Key Insights

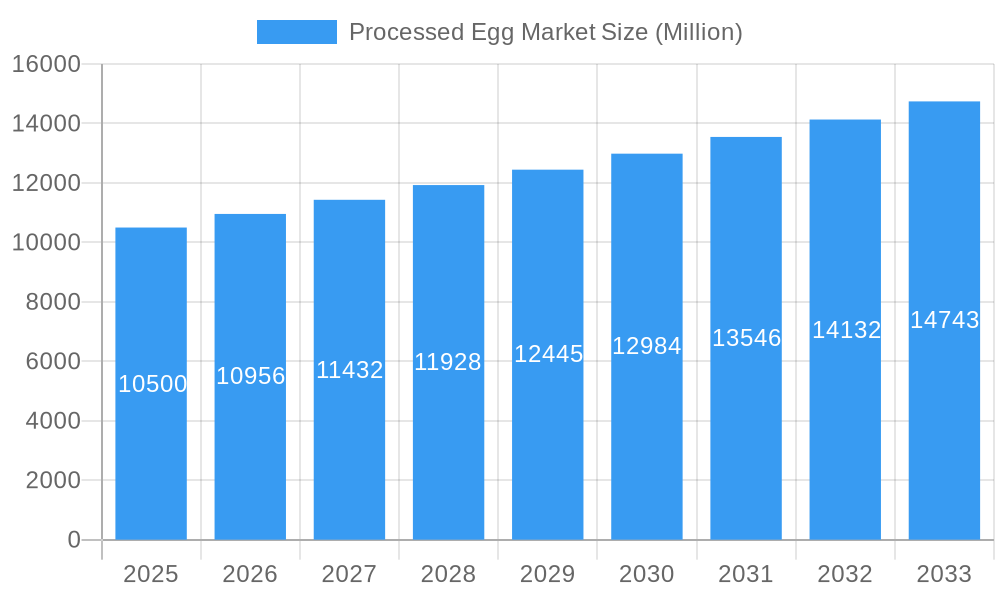

The global processed egg market is projected for substantial growth, anticipated to reach $5.05 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.82% forecast through 2033. This expansion is driven by increasing consumer preference for convenient, nutritious, and versatile food ingredients. Key application segments include bakery and dairy products, where processed eggs enhance formulation and texture. The rising demand for ready-to-eat meals and nutritional supplements further fuels market opportunities, aligning with modern dietary habits and fast-paced lifestyles. Enhanced consumer awareness of eggs as an economical source of high-quality protein and essential nutrients, coupled with technological advancements improving shelf-life and product quality, are significant market drivers.

Processed Egg Market Market Size (In Billion)

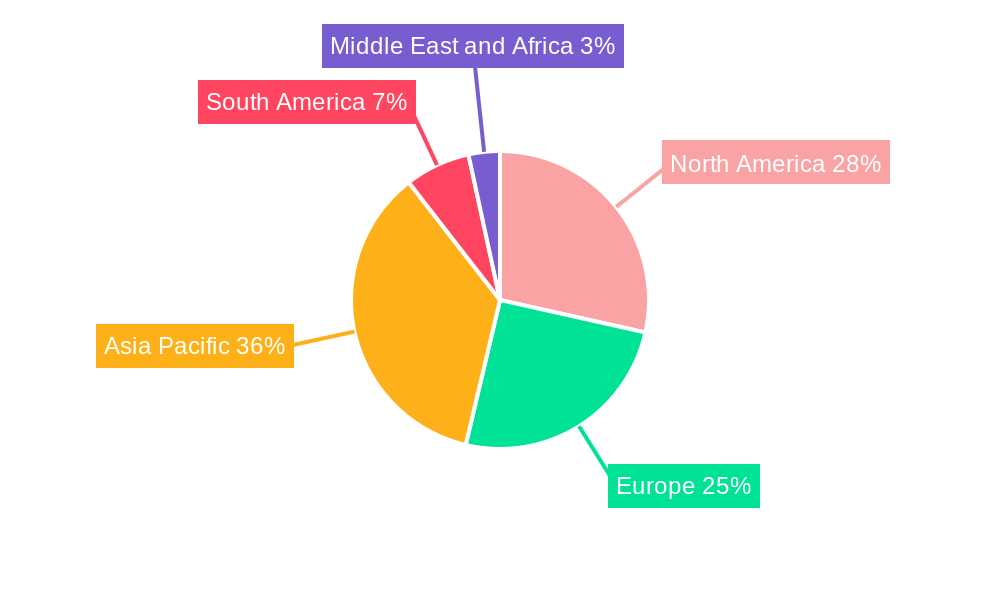

However, market growth is tempered by challenges such as price volatility of raw eggs due to factors like avian influenza and feed costs, which can affect processor profitability. Stringent regional food safety and labeling regulations also present compliance complexities. Despite these restraints, the market is marked by continuous product innovation, with companies developing novel applications and value-added offerings. Major industry players, including Cal-Maine Foods Inc., Rose Acre Farms Inc., and Dr. Oetker, are actively investing in research, development, strategic alliances, and market expansion. The Asia Pacific region is expected to witness particularly robust growth, supported by a large population and increasing disposable incomes, with North America and Europe also demonstrating sustained demand.

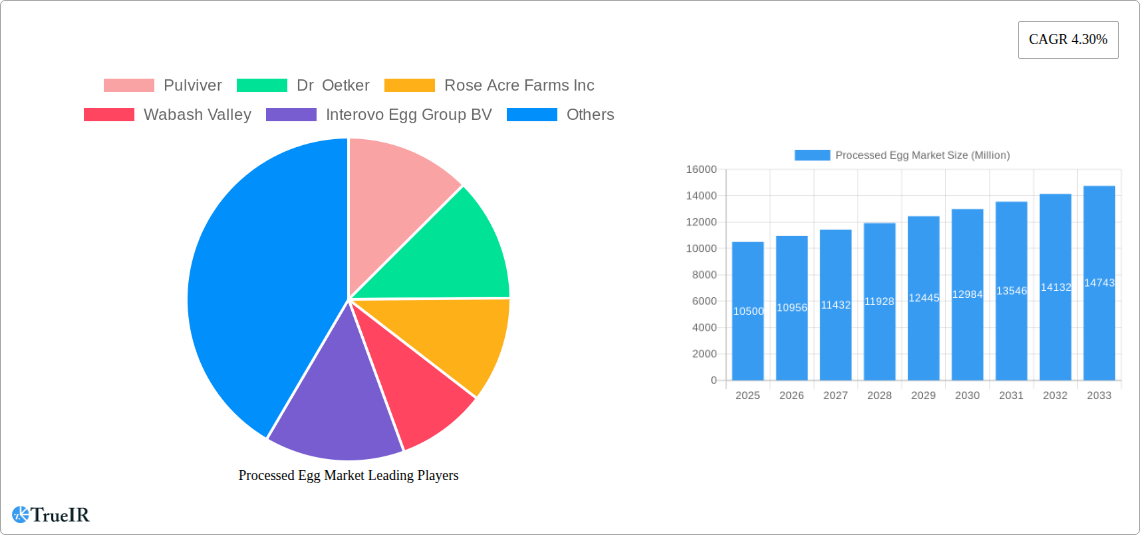

Processed Egg Market Company Market Share

This report offers a dynamic, SEO-optimized analysis of the Processed Egg Market, designed for industry professionals and enhanced search visibility. It provides an in-depth examination of market structure, competitive dynamics, emerging trends, opportunities, key segments, and future projections for the period 2019-2033, with 2025 as the base year.

Leveraging high-volume keywords such as "processed egg market," "egg products," "liquid egg," "frozen egg," "dried egg," "bakery ingredients," "dairy product additives," "confectionery ingredients," and "nutritional supplements," this comprehensive study delivers critical insights for stakeholders navigating the processed egg industry landscape.

Processed Egg Market Market Structure & Competitive Landscape

The processed egg market exhibits a moderate to high degree of concentration, with key players continuously vying for market share through strategic acquisitions and product innovation. Innovation drivers are primarily focused on enhancing shelf-life, improving nutritional profiles, and developing convenient, ready-to-use egg formulations. Regulatory impacts, particularly concerning food safety standards and animal welfare, significantly shape market entry and operational strategies. Product substitutes, such as plant-based protein alternatives, pose an increasing challenge, necessitating continuous value proposition enhancement for egg-based products. End-user segmentation reveals a strong reliance on the bakery, dairy, and confectionery sectors, while the growing demand for convenient food options fuels the ready-to-eat segment. Mergers and acquisitions (M&A) are a prevalent trend, aimed at consolidating market presence, expanding product portfolios, and achieving economies of scale. For instance, recent M&A activities in the past three years have involved over $500 Million in deal value, indicating significant consolidation efforts by major players like Cal-Maine Foods Inc and Rose Acre Farms Inc. The market is characterized by a few large global players and numerous regional manufacturers, with the top 5 companies holding approximately 60% of the global market share.

Processed Egg Market Market Trends & Opportunities

The global processed egg market is poised for substantial growth, driven by evolving consumer preferences for convenience, health, and nutritional fortification. The market size is projected to reach an estimated $15,000 Million by 2025, expanding at a compound annual growth rate (CAGR) of approximately 5.5% during the forecast period of 2025–2033. Technological advancements in processing techniques, such as advanced pasteurization methods and spray-drying technologies, are enhancing product quality, safety, and shelf-life, thereby expanding application possibilities. Consumer demand for clean-label products and ingredients with natural sourcing is a significant trend, pushing manufacturers to adopt more transparent and sustainable production practices. The rising global population and increasing disposable incomes, particularly in emerging economies, are contributing to a higher demand for processed foods, including those incorporating egg products. Furthermore, the growing awareness of the nutritional benefits of eggs, such as high protein content and essential vitamins and minerals, is driving their incorporation into a wider range of food products and dietary supplements. The market penetration of liquid egg products, which offer enhanced convenience and reduced waste for food service providers and manufacturers, is expected to continue its upward trajectory. Opportunities lie in developing value-added processed egg products with specialized functionalities, such as enhanced emulsification properties for bakery applications or allergen-free formulations. The expanding ready-to-eat meal market also presents a significant avenue for growth, with processed eggs serving as a key ingredient in various convenient meal solutions. Competitive dynamics are influenced by price sensitivity, product differentiation, and the ability to meet stringent quality and safety standards.

Dominant Markets & Segments in Processed Egg Market

The liquid egg segment is expected to dominate the processed egg market, driven by its unparalleled convenience and versatility across various food applications. In 2025, liquid egg is projected to account for over 50% of the global processed egg market revenue, estimated at $7,500 Million. This dominance is fueled by its extensive use in the bakery sector, where it offers consistent quality, ease of handling, and reduced preparation time for manufacturers of cakes, pastries, and bread. The bakery segment itself is a leading application, expected to contribute approximately $4,000 Million to the processed egg market by 2025, representing a significant portion of the overall demand.

- Dominant Product Type: Liquid Egg:

- Key Growth Drivers: High convenience, reduced waste, consistent quality, ease of integration into industrial processes.

- Market Dominance Analysis: Liquid eggs are favored by food manufacturers and food service providers for their efficiency. Advanced processing techniques ensure safety and extend shelf life, further solidifying their market position.

- Dominant Application: Bakery:

- Key Growth Drivers: Widespread use in cakes, cookies, pastries, and bread for binding, leavening, and emulsification. Growing demand for convenience baked goods.

- Market Dominance Analysis: The bakery industry's reliance on precise ingredient ratios and consistent performance makes liquid egg a preferred choice. Innovation in egg blends for specific bakery needs also supports this dominance.

- Leading Region: North America:

- Key Growth Drivers: High per capita consumption of processed foods, robust food manufacturing infrastructure, strong presence of major egg processors like Cal-Maine Foods Inc and Rose Acre Farms Inc.

- Market Dominance Analysis: North America's well-established food industry, coupled with a growing demand for convenience and protein-rich products, positions it as a key market. Favorable regulatory frameworks and advanced supply chains contribute to its leadership.

- Emerging Application: Nutritional Supplements:

- Key Growth Drivers: Increasing consumer focus on health and wellness, demand for high-quality protein sources.

- Market Dominance Analysis: While not yet dominant, this segment shows significant growth potential due to the inherent nutritional value of eggs and their appeal to fitness enthusiasts and health-conscious individuals.

Processed Egg Market Product Analysis

Product innovations in the processed egg market are centered around enhanced functionality and consumer convenience. Liquid egg products, offering various forms like whole egg, egg whites, and egg yolks, provide manufacturers with ready-to-use ingredients that simplify production processes and ensure consistent quality. Frozen egg products offer extended shelf life while retaining nutritional value, ideal for specific culinary applications. Dried egg powders, particularly spray-dried versions, are highly versatile, enabling longer storage and transportation, and find extensive use in bakery mixes and other dry food products. Competitive advantages stem from advanced processing technologies that guarantee food safety, extend shelf life, and preserve nutritional integrity, making them indispensable ingredients in the global food industry.

Key Drivers, Barriers & Challenges in Processed Egg Market

Key Drivers: The processed egg market is propelled by several key factors. Technological advancements in processing and preservation techniques are enhancing product quality, safety, and shelf-life. The growing consumer demand for convenience and ready-to-eat foods directly translates to increased demand for processed egg products. Furthermore, the recognized nutritional benefits of eggs, particularly their high protein content, are driving their incorporation into a wider array of food products and supplements. Economic factors, such as rising disposable incomes in developing regions, are also contributing to market expansion. Policy-driven factors, including supportive food safety regulations, further bolster market growth.

Key Barriers & Challenges: Despite its growth, the processed egg market faces significant challenges. Supply chain disruptions, such as those caused by avian influenza outbreaks or logistical issues, can impact availability and pricing. Stringent regulatory hurdles related to food safety and hygiene standards require continuous investment in compliance. Intensifying competitive pressures from both established players and emerging substitutes, like plant-based alternatives, necessitate ongoing innovation and cost-effectiveness. Fluctuations in raw egg prices, which are subject to agricultural factors and market demand, can impact profit margins.

Growth Drivers in the Processed Egg Market Market

Key growth drivers in the processed egg market include ongoing technological innovations in processing, such as improved pasteurization and drying methods that enhance shelf-life and maintain nutritional value. The increasing global demand for convenience foods and ready-to-eat meals, where processed eggs offer significant advantages in preparation and consistency, is a major catalyst. Economically, rising disposable incomes in emerging markets are leading to greater consumption of processed food products. Furthermore, the growing consumer awareness of the nutritional benefits of eggs, particularly their high protein content and essential nutrients, is driving their inclusion in a broader range of food applications and dietary supplements. Policy initiatives that support food safety and streamline production processes also contribute to market expansion.

Challenges Impacting Processed Egg Market Growth

Several challenges are impacting the growth of the processed egg market. Regulatory complexities and evolving food safety standards across different regions require continuous adaptation and investment from manufacturers. Vulnerability to supply chain disruptions, including outbreaks of avian influenza and logistical bottlenecks, can lead to price volatility and availability issues. Intensifying competition from plant-based alternatives, driven by consumer trends towards veganism and perceived health benefits, poses a significant threat. Fluctuations in the price of raw eggs, which are directly influenced by agricultural factors, feed costs, and demand, can impact profitability and pricing strategies for processed egg products.

Key Players Shaping the Processed Egg Market Market

- Pulviver

- Dr Oetker

- Rose Acre Farms Inc

- Wabash Valley

- Interovo Egg Group BV

- Cal-Maine Foods Inc

- Gruppo Eurovo

- Rembrandt Enterprises Inc

- Daybreak Foods

- Honeyville Inc

Significant Processed Egg Market Industry Milestones

- 2019: Increased investment in spray-drying technology by major players to enhance shelf-life and market reach.

- 2020: Launch of fortified liquid egg products with added Omega-3 fatty acids to cater to health-conscious consumers.

- 2021: Growing adoption of advanced pasteurization techniques for improved safety and extended shelf-life of liquid egg products.

- 2022: Significant M&A activity, with larger companies acquiring smaller processors to consolidate market share and expand product portfolios.

- 2023: Increased focus on sustainable sourcing and transparent production practices in response to consumer demand.

- 2024: Introduction of innovative egg-based ingredients for the rapidly growing plant-based food sector, enhancing texture and binding properties.

Future Outlook for Processed Egg Market Market

The future outlook for the processed egg market is highly promising, driven by persistent consumer demand for convenient, nutritious, and versatile food ingredients. The projected market growth is underpinned by ongoing technological advancements in processing and preservation, leading to enhanced product quality and extended shelf-life. The expanding global food industry, coupled with increasing disposable incomes in emerging economies, will continue to fuel demand across various applications, particularly in bakery, dairy, and ready-to-eat segments. Strategic opportunities lie in the development of value-added products, such as specialized protein isolates and functional egg ingredients tailored for specific nutritional and culinary needs. Furthermore, a continued focus on clean-label formulations and sustainable production practices will be crucial for sustained market leadership and consumer trust.

Processed Egg Market Segmentation

-

1. Product Type

- 1.1. Liquid Egg

- 1.2. Frozen Egg

- 1.3. Dried Egg

- 1.4. Others

-

2. Application

- 2.1. Bakery

- 2.2. Dairy Products

- 2.3. Confectionery

- 2.4. Ready-to Eat

- 2.5. Nutritional Supplement

- 2.6. Others

Processed Egg Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Processed Egg Market Regional Market Share

Geographic Coverage of Processed Egg Market

Processed Egg Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry

- 3.3. Market Restrains

- 3.3.1. Health Concerns Pertaining to the Excessive Consumption of Fats and Oils

- 3.4. Market Trends

- 3.4.1. Increasing Demand for the Convenient and Healthy Instant Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Processed Egg Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Liquid Egg

- 5.1.2. Frozen Egg

- 5.1.3. Dried Egg

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy Products

- 5.2.3. Confectionery

- 5.2.4. Ready-to Eat

- 5.2.5. Nutritional Supplement

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Processed Egg Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Liquid Egg

- 6.1.2. Frozen Egg

- 6.1.3. Dried Egg

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Dairy Products

- 6.2.3. Confectionery

- 6.2.4. Ready-to Eat

- 6.2.5. Nutritional Supplement

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Processed Egg Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Liquid Egg

- 7.1.2. Frozen Egg

- 7.1.3. Dried Egg

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Dairy Products

- 7.2.3. Confectionery

- 7.2.4. Ready-to Eat

- 7.2.5. Nutritional Supplement

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Processed Egg Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Liquid Egg

- 8.1.2. Frozen Egg

- 8.1.3. Dried Egg

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Dairy Products

- 8.2.3. Confectionery

- 8.2.4. Ready-to Eat

- 8.2.5. Nutritional Supplement

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Processed Egg Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Liquid Egg

- 9.1.2. Frozen Egg

- 9.1.3. Dried Egg

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery

- 9.2.2. Dairy Products

- 9.2.3. Confectionery

- 9.2.4. Ready-to Eat

- 9.2.5. Nutritional Supplement

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Processed Egg Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Liquid Egg

- 10.1.2. Frozen Egg

- 10.1.3. Dried Egg

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery

- 10.2.2. Dairy Products

- 10.2.3. Confectionery

- 10.2.4. Ready-to Eat

- 10.2.5. Nutritional Supplement

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pulviver

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dr Oetker

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rose Acre Farms Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wabash Valley

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Interovo Egg Group BV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cal-Maine Foods Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gruppo Eurovo*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rembrandt Enterprises Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Daybreak Foods

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Honeyville Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Pulviver

List of Figures

- Figure 1: Global Processed Egg Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Processed Egg Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Processed Egg Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Processed Egg Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Processed Egg Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Processed Egg Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Processed Egg Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Processed Egg Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Processed Egg Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Processed Egg Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Processed Egg Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Processed Egg Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Processed Egg Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Processed Egg Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Processed Egg Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Processed Egg Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Processed Egg Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Processed Egg Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Processed Egg Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Processed Egg Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Processed Egg Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Processed Egg Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Processed Egg Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Processed Egg Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Processed Egg Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Processed Egg Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Processed Egg Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Processed Egg Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Processed Egg Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Processed Egg Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Processed Egg Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Processed Egg Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Processed Egg Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Processed Egg Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Processed Egg Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Processed Egg Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Processed Egg Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Processed Egg Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Processed Egg Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Processed Egg Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Processed Egg Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Processed Egg Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Processed Egg Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Processed Egg Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Processed Egg Market Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Processed Egg Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Processed Egg Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Processed Egg Market Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Processed Egg Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Processed Egg Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Processed Egg Market?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the Processed Egg Market?

Key companies in the market include Pulviver, Dr Oetker, Rose Acre Farms Inc, Wabash Valley, Interovo Egg Group BV, Cal-Maine Foods Inc, Gruppo Eurovo*List Not Exhaustive, Rembrandt Enterprises Inc, Daybreak Foods, Honeyville Inc.

3. What are the main segments of the Processed Egg Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry.

6. What are the notable trends driving market growth?

Increasing Demand for the Convenient and Healthy Instant Food.

7. Are there any restraints impacting market growth?

Health Concerns Pertaining to the Excessive Consumption of Fats and Oils.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Processed Egg Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Processed Egg Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Processed Egg Market?

To stay informed about further developments, trends, and reports in the Processed Egg Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence