Key Insights

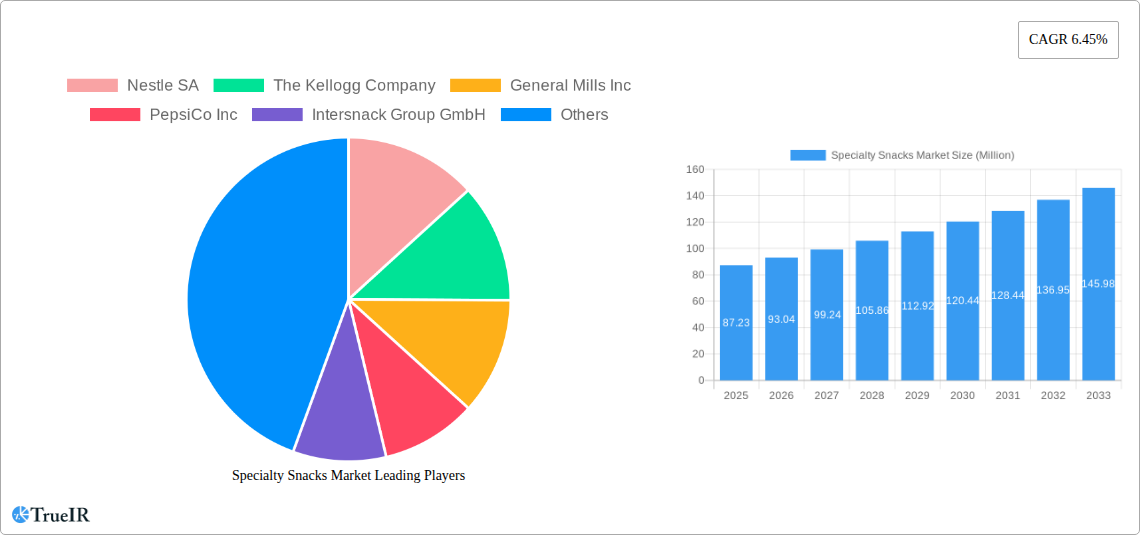

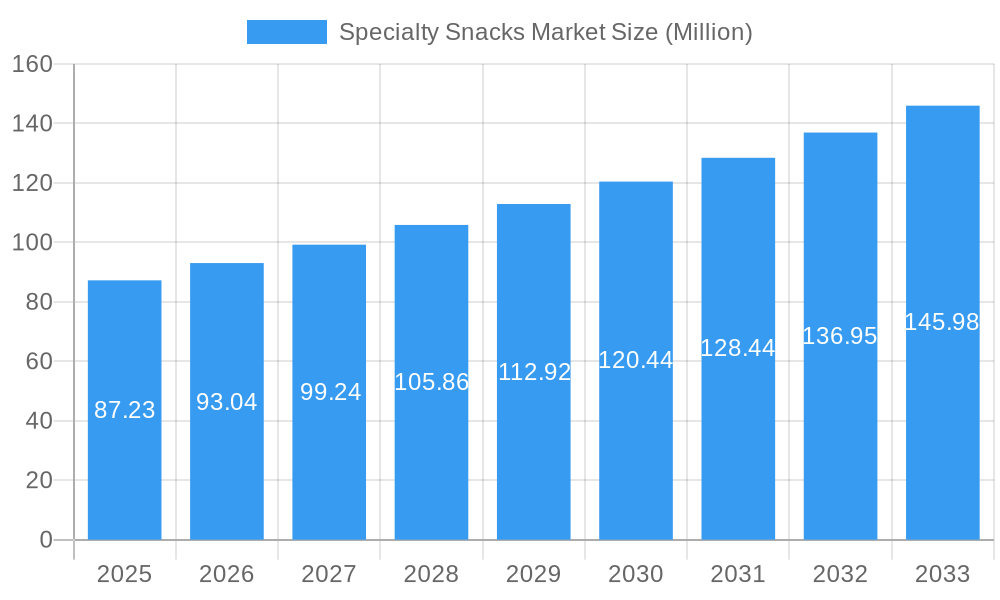

The global Specialty Snacks Market is experiencing robust growth, projected to reach $87.23 million by 2025 with a Compound Annual Growth Rate (CAGR) of 6.45% between 2025 and 2033. This upward trajectory is fueled by evolving consumer preferences towards healthier, more convenient, and indulgent snack options. Key market drivers include the increasing demand for premium ingredients, functional benefits (e.g., protein-rich, gluten-free, plant-based), and diverse flavor profiles that cater to adventurous palates. The rise of the "snacking anytime, anywhere" culture, coupled with busy lifestyles, further propels the adoption of specialty snacks as meal replacements or guilt-free indulgences. Innovation in product development, including the creation of novel snack formats and sustainable packaging, plays a crucial role in capturing consumer attention and driving market expansion.

Specialty Snacks Market Market Size (In Million)

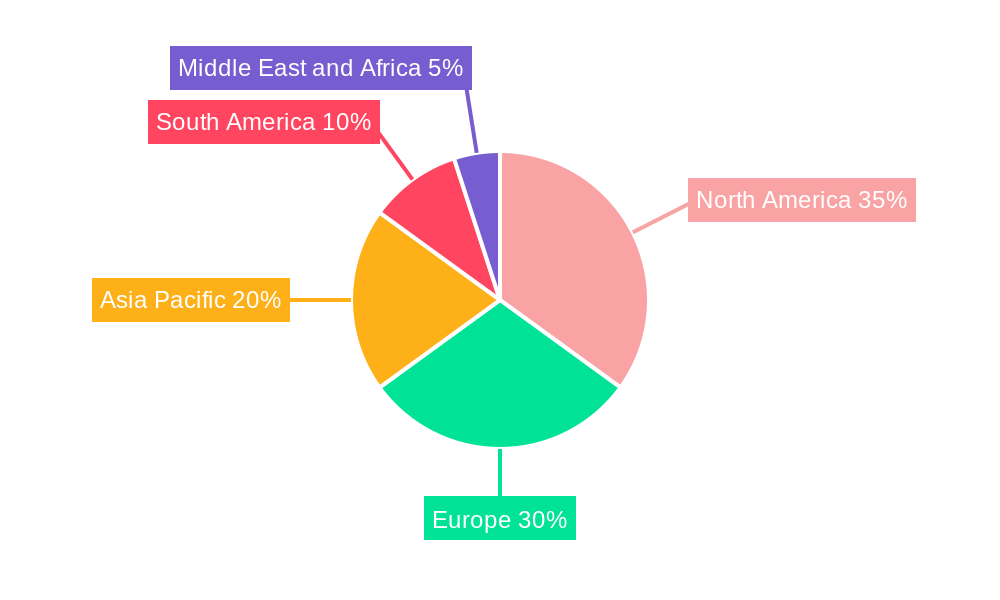

The market is segmented across various product types, with Snack Bars, Bakery-based Snacks, and Nuts and Seeds Snacks emerging as dominant categories. Supermarkets/Hypermarkets and Online Retailer Stores are the primary distribution channels, reflecting both traditional shopping habits and the growing influence of e-commerce in the food sector. Geographically, North America and Europe are expected to maintain significant market shares due to high disposable incomes and a well-established demand for premium food products. However, the Asia Pacific region presents substantial growth opportunities, driven by rising disposable incomes, increasing urbanization, and a burgeoning middle class adopting Western snacking trends. While growth is strong, potential restraints include intense competition from conventional snack manufacturers, fluctuating raw material prices, and the need for continuous product differentiation to maintain consumer interest in an increasingly saturated market.

Specialty Snacks Market Company Market Share

This comprehensive report delves into the dynamic Specialty Snacks Market, analyzing its structure, competitive landscape, key trends, opportunities, and future outlook. Covering the study period from 2019 to 2033, with a base year of 2025, this report provides in-depth insights into a market driven by evolving consumer preferences for healthier, functional, and convenient snacking options.

Specialty Snacks Market Market Structure & Competitive Landscape

The specialty snacks market exhibits a moderately concentrated structure, with key players like Nestle SA, The Kellogg Company, General Mills Inc., PepsiCo Inc., and Mondelez International holding significant market share. Innovation is a primary driver, with companies continuously investing in R&D to develop novel products catering to specific dietary needs and taste profiles, such as keto-friendly, plant-based, and low-sugar options. Regulatory impacts, particularly concerning labeling, health claims, and ingredient transparency, are also shaping the market. Product substitutes, including traditional snacks and fresh food alternatives, present a competitive challenge, necessitating continuous differentiation. End-user segmentation reveals a growing demand from health-conscious millennials and Gen Z consumers, as well as individuals with specific dietary restrictions. Mergers and acquisitions (M&A) are a prominent strategy for market consolidation and expansion, with an estimated XX M&A deals annually in the historical period. The concentration ratio of the top 5 players is estimated at XX%.

- Key Market Structure Factors:

- Moderate market concentration.

- High reliance on product innovation.

- Significant influence of regulatory frameworks.

- Diverse range of product substitutes.

- Growing influence of health-conscious end-users.

- M&A Trends:

- Strategic acquisitions to expand product portfolios.

- Consolidation for enhanced market reach.

- Targeting of niche and innovative snack brands.

Specialty Snacks Market Market Trends & Opportunities

The global specialty snacks market is poised for robust growth, projected to reach a valuation of over $XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This expansion is fueled by a confluence of factors, including rising disposable incomes, an increasingly health-conscious global population, and a pervasive demand for convenient yet nutritious food options. The shift towards mindful eating has propelled segments like snack bars and nuts and seeds snacks to the forefront, as consumers actively seek products that align with their wellness goals. Technological advancements in food processing and ingredient innovation are enabling manufacturers to create a wider array of functional snacks, incorporating elements like probiotics, prebiotics, and adaptogens.

The surge in online retail channels has significantly democratized access to specialty snacks, allowing smaller brands to reach a wider audience and consumers to discover niche products with greater ease. This digital shift is complemented by the enduring popularity of traditional brick-and-mortar channels, such as supermarkets and hypermarkets, which continue to dominate sales due to their extensive product selection and convenience. The market penetration rate for specialty snacks is estimated at XX% and is expected to rise with increased awareness and product availability.

Opportunities abound for companies that can effectively cater to specific dietary preferences, such as gluten-free, vegan, and low-FODMAP options. The growing prevalence of chronic diseases like diabetes also presents a significant opportunity for the development of snacks formulated to manage blood sugar levels, as exemplified by recent product launches. Furthermore, the increasing focus on sustainability and ethical sourcing is creating demand for eco-friendly packaging and responsibly produced ingredients, offering a competitive advantage to brands that prioritize these aspects. The market is also witnessing a trend towards personalization, with consumers seeking customized snack experiences tailored to their individual nutritional needs and taste preferences.

Dominant Markets & Segments in Specialty Snacks Market

The Specialty Snacks Market is characterized by significant regional dominance and segment-specific growth. Globally, North America stands out as a leading region, driven by high consumer awareness regarding health and wellness, coupled with a robust disposable income that supports premium product purchases. Within North America, the United States leads in terms of market value and volume, owing to a well-established distribution network and a strong preference for innovative and health-oriented food products.

In terms of Product Type, Snack Bars are a dominant segment, consistently outperforming others. This is attributable to their convenience, portability, and the wide variety of formulations available, catering to diverse needs like energy boosts, meal replacements, and targeted nutritional benefits. Nuts and Seeds Snacks represent another substantial segment, benefiting from their inherent nutritional value and growing appeal as a healthier alternative to traditional fried snacks. Bakery-based Snacks, while a significant category, are seeing a more measured growth trajectory compared to the faster-paced snack bar and nuts segments. Popped Snacks are gaining traction due to their perceived healthiness and lower fat content compared to fried varieties. The "Other Product Types" category encompasses emerging and niche offerings, demonstrating the market's dynamic and innovative nature.

The Distribution Channel landscape is led by Supermarkets/Hypermarkets, which continue to be the primary point of purchase for a vast majority of specialty snacks due to their broad reach and one-stop-shop convenience. However, Online Retailer Stores are exhibiting the most rapid growth, fueled by evolving consumer shopping habits, the convenience of home delivery, and the ability to discover niche and international brands. Convenience/Grocery Stores play a vital role in impulse purchases and immediate consumption occasions.

- Key Growth Drivers in Dominant Regions and Segments:

- North America (especially USA): High disposable income, strong health and wellness culture, advanced retail infrastructure.

- Snack Bars: Convenience, diverse functional benefits, on-the-go consumption trends.

- Nuts and Seeds Snacks: Perceived health benefits, protein content, versatility in formulations.

- Online Retailer Stores: E-commerce adoption, wider product discovery, direct-to-consumer models.

- Supermarkets/Hypermarkets: Extensive product selection, established consumer trust, accessibility.

Specialty Snacks Market Product Analysis

Product innovation in the specialty snacks market is primarily focused on enhancing nutritional profiles, catering to specific dietary needs, and improving taste and texture. Manufacturers are leveraging advancements in ingredient technology to develop snacks that are low in sugar, high in protein, rich in fiber, and free from common allergens. Competitive advantages are being carved out by brands that successfully incorporate functional ingredients like adaptogens, probiotics, and plant-based proteins, offering tangible health benefits beyond basic sustenance. The application of these products spans from on-the-go energy boosts and healthy meal replacements to targeted nutritional support for individuals managing health conditions.

Key Drivers, Barriers & Challenges in Specialty Snacks Market

The specialty snacks market is propelled by several key drivers, including a heightened consumer focus on health and wellness, leading to increased demand for nutrient-dense and functional snacks. Technological advancements in food science enable the creation of innovative formulations with appealing taste and texture. The growing prevalence of dietary restrictions and lifestyle choices, such as keto, vegan, and gluten-free diets, creates substantial market opportunities. Economic factors like rising disposable incomes in emerging economies also contribute to market growth.

However, the market faces significant barriers and challenges. Supply chain disruptions and volatility in raw material prices, particularly for ingredients like nuts and seeds, can impact profitability and product availability. Stringent regulatory requirements regarding labeling, health claims, and food safety add complexity and cost to product development and market entry. Intense competition from established players and emerging niche brands can lead to price pressures and market saturation. Consumer skepticism towards health claims and the need for transparent ingredient sourcing also pose challenges for brand building and consumer trust.

Growth Drivers in the Specialty Snacks Market Market

Key growth drivers in the specialty snacks market are multifaceted, encompassing technological, economic, and policy-driven factors. Technologically, advancements in food processing and ingredient innovation allow for the development of healthier and more functional snacks, such as those incorporating plant-based proteins, low-glycemic sweeteners like allulose, and novel superfoods. Economically, increasing disposable incomes globally, particularly in emerging markets, are enabling consumers to spend more on premium and health-conscious food options. Policy-wise, growing government initiatives promoting healthier lifestyles and stricter regulations on less healthy food options indirectly favor the specialty snacks market. The rising awareness about the link between diet and chronic diseases, coupled with a greater demand for convenience in busy lifestyles, further fuels the expansion of this market.

Challenges Impacting Specialty Snacks Market Growth

Challenges impacting the specialty snacks market growth are primarily centered around regulatory complexities, supply chain issues, and competitive pressures. Navigating diverse and evolving food regulations across different regions, particularly concerning novel ingredients and health claims, can be a significant hurdle. Supply chain volatility, including fluctuations in the availability and cost of key ingredients like nuts, seeds, and specialty grains, can disrupt production and impact pricing strategies. The market also faces intense competitive pressure from both large multinational corporations and agile start-ups, leading to potential price wars and the need for continuous innovation to maintain market share. Consumer education regarding the benefits of specialty ingredients and the distinction from less healthy alternatives remains an ongoing challenge.

Key Players Shaping the Specialty Snacks Market Market

- Nestle SA

- The Kellogg Company

- General Mills Inc.

- PepsiCo Inc.

- Intersnack Group GmbH

- Conagra Brands Inc (SlimJim)

- Blue Diamond Growers

- Mars Incorporated

- The Kraft Heinz Company

- Mondelez International

Significant Specialty Snacks Market Industry Milestones

- May 2022: Mondelez International acquired Chipita Global SA, a high-growth leader in the Central and Eastern European croissants and baked snacks market, significantly expanding its baked goods portfolio.

- September 2021: General Mills Inc. introduced Good Measure, a new brand of snacks tailored for consumers monitoring blood sugar, including those with diabetes and pre-diabetes. The launch included Creamy Nut Butter Bars and Crunchy Almond Crisps, sweetened with allulose.

- June 2021: The Kellogg Company launched Kellogg's Special K Keto-Friendly Snack Bars, available in chocolate almond fudge and peanut butter fudge flavors, catering to the growing keto diet trend.

Future Outlook for Specialty Snacks Market Market

The future outlook for the specialty snacks market remains exceptionally promising, driven by enduring consumer trends towards health, wellness, and convenience. Strategic opportunities lie in further innovation within functional ingredients, plant-based alternatives, and personalized nutrition solutions. The increasing digital adoption in retail will continue to empower smaller brands and provide consumers with broader access to specialized products. As global awareness of diet's impact on health grows, the demand for snacks that offer tangible benefits, such as improved gut health, energy management, and targeted nutrient delivery, will only intensify. Companies that can adeptly navigate regulatory landscapes, ensure sustainable sourcing, and build strong consumer trust through transparent practices are poised for significant growth and market leadership in the coming years.

Specialty Snacks Market Segmentation

-

1. Product Type

- 1.1. Snack Bars

- 1.2. Bakery-based Snacks

- 1.3. Nuts and Seeds Snacks

- 1.4. Popped Snacks

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retailer Stores

- 2.4. Other Distribution Channels

Specialty Snacks Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Specialty Snacks Market Regional Market Share

Geographic Coverage of Specialty Snacks Market

Specialty Snacks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Convenient and Healthy Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Snack Bars

- 5.1.2. Bakery-based Snacks

- 5.1.3. Nuts and Seeds Snacks

- 5.1.4. Popped Snacks

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retailer Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Snack Bars

- 6.1.2. Bakery-based Snacks

- 6.1.3. Nuts and Seeds Snacks

- 6.1.4. Popped Snacks

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience/Grocery Stores

- 6.2.3. Online Retailer Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Snack Bars

- 7.1.2. Bakery-based Snacks

- 7.1.3. Nuts and Seeds Snacks

- 7.1.4. Popped Snacks

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience/Grocery Stores

- 7.2.3. Online Retailer Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Snack Bars

- 8.1.2. Bakery-based Snacks

- 8.1.3. Nuts and Seeds Snacks

- 8.1.4. Popped Snacks

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience/Grocery Stores

- 8.2.3. Online Retailer Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Snack Bars

- 9.1.2. Bakery-based Snacks

- 9.1.3. Nuts and Seeds Snacks

- 9.1.4. Popped Snacks

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience/Grocery Stores

- 9.2.3. Online Retailer Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Snack Bars

- 10.1.2. Bakery-based Snacks

- 10.1.3. Nuts and Seeds Snacks

- 10.1.4. Popped Snacks

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience/Grocery Stores

- 10.2.3. Online Retailer Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Kellogg Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Mills Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PepsiCo Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Intersnack Group GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Conagra Brands Inc (SlimJim)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Blue Diamond Growers

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mars Incorporated

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Kraft Heinz Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mondelez International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Specialty Snacks Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Specialty Snacks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Specialty Snacks Market?

The projected CAGR is approximately 6.45%.

2. Which companies are prominent players in the Specialty Snacks Market?

Key companies in the market include Nestle SA, The Kellogg Company, General Mills Inc, PepsiCo Inc, Intersnack Group GmbH, Conagra Brands Inc (SlimJim), Blue Diamond Growers, Mars Incorporated, The Kraft Heinz Company, Mondelez International.

3. What are the main segments of the Specialty Snacks Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Growing Demand for Convenient and Healthy Snacking.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

May 2022: Mondelez International acquired Chipita Global SA, a high-growth leader in the Central and Eastern European croissants and baked snacks market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Specialty Snacks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Specialty Snacks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Specialty Snacks Market?

To stay informed about further developments, trends, and reports in the Specialty Snacks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence