Key Insights

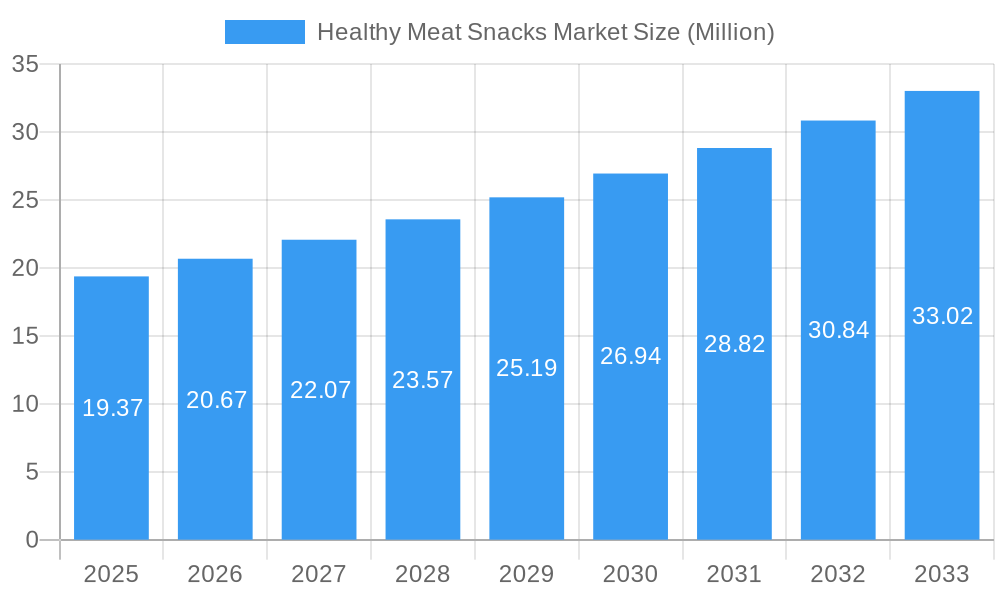

The global Healthy Meat Snacks market is projected to experience robust growth, reaching an estimated USD 19.37 million in 2025, and is poised to expand at a Compound Annual Growth Rate (CAGR) of 6.67% through 2033. This upward trajectory is fueled by a confluence of evolving consumer preferences and an increasing demand for convenient, protein-rich food options. Consumers are becoming more health-conscious, actively seeking out snacks that offer nutritional benefits beyond simple satiety. This has led to a significant shift towards products made with high-quality, lean meats, often seasoned with natural ingredients and free from artificial additives, preservatives, and excessive sodium. The market is witnessing a surge in demand for jerky, sticks, and sausages that align with these healthy eating paradigms. Furthermore, the growing awareness of the benefits of protein for satiety, muscle health, and energy levels is a significant driver, particularly among fitness enthusiasts and individuals managing their weight. The convenience factor of these snacks, suitable for on-the-go consumption, further bolsters their appeal in today's fast-paced lifestyle.

Healthy Meat Snacks Market Market Size (In Million)

The market's expansion is further supported by favorable distribution channels and emerging trends. Online retail stores have become a pivotal platform for reaching a wider consumer base, offering convenience and a diverse product selection. Supermarkets and hypermarkets also continue to play a crucial role, providing accessible purchasing points. Key players like ConAgra Brands Inc., Country Archer Provisions, and Hormel Foods Corporation are strategically investing in product innovation, developing new flavors and formulations to cater to diverse palates and dietary needs, including low-fat and low-sodium options. Emerging trends indicate a move towards ethically sourced and sustainable meat products, appealing to a segment of consumers who prioritize environmental and social responsibility in their purchasing decisions. While the market presents significant opportunities, potential restraints such as fluctuating raw material prices and stringent regulatory standards for food processing may pose challenges to sustained growth, necessitating strategic planning and adaptation by market participants.

Healthy Meat Snacks Market Company Market Share

This in-depth report delves into the dynamic healthy meat snacks market, providing a comprehensive analysis of its structure, trends, and future trajectory. With a study period spanning from 2019 to 2033, a base and estimated year of 2025, and a forecast period from 2025 to 2033, this research offers critical insights for stakeholders navigating this rapidly expanding sector. We dissect key segments, including product types like jerky, sticks, and sausages, and distribution channels such as supermarkets/hypermarkets, convenience stores/grocery stores, and online retail stores. Leveraging high-volume keywords and detailed market data, this report is optimized for SEO and designed to engage industry professionals seeking actionable intelligence on the protein snacks market, meat-based snacks, and convenient healthy eating.

Healthy Meat Snacks Market Market Structure & Competitive Landscape

The healthy meat snacks market is characterized by a moderately fragmented structure, with both established food conglomerates and agile startups vying for market share. Innovation serves as a primary driver, fueled by evolving consumer demand for convenient, protein-rich, and cleaner-label food options. Regulatory landscapes, particularly concerning food safety and labeling standards, play a crucial role in shaping market entry and product development strategies. The prevalence of jerky, meat sticks, and protein bars offers a degree of product substitutability, though brands are increasingly differentiating through ingredient sourcing, flavor profiles, and functional benefits. End-user segmentation highlights a strong preference among health-conscious consumers, athletes, and busy professionals seeking on-the-go nutrition. Merger and acquisition (M&A) activity is anticipated to increase as larger players seek to acquire innovative brands and expand their healthy snack portfolios. Current M&A volumes indicate a growing consolidation trend, with an estimated xx billion USD in transactions within the broader healthy snack segment in recent years. Concentration ratios are expected to shift as key players expand their market reach through strategic partnerships and product launches.

Healthy Meat Snacks Market Market Trends & Opportunities

The healthy meat snacks market is experiencing robust growth, driven by a confluence of evolving consumer preferences and a heightened awareness of nutritional benefits. Market size is projected to reach an estimated XX Billion USD by 2033, exhibiting a compelling Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Technological advancements in food processing and preservation are enabling the creation of a wider variety of healthier meat snack options with improved shelf life and nutritional profiles. Consumer demand for natural, organic, and grass-fed ingredients is a significant trend, pushing manufacturers to prioritize transparent sourcing and clean-label formulations. The increasing popularity of high-protein diets and the rise of the on-the-go snacking culture further fuel market expansion. Opportunities abound for brands that can effectively cater to specific dietary needs, such as keto-friendly or gluten-free options. Competitive dynamics are intensifying, with a focus on product differentiation through unique flavor combinations, functional ingredients (e.g., added vitamins, prebiotics), and sustainable packaging. The online retail channel, in particular, presents a significant opportunity for market penetration and direct-to-consumer engagement, further amplified by digital marketing strategies targeting health-conscious demographics. The market penetration rate for healthy meat snacks is steadily increasing, indicating a growing adoption by a broader consumer base seeking convenient and nutritious snacking solutions.

Dominant Markets & Segments in Healthy Meat Snacks Market

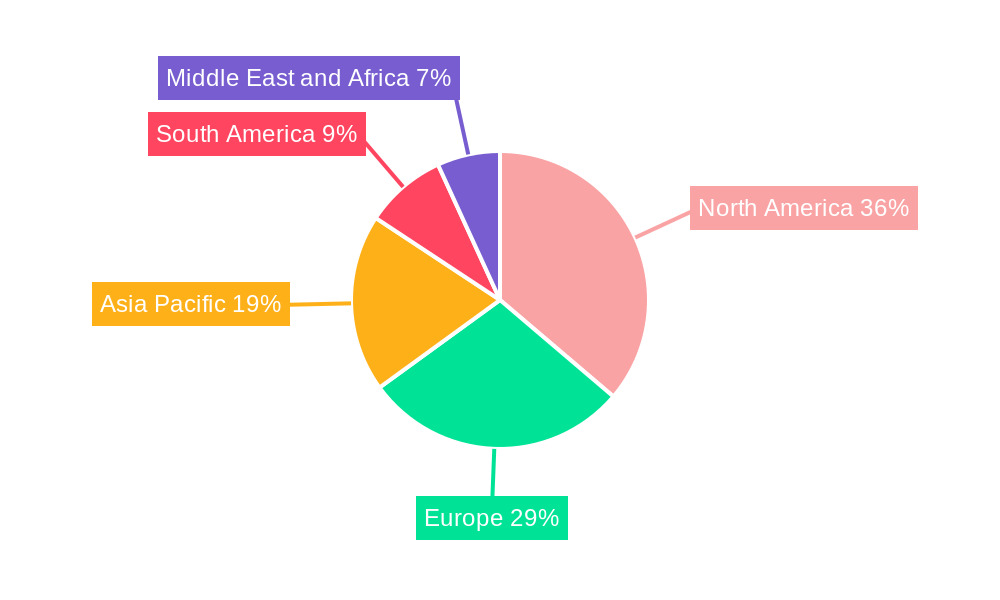

North America currently stands as the dominant region in the healthy meat snacks market, propelled by a well-established consumer base with a strong inclination towards health and wellness products. Within this region, the United States leads in market share and consumption, driven by extensive product availability and sophisticated distribution networks. The Jerky segment reigns supreme in terms of product type, accounting for a significant portion of the market due to its long-standing popularity and versatility. However, Sticks are witnessing a substantial surge in demand, particularly among younger demographics and those seeking portion-controlled snacks.

- Dominant Product Type:

- Jerky: Continues to be a core offering, with continuous innovation in flavors and meat sources (e.g., beef, turkey, chicken, plant-based alternatives).

- Sticks: Experiencing rapid growth due to convenience, portion control, and appeal to a younger, active demographic.

- Dominant Distribution Channel:

- Supermarkets/Hypermarkets: Remain the primary retail channel, offering broad accessibility and diverse product selection for consumers.

- Convenience Stores/Grocery Stores: Crucial for impulse purchases and immediate consumption, catering to on-the-go needs.

- Online Retail Stores: Growing exponentially, offering convenience, wider product variety, and direct-to-consumer models, especially for niche and specialty brands.

Key growth drivers in these dominant segments include increasing disposable incomes, a growing trend towards mindful eating, and the demand for portable, protein-rich food options that fit into busy lifestyles. Government initiatives promoting healthy eating habits and supportive regulatory frameworks for food production also contribute to the expansion of these segments. The robust infrastructure for cold chain logistics in North America further supports the widespread availability of fresh and processed meat snacks.

Healthy Meat Snacks Market Product Analysis

Product innovations in the healthy meat snacks market are predominantly focused on enhancing nutritional value, improving ingredient profiles, and expanding flavor diversity. Manufacturers are actively developing low-sodium, low-fat, and high-protein formulations, often incorporating functional ingredients like probiotics, prebiotics, and added vitamins. The application scope is broad, ranging from convenient on-the-go snacks for athletes and busy professionals to healthier alternatives for traditional snack options. Competitive advantages are being carved out through the use of premium ingredients, such as grass-fed beef, organic poultry, and ethically sourced meats. Furthermore, advancements in processing techniques allow for a wider array of textures and chewiness, catering to diverse consumer preferences. Brands are also leveraging technology to offer clean-label products with shorter ingredient lists, appealing to the growing segment of health-conscious consumers.

Key Drivers, Barriers & Challenges in Healthy Meat Snacks Market

The healthy meat snacks market is propelled by several key drivers. The increasing global focus on health and wellness, coupled with rising disposable incomes, fuels demand for nutrient-dense, convenient food options. Technological advancements in food processing and preservation contribute to product innovation, enabling the creation of diverse and appealing protein snacks. The growing popularity of high-protein diets and the "on-the-go" lifestyle further amplifies the need for portable snacking solutions. Regulatory support for healthy food initiatives and the growing awareness of the benefits of protein consumption are also significant catalysts.

Conversely, several barriers and challenges exist. Stringent regulatory requirements for food safety, labeling, and ingredient sourcing can increase production costs and complexity. Concerns regarding the sodium content and processing methods of some meat snacks can act as a deterrent for highly health-conscious consumers. Supply chain disruptions, particularly for specialty or premium ingredients, can impact product availability and cost. Intense competition from other snack categories, including plant-based alternatives and traditional confectionery, poses a constant challenge. Fluctuations in the price of raw meat also present a significant economic hurdle for manufacturers.

Growth Drivers in the Healthy Meat Snacks Market Market

The healthy meat snacks market is experiencing significant growth driven by several compelling factors. The increasing consumer awareness of health and wellness is a primary catalyst, with individuals actively seeking protein-rich and nutritious snack options. The rising popularity of high-protein diets, including keto and paleo, directly translates into higher demand for meat-based snacks. Technological advancements in food processing have enabled the development of innovative products with improved shelf life, diverse flavors, and cleaner ingredient labels. The on-the-go lifestyle of modern consumers fuels the need for convenient, portable, and ready-to-eat snacks. Furthermore, supportive government policies and initiatives promoting healthy eating habits indirectly bolster the growth of this market.

Challenges Impacting Healthy Meat Snacks Market Growth

Despite its promising trajectory, the healthy meat snacks market faces several considerable challenges. Stringent food safety regulations and evolving labeling requirements necessitate continuous compliance and can lead to increased operational costs. Consumer perceptions regarding the healthiness of processed meats, particularly concerning sodium and fat content, remain a hurdle for some segments of the market. Supply chain volatility, including fluctuations in raw material prices and availability, can impact profitability and product consistency. The intense competition from a wide array of snack alternatives, including plant-based options, requires continuous product innovation and effective marketing strategies. Addressing these challenges is crucial for sustained market expansion.

Key Players Shaping the Healthy Meat Snacks Market Market

- ConAgra Brands Inc

- Country Archer Provisions

- WorldPantry com LLC

- The Meatsnacks Group

- Golden Valley Natural LLC

- Sweetwood Smoke & Co

- Monogram Food Solutions LLC

- Link Snacks Inc

- Hormel Foods Corporation

- Wild West Jerky

- Bridgford Foods Corporation

Significant Healthy Meat Snacks Market Industry Milestones

- October 2023: Meat snack brand, Country Archer Provisions, launched two new meat snack products including Rosemary Turkey Mini Sticks and Original Beef Jerky Snack Packs. As per the company, the portioned protein snacks offer clean-label ingredients for health-conscious consumers. Furthermore, the company claims that the Rosemary Turkey Mini Sticks are fortified with herbs and spices like rosemary, basil, thyme, garlic, and onion, and the original Beef Jerky Snack Packs are made from grass-fed beef combined with spices like garlic and onion powder.

- September 2023: A United States-based company Volpi Foods expanded its presence in the meat snacks category with a new line of Salami Stix. The company claims the products to be high-quality, all-natural with the best ingredients. Furthermore, the company asserts the products are available in 2-oz packages, in two flavors, Spicy and Original.

- April 2023: Doki Foods, a New Delhi-based startup launched chicken chips and buffalo jerky in the country. As per the company, the products are available in flavors like Korean Gochujang, Tokyo Teriyaki, and Telicherry pepper.

Future Outlook for Healthy Meat Snacks Market Market

The future outlook for the healthy meat snacks market remains exceptionally bright, driven by sustained consumer demand for convenient, nutritious, and protein-forward food options. Strategic opportunities lie in the continued innovation of clean-label products, the expansion into niche dietary segments (e.g., plant-based meat alternatives), and the leveraging of e-commerce channels for direct-to-consumer sales. As consumer awareness around health and wellness continues to grow, the market for healthy meat snacks is poised for significant expansion, with a projected market size of XX Billion USD by 2033. Manufacturers focusing on quality ingredients, unique flavor profiles, and transparent sourcing will be best positioned to capitalize on this evolving market landscape. The integration of functional ingredients and the development of sustainable packaging solutions will further enhance market appeal and drive long-term growth.

Healthy Meat Snacks Market Segmentation

-

1. Product Type

- 1.1. Jerky

- 1.2. Sticks

- 1.3. Sausages

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores/Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Healthy Meat Snacks Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Russia

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Healthy Meat Snacks Market Regional Market Share

Geographic Coverage of Healthy Meat Snacks Market

Healthy Meat Snacks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Rising Demand for Convenient Snacking Options

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Healthy Meat Snacks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Jerky

- 5.1.2. Sticks

- 5.1.3. Sausages

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores/Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Healthy Meat Snacks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Jerky

- 6.1.2. Sticks

- 6.1.3. Sausages

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores/Grocery Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Healthy Meat Snacks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Jerky

- 7.1.2. Sticks

- 7.1.3. Sausages

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores/Grocery Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Healthy Meat Snacks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Jerky

- 8.1.2. Sticks

- 8.1.3. Sausages

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores/Grocery Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Healthy Meat Snacks Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Jerky

- 9.1.2. Sticks

- 9.1.3. Sausages

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores/Grocery Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Healthy Meat Snacks Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Jerky

- 10.1.2. Sticks

- 10.1.3. Sausages

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores/Grocery Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ConAgra Brands Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Country Archer Provisions & WorldPantry com LLC*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Meatsnacks Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Golden Valley Natural LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sweetwood Smoke & Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Monogram Food Solutions LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Link Snacks Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hormel Foods Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wild West Jerky

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bridgford Foods Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ConAgra Brands Inc

List of Figures

- Figure 1: Global Healthy Meat Snacks Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Healthy Meat Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Healthy Meat Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Healthy Meat Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Healthy Meat Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Healthy Meat Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Healthy Meat Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Healthy Meat Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Healthy Meat Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Healthy Meat Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Healthy Meat Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Healthy Meat Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Healthy Meat Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Healthy Meat Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Healthy Meat Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Healthy Meat Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Healthy Meat Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Healthy Meat Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Healthy Meat Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Healthy Meat Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Healthy Meat Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Healthy Meat Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Healthy Meat Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Healthy Meat Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Healthy Meat Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Healthy Meat Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Healthy Meat Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Healthy Meat Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Healthy Meat Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Healthy Meat Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Healthy Meat Snacks Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Healthy Meat Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Healthy Meat Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Healthy Meat Snacks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Healthy Meat Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Healthy Meat Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Healthy Meat Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Healthy Meat Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Healthy Meat Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Healthy Meat Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Healthy Meat Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Healthy Meat Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Healthy Meat Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Healthy Meat Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Healthy Meat Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Healthy Meat Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Healthy Meat Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Healthy Meat Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Healthy Meat Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Healthy Meat Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthy Meat Snacks Market?

The projected CAGR is approximately 6.67%.

2. Which companies are prominent players in the Healthy Meat Snacks Market?

Key companies in the market include ConAgra Brands Inc, Country Archer Provisions & WorldPantry com LLC*List Not Exhaustive, The Meatsnacks Group, Golden Valley Natural LLC, Sweetwood Smoke & Co, Monogram Food Solutions LLC, Link Snacks Inc, Hormel Foods Corporation, Wild West Jerky, Bridgford Foods Corporation.

3. What are the main segments of the Healthy Meat Snacks Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks.

6. What are the notable trends driving market growth?

Rising Demand for Convenient Snacking Options.

7. Are there any restraints impacting market growth?

Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

October 2023: Meat snack brand, Country Archer Provisions, launched two new meat snack products including Rosemary Turkey Mini Sticks and Original Beef Jerky Snack Packs. As per the company, the portioned protein snacks offer clean-label ingredients for health-conscious consumers. Furthermore, the company claims that the Rosemary Turkey Mini Sticks are fortified with herbs and spices like rosemary, basil, thyme, garlic, and onion, and the original Beef Jerky Snack Packs are made from grass-fed beef combined with spices like garlic and onion powder.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Healthy Meat Snacks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Healthy Meat Snacks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Healthy Meat Snacks Market?

To stay informed about further developments, trends, and reports in the Healthy Meat Snacks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence