Key Insights

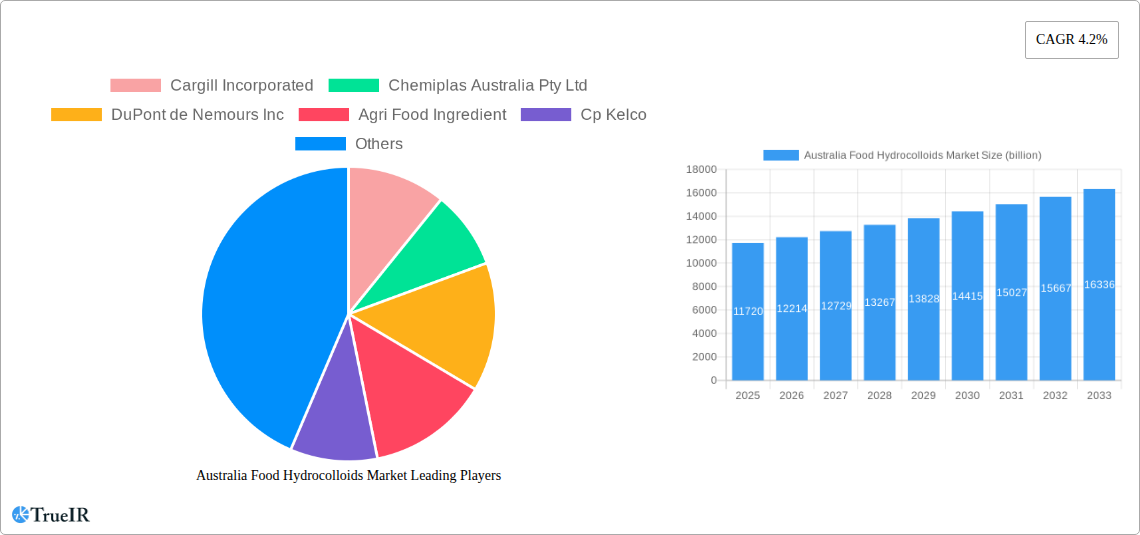

The Australian Food Hydrocolloids Market is poised for significant growth, projected to reach AUD 11.72 billion by 2025. This expansion is fueled by a robust CAGR of 4.2% during the forecast period of 2025-2033. The increasing demand for processed and convenience foods, coupled with a growing consumer preference for clean-label ingredients and natural alternatives, is driving the adoption of hydrocolloids. These versatile ingredients play a crucial role in enhancing texture, stability, and shelf-life across various food applications, making them indispensable in the modern food industry. The dairy and frozen products segment, in particular, is a major consumer of hydrocolloids due to their ability to improve mouthfeel and prevent ice crystal formation. Bakery products also contribute significantly to market demand, leveraging hydrocolloids for dough conditioning and improved crumb structure.

Australia Food Hydrocolloids Market Market Size (In Billion)

The market is characterized by a dynamic interplay of drivers and restraints. Key drivers include the rising health consciousness among Australian consumers, leading to a demand for products with improved nutritional profiles and specific functionalities that hydrocolloids can help achieve. Innovations in ingredient technology are also paving the way for novel applications and enhanced performance of hydrocolloids. However, the market faces certain restraints, such as price volatility of raw materials and stringent regulatory frameworks surrounding food additives. Despite these challenges, the broad spectrum of applications, from confectionery and beverages to meat and seafood products, ensures a sustained and upward trajectory for the Australian Food Hydrocolloids Market. Companies are actively investing in research and development to create customized hydrocolloid solutions that meet evolving consumer needs and regulatory standards.

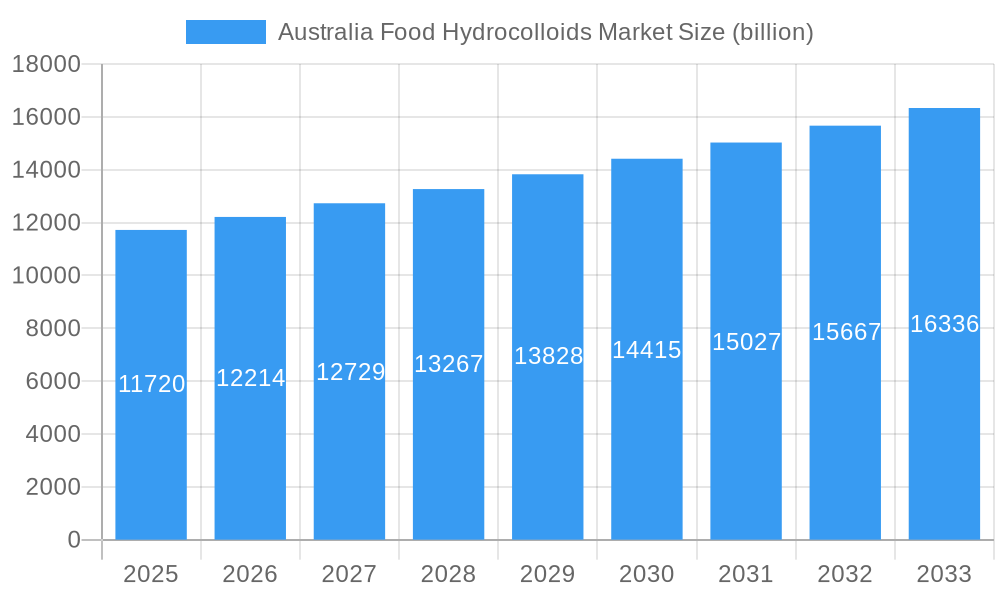

Australia Food Hydrocolloids Market Company Market Share

Dive deep into the dynamic Australia Food Hydrocolloids Market with this in-depth report. Covering the historical period of 2019–2024, the base year of 2025, and a comprehensive forecast from 2025–2033, this report provides unparalleled insights into market size, trends, opportunities, and competitive strategies. Leveraging high-volume keywords such as "food thickeners," "stabilizers," "gelling agents," "plant-based hydrocolloids," and "functional food ingredients," this SEO-optimized analysis will equip industry stakeholders with the crucial data needed to navigate and capitalize on this burgeoning market. The Australia food hydrocolloids market is projected to reach an estimated value of AUD xx billion by 2025, with a significant CAGR of xx% projected for the forecast period.

Australia Food Hydrocolloids Market Market Structure & Competitive Landscape

The Australia food hydrocolloids market exhibits a moderate to high concentration, with a few key global players dominating market share. Innovation in novel hydrocolloid applications and sustainable sourcing remains a significant driver of competition. Regulatory frameworks surrounding food additives, including hydrocolloids, play a crucial role in market access and product development. The threat of product substitutes, particularly from natural and novel plant-based alternatives, is an evolving factor impacting market dynamics. End-user segmentation across dairy, bakery, beverages, and confectionery products showcases diverse demand patterns. Mergers and acquisitions (M&A) are anticipated to shape the competitive landscape, with an estimated xx number of M&A activities expected throughout the study period, consolidating market presence and expanding product portfolios.

- Market Concentration: Dominated by major global players and a few regional specialists.

- Innovation Drivers: Focus on clean-label ingredients, plant-based alternatives, and enhanced functional properties.

- Regulatory Impacts: Stringent food safety standards and labeling requirements influence product formulation and market entry.

- Product Substitutes: Growing interest in natural gums and alternative texturizers.

- End-User Segmentation: Diverse applications across food and beverage sectors.

- M&A Trends: Strategic acquisitions to expand product offerings and market reach.

Australia Food Hydrocolloids Market Market Trends & Opportunities

The Australia food hydrocolloids market is experiencing robust growth, driven by an escalating consumer demand for processed and convenience foods, coupled with a rising awareness of the functional benefits offered by these ingredients. The market size, estimated at AUD xx billion in the base year of 2025, is projected to expand significantly throughout the forecast period. Technological advancements are continuously introducing novel hydrocolloids with superior functionalities, such as improved texture, stability, and emulsification properties, thereby opening new avenues for product development in sectors like plant-based meat alternatives and specialized dietary supplements. Consumer preferences are shifting towards healthier, cleaner label products, which propels the demand for naturally derived hydrocolloids like pectin and gums. The competitive dynamics are characterized by strategic partnerships, product differentiation, and a growing emphasis on sustainable sourcing and production methods. The market penetration rate for specialized hydrocolloids in niche applications is expected to witness a considerable increase. The compound annual growth rate (CAGR) for the Australia food hydrocolloids market is anticipated to be around xx% during the forecast period. Opportunities abound in addressing the demand for allergen-free and vegan hydrocolloid solutions, as well as in leveraging the growing e-commerce channels for ingredient distribution. The continuous evolution of food processing technologies further supports the integration of diverse hydrocolloids, creating a fertile ground for market expansion and innovation. The increasing adoption of fortified foods and beverages also presents a significant opportunity for hydrocolloids to act as carriers and stabilizers for various nutrients and active ingredients.

Dominant Markets & Segments in Australia Food Hydrocolloids Market

Within the Australian food hydrocolloids market, the Dairy and Frozen Products segment stands out as a dominant force, consistently driving demand. This dominance is attributed to the widespread use of hydrocolloids in products like ice cream, yogurt, processed cheese, and frozen desserts for their crucial roles in texture enhancement, preventing ice crystal formation, and improving mouthfeel. The Bakery segment also represents a significant and growing market, where hydrocolloids are essential for dough conditioning, moisture retention, and extending shelf life in various baked goods, from bread and pastries to cakes and cookies. The Beverages sector is another key area, with hydrocolloids utilized for viscosity control, suspension of particles, and achieving desired textures in juices, smoothies, and functional drinks.

- Dominant Application Segment: Dairy and Frozen Products

- Key Growth Drivers: High consumer consumption of dairy-based products, demand for creamy textures and improved stability in frozen items.

- Market Share Contribution: Estimated to contribute xx% to the overall market revenue in the base year.

- Strong Performing Application Segment: Bakery

- Key Growth Drivers: Growing demand for convenience bakery items, innovation in gluten-free and low-carbohydrate baked goods requiring texturizing agents.

- Market Share Contribution: Projected to hold a xx% share of the market.

- Emerging Application Segment: Beverages

- Key Growth Drivers: Rise of functional beverages, plant-based milk alternatives, and the need for texture modification in ready-to-drink products.

- Market Share Contribution: Expected to show a CAGR of xx% during the forecast period.

- Dominant Type Segment: Gelatin Gum (often encompassing a broader category of gums)

- Key Growth Drivers: Versatility, cost-effectiveness, and widespread application across multiple food categories.

- Market Share Contribution: Represents a substantial portion of the hydrocolloid market.

- High Growth Type Segment: Pectin

- Key Growth Drivers: Increasing preference for natural ingredients, demand in jams, jellies, and fruit preparations, and its use in plant-based products.

- Market Share Contribution: Experiencing a steady growth trajectory.

- Expanding Type Segment: Xanthan Gum

- Key Growth Drivers: Crucial for gluten-free baking, a powerful thickener, and widely used in dressings and sauces.

- Market Share Contribution: Continues to see strong demand due to its functional properties.

The Australian food hydrocolloids market is expected to see continued dominance by segments catering to established food categories while also experiencing rapid expansion in areas influenced by health and wellness trends.

Australia Food Hydrocolloids Market Product Analysis

Product innovation in the Australia food hydrocolloids market focuses on enhancing functionality, improving sustainability, and meeting clean-label demands. Key developments include the creation of specialized blends offering synergistic texturizing and stabilizing effects, particularly for plant-based food applications. Companies are investing in R&D to extract hydrocolloids from novel and underutilized sources, promoting a circular economy and reducing reliance on traditional raw materials. The competitive advantage lies in offering hydrocolloids that deliver superior performance in challenging processing conditions and contribute to desired sensory attributes like mouthfeel and texture. Technological advancements are enabling the production of hydrocolloids with precise molecular weights and controlled release properties, opening doors for more sophisticated ingredient formulations.

Key Drivers, Barriers & Challenges in Australia Food Hydrocolloids Market

Key Drivers: The Australia food hydrocolloids market is propelled by several key drivers. Technological advancements in extraction and modification processes enable the development of hydrocolloids with enhanced functionalities, catering to specific product needs. Growing consumer preference for processed and convenient foods directly fuels demand for ingredients that improve texture, stability, and shelf life. Furthermore, the increasing popularity of plant-based diets necessitates effective texturizing and gelling agents, creating significant opportunities for hydrocolloids. Economic growth and rising disposable incomes in Australia also contribute to increased spending on a wider variety of food products.

Barriers & Challenges: Supply chain volatility, including fluctuations in raw material availability and pricing, poses a significant challenge. Stringent regulatory approvals and evolving food additive regulations can create hurdles for new product launches and market access. Intense competition among established global players and emerging regional suppliers can lead to price pressures and impact profit margins. Consumer perception regarding artificial versus natural ingredients can also influence purchasing decisions, necessitating clear labeling and consumer education.

Growth Drivers in the Australia Food Hydrocolloids Market Market

Several factors are driving growth in the Australia food hydrocolloids market. Technological innovation in hydrocolloid processing is leading to the development of more efficient and functional ingredients, such as improved gelling agents and emulsifiers. The expanding demand for clean-label and naturally sourced ingredients is a significant growth catalyst, encouraging the use of pectin, agar-agar, and various gums. Economic stability and increasing consumer spending power in Australia lead to a higher consumption of processed foods and beverages, directly benefiting the hydrocolloids market. Government initiatives promoting food innovation and supporting the local food industry can also create a more favorable environment for market expansion. The rising trend of plant-based diets is a powerful driver, demanding functional ingredients to replicate the texture and mouthfeel of traditional animal-derived products.

Challenges Impacting Australia Food Hydrocolloids Market Growth

The Australia food hydrocolloids market faces several challenges that can impact its growth trajectory. Supply chain disruptions, including weather-related impacts on raw material crops and geopolitical events, can lead to price volatility and availability issues for key hydrocolloids. Navigating complex and evolving food safety regulations across different Australian states and territories can be a significant hurdle for manufacturers. Intense competition from both domestic and international players often leads to price wars, squeezing profit margins. Furthermore, fluctuating consumer perceptions regarding the health implications and "naturalness" of certain hydrocolloids necessitate ongoing consumer education and clear labeling strategies to maintain market trust.

Key Players Shaping the Australia Food Hydrocolloids Market Market

- Cargill Incorporated

- Chemiplas Australia Pty Ltd

- DuPont de Nemours Inc

- Agri Food Ingredient

- Cp Kelco

- Hawkins Watts Limited

- Koninklijke DSM N V

- Ingredion Incorporated

Significant Australia Food Hydrocolloids Market Industry Milestones

- 2023 (H2): Acquisition of Bioglan by Blackmores Group, signaling consolidation in the health and wellness ingredient space, potentially impacting specialized hydrocolloid suppliers.

- 2024 (Q1): Establishment of the National Food Industry Innovation Council, aiming to foster collaboration and drive innovation across the Australian food sector, likely benefiting hydrocolloid research and application.

- 2024 (Q3): Launch of new plant-based food products by V2 Food, demonstrating the growing market for meat alternatives and the increasing reliance on hydrocolloids for texture and binding.

Future Outlook for Australia Food Hydrocolloids Market Market

The future outlook for the Australia food hydrocolloids market is exceptionally promising. Driven by sustained consumer demand for convenient, healthy, and plant-based food options, the market is poised for continuous expansion. Strategic opportunities lie in the development of novel hydrocolloids with enhanced functionalities, such as improved emulsification and controlled release properties for functional ingredients. The growing emphasis on sustainability and clean-label ingredients will further propel the demand for naturally derived hydrocolloids. Innovations in biotechnology and agricultural practices are expected to improve the efficiency and cost-effectiveness of hydrocolloid production, making them more accessible across various food applications. The market potential is significant, with opportunities in expanding applications within dairy alternatives, savory snacks, and specialized nutritional products.

Australia Food Hydrocolloids Market Segmentation

-

1. Type

- 1.1. Gelatin Gum

- 1.2. Pectin

- 1.3. Xanthan Gum

- 1.4. Other Types

-

2. Application

- 2.1. Dairy and Frozen Products

- 2.2. Bakery

- 2.3. Beverages

- 2.4. Confectionery

- 2.5. Meat and Seafood Products

- 2.6. Oils and Fats

- 2.7. Other Applications

Australia Food Hydrocolloids Market Segmentation By Geography

- 1. Australia

Australia Food Hydrocolloids Market Regional Market Share

Geographic Coverage of Australia Food Hydrocolloids Market

Australia Food Hydrocolloids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Pectin Holds a Significant Share in The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Food Hydrocolloids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gelatin Gum

- 5.1.2. Pectin

- 5.1.3. Xanthan Gum

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy and Frozen Products

- 5.2.2. Bakery

- 5.2.3. Beverages

- 5.2.4. Confectionery

- 5.2.5. Meat and Seafood Products

- 5.2.6. Oils and Fats

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemiplas Australia Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DuPont de Nemours Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Agri Food Ingredient

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cp Kelco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hawkins Watts Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke DSM N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ingredion Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Australia Food Hydrocolloids Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Food Hydrocolloids Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Food Hydrocolloids Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Australia Food Hydrocolloids Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Australia Food Hydrocolloids Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Australia Food Hydrocolloids Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Australia Food Hydrocolloids Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Australia Food Hydrocolloids Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Food Hydrocolloids Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Australia Food Hydrocolloids Market?

Key companies in the market include Cargill Incorporated, Chemiplas Australia Pty Ltd, DuPont de Nemours Inc, Agri Food Ingredient, Cp Kelco, Hawkins Watts Limited, Koninklijke DSM N V, Ingredion Incorporated.

3. What are the main segments of the Australia Food Hydrocolloids Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.72 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Pectin Holds a Significant Share in The Market.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Bioglan by Blackmores Group 2. Establishment of the National Food Industry Innovation Council 3. Launch of new plant-based food products by V2 Food

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Food Hydrocolloids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Food Hydrocolloids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Food Hydrocolloids Market?

To stay informed about further developments, trends, and reports in the Australia Food Hydrocolloids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence