Key Insights

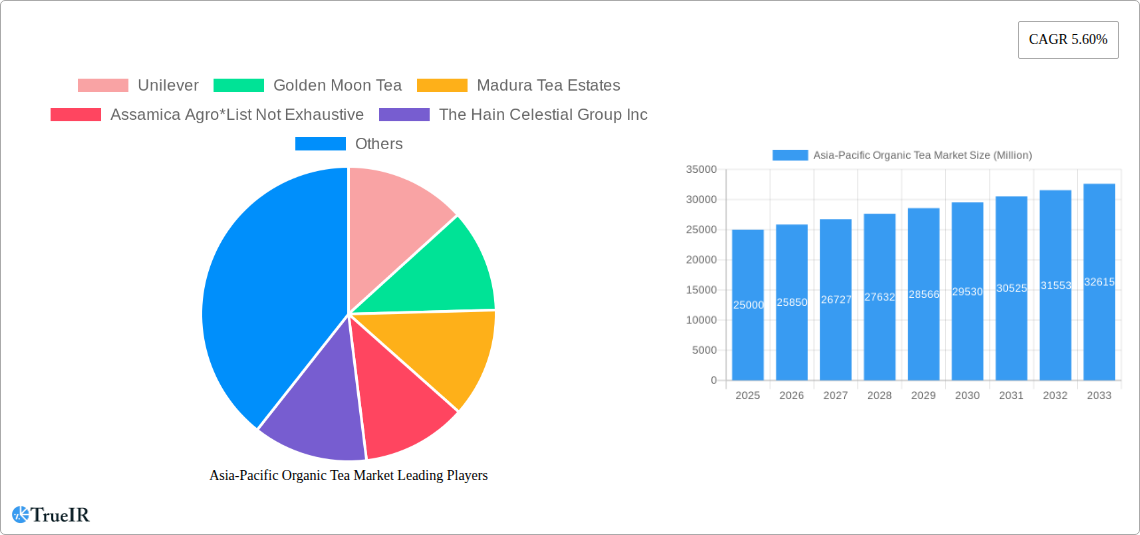

The Asia-Pacific organic tea market is poised for significant expansion, projected to reach USD 25 billion by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.4% through 2033. This robust growth is fueled by an increasing consumer preference for healthier, sustainably sourced beverages, driven by heightened awareness of the adverse effects of pesticides and artificial additives. Consumers across the region are actively seeking organic alternatives, with rising disposable incomes and a growing middle class in key markets like India and China further accelerating this trend. The product landscape is diversifying, with green tea and herbal tea segments witnessing particularly strong demand due to their perceived health benefits and a growing interest in wellness beverages. Packaging innovations, such as convenient tea bags and eco-friendly loose-leaf options, are also catering to evolving consumer lifestyles and sustainability concerns.

Asia-Pacific Organic Tea Market Market Size (In Billion)

The market's expansion is further supported by the proactive engagement of major players like Tata Group and Unilever, alongside emerging brands emphasizing purity and ethical sourcing. Distribution channels are broadening, with online stores playing an increasingly crucial role in reaching a wider consumer base, complementing traditional retail presence in supermarkets and hypermarkets. While the market exhibits strong growth potential, certain factors could influence its trajectory. Stringent organic certification processes and the higher cost associated with organic production might present challenges. However, the overarching trend towards mindful consumption, coupled with government initiatives promoting sustainable agriculture in countries like India and China, is expected to drive sustained growth and market penetration for organic teas across the Asia-Pacific region.

Asia-Pacific Organic Tea Market Company Market Share

This in-depth report offers a dynamic, SEO-optimized analysis of the Asia-Pacific Organic Tea Market, crucial for industry stakeholders seeking to understand evolving consumer preferences, competitive landscapes, and future growth trajectories. Leveraging high-volume keywords such as "organic tea Asia-Pacific," "green tea market," "black tea market," and "herbal tea demand," this report provides actionable insights for businesses operating within or looking to enter this burgeoning sector. Our comprehensive study spans from 2019 to 2033, with a base year of 2025 and a detailed forecast period from 2025 to 2033, providing a robust outlook for market expansion.

Asia-Pacific Organic Tea Market Market Structure & Competitive Landscape

The Asia-Pacific Organic Tea Market is characterized by a moderately fragmented structure, with a mix of large multinational corporations and smaller, specialized organic tea producers. Innovation is a key driver, with companies continuously introducing new blends, functional teas, and sustainable packaging solutions to capture consumer attention. Regulatory frameworks surrounding organic certifications and labeling vary across countries, presenting both challenges and opportunities for market entrants. Product substitutes, such as conventional teas, coffee, and other beverages, exert pressure, necessitating a strong emphasis on the unique health and environmental benefits of organic tea. End-user segmentation reveals a growing demand from health-conscious millennials and Gen Z consumers, as well as a sustained interest from traditional tea-drinking populations seeking premium and healthier options. Mergers and acquisitions (M&A) are anticipated to play a significant role in market consolidation, with larger players looking to acquire innovative startups and expand their product portfolios. For instance, the historical period (2019-2024) saw an estimated xx number of M&A deals within the broader beverage sector with a focus on organic products. The Herfindahl-Hirschman Index (HHI) for the Asia-Pacific organic tea market is estimated to be around xx, indicating moderate concentration.

Asia-Pacific Organic Tea Market Market Trends & Opportunities

The Asia-Pacific Organic Tea Market is poised for substantial growth, driven by a confluence of evolving consumer preferences, increasing health awareness, and a growing demand for sustainable products. The market size is projected to reach an estimated value of over $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). Technological advancements are playing a pivotal role, from enhanced agricultural practices that improve organic tea yields and quality to innovative processing techniques that preserve the natural beneficial compounds in tea leaves. The rise of e-commerce and direct-to-consumer (DTC) models presents significant opportunities for brands to reach wider audiences and build stronger customer relationships. Consumer preferences are shifting towards premium, ethically sourced, and functional organic teas, with a particular interest in variants offering specific health benefits, such as stress relief, immune support, and digestive wellness. This trend is further amplified by the increasing prevalence of chronic diseases and a proactive approach to well-being across the region. Competitive dynamics are intensifying, with established players and new entrants vying for market share through product differentiation, strategic partnerships, and aggressive marketing campaigns. The growing disposable income in many Asia-Pacific nations is also a key enabler of premium product adoption, including high-quality organic teas. Furthermore, the growing awareness of environmental sustainability and the detrimental effects of pesticide use on health and ecosystems is driving a strong preference for organic alternatives. The market penetration rate for organic tea in the Asia-Pacific region is expected to climb from an estimated xx% in 2025 to over xx% by 2033, highlighting the rapid adoption of these healthier and more sustainable beverage options.

Dominant Markets & Segments in Asia-Pacific Organic Tea Market

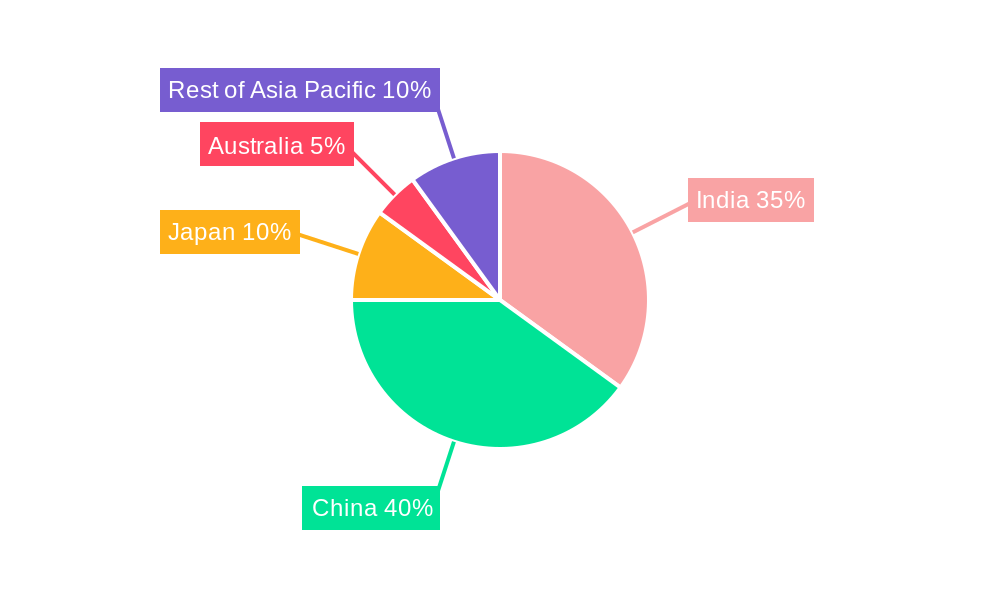

Within the Asia-Pacific Organic Tea Market, China is emerging as a dominant force, driven by its vast population, increasing disposable income, and a rapidly growing middle class with a burgeoning interest in health and wellness. The market's dominance is further bolstered by significant government support for organic agriculture and a well-established tea culture. India also presents a substantial market, being one of the world's largest tea producers and exporters, with a growing domestic demand for organic and specialty teas.

Dominant Product Types:

- Green Tea: This segment is experiencing robust growth, fueled by its perceived health benefits, including antioxidant properties and its association with weight management and cardiovascular health. The ease of preparation and refreshing taste make it a popular choice across various demographics.

- Black Tea: While traditional, organic black tea is witnessing a resurgence, particularly in its premium variants and flavored infusions, catering to established tea-drinking habits with a healthier, organic twist.

Dominant Packaging Formats:

- Bags: The convenience of tea bags continues to drive their dominance, especially for everyday consumption in households and offices.

- Loose: A growing segment of connoisseurs and health-conscious consumers are opting for loose-leaf organic teas, valuing the superior quality, freshness, and the ritual of brewing.

Dominant Distribution Channels:

- Supermarkets/Hypermarkets: These remain the primary retail touchpoints for a broad consumer base, offering wide selection and accessibility.

- Online Stores: The e-commerce boom has significantly propelled online sales, providing consumers with unparalleled access to specialized organic tea brands and a wider variety of products, including subscription services.

Dominant Geographies:

- China: Its sheer market size and growing health consciousness make it a leading region.

- India: A significant producer and consumer with a rapidly expanding organic market.

- Japan: A mature market with a deep-rooted tea culture and a high appreciation for quality and health benefits.

Key growth drivers include supportive government policies promoting organic farming, increased consumer awareness regarding the health and environmental benefits of organic products, and the expansion of modern retail infrastructure. The growing adoption of e-commerce platforms further democratizes access to organic tea, particularly in developing regions.

Asia-Pacific Organic Tea Market Product Analysis

Product innovations in the Asia-Pacific Organic Tea Market are heavily focused on health and wellness, with a surge in functional organic teas infused with superfoods, adaptogens, and therapeutic herbs. Companies are leveraging advanced extraction and preservation techniques to maximize the bioavailability of beneficial compounds. Competitive advantages are being carved out through unique flavor profiles, sustainable sourcing stories, and eco-friendly packaging. The market is witnessing a strong emphasis on certifications like USDA Organic and EU Organic to build consumer trust and product credibility. Technological advancements in agricultural practices are leading to higher yields and improved quality of organic tea leaves, enabling brands to offer premium products at competitive price points.

Key Drivers, Barriers & Challenges in Asia-Pacific Organic Tea Market

Key Drivers:

- Rising Health and Wellness Consciousness: Consumers are increasingly prioritizing healthier food and beverage choices, driving demand for organic teas due to their perceived lack of pesticides and artificial additives.

- Growing Disposable Income: Increased purchasing power in many Asia-Pacific nations allows consumers to opt for premium organic products.

- Environmental Sustainability Concerns: A growing awareness of the ecological benefits of organic farming practices is influencing consumer choices.

- Government Initiatives and Support: Favorable policies promoting organic agriculture and certifications in countries like China and India are boosting production and market growth.

Barriers & Challenges:

- Higher Production Costs: Organic farming often incurs higher labor and certification costs, leading to premium pricing that can be a barrier for price-sensitive consumers.

- Supply Chain Complexities: Ensuring consistent quality and availability of organic tea across diverse geographical regions can be challenging, involving stringent sourcing and logistical management.

- Regulatory Hurdles and Varied Standards: Navigating the diverse organic certification requirements and labeling regulations across different Asia-Pacific countries can be complex for businesses.

- Intense Competition: The market faces competition from both conventional tea brands and other healthy beverage alternatives, requiring continuous product innovation and effective marketing.

Growth Drivers in the Asia-Pacific Organic Tea Market Market

The Asia-Pacific Organic Tea Market is experiencing significant growth propelled by several key factors. The escalating global consciousness towards health and wellness is a primary driver, with consumers actively seeking natural and pesticide-free beverages like organic tea for its inherent health benefits. This trend is amplified by the growing prevalence of lifestyle diseases, prompting a shift towards preventative healthcare and healthier dietary choices. Economically, rising disposable incomes across the Asia-Pacific region, particularly in emerging economies, are enabling consumers to allocate more spending towards premium and ethically produced goods, including organic teas. Furthermore, government support through favorable policies, subsidies for organic farming, and the promotion of organic certifications in key markets like China and India are creating a conducive environment for market expansion and increased production. Technological advancements in organic farming, such as precision agriculture and sustainable cultivation techniques, are also contributing to improved yields and quality, making organic tea more accessible and appealing.

Challenges Impacting Asia-Pacific Organic Tea Market Growth

Despite the promising growth, the Asia-Pacific Organic Tea Market faces several significant challenges. The higher cost of production associated with organic farming, including the expense of certification and labor-intensive methods, can translate into premium pricing. This elevated price point may pose a barrier for a segment of price-sensitive consumers, limiting market penetration in some demographics. Supply chain complexities represent another considerable hurdle. Ensuring the consistent availability of high-quality organic tea across the vast and diverse Asia-Pacific region requires robust logistical networks and stringent quality control measures, from cultivation to distribution. Regulatory complexities also present a challenge, as varying organic certification standards and labeling requirements across different countries can be cumbersome for businesses to navigate and comply with. Finally, the market is subject to intense competitive pressures, not only from other organic tea brands but also from conventional teas and a wide array of alternative healthy beverage options. This necessitates continuous innovation, effective branding, and strategic marketing to maintain and grow market share.

Key Players Shaping the Asia-Pacific Organic Tea Market Market

- Unilever

- Golden Moon Tea

- Madura Tea Estates

- Assamica Agro

- The Hain Celestial Group Inc

- Tata Group

- Organic India

- Orgse Tea

Significant Asia-Pacific Organic Tea Market Industry Milestones

- 2020 January: Launch of a new line of functional organic herbal teas by Organic India, focusing on stress relief and immune support, catering to the growing wellness trend.

- 2021 March: Unilever announces its commitment to sourcing 100% of its tea sustainably by 2025, with a notable increase in its organic tea portfolio, indicating a strategic shift towards healthier and more sustainable offerings.

- 2022 July: Madura Tea Estates expands its organic green tea production capacity in Australia, driven by increasing domestic and export demand, highlighting regional growth.

- 2023 February: The Hain Celestial Group Inc. acquires a majority stake in a prominent Chinese organic tea company, signaling the growing interest of global players in the expanding Chinese organic market.

- 2024 May: Assamica Agro introduces innovative, biodegradable packaging for its organic black tea range, aligning with increasing consumer demand for eco-friendly products.

Future Outlook for Asia-Pacific Organic Tea Market Market

The future outlook for the Asia-Pacific Organic Tea Market is exceptionally positive, driven by sustained growth catalysts and emerging opportunities. The increasing consumer consciousness regarding health, wellness, and environmental sustainability will continue to be the primary growth engine. Strategic opportunities lie in the expansion of product portfolios to include more specialized functional teas, such as those catering to cognitive function or gut health. The continued adoption of e-commerce and direct-to-consumer models will enable brands to reach wider audiences and foster stronger customer loyalty. Furthermore, government support for organic agriculture in key markets will facilitate increased production and market accessibility. The market is expected to witness further innovation in sustainable packaging and ethical sourcing practices, further enhancing brand appeal. The growing middle class in emerging economies presents a vast untapped potential for premium organic tea consumption.

Asia-Pacific Organic Tea Market Segmentation

-

1. Product Type

- 1.1. Black Tea

- 1.2. Green Tea

- 1.3. Herbal Tea

- 1.4. Oolong Tea

- 1.5. Other Product Types

-

2. Packaging Format

- 2.1. Bags

- 2.2. Loose

-

3. Distribution Channel

- 3.1. Supermarket/ Hypermarket

- 3.2. Convenience Stores

- 3.3. Online Stores

- 3.4. Others

-

4. Geography

- 4.1. India

- 4.2. China

- 4.3. Japan

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

Asia-Pacific Organic Tea Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Organic Tea Market Regional Market Share

Geographic Coverage of Asia-Pacific Organic Tea Market

Asia-Pacific Organic Tea Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Synthetic Food Colorant

- 3.4. Market Trends

- 3.4.1. Green Tea to Foster Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Organic Tea Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Black Tea

- 5.1.2. Green Tea

- 5.1.3. Herbal Tea

- 5.1.4. Oolong Tea

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Packaging Format

- 5.2.1. Bags

- 5.2.2. Loose

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/ Hypermarket

- 5.3.2. Convenience Stores

- 5.3.3. Online Stores

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.5.2. China

- 5.5.3. Japan

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. India Asia-Pacific Organic Tea Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Black Tea

- 6.1.2. Green Tea

- 6.1.3. Herbal Tea

- 6.1.4. Oolong Tea

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Packaging Format

- 6.2.1. Bags

- 6.2.2. Loose

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarket/ Hypermarket

- 6.3.2. Convenience Stores

- 6.3.3. Online Stores

- 6.3.4. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. India

- 6.4.2. China

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. China Asia-Pacific Organic Tea Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Black Tea

- 7.1.2. Green Tea

- 7.1.3. Herbal Tea

- 7.1.4. Oolong Tea

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Packaging Format

- 7.2.1. Bags

- 7.2.2. Loose

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarket/ Hypermarket

- 7.3.2. Convenience Stores

- 7.3.3. Online Stores

- 7.3.4. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. India

- 7.4.2. China

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia-Pacific Organic Tea Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Black Tea

- 8.1.2. Green Tea

- 8.1.3. Herbal Tea

- 8.1.4. Oolong Tea

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Packaging Format

- 8.2.1. Bags

- 8.2.2. Loose

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarket/ Hypermarket

- 8.3.2. Convenience Stores

- 8.3.3. Online Stores

- 8.3.4. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. India

- 8.4.2. China

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia-Pacific Organic Tea Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Black Tea

- 9.1.2. Green Tea

- 9.1.3. Herbal Tea

- 9.1.4. Oolong Tea

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Packaging Format

- 9.2.1. Bags

- 9.2.2. Loose

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarket/ Hypermarket

- 9.3.2. Convenience Stores

- 9.3.3. Online Stores

- 9.3.4. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. India

- 9.4.2. China

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Asia-Pacific Organic Tea Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Black Tea

- 10.1.2. Green Tea

- 10.1.3. Herbal Tea

- 10.1.4. Oolong Tea

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Packaging Format

- 10.2.1. Bags

- 10.2.2. Loose

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarket/ Hypermarket

- 10.3.2. Convenience Stores

- 10.3.3. Online Stores

- 10.3.4. Others

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. India

- 10.4.2. China

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Unilever

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Golden Moon Tea

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Madura Tea Estates

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Assamica Agro*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Hain Celestial Group Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tata Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Organic India

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Orgse Tea

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Unilever

List of Figures

- Figure 1: Asia-Pacific Organic Tea Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Organic Tea Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Packaging Format 2020 & 2033

- Table 3: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Packaging Format 2020 & 2033

- Table 8: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 9: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Packaging Format 2020 & 2033

- Table 13: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Packaging Format 2020 & 2033

- Table 18: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 19: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Packaging Format 2020 & 2033

- Table 23: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 24: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Packaging Format 2020 & 2033

- Table 28: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 29: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Organic Tea Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Organic Tea Market?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Asia-Pacific Organic Tea Market?

Key companies in the market include Unilever, Golden Moon Tea, Madura Tea Estates, Assamica Agro*List Not Exhaustive, The Hain Celestial Group Inc, Tata Group, Organic India, Orgse Tea.

3. What are the main segments of the Asia-Pacific Organic Tea Market?

The market segments include Product Type, Packaging Format, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Green Tea to Foster Market Growth.

7. Are there any restraints impacting market growth?

Easy Availability of Synthetic Food Colorant.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Organic Tea Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Organic Tea Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Organic Tea Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Organic Tea Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence