Key Insights

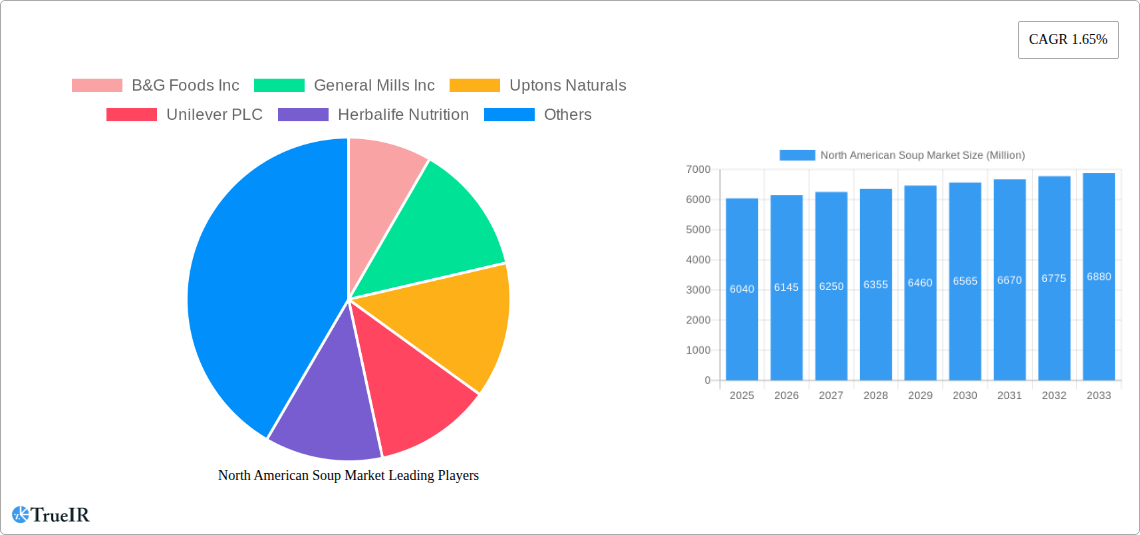

The North American soup market is poised for steady growth, with a projected market size of approximately USD 6,040 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 1.65% through 2033. This moderate but consistent expansion is driven by a confluence of factors that cater to evolving consumer preferences and lifestyles. The demand for convenient and ready-to-eat meal solutions remains a primary catalyst, fueled by busy schedules and an increasing preference for quick, nutritious options. Furthermore, a growing awareness of health and wellness is propelling the organic soup segment, as consumers actively seek products with natural ingredients and transparent sourcing. This trend is further amplified by innovative product development, including a rise in plant-based and specialized dietary soups, addressing specific nutritional needs and dietary restrictions. The convenience of readily available soups through diverse distribution channels, from traditional supermarkets to emerging online platforms, ensures accessibility and continuous market engagement.

North American Soup Market Market Size (In Billion)

The market's trajectory is shaped by key trends including the increasing popularity of chilled and dehydrated/instant soup varieties, offering enhanced shelf-life and ease of preparation without compromising on taste or nutritional value. While conventional soups maintain a strong foothold, the organic and healthier alternatives are capturing significant market share. The competitive landscape features established giants like Campbell Soup Company and Nestle SA, alongside agile players like Uptons Naturals, innovating in plant-based and specialty offerings. Distribution channels are adapting, with online stores witnessing substantial growth, reflecting a broader shift in consumer purchasing habits towards e-commerce for groceries. Despite the steady growth, potential restraints could emerge from fluctuating raw material costs, intense competition leading to price pressures, and the ongoing need for product innovation to stay ahead of evolving consumer palates and dietary trends. Nonetheless, the overall outlook for the North American soup market remains positive, underpinned by its inherent convenience and adaptability to changing consumer demands.

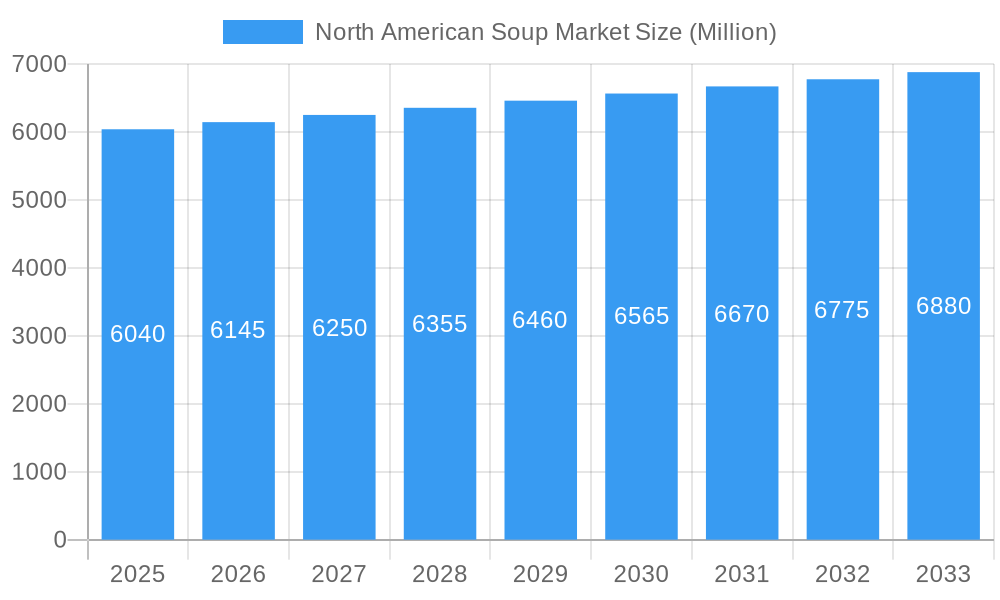

North American Soup Market Company Market Share

North American Soup Market: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides an exhaustive analysis of the North American Soup Market, offering critical insights into market dynamics, competitive strategies, and future growth trajectories. Covering the historical period from 2019 to 2024 and extending the forecast to 2033, with a base year of 2025, this study is essential for stakeholders seeking to understand and capitalize on evolving consumer preferences, technological advancements, and emerging opportunities in the multi-billion dollar North American soup industry.

North American Soup Market Market Structure & Competitive Landscape

The North American soup market exhibits a moderately concentrated structure, with key players like Campbell Soup Company, Nestle SA, General Mills Inc., and Kraft Heinz Company holding significant market share. Innovation remains a crucial driver, with companies consistently introducing new flavors, healthier options, and convenient formats to cater to diverse consumer demands. Regulatory impacts, particularly those concerning food safety, labeling, and nutritional content, shape product development and market access. Product substitutes, including ready-to-eat meals, frozen entrees, and fresh deli options, exert competitive pressure, necessitating continuous product differentiation. End-user segmentation is increasingly defined by health-consciousness, convenience, and dietary preferences (e.g., vegan, gluten-free). Mergers and acquisitions (M&A) trends, with an estimated volume of xx transactions annually during the historical period, reflect the industry's consolidation efforts and strategic expansions. The estimated concentration ratio for the top 4 players stands at approximately 55% in 2025, indicating a competitive yet dominated landscape.

North American Soup Market Market Trends & Opportunities

The North American soup market is poised for robust growth, driven by shifting consumer lifestyles, a heightened focus on health and wellness, and the increasing demand for convenient and affordable meal solutions. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033, reaching an estimated market value of over $XX Million by 2033. Technological advancements are influencing product development and distribution, with innovations in shelf-stable packaging, quicker cooking methods, and enhanced flavor profiles gaining traction. Consumer preferences are leaning towards soups with natural ingredients, lower sodium content, and plant-based protein options. The rise of online retail channels offers new avenues for market penetration, allowing brands to reach a wider demographic. Competitive dynamics are intensifying, with established players and emerging niche brands vying for market share through product diversification and strategic marketing campaigns. The market penetration rate for ready-to-eat soups is expected to reach over 60% by 2028, highlighting a significant shift in consumer habits. Opportunities abound in the development of specialized soups catering to specific dietary needs, such as low-FODMAP or allergen-free options, and the expansion of subscription-based soup delivery services. The increasing disposable income in key North American economies further bolsters the market's growth potential.

Dominant Markets & Segments in North American Soup Market

The Supermarkets/Hypermarkets distribution channel continues to dominate the North American soup market, accounting for an estimated 55% of sales in 2025, owing to their extensive product assortment and widespread consumer accessibility. Canned/Preserved soups remain the leading segment by type, representing over 60% of the market due to their long shelf life and affordability, though the Chilled segment is experiencing rapid growth fueled by demand for fresh, ready-to-heat options. In terms of category, Conventional Soup holds the largest share, but the Organic Soup segment is witnessing a significant surge in demand, driven by growing consumer awareness regarding health and sustainability.

- Dominant Region: The United States is the largest market within North America, driven by its large population and high per capita consumption of convenience foods.

- Key Growth Drivers for Supermarkets/Hypermarkets:

- Extensive shelf space and product variety.

- Promotional activities and discounts.

- Established supply chain infrastructure.

- Growth Drivers for Canned/Preserved Soups:

- Cost-effectiveness and long shelf life.

- Widespread availability and consumer familiarity.

- Growth Drivers for Conventional Soup:

- Broad appeal across demographics.

- Established brand loyalty.

- Emerging Trends: The Online Stores distribution channel is expected to grow at a CAGR of over 8% during the forecast period, driven by the convenience of home delivery and the increasing popularity of e-commerce platforms. The Chilled soup segment is projected to outpace other types in terms of growth, reflecting a strong consumer shift towards fresher, less processed options. The Organic Soup category is also poised for substantial expansion, as consumers prioritize natural ingredients and sustainable production practices.

North American Soup Market Product Analysis

Product innovation in the North American soup market centers on enhancing nutritional profiles, expanding flavor diversity, and improving convenience. Companies are leveraging advancements in food science to develop soups with increased plant-based protein content, reduced sodium, and the incorporation of functional ingredients. Competitive advantages are being built through the development of premium, artisanal soups, as well as cost-effective, everyday staples. The market fit is strong for products that address evolving consumer demands for health-conscious, plant-forward, and ethically sourced food options.

Key Drivers, Barriers & Challenges in North American Soup Market

Key Drivers: The North American soup market is propelled by several key drivers. The increasing demand for convenient and quick meal solutions, especially among busy professionals and families, remains paramount. Growing health consciousness fuels the demand for soups with improved nutritional profiles, such as reduced sodium, added protein, and plant-based ingredients. Technological advancements in processing and packaging enhance product quality and shelf life. Favorable economic conditions and rising disposable incomes also contribute to market growth. For instance, the popularity of "souper lunches" continues to rise.

Barriers & Challenges: Key challenges impacting the market include intense competition from various food categories and substitute products. Fluctuations in the prices of raw materials, such as vegetables and meats, can affect profitability. Stringent food safety regulations and evolving labeling requirements add to operational complexities. Supply chain disruptions, as witnessed in recent years, can lead to ingredient shortages and increased costs. The cost of innovative product development and marketing can also be a barrier for smaller players. For example, an estimated xx% increase in raw material costs during 2023 posed a significant challenge.

Growth Drivers in the North American Soup Market Market

Growth in the North American soup market is primarily driven by the escalating consumer preference for convenient, healthy, and flavorful meal options. The rising demand for plant-based and organic soups, aligning with global wellness trends, is a significant catalyst. Technological innovations in product formulation and packaging are enabling the creation of soups with extended shelf life and improved nutritional value. Economic factors, including increasing disposable incomes and a growing population, further stimulate market expansion. Policy-driven initiatives promoting healthy eating habits also indirectly support market growth.

Challenges Impacting North American Soup Market Growth

Several challenges impact the growth of the North American soup market. Intense competition from a wide array of processed and fresh food alternatives poses a constant threat. Volatile raw material prices can squeeze profit margins, impacting the affordability of finished products. Stringent food safety regulations and the need for continuous compliance add to operational costs. Furthermore, supply chain vulnerabilities, including transportation issues and ingredient availability, can disrupt production and distribution networks. Consumer perception regarding processed foods and the demand for perceived "freshness" can also act as a restraint for certain soup categories.

Key Players Shaping the North American Soup Market Market

- B&G Foods Inc.

- General Mills Inc.

- Uptons Naturals

- Unilever PLC

- Herbalife Nutrition

- Baxters Food Group Limited

- Campbell Soup Company

- Nestle SA

- Blount Fine Foods Corp

- Kraft Heinz Company

Significant North American Soup Market Industry Milestones

- October 2022: Campbell launched a new exciting series of soups for lunchtime called Chunky Soup. It is available in four new flavors, namely chicken noodle, streak and potato, sirloin burger, and chicken and sausage gumbo.

- July 2022: Upton's Naturals introduced three new recipes to its lineup of vegan soups that provide plant-based protein (8-11g per serving) and only 180-300 calories a bowl. The new products are Non-GMO Certified (NSF), Plant-Based Certified, contain no added colors, flavors, or preservatives, and are completely free of cholesterol and trans fat.

- November 2021: Herbalife Nutrition expanded its offering into the soup category in the United States with instant soup, a soup mix formulated with 15 gms of plant-based protein to help satisfy hunger and provide long-lasting energy of 3 gms of fiber.

Future Outlook for North American Soup Market Market

The future outlook for the North American soup market is exceptionally positive, with sustained growth anticipated throughout the forecast period. Key growth catalysts include the ongoing trend towards healthier eating habits, the increasing adoption of plant-based diets, and the persistent demand for convenient meal solutions. Innovations in sustainable packaging and plant-based protein fortification will unlock new market segments. Strategic partnerships and targeted marketing campaigns aimed at health-conscious consumers and specific dietary needs will be crucial for success. The market also stands to benefit from the continued expansion of online retail channels and the potential for product diversification into specialized soup categories like functional or meal-replacement soups, reaching an estimated market value of over $XX Million by 2033.

North American Soup Market Segmentation

-

1. Type

- 1.1. Canned/Preserved

- 1.2. Chilled

- 1.3. Dehydrated/Instant

- 1.4. Other Types

-

2. Category

- 2.1. Conventional Soup

- 2.2. Organic Soup

-

3. Distribution Channel

- 3.1. Supermarkets/ Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

North American Soup Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Soup Market Regional Market Share

Geographic Coverage of North American Soup Market

North American Soup Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Healthy Options; Increased the demand for convenient meal solutions

- 3.3. Market Restrains

- 3.3.1. Growing among consumers to prefer fresh and homemade foods over processed and packaged options

- 3.4. Market Trends

- 3.4.1. Increasing popularity of plant-based diets has led to a surge in demand for vegan and vegetarian soups

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Soup Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Canned/Preserved

- 5.1.2. Chilled

- 5.1.3. Dehydrated/Instant

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Conventional Soup

- 5.2.2. Organic Soup

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/ Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 B&G Foods Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Mills Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uptons Naturals

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unilever PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Herbalife Nutrition

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Baxters Food Group Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Campbell Soup Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nestle SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Blount Fine Foods Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kraft Heinz Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 B&G Foods Inc

List of Figures

- Figure 1: North American Soup Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North American Soup Market Share (%) by Company 2025

List of Tables

- Table 1: North American Soup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North American Soup Market Revenue Million Forecast, by Category 2020 & 2033

- Table 3: North American Soup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North American Soup Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North American Soup Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: North American Soup Market Revenue Million Forecast, by Category 2020 & 2033

- Table 7: North American Soup Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: North American Soup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North American Soup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North American Soup Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North American Soup Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Soup Market?

The projected CAGR is approximately 1.65%.

2. Which companies are prominent players in the North American Soup Market?

Key companies in the market include B&G Foods Inc, General Mills Inc, Uptons Naturals, Unilever PLC, Herbalife Nutrition, Baxters Food Group Limited, Campbell Soup Company, Nestle SA, Blount Fine Foods Corp, Kraft Heinz Company.

3. What are the main segments of the North American Soup Market?

The market segments include Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Healthy Options; Increased the demand for convenient meal solutions.

6. What are the notable trends driving market growth?

Increasing popularity of plant-based diets has led to a surge in demand for vegan and vegetarian soups.

7. Are there any restraints impacting market growth?

Growing among consumers to prefer fresh and homemade foods over processed and packaged options.

8. Can you provide examples of recent developments in the market?

October 2022: Campbell launched a new exciting series of soups for lunchtime called Chunky Soup. It is available in four new flavors, namely chicken noodle, streak and potato, sirloin burger, and chicken and sausage gumbo.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Soup Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Soup Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Soup Market?

To stay informed about further developments, trends, and reports in the North American Soup Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence