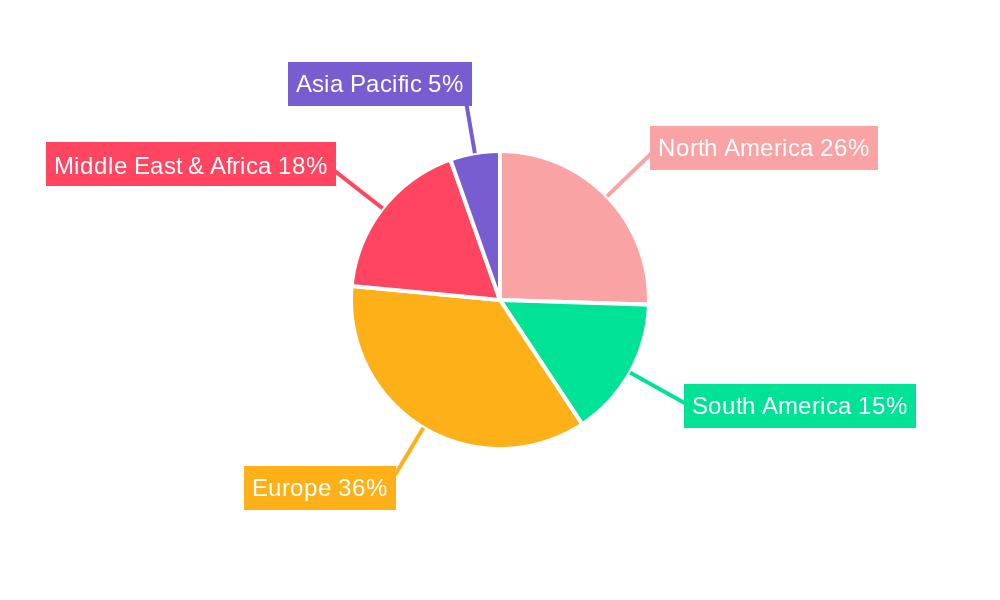

MEA Wine Industry Regional Market Share

Geographic Coverage of MEA Wine Industry

MEA Wine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Changing Lifestyle and Consumption Habits of Wine

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Wine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Dessert Wine

- 5.1.4. Fortified Wine

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Specialty Stores

- 5.2.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America MEA Wine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Still Wine

- 6.1.2. Sparkling Wine

- 6.1.3. Dessert Wine

- 6.1.4. Fortified Wine

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Specialty Stores

- 6.2.2.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America MEA Wine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Still Wine

- 7.1.2. Sparkling Wine

- 7.1.3. Dessert Wine

- 7.1.4. Fortified Wine

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Specialty Stores

- 7.2.2.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe MEA Wine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Still Wine

- 8.1.2. Sparkling Wine

- 8.1.3. Dessert Wine

- 8.1.4. Fortified Wine

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Specialty Stores

- 8.2.2.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa MEA Wine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Still Wine

- 9.1.2. Sparkling Wine

- 9.1.3. Dessert Wine

- 9.1.4. Fortified Wine

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Specialty Stores

- 9.2.2.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific MEA Wine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Still Wine

- 10.1.2. Sparkling Wine

- 10.1.3. Dessert Wine

- 10.1.4. Fortified Wine

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Specialty Stores

- 10.2.2.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 E & J Gallo Winery

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Birthmark of Africa Wines

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Compagnia del Vino*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Suntory Holdings Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Constellation Brands Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Treasury Wine Estates

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Accolade Wines

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Wine Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Davide Campari-Milano N V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pernod Ricard

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 E & J Gallo Winery

List of Figures

- Figure 1: Global MEA Wine Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America MEA Wine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America MEA Wine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America MEA Wine Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America MEA Wine Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America MEA Wine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America MEA Wine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America MEA Wine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: South America MEA Wine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America MEA Wine Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: South America MEA Wine Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America MEA Wine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America MEA Wine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe MEA Wine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe MEA Wine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe MEA Wine Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Europe MEA Wine Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe MEA Wine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe MEA Wine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa MEA Wine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East & Africa MEA Wine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa MEA Wine Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa MEA Wine Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa MEA Wine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa MEA Wine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific MEA Wine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Asia Pacific MEA Wine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific MEA Wine Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific MEA Wine Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific MEA Wine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific MEA Wine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Wine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global MEA Wine Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global MEA Wine Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global MEA Wine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global MEA Wine Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global MEA Wine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global MEA Wine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global MEA Wine Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global MEA Wine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Wine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global MEA Wine Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global MEA Wine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global MEA Wine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global MEA Wine Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global MEA Wine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global MEA Wine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global MEA Wine Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global MEA Wine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific MEA Wine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Wine Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the MEA Wine Industry?

Key companies in the market include E & J Gallo Winery, Birthmark of Africa Wines, Compagnia del Vino*List Not Exhaustive, Suntory Holdings Limited, Constellation Brands Inc, Treasury Wine Estates, Accolade Wines, The Wine Group, Davide Campari-Milano N V, Pernod Ricard.

3. What are the main segments of the MEA Wine Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Changing Lifestyle and Consumption Habits of Wine.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

In December 2021, Nigerian pharmacists launched new wine brands in Nigeria. He partnered with leading wine makers in France to produce Princi wines like Princi Pinal, Princi Merlot, and Princi Cabernet Sauvignon for the Nigerian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Wine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Wine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Wine Industry?

To stay informed about further developments, trends, and reports in the MEA Wine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence