Key Insights

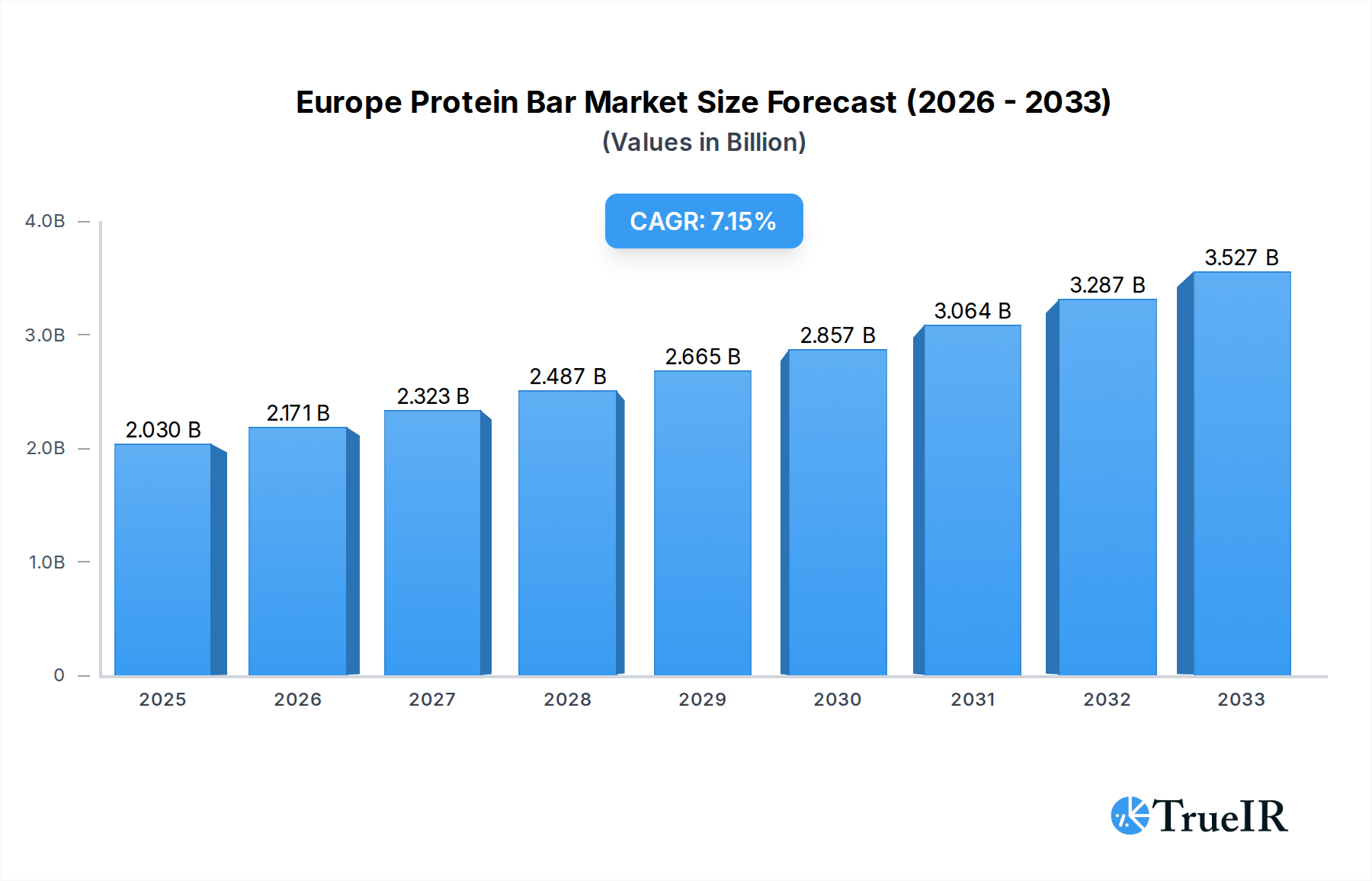

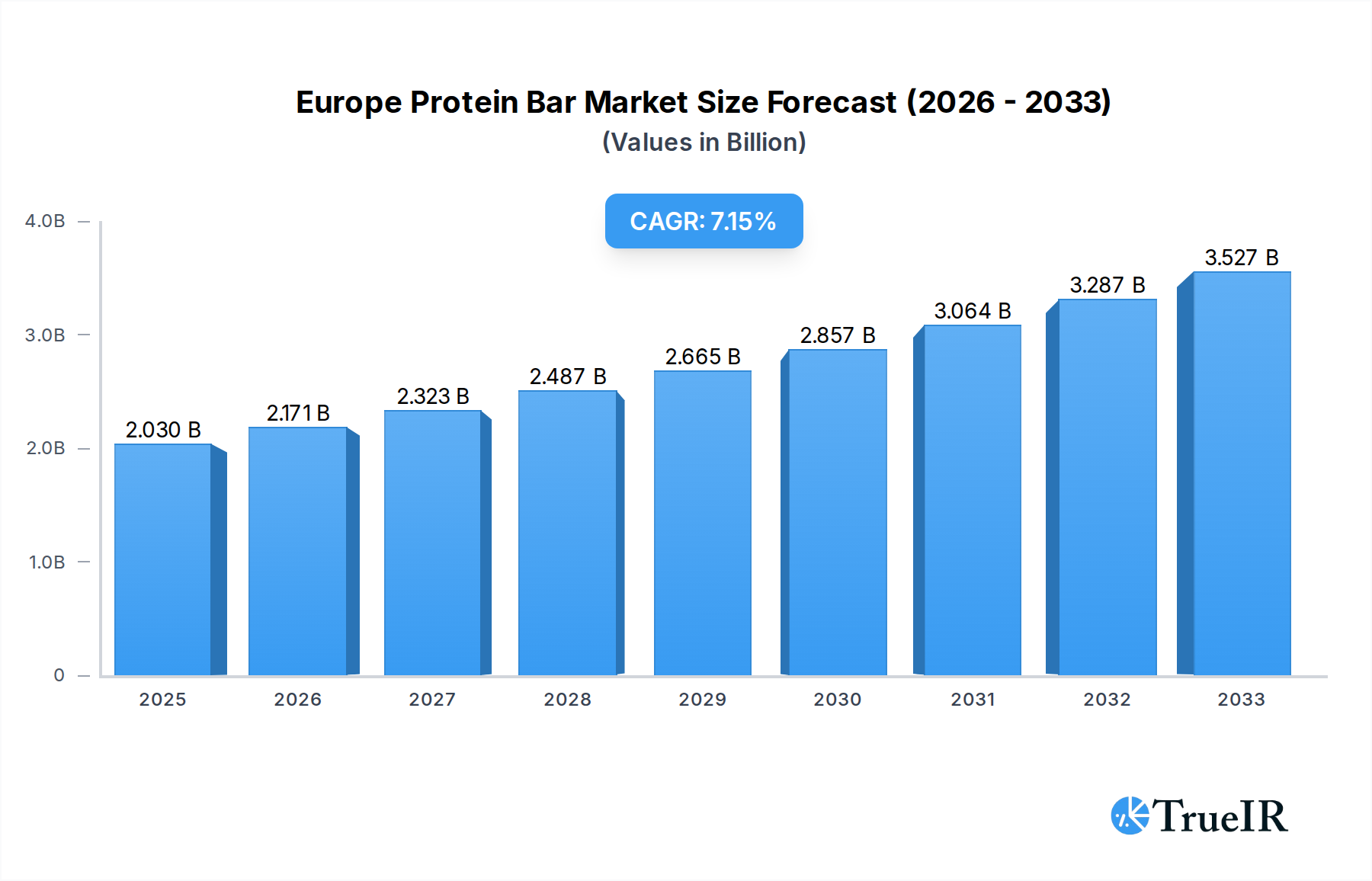

The European protein bar market is poised for robust growth, projected to reach USD 2.03 billion in 2025 with a significant Compound Annual Growth Rate (CAGR) of 6.8%. This expansion is primarily fueled by increasing consumer awareness of health and wellness, the growing demand for convenient and on-the-go nutritional solutions, and the rising popularity of sports nutrition products among both athletes and fitness enthusiasts. The market's dynamism is further propelled by the continuous introduction of innovative product formulations, incorporating diverse protein sources, appealing flavors, and functional ingredients to cater to evolving consumer preferences. Furthermore, the trend towards plant-based and vegan protein options is gaining substantial traction, reflecting a broader shift in dietary habits across Europe.

Europe Protein Bar Market Market Size (In Billion)

Several factors are expected to drive this upward trajectory. The increasing prevalence of obesity and lifestyle-related diseases is prompting consumers to seek healthier snack alternatives, with protein bars emerging as a favored choice for their satiating properties and contribution to muscle health. The accessibility and variety offered through various distribution channels, including supermarkets, convenience stores, specialty outlets, and a rapidly growing online segment, are also playing a crucial role in market expansion. While the market benefits from strong growth drivers, potential restraints include intense competition from established and emerging players, fluctuating raw material prices for protein sources, and the need for continuous product innovation to stay ahead of evolving consumer demands and dietary trends. The market is segmented by distribution channel, with supermarkets/hypermarkets currently holding a significant share, though online stores are expected to witness rapid growth.

Europe Protein Bar Market Company Market Share

Europe Protein Bar Market Report: Unlocking Growth in a Billion-Dollar Industry (2019-2033)

This comprehensive report delves into the dynamic Europe protein bar market, a sector projected to witness significant expansion, reaching an estimated valuation of over USD 3 billion by 2025. With a detailed study period spanning from 2019 to 2033, encompassing historical analysis (2019-2024), a base year of 2025, and an extensive forecast period from 2025 to 2033, this report provides unparalleled insights into market drivers, trends, opportunities, and competitive strategies. Leveraging high-volume SEO keywords such as "protein bar Europe," "healthy snacks market," "nutritional supplements," and "sports nutrition," this analysis is meticulously crafted for industry professionals, investors, and manufacturers seeking to capitalize on the burgeoning demand for convenient and health-conscious food options.

Europe Protein Bar Market Market Structure & Competitive Landscape

The Europe protein bar market is characterized by a moderately concentrated landscape, with a blend of global conglomerates and agile niche players vying for market share. Innovation remains a critical differentiator, driven by the increasing consumer focus on health and wellness, leading to a surge in product development targeting specific dietary needs, such as vegan protein bars, low-sugar protein bars, and plant-based protein bars. Regulatory frameworks, while generally supportive of food product development, require adherence to strict labeling and nutritional content standards across different European nations. Product substitutes, including protein shakes, protein yogurts, and other convenient protein sources, pose a competitive challenge, necessitating continuous product differentiation and value proposition enhancement. End-user segmentation reveals a strong presence among fitness enthusiasts, athletes, and health-conscious individuals seeking convenient nutritional solutions. Mergers and acquisitions (M&A) activity is a notable trend, with Mondelez International's acquisition of Clif Bar & Company for over USD 1 billion in August 2022 highlighting consolidation efforts and strategic expansion within the broader snack bar segment. This M&A trend, alongside strategic partnerships and product line extensions, is expected to shape the competitive dynamics, with companies like The Kellogg Company, PepsiCo Inc., The Simply Good Foods Company (Quest Nutrition LLC), Mondelēz International Inc (Clif Bar & Company), Mars Incorporated (Kind LLC), Optimum Nutrition Inc, Barebells Functional Foods AB, General Mills Inc, Nestlé S A, and Class Delta Ltd (Protein Works) actively contributing to market evolution.

Europe Protein Bar Market Market Trends & Opportunities

The Europe protein bar market is poised for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is fueled by a confluence of evolving consumer preferences, technological advancements, and strategic market initiatives. The increasing health consciousness across Europe has positioned protein bars as a go-to snack for a broad demographic, extending beyond traditional athletes to include busy professionals, students, and older adults seeking convenient ways to meet their daily protein intake. This dietary shift represents a substantial market opportunity for manufacturers to innovate and cater to a wider consumer base.

Technological advancements are playing a pivotal role in shaping the Europe protein bar market. Innovations in ingredient sourcing, such as the development of novel plant-based protein sources and clean label ingredients, are addressing consumer demand for natural and sustainable products. Furthermore, advancements in flavor profiling and texture development are leading to more palatable and appealing protein bars, enhancing consumer satisfaction and driving repeat purchases. The integration of functional ingredients, including vitamins, minerals, and probiotics, is also a growing trend, transforming protein bars into more comprehensive nutritional solutions.

Consumer preferences are increasingly leaning towards personalized nutrition and functional benefits. This presents a significant opportunity for brands to develop specialized protein bars catering to specific needs, such as post-workout recovery bars, meal replacement bars, and energy-boosting bars. The demand for sugar-free protein bars and keto-friendly protein bars is also on the rise, indicating a growing awareness of macronutrient content and its impact on health goals. Online retail channels are becoming increasingly influential, offering consumers unparalleled convenience and a wider selection of products, thereby creating a significant opportunity for e-commerce-focused brands and strategies.

Competitive dynamics within the Europe protein bar market are intensifying, with established players and emerging brands alike investing in marketing, product innovation, and strategic distribution. The launch of multipack missions by Grenade in the UK's major retailers like Tesco and Sainsbury's in September 2022 exemplifies the strategies employed to capture market share through convenient and value-driven offerings. Similarly, the acquisition of Clif Bar & Company by Mondelez International underscores the consolidation trend, aiming to leverage synergies and expand global reach. The introduction of vegan protein bars by SternVitamin and SternLife in May 2022 highlights the industry's responsiveness to emerging dietary trends and sustainability concerns. These developments collectively point towards a dynamic and opportunity-rich market, where agility, innovation, and consumer-centric approaches will be key to sustained success. The penetration rate of protein bars is steadily increasing, especially in urban centers and among younger demographics, signaling substantial headroom for further market penetration and growth.

Dominant Markets & Segments in Europe Protein Bar Market

The Europe protein bar market exhibits distinct regional dominance and segment leadership, driven by a combination of demographic factors, consumer purchasing power, and retail infrastructure.

United Kingdom: A Leading Market Hub

- Market Dominance: The United Kingdom consistently emerges as a frontrunner in the Europe protein bar market. This leadership is attributed to a highly developed health and wellness culture, robust disposable incomes, and widespread consumer adoption of fitness and dietary supplements.

- Growth Drivers:

- High Health Consciousness: A significant portion of the UK population actively engages in fitness activities and prioritizes healthy eating, creating a strong demand for protein-rich snacks.

- Retail Penetration: The presence of major supermarket chains like Tesco and Sainsbury's, which actively feature protein bars in their 'Fan Favourites' and promotional sections, ensures broad accessibility. The launch of Grenade's multipack missions in these retailers exemplifies this strong retail support.

- Athletic Population: A large and active community of athletes and fitness enthusiasts actively seeks out protein bars for performance enhancement and recovery.

- Online Retail Growth: The rapid expansion of e-commerce platforms in the UK facilitates easy access to a wide array of protein bar brands and products.

Germany and France: Emerging Powerhouses

- Market Contribution: Germany and France represent significant and growing markets for protein bars. Germany, with its established food manufacturing sector and increasing consumer interest in functional foods, is a key player. France, driven by a rising focus on health and lifestyle, is also showing substantial growth.

- Growth Drivers:

- Increasing Awareness of Health Benefits: Consumers in both countries are becoming more aware of the health benefits associated with protein consumption.

- Growing Sports Nutrition Segment: The sports nutrition market is expanding in both Germany and France, directly benefiting the protein bar segment.

- Product Diversification: Manufacturers are increasingly introducing diverse product offerings, including vegan and specialized protein bars, to cater to evolving consumer needs in these markets.

Distribution Channel Analysis: Online Stores Leading the Charge

Online Stores: This segment is experiencing the most significant growth and is projected to become the dominant distribution channel within the Europe protein bar market.

- Convenience and Accessibility: Consumers appreciate the ease of ordering from home and having products delivered directly to their doorstep.

- Wider Product Selection: Online platforms offer a far more extensive range of brands, flavors, and specialized protein bars than physical retail outlets.

- Competitive Pricing: E-commerce often facilitates competitive pricing and attractive promotional offers, drawing in price-conscious consumers.

- Personalized Marketing: Online retailers can leverage data to offer personalized recommendations and targeted marketing campaigns.

Supermarkets/Hypermarkets: This remains a crucial channel, providing broad reach and visibility.

- Impulse Purchases: Their widespread presence makes them ideal for impulse buys and convenient top-ups for consumers.

- Brand Visibility: Prominent placement in supermarket aisles ensures consistent brand exposure to a large consumer base.

- Product Bundling: Opportunities exist for cross-promotions with other health food or beverage items.

Specialty Stores: These include health food stores and dedicated sports nutrition retailers.

- Niche Market Focus: They cater to a more informed and dedicated consumer base seeking specialized products.

- Expert Advice: Consumers can often receive expert advice and product recommendations, fostering loyalty.

Convenience Stores: Offer grab-and-go options for consumers on the move.

- On-the-Go Consumption: Protein bars are ideal for quick snacks and energy boosts throughout the day.

- Location Advantage: Their ubiquity in high-traffic areas ensures accessibility.

Other Distribution Channels: This category might include gyms, vending machines in workplaces or educational institutions, and direct-to-consumer (DTC) sales through brand websites. These channels cater to specific consumption occasions and target audiences.

The interplay between these dominant markets and evolving distribution channels will continue to shape the Europe protein bar market, presenting unique opportunities for strategic market entry and expansion.

Europe Protein Bar Market Product Analysis

Product innovation is central to the Europe protein bar market. Manufacturers are actively developing bars with enhanced nutritional profiles, focusing on high protein content, low sugar, and natural ingredients. The rise of vegan protein bars, exemplified by the launch from SternVitamin and SternLife, signifies a key trend driven by ethical and environmental concerns. Competitive advantages are increasingly derived from unique flavor combinations, allergen-free formulations (e.g., gluten-free, dairy-free), and the incorporation of functional ingredients like probiotics and adaptogens. These advancements cater to a diverse range of consumer needs, from athletic performance and weight management to general wellness, ensuring sustained market relevance and appeal.

Key Drivers, Barriers & Challenges in Europe Protein Bar Market

The Europe protein bar market is propelled by several key drivers, primarily the escalating consumer demand for convenient, health-conscious food options. The growing awareness of protein's benefits for muscle building, satiety, and overall well-being significantly fuels this demand. Technological advancements in ingredient processing and flavor development enable manufacturers to create more appealing and diverse product portfolios, catering to specific dietary preferences like vegan protein bars and low-carb protein bars. Economic factors, such as rising disposable incomes in key European regions, also contribute to the market's growth, allowing consumers to invest in premium health foods. Policy-driven initiatives promoting healthier lifestyles and nutrition further support market expansion.

However, the market faces significant barriers and challenges. Supply chain disruptions, including volatility in raw material prices and logistical complexities, can impact production costs and product availability. Stringent regulatory hurdles concerning food labeling, ingredient claims, and health certifications across different European countries can create compliance complexities for manufacturers. Intense competitive pressures from both established brands and emerging players lead to price sensitivity and necessitate continuous innovation to maintain market share. Furthermore, consumer skepticism regarding the taste and texture of some protein bars, coupled with the availability of protein bar substitutes like shakes and yogurts, presents ongoing challenges for market penetration and consumer adoption. The economic downturn in some regions can also affect discretionary spending on premium food products.

Growth Drivers in the Europe Protein Bar Market Market

The Europe protein bar market is experiencing robust growth driven by several interconnected factors. The escalating health and wellness trend across the continent is a primary catalyst, with consumers actively seeking convenient nutritional solutions to support active lifestyles and dietary goals. Technological advancements in food science are enabling the creation of more palatable and functional protein bars, featuring innovative flavor profiles and improved textures. The increasing popularity of plant-based diets is creating a significant demand for vegan protein bars, expanding the market's reach. Furthermore, economic factors such as rising disposable incomes in key European countries allow consumers to prioritize expenditure on premium health foods. Regulatory support for clearer nutritional labeling and health claims also contributes to consumer confidence and market expansion.

Challenges Impacting Europe Protein Bar Market Growth

Despite its growth trajectory, the Europe protein bar market faces several impediments. Supply chain volatility poses a significant challenge, impacting the cost and availability of key ingredients like whey and plant-based proteins. Navigating the complex and diverse regulatory landscapes across different European nations, particularly concerning ingredient sourcing and labeling standards, can be burdensome. Intense competitive pressures from a crowded market, with numerous established brands and new entrants, lead to pricing pressures and the constant need for product differentiation and marketing investment. Moreover, consumer perception regarding the taste and palatability of certain protein bars remains a barrier, alongside the availability of a wide range of protein bar substitutes such as protein shakes and ready-to-eat meals. Economic uncertainties and inflation can also impact consumer spending on discretionary food items.

Key Players Shaping the Europe Protein Bar Market Market

- The Kellogg Company

- PepsiCo Inc

- The Simply Good Foods Company (Quest Nutrition LLC)

- Mondelēz International Inc (Clif Bar & Company)

- Mars Incorporated (Kind LLC)

- Optimum Nutrition Inc

- Barebells Functional Foods AB

- General Mills Inc

- Nestlé S A

- Class Delta Ltd (Protein Works)

Significant Europe Protein Bar Market Industry Milestones

- September 2022: Grenade, a UK-based protein bar brand, launched two multipack missions in Tesco and Sainsbury's, featuring 10-pack selection boxes of their popular (60g) protein bars with flavors including chocolate chips salted caramel, white chocolate salted peanut, cookie dough, and white chocolate cookie, and fudged up. This initiative aimed to enhance customer accessibility and choice.

- August 2022: Mondelez International, Inc. acquired Clif Bar & Company, a renowned provider of energy bars with leading brands like CLIF, CLIF Kid, and LUNA. This acquisition is anticipated to significantly boost Mondelez International's global snack bar business, projected to exceed USD 1 billion.

- May 2022: SternVitamin and SternLife, subsidiaries of the German-based Stern-Wywiol Gruppe, introduced a new vegan protein bar, addressing the growing consumer demand for plant-based and ethical food options in the market.

Future Outlook for Europe Protein Bar Market Market

The future outlook for the Europe protein bar market is exceptionally promising, driven by sustained consumer interest in health, convenience, and functional nutrition. The market is expected to witness continued innovation in plant-based protein bars, catering to ethical and environmental concerns. Advancements in ingredient technology will likely lead to bars with improved taste profiles, textures, and enhanced nutritional benefits, such as added vitamins, minerals, and probiotics. The expansion of online retail channels will further democratize access and foster personalized consumer experiences. Strategic collaborations and potential mergers among key players will continue to shape the competitive landscape. Emerging markets within Europe are anticipated to show accelerated growth, presenting new opportunities for market penetration. The increasing focus on personalized nutrition and specialized dietary needs, such as keto and low-sugar options, will also be a significant growth catalyst, ensuring the Europe protein bar market remains a dynamic and lucrative sector for years to come.

Europe Protein Bar Market Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Specialty Stores

- 1.4. Online Stores

- 1.5. Other Distribution Channels

Europe Protein Bar Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

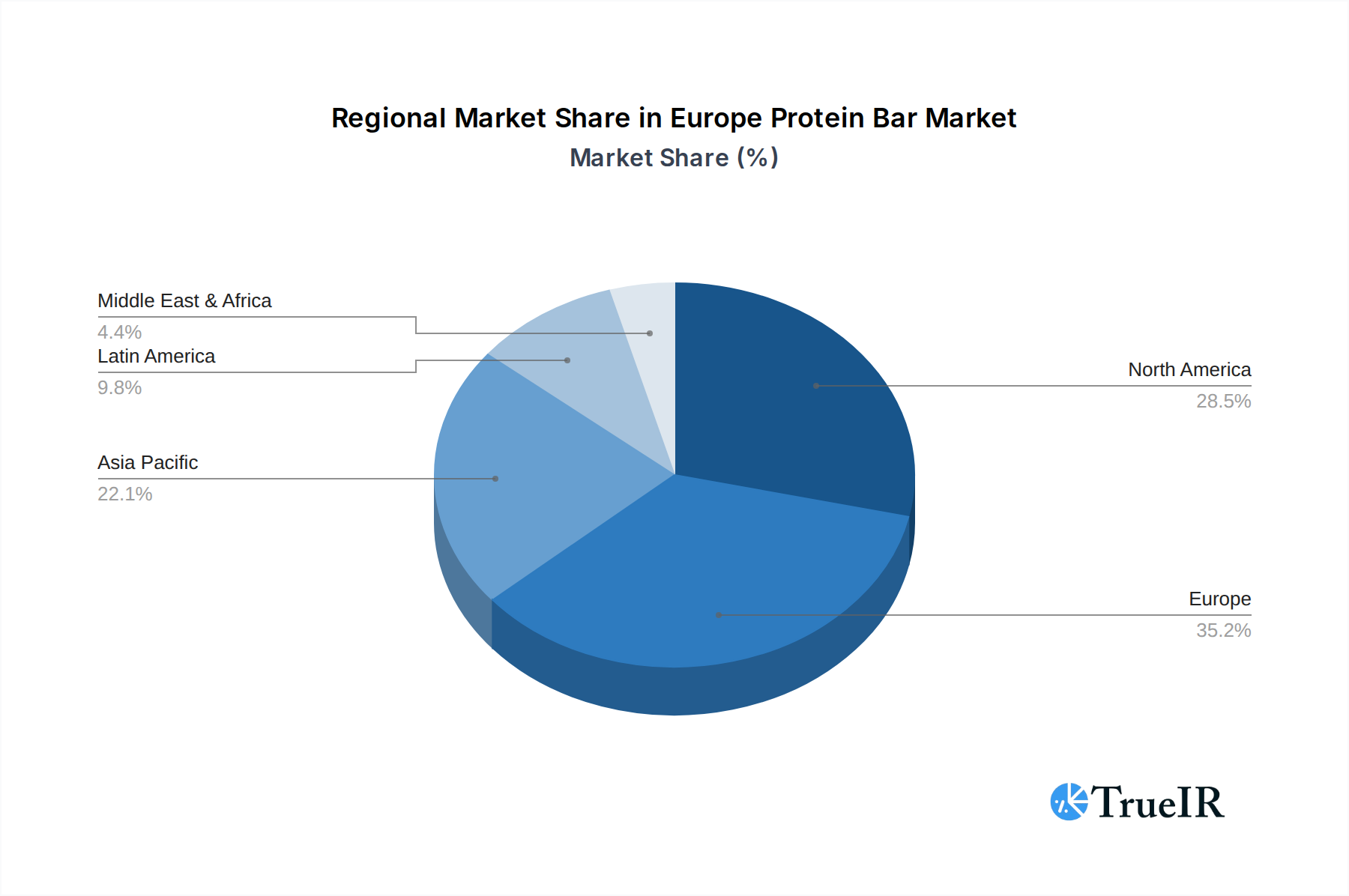

Europe Protein Bar Market Regional Market Share

Geographic Coverage of Europe Protein Bar Market

Europe Protein Bar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Hypermarkets/Supermarkets to Drive the Regional Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Protein Bar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Specialty Stores

- 5.1.4. Online Stores

- 5.1.5. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Kellogg Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PepsiCo Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Simply Good Foods Company (Quest Nutrition LLC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mondelēz International Inc (Clif Bar & Company)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mars Incorporated (Kind LLC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Optimum Nutrition Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Barebells Functional Foods AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Mills Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nestlé S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Class Delta Ltd (Protein Works)*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Kellogg Company

List of Figures

- Figure 1: Europe Protein Bar Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Protein Bar Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Protein Bar Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: Europe Protein Bar Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Protein Bar Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Protein Bar Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Protein Bar Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Protein Bar Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Europe Protein Bar Market?

Key companies in the market include The Kellogg Company, PepsiCo Inc, The Simply Good Foods Company (Quest Nutrition LLC), Mondelēz International Inc (Clif Bar & Company), Mars Incorporated (Kind LLC), Optimum Nutrition Inc, Barebells Functional Foods AB, General Mills Inc, Nestlé S A, Class Delta Ltd (Protein Works)*List Not Exhaustive.

3. What are the main segments of the Europe Protein Bar Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.03 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Hypermarkets/Supermarkets to Drive the Regional Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2022, United Kingdom-based protein bar brand, Grenade, launched 2 multipack missions for customers looking to get their protein bar fix. The products were launched in Tesco and Sainsbury's 'Fan Favourites' featuring a 10-pack selection box of Grenade's popular (60g) protein bars. The new launches comprised two bars of flavors including chocolate chips salted caramel, white chocolate salted peanut, cookie dough, and white chocolate cookie, and fudged up.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Protein Bar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Protein Bar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Protein Bar Market?

To stay informed about further developments, trends, and reports in the Europe Protein Bar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence