Key Insights

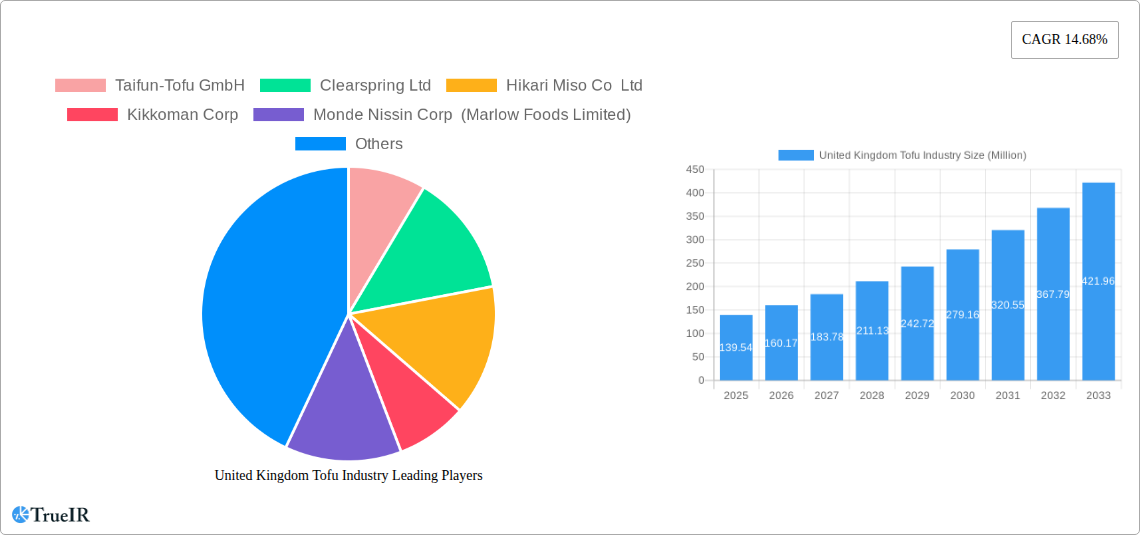

The United Kingdom tofu market is poised for significant expansion, with an estimated market size of £139.54 million in 2025, driven by a robust 14.68% CAGR. This impressive growth is fueled by a confluence of factors including rising consumer awareness regarding the health benefits of plant-based diets, the increasing prevalence of flexitarian and vegan lifestyles across the UK, and a growing demand for diverse and convenient protein alternatives. The market's dynamism is further underscored by a strong historical growth trend from 2019-2024, indicating sustained consumer adoption. Key market players are actively innovating, introducing a wider array of tofu products and expanding their distribution networks to cater to evolving consumer preferences. The expanding availability of tofu in mainstream supermarkets and the burgeoning online retail sector are key enablers of this market's ascent.

United Kingdom Tofu Industry Market Size (In Million)

The competitive landscape features established companies and emerging brands vying for market share. Distribution channels like supermarkets/hypermarkets and online retail stores are expected to dominate, reflecting current consumer shopping habits and the convenience offered by these platforms. While the UK market presents substantial opportunities, potential restraints might include fluctuating raw material costs and the need for continuous product development to stay ahead of evolving consumer tastes and dietary trends. However, the overarching positive sentiment, characterized by strong market size and a high CAGR, suggests that the UK tofu industry is on a trajectory of substantial growth, presenting lucrative prospects for stakeholders and continuing to contribute to the nation's shift towards more sustainable and health-conscious food choices.

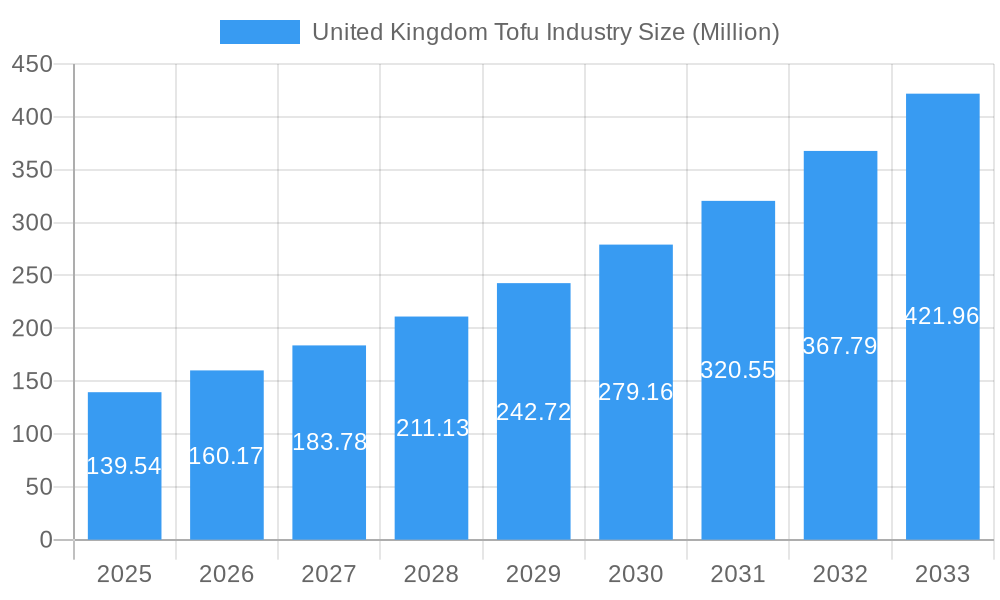

United Kingdom Tofu Industry Company Market Share

This comprehensive report delves into the dynamic United Kingdom tofu market, offering an in-depth analysis of its structure, competitive landscape, and future trajectory. Covering the historical period of 2019–2024 and extending to the forecast period of 2025–2033, this study provides critical insights for businesses seeking to capitalize on the burgeoning demand for plant-based proteins. With a focus on high-volume keywords such as UK tofu market size, plant-based protein UK, vegan food trends UK, and tofu market growth, this report is optimized for search engines and designed to engage industry professionals.

United Kingdom Tofu Industry Market Structure & Competitive Landscape

The UK tofu industry exhibits a moderately concentrated market structure, characterized by the presence of both established multinational corporations and agile domestic players. Innovation serves as a primary driver, with companies continually launching new products to meet evolving consumer preferences for taste, convenience, and sustainability. Regulatory frameworks, particularly concerning food labeling and ethical sourcing, are increasingly influencing market dynamics. Product substitutes, including tempeh, seitan, and other plant-based meat alternatives, present a competitive challenge, necessitating continuous product differentiation. The end-user segmentation reveals strong growth in health-conscious consumers and vegans/vegetarians. Mergers and acquisitions (M&A) activity, though not extensive, plays a role in market consolidation and expansion. For instance, the acquisition of Quorn by Monde Nissin Corp (Marlow Foods Limited) highlights strategic moves to strengthen portfolios within the plant-based sector. Concentration ratios indicate a significant market share held by the top 5-7 players.

- Innovation Drivers: Product development, sustainable sourcing, plant-based protein innovation.

- Regulatory Impacts: Food safety standards, clear labeling regulations, sustainability mandates.

- Product Substitutes: Tempeh, seitan, other meat alternatives, legumes.

- End-User Segmentation: Health-conscious consumers, vegans, vegetarians, flexitarians.

- M&A Trends: Strategic acquisitions to enhance market presence and product offerings.

United Kingdom Tofu Industry Market Trends & Opportunities

The United Kingdom tofu market is experiencing robust growth, projected to reach a market size of over £500 Million by the estimated year of 2025, with a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is fueled by a significant shift in consumer dietary habits towards plant-based protein UK and vegan food trends UK. The increasing awareness of health benefits associated with tofu, such as its high protein content and lower saturated fat, coupled with environmental concerns surrounding traditional meat consumption, are major catalysts. Technological advancements in tofu production are leading to improved textures, flavors, and shelf-life, making tofu a more appealing option for a broader consumer base. The rise of online retail stores and direct-to-consumer models is enhancing market penetration, offering greater accessibility. Furthermore, the growing demand for convenient, ready-to-cook meals is creating significant opportunities for innovative tofu products. The market penetration rate for tofu, while still lower than in some European countries, is steadily increasing. This evolving landscape presents a fertile ground for new entrants and existing players to expand their offerings, focusing on specialty tofu products, fortified options, and convenient formats. The UK plant-based market is a key indicator of this growth.

Dominant Markets & Segments in United Kingdom Tofu Industry

The Supermarkets/Hypermarkets distribution channel currently dominates the United Kingdom tofu industry, accounting for a significant share of market sales. This dominance is driven by their extensive reach, the convenience they offer to a broad consumer base, and their ability to stock a wide variety of tofu brands and product types. The increasing shelf space allocated to plant-based alternatives within these retailers further bolsters tofu's presence.

- Supermarkets/Hypermarkets:

- Growth Drivers: Wide product assortment, promotional activities, increased demand for plant-based options, enhanced visibility.

- Market Dominance: Consumers prioritize convenience and accessibility, making these channels the primary point of purchase for the majority of households. The ability to compare various brands and product formats in one location also contributes to their leading position.

Online Retail Stores represent a rapidly growing segment, demonstrating exceptional growth potential. This channel caters to the evolving shopping habits of consumers, offering the convenience of home delivery and a vast selection of niche and specialty tofu products that may not be readily available in physical stores.

- Online Retail Stores:

- Growth Drivers: E-commerce expansion, convenience of home delivery, access to specialty products, subscription box models for plant-based foods.

- Market Dominance: Growing preference for online grocery shopping, particularly among younger demographics and busy professionals. The ability to offer a wider range of specialized tofu products, catering to specific dietary needs or preferences, also fuels this segment's growth.

Convenience/Grocery Stores play a crucial role in providing accessible options, especially for impulse purchases and for consumers seeking quick meal solutions. While their market share is smaller than supermarkets, their strategic locations ensure consistent visibility.

- Convenience/Grocery Stores:

- Growth Drivers: Local accessibility, impulse purchase opportunities, catering to immediate needs for meal preparation.

- Market Dominance: Serve as an important channel for immediate consumption needs and fill gaps in accessibility, particularly in urban areas and smaller towns.

Other Distribution Channels, including health food stores, independent retailers, and food service providers (restaurants, cafes), contribute to the market's diversification. These channels often cater to niche markets and those actively seeking out specialized vegan and vegetarian offerings.

- Other Distribution Channels:

- Growth Drivers: Specialization in health foods, catering to food service industry demand for plant-based ingredients, direct sales to consumers.

- Market Dominance: Essential for reaching specific consumer segments and for the expansion of tofu in the out-of-home consumption market.

United Kingdom Tofu Industry Product Analysis

Product innovation in the UK tofu market is rapidly expanding beyond traditional blocks. Companies are introducing diverse formats like smoked tofu, marinated tofu, and pre-cubed options for enhanced convenience. The focus on sustainable soy sourcing and eco-friendly packaging is a significant competitive advantage, appealing to environmentally conscious consumers. Technological advancements are enabling the creation of tofu with improved textures, such as firmer or softer varieties, catering to a wider range of culinary applications. Market fit is achieved by aligning product development with current UK plant-based trends and consumer demand for healthy, versatile, and ethically produced food ingredients.

Key Drivers, Barriers & Challenges in United Kingdom Tofu Industry

Key Drivers propelling the United Kingdom tofu industry include the accelerating UK plant-based movement, driven by health consciousness, ethical considerations, and environmental awareness. Technological advancements in production are yielding improved taste and texture, making tofu more appealing. Favorable government policies and initiatives promoting sustainable agriculture and healthy eating also contribute. The increasing availability and visibility in mainstream retail channels are expanding consumer access and adoption.

Key Barriers and Challenges impacting the UK tofu market growth include entrenched consumer preferences for traditional protein sources, leading to slower adoption rates in certain demographics. Supply chain complexities, particularly concerning the sourcing of non-GMO and sustainable soybeans, can pose logistical and cost challenges. Regulatory hurdles related to food safety and labeling, while necessary, can add to operational complexities. Intense competition from a growing array of plant-based alternatives, including other soy-based products and emerging protein sources, requires continuous innovation and differentiation. Price sensitivity among some consumer segments also remains a consideration.

Growth Drivers in the United Kingdom Tofu Industry Market

The United Kingdom tofu market is experiencing significant growth driven by several key factors. The escalating adoption of vegan and vegetarian diets in the UK, fueled by growing awareness of health benefits and environmental sustainability, is a primary catalyst. Technological innovations in processing are leading to the development of more appealing textures and flavors, enhancing tofu's culinary versatility. Furthermore, increasing investment in plant-based food research and development by major food corporations is expanding product portfolios and driving market penetration. Government initiatives promoting healthy eating and sustainable food systems also create a supportive environment for the UK plant-based protein market.

Challenges Impacting United Kingdom Tofu Industry Growth

Several challenges are impacting the growth trajectory of the United Kingdom tofu industry. A significant barrier is the persistent perception of tofu as a niche product, with a need for greater consumer education regarding its versatility and nutritional benefits. Supply chain vulnerabilities, including the reliance on imported soybeans and the need for stringent quality control for non-GMO and sustainable sourcing, can lead to price volatility and availability issues. The competitive landscape is intense, with numerous plant-based protein alternatives vying for consumer attention, necessitating continuous product innovation and effective marketing. Regulatory complexities surrounding food labeling and allergen information also require careful navigation.

Key Players Shaping the United Kingdom Tofu Industry Market

- Taifun-Tofu GmbH

- Clearspring Ltd

- Hikari Miso Co Ltd

- Kikkoman Corp

- Monde Nissin Corp (Marlow Foods Limited)

- House Foods Group Inc

- Associated British Foods (AB World Foods Limited)

- The Tofoo Co Ltd

- Morinaga Milk Industry Co Ltd

- Wilson International Frozen Foods (H K ) Limited (Tazaki Foods)

Significant United Kingdom Tofu Industry Industry Milestones

- April 2022: Cauldron Foods, a division of Marlow Foods Ltd, expanded its famous range with the addition of two new tofu products, namely Quick & Tasty Smoky BBQ Block and Hoisin Tofu. The new SKUs are created from sustainable soy and come in 100% recyclable packaging.

- December 2021: The Tofoo Co., a UK tofu brand, expanded its portfolio with a new line of frozen tofu products called Straight to Wok. Straight to Wok is prepared with tofu cubes coated in cornflour. The new line comes in two flavors, such as Naked and Ginger & Chilli.

- February 2021: The Tofoo Co., a British company, launched the country's first frozen tofu product, Tofoo Chunkies, which is intended to make tofu more accessible.

Future Outlook for United Kingdom Tofu Industry Market

The future outlook for the United Kingdom tofu industry is exceptionally promising, driven by sustained consumer demand for healthy, sustainable, and plant-based food options. Continued innovation in product development, focusing on diverse flavors, textures, and convenient formats, will be crucial for market expansion. The growing penetration in online retail and the food service sector presents significant growth catalysts. Strategic partnerships and potential mergers will likely shape the competitive landscape. Investments in scalable and sustainable sourcing and production will be key to meeting future demand, solidifying tofu's position as a staple in the UK plant-based diet and contributing to the overall growth of the vegan food market UK.

United Kingdom Tofu Industry Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience/Grocery Stores

- 1.3. Online Retail Stores

- 1.4. Other Distribution Channels

United Kingdom Tofu Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Tofu Industry Regional Market Share

Geographic Coverage of United Kingdom Tofu Industry

United Kingdom Tofu Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing consumer awareness about the health benefits of tofu

- 3.3. Market Restrains

- 3.3.1. Processing and Shelf Life Issues

- 3.4. Market Trends

- 3.4.1. Increased demand for organic and non-GMO tofu products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Tofu Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience/Grocery Stores

- 5.1.3. Online Retail Stores

- 5.1.4. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Taifun-Tofu GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clearspring Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hikari Miso Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kikkoman Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monde Nissin Corp (Marlow Foods Limited)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 House Foods Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Associated British Foods (AB World Foods Limited)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Tofoo Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Morinaga Milk Industry Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wilson International Frozen Foods (H K ) Limited (Tazaki Foods)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Taifun-Tofu GmbH

List of Figures

- Figure 1: United Kingdom Tofu Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Tofu Industry Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Tofu Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 2: United Kingdom Tofu Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 3: United Kingdom Tofu Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Tofu Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Tofu Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United Kingdom Tofu Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: United Kingdom Tofu Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: United Kingdom Tofu Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Tofu Industry?

The projected CAGR is approximately 14.68%.

2. Which companies are prominent players in the United Kingdom Tofu Industry?

Key companies in the market include Taifun-Tofu GmbH, Clearspring Ltd, Hikari Miso Co Ltd, Kikkoman Corp, Monde Nissin Corp (Marlow Foods Limited), House Foods Group Inc, Associated British Foods (AB World Foods Limited)*List Not Exhaustive, The Tofoo Co Ltd, Morinaga Milk Industry Co Ltd, Wilson International Frozen Foods (H K ) Limited (Tazaki Foods).

3. What are the main segments of the United Kingdom Tofu Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing consumer awareness about the health benefits of tofu.

6. What are the notable trends driving market growth?

Increased demand for organic and non-GMO tofu products.

7. Are there any restraints impacting market growth?

Processing and Shelf Life Issues.

8. Can you provide examples of recent developments in the market?

April 2022: Cauldron Foods, a division of Marlow Foods Ltd, expanded its famous range with the addition of two new tofu products, namely Quick & Tasty Smoky BBQ Block and Hoisin Tofu. The new SKUs are created from sustainable soy and come in 100% recyclable packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Tofu Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Tofu Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Tofu Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Tofu Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence