Key Insights

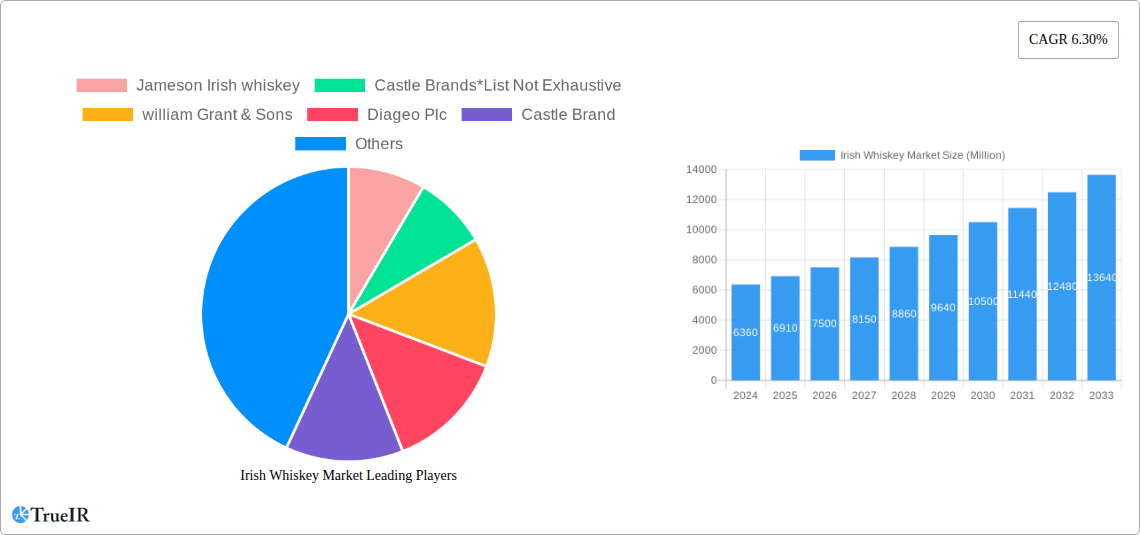

The global Irish Whiskey market is poised for significant expansion, with a current market size estimated at $6.36 billion in 2024. Projections indicate a robust compound annual growth rate (CAGR) of 9.2% over the forecast period of 2025-2033, underscoring the spirit's growing global appeal. This remarkable growth is fueled by several key drivers, including increasing consumer preference for premium spirits, the ongoing craft spirits revolution, and expanding distribution networks, particularly in emerging markets across Asia Pacific and South America. The versatility of Irish whiskey, ranging from the smooth accessibility of Blended whiskeys to the complex character of Single Malts and Single Pot Still varieties, caters to a broad spectrum of consumer tastes, further bolstering market penetration.

Irish Whiskey Market Market Size (In Billion)

The market's expansion is further propelled by evolving consumption patterns. The rise of the "on-trade" sector, encompassing bars and restaurants, as well as the burgeoning "off-trade" segment, particularly online retail stores, are making Irish whiskey more accessible than ever. Key players such as Jameson Irish Whiskey, Diageo Plc, and Pernod Ricard are actively investing in marketing, product innovation, and geographical expansion to capitalize on this momentum. While the market demonstrates strong positive trends, potential restraints such as increasing raw material costs and evolving regulatory landscapes in certain regions could pose challenges. Nevertheless, the overarching trajectory points towards sustained and vigorous growth for the Irish Whiskey market in the coming years.

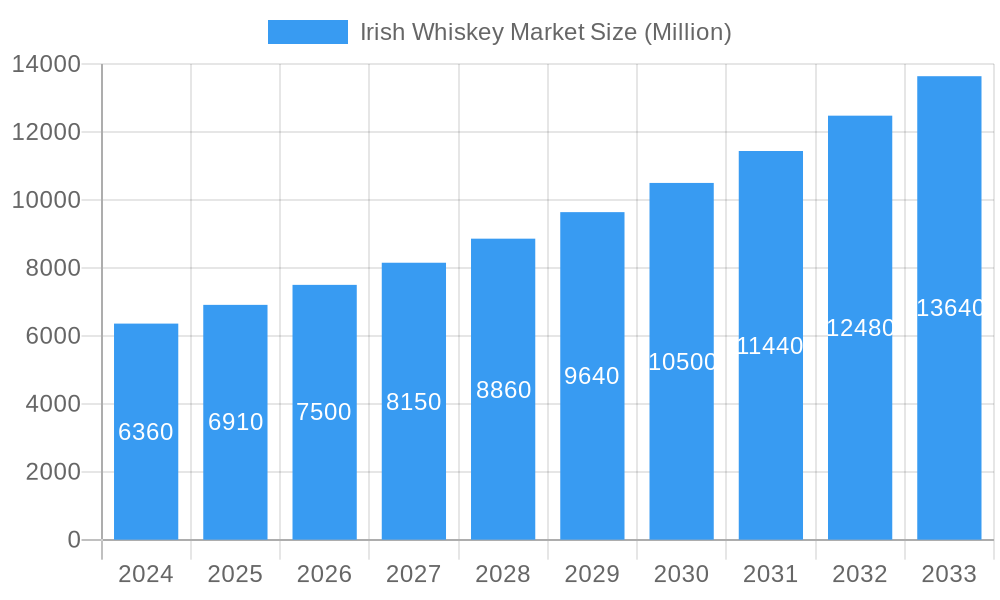

Irish Whiskey Market Company Market Share

Uncorking the Future: The Definitive Irish Whiskey Market Report (2019-2033)

Embark on a comprehensive exploration of the booming Irish Whiskey Market, a dynamic landscape poised for substantial growth. This report delves into market structures, trends, dominant segments, and competitive forces, offering unparalleled insights for industry stakeholders. With a study period spanning 2019 to 2033 and a base year of 2025, this analysis leverages high-volume keywords and provides actionable intelligence to navigate this thriving sector. The global Irish whiskey market is projected to reach an estimated value exceeding $10 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) expected to continue through 2033.

Irish Whiskey Market Market Structure & Competitive Landscape

The Irish Whiskey Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Innovation remains a key driver, fueled by premiumization trends and the demand for unique flavor profiles. Regulatory impacts, while generally supportive of the industry's growth, can influence production standards and export policies. Product substitutes, primarily other premium spirits like Scotch whisky and bourbon, exert competitive pressure, though the distinctive character of Irish whiskey often differentiates it. End-user segmentation spans a broad spectrum, from casual consumers to connoisseurs, influencing product development and marketing strategies. Mergers and Acquisitions (M&A) activity, though not consistently high, plays a role in market consolidation and expansion, with an estimated volume of over $2 billion in M&A transactions observed between 2019 and 2024.

- Market Concentration: Dominated by large multinational corporations, but with a growing number of craft distilleries increasing competition.

- Innovation Drivers: Focus on cask maturation, single cask releases, and heritage storytelling.

- Regulatory Impacts: Adherence to strict geographical indication (GI) protections and quality standards.

- Product Substitutes: Scotch Whisky, Bourbon, Rye Whiskey, and other premium spirits.

- End-User Segmentation: Young adults, millennials, and established whiskey enthusiasts.

- M&A Trends: Strategic acquisitions by larger players to expand their Irish whiskey portfolios.

Irish Whiskey Market Market Trends & Opportunities

The Irish Whiskey Market is experiencing an unprecedented surge in popularity, driven by a confluence of factors that are reshaping its trajectory. The global market size for Irish whiskey, valued at an impressive $6 billion in 2024, is forecasted to experience a substantial CAGR of approximately 7.5% from 2025 to 2033, projecting it to surpass $10 billion by the end of the forecast period. This growth is underpinned by a widening appreciation for its smooth, approachable character, making it a preferred choice for both seasoned whiskey drinkers and those new to the spirit. Technological advancements in distillation and maturation processes are enabling distilleries to experiment with novel flavor profiles, leading to a richer and more diverse product offering. Consumer preferences are increasingly leaning towards premium and artisanal products, with a strong emphasis on provenance, sustainability, and unique storytelling. This shift presents significant opportunities for distilleries that can effectively communicate their heritage and commitment to quality. The competitive landscape is evolving, with established giants facing increasing pressure from agile craft distilleries that are quickly gaining market penetration. This dynamic fosters innovation and encourages a focus on niche markets and export opportunities, particularly in emerging economies eager to explore premium alcoholic beverages. The increasing demand for 'experiences' – distillery tours, tasting events, and immersive brand activations – further fuels market growth and brand loyalty. Opportunities abound in product line extensions, such as flavored Irish whiskeys and ready-to-drink (RTD) formats, catering to broader consumer tastes.

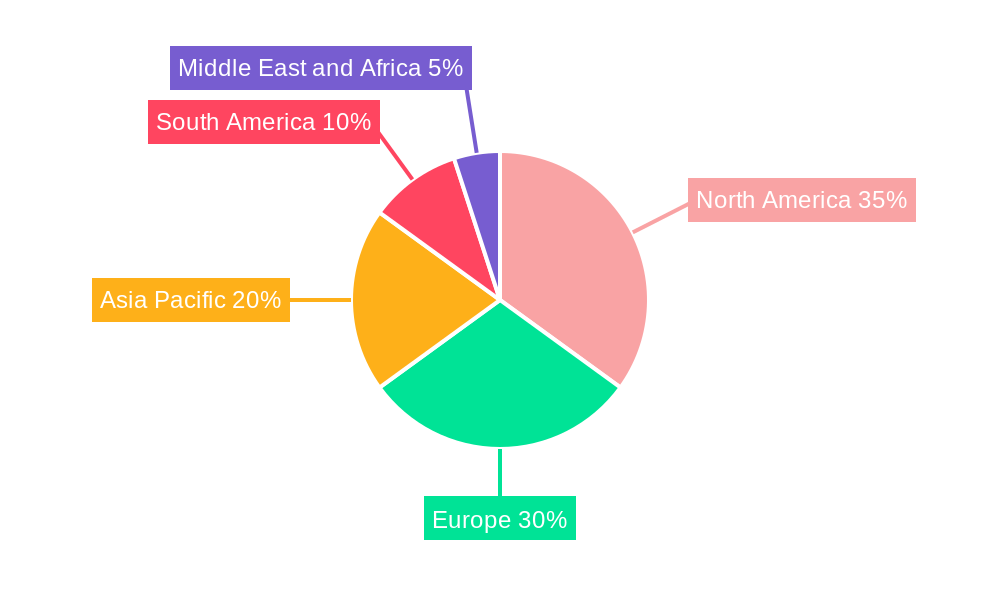

Dominant Markets & Segments in Irish Whiskey Market

The global Irish Whiskey market demonstrates a clear dominance in certain regions and segments, driven by established consumption patterns and emerging growth pockets. North America, particularly the United States, represents a leading market, accounting for over 40% of global sales, driven by a long-standing appreciation for whiskey and a growing premium spirits culture. Europe, with its historical ties to the spirit and significant domestic consumption, follows closely, with key markets including Ireland itself, the United Kingdom, and France. Asia-Pacific is an emerging powerhouse, with rapid growth anticipated in countries like India and China as disposable incomes rise and consumers explore international spirits.

Within the product type segmentation, Blended Irish Whiskey continues to hold the largest market share, estimated at over 60%, due to its accessibility, consistent quality, and broad appeal. However, Single Malt and Single Pot Still whiskeys are experiencing the fastest growth rates, driven by consumer demand for complexity, craftsmanship, and unique tasting experiences. The market for Single Grain is also steadily expanding as distilleries experiment with this less traditional but increasingly popular style.

Distribution channel analysis reveals that Off-Trade channels, encompassing Online Retail Stores and Offline Retail Stores, dominate sales, representing approximately 70% of the market. The proliferation of e-commerce platforms and the convenience of home delivery have significantly boosted online sales. Nevertheless, the On-Trade channel, including bars, restaurants, and hotels, remains crucial for brand building, consumer engagement, and trial, particularly for premium and limited-edition releases.

- Key Growth Drivers (Regional):

- North America: Robust economic conditions, increasing disposable incomes, and a sophisticated consumer base for premium spirits.

- Europe: Strong heritage and established consumer base, coupled with growing interest in craft and artisanal products.

- Asia-Pacific: Rapid economic development, growing middle class, and increasing adoption of Western lifestyle trends.

- Key Growth Drivers (Segment-wise):

- Blended: Wide availability, competitive pricing, and consistent taste profiles appealing to a broad audience.

- Single Malt/Single Pot Still: Premiumization trend, demand for artisanal products, and the allure of unique aging and distillation processes.

- Off-Trade: Convenience of online purchasing, expansion of retail footprints, and effective marketing by retailers.

- On-Trade: Experiential marketing, brand visibility, and the role of bartenders in influencing consumer choices.

Irish Whiskey Market Product Analysis

Product innovation in the Irish Whiskey Market is characterized by a strong emphasis on heritage-inspired expressions and forward-thinking maturation techniques. Distilleries are increasingly exploring diverse cask finishes, including ex-Sherry, ex-Port, and even unique wine cask influences, to impart distinctive flavor notes and cater to evolving consumer palates. The demand for limited-edition and single cask releases is on the rise, offering collectors and enthusiasts rare and highly sought-after bottlings. Technological advancements in distillation, such as triple distillation, are being leveraged to achieve exceptionally smooth profiles, while maturation in American oak and ex-Bourbon casks remains a cornerstone, contributing classic vanilla and caramel notes. Competitive advantages are being built on authenticity, the story behind the brand, and the quality of the spirit. The market is also witnessing a surge in the popularity of Single Pot Still whiskey, celebrated for its rich, spicy character.

Key Drivers, Barriers & Challenges in Irish Whiskey Market

Key Drivers:

- Growing Global Demand for Premium Spirits: Increasing disposable incomes worldwide are fueling demand for higher-quality alcoholic beverages, with Irish whiskey benefiting from its approachable and smooth profile.

- Heritage and Authenticity: The rich history and traditional production methods of Irish whiskey resonate strongly with consumers seeking authentic experiences.

- Innovation in Cask Maturation and Blending: Distilleries are actively experimenting with new cask types and blending techniques, leading to a diverse and appealing product portfolio.

- Effective Marketing and Global Expansion: Strategic marketing campaigns and a focus on export markets, particularly in North America and Asia, are driving significant growth.

Barriers & Challenges:

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of key ingredients, packaging materials, and shipping logistics, potentially affecting production timelines and costs.

- Regulatory Hurdles and Trade Policies: Navigating diverse international regulations, tariffs, and trade agreements can pose challenges for market access and expansion.

- Intense Competition: The market faces fierce competition from established global spirits brands and a growing number of craft distilleries, necessitating continuous innovation and strong brand differentiation.

- Sustainability Concerns: Increasing consumer and regulatory focus on environmental impact requires distilleries to adopt sustainable production practices, which can involve significant investment.

Growth Drivers in the Irish Whiskey Market Market

The Irish Whiskey Market's growth is propelled by several key factors. Technologically, advancements in distillation techniques and the exploration of diverse cask maturation strategies are creating a more complex and appealing product range. Economically, rising disposable incomes in emerging markets and a global trend towards premiumization are significantly boosting demand. Policy-wise, favorable trade agreements and governmental support for the spirits industry in Ireland contribute to a conducive business environment. The growing popularity of "whiskey tourism," with more visitors flocking to distillery tours and heritage sites, also acts as a significant growth catalyst, fostering brand loyalty and introducing new consumers to the spirit.

Challenges Impacting Irish Whiskey Market Growth

Several challenges could impede the growth of the Irish Whiskey Market. Regulatory complexities in different export markets, including varying alcohol duty structures and labeling requirements, can hinder smooth market penetration. Supply chain issues, from raw material sourcing to bottled product distribution, present ongoing logistical hurdles. Competitive pressures from other established whiskey categories like Scotch and Bourbon, as well as other premium spirits, necessitate continuous innovation and aggressive marketing. Furthermore, fluctuating currency exchange rates can impact the profitability of international sales for Irish whiskey producers.

Key Players Shaping the Irish Whiskey Market Market

- Jameson Irish whiskey

- William Grant & Sons

- Diageo Plc

- Castle Brands

- The Old Bushmills Distillery Co

- Beam Suntory Inc

- Brown-Forman

- Pernod Ricard

Significant Irish Whiskey Market Industry Milestones

- October 2021: Clonakilty Distillery launches its brand-new Single Malt whiskey, the latest addition to their award-winning range of spirits.

- August 2022: Slainte Irish Whiskey collaborates with BlueCheck Ukraine to launch its two new whiskeys in the United States, featuring a blended Irish whiskey aged in Bourbon and Sherry Casks and a limited edition 18-year-old single malt aged in Bourbon Casks and finished in Muscat Hogsheads.

- September 2022: Proclamation Blended Irish Whiskey launches its operations in the United States, offering triple distilled whiskey aged in American oak barrels, matured in bourbon casks, with a touch of sherry-finished malt in the blend.

Future Outlook for Irish Whiskey Market Market

The future outlook for the Irish Whiskey Market is exceptionally bright, driven by sustained global demand and continuous innovation. Strategic opportunities lie in expanding into untapped Asian and African markets, where the appeal of premium spirits is growing exponentially. The continued consumer preference for authentic, heritage-driven brands, coupled with the success of craft distilleries, will foster a dynamic and competitive landscape. Investments in sustainable production practices and experiential tourism will further enhance brand value and consumer engagement. The market is poised to witness further product diversification, with an anticipated rise in niche offerings and flavored expressions catering to a broader demographic, solidifying its position as a leading global spirits category.

Irish Whiskey Market Segmentation

-

1. Type

- 1.1. Blended

- 1.2. Single-Malt

- 1.3. Single Pot Still

- 1.4. Single Grain

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Online Retail Stores

- 2.2.2. Offline Retail Stores

Irish Whiskey Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Irish Whiskey Market Regional Market Share

Geographic Coverage of Irish Whiskey Market

Irish Whiskey Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convenience Offered By Online Food Delivery Services; Attractive Offers And Memberships Along With Advertisements And Marketing By Players

- 3.3. Market Restrains

- 3.3.1. Consumers Desire For Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. Growing demand for premium beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Irish Whiskey Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Blended

- 5.1.2. Single-Malt

- 5.1.3. Single Pot Still

- 5.1.4. Single Grain

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Online Retail Stores

- 5.2.2.2. Offline Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Irish Whiskey Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Blended

- 6.1.2. Single-Malt

- 6.1.3. Single Pot Still

- 6.1.4. Single Grain

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Online Retail Stores

- 6.2.2.2. Offline Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Irish Whiskey Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Blended

- 7.1.2. Single-Malt

- 7.1.3. Single Pot Still

- 7.1.4. Single Grain

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Online Retail Stores

- 7.2.2.2. Offline Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Irish Whiskey Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Blended

- 8.1.2. Single-Malt

- 8.1.3. Single Pot Still

- 8.1.4. Single Grain

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Online Retail Stores

- 8.2.2.2. Offline Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Irish Whiskey Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Blended

- 9.1.2. Single-Malt

- 9.1.3. Single Pot Still

- 9.1.4. Single Grain

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Online Retail Stores

- 9.2.2.2. Offline Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Irish Whiskey Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Blended

- 10.1.2. Single-Malt

- 10.1.3. Single Pot Still

- 10.1.4. Single Grain

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.2.2.1. Online Retail Stores

- 10.2.2.2. Offline Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jameson Irish whiskey

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Castle Brands*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 william Grant & Sons

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Diageo Plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Castle Brand

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Old Bushmills Distillery Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Beam Suntory Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Brown-Forman

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pernod Ricard

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Jameson Irish whiskey

List of Figures

- Figure 1: Global Irish Whiskey Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Irish Whiskey Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Irish Whiskey Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Irish Whiskey Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Irish Whiskey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Irish Whiskey Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Irish Whiskey Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Irish Whiskey Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Irish Whiskey Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Irish Whiskey Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: Europe Irish Whiskey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Irish Whiskey Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Irish Whiskey Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Irish Whiskey Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Irish Whiskey Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Irish Whiskey Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Irish Whiskey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Irish Whiskey Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Irish Whiskey Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Irish Whiskey Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Irish Whiskey Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Irish Whiskey Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: South America Irish Whiskey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Irish Whiskey Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Irish Whiskey Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Irish Whiskey Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Irish Whiskey Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Irish Whiskey Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Irish Whiskey Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Irish Whiskey Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Irish Whiskey Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Irish Whiskey Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Irish Whiskey Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Irish Whiskey Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Irish Whiskey Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Irish Whiskey Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Irish Whiskey Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Irish Whiskey Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Irish Whiskey Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Irish Whiskey Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Germany Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: France Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Russia Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Irish Whiskey Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Irish Whiskey Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Irish Whiskey Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: India Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: China Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Japan Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Australia Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Irish Whiskey Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Irish Whiskey Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Irish Whiskey Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Argentina Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Irish Whiskey Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 36: Global Irish Whiskey Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Irish Whiskey Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: South Africa Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Irish Whiskey Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Irish Whiskey Market?

The projected CAGR is approximately 4.86%.

2. Which companies are prominent players in the Irish Whiskey Market?

Key companies in the market include Jameson Irish whiskey, Castle Brands*List Not Exhaustive, william Grant & Sons, Diageo Plc, Castle Brand, The Old Bushmills Distillery Co, Beam Suntory Inc, Brown-Forman, Pernod Ricard.

3. What are the main segments of the Irish Whiskey Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Convenience Offered By Online Food Delivery Services; Attractive Offers And Memberships Along With Advertisements And Marketing By Players.

6. What are the notable trends driving market growth?

Growing demand for premium beverages.

7. Are there any restraints impacting market growth?

Consumers Desire For Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

In August 2022, Slainte Irish Whiskey collaborated with BlueCheck Ukraine to launch its two new whiskeys in the United States, which include a blended Irish whiskey aged in Bourbon and Sherry Casks and a limited edition 18-year-old single malt aged in Bourbon Casks and finished in Muscat Hogsheads.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Irish Whiskey Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Irish Whiskey Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Irish Whiskey Market?

To stay informed about further developments, trends, and reports in the Irish Whiskey Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence