Key Insights

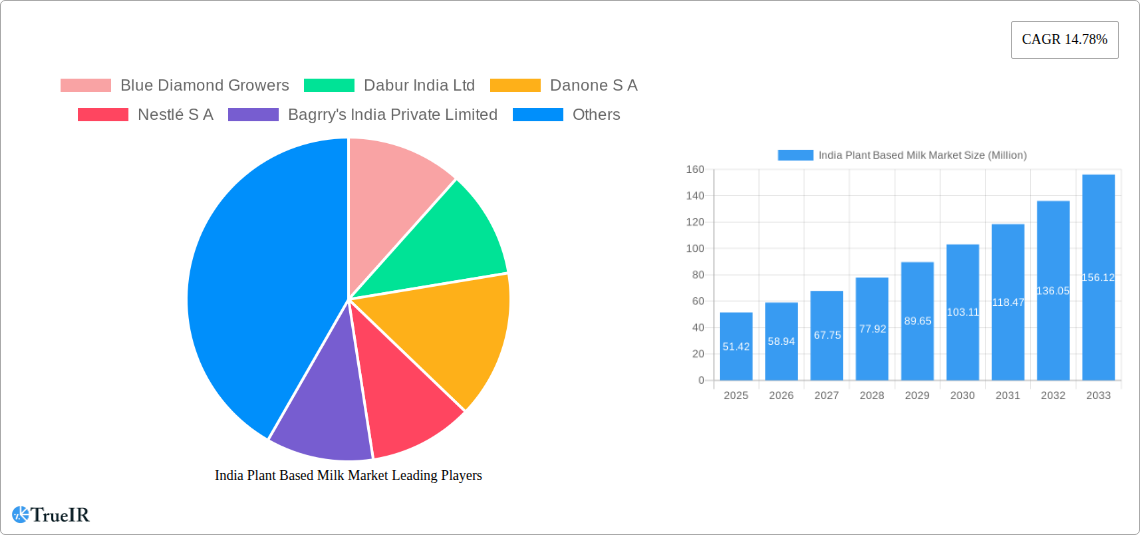

The Indian plant-based milk market is poised for substantial growth, projected to reach approximately USD 51.42 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 14.78% expected to continue through 2033. This robust expansion is fueled by a confluence of evolving consumer preferences, increasing health consciousness, and a growing awareness of environmental sustainability. Health-conscious consumers are actively seeking alternatives to dairy milk due to concerns about lactose intolerance, allergies, and the perceived health benefits of plant-derived beverages. Furthermore, the rising prominence of vegan and flexitarian diets, coupled with a growing understanding of the environmental footprint associated with traditional dairy farming, is significantly driving the adoption of plant-based milk alternatives.

India Plant Based Milk Market Market Size (In Million)

Key market drivers include the burgeoning demand for a diverse range of plant-based options, catering to varied taste profiles and dietary needs. The market is segmented across popular product types such as almond milk, oat milk, soy milk, coconut milk, cashew milk, and hazelnut milk, with oat and almond milk currently leading consumption. Distribution channels are also diversifying, with off-trade channels, particularly supermarkets/hypermarkets and online retail stores, witnessing significant traction. The increasing availability of these products through modern retail formats and e-commerce platforms is making plant-based milk more accessible to a wider consumer base across India. While growth is strong, potential restraints include price sensitivity among some consumer segments and the need for further consumer education to overcome lingering misconceptions about plant-based milk.

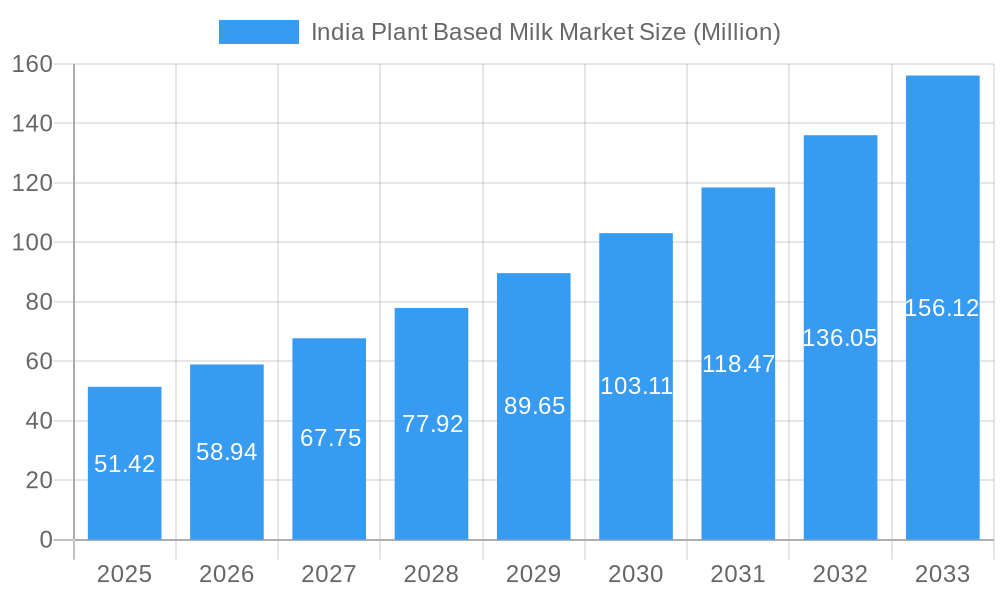

India Plant Based Milk Market Company Market Share

India Plant Based Milk Market: Growth, Trends, and Opportunities in the Dairy-Free Revolution (2019–2033)

Dive deep into the burgeoning India Plant Based Milk Market with this comprehensive report, meticulously designed to provide actionable insights for industry stakeholders. Covering the Study Period: 2019–2033, with a Base Year: 2025 and Forecast Period: 2025–2033, this analysis offers an in-depth look at market dynamics, key players, and future potential. Leverage high-volume keywords such as "plant-based milk India," "almond milk market," "oat milk demand," "dairy-free alternatives," and "vegan beverages India" to enhance your understanding and strategic planning. This report is your definitive guide to navigating the rapidly expanding Indian dairy-free market.

India Plant Based Milk Market Market Structure & Competitive Landscape

The India Plant Based Milk Market is characterized by a dynamic and evolving competitive landscape, marked by increasing market concentration alongside fierce competition from both established food giants and agile startups. Innovation remains a key differentiator, with companies heavily investing in R&D to develop novel plant-based milk formulations, enhance taste profiles, and improve nutritional content. Regulatory impacts, while currently less stringent than in some Western markets, are anticipated to grow as consumer awareness and demand for clearer labeling and health standards rise. Product substitutes, primarily traditional dairy milk, continue to exert influence, but the rising tide of health consciousness and environmental concerns is steadily eroding dairy's dominance. End-user segmentation reveals a diverse consumer base, ranging from the health-conscious urban demographic to the growing vegan population and individuals with lactose intolerance. Mergers and acquisitions (M&A) trends are expected to intensify as larger players seek to consolidate market share and acquire innovative technologies or brands. Quantitative insights indicate a market concentration ratio of approximately XX% among the top five players, with an estimated XX M&A deals recorded in the historical period. Qualitative analysis highlights a strong emphasis on flavor, texture, and fortified nutritional benefits as crucial competitive advantages in this burgeoning market.

India Plant Based Milk Market Market Trends & Opportunities

The India Plant Based Milk Market is experiencing an unprecedented surge, driven by a confluence of evolving consumer preferences, technological advancements, and supportive industry developments. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period, indicating robust expansion and significant opportunities for market penetration. A key trend is the escalating consumer demand for healthier, lactose-free alternatives, fueled by increasing awareness of the health benefits associated with plant-based diets and the growing prevalence of lactose intolerance. Technological shifts are evident in the development of advanced processing techniques that enhance the taste, texture, and nutritional profile of plant-based milks, making them more palatable and competitive with traditional dairy. Consumer preferences are increasingly leaning towards products that offer added health benefits, such as low cholesterol, high fiber, and fortified vitamins and minerals. Competitive dynamics are intensifying, with both domestic and international players vying for market share. This presents a lucrative opportunity for new entrants and existing companies to innovate and capture a larger segment of this rapidly growing market. The market penetration rate for plant-based milk is estimated to reach XX% by the end of the forecast period. Opportunities abound in product diversification, targeting specific dietary needs, and expanding distribution channels to reach a wider consumer base across Tier 1, Tier 2, and Tier 3 cities. Furthermore, the growing e-commerce penetration in India provides a significant avenue for direct-to-consumer sales and wider market reach. The rising disposable incomes and a growing middle class are also contributing factors to the increased affordability and adoption of premium dairy-free products. Sustainability concerns are also playing a pivotal role, with consumers actively seeking out environmentally friendly product choices, which further bolsters the appeal of plant-based alternatives.

Dominant Markets & Segments in India Plant Based Milk Market

The India Plant Based Milk Market is witnessing significant growth across various segments, with Almond Milk currently holding a dominant position due to its established popularity and widespread availability. However, Oat Milk is rapidly gaining traction, driven by its perceived health benefits, versatility in culinary applications, and growing appeal among health-conscious consumers. The Distribution Channel landscape is also evolving, with Off-Trade channels, particularly Supermarkets/Hypermarkets and Online Retail Stores, emerging as the leading avenues for sales. The convenience and accessibility offered by these channels cater to the evolving shopping habits of Indian consumers.

Key Growth Drivers for Dominant Segments:

- Almond Milk:

- Established consumer awareness and preference.

- Wide range of product offerings and price points.

- Perceived health benefits, including low calories and healthy fats.

- Oat Milk:

- Growing trend of veganism and lactose intolerance.

- Versatility in beverages (coffee, smoothies) and cooking.

- Increasing availability of premium and flavored variants.

- Positive perception regarding environmental sustainability compared to other alternatives.

- Supermarkets/Hypermarkets:

- One-stop shopping experience for consumers.

- Prime shelf space and promotional opportunities.

- Increasing adoption of private label plant-based milk brands by retailers.

- Effective reach to a broad consumer base in urban and semi-urban areas.

- Online Retail Stores:

- Growing e-commerce penetration and digital adoption in India.

- Convenience of home delivery and wider product selection.

- Subscription models offering recurring purchase convenience.

- Targeted marketing and personalized offers to online shoppers.

While Almond Milk and Oat Milk are leading in product type, Coconut Milk is also carving out a niche, particularly for its culinary applications and potential health benefits. Soy Milk, a traditional player, continues to hold its ground, albeit facing increasing competition from newer alternatives. The On-Trade segment, encompassing cafes and restaurants, is also a growing contributor, with the inclusion of plant-based milk options in menus becoming increasingly common. The expansion of modern retail infrastructure and the increasing digital connectivity across India are pivotal in driving the dominance of these segments and channels. Government initiatives promoting healthier lifestyles and the growing influence of social media in shaping dietary trends further contribute to the robust growth trajectory of these dominant markets and segments within the India Plant Based Milk Market.

India Plant Based Milk Market Product Analysis

Product innovations in the India Plant Based Milk Market are primarily focused on enhancing taste, texture, and nutritional value to rival traditional dairy. Companies are actively developing Almond Milk, Oat Milk, and Coconut Milk with fortified vitamins and minerals like Vitamin D and B12, catering to health-conscious consumers and those seeking lactose-free options. Competitive advantages are being forged through the introduction of unsweetened variants, reduced sugar content, and the use of premium ingredients. The application scope is broadening beyond beverages to include culinary uses in baking, cooking, and as a dairy substitute in various recipes. Technological advancements in processing are enabling the creation of smoother, creamier textures that closely mimic dairy milk, thereby increasing market appeal and facilitating wider adoption across diverse consumer segments looking for healthier and sustainable alternatives.

Key Drivers, Barriers & Challenges in India Plant Based Milk Market

Key Drivers: The India Plant Based Milk Market is propelled by a strong surge in health consciousness, with consumers actively seeking healthier, lactose-free, and cholesterol-free alternatives. The burgeoning vegan and vegetarian population in India, coupled with increasing awareness of the environmental sustainability of plant-based diets, acts as a significant growth catalyst. Technological advancements in product formulation, leading to improved taste and texture, are making plant-based milks more appealing. Furthermore, supportive government policies promoting healthier food consumption and growing disposable incomes contribute to market expansion.

Barriers & Challenges: Despite the optimistic outlook, the India Plant Based Milk Market faces several challenges. The primary restraint is the strong cultural preference and established dominance of traditional dairy milk, which often remains a more affordable option. Supply chain complexities, including sourcing of raw materials and ensuring consistent quality, can pose hurdles. Regulatory complexities related to labeling and fortification standards, while evolving, can create compliance challenges for manufacturers. Intense competitive pressure from both established dairy brands venturing into plant-based and a growing number of startups requires continuous innovation and effective marketing strategies. The estimated price premium of XX% for plant-based milk over dairy can also be a barrier for price-sensitive consumers.

Growth Drivers in the India Plant Based Milk Market Market

The India Plant Based Milk Market is experiencing robust growth driven by a trifecta of technological, economic, and regulatory factors. Technological innovations are enabling the creation of plant-based milks with superior taste, texture, and nutritional profiles, effectively mimicking dairy. Economic drivers include the rising disposable incomes and a growing middle class that can afford premium dairy-free options. Furthermore, increasing awareness of the health benefits associated with plant-based diets, such as lower cholesterol and reduced risk of certain diseases, is a significant catalyst. Supportive government policies promoting healthier food choices and the growing trend of veganism and lactose intolerance further fuel this expansion.

Challenges Impacting India Plant Based Milk Market Growth

The India Plant Based Milk Market faces considerable challenges that can temper its growth trajectory. A primary restraint is the deeply entrenched cultural preference and affordability of traditional dairy milk, making it difficult for plant-based alternatives to gain widespread adoption, especially among price-sensitive segments. Regulatory complexities regarding food standards, labeling, and fortification can pose compliance hurdles for manufacturers. Supply chain issues, including the sourcing of raw materials like almonds and oats, and ensuring their consistent availability and quality, present ongoing challenges. Furthermore, the intense competitive pressure from both established dairy players and a rapidly growing number of plant-based brands necessitates continuous innovation and aggressive marketing strategies to capture market share.

Key Players Shaping the India Plant Based Milk Market Market

- Blue Diamond Growers

- Dabur India Ltd

- Danone S A

- Nestlé S A

- Bagrry's India Private Limited

- Wingreens Farms Private Limited

- Sanitarium Health & Wellbeing Company (Life Health Foods)

- The Hershey Company

- The Alternative Company

- Drums Food International Private Limited

Significant India Plant Based Milk Market Industry Milestones

- September 2024: Maiva Fresh introduced its flagship product - the Maiva Unsweetened Almond Milk. The newly branded health beverage line, "Maiva Fresh," was promoted with the slogans "Pure Good" (focusing on health) and "Pure Joy" (emphasizing taste), highlighting its dual appeal of health and flavor. With zero cholesterol, a low glycemic index (GI), and fortification with Vitamin B12 and Vitamin D, Maiva Fresh Almond is positioned as an ideal daily choice, signaling a focus on health and taste innovation.

- September 2024: Oxbow Brands unveiled its latest venture, the Vegan Drink Company (VDC). VDC emerges in response to the surging demand for dairy-free products, particularly among the expanding lactose-intolerant and vegan demographics. Understanding the unique nutritional requirements of its audience, VDC crafts its beverages with a rich mix of vital vitamins, such as A, D, B1, B2, and B12, guaranteeing a tasty and wholesome dairy-free choice, indicating strategic expansion into the vegan beverage sector with a focus on nutritional value.

- August 2024: 1.5 Degree Inc. launched a product line that includes oat milk and soy milk, catering to both vegan and non-vegan consumers in search of healthier, lactose-free alternatives. The entire product line underscores health benefits, boasting gluten-free, eco-friendly, cholesterol-free, and 100% vegan options, highlighting the growing trend of diversified plant-based offerings and appeal to a broader health-conscious audience.

Future Outlook for India Plant Based Milk Market Market

The future outlook for the India Plant Based Milk Market is exceptionally promising, driven by sustained consumer demand for healthier and more sustainable dietary choices. Growth catalysts include the increasing adoption of vegan and flexitarian lifestyles, coupled with heightened awareness of the health benefits associated with plant-based alternatives like Almond Milk, Oat Milk, and Coconut Milk. Strategic opportunities lie in further product innovation, focusing on taste enhancement, novel ingredient combinations, and fortified nutritional profiles to appeal to a wider demographic. Expansion into Tier 2 and Tier 3 cities, coupled with robust online retail strategies, will be crucial for market penetration. The market is poised for continued growth, with an anticipated expansion in the range of dairy-free products and an increasing market share for plant-based alternatives as consumer preferences solidify.

India Plant Based Milk Market Segmentation

-

1. Product Type

- 1.1. Almond Milk

- 1.2. Cashew Milk

- 1.3. Coconut Milk

- 1.4. Hazelnut Milk

- 1.5. Oat Milk

- 1.6. Soy Milk

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Supermarkets/Hypermarkets

- 2.1.2. Convenience Stores

- 2.1.3. Specialist Retailers

- 2.1.4. Online Retail Stores

- 2.1.5. Other Off-Trade Channels

- 2.2. On-Trade

-

2.1. Off-Trade

India Plant Based Milk Market Segmentation By Geography

- 1. India

India Plant Based Milk Market Regional Market Share

Geographic Coverage of India Plant Based Milk Market

India Plant Based Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Proclivity Toward Vegan/Non-Dairy Milk; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Growing Proclivity Toward Vegan/Non-Dairy Milk; Favorable Government Initiatives

- 3.4. Market Trends

- 3.4.1. Soy Milk Is Liked By Majority

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Plant Based Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Almond Milk

- 5.1.2. Cashew Milk

- 5.1.3. Coconut Milk

- 5.1.4. Hazelnut Milk

- 5.1.5. Oat Milk

- 5.1.6. Soy Milk

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Supermarkets/Hypermarkets

- 5.2.1.2. Convenience Stores

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Online Retail Stores

- 5.2.1.5. Other Off-Trade Channels

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Blue Diamond Growers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dabur India Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Danone S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nestlé S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bagrry's India Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wingreens Farms Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanitarium Health & Wellbeing Company (Life Health Foods)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Hershey Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Alternative Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Drums Food International Private Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Blue Diamond Growers

List of Figures

- Figure 1: India Plant Based Milk Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Plant Based Milk Market Share (%) by Company 2025

List of Tables

- Table 1: India Plant Based Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Plant Based Milk Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: India Plant Based Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: India Plant Based Milk Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: India Plant Based Milk Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Plant Based Milk Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: India Plant Based Milk Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Plant Based Milk Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: India Plant Based Milk Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: India Plant Based Milk Market Volume Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: India Plant Based Milk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Plant Based Milk Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Plant Based Milk Market?

The projected CAGR is approximately 14.78%.

2. Which companies are prominent players in the India Plant Based Milk Market?

Key companies in the market include Blue Diamond Growers, Dabur India Ltd, Danone S A, Nestlé S A, Bagrry's India Private Limited, Wingreens Farms Private Limited, Sanitarium Health & Wellbeing Company (Life Health Foods), The Hershey Company, The Alternative Company, Drums Food International Private Limited*List Not Exhaustive.

3. What are the main segments of the India Plant Based Milk Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Proclivity Toward Vegan/Non-Dairy Milk; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Soy Milk Is Liked By Majority.

7. Are there any restraints impacting market growth?

Growing Proclivity Toward Vegan/Non-Dairy Milk; Favorable Government Initiatives.

8. Can you provide examples of recent developments in the market?

September 2024: Maiva Fresh introduced its flagship product - the Maiva Unsweetened Almond Milk. The newly branded health beverage line, "Maiva Fresh," was promoted with the slogans "Pure Good" (focusing on health) and "Pure Joy" (emphasizing taste), highlighting its dual appeal of health and flavor. With zero cholesterol, a low glycemic index (GI), and fortification with Vitamin B12 and Vitamin D, Maiva Fresh Almond is positioned as an ideal daily choice.September 2024: Oxbow Brands unveiled its latest venture, the Vegan Drink Company (VDC). VDC emerges in response to the surging demand for dairy-free products, particularly among the expanding lactose-intolerant and vegan demographics. Understanding the unique nutritional requirements of its audience, VDC crafts its beverages with a rich mix of vital vitamins, such as A, D, B1, B2, and B12, guaranteeing a tasty and wholesome dairy-free choice.August 2024: 1.5 Degree Inc. launched a product line that includes oat milk and soy milk, catering to both vegan and non-vegan consumers in search of healthier, lactose-free alternatives. The entire product line underscores health benefits, boasting gluten-free, eco-friendly, cholesterol-free, and 100% vegan options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Plant Based Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Plant Based Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Plant Based Milk Market?

To stay informed about further developments, trends, and reports in the India Plant Based Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence