Key Insights

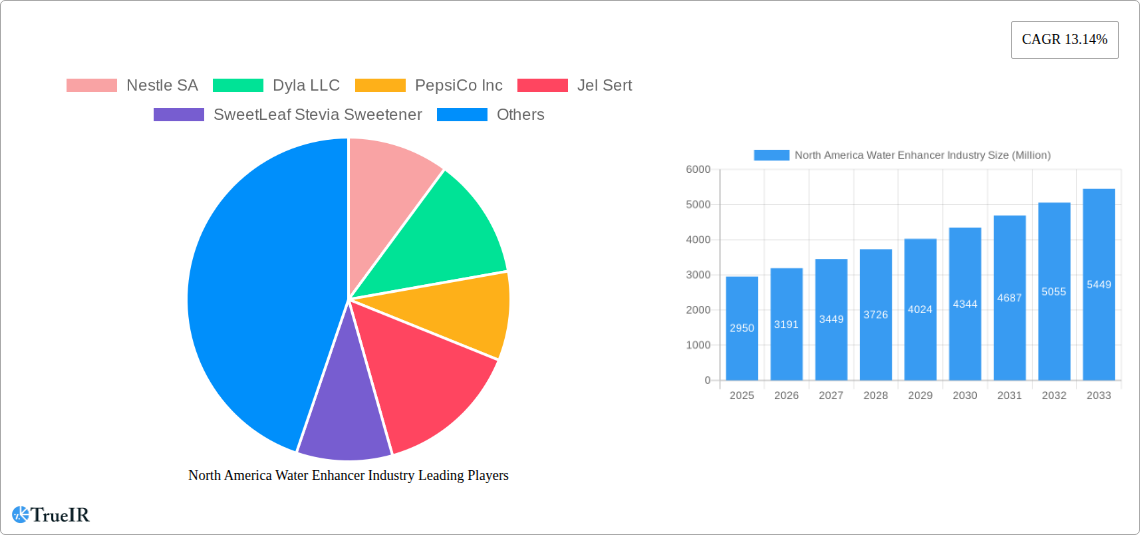

The North America water enhancer market is poised for robust expansion, projected to reach USD 2.95 billion in 2025. This growth is driven by an increasing consumer focus on health and wellness, a desire for convenient and enjoyable hydration solutions, and the growing prevalence of lifestyle-related diseases that encourage reduced sugar intake. The market's CAGR of 8.3% signifies a dynamic landscape where innovation in flavors, ingredients, and packaging is paramount. Consumers are actively seeking alternatives to sugary beverages, and water enhancers offer a versatile and customizable solution that caters to diverse palates. The expanding availability through various distribution channels, including online retail and specialized health stores, further fuels this upward trajectory. Key players are investing in product development to offer natural, low-calorie, and functional variants, aligning with evolving consumer preferences.

North America Water Enhancer Industry Market Size (In Billion)

The competitive environment is characterized by the presence of established beverage giants and specialized players, all vying for market share. The primary growth drivers include the rising demand for zero-calorie and natural sweeteners, the convenience offered by portable enhancer formats, and increasing consumer awareness about the benefits of adequate hydration. However, potential restraints such as fluctuating raw material costs and evolving regulatory landscapes for food additives could pose challenges. Segments like supermarkets/hypermarkets and online retail are expected to dominate distribution, while innovation in functional enhancers (e.g., those with added vitamins or electrolytes) and exotic flavor profiles will likely shape future market trends. The United States is anticipated to remain the largest regional market within North America, followed by Canada and Mexico, each presenting unique opportunities and challenges.

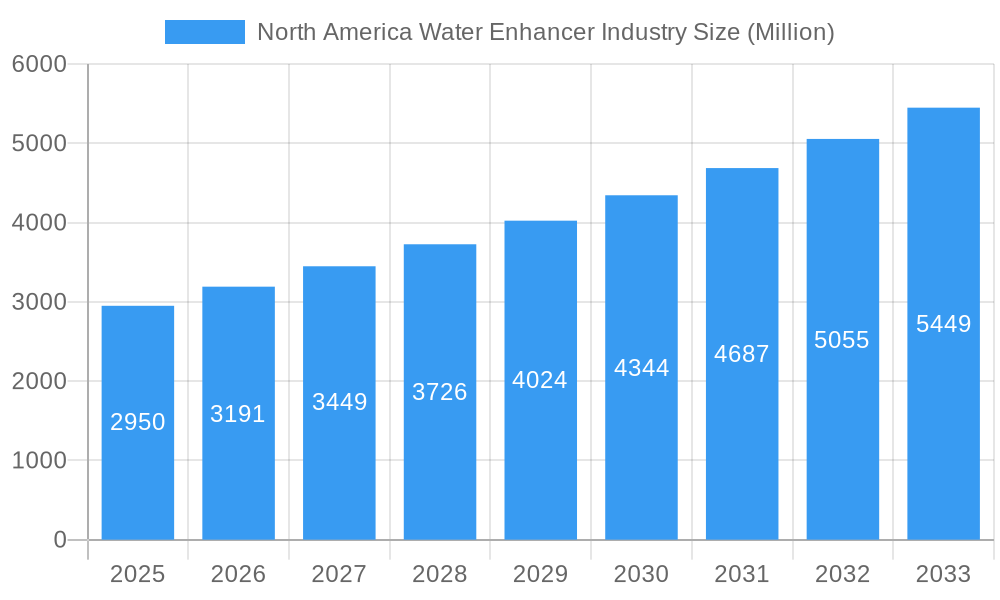

North America Water Enhancer Industry Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the North America Water Enhancer Industry. Leveraging high-volume keywords and presented with clear structure and actionable insights, this report is designed to engage industry professionals and enhance search rankings. It covers market structure, trends, opportunities, dominant segments, product analysis, key drivers, challenges, leading players, significant milestones, and a future outlook, with all monetary values presented in billions. The study period spans from 2019 to 2033, with a base and estimated year of 2025.

North America Water Enhancer Industry Market Structure & Competitive Landscape

The North America water enhancer market exhibits a moderately concentrated structure, characterized by the presence of large multinational corporations alongside agile niche players. Innovation serves as a key driver, with companies continuously introducing new flavors, functional benefits (e.g., electrolytes, vitamins), and sustainable packaging solutions. Regulatory impacts, primarily concerning ingredient labeling, health claims, and food safety standards, significantly influence product development and market entry strategies. The prevalence of product substitutes, such as ready-to-drink flavored beverages and traditional fruit juices, necessitates ongoing differentiation and value proposition enhancement for water enhancers. End-user segmentation reveals a strong demand from health-conscious consumers, fitness enthusiasts, and individuals seeking convenient ways to increase water intake. Mergers and acquisitions (M&A) activity, while not at extreme levels, are observed as companies seek to expand their product portfolios, gain market share, and consolidate their positions. For instance, the historical period saw several strategic partnerships and minor acquisitions aiming at specific distribution channels or technological advancements. Anticipated M&A volumes for the forecast period are projected to be in the low hundreds of millions, driven by the pursuit of market consolidation and synergistic growth. The competitive landscape is dynamic, with companies like Nestle SA, PepsiCo Inc., The Coca-Cola Company, and The Kraft Heinz Company leveraging their extensive distribution networks and brand recognition. Smaller, innovative players such as Dyla LLC, Jel Sert, SweetLeaf Stevia Sweetener, and Nuun are carving out significant niches through specialized offerings and direct-to-consumer strategies.

North America Water Enhancer Industry Market Trends & Opportunities

The North America water enhancer market is poised for robust growth, projected to achieve a market size of approximately $10 billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 8.5% during the forecast period of 2025–2033. This expansion is fueled by evolving consumer preferences for healthier hydration alternatives and the increasing demand for convenient, on-the-go beverage solutions. Technological shifts are evident in the development of advanced formulations, including sugar-free and natural sweetener options, as well as innovative delivery mechanisms like dissolvable tablets and concentrated liquid drops. These advancements cater to a growing segment of consumers actively seeking to reduce sugar intake and artificial ingredients. Consumer preferences are increasingly leaning towards functional benefits, with a rising demand for water enhancers infused with vitamins, minerals, electrolytes, and even adaptogens, addressing specific health and wellness goals such as energy enhancement, stress reduction, and immune support. The competitive dynamics are intensifying, marked by aggressive product innovation, strategic pricing, and expanding distribution channels. Online retail stores, in particular, are emerging as a significant growth avenue, offering direct access to a wider consumer base and facilitating personalized marketing efforts. The market penetration rate for water enhancers, currently around 35%, is expected to climb steadily as awareness and product availability increase across diverse demographic groups. Opportunities lie in capitalizing on the trend towards personalization, developing customized flavor profiles and functional blends based on individual needs and preferences. Furthermore, strategic partnerships with fitness centers, wellness brands, and corporate wellness programs can unlock new consumer segments. The growing awareness of the environmental impact of single-use plastic bottles also presents an opportunity for water enhancers as a sustainable alternative for improving plain water's appeal. The market's growth trajectory is further supported by increasing disposable incomes and a greater emphasis on preventative healthcare measures across the North American region.

Dominant Markets & Segments in North America Water Enhancer Industry

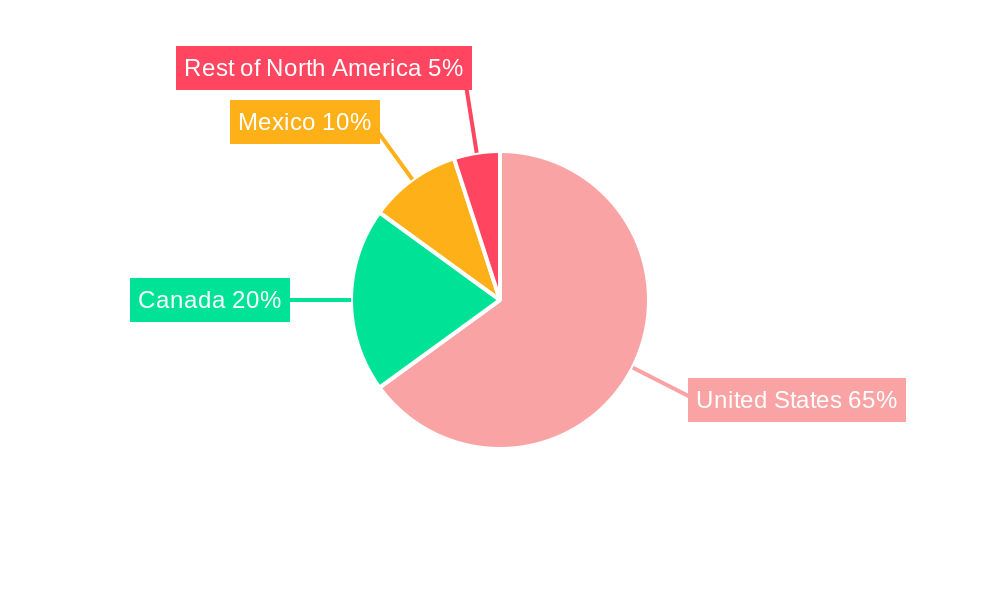

The United States stands as the dominant market within the North America water enhancer industry, accounting for an estimated 70% of the total market revenue, projected to reach over $7 billion by 2025. This dominance is driven by a large and health-conscious population, a highly developed retail infrastructure, and a strong culture of convenience and product innovation. Within the United States, Supermarkets/Hypermarkets represent the leading distribution channel, capturing approximately 45% of sales due to their widespread accessibility and ability to offer a broad range of products from leading brands. This segment benefits from high foot traffic and the convenience it offers consumers for their regular grocery shopping.

Online Retail Stores are experiencing the most rapid growth, projected to witness a CAGR exceeding 15% over the forecast period, reaching a market share of approximately 25% by 2033. This surge is attributed to the convenience of online shopping, the ability to discover niche brands, and the effectiveness of targeted digital marketing strategies. Consumers increasingly value the ease of ordering water enhancers from the comfort of their homes.

Convenience Stores and Pharmacy and Health Stores also play a significant role, with convenience stores catering to impulse purchases and on-the-go needs, while pharmacy and health stores attract consumers seeking specialized, health-oriented products.

In terms of geography, Canada and Mexico represent significant secondary markets. Canada, with its similar consumer preferences and developed retail landscape, is expected to contribute around 15% to the market share. Mexico, while traditionally having a different beverage consumption pattern, is showing increasing adoption of healthier alternatives, with its market share projected to grow from approximately 10% to 12% by 2033, driven by rising health awareness and the expansion of modern retail formats. The "Rest of North America" segment, though smaller, contributes to market diversification. Key growth drivers for these regions include:

- Infrastructure Development: Expansion of modern retail chains and e-commerce logistics in Canada and Mexico.

- Policy Shifts: Growing government initiatives promoting healthier lifestyles and reduced sugar consumption, indirectly benefiting water enhancers.

- Consumer Education: Increased awareness campaigns about the benefits of proper hydration and the role of water enhancers.

- Product Affordability: The cost-effectiveness of water enhancers compared to premium bottled beverages makes them attractive to a wider consumer base.

- Growing Middle Class: In Mexico, a burgeoning middle class with increasing disposable income is more inclined to adopt health and wellness trends.

North America Water Enhancer Industry Product Analysis

Product innovation in the North America water enhancer industry is characterized by advancements in natural and artificial sweetener technologies, the incorporation of functional ingredients, and diverse flavor profiles. Key competitive advantages stem from sugar-free and low-calorie formulations that appeal to health-conscious consumers. Technological advancements are leading to improved dissolvability and shelf stability of enhancers, enhancing user convenience. The application spectrum ranges from simple taste enhancement of plain water to the provision of essential nutrients and energizing compounds, catering to a broad consumer base from athletes to busy professionals.

Key Drivers, Barriers & Challenges in North America Water Enhancer Industry

Key Drivers:

- Growing Health and Wellness Trend: Increasing consumer focus on hydration, sugar reduction, and a desire for functional beverages.

- Convenience and Portability: Water enhancers offer a convenient and portable way to improve water intake, fitting busy lifestyles.

- Product Innovation: Continuous introduction of new flavors, natural sweeteners, and added functional benefits (vitamins, electrolytes).

- Affordability: Cost-effective alternative to premium bottled flavored waters and other beverages.

- Digital Marketing and E-commerce Growth: Enhanced reach and accessibility through online platforms.

Key Barriers & Challenges:

- Intense Competition: From established beverage giants and a growing number of specialized brands.

- Consumer Perception and Skepticism: Some consumers may view enhancers as artificial or unnecessary.

- Regulatory Scrutiny: Evolving regulations regarding food additives, health claims, and ingredient transparency.

- Supply Chain Disruptions: Potential for volatility in raw material sourcing and distribution networks.

- Price Sensitivity: While generally affordable, intense competition can lead to price wars, impacting profit margins.

Growth Drivers in the North America Water Enhancer Industry Market

The North America water enhancer market is propelled by a confluence of factors. Technologically, advancements in natural sweeteners like stevia and monk fruit are addressing consumer demand for healthier options. Economically, rising disposable incomes and a growing emphasis on preventative healthcare encourage consumers to invest in products that support well-being. Policy-driven factors, such as public health campaigns promoting hydration and reducing sugar intake, indirectly benefit the market. For instance, initiatives like the U.S. Dietary Guidelines for Americans, which emphasize water as a primary beverage, create a favorable environment. The increasing availability and visibility of these products across various retail channels, coupled with effective digital marketing strategies, are significant growth catalysts.

Challenges Impacting North America Water Enhancer Industry Growth

Despite its growth potential, the North America water enhancer industry faces several challenges. Regulatory complexities, particularly concerning the approval and labeling of novel ingredients, can pose a hurdle for new product development. Supply chain issues, including the sourcing of key ingredients and potential disruptions in logistics, can impact production and availability. Competitive pressures are intense, with both large corporations and emerging startups vying for market share, potentially leading to price erosion and increased marketing expenditures. Moreover, overcoming consumer skepticism regarding the perceived artificiality or necessity of water enhancers remains a persistent challenge, requiring continuous consumer education and product transparency.

Key Players Shaping the North America Water Enhancer Industry Market

- Nestle SA

- Dyla LLC

- PepsiCo Inc.

- Jel Sert

- SweetLeaf Stevia Sweetener

- Nuun

- The Kraft Heinz Company

- The Coca-Cola Company

Significant North America Water Enhancer Industry Industry Milestones

- 2019: Increased launch of stevia-sweetened water enhancers, responding to growing demand for natural options.

- 2020: Rise in online sales and direct-to-consumer models for water enhancers due to the COVID-19 pandemic.

- 2021: Introduction of water enhancers with added vitamins and functional ingredients (e.g., adaptogens) by niche brands.

- 2022: Major beverage companies expand their water enhancer portfolios through acquisitions and new product development.

- 2023: Growing focus on sustainable packaging solutions for water enhancer products.

- 2024: Expansion of e-commerce presence and targeted digital marketing campaigns by leading players.

Future Outlook for North America Water Enhancer Industry Market

The future outlook for the North America water enhancer market is highly positive, driven by sustained consumer demand for convenient, healthy, and personalized hydration solutions. Continued product innovation, focusing on natural ingredients, functional benefits, and innovative delivery systems, will be crucial for market growth. The expansion of online retail channels and strategic partnerships will further enhance market penetration. Emerging opportunities include the development of customized blends catering to specific dietary needs and wellness goals, as well as increased adoption in workplace and institutional settings. The market is projected to witness sustained growth, driven by a conscious shift towards healthier beverage choices and a desire for enhanced water consumption.

North America Water Enhancer Industry Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Pharmacy and Health Stores

- 1.4. Online Retail Stores

- 1.5. Other Distribution Channels

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

North America Water Enhancer Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Water Enhancer Industry Regional Market Share

Geographic Coverage of North America Water Enhancer Industry

North America Water Enhancer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer shift towards health based beverages; Demand for plant based and vegan products

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of the product

- 3.4. Market Trends

- 3.4.1. Rising Innovations with Tempting Marketing Approaches by Manufacturers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Pharmacy and Health Stores

- 5.1.4. Online Retail Stores

- 5.1.5. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.2.4. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. United States North America Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarkets/Hypermarkets

- 6.1.2. Convenience Stores

- 6.1.3. Pharmacy and Health Stores

- 6.1.4. Online Retail Stores

- 6.1.5. Other Distribution Channels

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.2.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. Canada North America Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarkets/Hypermarkets

- 7.1.2. Convenience Stores

- 7.1.3. Pharmacy and Health Stores

- 7.1.4. Online Retail Stores

- 7.1.5. Other Distribution Channels

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.2.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Mexico North America Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarkets/Hypermarkets

- 8.1.2. Convenience Stores

- 8.1.3. Pharmacy and Health Stores

- 8.1.4. Online Retail Stores

- 8.1.5. Other Distribution Channels

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.2.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Rest of North America North America Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarkets/Hypermarkets

- 9.1.2. Convenience Stores

- 9.1.3. Pharmacy and Health Stores

- 9.1.4. Online Retail Stores

- 9.1.5. Other Distribution Channels

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United States

- 9.2.2. Canada

- 9.2.3. Mexico

- 9.2.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nestle SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Dyla LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 PepsiCo Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Jel Sert

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SweetLeaf Stevia Sweetener

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nuun*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Kraft Heinz Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The Coca-Cola Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Nestle SA

List of Figures

- Figure 1: North America Water Enhancer Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Water Enhancer Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Water Enhancer Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 2: North America Water Enhancer Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: North America Water Enhancer Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Water Enhancer Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Water Enhancer Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: North America Water Enhancer Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: North America Water Enhancer Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: North America Water Enhancer Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: North America Water Enhancer Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: North America Water Enhancer Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Water Enhancer Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Water Enhancer Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Water Enhancer Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Water Enhancer Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: North America Water Enhancer Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Water Enhancer Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the North America Water Enhancer Industry?

Key companies in the market include Nestle SA, Dyla LLC, PepsiCo Inc, Jel Sert, SweetLeaf Stevia Sweetener, Nuun*List Not Exhaustive, The Kraft Heinz Company, The Coca-Cola Company.

3. What are the main segments of the North America Water Enhancer Industry?

The market segments include Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Consumer shift towards health based beverages; Demand for plant based and vegan products.

6. What are the notable trends driving market growth?

Rising Innovations with Tempting Marketing Approaches by Manufacturers.

7. Are there any restraints impacting market growth?

Lack of awareness of the product.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Water Enhancer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Water Enhancer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Water Enhancer Industry?

To stay informed about further developments, trends, and reports in the North America Water Enhancer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence