Key Insights

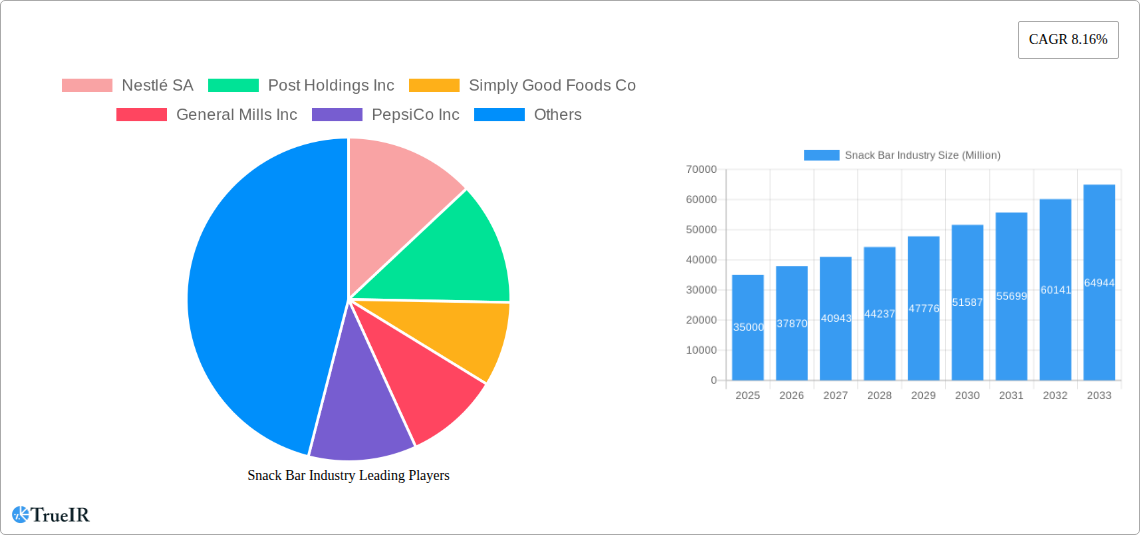

The global snack bar market is projected for substantial growth, estimated at $18.36 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.9% through 2033. This expansion is driven by evolving consumer lifestyles, a strong emphasis on health and wellness, and the demand for convenient, on-the-go nutrition. Consumers are increasingly seeking snack bars that offer both satiety and nutritional value, leading to a rise in demand for diverse variants. Cereal bars remain popular for quick energy, while fruit & nut bars are gaining traction due to their perceived natural ingredients. The protein bar segment is experiencing significant growth, appealing to fitness enthusiasts and those seeking meal replacement options.

Snack Bar Industry Market Size (In Billion)

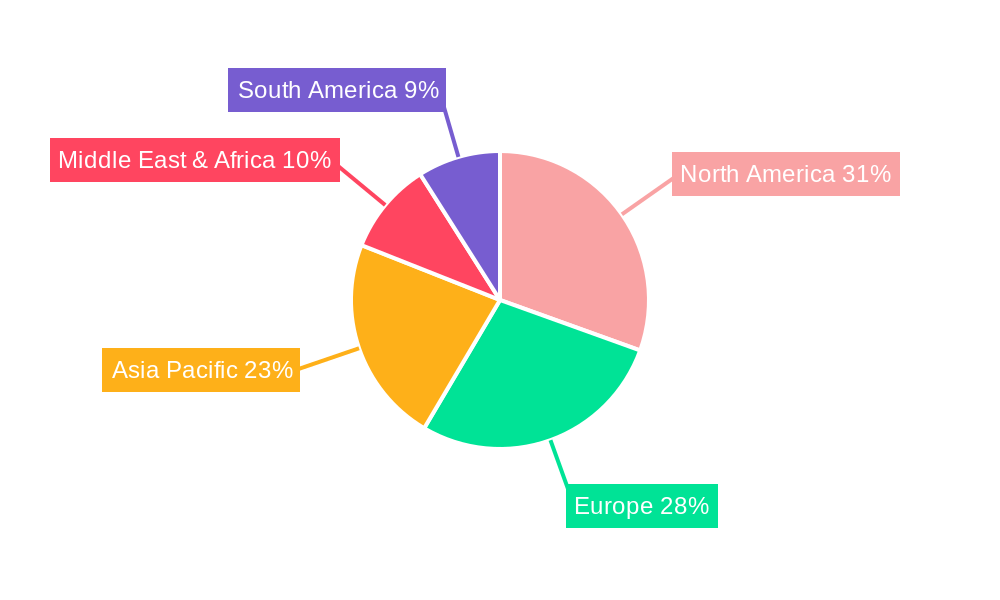

The snack bar distribution landscape is shifting. While supermarkets and hypermarkets remain key channels, online retail is rapidly growing, offering convenience and a wider product selection. Convenience stores are also important for impulse purchases. Leading companies like Nestlé, PepsiCo, Mars, and Hershey are investing in innovation, developing products for niche dietary needs and evolving tastes. Emerging trends include functional ingredients, plant-based formulations, and reduced sugar content. Potential challenges include market competition and fluctuating raw material prices. North America and Europe are expected to lead the market, with Asia Pacific showing the highest growth potential due to a growing middle class and increasing disposable income.

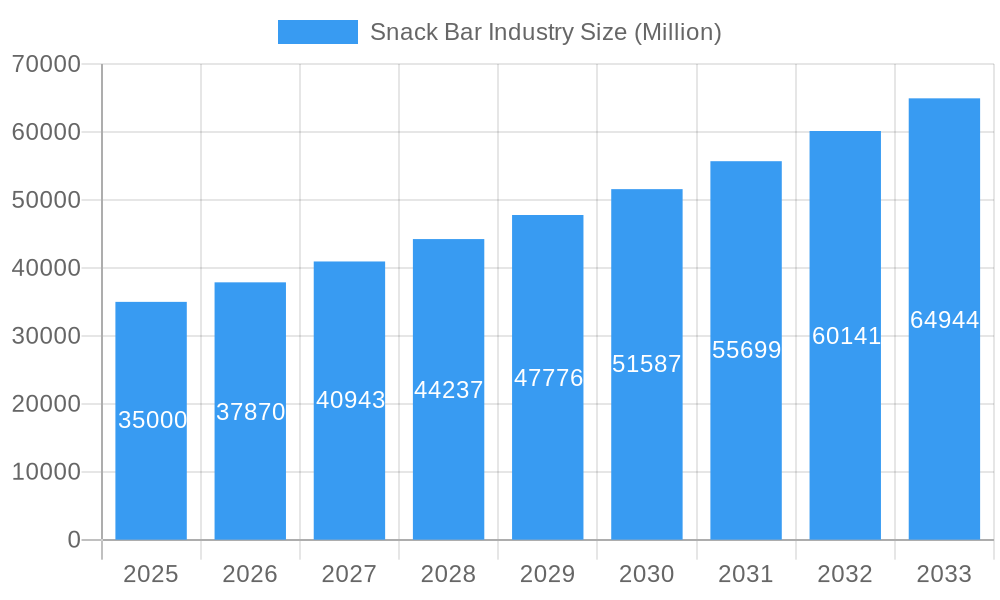

Snack Bar Industry Company Market Share

This report offers an in-depth analysis of the global snack bar industry, including market structure, competitive landscape, trends, opportunities, and future outlook. Designed for optimal SEO, it incorporates keywords such as "healthy snacks," "protein bars," "confectionery snacks," "convenience store snacks," and "online snack retail." Our analysis covers the historical period of 2019–2024, with 2025 as the base and estimated year, and a forecast extending to 2033. The global snack bar market is projected to reach $18.36 billion by 2025, exhibiting a CAGR of 3.9% during the forecast period.

Snack Bar Industry Market Structure & Competitive Landscape

The global Snack Bar Industry exhibits a moderately concentrated market structure, with a few key players holding significant market share, complemented by a growing number of smaller, niche brands. Innovation is a primary driver, fueled by evolving consumer demand for healthier, functional, and convenient snack options. Regulatory impacts, particularly concerning nutritional labeling and ingredient disclosures, play a crucial role in shaping product development and market entry. Product substitutes include traditional confectionery, fresh fruit, nuts, and other portable snacks, necessitating continuous product differentiation. End-user segmentation is diverse, encompassing health-conscious individuals, athletes, busy professionals, and families. Mergers and Acquisitions (M&A) trends indicate strategic consolidation and expansion of product portfolios. For instance, the partnership between Emirates Snack Foods (ESF) and Hershey in July 2023 signifies a move to expand market reach and product offerings in a key region. M&A activity in the past five years has seen an estimated XX Billion in deal value. Concentration ratios for the top five players stand at approximately XX%, highlighting the competitive intensity.

Snack Bar Industry Market Trends & Opportunities

The Snack Bar Industry is experiencing robust growth, driven by an increasing global consumer consciousness towards health and wellness, leading to a substantial market size expansion. The market is projected to reach XX Billion by 2033. Technological shifts are enabling the development of innovative ingredients and formulations, catering to specific dietary needs like gluten-free, vegan, and keto. Consumer preferences are rapidly evolving towards bars offering added functional benefits, such as sustained energy release, protein fortification, and gut health support. This trend is evident in Nestle's Milo protein snack bar launch in May 2023, offering 6g of protein and fiber, and Uncle Tobys' unveiling of a new protein muesli bar with 20% protein. Competitive dynamics are intensifying, with established players focusing on premiumization and the introduction of plant-based and sustainable options. The market penetration rate for health-focused snack bars has seen a significant uptick, currently estimated at XX%. Opportunities lie in leveraging emerging online retail channels, which are projected to grow at a CAGR of XX%, and in developing personalized nutrition solutions. The CAGR for the overall Snack Bar Market is estimated to be XX% during the forecast period.

Dominant Markets & Segments in Snack Bar Industry

The Confectionery segment currently holds a significant market share within the Snack Bar Industry, driven by established brand recognition and widespread consumer appeal. However, the Protein Bar segment is experiencing the fastest growth, projected to expand at a CAGR of XX% due to the rising demand for sports nutrition and post-workout recovery. Regionally, North America continues to dominate the market, accounting for approximately XX% of global sales, attributed to high disposable incomes and a strong existing health and fitness culture. Key growth drivers in this region include robust distribution networks, advanced manufacturing capabilities, and significant investment in product innovation.

Segments:

- Confectionery Variant: While historically dominant, this segment is facing increased competition from healthier alternatives.

- Cereal Bar: A steady performer, catering to the demand for quick and convenient breakfast and on-the-go snacks.

- Fruit & Nut Bar: Benefiting from the "natural" and "whole food" trend, appealing to health-conscious consumers.

- Protein Bar: The star performer, driven by fitness enthusiasts, athletes, and the general population seeking higher protein intake. Its market share is expected to reach XX% by 2033.

Distribution Channel:

- Supermarket/Hypermarket: Remains the largest distribution channel, offering extensive product variety and accessibility.

- Online Retail Store: Witnessing exponential growth, driven by convenience and broader product availability. Expected to capture XX% of the market by 2033.

- Convenience Store: Crucial for impulse purchases and on-the-go consumption, maintaining a consistent market share.

- Others: Includes specialized health food stores and direct-to-consumer models.

Snack Bar Industry Product Analysis

Product innovation in the Snack Bar Industry is characterized by a strong focus on functional ingredients and clean labels. Manufacturers are increasingly incorporating superfoods, probiotics, adaptogens, and diverse protein sources (plant-based and whey) to cater to specific health and wellness needs. Competitive advantages are being built through novel flavor combinations, allergen-free formulations, and sustainable packaging solutions. Technological advancements in processing and ingredient sourcing allow for enhanced nutritional profiles and extended shelf life. For example, the development of low-sugar, high-fiber bars aligns with growing consumer awareness of metabolic health.

Key Drivers, Barriers & Challenges in Snack Bar Industry

Key Drivers:

- Growing Health & Wellness Trend: Increased consumer focus on healthy eating and preventative healthcare fuels demand for nutritious snack options.

- Convenience & Portability: Busy lifestyles necessitate on-the-go food solutions, making snack bars an ideal choice.

- Product Innovation & Customization: Development of specialized bars (e.g., high protein, low sugar, vegan) caters to diverse dietary requirements.

- Rising Disposable Incomes: Particularly in emerging economies, enabling consumers to spend more on premium and functional food products.

Barriers & Challenges:

- Intense Competition: A saturated market with numerous established brands and new entrants leads to price pressures and marketing challenges. The number of competing brands is estimated to be over XX thousand.

- Supply Chain Disruptions: Volatility in raw material prices (e.g., nuts, grains, sweeteners) and logistical complexities can impact production costs and availability. An estimated XX% of manufacturers reported supply chain challenges in the last fiscal year.

- Regulatory Scrutiny: Evolving regulations regarding nutritional claims, ingredient transparency, and labeling can necessitate product reformulation and compliance efforts.

- Consumer Perception of "Processed" Foods: Some consumers remain hesitant about processed snack bars, driving demand for "natural" and "whole food" alternatives.

Growth Drivers in the Snack Bar Industry Market

The Snack Bar Industry is propelled by several key growth drivers. The persistent global trend towards healthier lifestyles and preventative healthcare significantly boosts the demand for nutrient-dense, convenient snack bars. Technological advancements in food science enable the creation of innovative, functional ingredients that offer specific health benefits, such as improved gut health or sustained energy release. Economically, rising disposable incomes in both developed and developing nations allow consumers to allocate more resources towards premium and health-oriented food products. Furthermore, supportive government policies promoting healthier food choices and clearer nutritional labeling encourage product development and market expansion.

Challenges Impacting Snack Bar Industry Growth

Several barriers and restraints impact the growth trajectory of the Snack Bar Industry. Intense competition from a vast array of existing brands and new market entrants leads to significant pricing pressures and necessitates substantial marketing investments for differentiation. Complex and evolving regulatory landscapes concerning ingredient sourcing, nutritional claims, and product safety can pose compliance hurdles and increase operational costs. Supply chain vulnerabilities, including fluctuations in raw material availability and pricing for ingredients like nuts, fruits, and grains, can disrupt production and impact profitability. An estimated XX% of industry participants experienced raw material cost increases exceeding XX% in the past year. Competitive pressures also manifest in the need for constant product innovation to stay ahead of evolving consumer preferences.

Key Players Shaping the Snack Bar Industry Market

- Nestlé SA

- Post Holdings Inc

- Simply Good Foods Co

- General Mills Inc

- PepsiCo Inc

- Lotus Bakeries

- Abbott Laboratories

- Associated British Foods plc

- Ferrero International SA

- Halo Foods Ltd

- Mars Incorporated

- The Hershey Company

- Mondelēz International Inc

- Kellogg Company

Significant Snack Bar Industry Industry Milestones

- July 2023: Emirates Snack Foods (ESF) and Hershey formed a strategic partnership aimed at expanding Hershey's product portfolio and driving growth in the regional snacking market.

- May 2023: Nestlé's Milo launched a new protein snack bar, offering 6g of protein and a source of fiber, retailing at USD 8 for a 180g pack (six bars) and available in major Australian grocers.

- May 2023: Uncle Tobys introduced a new range of protein muesli bars, featuring 20% protein (7g per bar), available in multipacks of 5 for AUD 6.70. Flavors include Caramel and Dark Choc, Raspberry, Goji and White Choc, Lemon with a Yoghurty Drizzle, and Double Choc.

Future Outlook for Snack Bar Industry Market

The future outlook for the Snack Bar Industry remains exceptionally promising, driven by sustained consumer interest in health, wellness, and convenient nutrition. Strategic opportunities lie in the expansion of plant-based and allergen-free product lines, catering to growing ethical and dietary concerns. The increasing adoption of e-commerce platforms will further enhance market reach and offer direct-to-consumer engagement. Personalized nutrition solutions, leveraging data analytics and advanced formulation, represent a significant untapped market potential. Investments in sustainable sourcing and environmentally friendly packaging will also be crucial for brand differentiation and consumer loyalty in the coming years, ensuring continued market expansion and innovation. The market is anticipated to grow by XX% by 2033, driven by these key catalysts.

Snack Bar Industry Segmentation

-

1. Confectionery Variant

- 1.1. Cereal Bar

- 1.2. Fruit & Nut Bar

- 1.3. Protein Bar

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Snack Bar Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Snack Bar Industry Regional Market Share

Geographic Coverage of Snack Bar Industry

Snack Bar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Snack Bar Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Cereal Bar

- 5.1.2. Fruit & Nut Bar

- 5.1.3. Protein Bar

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. North America Snack Bar Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6.1.1. Cereal Bar

- 6.1.2. Fruit & Nut Bar

- 6.1.3. Protein Bar

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Store

- 6.2.2. Online Retail Store

- 6.2.3. Supermarket/Hypermarket

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7. South America Snack Bar Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7.1.1. Cereal Bar

- 7.1.2. Fruit & Nut Bar

- 7.1.3. Protein Bar

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Store

- 7.2.2. Online Retail Store

- 7.2.3. Supermarket/Hypermarket

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8. Europe Snack Bar Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8.1.1. Cereal Bar

- 8.1.2. Fruit & Nut Bar

- 8.1.3. Protein Bar

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Store

- 8.2.2. Online Retail Store

- 8.2.3. Supermarket/Hypermarket

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9. Middle East & Africa Snack Bar Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9.1.1. Cereal Bar

- 9.1.2. Fruit & Nut Bar

- 9.1.3. Protein Bar

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Store

- 9.2.2. Online Retail Store

- 9.2.3. Supermarket/Hypermarket

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10. Asia Pacific Snack Bar Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10.1.1. Cereal Bar

- 10.1.2. Fruit & Nut Bar

- 10.1.3. Protein Bar

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Store

- 10.2.2. Online Retail Store

- 10.2.3. Supermarket/Hypermarket

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestlé SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Post Holdings Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Simply Good Foods Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Mills Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PepsiCo Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lotus Bakeries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbott Laboratories

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Associated British Foods plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ferrero International SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Halo Foods Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mars Incorporated

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Hershey Compan

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mondelēz International Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kellogg Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Nestlé SA

List of Figures

- Figure 1: Global Snack Bar Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Snack Bar Industry Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 3: North America Snack Bar Industry Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 4: North America Snack Bar Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Snack Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Snack Bar Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Snack Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Snack Bar Industry Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 9: South America Snack Bar Industry Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 10: South America Snack Bar Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Snack Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Snack Bar Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Snack Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Snack Bar Industry Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 15: Europe Snack Bar Industry Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 16: Europe Snack Bar Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Snack Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Snack Bar Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Snack Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Snack Bar Industry Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 21: Middle East & Africa Snack Bar Industry Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 22: Middle East & Africa Snack Bar Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Snack Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Snack Bar Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Snack Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Snack Bar Industry Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 27: Asia Pacific Snack Bar Industry Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 28: Asia Pacific Snack Bar Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Snack Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Snack Bar Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Snack Bar Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Snack Bar Industry Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 2: Global Snack Bar Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Snack Bar Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Snack Bar Industry Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 5: Global Snack Bar Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Snack Bar Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Snack Bar Industry Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 11: Global Snack Bar Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Snack Bar Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Snack Bar Industry Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 17: Global Snack Bar Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Snack Bar Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Snack Bar Industry Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 29: Global Snack Bar Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Snack Bar Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Snack Bar Industry Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 38: Global Snack Bar Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Snack Bar Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Snack Bar Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Snack Bar Industry?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Snack Bar Industry?

Key companies in the market include Nestlé SA, Post Holdings Inc, Simply Good Foods Co, General Mills Inc, PepsiCo Inc, Lotus Bakeries, Abbott Laboratories, Associated British Foods plc, Ferrero International SA, Halo Foods Ltd, Mars Incorporated, The Hershey Compan, Mondelēz International Inc, Kellogg Company.

3. What are the main segments of the Snack Bar Industry?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.36 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

July 2023: Emirates Snack Foods (ESF) and Hershey have formed a partnership to expand Hershey's portfolio and develop products to expand the snacking market in the region.May 2023: Nestle’s Milo launched a protein snack bar offering 6 g of protein and a source of fiber. These protein snack bars retail at USD 8 for 180 g or six bars and are available in Coles and independent grocers across Australia.May 2023: Uncle Tobys unveiled a protein muesli bar in four new flavors. The muesli bar is made with 20% protein, i.e., 7 g of protein per bar, comes in multipacks of 5, and can be found in supermarkets for RRP AUD 6.70. The bars are available in flavors like Caramel and Dark Choc, Raspberry, Goji and White Choc, Lemon with a Yoghurty Drizzle, and Double Choc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Snack Bar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Snack Bar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Snack Bar Industry?

To stay informed about further developments, trends, and reports in the Snack Bar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence