Key Insights

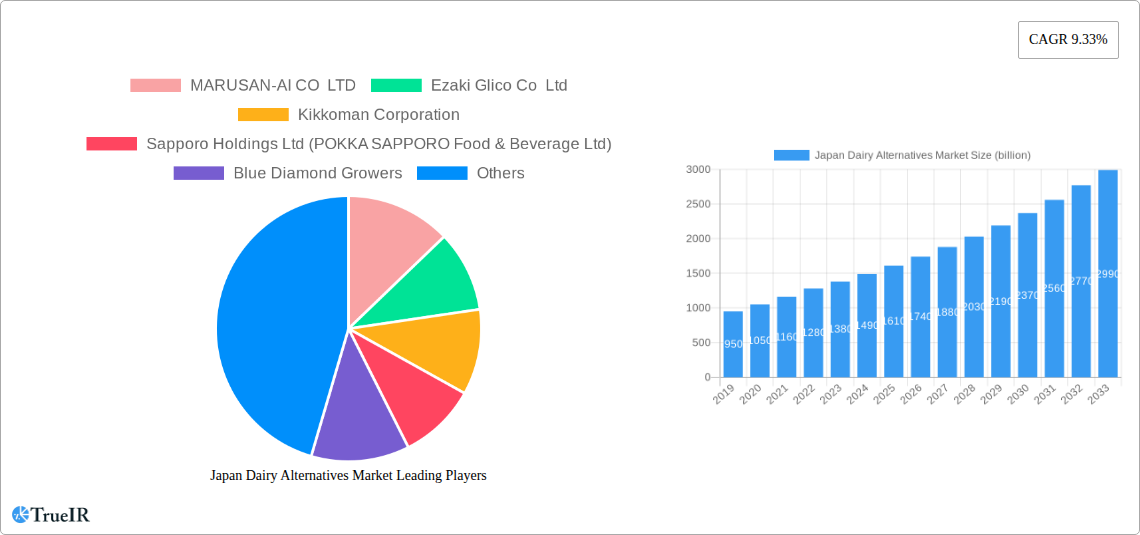

The Japanese dairy alternatives market is experiencing robust growth, projected to reach an estimated USD 1.49 billion in 2024, with a strong Compound Annual Growth Rate (CAGR) of 9.33% anticipated to continue through 2033. This expansion is primarily fueled by a growing consumer consciousness around health and wellness, increasing lactose intolerance, and a heightened awareness of environmental sustainability. Consumers are actively seeking plant-based options that offer comparable nutritional profiles and taste to traditional dairy products. The market is segmented across various product categories, including non-dairy butter, cheese, milk, and yogurt. Within non-dairy milk, almond milk, oat milk, and soy milk are leading the charge, catering to diverse dietary preferences and allergen concerns. The convenience of access through various distribution channels, from online retail and supermarkets to specialist stores, further propels market penetration and adoption.

Japan Dairy Alternatives Market Market Size (In Million)

The Japanese market for dairy alternatives is also shaped by evolving consumer trends such as the demand for functional beverages with added health benefits, the rise of innovative, gourmet plant-based cheese, and the increasing popularity of oat milk due to its creamy texture and versatile application. While growth drivers are strong, potential restraints such as the perceived higher cost of some dairy alternatives compared to conventional dairy and consumer preference for traditional flavors in certain applications need to be navigated by market players. Companies are actively investing in research and development to enhance taste, texture, and nutritional value, while also focusing on sustainable sourcing and production methods. Strategic collaborations and expansions are also key to capturing market share and meeting the escalating demand for dairy-free products across Japan.

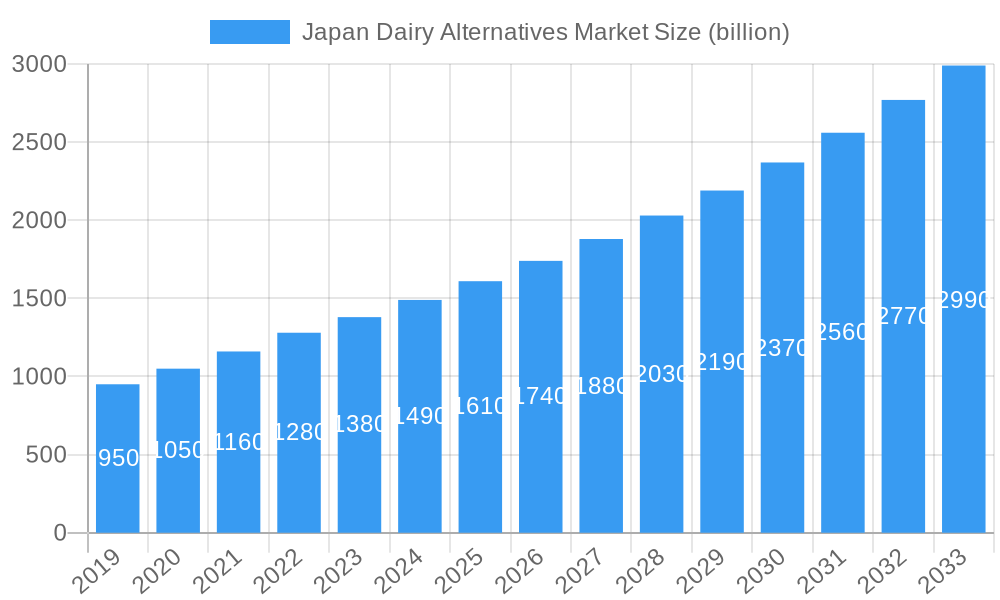

Japan Dairy Alternatives Market Company Market Share

Japan Dairy Alternatives Market: Unveiling a Billion-Dollar Growth Trajectory

This comprehensive report provides an in-depth analysis of the Japan Dairy Alternatives Market, a dynamic sector poised for significant expansion. Leveraging high-volume keywords such as "Japan dairy alternatives," "plant-based milk Japan," "non-dairy yogurt Japan," and "vegan cheese Japan," this report is meticulously crafted for industry professionals, investors, and stakeholders seeking actionable insights into market size, trends, opportunities, and competitive dynamics. The study covers the historical period from 2019 to 2024, with a base year of 2025, and projects growth through a forecast period extending to 2033.

Japan Dairy Alternatives Market Market Structure & Competitive Landscape

The Japan Dairy Alternatives Market is characterized by a moderately concentrated structure, with key players actively driving innovation and market penetration. The competitive landscape is shaped by evolving consumer preferences for healthier and sustainable food options, alongside increasing awareness of the environmental impact of traditional dairy. Innovation remains a significant driver, with companies continuously launching new products and formulations to cater to diverse dietary needs and taste profiles. Regulatory impacts, while generally supportive of food product safety, can influence product labeling and ingredient sourcing. Product substitutes, primarily traditional dairy products, continue to present a competitive challenge, though the growing acceptance of plant-based alternatives is steadily eroding their dominance. End-user segmentation reveals a strong demand from health-conscious individuals, lactose-intolerant consumers, and the growing vegan and vegetarian populations. Mergers and acquisitions (M&A) trends, while not yet dominant, are anticipated to increase as larger food conglomerates seek to capitalize on the burgeoning plant-based market. Quantitative insights suggest a substantial increase in product launches within the last three years, indicating a competitive push for market share.

- Market Concentration: Moderately concentrated with key multinational and domestic players.

- Innovation Drivers: Health and wellness trends, environmental sustainability, ethical consumerism.

- Regulatory Impacts: Focus on food safety, labeling standards, and ingredient disclosure.

- Product Substitutes: Traditional dairy products, other emerging plant-based beverages.

- End-User Segmentation: Health-conscious, lactose-intolerant, vegan, vegetarian consumers.

- M&A Trends: Emerging, with potential for increased activity in the coming years.

Japan Dairy Alternatives Market Market Trends & Opportunities

The Japan Dairy Alternatives Market is experiencing robust growth, projected to reach billions in market value within the forecast period. This expansion is fueled by a confluence of factors, including rising health consciousness, increasing prevalence of lactose intolerance, and a growing ethical concern for animal welfare and environmental sustainability. Technological advancements in ingredient processing and formulation are enabling the creation of dairy alternatives that closely mimic the taste, texture, and nutritional profile of traditional dairy products, thereby enhancing consumer acceptance and product appeal. The market penetration rate for dairy alternatives is steadily increasing, particularly within urban centers, as consumers become more exposed to and willing to experiment with plant-based options.

Consumer preferences are shifting towards a wider variety of non-dairy milk bases, beyond traditional soy milk, with almond, oat, and coconut milk gaining significant traction. The demand for non-dairy yogurt and cheese is also on an upward trajectory as consumers seek versatile plant-based alternatives for their culinary needs. Online retail channels are emerging as a crucial distribution avenue, offering convenience and a wider product selection, complementing the presence of dairy alternatives in supermarkets and hypermarkets. This evolving consumer landscape presents numerous opportunities for market players to introduce innovative products, expand their distribution networks, and capture a larger share of this rapidly expanding market. The projected CAGR for the Japan Dairy Alternatives Market indicates a sustained period of significant growth, presenting a lucrative avenue for investment and business development. The market is also witnessing a growing interest in functional dairy alternatives, fortified with vitamins and minerals, further broadening their appeal.

Dominant Markets & Segments in Japan Dairy Alternatives Market

The dominant force within the Japan Dairy Alternatives Market is undeniably Non-Dairy Milk, driven by its widespread application and consumer familiarity. Within this category, Almond Milk and Oat Milk are experiencing particularly rapid growth, propelled by their perceived health benefits, versatility, and increasingly sophisticated flavor profiles. The Soy Milk segment, while mature, continues to hold a significant market share due to its long-standing presence and affordability. Coconut milk and hemp milk are emerging as niche but growing segments, catering to consumers seeking specific taste experiences and nutritional benefits.

The Non-Dairy Yogurt segment is also a significant contributor to market growth, with consumers increasingly seeking plant-based alternatives for their breakfast and snack routines. The innovation in this segment, offering a wide array of flavors and textures, is a key growth driver. While Non-Dairy Cheese is still a developing segment, its market presence is steadily expanding as culinary applications for vegan cheese become more diverse and accessible. The demand for Non-Dairy Butter is also on the rise, driven by its utility in baking and cooking.

In terms of distribution channels, Off-Trade holds a dominant position, with Supermarkets and Hypermarkets serving as the primary points of purchase for the majority of consumers. However, Online Retail is a rapidly expanding channel, offering unparalleled convenience and a broader product selection, especially for niche or specialized dairy alternatives. Convenience Stores are also increasingly stocking a range of dairy alternatives, catering to impulse purchases and on-the-go consumption. The On-Trade channel, including cafes and restaurants, represents a growing opportunity for dairy alternative brands as they increasingly feature plant-based options on their menus.

- Leading Category: Non-Dairy Milk

- Key Product Types: Almond Milk, Oat Milk, Soy Milk, Coconut Milk, Hemp Milk

- Growth Drivers: Perceived health benefits, versatility, improved taste and texture, demand for vegan and lactose-free options.

- Significant Growing Segment: Non-Dairy Yogurt

- Growth Drivers: Breakfast and snack trends, diverse flavor offerings, health-conscious consumers.

- Emerging Segments: Non-Dairy Cheese, Non-Dairy Butter

- Growth Drivers: Expanding culinary applications, increased availability, growing vegan population.

- Dominant Distribution Channel: Off-Trade

- Key Sub-Channels: Supermarkets and Hypermarkets, Online Retail, Convenience Stores.

- Growth Drivers for Online Retail: Convenience, wider selection, accessibility.

Japan Dairy Alternatives Market Product Analysis

Product innovation in the Japan Dairy Alternatives Market is a cornerstone of growth. Manufacturers are actively developing novel formulations that enhance taste, texture, and nutritional value, closely mimicking traditional dairy products. Technological advancements in plant-based protein extraction and emulsification are key to achieving superior sensory attributes and extended shelf life. The competitive advantage lies in offering a diverse range of non-dairy milk bases, including almond, oat, coconut, and soy, catering to varied consumer preferences and dietary needs. Furthermore, the development of specialized products like non-dairy yogurts and cheeses with improved meltability and flavor profiles is attracting a broader consumer base. Applications are expanding beyond simple beverage consumption to include baking, cooking, and as ingredients in processed foods, underscoring the versatility and growing acceptance of these alternatives.

Key Drivers, Barriers & Challenges in Japan Dairy Alternatives Market

The Japan Dairy Alternatives Market is propelled by several key drivers. Growing consumer awareness regarding the health benefits associated with plant-based diets, including lower cholesterol and fat content, is a primary catalyst. The increasing prevalence of lactose intolerance and dairy allergies further fuels demand for non-dairy alternatives. Environmental concerns regarding the carbon footprint and resource intensity of traditional dairy farming are also significant motivators for consumers to opt for sustainable plant-based products. Technological advancements in processing and formulation have led to improved taste and texture, making dairy alternatives more appealing to a wider audience.

However, the market faces certain barriers and challenges. The relatively higher price point of many dairy alternatives compared to traditional dairy products can be a deterrent for price-sensitive consumers. The availability of a wide variety of fortified dairy alternatives with comparable or superior nutritional profiles can also pose a challenge. Supply chain complexities, particularly for sourcing specific plant-based ingredients, and potential regulatory hurdles related to product labeling and claims can impact market expansion. Intense competition among established dairy giants and emerging plant-based brands necessitates continuous innovation and effective marketing strategies.

- Drivers:

- Rising health consciousness and demand for plant-based diets.

- Increasing prevalence of lactose intolerance and dairy allergies.

- Growing environmental and ethical concerns related to dairy production.

- Technological advancements improving taste, texture, and nutritional value.

- Barriers & Challenges:

- Higher price points of some dairy alternatives.

- Competition from nutritionally fortified traditional dairy products.

- Supply chain complexities and ingredient sourcing.

- Potential regulatory hurdles and labeling requirements.

- Intense competitive landscape requiring constant innovation.

Growth Drivers in the Japan Dairy Alternatives Market Market

The Japan Dairy Alternatives Market's growth is underpinned by a powerful interplay of technological, economic, and regulatory factors. Technological advancements in ingredient processing, such as improved methods for extracting and refining plant-based proteins and fats, are crucial. These innovations lead to dairy alternatives with enhanced nutritional profiles, superior textures, and more appealing flavors, directly addressing consumer taste preferences. Economically, the increasing disposable income in Japan allows consumers to explore premium and health-oriented food options, including plant-based alternatives. The growing awareness and adoption of vegan and vegetarian lifestyles, influenced by global trends and media, also contribute significantly. Furthermore, favorable government initiatives and increasing support for sustainable food production and consumption can positively impact the market.

Challenges Impacting Japan Dairy Alternatives Market Growth

Several challenges can impede the growth trajectory of the Japan Dairy Alternatives Market. Regulatory complexities surrounding the naming and labeling of plant-based products, particularly in relation to traditional dairy terms, can create confusion and market barriers. Supply chain issues, such as ensuring a consistent and high-quality supply of key ingredients like almonds, oats, and coconuts, can impact production volumes and cost. Competitive pressures are mounting as both established dairy companies and new entrants vie for market share, leading to intense price competition and the need for continuous product differentiation. Consumer perception regarding the taste and nutritional completeness of certain dairy alternatives, especially compared to fortified dairy products, can also act as a restraint, necessitating sustained consumer education and product development efforts.

Key Players Shaping the Japan Dairy Alternatives Market Market

- MARUSAN-AI CO LTD

- Ezaki Glico Co Ltd

- Kikkoman Corporation

- Sapporo Holdings Ltd (POKKA SAPPORO Food & Beverage Ltd)

- Blue Diamond Growers

- Marinfood Co Ltd

- Otsuka Holdings Co Ltd

- Saputo Inc

Significant Japan Dairy Alternatives Market Industry Milestones

- November 2021: Blue Diamond Growers expanded its product portfolio by introducing a new product, Extra Cream Almond Milk, catering to demand for richer textures.

- August 2021: Sapporo Holdings Ltd's (Pokka) subsidiary, Pokka Sapporo, launched a new range of soy, coconut, and almond-based yogurt under its Soibio brand. The product is available in various sizes, signifying a strategic move into the dairy-free yogurt market.

- October 2019: Blue Diamond expanded its Almond Breeze range by launching two new creamers and almond milk blended with bananas, demonstrating a continuous effort to diversify and innovate within the almond milk category.

Future Outlook for Japan Dairy Alternatives Market Market

The future outlook for the Japan Dairy Alternatives Market is exceptionally bright, driven by sustained consumer demand for healthier, more sustainable, and ethically produced food options. The market is expected to witness continued innovation in product development, with an emphasis on enhancing taste, texture, and nutritional fortification to rival traditional dairy products. Emerging opportunities lie in expanding the reach of non-dairy cheese and butter alternatives, as well as exploring novel plant-based milk bases to cater to evolving consumer preferences. Strategic collaborations between ingredient suppliers, manufacturers, and retailers will be pivotal in addressing supply chain challenges and expanding distribution networks. The growing awareness of environmental sustainability is expected to further propel the adoption of dairy alternatives, positioning the market for significant, long-term growth and market penetration.

Japan Dairy Alternatives Market Segmentation

-

1. Category

- 1.1. Non-Dairy Butter

- 1.2. Non-Dairy Cheese

-

1.3. Non-Dairy Milk

-

1.3.1. By Product Type

- 1.3.1.1. Almond Milk

- 1.3.1.2. Coconut Milk

- 1.3.1.3. Hemp Milk

- 1.3.1.4. Oat Milk

- 1.3.1.5. Soy Milk

-

1.3.1. By Product Type

- 1.4. Non-Dairy Yogurt

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Japan Dairy Alternatives Market Segmentation By Geography

- 1. Japan

Japan Dairy Alternatives Market Regional Market Share

Geographic Coverage of Japan Dairy Alternatives Market

Japan Dairy Alternatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Dairy Alternatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Non-Dairy Butter

- 5.1.2. Non-Dairy Cheese

- 5.1.3. Non-Dairy Milk

- 5.1.3.1. By Product Type

- 5.1.3.1.1. Almond Milk

- 5.1.3.1.2. Coconut Milk

- 5.1.3.1.3. Hemp Milk

- 5.1.3.1.4. Oat Milk

- 5.1.3.1.5. Soy Milk

- 5.1.3.1. By Product Type

- 5.1.4. Non-Dairy Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MARUSAN-AI CO LTD

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ezaki Glico Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kikkoman Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sapporo Holdings Ltd (POKKA SAPPORO Food & Beverage Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Blue Diamond Growers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marinfood Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Otsuka Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saputo Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 MARUSAN-AI CO LTD

List of Figures

- Figure 1: Japan Dairy Alternatives Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Dairy Alternatives Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Dairy Alternatives Market Revenue billion Forecast, by Category 2020 & 2033

- Table 2: Japan Dairy Alternatives Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Japan Dairy Alternatives Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Dairy Alternatives Market Revenue billion Forecast, by Category 2020 & 2033

- Table 5: Japan Dairy Alternatives Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Japan Dairy Alternatives Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Dairy Alternatives Market?

The projected CAGR is approximately 9.33%.

2. Which companies are prominent players in the Japan Dairy Alternatives Market?

Key companies in the market include MARUSAN-AI CO LTD, Ezaki Glico Co Ltd, Kikkoman Corporation, Sapporo Holdings Ltd (POKKA SAPPORO Food & Beverage Ltd), Blue Diamond Growers, Marinfood Co Ltd, Otsuka Holdings Co Ltd, Saputo Inc.

3. What are the main segments of the Japan Dairy Alternatives Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

November 2021: Blue Diamond Growers expanded its product portfolio by introducing a new product, Extra Cream Almond Milk.August 2021: Sapporo Holdings Ltd's (Pokka) subsidiary, Pokka Sapporo, launched a new range of soy, coconut, and almond-based yogurt under its Soibio brand. The product is available in various sizes.October 2019: Blue Diamond expanded its Almond Breeze range by launching two new creamers and almond milk blended with bananas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Dairy Alternatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Dairy Alternatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Dairy Alternatives Market?

To stay informed about further developments, trends, and reports in the Japan Dairy Alternatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence