Key Insights

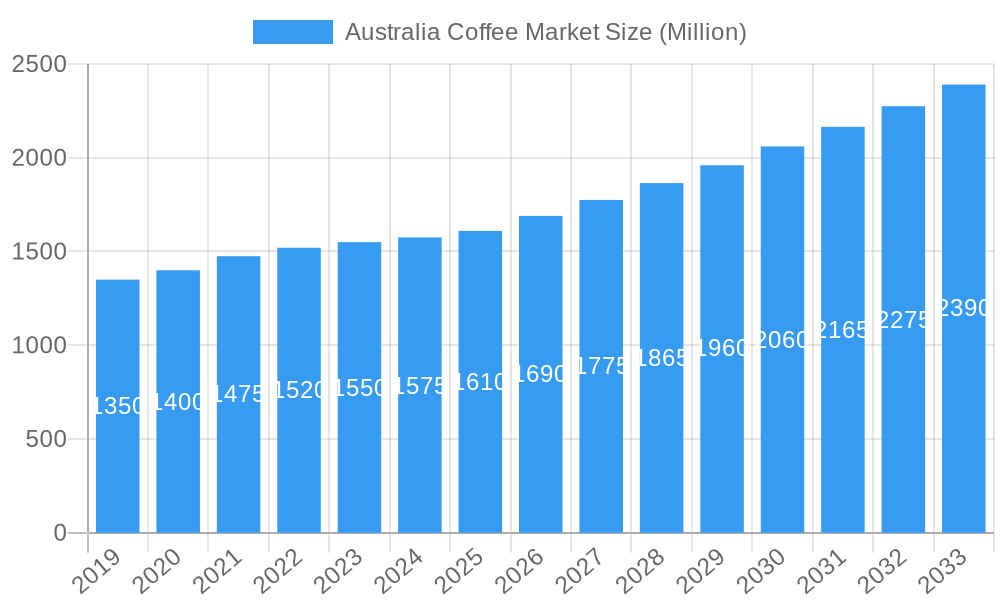

The Australian coffee market is projected for robust expansion, exhibiting a Compound Annual Growth Rate (CAGR) of 5.73% from 2019 to 2033. Starting from an estimated market size of AUD 1,550 million in 2025, the sector is anticipated to reach significant heights by 2033, fueled by evolving consumer preferences and an increasing appreciation for premium coffee experiences. The market's dynamism is further underscored by a diverse range of product segments, including whole bean, ground coffee, instant coffee, and increasingly popular single-serve options like coffee pods and capsules. This product diversification caters to a broad spectrum of consumer habits, from traditional brewing methods to convenient, on-the-go solutions. The growth drivers are primarily attributed to the rising disposable incomes, a burgeoning café culture, and a growing awareness of the health benefits associated with moderate coffee consumption. Furthermore, an increasing demand for ethically sourced and specialty coffee beans, coupled with innovative product offerings from leading companies, will continue to propel market advancement.

Australia Coffee Market Market Size (In Billion)

Distribution channels are playing a crucial role in shaping market accessibility and consumer reach. Hypermarkets and supermarkets, alongside convenience and grocery stores, currently hold a significant share, reflecting traditional purchasing habits. However, the burgeoning online retail sector is demonstrating exceptional growth, driven by convenience, wider product selection, and direct-to-consumer models adopted by both established brands and emerging specialty roasters. This shift highlights the increasing digital savviness of Australian consumers. While the market benefits from these growth drivers, it also faces certain restraints. Fluctuations in raw material prices, particularly for coffee beans, can impact profitability and consumer pricing. Moreover, increasing competition from alternative beverages and a growing emphasis on sustainability and ethical sourcing by consumers may necessitate strategic adjustments from market players. Nonetheless, the overarching trend points towards a sophisticated and expanding Australian coffee market, driven by quality, convenience, and a deep-seated consumer passion for coffee.

Australia Coffee Market Company Market Share

Here is a dynamic, SEO-optimized report description for the Australia Coffee Market, leveraging high-volume keywords and adhering to your specified structure and content requirements.

Australia Coffee Market: Comprehensive Analysis & Future Outlook (2019-2033)

Dive deep into the Australia Coffee Market with this exhaustive report, providing unparalleled insights into market dynamics, growth drivers, and future potential. This research covers the Australia coffee industry from 2019 to 2033, with a detailed analysis of the base year 2025 and a forecast period extending to 2033. Gain a competitive edge by understanding key trends, dominant segments, and the strategies of leading coffee companies in Australia.

Australia Coffee Market Market Structure & Competitive Landscape

The Australia coffee market exhibits a moderately concentrated structure, influenced by the presence of both global giants and prominent local players. Key companies such as Nestle SA, JAB Holding Company, and Vittoria Coffee Pty Ltd command significant market share. Innovation remains a critical driver, with companies continuously investing in new product development, sustainable sourcing, and enhanced consumer experiences. Regulatory impacts, primarily related to food safety standards and import/export policies, play a role in shaping market entry and operational strategies. Product substitutes, including tea and energy drinks, are present but the strong cultural preference for coffee in Australia limits their immediate threat. The end-user segmentation reveals a growing demand for premium and specialty coffee offerings. Mergers and acquisitions (M&A) trends, while not overly aggressive, are observed as companies seek to consolidate market positions and expand their product portfolios. For instance, recent years have seen smaller artisanal roasters being acquired by larger entities aiming for broader distribution. The market's competitive intensity is further fueled by evolving consumer tastes and a burgeoning café culture.

Australia Coffee Market Market Trends & Opportunities

The Australia coffee market is on a robust growth trajectory, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025-2033. This expansion is underpinned by a confluence of factors including increasing disposable incomes, a sophisticated consumer palate, and a strong café culture that drives demand for both at-home and out-of-home coffee consumption. Technological shifts are significantly influencing the market, with a rise in sophisticated brewing equipment and a growing adoption of smart home coffee machines. The online retail channel is experiencing exponential growth, offering convenience and wider product selection to consumers. Consumer preferences are increasingly leaning towards ethically sourced, sustainable, and specialty coffee beans. There's a discernible trend towards premiumization, with consumers willing to pay more for high-quality, single-origin, and artisanal coffee. The competitive landscape is dynamic, with established players like Nestle SA and JAB Holding Company constantly innovating to meet these evolving demands. Furthermore, the proliferation of independent coffee shops and the growing popularity of ready-to-drink (RTD) coffee beverages are carving out new market niches. Opportunities abound in areas such as plant-based coffee creamer alternatives, innovative coffee-based beverages, and the expansion of subscription-based coffee services. The demand for convenient, single-serve formats like coffee pods and capsules is also on the rise, catering to busy lifestyles.

Dominant Markets & Segments in Australia Coffee Market

The Australia coffee market is characterized by the dominance of certain segments and distribution channels that cater to the nation's distinct consumption patterns.

Dominant Product Segments:

- Ground Coffee: Continues to hold a substantial market share due to its convenience and wide availability across various retail formats. Its versatility appeals to a broad consumer base seeking easy preparation at home.

- Whole Bean: Experiencing significant growth driven by a rising appreciation for fresh coffee and the home brewing trend. Consumers are increasingly investing in grinders to unlock the optimal flavor profiles of premium beans.

- Coffee Pods and Capsules: This segment is a major growth engine, propelled by the convenience and consistent quality it offers. The proliferation of pod-based brewing systems in households and offices fuels its expansion.

- Instant Coffee: While mature, it still maintains a loyal consumer base due to its speed and affordability, particularly in convenience stores and for on-the-go consumption.

Dominant Distribution Channels:

- Hypermarkets/Supermarkets: These remain the primary retail channel for coffee products in Australia, offering wide selection, competitive pricing, and accessibility to a vast consumer base. Their extensive reach makes them crucial for mass-market penetration.

- Online Retail Stores: This channel is witnessing rapid expansion, driven by e-commerce growth and consumer demand for convenience, wider product variety, and specialized coffee offerings that may not be readily available in brick-and-mortar stores.

- Convenience/Grocery Stores: These cater to impulse purchases and on-the-go consumption, offering a convenient option for consumers seeking immediate coffee solutions.

The dominance of these segments is further bolstered by favorable consumer policies promoting food retail, and the well-established infrastructure supporting both product manufacturing and distribution across the continent.

Australia Coffee Market Product Analysis

Product innovation in the Australia coffee market is primarily focused on enhancing consumer experience and convenience. This includes the development of ethically sourced and single-origin whole beans, offering distinct flavor profiles and supporting sustainable farming practices. Ground coffee innovations emphasize freshness and optimal grind sizes for various brewing methods. The burgeoning coffee pods and capsules segment sees continuous advancements in capsule technology for better flavor preservation and environmental sustainability, such as compostable options. Instant coffee is also being reformulated for improved taste and texture. Competitive advantages are derived from unique blending technologies, artisanal roasting techniques, and sophisticated packaging that ensures product freshness and shelf appeal. Applications range from everyday home brewing to premium café offerings and on-the-go consumption.

Key Drivers, Barriers & Challenges in Australia Coffee Market

The Australia coffee market is propelled by several key drivers. Technological advancements in brewing and packaging, coupled with rising consumer disposable incomes, are significant growth catalysts. The increasing popularity of specialty coffee and the strong café culture further fuel demand. Furthermore, government policies supporting the food and beverage industry contribute positively.

However, the market faces notable barriers and challenges. Supply chain disruptions, influenced by global agricultural factors and logistics, can impact availability and cost. Regulatory hurdles, including import restrictions and evolving food safety standards, can pose challenges for new entrants and existing players. Intense competitive pressures, particularly from both established international brands and emerging local artisanal roasters, necessitate continuous innovation and strategic marketing efforts to maintain market share.

Growth Drivers in the Australia Coffee Market Market

Several factors are driving growth in the Australia coffee market. The increasing consumer demand for premium and specialty coffee, driven by a more discerning palate and a desire for unique flavor experiences, is a major catalyst. Technological innovations in home brewing equipment, such as advanced espresso machines and smart coffee makers, are making high-quality coffee more accessible at home. Economic prosperity, leading to higher disposable incomes, allows consumers to allocate more resources towards discretionary spending on premium food and beverages like specialty coffee. Furthermore, the strong social and cultural integration of coffee consumption, particularly within the vibrant Australian café culture, ensures consistent demand. Government initiatives promoting the food and beverage sector and trade agreements facilitating coffee bean imports also play a supportive role.

Challenges Impacting Australia Coffee Market Growth

The Australia coffee market growth is subject to several challenges. Volatility in global coffee bean prices, influenced by climate change, geopolitical factors, and agricultural yields in producing countries, can impact profitability and retail prices. Intense competition from a wide array of players, ranging from global corporations to local artisanal roasters and private label brands, necessitates significant marketing investment and product differentiation. Regulatory complexities surrounding food safety, labeling requirements, and import standards can add to operational costs and compliance burdens. Furthermore, evolving consumer preferences towards healthier alternatives or different beverage categories present a potential threat. Supply chain disruptions, as seen in recent global events, can lead to stockouts and increased logistics costs, impacting product availability and consumer satisfaction.

Key Players Shaping the Australia Coffee Market Market

- JAB Holding Company

- Nestle SA

- FreshFood Services Pty Ltd

- DC Roasters Pty Ltd

- Vittoria Coffee Pty Ltd

- Sensory Lab Australia Pty Ltd

- Illycaffè SpA

- St Ali Pty Ltd

- Republica Coffee Pty Ltd

- Luigi Lavazza SpA

Significant Australia Coffee Market Industry Milestones

- May 2024: Nutella partnered with Lavazza to launch Nutella & Lavazza’s biscuits and coffee ‘Perfect Match.’ Lavazza also offers the Espresso Barista coffee range, which uses beans from Central and South America, Africa, and Asia and has aromatic notes of flowers, cocoa, and wood. This collaboration expands Lavazza's product portfolio and taps into the popular Nutella brand, potentially increasing sales and market visibility.

- April 2024: Nescafe and Arnott teamed up to launch another Tim Tam-inspired drink, the Nescafe White Choc Mocha. The company states that the new flavors combine creamy coffee with the white chocolate taste of Tim Tam biscuits. This co-branded product leverages the strong recognition of both brands to create limited-edition offerings, driving consumer interest and sales through novelty.

- February 2024: L’OR Espresso entered a new global partnership with Ferrari. The collaboration sees L’OR Espresso embark on a new chapter alongside Ferrari in the FIA World Endurance Championship (WEC). This high-profile partnership enhances L'OR Espresso's brand prestige and global reach, associating it with luxury and performance, which can translate into increased brand appeal and sales.

Future Outlook for Australia Coffee Market Market

The future outlook for the Australia coffee market remains highly positive, driven by sustained consumer demand for quality, convenience, and unique experiences. The increasing adoption of sustainable and ethically sourced coffee will continue to shape product development and brand strategies. Growth opportunities lie in the expansion of ready-to-drink (RTD) coffee beverages, the development of functional coffee products, and the further penetration of online retail channels. Innovations in plant-based coffee alternatives and advancements in at-home brewing technology will also play a crucial role. The market is expected to see continued investment in premiumization and artisanal offerings, catering to a growing segment of coffee connoisseurs. Collaboration and strategic partnerships among players will likely intensify to capture market share and innovate effectively.

Australia Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. Hypermarkets/ Supermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Australia Coffee Market Segmentation By Geography

- 1. Australia

Australia Coffee Market Regional Market Share

Geographic Coverage of Australia Coffee Market

Australia Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 There is a growing trend towards specialty coffee

- 3.2.2 with consumers increasingly seeking out single-origin beans

- 3.2.3 artisanal roasting

- 3.2.4 and unique flavor profiles. The rise of independent cafés and micro-roasters has fueled this trend.

- 3.3. Market Restrains

- 3.3.1 The Australian coffee market is highly competitive

- 3.3.2 with numerous local and international players. This can lead to price wars and challenges for new entrants trying to establish a foothold.

- 3.4. Market Trends

- 3.4.1 The demand for fair-trade

- 3.4.2 organic

- 3.4.3 and sustainably sourced coffee is on the rise. Consumers are increasingly looking for products that align with their environmental and social values.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/ Supermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JAB Holding Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FreshFood Services Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DC Roasters Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vittoria Coffee Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sensory Lab Australia Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Illycaffè SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 St Ali Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Republica Coffee Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Luigi Lavazza SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JAB Holding Company

List of Figures

- Figure 1: Australia Coffee Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Coffee Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Australia Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australia Coffee Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Australia Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Australia Coffee Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Coffee Market?

The projected CAGR is approximately 5.73%.

2. Which companies are prominent players in the Australia Coffee Market?

Key companies in the market include JAB Holding Company, Nestle SA, FreshFood Services Pty Ltd, DC Roasters Pty Ltd, Vittoria Coffee Pty Ltd, Sensory Lab Australia Pty Ltd, Illycaffè SpA, St Ali Pty Ltd, Republica Coffee Pty Ltd, Luigi Lavazza SpA.

3. What are the main segments of the Australia Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.55 Million as of 2022.

5. What are some drivers contributing to market growth?

There is a growing trend towards specialty coffee. with consumers increasingly seeking out single-origin beans. artisanal roasting. and unique flavor profiles. The rise of independent cafés and micro-roasters has fueled this trend..

6. What are the notable trends driving market growth?

The demand for fair-trade. organic. and sustainably sourced coffee is on the rise. Consumers are increasingly looking for products that align with their environmental and social values..

7. Are there any restraints impacting market growth?

The Australian coffee market is highly competitive. with numerous local and international players. This can lead to price wars and challenges for new entrants trying to establish a foothold..

8. Can you provide examples of recent developments in the market?

May 2024: Nutella partnered with Lavazza to launch Nutella & Lavazza’s biscuits and coffee ‘Perfect Match.’ Lavazza also offers the Espresso Barista coffee range, which uses beans from Central and South America, Africa, and Asia and has aromatic notes of flowers, cocoa, and wood.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Coffee Market?

To stay informed about further developments, trends, and reports in the Australia Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence