Key Insights

The Austrian protein powder market, valued at approximately $0.52 billion in 2024, is poised for significant expansion. This growth is driven by escalating consumer health consciousness and the increasing popularity of fitness and wellness activities. Key trends fueling this market include the rising adoption of plant-based protein sources to cater to vegan and vegetarian demographics, and the growing demand for convenient ready-to-drink (RTD) protein shakes that align with modern, busy lifestyles. The market is segmented by product type (powder, RTD shakes, protein bars), protein source (whey, casein, soy, others), and distribution channel (supermarkets, pharmacies, specialist retailers, online). While whey protein maintains its dominance, the growth of plant-based alternatives and innovative formats such as protein bars are actively reshaping the competitive landscape. Leading entities like General Mills, Glanbia, and Myprotein are strategically investing in product innovation and partnerships to capitalize on these emerging opportunities. However, potential constraints include fluctuating raw material costs and stringent regulatory requirements for food supplements.

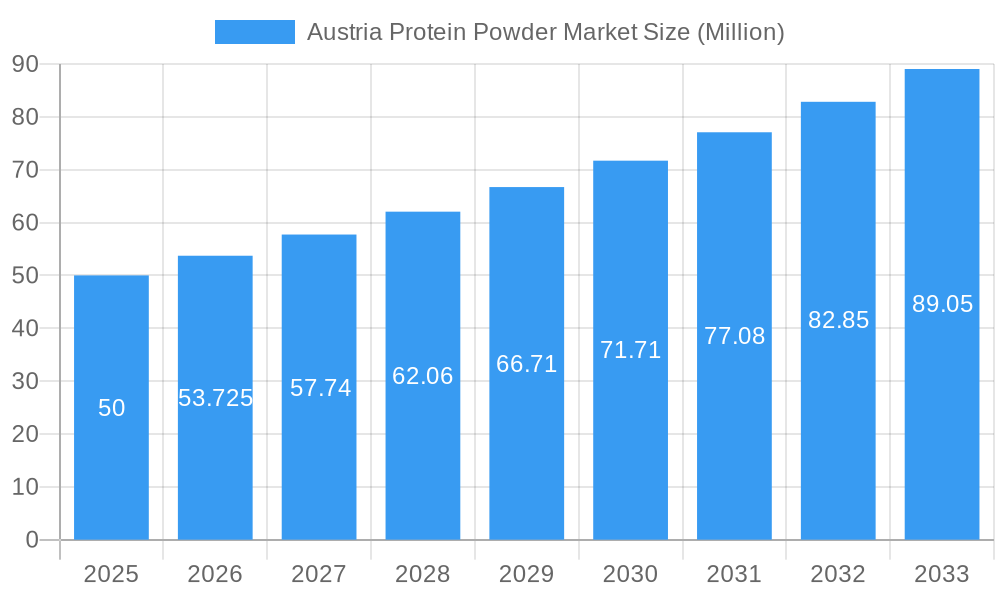

Austria Protein Powder Market Market Size (In Million)

The forecast period (2024-2033) anticipates a Compound Annual Growth Rate (CAGR) of 6%, signifying substantial market size growth. Increased e-commerce penetration and the expansion of specialist sports nutrition retailers will further propel this trajectory. Consumer preferences are shifting towards high-quality, functional protein powders offering added benefits such as enhanced digestibility, reduced allergens, and integrated vitamins/minerals. Continued consumer education on the benefits of protein supplementation, coupled with targeted marketing, will likely stimulate further market expansion, creating avenues for both established and new entrants to innovate and meet the evolving demands of health-conscious Austrian consumers.

Austria Protein Powder Market Company Market Share

This comprehensive analysis offers invaluable insights into the Austria protein powder market, focusing on market size, segmentation, competitive dynamics, and future trends, essential for informed strategic decision-making. The study encompasses the period 2019-2033, with 2024 as the base year and 2024-2033 as the forecast period. Keywords such as "Austria protein powder market," "protein powder market size Austria," "whey protein Austria," and "protein supplement market Austria" are prioritized for enhanced discoverability.

Austria Protein Powder Market Market Structure & Competitive Landscape

This section analyzes the structure and competitive dynamics of the Austrian protein powder market. The market is characterized by a mix of multinational corporations and local players, resulting in a moderately concentrated market. While precise concentration ratios are unavailable (xx), the presence of key players like General Mills Inc., Glanbia PLC, and Amway indicates a significant level of competition. However, the rise of smaller, innovative companies such as Arkeon Biotechnologie presents a dynamic shift in the market.

Market Concentration: The market concentration is estimated at xx, indicating a moderately competitive landscape. Further research is needed to quantify the exact concentration ratios, but the presence of both established and emerging players suggests a diverse market structure.

Innovation Drivers: Key innovation drivers include the development of novel protein sources (e.g., from CO2 utilization by Arkeon), sustainable packaging solutions, and functional formulations catering to specific dietary needs (vegan, keto, etc.).

Regulatory Impacts: Austrian food safety and labeling regulations significantly impact market players. Compliance with these regulations is crucial, influencing product development and marketing strategies.

Product Substitutes: Other protein sources, such as meat, eggs, and legumes, serve as substitutes. However, the convenience and nutritional profile of protein powders continue to drive demand.

End-User Segmentation: The market caters to a diverse range of consumers, including athletes, fitness enthusiasts, health-conscious individuals, and those seeking dietary supplements.

M&A Trends: While specific M&A transaction volumes for the Austria protein powder market are currently unavailable (xx), the global trend of consolidation in the food and beverage sector suggests potential for future mergers and acquisitions in this market.

Austria Protein Powder Market Market Trends & Opportunities

The Austria protein powder market is experiencing significant growth driven by factors like rising health consciousness, increasing fitness activity, and the growing popularity of dietary supplements. The market size is projected to reach xx Million by 2025 and to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is influenced by several key trends:

Rising Health Consciousness: Austrian consumers are increasingly prioritizing health and wellness, leading to higher demand for nutritional supplements, including protein powders.

Technological Advancements: Innovations in protein extraction, formulation, and packaging are enhancing product quality and consumer experience. Arkeon's CO2-based protein production is a prime example.

E-commerce Growth: Online retail channels are gaining traction, offering convenient access to a wider range of protein powders.

Consumer Preferences: Demand for specific protein sources (e.g., whey, casein, plant-based) varies based on dietary preferences and health goals. This drives product diversification.

Competitive Dynamics: Intense competition necessitates continuous innovation and strategic marketing to maintain market share.

Dominant Markets & Segments in Austria Protein Powder Market

The Austrian protein powder market is dominated by the powder product type, followed by RTD shakes and protein bars. Within protein sources, whey protein holds the largest market share, driven by its high protein content and bioavailability. Supermarkets/Hypermarkets and online retail are the leading distribution channels.

Key Growth Drivers:

- Increasing disposable incomes: Fueling consumer spending on health and wellness products.

- Growing fitness culture: Promoting the use of protein supplements among athletes and fitness enthusiasts.

- Government initiatives promoting health and wellness: Indirectly stimulating demand for protein powders.

Market Dominance Analysis:

The dominance of whey protein is attributed to its established reputation, broad consumer acceptance, and relatively lower cost compared to other protein sources. Supermarkets/Hypermarkets are prominent channels due to wide accessibility, while online retail thrives on convenience and broader product choice.

Austria Protein Powder Market Product Analysis

The Austrian protein powder market showcases a variety of products, from basic whey protein isolates to specialized blends with added ingredients like vitamins, minerals, and creatine. Technological advancements focus on improving protein digestibility, taste, and solubility. Product innovations cater to specific consumer needs, such as vegan protein powders, low-sugar options, and products designed for specific athletic activities. The market sees a continuous influx of new formulations, creating competitive advantages through enhanced functionality and targeted consumer segments.

Key Drivers, Barriers & Challenges in Austria Protein Powder Market

Key Drivers:

The market is propelled by a confluence of factors, including the rising prevalence of health-conscious lifestyles, expanding fitness and sports culture, and increasing investments in research and development within the sector. Economic growth and improved purchasing power contribute significantly to the market's growth trajectory. Further driving forces are advancements in production technologies and supportive governmental initiatives promoting health and wellness.

Challenges and Restraints:

Major challenges include fluctuating raw material costs, strict regulatory compliance requirements, and intense competition from both established and emerging players. Supply chain vulnerabilities, arising from factors such as geopolitical instability and disruptions in global trade, pose further constraints. Moreover, educating consumers about responsible supplementation practices poses an ongoing challenge.

Growth Drivers in the Austria Protein Powder Market Market

Similar to the previous section, the key growth drivers are the rising health-conscious lifestyle, the booming fitness culture, and technological advancements within the sector. Economic stability and associated increased consumer spending further propel market expansion.

Challenges Impacting Austria Protein Powder Market Growth

Similar to the previous section, the main challenges include volatility in raw material prices, stringent regulatory compliance mandates, and fierce competition. Supply chain disruptions and the necessity of effective consumer education concerning responsible supplementation also represent considerable market hurdles.

Key Players Shaping the Austria Protein Powder Market Market

- General Mills Inc.

- Schalk Mühle KG

- Glanbia PLC

- Amway

- Arkeon Biotechnologie

- The Hut Group (Myprotein)

- MusclePharm Corporation

- Clif Bar & Company

- Body Attack Sports Nutrition GmbH & Co KG

- Peeroton GmbH

- Bulk Powders

- TOHO HOLDINGS CO LTD (COSMOS HEALTH INC)

Significant Austria Protein Powder Market Industry Milestones

- September 2022: Cosmos Health launched Sky Premium Life nutritional supplements in Germany and Austria via Amazon and eBay, expanding market reach.

- December 2022: Arkeon Biotechnologie secured funding to expand its CO2-based protein production, signaling a technological leap and increased production capacity.

Future Outlook for Austria Protein Powder Market Market

The Austria protein powder market is poised for continued growth, driven by ongoing consumer preference shifts towards health and wellness, expanding athletic pursuits, and the potential for further innovation in protein production technologies. Strategic opportunities exist in developing sustainable and ethically sourced products, catering to specific dietary requirements, and leveraging digital marketing to reach a wider consumer base. The market's potential for expansion is significant, considering the growing health-consciousness among Austrian consumers.

Austria Protein Powder Market Segmentation

-

1. Product Type

- 1.1. Powder

- 1.2. RTD Shakes

- 1.3. Protein Bars

-

2. Source

- 2.1. Whey

- 2.2. Casein

- 2.3. Soy

- 2.4. Other Sources

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Pharmacies/Drugstores

- 3.3. Specialist Retailers

- 3.4. Online Retail

- 3.5. Other Distribution Channels

Austria Protein Powder Market Segmentation By Geography

- 1. Austria

Austria Protein Powder Market Regional Market Share

Geographic Coverage of Austria Protein Powder Market

Austria Protein Powder Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Evolving Physical Fitness Trends Leading to High Demand for Protein-Rich Diet

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria Protein Powder Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Powder

- 5.1.2. RTD Shakes

- 5.1.3. Protein Bars

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Whey

- 5.2.2. Casein

- 5.2.3. Soy

- 5.2.4. Other Sources

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Pharmacies/Drugstores

- 5.3.3. Specialist Retailers

- 5.3.4. Online Retail

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Mills Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Schalk Mühle KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Glanbia PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arkeon Biotechnologie

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Hut Group (Myprotein)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MusclePharm Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clif Bar & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Body Attack Sports Nutrition GmbH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Peeroton GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bulk Powders

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 TOHO HOLDINGS CO LTD (COSMOS HEALTH INC )

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 General Mills Inc

List of Figures

- Figure 1: Austria Protein Powder Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Austria Protein Powder Market Share (%) by Company 2025

List of Tables

- Table 1: Austria Protein Powder Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Austria Protein Powder Market Volume K Ton Forecast, by Region 2020 & 2033

- Table 3: Austria Protein Powder Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Austria Protein Powder Market Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 5: Austria Protein Powder Market Revenue billion Forecast, by Source 2020 & 2033

- Table 6: Austria Protein Powder Market Volume K Ton Forecast, by Source 2020 & 2033

- Table 7: Austria Protein Powder Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Austria Protein Powder Market Volume K Ton Forecast, by Distribution Channel 2020 & 2033

- Table 9: Austria Protein Powder Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Austria Protein Powder Market Volume K Ton Forecast, by Region 2020 & 2033

- Table 11: Austria Protein Powder Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Austria Protein Powder Market Volume K Ton Forecast, by Country 2020 & 2033

- Table 13: Austria Protein Powder Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Austria Protein Powder Market Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 15: Austria Protein Powder Market Revenue billion Forecast, by Source 2020 & 2033

- Table 16: Austria Protein Powder Market Volume K Ton Forecast, by Source 2020 & 2033

- Table 17: Austria Protein Powder Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Austria Protein Powder Market Volume K Ton Forecast, by Distribution Channel 2020 & 2033

- Table 19: Austria Protein Powder Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Austria Protein Powder Market Volume K Ton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria Protein Powder Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Austria Protein Powder Market?

Key companies in the market include General Mills Inc, Schalk Mühle KG, Glanbia PLC, Amway, Arkeon Biotechnologie, The Hut Group (Myprotein), MusclePharm Corporation, Clif Bar & Company, Body Attack Sports Nutrition GmbH & Co KG, Peeroton GmbH, Bulk Powders, TOHO HOLDINGS CO LTD (COSMOS HEALTH INC ).

3. What are the main segments of the Austria Protein Powder Market?

The market segments include Product Type, Source, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.52 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Evolving Physical Fitness Trends Leading to High Demand for Protein-Rich Diet.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

December 2022: A new round of funding was secured by the tech startup Arkeon, based in Vienna (Austria), to expand its CO2 utilization technology, enabling it to turn carbon dioxide straight into protein components. The investments include infrastructure expansion, product development, and technology buildout funding. The expansion of Arkeon's production process will also feature a new research and development (R&D) hub, which will pave the way for the company's products to be used in industrial applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Ton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria Protein Powder Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria Protein Powder Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria Protein Powder Market?

To stay informed about further developments, trends, and reports in the Austria Protein Powder Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence