Key Insights

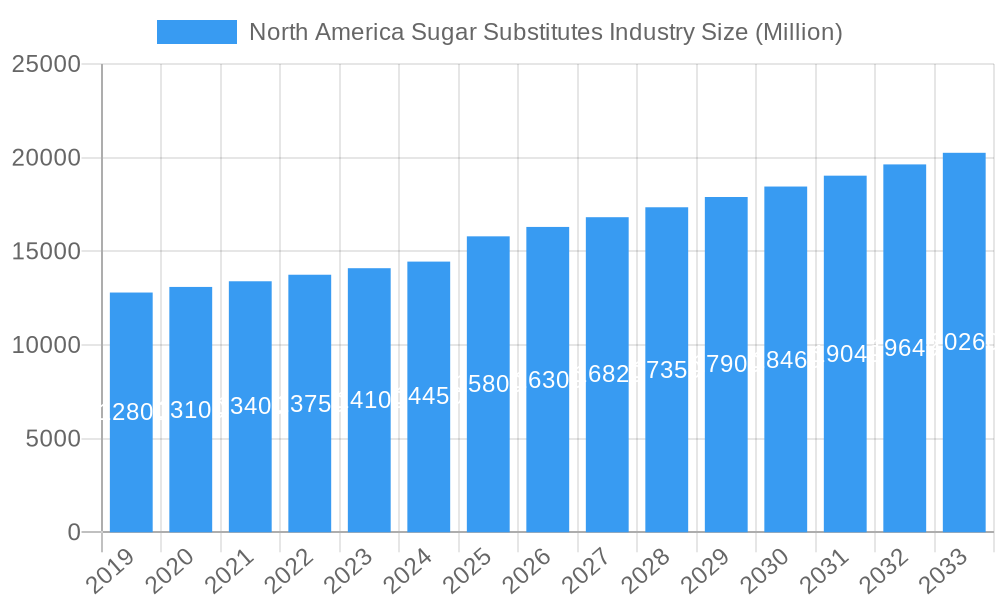

The North American sugar substitutes market is projected for substantial growth, reaching an estimated $8.89 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 7.88%. This expansion is fueled by increasing consumer health consciousness and the rising incidence of lifestyle diseases such as diabetes and obesity. Demand for low-calorie and natural sweeteners is surging as consumers actively seek healthier sugar alternatives. Government regulations and public health initiatives promoting reduced sugar consumption further amplify this trend. The food and beverage sector leads applications, with bakery, confectionery, and beverages being key adopters of sugar substitutes. The natural segment, particularly stevia, is experiencing significant growth due to its perceived health benefits and broad consumer acceptance.

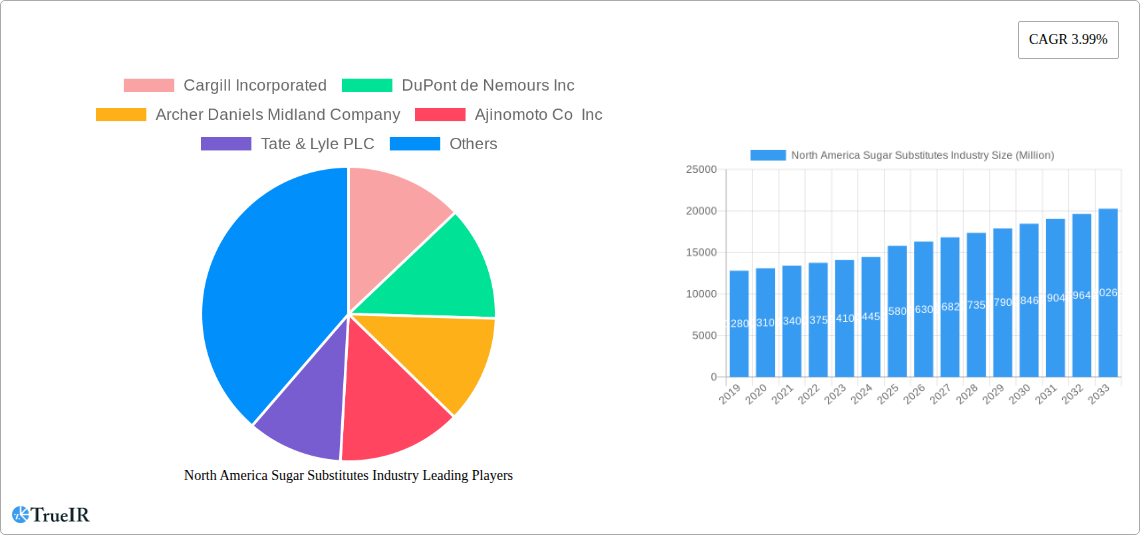

North America Sugar Substitutes Industry Market Size (In Billion)

Market growth is further supported by continuous product innovation, with manufacturers focusing on enhancing taste profiles and expanding the versatility of various sugar substitutes. Leading companies are investing in research and development to introduce novel solutions that align with evolving consumer preferences and specific food application needs. Potential challenges include the cost-effectiveness of some natural sweeteners compared to traditional sugar and possible taste alterations in certain applications. Nevertheless, the overarching shift towards healthier lifestyles and sustained demand for sugar reduction are expected to drive significant growth and innovation opportunities within the North American sugar substitutes market.

North America Sugar Substitutes Industry Company Market Share

This comprehensive report offers in-depth analysis of the North America Sugar Substitutes Industry, providing critical insights into market dynamics, competitive landscapes, emerging trends, and future projections. Covering the historical period from 2019 to 2024 and extending to a forecast period up to 2033, with a base year of 2024, this research is vital for stakeholders seeking to understand and capitalize on the evolving sugar substitutes market. The report meticulously examines market segmentation by Origin (Natural, Artificial/Synthetic), Type (Acesulfame K, Aspartame, Saccharin, Sucralose, Neotame, Stevia, Other Types), and Application (Food and Beverage, Dietary Supplements, Pharmaceuticals), with a granular focus on North America, including the United States, Canada, and Mexico.

North America Sugar Substitutes Industry Market Structure & Competitive Landscape

The North America Sugar Substitutes Industry is characterized by a moderately concentrated market structure, with key players like Cargill Incorporated, DuPont de Nemours Inc, Archer Daniels Midland Company, Ajinomoto Co Inc, Tate & Lyle PLC, Roquette Freres, PureCircle Ltd, and Ingredion Incorporated holding significant market shares. Innovation remains a primary driver, fueled by ongoing research and development in new sweetener technologies, particularly in the natural segment. Regulatory frameworks, while generally supportive of sugar reduction initiatives, can present varying compliance challenges across different product types and applications. The threat of product substitutes, including advanced natural sweeteners and innovative food formulations that reduce the need for added sweetness, is a constant consideration. End-user segmentation analysis reveals a robust demand from the food and beverage sector, followed by dietary supplements and pharmaceuticals. Mergers and acquisitions (M&A) trends, though not always high in volume, are strategic, aiming to expand product portfolios, secure raw material supply chains, and enhance market reach. For instance, the acquisition of stevia producers by larger ingredient companies has been a notable trend, reflecting the growing consumer preference for natural sugar alternatives. The industry's competitive intensity is driven by product differentiation, price, and the ability to meet evolving consumer demands for healthier and natural ingredients.

North America Sugar Substitutes Industry Market Trends & Opportunities

The North America Sugar Substitutes Industry is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) throughout the forecast period. This expansion is primarily driven by a confluence of factors including escalating consumer awareness regarding the health implications of excessive sugar consumption, a rising prevalence of lifestyle diseases like diabetes and obesity, and increasing government initiatives promoting sugar reduction in food and beverage products. Technological shifts are playing a pivotal role, with advancements in extraction and purification processes for natural sweeteners such as stevia and monk fruit enabling higher purity and improved taste profiles. This has led to a surge in demand for these natural alternatives, creating substantial opportunities for manufacturers. Consumer preferences are decisively leaning towards natural and plant-based ingredients, impacting product development and marketing strategies. The demand for clean-label products, free from artificial additives and synthetic compounds, is a dominant trend influencing ingredient sourcing and formulation. Competitive dynamics are intensifying, with established players investing heavily in R&D and new entrants focusing on niche markets and innovative solutions. Opportunities abound in developing novel sweetener blends that offer synergistic benefits in taste and functionality, catering to specific application needs in bakery, confectionery, and beverages. The growing acceptance of sugar substitutes in pharmaceutical formulations and dietary supplements also presents a significant avenue for growth. The industry is witnessing a paradigm shift where sugar substitutes are no longer viewed solely as replacements but as essential components contributing to healthier product portfolios. The increasing focus on sustainability in ingredient sourcing and production is also a key trend, with consumers and businesses alike prioritizing environmentally conscious practices. Market penetration rates for sugar substitutes are projected to climb as more food and beverage manufacturers reformulate their products to meet the growing demand for reduced-sugar options. The rise of personalized nutrition and functional foods further amplifies the demand for specialized sweeteners that can complement specific health goals.

Dominant Markets & Segments in North America Sugar Substitutes Industry

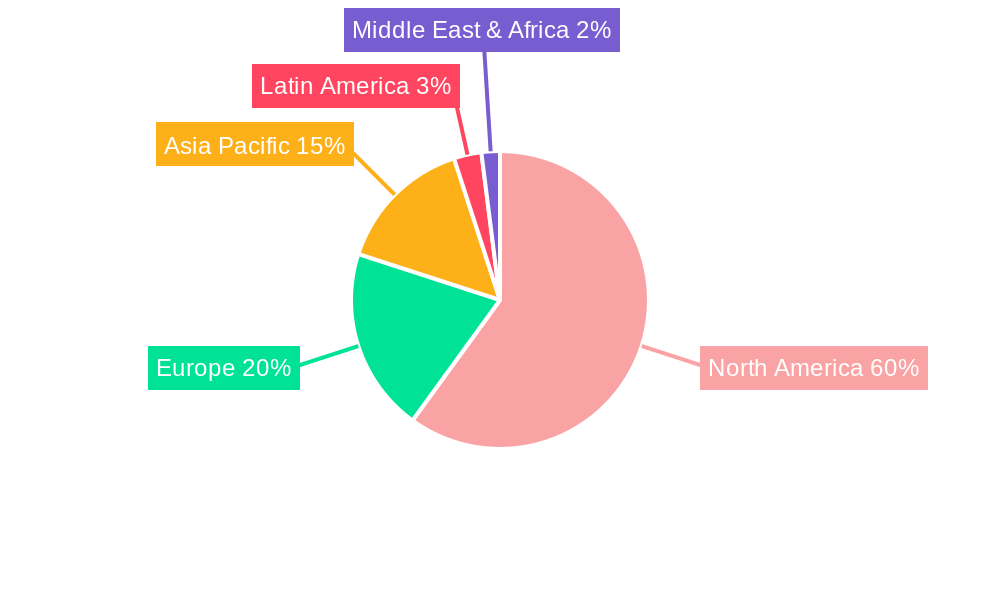

The United States stands as the dominant market within the North America Sugar Substitutes Industry, driven by a large consumer base with high awareness of health and wellness trends, coupled with a well-established food and beverage manufacturing sector. The Natural origin segment is experiencing exceptional growth, significantly outpacing its Artificial/Synthetic counterpart. Within the Type segmentation, Stevia is a leading sweetener, commanding a substantial market share due to its zero-calorie nature and plant-derived origin, aligning perfectly with consumer demand for natural alternatives. Other natural sweeteners are also gaining traction. In the Application segment, Food and Beverage applications are the primary revenue generators. Within this broad category, Beverages (including carbonated soft drinks, fruit juices, and functional drinks) and Confectionery (sugar-free candies, chocolates, and baked goods) are particularly strong growth areas. The increasing demand for low-sugar and sugar-free options in these categories is a significant growth driver. The Dietary Supplements segment is also a notable contributor, with sugar substitutes being incorporated into protein powders, vitamins, and other wellness products. Pharmaceuticals represent a more niche but growing application, where sugar substitutes are used to improve palatability in medications, especially for pediatric and diabetic patients. Policies promoting sugar reduction, such as taxes on sugar-sweetened beverages in certain regions, further bolster the demand for sugar substitutes. Infrastructure development, including advancements in processing technologies and distribution networks, supports the widespread availability and adoption of these ingredients. The "Rest of North America" geographic segment, encompassing smaller countries in the region, is also exhibiting steady growth as awareness and market penetration increase. The competitive landscape within these dominant segments is characterized by intense innovation and strategic partnerships aimed at securing supply chains and expanding market reach. The continuous introduction of new stevia-derived sweeteners with improved taste profiles and functionality is a key driver in the natural segment.

North America Sugar Substitutes Industry Product Analysis

Product innovation in the North America Sugar Substitutes Industry is rapidly evolving, with a strong emphasis on enhancing taste profiles, improving functionality in various applications, and ensuring natural sourcing. Stevia and Monk Fruit extracts are at the forefront of these advancements, with ongoing research focusing on reducing the lingering aftertaste often associated with these sweeteners. Companies are developing proprietary blends and purified extracts to offer a superior sensory experience. Technological advancements in fermentation and enzymatic modification are also enabling the creation of novel high-intensity sweeteners with enhanced stability and solubility. These innovations are crucial for their successful integration into a wide array of food and beverage products, including baked goods, dairy, and confectionery. The competitive advantage lies in offering cost-effective, high-performance, and consumer-preferred sugar substitutes that align with health and wellness trends.

Key Drivers, Barriers & Challenges in North America Sugar Substitutes Industry

Key Drivers: The North America Sugar Substitutes Industry is propelled by a powerful combination of factors. Rising health consciousness among consumers, driven by increasing awareness of the detrimental effects of high sugar intake on health, is a primary catalyst. The escalating global burden of lifestyle diseases such as obesity, diabetes, and cardiovascular conditions further fuels demand for low-calorie and sugar-free alternatives. Supportive government initiatives and regulations promoting sugar reduction in food and beverage products, including taxes on sugary drinks, create a favorable market environment. Technological advancements in the production and purification of both natural and artificial sweeteners, leading to improved taste profiles and cost-effectiveness, are also significant drivers. The growing demand for clean-label products and natural ingredients is a major shift influencing ingredient choices.

Barriers & Challenges: Despite robust growth, the industry faces several challenges. Regulatory hurdles and varying approval processes for new sweeteners across different countries can pose complexities. Supply chain disruptions, particularly for natural sweeteners which can be subject to agricultural uncertainties and geopolitical factors, present a significant risk. The high cost of certain natural sweeteners compared to conventional sugar can be a barrier to widespread adoption, especially in price-sensitive markets. Intense competition among established players and the emergence of new innovative brands can lead to price pressures and market fragmentation. Consumer perception and lingering concerns regarding the safety and long-term health effects of certain artificial sweeteners, though often unsubstantiated by scientific consensus, can impact market acceptance. Furthermore, the development of artificial sweeteners with taste profiles that perfectly mimic sugar remains an ongoing challenge.

Growth Drivers in the North America Sugar Substitutes Industry Market

Several key drivers are propelling the North America Sugar Substitutes Industry. Technologically, advancements in extraction and refinement processes for natural sweeteners like stevia and monk fruit are yielding higher purity, better taste, and more cost-effective options. Economically, the increasing disposable income in the region and the growing demand for health-conscious products are creating a fertile ground for sugar substitutes. Policy-driven factors, such as government campaigns promoting healthy eating and the implementation of sugar taxes on sweetened beverages, are directly encouraging the shift away from sugar. The rising incidence of diet-related diseases like diabetes and obesity acts as a powerful incentive for consumers to seek out sugar alternatives.

Challenges Impacting North America Sugar Substitutes Industry Growth

The growth of the North America Sugar Substitutes Industry is not without its obstacles. Regulatory complexities and the need for stringent approvals for novel sweeteners can slow down market entry. Supply chain vulnerabilities, particularly for agricultural commodities used in natural sweeteners, can lead to price volatility and availability issues. Intense competitive pressures from both established giants and agile startups necessitate continuous innovation and aggressive market strategies. Consumer skepticism and the spread of misinformation regarding the safety of artificial sweeteners can dampen demand for certain product categories. The constant evolution of consumer preferences, demanding both efficacy and natural sourcing, requires manufacturers to be agile and responsive.

Key Players Shaping the North America Sugar Substitutes Industry Market

- Cargill Incorporated

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- Ajinomoto Co Inc

- Tate & Lyle PLC

- Roquette Freres

- PureCircle Ltd

- Ingredion Incorporated

Significant North America Sugar Substitutes Industry Industry Milestones

- 2019: Increased investment in R&D for novel stevia formulations with improved taste profiles.

- 2020: Growing adoption of sugar substitutes in plant-based food and beverage products.

- 2021: Expansion of product lines by major manufacturers to include a wider range of natural and organic sugar substitutes.

- 2022: Introduction of new monk fruit-derived sweeteners with enhanced functional properties.

- 2023: Greater emphasis on sustainable sourcing and production practices within the industry.

- 2024: Anticipated launch of new blends of high-intensity sweeteners offering synergistic taste benefits.

Future Outlook for North America Sugar Substitutes Industry Market

The future outlook for the North America Sugar Substitutes Industry is exceptionally promising, driven by sustained consumer demand for healthier food options and ongoing innovation. The market is poised for continued expansion, with opportunities arising from the development of next-generation sweeteners that offer improved taste, functionality, and cost-effectiveness. Strategic collaborations and acquisitions are expected to shape the competitive landscape, as companies seek to secure market share and diversify their product portfolios. The growing acceptance of sugar substitutes in diverse applications, from mainstream food and beverages to specialized dietary supplements and pharmaceuticals, will fuel further growth. Furthermore, a stronger focus on clean-label and sustainable ingredients will likely lead to increased market penetration for naturally derived sweeteners.

North America Sugar Substitutes Industry Segmentation

-

1. Origin

- 1.1. Natural

- 1.2. Artificial/Synthetic

-

2. Type

- 2.1. Acesulfame K

- 2.2. Aspartame

- 2.3. Saccharin

- 2.4. Sucralose

- 2.5. Neotame

- 2.6. Stevia

- 2.7. Other Types

-

3. Application

-

3.1. Food and Beverage

- 3.1.1. Bakery

- 3.1.2. Confectionery

- 3.1.3. Dairy Products

- 3.1.4. Beverages

- 3.1.5. Meat and Seafood

- 3.1.6. Others

- 3.2. Dietary Supplements

- 3.3. Pharmaceuticals

-

3.1. Food and Beverage

-

4. Geography

-

4.1. North America

- 4.1.1. United States

- 4.1.2. Canada

- 4.1.3. Mexixo

- 4.1.4. Rest of North America

-

4.1. North America

North America Sugar Substitutes Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexixo

- 1.4. Rest of North America

North America Sugar Substitutes Industry Regional Market Share

Geographic Coverage of North America Sugar Substitutes Industry

North America Sugar Substitutes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Other Vinegar Types

- 3.4. Market Trends

- 3.4.1. Rising Popularity of Stevia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sugar Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 5.1.1. Natural

- 5.1.2. Artificial/Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Acesulfame K

- 5.2.2. Aspartame

- 5.2.3. Saccharin

- 5.2.4. Sucralose

- 5.2.5. Neotame

- 5.2.6. Stevia

- 5.2.7. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverage

- 5.3.1.1. Bakery

- 5.3.1.2. Confectionery

- 5.3.1.3. Dairy Products

- 5.3.1.4. Beverages

- 5.3.1.5. Meat and Seafood

- 5.3.1.6. Others

- 5.3.2. Dietary Supplements

- 5.3.3. Pharmaceuticals

- 5.3.1. Food and Beverage

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. North America

- 5.4.1.1. United States

- 5.4.1.2. Canada

- 5.4.1.3. Mexixo

- 5.4.1.4. Rest of North America

- 5.4.1. North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DuPont de Nemours Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Archer Daniels Midland Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ajinomoto Co Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tate & Lyle PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Roquette Freres*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PureCircle Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ingredion Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: North America Sugar Substitutes Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Sugar Substitutes Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Sugar Substitutes Industry Revenue billion Forecast, by Origin 2020 & 2033

- Table 2: North America Sugar Substitutes Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: North America Sugar Substitutes Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: North America Sugar Substitutes Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Sugar Substitutes Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Sugar Substitutes Industry Revenue billion Forecast, by Origin 2020 & 2033

- Table 7: North America Sugar Substitutes Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: North America Sugar Substitutes Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: North America Sugar Substitutes Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Sugar Substitutes Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Sugar Substitutes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Sugar Substitutes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexixo North America Sugar Substitutes Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America North America Sugar Substitutes Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sugar Substitutes Industry?

The projected CAGR is approximately 7.88%.

2. Which companies are prominent players in the North America Sugar Substitutes Industry?

Key companies in the market include Cargill Incorporated, DuPont de Nemours Inc, Archer Daniels Midland Company, Ajinomoto Co Inc, Tate & Lyle PLC, Roquette Freres*List Not Exhaustive, PureCircle Ltd, Ingredion Incorporated.

3. What are the main segments of the North America Sugar Substitutes Industry?

The market segments include Origin, Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.89 billion as of 2022.

5. What are some drivers contributing to market growth?

Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular.

6. What are the notable trends driving market growth?

Rising Popularity of Stevia.

7. Are there any restraints impacting market growth?

Rising Demand for Other Vinegar Types.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sugar Substitutes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sugar Substitutes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sugar Substitutes Industry?

To stay informed about further developments, trends, and reports in the North America Sugar Substitutes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence