Key Insights

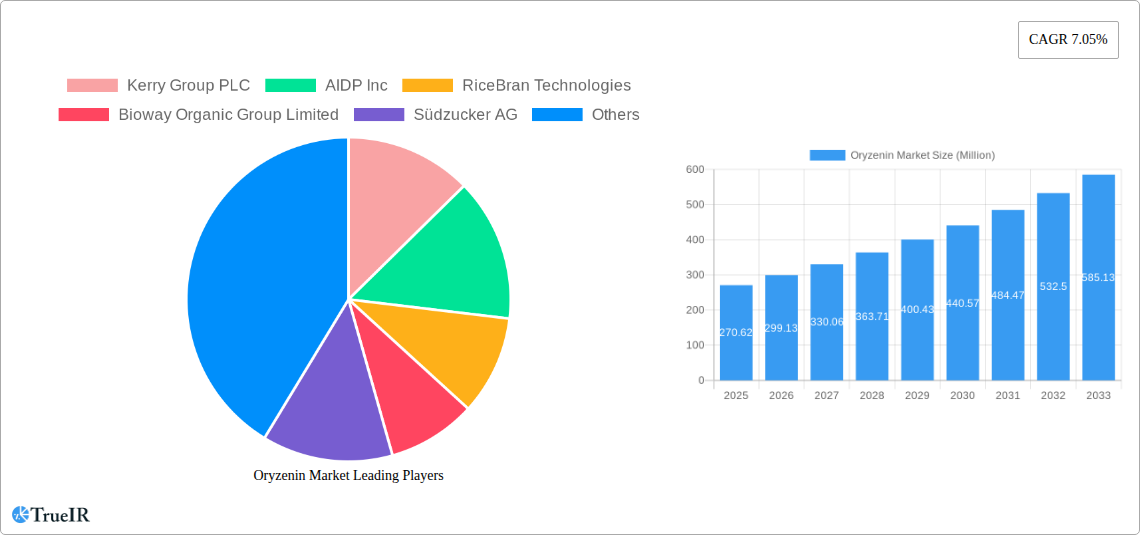

The global Oryzenin market is poised for robust expansion, projected to reach USD 270.62 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period of 2025-2033. This significant growth is primarily fueled by the escalating demand for plant-based protein sources across various industries. The increasing consumer awareness regarding health and wellness, coupled with a rising preference for sustainable and ethical food choices, is a major driver for oryzenin, a protein derived from rice bran. Its versatile applications in bakery and confectionery, beverages, sports and energy nutrition, dairy alternatives, and meat substitutes are further propelling its market penetration. The "Isolates" and "Concentrates" segments are expected to lead the market due to their high purity and functional properties, catering to the specific needs of food and beverage manufacturers seeking to enhance nutritional profiles.

Oryzenin Market Market Size (In Million)

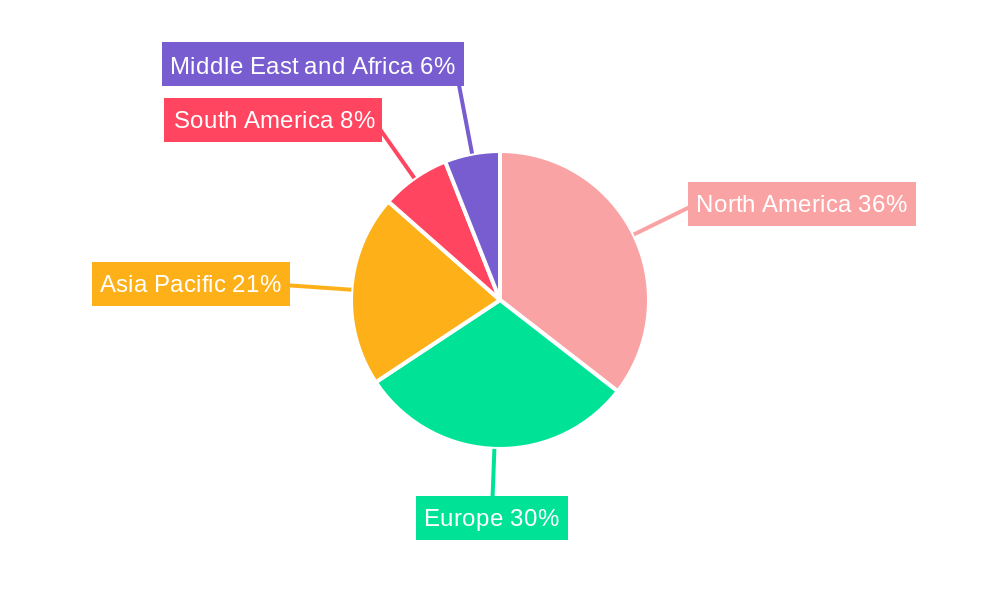

Emerging trends like the development of novel oryzenin extraction technologies and its incorporation into functional foods and specialized dietary supplements are expected to contribute significantly to market growth. While the market demonstrates strong upward momentum, potential restraints such as the fluctuating availability of raw rice bran and the establishment of comparable plant-based proteins could present challenges. However, the inherent nutritional benefits of oryzenin, including its hypoallergenic nature and rich amino acid profile, position it favorably against competitors. Key regions like North America and Europe are leading the adoption, driven by established health food markets and a proactive stance on sustainable agriculture. Asia Pacific, with its vast rice production, presents substantial untapped potential for market expansion and innovation in the oryzenin landscape.

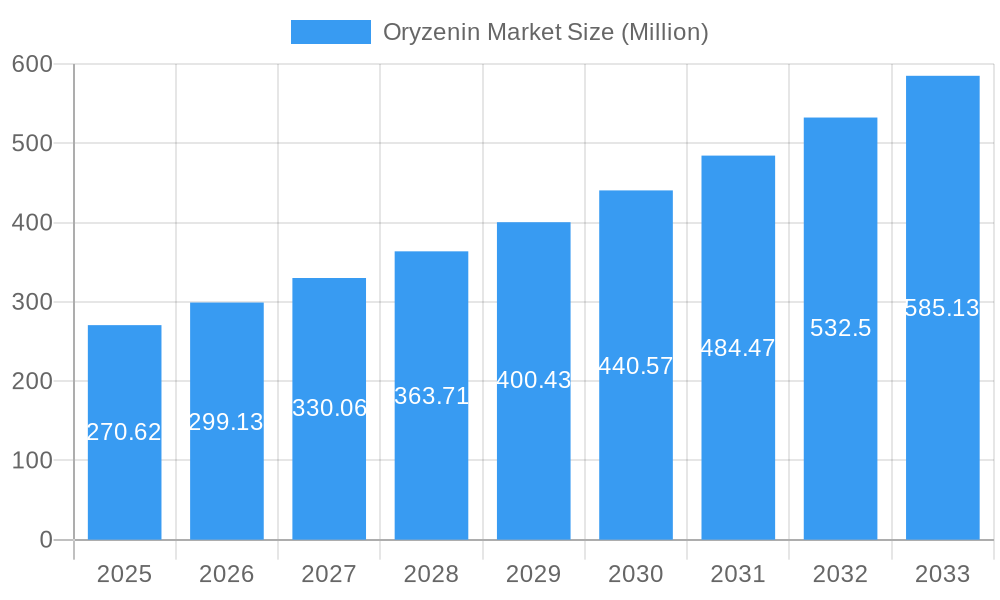

Oryzenin Market Company Market Share

This in-depth Oryzenin Market report provides a definitive analysis of the global market, covering the historical period from 2019 to 2024, with a base year of 2025 and a comprehensive forecast extending to 2033. Leveraging high-volume keywords such as "oryzenin market size," "oryzenin market growth," "oryzenin applications," and "oryzenin market trends," this report is meticulously crafted for SEO optimization, ensuring maximum visibility and engagement with industry stakeholders. We explore the dynamic landscape of rice protein and its derivatives, offering unparalleled insights into market structure, competitive dynamics, emerging opportunities, and future projections.

Oryzenin Market Market Structure & Competitive Landscape

The Oryzenin Market exhibits a moderately concentrated structure, with key players investing heavily in research and development to drive innovation. The competitive landscape is shaped by factors such as product purity, functional properties, and cost-effectiveness. Innovation drivers include the growing demand for plant-based proteins, advancements in extraction and purification technologies, and the increasing application of oryzenin in diverse food and beverage sectors. Regulatory impacts, while evolving, are largely supportive of novel plant-derived ingredients, fostering market expansion. Product substitutes, primarily other plant proteins like pea and soy protein, pose a competitive challenge, but the unique nutritional profile and hypoallergenic properties of oryzenin offer a distinct advantage. End-user segmentation reveals a strong focus on health-conscious consumers seeking clean-label, sustainable protein sources. Mergers and acquisitions (M&A) trends are observed, indicating a strategic consolidation aimed at expanding market reach and product portfolios. For instance, the acquisition of advanced processing technologies or smaller specialty ingredient suppliers by larger players would likely increase the market concentration ratio.

Oryzenin Market Market Trends & Opportunities

The global Oryzenin Market is experiencing robust growth, driven by an escalating consumer preference for plant-based diets and a heightened awareness of the health benefits associated with rice protein. This market, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period of 2025–2033, is poised for substantial expansion, reaching an estimated market size of over 300 million in 2025 and projected to exceed 600 million by 2033. Technological shifts in protein extraction and processing are enabling the production of higher-purity oryzenin isolates and concentrates, thereby broadening their applicability across various industries. Consumer preferences are increasingly leaning towards sustainable, non-GMO, and allergen-free ingredients, aligning perfectly with the attributes of oryzenin. Competitive dynamics are intensifying, with established food ingredient giants and specialized plant-protein manufacturers vying for market share. The market penetration rate for oryzenin in mainstream food products is still relatively low but is rapidly increasing, presenting significant opportunities for early adopters and innovators. The rising disposable incomes in emerging economies are further fueling demand for premium, health-enhancing food ingredients. Furthermore, the expanding market for sports nutrition and functional foods provides a fertile ground for oryzenin-based products. The development of novel applications, such as in pet food and animal feed, also represents a significant untapped opportunity. The trend towards personalized nutrition is also creating a niche for specialized oryzenin formulations tailored to specific dietary needs. The increasing demand for protein fortification in everyday food items, from breakfast cereals to snacks, underscores the vast potential for oryzenin. This growth trajectory is further supported by ongoing research into the functional and health-promoting properties of oryzenin, which continue to uncover new benefits and applications.

Dominant Markets & Segments in Oryzenin Market

The global Oryzenin Market is witnessing significant dominance in the Asia Pacific region, primarily driven by its origins and widespread cultivation of rice. Countries like China, India, and Southeast Asian nations are major contributors to both production and consumption of rice-derived ingredients. Within the Type segment, Isolates are currently the dominant force, accounting for over 50% of the market share, owing to their high protein content and superior functionality, making them ideal for specialized applications. Concentrates represent a significant, albeit smaller, segment, with growing potential in less demanding applications. The Application segment reveals that Bakery & Confectionery and Beverages are leading sectors, capitalizing on the demand for plant-based protein fortification and clean-label ingredients. Sports & Energy Nutrition is another crucial segment, benefiting from the high protein bioavailability of oryzenin. The burgeoning Dairy Alternatives and Meat Substitutes markets are also emerging as significant growth areas, where oryzenin's texture-imparting and binding properties are highly valued. Key growth drivers in dominant markets include robust agricultural infrastructure, supportive government policies promoting food processing and export, and a burgeoning middle class with increasing disposable income and a focus on health and wellness.

Oryzenin Market Product Analysis

Product innovations in the Oryzenin Market are primarily focused on enhancing protein purity, improving solubility, and diversifying functional properties. Advanced enzymatic hydrolysis and chromatographic separation techniques are yielding oryzenin isolates with protein concentrations exceeding 90%, offering superior nutritional and functional benefits. These refined products are finding expanded applications in high-protein beverages, specialized dietary supplements, and infant nutrition formulations. The competitive advantage lies in oryzenin's hypoallergenic nature and its complete amino acid profile, differentiating it from other plant proteins.

Key Drivers, Barriers & Challenges in Oryzenin Market

Key Drivers:

- Growing demand for plant-based proteins: Increasing consumer preference for vegan, vegetarian, and flexitarian diets is a primary growth catalyst.

- Health and wellness trend: Oryzenin's nutritional profile, including its high protein content and amino acid balance, appeals to health-conscious consumers.

- Technological advancements: Improved extraction and processing technologies are leading to higher purity and functional oryzenin ingredients.

- Allergen-free properties: Oryzenin is a viable alternative for individuals with allergies to common proteins like soy and dairy.

Barriers & Challenges:

- Price volatility of rice: Fluctuations in rice commodity prices can impact the cost-effectiveness of oryzenin production, potentially limiting market penetration, especially in price-sensitive applications, with an estimated impact of 10-15% on production costs.

- Limited consumer awareness: Compared to more established plant proteins, consumer awareness and understanding of oryzenin's benefits are still developing.

- Supply chain complexities: Ensuring consistent quality and availability of raw rice and efficient processing can present logistical challenges.

- Competition from established proteins: Soy and pea protein, with their established market presence and lower price points, remain strong competitors.

Growth Drivers in the Oryzenin Market Market

Key growth drivers in the Oryzenin Market are fundamentally rooted in the overarching shift towards sustainable and healthier dietary choices. Technologically, advancements in enzyme technology and membrane filtration are enabling the production of highly pure oryzenin isolates with enhanced functionalities, driving demand for specialized applications. Economically, rising disposable incomes globally, particularly in emerging markets, are empowering consumers to invest in premium health ingredients. Regulatory bodies are increasingly supportive of novel plant-based protein sources, encouraging innovation and market entry. The demand for allergen-free ingredients, a significant unmet need in the food industry, is also a powerful driver for oryzenin.

Challenges Impacting Oryzenin Market Growth

Several challenges can impede the growth trajectory of the Oryzenin Market. Regulatory complexities, particularly regarding novel food approvals in different regions, can create barriers to market entry and slow down product commercialization. Supply chain issues, including the consistent availability of high-quality rice suitable for protein extraction and potential disruptions due to climate change or agricultural policies, can impact production volumes and costs. Competitive pressures from well-established plant proteins like soy and pea protein, which often benefit from economies of scale and lower price points, pose a significant restraint. Furthermore, the relatively lower consumer awareness and understanding of oryzenin compared to its counterparts necessitate significant marketing and educational efforts, adding to the overall cost of market development.

Key Players Shaping the Oryzenin Market Market

- Kerry Group PLC

- AIDP Inc

- RiceBran Technologies

- Bioway Organic Group Limited

- Südzucker AG

- Axiom Foods Inc

- The Green Labs LLC

- Ribus Inc

Significant Oryzenin Market Industry Milestones

- Jan 2022: Kerry announced the official opening of a new 21,500-square-foot facility at its Jeddah operation in the Kingdom of Saudi Arabia. Over the past four years, the company invested over EUR 80 million in the region. It was announced that the products manufactured at the new facility would be supplied across the Middle Eastern region, indicating strategic expansion in key growth markets.

- Nov 2019: In partnership with Brenntag Food & Nutrition, Healy Group, and Univar Solutions Brazil, Axiom Foods Inc. offers oryzenin products under the Oryzatein brand. Brenntag Food & Nutrition, a Brenntag Group company, will distribute the ingredients throughout Europe and Middle-East and Africa. The ingredients will be distributed particularly in the United Kingdom and Ireland by the Healy Group. Univar Solutions Brasil will spearhead the South American expansion. Univar Solutions, headquartered in Los Angeles, is already Axiom's official ingredient distributor in the United States, highlighting collaborative efforts to expand global reach and market penetration.

Future Outlook for Oryzenin Market Market

The future outlook for the Oryzenin Market is exceptionally promising, buoyed by sustained global trends towards plant-based nutrition and increasing demand for clean-label, functional ingredients. Strategic opportunities lie in further research and development to unlock novel applications in the pharmaceutical and nutraceutical sectors, alongside continued innovation in food and beverage formulations. The market's growth trajectory will be significantly influenced by the successful mitigation of supply chain challenges and proactive engagement in consumer education to build brand awareness and acceptance. The increasing focus on sustainability and ethical sourcing will further cement oryzenin's position as a preferred protein source.

Oryzenin Market Segmentation

-

1. Type

- 1.1. Isolates

- 1.2. Concentrates

- 1.3. Other Types

-

2. Application

- 2.1. Bakery & Confectionery

- 2.2. Beverages

- 2.3. Sports & Energy Nutrition

- 2.4. Dairy Alternatives

- 2.5. Meat Substitutes

- 2.6. Other Applications

Oryzenin Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Oryzenin Market Regional Market Share

Geographic Coverage of Oryzenin Market

Oryzenin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Surge in Demand for Meat Alternative Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oryzenin Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Isolates

- 5.1.2. Concentrates

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery & Confectionery

- 5.2.2. Beverages

- 5.2.3. Sports & Energy Nutrition

- 5.2.4. Dairy Alternatives

- 5.2.5. Meat Substitutes

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Oryzenin Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Isolates

- 6.1.2. Concentrates

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery & Confectionery

- 6.2.2. Beverages

- 6.2.3. Sports & Energy Nutrition

- 6.2.4. Dairy Alternatives

- 6.2.5. Meat Substitutes

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Oryzenin Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Isolates

- 7.1.2. Concentrates

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery & Confectionery

- 7.2.2. Beverages

- 7.2.3. Sports & Energy Nutrition

- 7.2.4. Dairy Alternatives

- 7.2.5. Meat Substitutes

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Oryzenin Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Isolates

- 8.1.2. Concentrates

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery & Confectionery

- 8.2.2. Beverages

- 8.2.3. Sports & Energy Nutrition

- 8.2.4. Dairy Alternatives

- 8.2.5. Meat Substitutes

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Oryzenin Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Isolates

- 9.1.2. Concentrates

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery & Confectionery

- 9.2.2. Beverages

- 9.2.3. Sports & Energy Nutrition

- 9.2.4. Dairy Alternatives

- 9.2.5. Meat Substitutes

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Oryzenin Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Isolates

- 10.1.2. Concentrates

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery & Confectionery

- 10.2.2. Beverages

- 10.2.3. Sports & Energy Nutrition

- 10.2.4. Dairy Alternatives

- 10.2.5. Meat Substitutes

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kerry Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AIDP Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RiceBran Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bioway Organic Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Südzucker AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Axiom Foods Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Green Labs LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ribus Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Kerry Group PLC

List of Figures

- Figure 1: Global Oryzenin Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Oryzenin Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Oryzenin Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Oryzenin Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Oryzenin Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Oryzenin Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Oryzenin Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Oryzenin Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Oryzenin Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Oryzenin Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Oryzenin Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Oryzenin Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Oryzenin Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Oryzenin Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Oryzenin Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Oryzenin Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Oryzenin Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Oryzenin Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Oryzenin Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Oryzenin Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Oryzenin Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Oryzenin Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Oryzenin Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Oryzenin Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Oryzenin Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Oryzenin Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Oryzenin Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Oryzenin Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Oryzenin Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Oryzenin Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Oryzenin Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oryzenin Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Oryzenin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Oryzenin Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Oryzenin Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Oryzenin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Oryzenin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Oryzenin Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Oryzenin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: Global Oryzenin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Germany Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: France Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Russia Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Spain Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Oryzenin Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Oryzenin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Oryzenin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: China Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: India Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Australia Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Oryzenin Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Oryzenin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 31: Global Oryzenin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Argentina Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Oryzenin Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 36: Global Oryzenin Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 37: Global Oryzenin Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: South Africa Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Oryzenin Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oryzenin Market?

The projected CAGR is approximately 10.5%.

2. Which companies are prominent players in the Oryzenin Market?

Key companies in the market include Kerry Group PLC, AIDP Inc, RiceBran Technologies, Bioway Organic Group Limited, Südzucker AG, Axiom Foods Inc, The Green Labs LLC, Ribus Inc *List Not Exhaustive.

3. What are the main segments of the Oryzenin Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Surge in Demand for Meat Alternative Products.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Jan 2022: Kerry announced the official opening of a new 21,500-square-foot facility at its Jeddah operation in the Kingdom of Saudi Arabia. Over the past four years, the company invested over EUR 80 million in the region. It was announced that the products manufactured at the new facility would be supplied across the Middle Eastern region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oryzenin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oryzenin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oryzenin Market?

To stay informed about further developments, trends, and reports in the Oryzenin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence