Key Insights

The South American baby food market is poised for significant expansion, projected to reach a substantial market size. Driven by evolving consumer preferences, increasing awareness of infant nutrition, and a rising disposable income among young families, the market is experiencing robust growth. Key factors fueling this expansion include a growing demand for organic and natural baby food products, reflecting a global trend towards healthier and more sustainable options for infants. Furthermore, the increasing prevalence of working mothers in the region is boosting the demand for convenient and ready-to-eat baby food options. Innovations in product formulations, such as the introduction of specialized formulas catering to specific dietary needs and allergies, are also contributing to market dynamism. The distribution landscape is also evolving, with a notable shift towards online channels and hypermarkets/supermarkets offering a wider variety of products and competitive pricing.

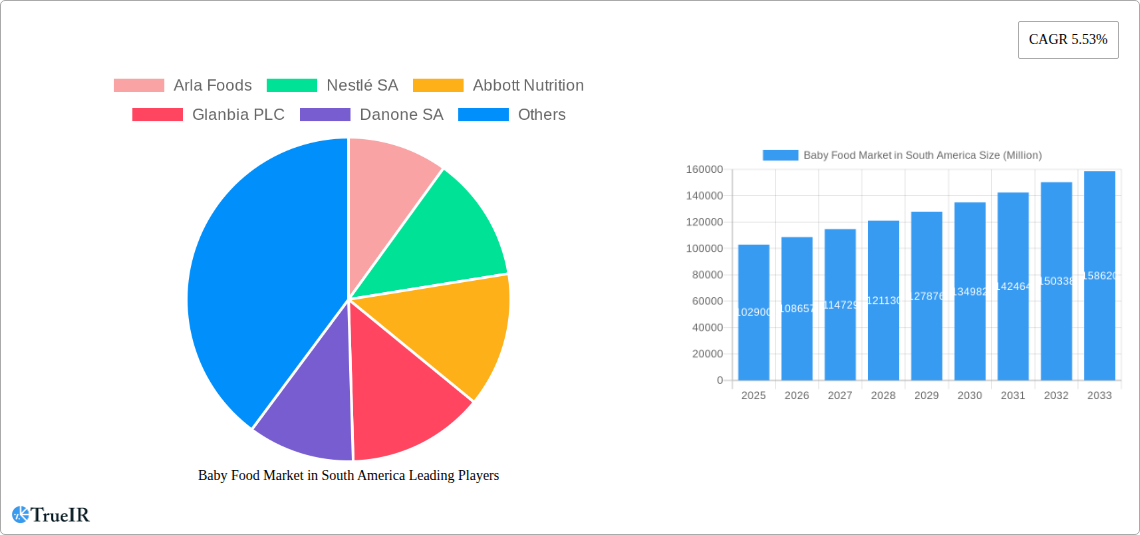

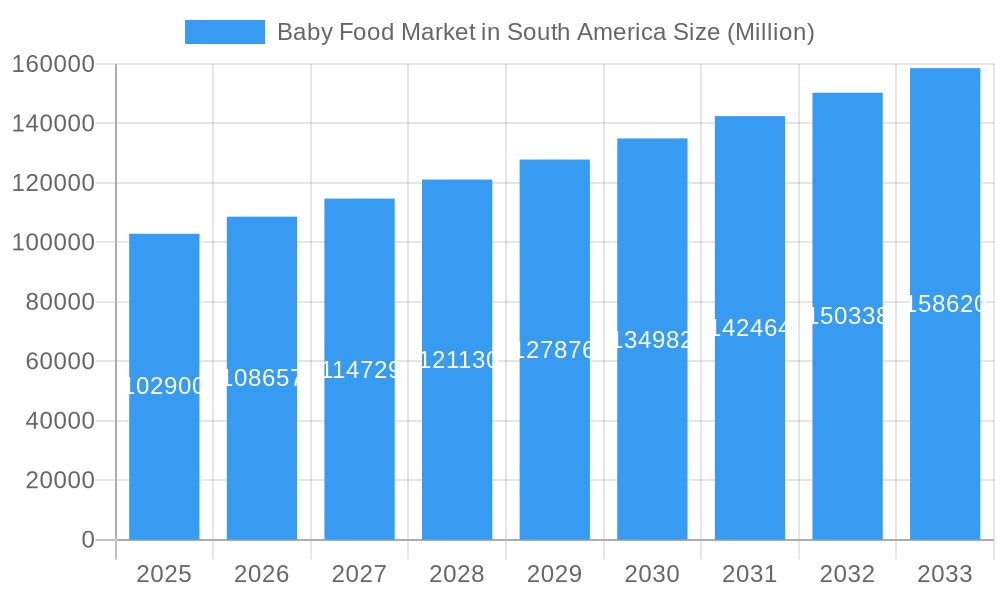

Baby Food Market in South America Market Size (In Billion)

The market's projected Compound Annual Growth Rate (CAGR) of 5.53% underscores its strong upward trajectory. Brazil and Argentina are anticipated to be the leading markets within South America, owing to their larger populations and more developed economies. However, the "Rest of South America" segment also presents considerable growth opportunities, particularly in emerging economies where infant nutrition awareness is on the rise. While the market is primarily driven by the demand for milk formula, dried baby food, and prepared baby food, there's a growing niche for specialized products. Restraints may include price sensitivity in certain segments of the population and the potential for regulatory hurdles in product approvals. Nevertheless, the overall outlook for the South American baby food market remains highly optimistic, presenting lucrative prospects for both established players and new entrants focusing on product innovation and accessible distribution strategies.

Baby Food Market in South America Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the South America Baby Food Market. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this research delves into market structure, trends, opportunities, dominant segments, product innovations, key drivers, challenges, and the competitive landscape. Leverage high-volume keywords like "baby formula South America," "organic baby food Brazil," "baby cereal market Argentina," and "infant nutrition South America" to enhance search rankings and engage industry professionals. This report is designed for immediate use without modification.

Baby Food Market in South America Market Structure & Competitive Landscape

The South America Baby Food Market exhibits a moderately concentrated structure, with key players like Nestlé SA, Abbott Nutrition, and Danone SA holding significant market shares, estimated to be over 60% collectively in 2025. Innovation remains a critical differentiator, driven by increasing consumer demand for organic, allergen-free, and functional baby foods. Regulatory frameworks, though evolving, impact product formulations and labeling, with strict adherence to safety and nutritional standards being paramount. Product substitutes, primarily homemade baby food, pose a challenge but are increasingly being outweighed by the convenience and assured nutritional value of commercially prepared options. The end-user segmentation highlights a growing preference for premium and specialized formulas. Mergers and acquisitions (M&A) are active, with an estimated XX M&A transactions in the historical period (2019-2024) as companies seek to expand their product portfolios and geographic reach. For instance, the acquisition of Plum Organics by Sun-Maid Growers of California in March 2021 exemplifies this trend, aiming to strengthen the organic baby food segment.

- Market Concentration: Moderately concentrated, with top players holding substantial market share.

- Innovation Drivers: Demand for organic, allergen-free, and functional baby food products.

- Regulatory Impacts: Strict adherence to safety and nutritional standards, influencing product development.

- Product Substitutes: Homemade baby food, though convenience drives commercial product adoption.

- End-User Segmentation: Growing demand for premium and specialized infant nutrition.

- M&A Trends: Active M&A landscape focused on portfolio expansion and market penetration.

- Quantitative Data: Estimated market concentration ratio (CR4) of >60% in 2025. XX M&A transactions in the historical period.

Baby Food Market in South America Market Trends & Opportunities

The South America Baby Food Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated market size of over USD 7.5 Billion by 2033. This growth is fueled by rising disposable incomes, increasing urbanization, and a growing awareness among parents regarding the critical importance of early childhood nutrition. Technological advancements are transforming the sector, with manufacturers investing heavily in research and development to create innovative products that cater to specific dietary needs and preferences. The emergence of organic and natural baby food products is a significant trend, driven by health-conscious parents seeking perceived healthier alternatives. Furthermore, the rise of e-commerce platforms is revolutionizing distribution channels, offering greater accessibility and convenience to consumers, particularly in remote areas. Opportunities abound for companies that can innovate with functional ingredients, sustainable packaging, and personalized nutrition solutions. The competitive dynamics are intensifying, with both global giants and emerging local players vying for market share. Market penetration rates for specialized infant formulas and organic baby food are steadily increasing across the region.

- Market Size Growth: Projected CAGR of 7.5% from 2025-2033, reaching over USD 7.5 Billion by 2033.

- Technological Shifts: Investment in R&D for functional ingredients, personalized nutrition, and innovative formulations.

- Consumer Preferences: Strong and growing demand for organic, natural, allergen-free, and specialized baby foods.

- Competitive Dynamics: Intensifying competition between global and local players, with a focus on product differentiation.

- Distribution Channel Evolution: Significant growth in online sales and direct-to-consumer models.

- Market Penetration Rates: Increasing adoption of premium and specialized infant nutrition products.

Dominant Markets & Segments in Baby Food Market in South America

Within the South America Baby Food Market, Brazil stands out as the dominant geographical market, driven by its large population, rising disposable incomes, and an increasing awareness of infant nutrition. The Rest of South America, encompassing countries like Colombia, Chile, and Peru, also presents significant growth potential. In terms of product type, Milk Formula continues to be the largest and most dominant segment, accounting for an estimated 55% of the market share in 2025. This is followed by Prepared Baby Food, which is experiencing rapid growth due to its convenience and variety. Dried Baby Food holds a steady, albeit smaller, market share, while Other Types, including organic snacks and specialized dietary supplements, are emerging as niche growth areas. The Hypermarket/Supermarket distribution channel remains the most significant, benefiting from wide product availability and consumer traffic, contributing approximately 40% of sales. However, Drugstores/Pharmacies are gaining traction for specialized medical baby foods and formulas, and Convenience Stores are expanding their offerings to cater to immediate needs.

- Leading Region: Brazil, due to its large population and increasing disposable income.

- Dominant Product Segment: Milk Formula, holding an estimated 55% market share in 2025.

- High-Growth Product Segment: Prepared Baby Food, driven by convenience and variety.

- Emerging Product Segment: Other Types (organic snacks, dietary supplements) showing niche growth.

- Dominant Distribution Channel: Hypermarket/Supermarket, accounting for ~40% of sales.

- Growing Distribution Channels: Drugstores/Pharmacies (for specialized products) and Convenience Stores.

- Key Growth Drivers (Geography): Favorable demographics, increasing urbanization, and rising per capita income in key countries.

- Key Growth Drivers (Segments): Parental awareness of nutritional needs, demand for convenience, and availability of specialized products.

Baby Food Market in South America Product Analysis

Product innovation in the South America Baby Food Market is characterized by a strong emphasis on functional ingredients, such as probiotics for digestive health and DHA for brain development. Companies are actively developing organic and natural formulations, aligning with increasing consumer demand for clean-label products. Ready-to-feed formulas and convenient pouch formats for purees and meals are gaining popularity due to their ease of use for busy parents. Competitive advantages are being built through fortification with essential vitamins and minerals, allergen-free options, and specialized formulas for infants with specific dietary needs. Technological advancements in processing and packaging ensure product safety, extend shelf life, and maintain nutritional integrity, making these products highly attractive to the South American consumer base.

Key Drivers, Barriers & Challenges in Baby Food Market in South America

Key Drivers:

- Rising Disposable Incomes: Enabling parents to afford premium and specialized baby food products.

- Increasing Health and Nutrition Awareness: Parents are more informed about the importance of early childhood nutrition, driving demand for high-quality products.

- Growing Working Women Population: Increased demand for convenient and ready-to-eat baby food options.

- Technological Advancements: Development of innovative and fortified baby food products.

- Expanding Retail Infrastructure: Improved accessibility through hypermarkets, supermarkets, and online channels.

Barriers & Challenges:

- Price Sensitivity: Economic fluctuations and affordability can impact purchasing decisions, especially in certain segments of the population.

- Regulatory Hurdles: Navigating diverse and sometimes complex food safety and labeling regulations across different South American countries.

- Supply Chain Disruptions: Challenges in sourcing raw materials and ensuring efficient distribution across vast geographical areas.

- Competition from Homemade Food: While decreasing, homemade options remain a consideration for some consumers.

- Limited Awareness in Rural Areas: Pockets of lower awareness regarding the benefits of specialized infant nutrition.

Growth Drivers in the Baby Food Market in South America Market

Growth in the Baby Food Market in South America is significantly propelled by a confluence of technological, economic, and regulatory factors. Economically, the steady increase in disposable incomes across key nations like Brazil and Argentina empowers parents to invest more in high-quality infant nutrition. Technologically, advancements in food science have led to the development of enriched formulas and organic baby food options, meeting the escalating demand for healthier and safer products. Regulatory bodies are increasingly focusing on standardizing and improving food safety, which, while posing initial challenges, ultimately builds consumer trust and encourages market growth. The growing awareness among parents regarding the critical role of early nutrition in child development further fuels the demand for specialized baby food products.

Challenges Impacting Baby Food Market in South America Growth

Despite the positive growth trajectory, the Baby Food Market in South America faces several challenges. Regulatory complexities, with varying standards across countries, can hinder market entry and product standardization, adding to operational costs and timelines. Supply chain issues, including logistics and raw material sourcing in a vast continent, can lead to inefficiencies and increased costs. Intense competitive pressures from established multinational corporations and agile local players necessitate continuous innovation and strategic pricing. Furthermore, economic volatility in some South American nations can impact consumer spending power, creating price sensitivity and potentially slowing the adoption of premium baby food products.

Key Players Shaping the Baby Food Market in South America Market

- Nestlé SA

- Abbott Nutrition

- Danone SA

- Arla Foods

- Glanbia PLC

- The Hero Group

- Neptune Wellness Company

- Sun-Maid Growers of California

- Dairy Farmers of America Inc

- Holle baby food AG

Significant Baby Food Market in South America Industry Milestones

- November 2021: Abbott Nutrition Launched Similac 360 Total Care, a baby formula containing five HMO probiotics designed to support babies' immune systems and brain development. This launch underscored the growing importance of immune-boosting ingredients in the infant nutrition market.

- July 2021: Abbott Nutrition launched Similac pro-Advance and Similac Pro-Sensative, baby formulas containing 2' FL-HMO, a probiotic found in human breast milk. This marked a significant step in replicating the beneficial components of breast milk in infant formula.

- March 2021: Sun-Maid Growers of California acquired Plum Organics, a premium, organic baby food, and kids snack brand, from Campbell Soup Company. Plum Organics offers a wide range of organic foods and snack products to meet the nutritional needs of babies, tots, and kids. Plum Organics' products are certified organic and non-GMO. This acquisition highlighted the increasing market demand for organic and premium baby food options.

Future Outlook for Baby Food Market in South America Market

The South America Baby Food Market is set for sustained growth, driven by an increasing focus on infant health and wellness, rising disposable incomes, and a burgeoning middle class. Strategic opportunities lie in the expansion of organic and specialized product lines, catering to specific dietary needs and preferences. The continued growth of e-commerce will further democratize access to a wider range of products. Innovation in functional ingredients and sustainable packaging will be crucial for maintaining competitive advantage. Companies that can effectively navigate regulatory landscapes and optimize their supply chains will be well-positioned to capitalize on the market's significant potential in the coming years. The overall outlook is highly positive, with a strong emphasis on premiumization and nutritional advancement.

Baby Food Market in South America Segmentation

-

1. Type

- 1.1. Milk Formula

- 1.2. Dried Baby Food

- 1.3. Prepared Baby Food

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Drugstores/Pharmacies

- 2.3. Convenience Stores

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

Baby Food Market in South America Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

Baby Food Market in South America Regional Market Share

Geographic Coverage of Baby Food Market in South America

Baby Food Market in South America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for sports nutritional supplements

- 3.3. Market Restrains

- 3.3.1. Rising demand for plant-based protein

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic Baby Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Baby Food Market in South America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Milk Formula

- 5.1.2. Dried Baby Food

- 5.1.3. Prepared Baby Food

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Drugstores/Pharmacies

- 5.2.3. Convenience Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arla Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestlé SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbott Nutrition

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Glanbia PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Hero Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Neptune Wellness Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sun-Maid Growers of California

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dairy Farmers of America Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Holle baby food AG*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arla Foods

List of Figures

- Figure 1: Baby Food Market in South America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Baby Food Market in South America Share (%) by Company 2025

List of Tables

- Table 1: Baby Food Market in South America Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Baby Food Market in South America Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Baby Food Market in South America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Baby Food Market in South America Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Baby Food Market in South America Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Baby Food Market in South America Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Baby Food Market in South America Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Baby Food Market in South America Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Baby Food Market in South America Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Baby Food Market in South America Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Baby Food Market in South America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Baby Food Market in South America Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 13: Baby Food Market in South America Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Baby Food Market in South America Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Baby Food Market in South America Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Baby Food Market in South America Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Brazil Baby Food Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Brazil Baby Food Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Argentina Baby Food Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Baby Food Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Baby Food Market in South America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of South America Baby Food Market in South America Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby Food Market in South America?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Baby Food Market in South America?

Key companies in the market include Arla Foods, Nestlé SA, Abbott Nutrition, Glanbia PLC, Danone SA, The Hero Group, Neptune Wellness Company, Sun-Maid Growers of California, Dairy Farmers of America Inc, Holle baby food AG*List Not Exhaustive.

3. What are the main segments of the Baby Food Market in South America?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 102900 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for sports nutritional supplements.

6. What are the notable trends driving market growth?

Increasing Demand for Organic Baby Food.

7. Are there any restraints impacting market growth?

Rising demand for plant-based protein.

8. Can you provide examples of recent developments in the market?

November 2021: Abbott Nutrition Launched Similac 360 Total Care, a baby formula containing five HMO probiotics designed to support babies' immune systems and brain development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Baby Food Market in South America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Baby Food Market in South America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Baby Food Market in South America?

To stay informed about further developments, trends, and reports in the Baby Food Market in South America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence