Key Insights

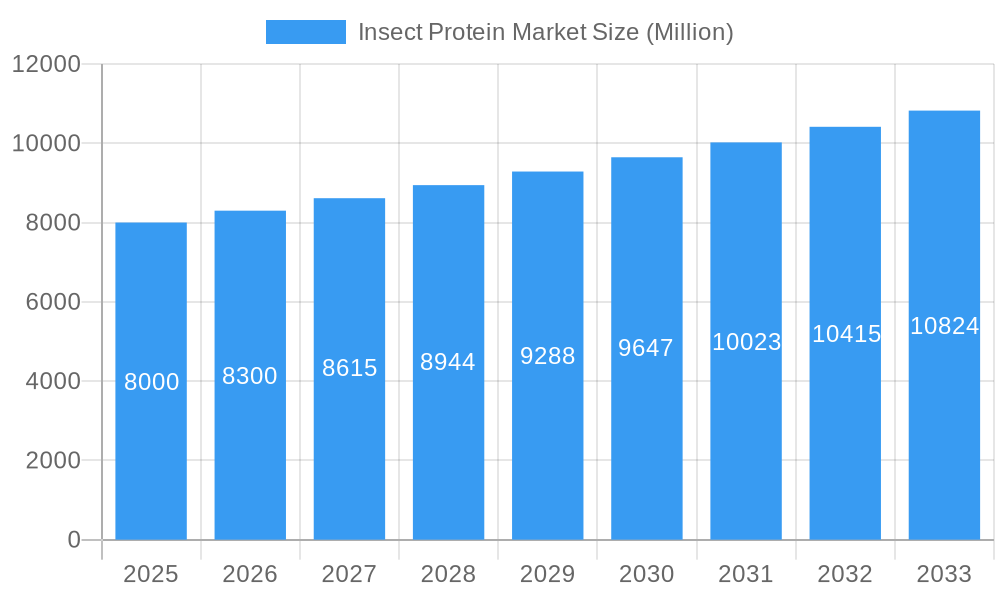

The global Insect Protein Market is poised for substantial growth, projected to reach a market size of approximately $8,000 million by the end of 2025, with a Compound Annual Growth Rate (CAGR) of 3.89% anticipated through 2033. This expansion is primarily fueled by the escalating demand for sustainable and protein-rich alternatives in animal feed, alongside increasing consumer acceptance and innovation in food and beverage applications. The inherent environmental benefits of insect farming, including reduced land and water usage compared to traditional livestock, are critical drivers. Furthermore, the rising awareness of insect protein's nutritional profile, rich in essential amino acids, vitamins, and minerals, is propelling its adoption in specialized supplement markets like elderly nutrition and medical nutrition. Key market players are actively investing in research and development to enhance production efficiency and expand product portfolios, ranging from insect-based flours and oils to whole insects.

Insect Protein Market Market Size (In Billion)

The market’s trajectory is influenced by a confluence of factors. Advancements in insect farming technologies, such as automated rearing systems and optimized feed formulations, are improving scalability and cost-effectiveness. The burgeoning "alternative protein" movement, driven by environmental concerns and ethical considerations, is creating a favorable environment for insect protein's mainstream acceptance. However, challenges such as consumer perception, regulatory hurdles in certain regions, and the need for standardized production practices remain. The animal feed segment is expected to dominate, given the long-standing use of insects as a protein source in aquaculture and pet food. In parallel, the food and beverage sector is witnessing innovation across categories like bakery, snacks, and ready-to-eat meals, as manufacturers leverage insect protein to enhance nutritional content and cater to evolving consumer preferences. Regional analysis indicates strong growth potential in Asia Pacific and North America, driven by their large populations and growing adoption of novel food technologies.

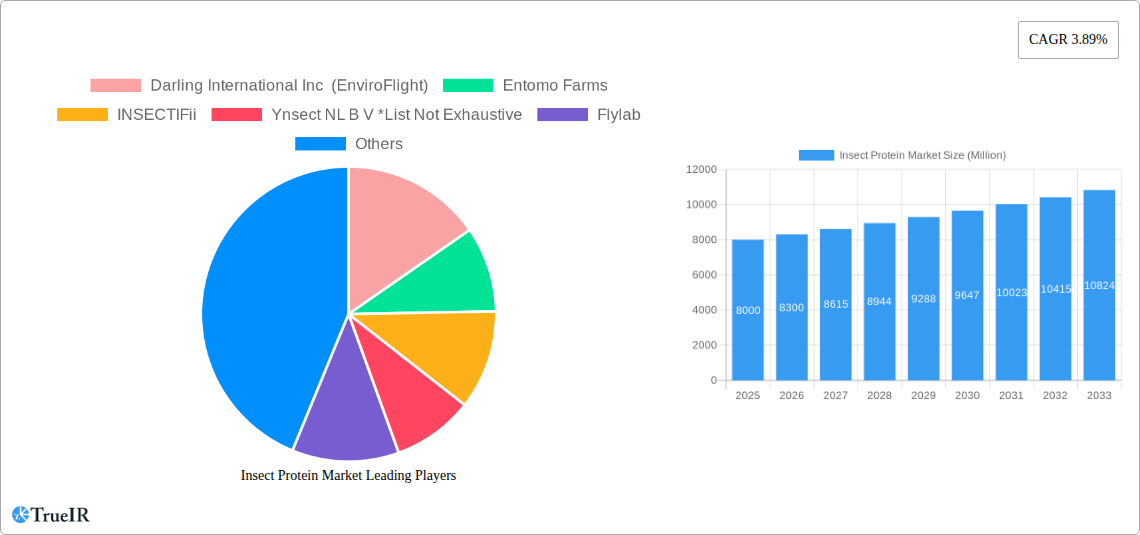

Insect Protein Market Company Market Share

Dive into the rapidly evolving insect protein market, a transformative sector poised to redefine sustainable food systems and animal nutrition. This comprehensive report, spanning from 2019 to 2033 with a base year of 2025, offers unparalleled insights into market dynamics, growth drivers, and competitive strategies. Harnessing high-volume keywords like "insect protein," "cricket protein," "mealworm protein," "sustainable food," "animal feed," and "alternative protein," this analysis is optimized for maximum SEO impact and industry engagement.

Insect Protein Market Market Structure & Competitive Landscape

The global insect protein market exhibits a dynamic structure characterized by increasing fragmentation yet a growing presence of key innovators. Market concentration is moderate, with a few dominant players investing heavily in R&D and scaling production, while a burgeoning number of startups are carving out niches. Innovation drivers are multifaceted, encompassing advancements in insect rearing technologies, processing techniques, and novel product formulations. Regulatory impacts are significant, with evolving frameworks in regions like Europe and North America shaping market entry and product acceptance. Product substitutes, primarily conventional animal proteins and plant-based alternatives, are being challenged by the unique nutritional profiles and environmental advantages of insect protein. End-user segmentation reveals a strong foothold in animal feed, followed by growing penetration in food and beverages and specialized supplements. Mergers and acquisitions (M&A) are becoming increasingly prevalent as established agribusiness and food companies seek to secure their position in this burgeoning sector. We anticipate a surge in M&A activity, with an estimated volume of XX million in the forecast period, driven by the pursuit of technological expertise and market access.

- Innovation Drivers: Automation in insect farming, advanced processing for protein extraction, development of insect-based flours and oils, and exploration of novel applications.

- Regulatory Landscape: Growing clarity in food safety regulations for insect consumption and feed applications, crucial for market expansion.

- Product Substitution Dynamics: Insect protein offers a more sustainable and resource-efficient alternative to traditional protein sources.

- End-User Focus: Dominance of animal feed, with accelerating growth in human food and specialized nutrition segments.

- M&A Trends: Strategic acquisitions aimed at consolidating market share and acquiring proprietary technologies.

Insect Protein Market Market Trends & Opportunities

The insect protein market is experiencing robust growth, projected to reach an estimated value of over XXX Million by 2033, with a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This expansion is fueled by a confluence of escalating consumer demand for sustainable and nutritious food options, coupled with increasing concerns over the environmental impact of conventional protein production. Technological shifts are at the forefront, with significant investments in automated insect farming, efficient feed conversion systems, and advanced processing technologies for creating diverse insect protein ingredients. Consumer preferences are rapidly evolving, with a growing acceptance of entomophagy (insect consumption) driven by awareness campaigns, celebrity endorsements, and the availability of innovative, palatable insect-based products. The competitive landscape is intensifying, characterized by strategic partnerships, product innovation, and market expansion initiatives by both established players and agile startups. Opportunities abound for companies that can leverage efficient production methods, develop appealing consumer-facing products, and navigate the evolving regulatory environments. The increasing market penetration of insect protein in niche applications, such as specialized pet food and high-protein snacks, is a testament to its growing versatility and appeal. We foresee a significant rise in the adoption of insect protein across various food categories, from bakery and confectionery to ready-to-eat meals, creating substantial market opportunities.

- Market Size Projections: Expected to exceed XXX Million by 2033.

- CAGR: Anticipated at XX% during the 2025–2033 forecast period.

- Technological Advancements: Automation in insect rearing, efficient processing, and novel ingredient development are key.

- Consumer Adoption: Growing acceptance driven by sustainability, health benefits, and product innovation.

- Competitive Dynamics: Intensified competition with strategic alliances and new product launches.

- Market Penetration: Increasing presence in animal feed, pet food, human food, and supplements.

Dominant Markets & Segments in Insect Protein Market

The insect protein market is witnessing dominant growth in the Animal Feed segment, driven by its superior nutritional profile, cost-effectiveness, and significantly lower environmental footprint compared to traditional feed ingredients like soy and fishmeal. This segment alone is projected to account for over XX% of the total market revenue by 2033, with a substantial CAGR of XX%. Within the Food and Beverages sector, Snacks are emerging as a high-growth sub-segment, with an estimated XX% market share and a CAGR of XX%. The burgeoning demand for protein-rich, sustainable snack options is fueling this trend, with products like insect protein bars and crisps gaining traction. The Supplements market, particularly for Elderly Nutrition and Medical Nutrition, is also exhibiting strong potential, driven by the need for highly digestible and nutrient-dense protein sources, with an anticipated XX% market share and a CAGR of XX%.

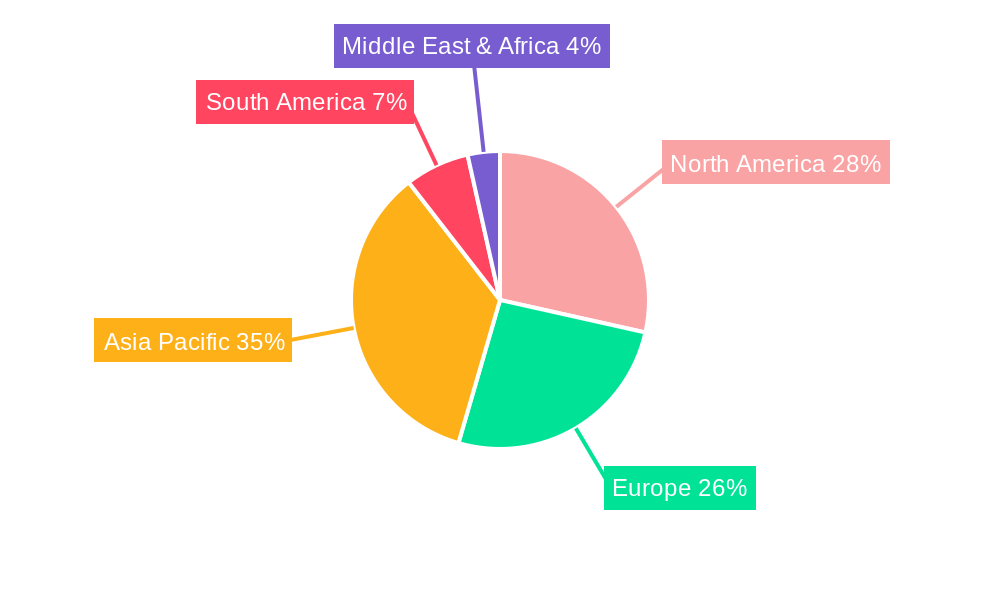

Leading Regions and Countries:

- Europe: Currently dominates the insect protein market due to proactive regulatory frameworks, a strong consumer focus on sustainability, and significant investment in insect farming infrastructure. Countries like the Netherlands, France, and the UK are at the forefront.

- Key Growth Drivers: Supportive policies for novel foods, established research institutions, and a receptive consumer base.

- North America: Experiencing rapid growth, driven by increasing consumer awareness, a thriving food tech industry, and growing interest in alternative proteins for both human and animal consumption. The United States and Canada are key markets.

- Key Growth Drivers: Venture capital investment, expanding product lines, and rising demand for sustainable pet food.

- Asia Pacific: Poised for substantial future growth, with large populations and a growing awareness of sustainable food solutions. Emerging markets like China, India, and Southeast Asian nations are expected to contribute significantly.

- Key Growth Drivers: Government initiatives supporting food security, increasing disposable incomes, and a growing acceptance of insect consumption in some cultures.

Dominant Segments Analysis:

- Animal Feed: Insect protein, particularly from mealworms and black soldier fly larvae, offers a highly digestible and nutrient-rich alternative to conventional feeds, reducing reliance on wild-caught fish and soy. This segment benefits from economies of scale and established supply chains for feed manufacturers.

- Food and Beverages:

- Snacks: Insect protein is being integrated into bars, chips, and other convenience foods, appealing to health-conscious and environmentally aware consumers seeking novel protein sources.

- Bakery: Insect flours are being used in bread, cookies, and pastries to boost protein content and nutritional value.

- Confectionery: Emerging use in chocolate and other sweets, offering a unique texture and nutritional enhancement.

- RTE/RTC Food Products: Potential for integration into ready-to-eat and ready-to-cook meals to improve protein profiles.

- Condiments/Sauces: Niche applications exploring insect-based flavor enhancers.

- Supplements:

- Elderly Nutrition: The high protein content and digestibility of insect protein make it ideal for combating sarcopenia and supporting overall health in older adults.

- Medical Nutrition: Its unique amino acid profile and hypoallergenic properties make it a valuable ingredient in specialized medical diets and nutritional support.

Insect Protein Market Product Analysis

Product innovation in the insect protein market is rapidly expanding the scope of applications and consumer accessibility. Key advancements include the development of highly purified insect protein isolates and concentrates, offering versatile functionalities for food and beverage manufacturers. Insect flours, derived from various insect species, are gaining traction as nutrient-dense ingredients for bakery products, snacks, and pasta. Furthermore, insect oils are being explored for their unique fatty acid profiles, presenting opportunities in cosmetics and dietary supplements. The competitive advantage of these products lies in their superior sustainability metrics, appealing nutritional profiles (high protein, essential amino acids, minerals), and potential for allergen reduction compared to some traditional protein sources.

Key Drivers, Barriers & Challenges in Insect Protein Market

Key Drivers:

- Sustainability Imperative: Growing global demand for environmentally friendly food and feed solutions, driven by climate change concerns and resource scarcity.

- Nutritional Superiority: Insect protein boasts a complete amino acid profile, high protein content, and essential micronutrients, positioning it as a valuable dietary component.

- Technological Advancements: Innovations in insect rearing, harvesting, and processing are improving efficiency and scalability, driving down costs.

- Regulatory Support: Evolving favorable regulatory frameworks in key markets are facilitating market entry and product acceptance.

- Investor Interest: Increasing venture capital and corporate investment signal strong market confidence and growth potential.

Barriers & Challenges:

- Consumer Perception (Entomophobia): Overcoming the psychological barrier and cultural aversion to consuming insects remains a significant hurdle in many Western markets.

- Scalability and Cost-Effectiveness: Achieving large-scale, cost-competitive production to rival established protein sources requires further technological maturation and infrastructure investment.

- Regulatory Harmonization: Inconsistent regulations across different regions can create market access complexities and hinder global expansion.

- Supply Chain Development: Establishing robust, reliable, and traceable supply chains for insect protein ingredients is crucial for widespread adoption.

- Competition from Alternatives: Intense competition from well-established animal proteins and rapidly growing plant-based alternatives necessitates clear differentiation and value proposition.

Growth Drivers in the Insect Protein Market Market

The insect protein market is propelled by several key growth drivers. Technologically, the ongoing development of highly automated and efficient insect farming systems, such as those employed by companies like Ynsect, significantly reduces operational costs and increases production volume. Economically, the increasing demand for sustainable and affordable protein sources in both animal feed and human consumption makes insect protein an attractive alternative. Regulatory advancements, with countries like those in the EU approving insect species for food and feed, are crucial enablers. For example, the strategic partnership forged by Ÿnsect with the Lotte R&D Center in April 2023 exemplifies efforts to drive regional market growth and consumer acceptance for insect-based foods.

Challenges Impacting Insect Protein Market Growth

Several challenges are impacting the growth of the insect protein market. Regulatory complexities, particularly the harmonization of standards across diverse geographical regions, can create hurdles for market entry and expansion. Supply chain issues, including ensuring consistent quality, traceability, and sufficient volume of insect protein ingredients, require further development. Competitive pressures from established protein industries and the rapidly advancing plant-based sector demand continuous innovation and effective market positioning. Quantifiable impacts include potential price volatility due to production bottlenecks and slower-than-expected consumer adoption rates in some segments.

Key Players Shaping the Insect Protein Market Market

- Darling International Inc (EnviroFlight)

- Entomo Farms

- INSECTIFii

- Ynsect NL B V

- Flylab

- Protix B V

- Nutrition Technologies

- Global Bugs

- Agronutris

- Aspire Food Group

- Protenga

Significant Insect Protein Market Industry Milestones

- April 2023: Ÿnsect forged a strategic partnership with the Lotte R&D Center, a prominent player in the Korean tech industry. The objective is to accelerate the advancement of insect-based food throughout Asia. This collaboration is marked by the signing of a Memorandum of Understanding (MOU), signifying Ÿnsect's commitment to raising awareness and fostering opportunities for insect-based food and beverages in the region.

- September 2022: Essentia unveiled its cricket protein product under the Omni brand. This innovative addition joins Essentia's existing lineup of nutritional ingredients, which includes collagen peptides and bone broth powders.

- January 2022: Ynsect embarked on an exciting journey with the launch of the ŸNFABRE program. This initiative is dedicated to the development of cutting-edge phenotyping tools tailored for the next generation of the company's breeders, aimed at ensuring a secure and robust supply of larvae to support its insect farms.

Future Outlook for Insect Protein Market Market

The future outlook for the insect protein market is exceptionally bright, driven by the escalating need for sustainable protein solutions. Strategic opportunities lie in further technological innovation to enhance production efficiency and reduce costs, making insect protein more competitive. Expansion into novel food applications, alongside continued growth in animal feed, will be crucial. Consumer education and marketing efforts to normalize entomophagy will be key to unlocking its full potential in the human food sector. As regulatory landscapes continue to mature and investor confidence remains strong, the insect protein market is poised for exponential growth, transforming global food systems towards a more sustainable and nutritious future.

Insect Protein Market Segmentation

-

1. End-User

- 1.1. Animal Feed

-

1.2. Food and Beverages

- 1.2.1. Bakery

- 1.2.2. Condiments/Sauces

- 1.2.3. Confectionery

- 1.2.4. RTE/RTC Food Products

- 1.2.5. Snacks

-

1.3. Supplements

- 1.3.1. Elderly Nutrition and Medical Nutrition

Insect Protein Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. France

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Iran

- 6.3. South Africa

- 6.4. Rest of Middle East

Insect Protein Market Regional Market Share

Geographic Coverage of Insect Protein Market

Insect Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness About Insect & Other Alternative Proteins; Increasing Applications Surge Demand for Insect Protein

- 3.3. Market Restrains

- 3.3.1. Augmenting Market Penetration of Other Proteins

- 3.4. Market Trends

- 3.4.1. Increasing Awareness About Insect & Other Alternative Proteins

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Animal Feed

- 5.1.2. Food and Beverages

- 5.1.2.1. Bakery

- 5.1.2.2. Condiments/Sauces

- 5.1.2.3. Confectionery

- 5.1.2.4. RTE/RTC Food Products

- 5.1.2.5. Snacks

- 5.1.3. Supplements

- 5.1.3.1. Elderly Nutrition and Medical Nutrition

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East

- 5.2.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Animal Feed

- 6.1.2. Food and Beverages

- 6.1.2.1. Bakery

- 6.1.2.2. Condiments/Sauces

- 6.1.2.3. Confectionery

- 6.1.2.4. RTE/RTC Food Products

- 6.1.2.5. Snacks

- 6.1.3. Supplements

- 6.1.3.1. Elderly Nutrition and Medical Nutrition

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. Europe Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Animal Feed

- 7.1.2. Food and Beverages

- 7.1.2.1. Bakery

- 7.1.2.2. Condiments/Sauces

- 7.1.2.3. Confectionery

- 7.1.2.4. RTE/RTC Food Products

- 7.1.2.5. Snacks

- 7.1.3. Supplements

- 7.1.3.1. Elderly Nutrition and Medical Nutrition

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Asia Pacific Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Animal Feed

- 8.1.2. Food and Beverages

- 8.1.2.1. Bakery

- 8.1.2.2. Condiments/Sauces

- 8.1.2.3. Confectionery

- 8.1.2.4. RTE/RTC Food Products

- 8.1.2.5. Snacks

- 8.1.3. Supplements

- 8.1.3.1. Elderly Nutrition and Medical Nutrition

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. South America Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Animal Feed

- 9.1.2. Food and Beverages

- 9.1.2.1. Bakery

- 9.1.2.2. Condiments/Sauces

- 9.1.2.3. Confectionery

- 9.1.2.4. RTE/RTC Food Products

- 9.1.2.5. Snacks

- 9.1.3. Supplements

- 9.1.3.1. Elderly Nutrition and Medical Nutrition

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Middle East Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Animal Feed

- 10.1.2. Food and Beverages

- 10.1.2.1. Bakery

- 10.1.2.2. Condiments/Sauces

- 10.1.2.3. Confectionery

- 10.1.2.4. RTE/RTC Food Products

- 10.1.2.5. Snacks

- 10.1.3. Supplements

- 10.1.3.1. Elderly Nutrition and Medical Nutrition

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. United Arab Emirates Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-User

- 11.1.1. Animal Feed

- 11.1.2. Food and Beverages

- 11.1.2.1. Bakery

- 11.1.2.2. Condiments/Sauces

- 11.1.2.3. Confectionery

- 11.1.2.4. RTE/RTC Food Products

- 11.1.2.5. Snacks

- 11.1.3. Supplements

- 11.1.3.1. Elderly Nutrition and Medical Nutrition

- 11.1. Market Analysis, Insights and Forecast - by End-User

- 12. North America Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Rest of North America

- 13. Europe Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 Italy

- 13.1.4 France

- 13.1.5 Rest of Europe

- 14. Asia Pacific Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 India

- 14.1.2 China

- 14.1.3 Japan

- 14.1.4 Australia

- 14.1.5 Rest of Asia Pacific

- 15. South America Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Middle East & Africa Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 UAE

- 16.1.2 South Africa

- 16.1.3 Saudi Arabia

- 16.1.4 Rest of MEA

- 17. United Arab Emirates Insect Protein Market Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 Saudi Arabia

- 17.1.2 Iran

- 17.1.3 South Africa

- 17.1.4 Rest of Middle East

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2025

- 18.2. Company Profiles

- 18.2.1 Darling International Inc (EnviroFlight)

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Entomo Farms

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 INSECTIFii

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Ynsect NL B V *List Not Exhaustive

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Flylab

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Protix B V

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Nutrition Technologies

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Global Bugs

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Agronutris

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Aspire Food Group

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Protenga

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 Darling International Inc (EnviroFlight)

List of Figures

- Figure 1: Insect Protein Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Insect Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Insect Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Insect Protein Market Volume k tons Forecast, by Region 2020 & 2033

- Table 3: Insect Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Insect Protein Market Volume k tons Forecast, by End-User 2020 & 2033

- Table 5: Insect Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Insect Protein Market Volume k tons Forecast, by Region 2020 & 2033

- Table 7: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 9: United States Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 11: Canada Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 15: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 17: Germany Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Germany Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 21: Italy Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 23: France Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 27: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 29: India Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 31: China Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: China Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 33: Japan Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Japan Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 35: Australia Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Australia Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 37: Rest of Asia Pacific Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Asia Pacific Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 39: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 41: Brazil Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Brazil Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 43: Argentina Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of South America Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 47: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 49: UAE Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: UAE Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 51: South Africa Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Africa Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 53: Saudi Arabia Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Saudi Arabia Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 55: Rest of MEA Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of MEA Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 57: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 59: Saudi Arabia Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Saudi Arabia Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 61: Iran Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Iran Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 63: South Africa Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 67: Insect Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 68: Insect Protein Market Volume k tons Forecast, by End-User 2020 & 2033

- Table 69: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 71: United States Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: United States Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 73: Canada Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Canada Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 75: Rest of North America Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of North America Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 77: Insect Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 78: Insect Protein Market Volume k tons Forecast, by End-User 2020 & 2033

- Table 79: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 81: Germany Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Germany Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 83: United Kingdom Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: United Kingdom Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 85: Italy Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Italy Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 87: France Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: France Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 89: Rest of Europe Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of Europe Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 91: Insect Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 92: Insect Protein Market Volume k tons Forecast, by End-User 2020 & 2033

- Table 93: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 94: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 95: India Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: India Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 97: China Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: China Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 99: Japan Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: Japan Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 101: Australia Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Australia Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 105: Insect Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 106: Insect Protein Market Volume k tons Forecast, by End-User 2020 & 2033

- Table 107: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 108: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 109: Brazil Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 110: Brazil Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 111: Argentina Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 112: Argentina Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 113: Rest of South America Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 114: Rest of South America Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 115: Insect Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 116: Insect Protein Market Volume k tons Forecast, by End-User 2020 & 2033

- Table 117: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 118: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 119: Insect Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 120: Insect Protein Market Volume k tons Forecast, by End-User 2020 & 2033

- Table 121: Insect Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 122: Insect Protein Market Volume k tons Forecast, by Country 2020 & 2033

- Table 123: Saudi Arabia Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 124: Saudi Arabia Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 125: Iran Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 126: Iran Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 127: South Africa Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 128: South Africa Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

- Table 129: Rest of Middle East Insect Protein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 130: Rest of Middle East Insect Protein Market Volume (k tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insect Protein Market?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the Insect Protein Market?

Key companies in the market include Darling International Inc (EnviroFlight), Entomo Farms, INSECTIFii, Ynsect NL B V *List Not Exhaustive, Flylab, Protix B V, Nutrition Technologies, Global Bugs, Agronutris, Aspire Food Group, Protenga.

3. What are the main segments of the Insect Protein Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness About Insect & Other Alternative Proteins; Increasing Applications Surge Demand for Insect Protein.

6. What are the notable trends driving market growth?

Increasing Awareness About Insect & Other Alternative Proteins.

7. Are there any restraints impacting market growth?

Augmenting Market Penetration of Other Proteins.

8. Can you provide examples of recent developments in the market?

April 2023: Ÿnsect forged a strategic partnership with the Lotte R&D Center, a prominent player in the Korean tech industry. The objective is to accelerate the advancement of insect-based food throughout Asia. This collaboration is marked by the signing of a Memorandum of Understanding (MOU), signifying Ÿnsect's commitment to raising awareness and fostering opportunities for insect-based food and beverages in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in k tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Insect Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Insect Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Insect Protein Market?

To stay informed about further developments, trends, and reports in the Insect Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence