Key Insights

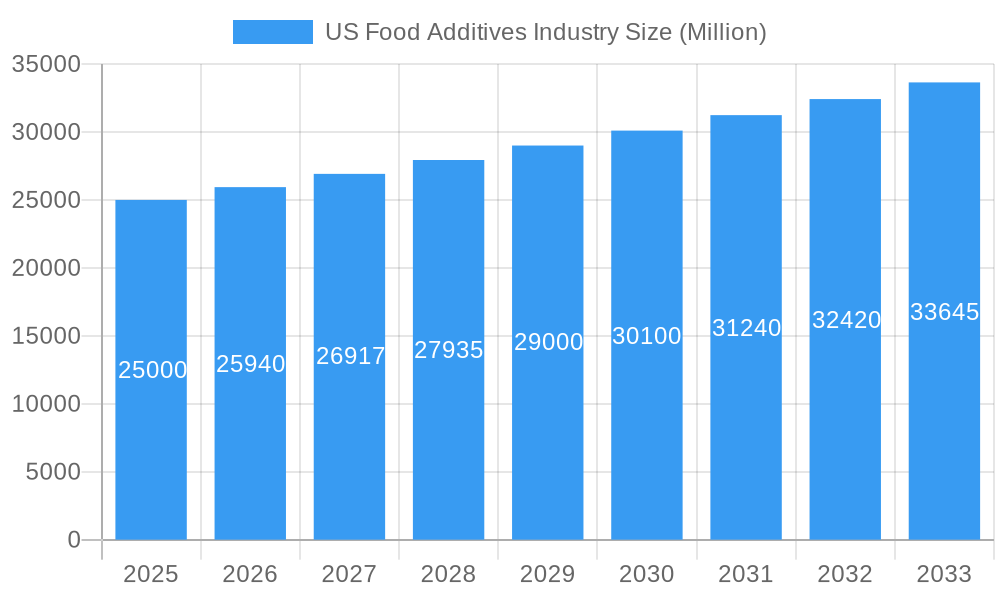

The US Food Additives market is a dynamic and substantial sector, projected to reach a market size of approximately $XX billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.76% anticipated through 2033. This robust growth is primarily fueled by an increasing consumer demand for processed and convenience foods, a growing awareness regarding the shelf-life extension and enhanced sensory appeal that food additives provide, and the continuous innovation in food processing technologies. Key drivers include the rising popularity of functional foods and beverages that incorporate specialized additives for health benefits, as well as the ongoing need for effective preservatives, sweeteners, and emulsifiers to meet consumer preferences for taste, texture, and appearance. Furthermore, the evolving regulatory landscape, while sometimes presenting challenges, also encourages the development and adoption of safer and more efficient additive solutions, contributing to market expansion.

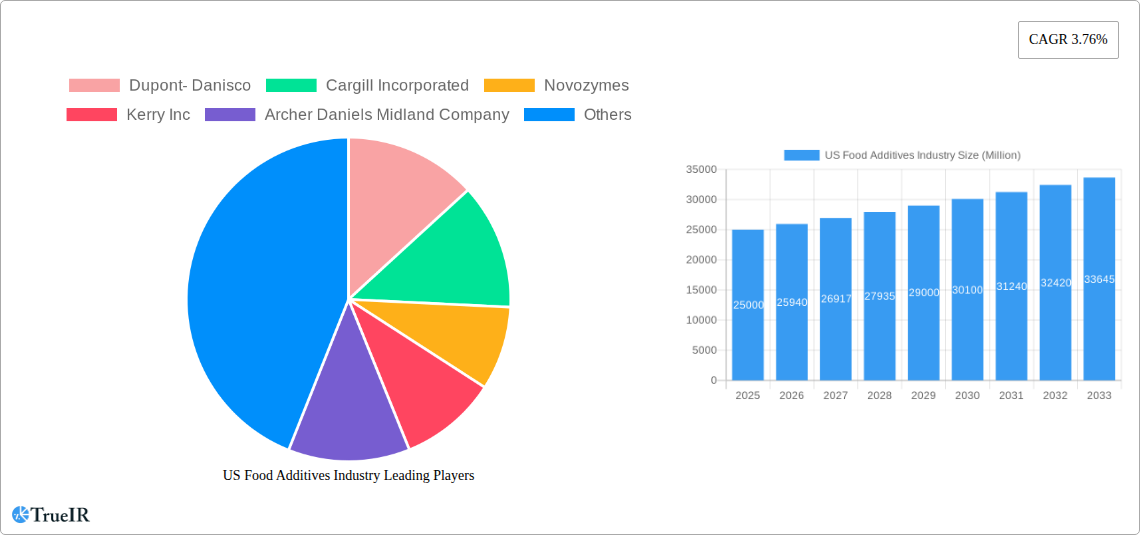

US Food Additives Industry Market Size (In Billion)

The market is segmented across various types of food additives, with Preservatives, Sweeteners, and Food Flavors & Enhancers expected to hold significant shares due to their widespread application in staple food products. Confectionery, Bakery Products, and Dairy & Frozen Food are leading application segments, driven by their high consumption rates and the critical role additives play in product formulation and preservation. Emerging trends such as the demand for natural and organic additives, the reduction of sugar and artificial ingredients, and the development of clean-label solutions are reshaping the competitive landscape. However, potential restraints include stringent regulatory approvals for new additives, negative consumer perceptions regarding certain additives, and the fluctuating costs of raw materials. Major players like Dupont-Danisco, Cargill, and Novozymes are actively investing in research and development to cater to these evolving demands and maintain their competitive edge within this expansive market.

US Food Additives Industry Company Market Share

This in-depth report provides a dynamic, SEO-optimized analysis of the US Food Additives Industry, leveraging high-volume keywords to enhance search rankings and engage industry professionals. Explore market size, growth trends, competitive landscape, and future opportunities. The study covers the historical period of 2019–2024, a base year of 2025, and forecasts market dynamics through 2033.

US Food Additives Industry Market Structure & Competitive Landscape

The US Food Additives Industry exhibits a moderately concentrated market structure, characterized by the presence of major global players alongside niche manufacturers. Innovation is a key driver, with significant investments in research and development focused on clean label, natural, and functional food additives. Regulatory impacts from bodies like the FDA are paramount, influencing product development and market entry strategies. Product substitutes, particularly those derived from natural sources, are increasingly gaining traction. End-user segmentation is diverse, spanning from large-scale food manufacturers to smaller, specialty food producers. Mergers and acquisitions (M&A) play a crucial role in market consolidation and expansion. For instance, M&A activities in the last five years are estimated to have involved over $2,500 Million in transaction volumes, signaling ongoing strategic realignments. Key players such as Dupont-Danisco, Cargill Incorporated, Novozymes, Kerry Inc, Archer Daniels Midland Company, Koninklijke DSM N V, Corbion NV, and Tate & Lyle are constantly vying for market share through product differentiation and strategic partnerships. The competitive intensity is high, driven by the constant need for novel solutions that address evolving consumer demands and regulatory landscapes.

US Food Additives Industry Market Trends & Opportunities

The US Food Additives Industry is poised for substantial growth, with market size projected to reach over $50,000 Million by 2033. The market is experiencing a healthy Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033. This robust expansion is fueled by a confluence of factors, including an increasing consumer demand for processed and convenience foods, coupled with a growing emphasis on food safety and extended shelf life. Technological shifts are evident, with a significant surge in the development and adoption of natural and clean label food additives, responding to consumer preferences for healthier and more transparent ingredient lists. This trend is driving innovation in areas such as plant-based emulsifiers, natural colorants, and fermentation-derived ingredients.

Competitive dynamics are intensifying, compelling companies to invest heavily in R&D to develop innovative solutions that meet evolving market needs. The market penetration rates for functional food additives, such as those promoting gut health or immune support, are also on an upward trajectory. Consumer preferences are increasingly leaning towards additives that offer perceived health benefits or contribute to a more sustainable food system. This is creating a significant opportunity for companies that can effectively communicate the value proposition of their products and align them with these consumer desires. Furthermore, the "health and wellness" trend is a dominant force, driving demand for sugar substitutes, low-calorie sweeteners, and preservatives that enhance product appeal without compromising perceived healthiness. The drive towards sustainability is also influencing the market, favoring bio-based and ethically sourced food additives.

Dominant Markets & Segments in US Food Additives Industry

The United States stands as the dominant market within the North American food additives landscape. Within the US, the Preservatives segment is a leading revenue generator, driven by the persistent need for extended shelf life and food safety across a wide range of food products. This segment is projected to account for a significant portion, estimated at over $10,000 Million in market value by 2025, due to its integral role in preventing spoilage and maintaining product quality.

Key Growth Drivers for Dominant Segments:

Preservatives:

- Food Safety Regulations: Stringent food safety standards necessitate effective preservation techniques to prevent microbial contamination and spoilage.

- Consumer Demand for Shelf-Stable Products: The rise of convenience foods and busy lifestyles fuels the demand for products with longer shelf lives, making preservatives indispensable.

- Global Supply Chain Complexity: Extended transportation and distribution networks require robust preservation methods to maintain product integrity from farm to fork.

Sweetener & Sugar Substitutes:

- Health and Wellness Trends: Growing awareness of the health implications of sugar consumption, coupled with rising obesity rates, is driving demand for low-calorie and sugar-free alternatives.

- Regulatory Initiatives: Government campaigns promoting healthier eating habits and sugar reduction further bolster the market for these additives.

- Product Reformulation: Food manufacturers are actively reformulating products to reduce sugar content to meet consumer demand and regulatory guidelines.

Food Flavors and Enhancers:

- Consumer Desire for Palatability: The constant pursuit of appealing taste profiles in food products makes flavors and enhancers crucial for product success.

- Innovation in Sensory Experiences: Development of novel flavor profiles and enhancement technologies catering to diverse palates.

- Growth in Processed Foods: The expanding market for processed foods, snacks, and ready-to-eat meals relies heavily on flavor additives to maintain consumer appeal.

In terms of applications, Confectionery and Bakery Products represent significant end-use markets for food additives, consuming a substantial volume of preservatives, sweeteners, and emulsifiers. The Dairy & Frozen Food sector also exhibits strong growth, with an increasing demand for hydrocolloids for texture modification and stabilizers. Beverages are another key application area, particularly for acidulants, sweeteners, and colorants. The Meat, Poultry, and Sea Food segment also relies on preservatives and flavor enhancers to ensure safety and palatability.

US Food Additives Industry Product Analysis

Product innovation in the US Food Additives Industry is primarily driven by the demand for clean label, natural, and functional ingredients. Companies are developing novel preservatives derived from plant sources, sugar substitutes with improved taste profiles, and emulsifiers that enhance texture without compromising health perceptions. Technological advancements are enabling the production of highly effective enzymes for specific food processing applications and hydrocolloids with tailored functionalities. Competitive advantages are gained through superior performance, cost-effectiveness, and the ability to meet stringent regulatory requirements while aligning with evolving consumer preferences for healthier, more sustainable food options.

Key Drivers, Barriers & Challenges in US Food Additives Industry

Key Drivers:

- Growing Demand for Processed & Convenience Foods: The increasing pace of modern life drives consumption of ready-to-eat and processed food items, necessitating the use of food additives for preservation, texture, and flavor.

- Health and Wellness Trends: Rising consumer awareness regarding diet-related health issues fuels demand for sugar substitutes, low-calorie options, and natural additives perceived as healthier.

- Technological Advancements: Innovations in biotechnology and food science are enabling the development of novel, functional, and sustainable food additives with improved efficacy and safety profiles.

- Stringent Food Safety Regulations: Robust regulatory frameworks in the US necessitate the use of specific additives to ensure food safety, prevent spoilage, and meet quality standards.

Barriers & Challenges:

- Negative Consumer Perception of "Chemical" Ingredients: Growing consumer preference for "natural" and "clean label" products creates resistance towards conventionally perceived artificial food additives, leading to market challenges for some traditional ingredients.

- Regulatory Scrutiny and Evolving Policies: The dynamic nature of food additive regulations can pose challenges for manufacturers, requiring constant adaptation and investment in compliance.

- Supply Chain Disruptions and Volatility: Geopolitical events, climate change, and global trade dynamics can impact the availability and cost of raw materials, affecting supply chain stability and pricing.

- Intense Competition and Price Pressure: The presence of numerous established players and emerging market entrants leads to significant competition, often resulting in price pressures and the need for continuous cost optimization. The global supply chain disruption in the past five years has impacted raw material costs, with an estimated increase of up to 15% in some key ingredients.

Growth Drivers in the US Food Additives Industry Market

The US Food Additives Industry is propelled by several key growth drivers. Technologically, advancements in enzyme technology and fermentation processes are enabling the creation of highly functional and sustainable additives. Economically, the sustained demand for convenient and processed foods, coupled with a growing middle class with higher disposable incomes, provides a strong market base. Regulatory drivers, such as the increasing focus on food safety standards and the push for healthier food options, also encourage the adoption of specific additives. For instance, the market for sugar substitutes is significantly boosted by global health initiatives.

Challenges Impacting US Food Additives Industry Growth

Challenges impacting US food additives industry growth are multifaceted. Regulatory complexities, including evolving labeling laws and permissible ingredient lists, create hurdles for new product development and market entry. Supply chain issues, exacerbated by global logistics bottlenecks and raw material price volatility, can impact production costs and availability. For example, the cost of certain natural emulsifiers has seen an increase of approximately 10-20% in the last two years due to supply constraints. Competitive pressures from both established giants and agile new entrants necessitate continuous innovation and cost-effectiveness. Furthermore, negative consumer perception of synthetic additives, fueled by clean label trends, presents a significant barrier that companies must address through education and product reformulation.

Key Players Shaping the US Food Additives Industry Market

- Dupont-Danisco

- Cargill Incorporated

- Novozymes

- Kerry Inc

- Archer Daniels Midland Company

- Koninklijke DSM N V

- Corbion NV

- Tate & Lyle

Significant US Food Additives Industry Industry Milestones

- 2021: Acquisition of Tate & Lyle by Symrise, a significant consolidation event in the sweetener and texturant market.

- 2022: Launch of new preservative-free, clean label additives by Cargill, aligning with growing consumer demand for natural ingredients.

- 2023: Investment in plant-based food additives by DuPont-Danisco, signaling a strategic focus on sustainable and alternative ingredient solutions.

Future Outlook for US Food Additives Industry Market

The future outlook for the US Food Additives Industry is exceptionally bright, driven by persistent consumer trends and ongoing innovation. The anticipated market growth is expected to be fueled by the increasing demand for natural, clean label, and functional ingredients, particularly in segments like sweeteners, sugar substitutes, and plant-based additives. Technological advancements in areas such as bio-fermentation and encapsulation will unlock new product possibilities and enhance existing ones. Strategic collaborations and acquisitions are likely to continue shaping the competitive landscape, leading to market consolidation and the introduction of novel solutions. The industry is also poised to benefit from a continued focus on food safety and the development of ingredients that support healthier lifestyles, promising a dynamic and evolving market. The total market size is projected to exceed $70,000 Million by 2033.

US Food Additives Industry Segmentation

-

1. Type

- 1.1. Preservatives

- 1.2. Sweetener

- 1.3. Sugar Substitutes

- 1.4. Emulsifier

- 1.5. Anti-Caking Agents

- 1.6. Enzymes

- 1.7. Hydrocolloids

- 1.8. Food Flavors and Enhancers

- 1.9. Food Colorants

- 1.10. Acidulants

-

2. Application

- 2.1. Confectionery

- 2.2. Bakery Products

- 2.3. Dairy & Frozen Food

- 2.4. Beverages

- 2.5. Meat, Poultry, and Sea Food

- 2.6. Others

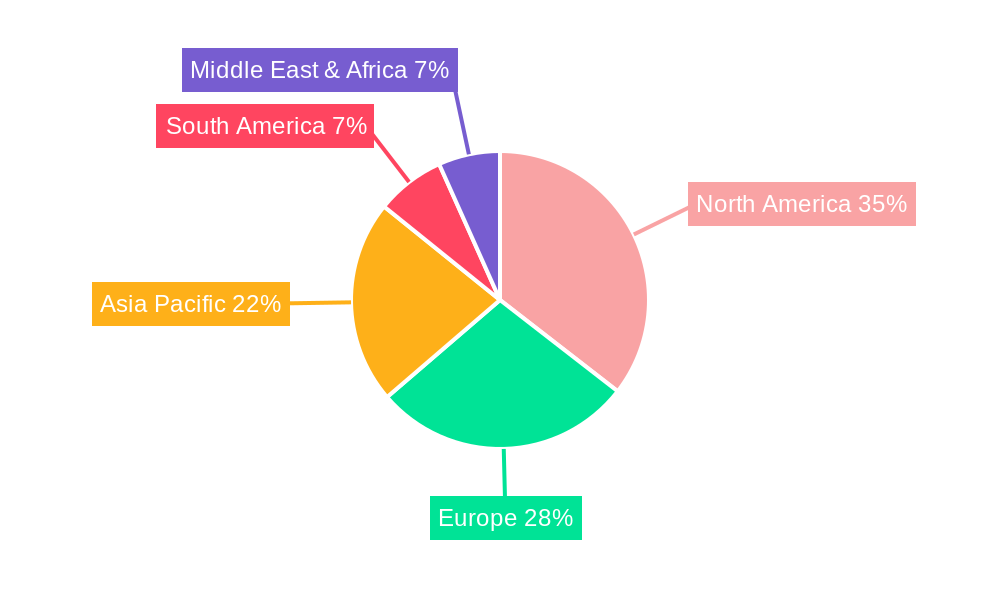

US Food Additives Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Food Additives Industry Regional Market Share

Geographic Coverage of US Food Additives Industry

US Food Additives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Growing Demand for Retail Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Food Additives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Preservatives

- 5.1.2. Sweetener

- 5.1.3. Sugar Substitutes

- 5.1.4. Emulsifier

- 5.1.5. Anti-Caking Agents

- 5.1.6. Enzymes

- 5.1.7. Hydrocolloids

- 5.1.8. Food Flavors and Enhancers

- 5.1.9. Food Colorants

- 5.1.10. Acidulants

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Confectionery

- 5.2.2. Bakery Products

- 5.2.3. Dairy & Frozen Food

- 5.2.4. Beverages

- 5.2.5. Meat, Poultry, and Sea Food

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Food Additives Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Preservatives

- 6.1.2. Sweetener

- 6.1.3. Sugar Substitutes

- 6.1.4. Emulsifier

- 6.1.5. Anti-Caking Agents

- 6.1.6. Enzymes

- 6.1.7. Hydrocolloids

- 6.1.8. Food Flavors and Enhancers

- 6.1.9. Food Colorants

- 6.1.10. Acidulants

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Confectionery

- 6.2.2. Bakery Products

- 6.2.3. Dairy & Frozen Food

- 6.2.4. Beverages

- 6.2.5. Meat, Poultry, and Sea Food

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Food Additives Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Preservatives

- 7.1.2. Sweetener

- 7.1.3. Sugar Substitutes

- 7.1.4. Emulsifier

- 7.1.5. Anti-Caking Agents

- 7.1.6. Enzymes

- 7.1.7. Hydrocolloids

- 7.1.8. Food Flavors and Enhancers

- 7.1.9. Food Colorants

- 7.1.10. Acidulants

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Confectionery

- 7.2.2. Bakery Products

- 7.2.3. Dairy & Frozen Food

- 7.2.4. Beverages

- 7.2.5. Meat, Poultry, and Sea Food

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Food Additives Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Preservatives

- 8.1.2. Sweetener

- 8.1.3. Sugar Substitutes

- 8.1.4. Emulsifier

- 8.1.5. Anti-Caking Agents

- 8.1.6. Enzymes

- 8.1.7. Hydrocolloids

- 8.1.8. Food Flavors and Enhancers

- 8.1.9. Food Colorants

- 8.1.10. Acidulants

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Confectionery

- 8.2.2. Bakery Products

- 8.2.3. Dairy & Frozen Food

- 8.2.4. Beverages

- 8.2.5. Meat, Poultry, and Sea Food

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Food Additives Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Preservatives

- 9.1.2. Sweetener

- 9.1.3. Sugar Substitutes

- 9.1.4. Emulsifier

- 9.1.5. Anti-Caking Agents

- 9.1.6. Enzymes

- 9.1.7. Hydrocolloids

- 9.1.8. Food Flavors and Enhancers

- 9.1.9. Food Colorants

- 9.1.10. Acidulants

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Confectionery

- 9.2.2. Bakery Products

- 9.2.3. Dairy & Frozen Food

- 9.2.4. Beverages

- 9.2.5. Meat, Poultry, and Sea Food

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Food Additives Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Preservatives

- 10.1.2. Sweetener

- 10.1.3. Sugar Substitutes

- 10.1.4. Emulsifier

- 10.1.5. Anti-Caking Agents

- 10.1.6. Enzymes

- 10.1.7. Hydrocolloids

- 10.1.8. Food Flavors and Enhancers

- 10.1.9. Food Colorants

- 10.1.10. Acidulants

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Confectionery

- 10.2.2. Bakery Products

- 10.2.3. Dairy & Frozen Food

- 10.2.4. Beverages

- 10.2.5. Meat, Poultry, and Sea Food

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dupont- Danisco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novozymes

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kerry Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Archer Daniels Midland Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koninklijke DSM N V

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Corbion NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tate & Lyle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Dupont- Danisco

List of Figures

- Figure 1: Global US Food Additives Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Food Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America US Food Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Food Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America US Food Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Food Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America US Food Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Food Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: South America US Food Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America US Food Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: South America US Food Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America US Food Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America US Food Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Food Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe US Food Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe US Food Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe US Food Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe US Food Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe US Food Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Food Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East & Africa US Food Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa US Food Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Middle East & Africa US Food Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa US Food Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Food Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Food Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Asia Pacific US Food Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific US Food Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: Asia Pacific US Food Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific US Food Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific US Food Additives Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Food Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global US Food Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global US Food Additives Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global US Food Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global US Food Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global US Food Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global US Food Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global US Food Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global US Food Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global US Food Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global US Food Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global US Food Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global US Food Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global US Food Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global US Food Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global US Food Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global US Food Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global US Food Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Food Additives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Food Additives Industry?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the US Food Additives Industry?

Key companies in the market include Dupont- Danisco, Cargill Incorporated, Novozymes, Kerry Inc, Archer Daniels Midland Company, Koninklijke DSM N V, Corbion NV, Tate & Lyle.

3. What are the main segments of the US Food Additives Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Growing Demand for Retail Food.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Tate & Lyle by Symrise in 2021 2. Launch of new preservative-free, clean label additives by Cargill in 2022 3. Investment in plant-based food additives by DuPont-Danisco in 2023

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Food Additives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Food Additives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Food Additives Industry?

To stay informed about further developments, trends, and reports in the US Food Additives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence