Key Insights

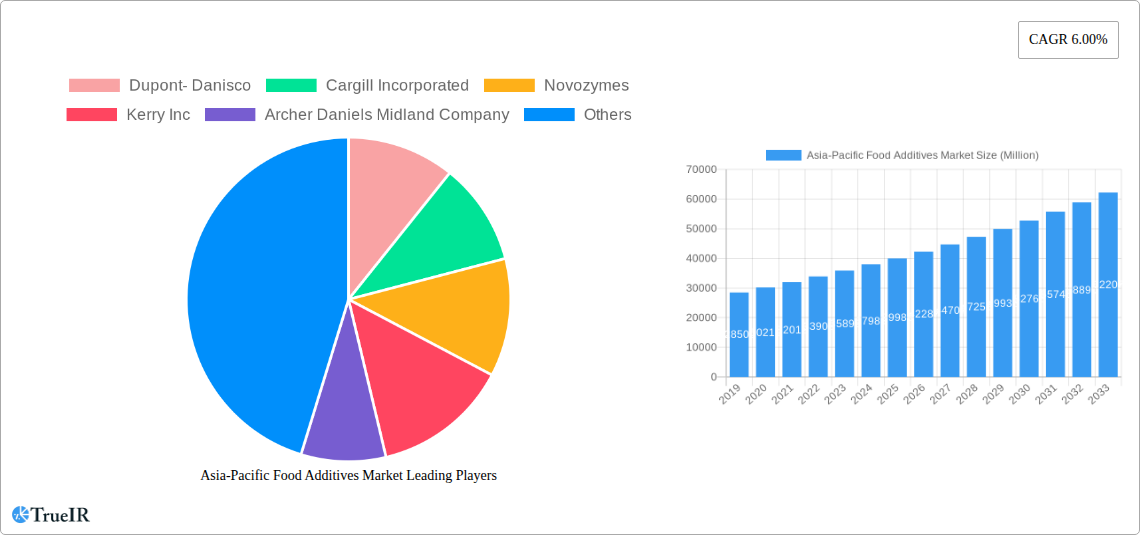

The Asia-Pacific Food Additives Market is projected for substantial growth, expected to reach $136.6 billion by 2025, with a CAGR of 10.1%. This expansion is propelled by evolving consumer demand for convenience foods and rising disposable incomes in emerging economies. The trend towards cleaner labels and natural ingredients presents a significant opportunity for innovation in natural preservatives and colorants. The burgeoning food and beverage industry, particularly in dairy and bakery sectors, requires high-quality food additives to enhance product appeal, shelf-life, and nutritional value. Technological advancements in additive production, focusing on efficiency and sustainability, are also crucial in meeting market demands.

Asia-Pacific Food Additives Market Market Size (In Billion)

The market is segmented by product type and application. Emulsifiers, Hydrocolloids, and Sweeteners are anticipated to lead demand, driven by their extensive use in beverages, bakery, and dairy. The "Others" application segment is also expected to contribute significantly. Key market drivers include the sustained interest in fortified foods and the growing acceptance of innovative food technologies. Potential challenges, such as stringent regulations and fluctuating raw material prices, are being addressed by industry leaders like Cargill Incorporated, DuPont, and Archer Daniels Midland Company, who are investing in R&D and production expansion within the region.

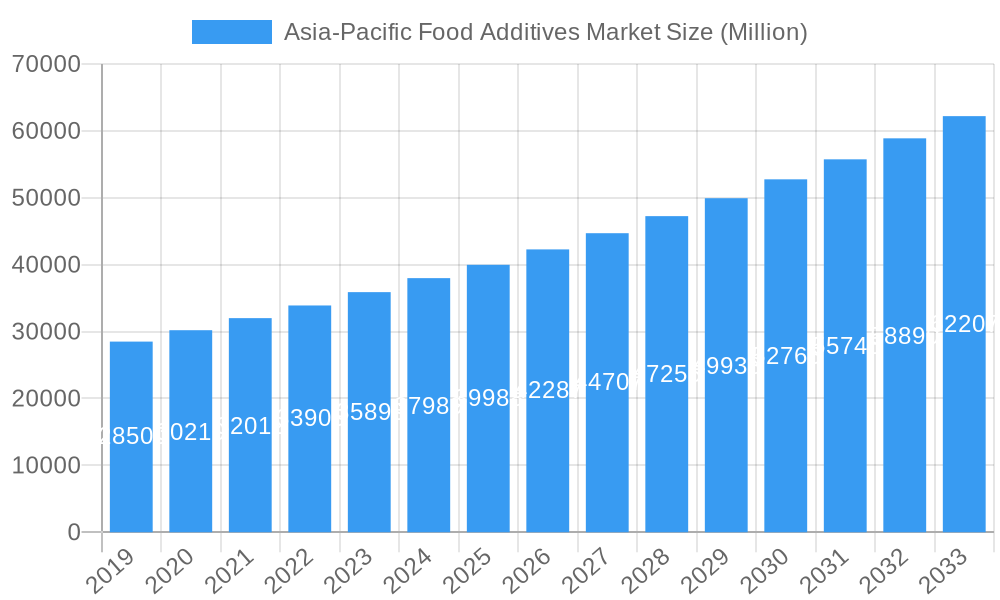

Asia-Pacific Food Additives Market Company Market Share

This comprehensive report offers a dynamic and SEO-optimized analysis of the Asia-Pacific Food Additives Market. Utilizing high-volume keywords and detailed data, it provides critical insights for manufacturers, suppliers, investors, and researchers. The analysis covers a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033.

The Asia-Pacific region is experiencing robust growth in its food additives market, driven by escalating demand for processed foods, evolving consumer preferences for healthier and cleaner labels, and advancements in food technology. This report delivers a 360-degree view of this rapidly evolving sector, examining market structure, prevailing trends, dominant segments, product innovations, key drivers, significant challenges, and the competitive landscape. The estimated market size for the Asia-Pacific Food Additives Market in 2025 is $136.6 billion.

Asia-Pacific Food Additives Market Market Structure & Competitive Landscape

The Asia-Pacific Food Additives Market exhibits a moderately concentrated structure, characterized by the presence of both multinational giants and regional players. Key companies like Dupont-Danisco, Cargill Incorporated, Novozymes, Kerry Inc, Archer Daniels Midland Company, Corbion NV, Koninklijke DSM N V, and Tate & Lyle are instrumental in shaping the market dynamics through significant investments in research and development, strategic acquisitions, and product portfolio expansion. Innovation drivers are primarily fueled by the growing consumer demand for natural and clean-label ingredients, coupled with stringent regulatory frameworks that necessitate adherence to safety and quality standards. Regulatory impacts, such as evolving food safety regulations and labeling requirements across various Asia-Pacific nations, play a crucial role in product development and market entry strategies. Product substitutes, while present, often differ in functionality and cost-effectiveness, allowing for niche market penetration. End-user segmentation is diverse, encompassing rapidly growing sectors like beverages, bakery, meat and meat products, and dairy products, each with distinct additive requirements. Mergers and acquisitions (M&A) trends are on the rise, with an estimated XX M&A deals observed in the historical period (2019-2024), reflecting a consolidation drive to enhance market share and technological capabilities.

Asia-Pacific Food Additives Market Market Trends & Opportunities

The Asia-Pacific Food Additives Market is poised for substantial growth, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust expansion is driven by a confluence of factors, including the burgeoning middle class in developing economies across the region, leading to increased disposable income and a higher consumption of processed and convenience foods. Technological shifts are profoundly influencing the market, with a growing emphasis on biotechnological solutions for producing natural food additives, such as enzymes and bio-based emulsifiers. Consumer preferences are increasingly leaning towards healthier food options, prompting a demand for sugar reduction through sweeteners, the use of natural preservatives to extend shelf life, and flavor enhancers that mimic natural taste profiles. The clean-label trend continues to gain momentum, pushing manufacturers to opt for additives with recognizable and natural origins. Furthermore, the increasing adoption of advanced processing techniques in the food and beverage industry necessitates specialized food additives to maintain product quality, texture, and stability. The competitive dynamics are intensifying, with companies focusing on differentiating their offerings through innovation, sustainability initiatives, and strategic partnerships. Market penetration rates for specialized food additives, particularly in emerging economies, are expected to rise significantly as consumer awareness and purchasing power grow. The push for healthier food products is creating a significant opportunity for functional food additives that offer health benefits beyond basic taste and preservation.

Dominant Markets & Segments in Asia-Pacific Food Additives Market

Within the Asia-Pacific region, China stands out as the dominant market for food additives, owing to its massive population, rapidly expanding food processing industry, and significant investments in food technology. Its market dominance is propelled by government policies supporting food innovation and safety, coupled with a vast consumer base driving demand across all application segments. The Rest of Asia-Pacific, encompassing countries like Southeast Asian nations, also presents substantial growth opportunities due to rapid industrialization and increasing urbanization.

Among the product types, Emulsifiers are projected to maintain a leading position, driven by their extensive use in bakery, dairy, and processed food products to improve texture, stability, and shelf life. Sweeteners are experiencing a surge in demand, fueled by the global health consciousness and the rising prevalence of lifestyle diseases like diabetes, leading consumers to seek sugar alternatives. Food Colorants, both natural and synthetic, are crucial for enhancing the visual appeal of food products, a key purchasing factor for consumers. The Enzymes segment is witnessing accelerated growth due to their versatile applications in food processing, from baking and brewing to dairy production, offering improved efficiency and product quality.

In terms of applications, the Beverages sector is a significant consumer of food additives, including acidulants, sweeteners, and flavor enhancers, to meet the evolving taste preferences and demand for functional beverages. The Bakery segment consistently ranks high due to the extensive use of emulsifiers, leavening agents, and preservatives to ensure product quality and shelf stability. The Meat and Meat Products sector is increasingly incorporating preservatives and flavor enhancers to improve palatability and extend shelf life. The Dairy Products segment utilizes emulsifiers, stabilizers, and acidulants to enhance texture and preservation.

Key growth drivers in these dominant markets and segments include:

- Infrastructure Development: Enhanced logistics and cold chain infrastructure facilitate the distribution of food additives and finished products.

- Favorable Government Policies: Subsidies, tax incentives, and supportive regulations encourage investment and innovation in the food processing and additive sectors.

- Rising Disposable Income: Increased purchasing power of consumers leads to higher demand for processed and convenience foods.

- Technological Advancements: Innovations in food additive production and application enhance product performance and sustainability.

- Consumer Awareness: Growing awareness about food quality, safety, and health benefits influences purchasing decisions and drives demand for specific additives.

Asia-Pacific Food Additives Market Product Analysis

The Asia-Pacific Food Additives Market is characterized by continuous product innovation aimed at meeting evolving consumer demands for healthier, cleaner, and more sustainable food options. Key advancements include the development of natural preservatives derived from plant extracts, bio-based emulsifiers produced through fermentation, and enzymes that enhance food texture and processing efficiency. The market is witnessing a rise in demand for high-performance additives that offer multiple functionalities, such as flavor enhancement coupled with shelf-life extension. Competitive advantages are increasingly being derived from ingredients that align with clean-label trends and provide demonstrable health benefits, alongside traditional attributes like stability and consistency.

Key Drivers, Barriers & Challenges in Asia-Pacific Food Additives Market

Key Drivers:

- Growing Demand for Processed Foods: An expanding middle class and urbanization are fueling the consumption of convenience and processed foods, directly increasing the need for food additives.

- Health and Wellness Trends: Consumers' focus on healthier diets is driving demand for low-sugar, low-fat, and natural food additives like sweeteners, natural colorants, and preservatives.

- Technological Advancements: Innovations in biotechnology and food processing are leading to the development of novel and more efficient food additives.

- Stringent Food Safety Regulations: Evolving regulations across the Asia-Pacific region necessitate the use of approved and high-quality food additives for product safety and compliance.

Barriers & Challenges:

- Regulatory Complexity: Navigating diverse and sometimes conflicting food additive regulations across different countries in the Asia-Pacific region poses a significant challenge for market entry and expansion.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and logistical hurdles can impact the availability and cost of raw materials, leading to supply chain vulnerabilities.

- Price Sensitivity: While demand for premium additives is growing, a significant segment of the market remains price-sensitive, creating pressure on profit margins for manufacturers.

- Consumer Perception of Additives: Negative consumer perceptions and concerns about the health implications of certain food additives can lead to demand shifts towards "free-from" products, requiring reformulation.

Growth Drivers in the Asia-Pacific Food Additives Market Market

The Asia-Pacific Food Additives Market is significantly propelled by a confluence of technological, economic, and regulatory factors. Economically, the burgeoning middle class across countries like China and India translates into increased disposable incomes, fostering a greater appetite for processed and convenience foods, which inherently rely on food additives for preservation, taste, and texture. Technologically, advancements in biotechnology are enabling the production of novel, natural, and functional food additives, such as enzymes for improved food processing and bio-based alternatives for traditional chemicals. Regulatory frameworks, while sometimes challenging, are also driving growth by mandating higher safety and quality standards, pushing manufacturers to invest in compliant and premium-grade additives. For instance, the increasing focus on reducing sugar content in beverages and processed foods directly drives the demand for innovative sweeteners and sugar replacers.

Challenges Impacting Asia-Pacific Food Additives Market Growth

Several barriers and restraints continue to impact the growth trajectory of the Asia-Pacific Food Additives Market. Regulatory complexities, including differing approval processes and labeling requirements across the region, can hinder seamless market access and increase compliance costs for companies. Supply chain disruptions, stemming from global events or localized logistical issues, can lead to volatile raw material prices and affect the consistent availability of essential additives, impacting production schedules and profitability. Competitive pressures from both established global players and emerging local manufacturers also intensify, particularly in price-sensitive segments, potentially squeezing profit margins and demanding continuous innovation to maintain market share. For example, the push for natural ingredients, while an opportunity, also presents a challenge in terms of sourcing, scalability, and cost-effectiveness compared to synthetic alternatives.

Key Players Shaping the Asia-Pacific Food Additives Market Market

- Dupont-Danisco

- Cargill Incorporated

- Novozymes

- Kerry Inc

- Archer Daniels Midland Company

- Corbion NV

- Koninklijke DSM N V

- Tate & Lyle

Significant Asia-Pacific Food Additives Market Industry Milestones

- 2022: Dupont-Danisco invests in bio-based emulsifiers, emphasizing a commitment to sustainable ingredient solutions and meeting growing demand for natural food components.

- 2023: Cargill acquires a food stabilizer manufacturer to expand its portfolio, signaling strategic growth through vertical integration and enhancing its offerings in texture and stability solutions for various food applications.

- 2023: Novozymes launches a new enzyme for improved food texture, showcasing ongoing innovation in biocatalysis to address specific processing challenges and enhance consumer product experience.

- 2024: Kerry Inc. develops a natural food preservative to meet consumer demand, reflecting a proactive response to the increasing consumer preference for clean-label products and the market's shift away from synthetic additives.

Future Outlook for Asia-Pacific Food Additives Market Market

The future outlook for the Asia-Pacific Food Additives Market is exceptionally promising, characterized by sustained growth driven by evolving consumer preferences and technological advancements. Strategic opportunities lie in the continued expansion of the clean-label movement, creating a strong demand for natural and plant-derived additives. The growing health and wellness consciousness will further propel the market for functional ingredients, including those offering enhanced nutritional benefits and sugar reduction solutions. Investments in research and development for sustainable and bio-based additives are expected to be a key differentiator, aligning with global environmental goals. The increasing adoption of advanced food processing technologies will also create a demand for highly specialized additives, solidifying the market's potential for innovation and expansion.

Asia-Pacific Food Additives Market Segmentation

-

1. Type

- 1.1. Emulsifiers

- 1.2. Anti-Caking Agents

- 1.3. Enzymes

- 1.4. Hydrocolloids

- 1.5. Acidulants

- 1.6. Preservatives

- 1.7. Sweeteners

- 1.8. Food Flavors

- 1.9. Food Flavor Enhancers

- 1.10. Food Colorants

-

2. Applications

- 2.1. Beverages

- 2.2. Bakery

- 2.3. Meat and Meat Products

- 2.4. Dairy Products

- 2.5. Others

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia Pacific

Asia-Pacific Food Additives Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia-Pacific Food Additives Market Regional Market Share

Geographic Coverage of Asia-Pacific Food Additives Market

Asia-Pacific Food Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Bakery Holds a Great Potential

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Food Additives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Emulsifiers

- 5.1.2. Anti-Caking Agents

- 5.1.3. Enzymes

- 5.1.4. Hydrocolloids

- 5.1.5. Acidulants

- 5.1.6. Preservatives

- 5.1.7. Sweeteners

- 5.1.8. Food Flavors

- 5.1.9. Food Flavor Enhancers

- 5.1.10. Food Colorants

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Beverages

- 5.2.2. Bakery

- 5.2.3. Meat and Meat Products

- 5.2.4. Dairy Products

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dupont- Danisco

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cargill Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novozymes

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kerry Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniels Midland Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corbion NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke DSM N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tate & Lyle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Dupont- Danisco

List of Figures

- Figure 1: Asia-Pacific Food Additives Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Food Additives Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Food Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Food Additives Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 3: Asia-Pacific Food Additives Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Food Additives Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Food Additives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Food Additives Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 7: Asia-Pacific Food Additives Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Food Additives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Food Additives Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Food Additives Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: India Asia-Pacific Food Additives Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Australia Asia-Pacific Food Additives Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Asia-Pacific Food Additives Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Food Additives Market?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Asia-Pacific Food Additives Market?

Key companies in the market include Dupont- Danisco, Cargill Incorporated, Novozymes, Kerry Inc, Archer Daniels Midland Company, Corbion NV, Koninklijke DSM N V , Tate & Lyle.

3. What are the main segments of the Asia-Pacific Food Additives Market?

The market segments include Type, Applications, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 136.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Bakery Holds a Great Potential.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Dupont-Danisco invests in bio-based emulsifiers. 2. Cargill acquires food stabilizer manufacturer to expand its portfolio. 3. Novozymes launches a new enzyme for improved food texture. 4. Kerry Inc. develops a natural food preservative to meet consumer demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Food Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Food Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Food Additives Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Food Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence