Key Insights

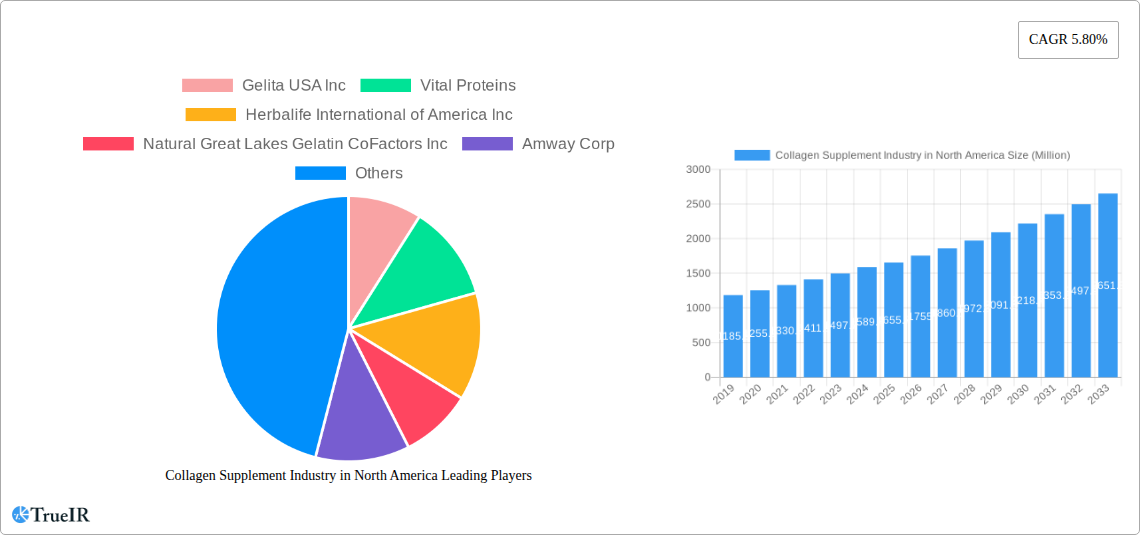

The North American collagen supplement market is poised for robust expansion, projected to reach an impressive $1,655.7 million in value. This growth is driven by a surging consumer awareness of collagen's multifaceted health benefits, spanning skin elasticity, joint health, and gut well-being. An estimated Compound Annual Growth Rate (CAGR) of 5.80% over the forecast period of 2025-2033 underscores the sustained demand for these products. Key market drivers include the increasing adoption of preventative healthcare approaches, a growing preference for natural and bioactive ingredients, and the continuous innovation in product formulations, such as ingestible beauty solutions and enhanced bioavailability. The rising disposable incomes across North America further empower consumers to invest in premium health and wellness products, solidifying collagen supplements as a staple in many routines.

Collagen Supplement Industry in North America Market Size (In Billion)

The market landscape is characterized by diverse collagen sources, with Animal-Based Collagen dominating due to its widespread availability and established efficacy in formulations. However, Marine-Based Collagen is steadily gaining traction, appealing to a segment of consumers seeking specific benefits or adhering to dietary preferences. Distribution channels are also diversifying; while Hypermarkets/Supermarkets and Pharmacies remain significant pillars, Internet Retailing is experiencing exponential growth, offering unparalleled convenience and accessibility to a broader consumer base. Leading companies such as Vital Proteins and Gelita USA Inc. are actively expanding their product portfolios and marketing efforts, capitalizing on these favorable market dynamics. The competitive environment is dynamic, with established players and emerging brands vying for market share through product differentiation and strategic partnerships.

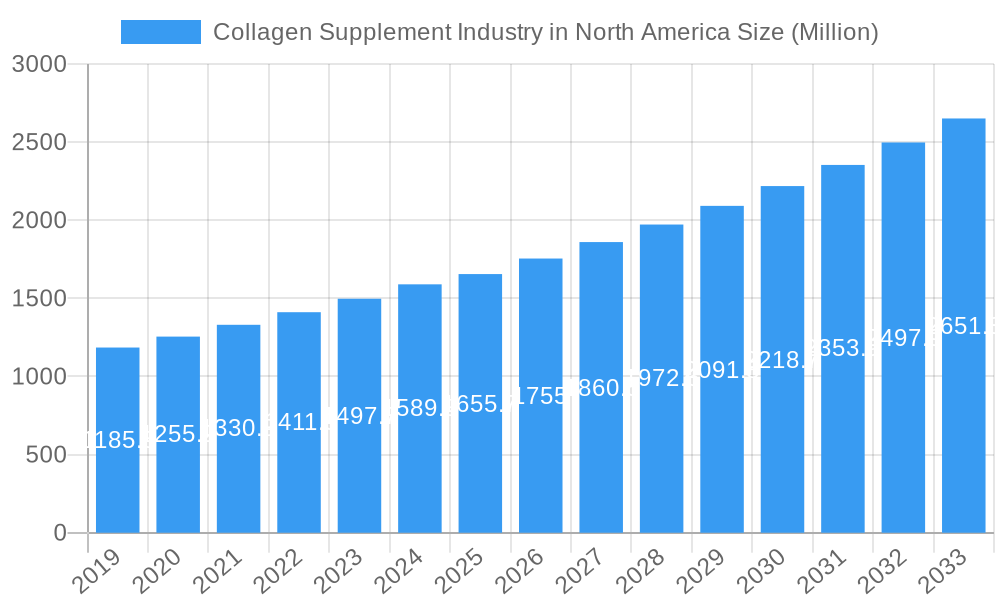

Collagen Supplement Industry in North America Company Market Share

Collagen Supplement Industry in North America Market Structure & Competitive Landscape

The North American collagen supplement market exhibits a dynamic and evolving structure, characterized by moderate to high market concentration. Key players like Vital Proteins, Gelita USA Inc., and Herbalife International of America Inc. hold significant market share, driven by strong brand recognition and extensive distribution networks. Innovation remains a crucial differentiator, with companies investing heavily in research and development to introduce novel product formulations, including enhanced bioavailability and specialized collagen types targeting specific health benefits like skin, joint, and gut health. Regulatory impacts are a constant consideration, with evolving guidelines from bodies like the FDA influencing product claims and manufacturing standards. Product substitutes, such as other protein supplements or alternative joint health formulations, pose a competitive threat, necessitating continuous product differentiation. End-user segmentation reveals a growing demand from health-conscious consumers, athletes, and individuals focused on anti-aging and wellness. Mergers and acquisitions (M&A) trends are notable, with larger entities acquiring smaller, innovative brands to expand their product portfolios and market reach. For instance, the acquisition of Vital Proteins by Nestle Health Science underscores this consolidation. The estimated concentration ratio for the top 5 players is approximately 65%, indicating a moderately consolidated market. M&A activity has seen a steady increase, with an estimated 10-15 significant transactions annually in the historical period, reflecting strategic moves to capture market share and synergistic growth.

Collagen Supplement Industry in North America Market Trends & Opportunities

The North American collagen supplement market is experiencing robust growth, driven by a confluence of increasing consumer awareness regarding health and wellness, a rising aging population, and growing demand for natural and functional ingredients. The market size for collagen supplements in North America was valued at approximately $2,500 Million in the base year of 2025, with projections indicating a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025–2033. This impressive growth trajectory is fueled by a paradigm shift in consumer preferences towards proactive health management and the prevention of age-related concerns. Technological advancements are playing a pivotal role, leading to the development of more effective and bioavailable collagen peptides through improved extraction and hydrolysis processes. This has resulted in a wider array of product formats, including powders, capsules, gummies, and even beverages, catering to diverse consumer needs and lifestyle preferences.

Consumer preferences are increasingly leaning towards ethically sourced and clean-label products. This trend is particularly evident with the growing interest in marine-based collagen, perceived as a sustainable and hypoallergenic alternative to animal-derived sources. The focus on holistic wellness is expanding the application of collagen supplements beyond traditional beauty and joint health to encompass gut health, muscle recovery, and overall vitality. This broadens the addressable market and creates new avenues for product innovation and marketing.

Competitive dynamics are intensifying, with both established giants and agile startups vying for market dominance. The entry of new players, often backed by significant investment, further fuels innovation and price competition. Key companies are strategizing to capture a larger market share through product diversification, strategic partnerships, and aggressive marketing campaigns highlighting the scientifically backed benefits of collagen. The market penetration rate for collagen supplements is estimated to be around 20% of the total health and wellness supplement market in North America, with significant room for expansion.

Digitalization and e-commerce have revolutionized distribution channels, with online retailers and direct-to-consumer (DTC) platforms becoming increasingly significant. This trend allows for greater accessibility and personalized marketing efforts, reaching a broader consumer base. Furthermore, the growing popularity of fitness and the desire for enhanced athletic performance are contributing to the demand for collagen supplements among athletes and fitness enthusiasts, further driving market growth. The overall outlook for the North American collagen supplement market remains exceptionally positive, characterized by sustained demand, continuous innovation, and expanding market opportunities.

Dominant Markets & Segments in Collagen Supplement Industry in North America

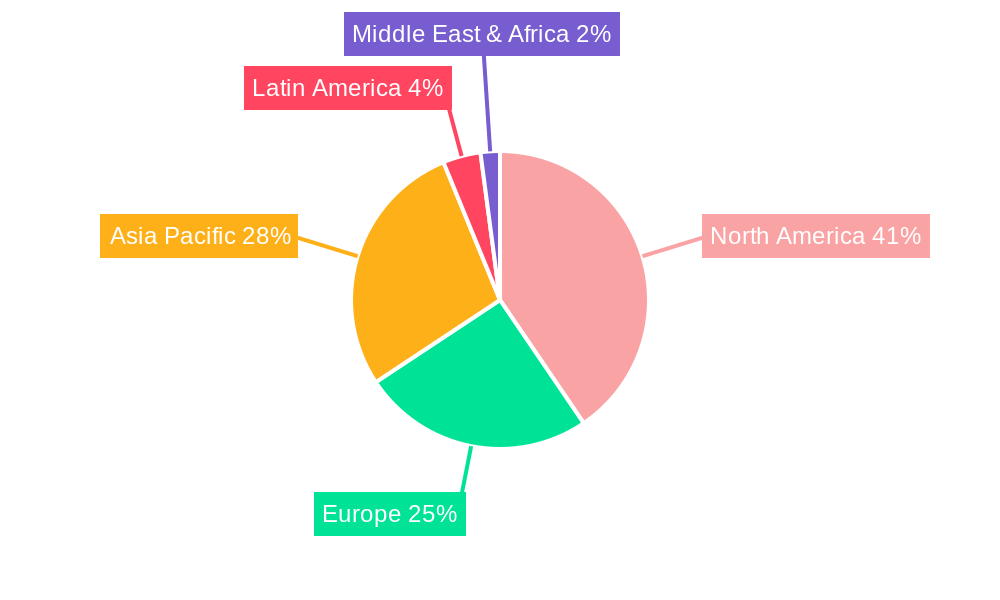

The North American collagen supplement market's dominance is clearly established in the United States, which accounts for approximately 70% of the total regional market share. This is attributed to a combination of factors including a large, health-conscious consumer base, higher disposable incomes, and a well-established dietary supplement industry with robust research and development capabilities. Canada represents the second-largest market within North America, contributing around 20% to the regional revenue, followed by Mexico with approximately 10%. The rest of North America, encompassing smaller markets and emerging economies, currently holds a marginal share but presents significant future growth potential.

Within the Sources segment, Animal-Based Collagen remains the dominant force, commanding an estimated 75% market share in 2025. This is largely due to the widespread availability and lower cost of sourcing from bovine and porcine origins. However, Marine-Based Collagen is experiencing a substantial growth spurt, projected to expand at a CAGR of 15% during the forecast period, driven by increasing consumer preference for perceived purity, sustainability, and suitability for individuals with dietary restrictions or allergies.

Analyzing Distribution Channels, Internet Retailing is emerging as the fastest-growing segment, projected to achieve a CAGR of 18% through 2033. The convenience of online shopping, coupled with the availability of a wider product selection and competitive pricing, makes it a preferred channel for many consumers. Hypermarkets/Supermarkets still hold a significant share, estimated at 35% of the market, due to their widespread accessibility and impulse purchase potential. Pharmacies contribute around 20%, catering to consumers seeking trusted health advice and products. "Other Distribution Channels," including specialty health stores and direct sales, make up the remaining 15%.

Key growth drivers in the dominant markets and segments include:

United States:

- High disposable income and spending on health and wellness products.

- Strong consumer awareness of the anti-aging and joint health benefits of collagen.

- Extensive retail infrastructure and a mature e-commerce ecosystem.

- Supportive regulatory environment for dietary supplements.

Marine-Based Collagen Segment:

- Growing consumer demand for sustainable and eco-friendly products.

- Increasing awareness of marine collagen's benefits for skin elasticity and joint health.

- Perception of higher purity and fewer allergen concerns compared to animal sources.

- Innovation in product formats and bioavailability.

Internet Retailing Distribution Channel:

- Unprecedented convenience and accessibility for consumers.

- Broader product selection and competitive pricing.

- Personalized marketing and direct-to-consumer (DTC) models.

- Growth of subscription services for recurring purchases.

The interplay of these factors – a concentrated geographical focus, a preference for established but evolving sources, and a rapidly digitizing distribution landscape – defines the current and future trajectory of the North American collagen supplement market.

Collagen Supplement Industry in North America Product Analysis

Product innovation in the North American collagen supplement industry is primarily focused on enhancing bioavailability, diversifying collagen types, and creating convenient delivery formats. Companies are leveraging advanced hydrolysis techniques to produce smaller, more easily absorbed peptides, maximizing their efficacy. The competitive advantage lies in offering specialized collagen formulations, such as types I, II, and III, tailored for specific benefits like skin hydration, joint support, and gut health. Product innovations also encompass the inclusion of synergistic ingredients like Vitamin C, hyaluronic acid, and biotin to amplify collagen's effects. The market fit is further strengthened by the introduction of ingestible beauty products, functional beverages, and easy-to-consume gummies, appealing to a broader consumer base seeking convenient wellness solutions.

Key Drivers, Barriers & Challenges in Collagen Supplement Industry in North America

Key Drivers: The North American collagen supplement market is propelled by several key drivers. Growing consumer awareness of the health benefits associated with collagen, particularly for skin health, joint mobility, and anti-aging, is a primary catalyst. The increasing prevalence of lifestyle-related health concerns and a proactive approach to wellness further fuels demand. Technological advancements in extraction and processing methods have led to improved product quality and bioavailability, enhancing consumer confidence. Furthermore, the growing popularity of fitness and sports nutrition, where collagen is recognized for muscle recovery and joint support, contributes significantly to market expansion.

Key Barriers & Challenges: Despite strong growth, the industry faces notable barriers and challenges. Regulatory complexities surrounding health claims and product labeling can impact marketing strategies and require significant compliance efforts, estimated to add 5-10% to operational costs. Supply chain issues, including fluctuating raw material availability and price volatility for animal and marine sources, can disrupt production and impact profitability. For example, disruptions in fish harvests can lead to a 15-20% increase in marine collagen costs. Intense competition from both established brands and new entrants can lead to price wars, squeezing profit margins, with an estimated 10% pressure on pricing due to competition. Consumer skepticism regarding the efficacy of supplements and the need for clear scientific evidence also present a challenge, requiring substantial investment in research and education.

Growth Drivers in the Collagen Supplement Industry in North America Market

Several key growth drivers are shaping the North American collagen supplement market. Firstly, the escalating demand for natural and clean-label products, aligning with consumer trends towards holistic wellness and ingredient transparency, is a significant factor. Secondly, technological advancements in peptide synthesis and bioavailability enhancement are leading to more effective and targeted collagen formulations, attracting a wider consumer base. Thirdly, the burgeoning aging population in North America is a major demographic driver, as older individuals increasingly seek solutions for joint health and age-related skin concerns. Lastly, supportive government initiatives and increasing investment in research and development for nutraceuticals are fostering innovation and market expansion.

Challenges Impacting Collagen Supplement Industry in North America Growth

The growth of the North American collagen supplement industry is impacted by several challenges. Regulatory scrutiny regarding unsubstantiated health claims can create hurdles for marketing and product development, potentially leading to compliance costs and product recalls. Supply chain vulnerabilities, including the availability and cost fluctuations of raw materials like animal hides and marine byproducts, pose a significant restraint, impacting production stability and pricing. For instance, a poor fishing season could lead to a 20% spike in marine collagen ingredient costs. Intense competition from numerous established and emerging brands can lead to market saturation and price erosion, impacting profitability margins. Furthermore, consumer skepticism regarding supplement efficacy and the need for robust scientific backing continue to present a challenge, necessitating ongoing educational efforts and clinical research.

Key Players Shaping the Collagen Supplement Industry in North America Market

- Gelita USA Inc.

- Vital Proteins

- Herbalife International of America Inc.

- Natural Great Lakes Gelatin CoFactors Inc.

- Amway Corp.

- Nutrawise Health & Beauty Corporation

- Natures Bounty

Significant Collagen Supplement Industry in North America Industry Milestones

- 2019: Increased consumer adoption of collagen for general wellness and anti-aging benefits.

- 2020: Rise of at-home beauty and wellness routines driving demand for ingestible beauty supplements.

- 2021: Significant investment in research on collagen's impact on gut health and athletic performance.

- 2022: Expansion of e-commerce channels and direct-to-consumer (DTC) sales models for collagen products.

- 2023: Growing emphasis on sustainable sourcing and the development of marine-based collagen alternatives.

- 2024: Introduction of advanced peptide formulations with enhanced bioavailability and specific health benefits.

Future Outlook for Collagen Supplement Industry in North America Market

The future outlook for the North American collagen supplement market is exceptionally bright, projecting sustained growth driven by an ever-increasing consumer focus on preventative health and holistic wellness. Strategic opportunities lie in further segmenting the market by targeting specific demographics and health concerns, such as post-menopausal women or individuals with autoimmune conditions. Continued investment in cutting-edge research to substantiate efficacy and explore novel applications, such as wound healing and bone health, will be crucial for market expansion. The integration of advanced delivery systems and personalized nutrition approaches will also play a pivotal role in capturing market share. The market potential remains significant, with an anticipated increase in market penetration and value over the forecast period, fueled by ongoing innovation and evolving consumer lifestyles.

Collagen Supplement Industry in North America Segmentation

-

1. Sources

- 1.1. Animal-Based Collagen

- 1.2. Marine-Based Collagen

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Pharmacies

- 2.3. Internet Retailing

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

Collagen Supplement Industry in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

Collagen Supplement Industry in North America Regional Market Share

Geographic Coverage of Collagen Supplement Industry in North America

Collagen Supplement Industry in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. United States is the dominating the Overall Sales in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Collagen Supplement Industry in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sources

- 5.1.1. Animal-Based Collagen

- 5.1.2. Marine-Based Collagen

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Pharmacies

- 5.2.3. Internet Retailing

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sources

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gelita USA Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vital Proteins

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Herbalife International of America Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Natural Great Lakes Gelatin CoFactors Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amway Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutrawise Health & Beauty Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Natures Bounty*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Gelita USA Inc

List of Figures

- Figure 1: Collagen Supplement Industry in North America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Collagen Supplement Industry in North America Share (%) by Company 2025

List of Tables

- Table 1: Collagen Supplement Industry in North America Revenue Million Forecast, by Sources 2020 & 2033

- Table 2: Collagen Supplement Industry in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Collagen Supplement Industry in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Collagen Supplement Industry in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Collagen Supplement Industry in North America Revenue Million Forecast, by Sources 2020 & 2033

- Table 6: Collagen Supplement Industry in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Collagen Supplement Industry in North America Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Collagen Supplement Industry in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Collagen Supplement Industry in North America?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Collagen Supplement Industry in North America?

Key companies in the market include Gelita USA Inc, Vital Proteins, Herbalife International of America Inc, Natural Great Lakes Gelatin CoFactors Inc, Amway Corp, Nutrawise Health & Beauty Corporation, Natures Bounty*List Not Exhaustive.

3. What are the main segments of the Collagen Supplement Industry in North America?

The market segments include Sources, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1,655.7 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

United States is the dominating the Overall Sales in the region.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Collagen Supplement Industry in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Collagen Supplement Industry in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Collagen Supplement Industry in North America?

To stay informed about further developments, trends, and reports in the Collagen Supplement Industry in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence