Key Insights

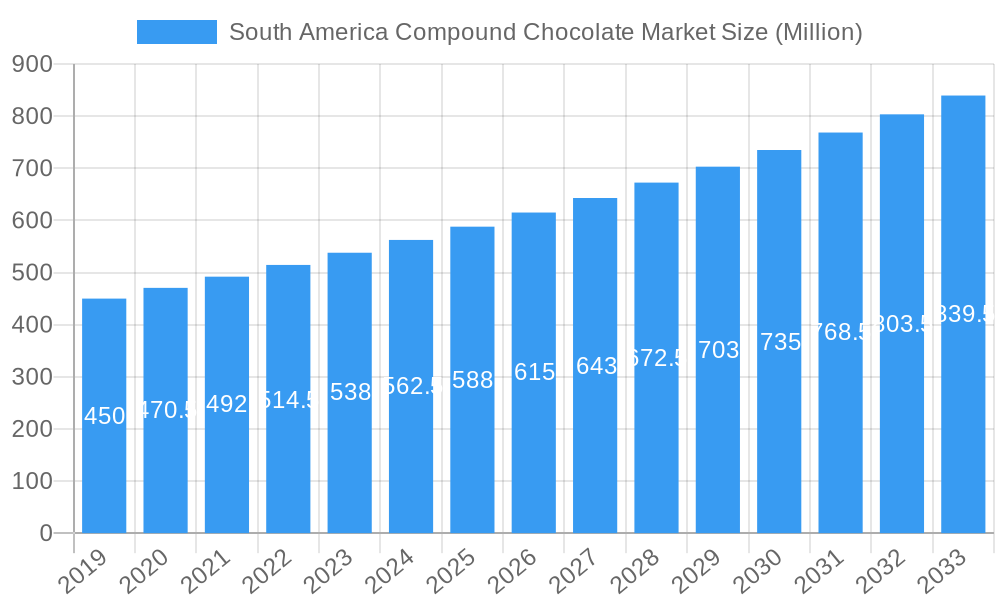

The South America Compound Chocolate Market is projected for significant expansion, anticipated to reach $1.87 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 5.64% through 2033. This growth is fueled by escalating consumer demand for chocolate products across confectionery, ice cream, and bakery applications. Compound chocolate's cost-effectiveness and ease of use for manufacturers, compared to traditional couverture chocolate, enhance its market adoption. Key growth drivers include rising disposable incomes in South American economies, increasing consumer spending on premium food items, and the growing use of chocolate as a versatile ingredient in food and beverage formulations. Market trends reveal innovation in flavor profiles, with rising demand for dark, milk, and white chocolate variations, alongside unique infusions. The expanding presence of artisanal and large-scale manufacturers further shapes product development and distribution.

South America Compound Chocolate Market Market Size (In Billion)

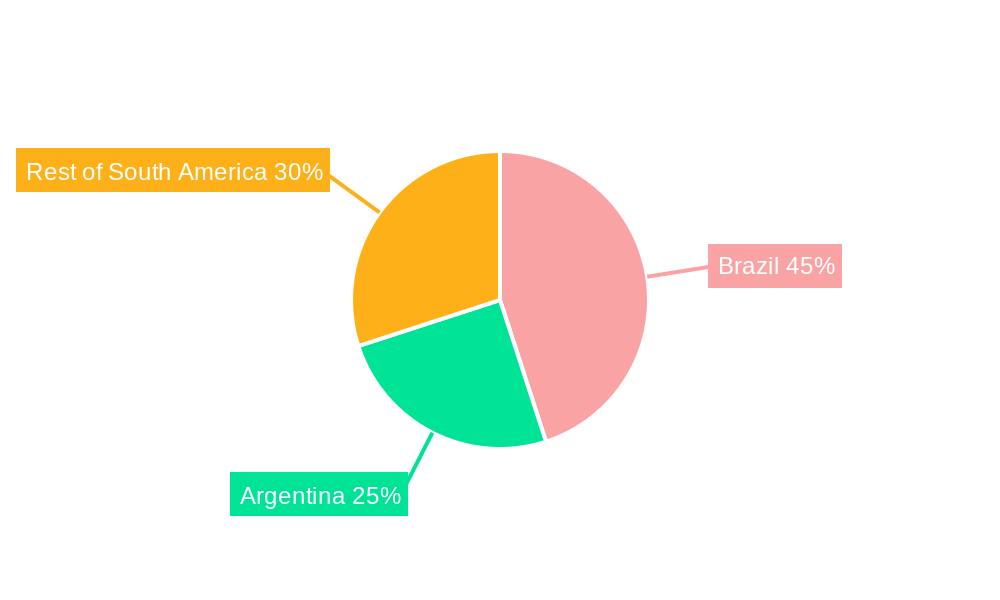

Potential market restraints include raw material price volatility, impacting manufacturing costs and consumer pricing. Evolving consumer preferences for healthier options and concerns regarding sugar content may necessitate product reformulation. However, chocolate's enduring appeal and ongoing industry innovation are expected to mitigate these challenges. The market is segmented by flavors, products (compound chocolate chips/drops/chunks, slabs), and applications (bakery, confectionery, ice cream, frozen desserts). Brazil is expected to lead the South American market due to its robust confectionery sector and large consumer base, with Argentina and other South American nations also showing steady growth. Key industry players like Cargill Incorporated, The Barry Callebaut Group, and Blommer Chocolate Company are actively contributing through innovation and strategic expansion.

South America Compound Chocolate Market Company Market Share

South America Compound Chocolate Market Market Structure & Competitive Landscape

The South America Compound Chocolate Market is characterized by a moderately concentrated landscape, with a few global players and several regional manufacturers vying for market share. The estimated market concentration ratio for the top four players is approximately 55%, indicating a significant presence of established entities. Innovation is a key differentiator, driven by the development of sugar-free compound chocolates, plant-based alternatives, and novel flavor profiles to cater to evolving consumer tastes. Regulatory impacts, particularly concerning food safety standards and labeling requirements, are gradually shaping market entry and product development strategies.

Product substitutes, primarily other confectionery ingredients and coatings, present a challenge, but the unique flavor and texture profile of compound chocolate continues to ensure its demand in core applications. End-user segmentation reveals a strong reliance on the bakery and confectionery sectors, which account for over 65% of the market's consumption. Merger and acquisition (M&A) trends are emerging, with estimated M&A volumes of USD 25 Million in the historical period (2019-2024) as larger companies seek to consolidate their market position and expand their product portfolios.

- Key Innovation Drivers:

- Development of reduced-sugar and sugar-free compound chocolate options.

- Introduction of vegan and dairy-free compound chocolate formulations.

- Exploration of exotic fruit and local ingredient-infused flavors.

- Advancements in processing technology for improved texture and melting properties.

- Regulatory Considerations:

- Adherence to regional food safety and quality certifications.

- Compliance with evolving labeling laws for allergens and ingredients.

- Potential impact of import/export policies on raw material sourcing.

- M&A Activity:

- Acquisitions aimed at expanding geographical reach within South America.

- Consolidation of smaller regional players by larger confectionery conglomerates.

- Investments in companies with unique technological capabilities or niche market access.

South America Compound Chocolate Market Market Trends & Opportunities

The South America Compound Chocolate Market is poised for robust growth, with an estimated CAGR of 5.8% from 2025 to 2033. This expansion is fueled by a confluence of factors, including increasing disposable incomes across the region, a growing preference for indulgent yet accessible confectionery products, and the expanding reach of food manufacturers into previously underserved markets. The market size is projected to reach USD 1,800 Million by 2033, a significant increase from the base year of 2025, underscoring its dynamic trajectory.

Technological shifts in manufacturing processes are enabling higher production efficiencies and the development of more sophisticated product offerings. This includes the adoption of advanced tempering techniques and automation, which contribute to consistent quality and reduced operational costs. Consumer preferences are evolving rapidly, with a discernible shift towards healthier indulgence options. This presents a significant opportunity for manufacturers to innovate in the reduced-sugar and dark compound chocolate segments. The rising demand for convenient and ready-to-eat treats further boosts the appeal of compound chocolate in various forms, from chocolate chips for baking to ready-to-use coatings.

Competitive dynamics are intensifying, with both global giants and agile local players leveraging their strengths. Global players benefit from established brands and extensive distribution networks, while local manufacturers often possess a deeper understanding of regional tastes and can offer more customized solutions. The market penetration rate for compound chocolate in urban areas is estimated to be around 60%, with significant untapped potential in rural and emerging markets. The increasing adoption of e-commerce platforms for food and beverage products also presents a growing channel for market expansion and consumer engagement.

- Market Size Growth Trajectory:

- Projected market size to exceed USD 1,800 Million by 2033.

- Estimated CAGR of 5.8% during the forecast period (2025-2033).

- Steady growth driven by demand from bakery, confectionery, and ice cream sectors.

- Technological Advancements:

- Investments in automated production lines for increased output and consistency.

- Development of specialized compound chocolates with enhanced texture and shelf-life.

- Adoption of sustainable manufacturing practices.

- Evolving Consumer Preferences:

- Growing demand for healthier options, including sugar-free and low-calorie variants.

- Increasing popularity of plant-based and vegan compound chocolates.

- Interest in unique and exotic flavor combinations, incorporating local ingredients.

- Competitive Landscape Evolution:

- Strategic partnerships and collaborations between manufacturers and ingredient suppliers.

- Focus on product differentiation through unique formulations and packaging.

- Expansion of distribution channels, including online retail and direct-to-consumer models.

Dominant Markets & Segments in South America Compound Chocolate Market

The Dominant Markets & Segments in the South America Compound Chocolate Market analysis reveals that Brazil stands out as the leading country, driven by its large population, established food industry, and high per capita consumption of confectionery products. The Rest of South America collectively represents a significant and growing market, encompassing countries like Colombia, Peru, and Chile, where rapid urbanization and increasing disposable incomes are fueling demand.

Within product segments, Chocolate Coatings are experiencing substantial growth, primarily due to their widespread use in the confectionery and bakery industries. The demand for efficient and visually appealing coatings for cookies, cakes, and snacks directly translates to higher compound chocolate consumption. Chocolate Chips/Drops/Chunks are another dominant product category, catering to the burgeoning home baking and artisanal bakery segments. Their versatility in various recipes ensures consistent demand.

Geographically, the dominance of Brazil is underpinned by its robust agricultural sector, providing a strong base for cocoa sourcing and processing. Government initiatives promoting local manufacturing and export incentives further bolster its position. The Rest of South America is characterized by emerging markets with high growth potential, where increasing penetration of modern retail formats is making compound chocolate more accessible to a wider consumer base.

From a flavor perspective, Milk Chocolate continues to hold a dominant position due to its widespread appeal and familiarity among consumers of all ages. However, Dark Chocolate is witnessing significant growth, driven by increasing consumer awareness of its perceived health benefits and the availability of higher cocoa content options. Other Flavors, including those incorporating local fruits and spices, are gaining traction, catering to the growing demand for unique and regional taste experiences.

In terms of applications, Confectionery remains the largest end-use sector, encompassing a vast array of products from chocolate bars to candies. The Bakery segment is a close second, with compound chocolate being an indispensable ingredient in cakes, cookies, pastries, and bread. The Ice Cream and Frozen Desserts sector also presents a substantial opportunity, with compound chocolate coatings and inclusions enhancing the appeal and flavor of frozen treats.

- Leading Region/Country:

- Brazil: Dominates due to population size, strong confectionery industry, and high consumption rates.

- Rest of South America: Rapidly growing market fueled by urbanization and increasing disposable incomes in countries like Colombia, Peru, and Chile.

- Dominant Product Segments:

- Chocolate Coatings: Essential for confectionery and bakery applications, offering visual appeal and flavor enhancement.

- Chocolate Chips/Drops/Chunks: High demand from home baking, artisanal bakeries, and as inclusions in various food products.

- Key Growth Drivers in Dominant Segments:

- Bakery: Increased demand for ready-to-use ingredients for both commercial and home baking.

- Confectionery: Continuous innovation in product development and expanding product portfolios.

- Ice Cream and Frozen Desserts: Growing preference for indulgent and flavor-rich frozen treats.

- Dominant Flavor Preferences:

- Milk Chocolate: Broad consumer appeal and familiarity.

- Dark Chocolate: Rising popularity due to perceived health benefits and availability of premium options.

- Other Flavors: Emerging trend driven by consumer interest in exotic and regional taste profiles.

South America Compound Chocolate Market Product Analysis

The South America Compound Chocolate Market is witnessing a wave of product innovations driven by evolving consumer demands and technological advancements. Manufacturers are actively developing sugar-free and low-sugar compound chocolates to cater to the growing health-conscious consumer base. Furthermore, the trend towards plant-based diets is spurring the development of vegan compound chocolates made with alternative fats and dairy-free ingredients.

New flavor profiles, often incorporating indigenous South American fruits and spices, are gaining traction, offering unique taste experiences. Applications are expanding beyond traditional confectionery and bakery, with increasing use in ice cream coatings, frozen dessert inclusions, and as toppings for savory snacks. Competitive advantages are being built on factors such as improved melt properties, enhanced gloss, and longer shelf life, achieved through advanced processing techniques.

Key Drivers, Barriers & Challenges in South America Compound Chocolate Market

Key Drivers:

- Growing Middle Class and Disposable Income: Increased purchasing power translates to higher demand for indulgence products like compound chocolate.

- Expansion of the Food Processing Industry: A robust food manufacturing sector drives demand for compound chocolate as a key ingredient.

- Consumer Preference for Convenience and Indulgence: Compound chocolate offers an accessible way to enjoy sweet treats in various formats.

- Innovation in Product Development: Introduction of healthier options (sugar-free, vegan) and novel flavors expands market appeal.

- Evolving Retail Landscape: Increased presence of modern supermarkets and online retail channels improves accessibility.

Barriers & Challenges:

- Volatility in Raw Material Prices: Fluctuations in the cost of vegetable oils and cocoa derivatives can impact profitability.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can affect the availability and cost of raw materials and finished products.

- Regulatory Complexities: Varying food safety standards and labeling requirements across different South American countries can pose compliance hurdles.

- Intense Competition: The market features a mix of global players and numerous local manufacturers, leading to price pressures.

- Consumer Perception: While growing, the perception of compound chocolate as a "lower quality" alternative to real chocolate can still be a barrier in some segments.

Growth Drivers in the South America Compound Chocolate Market Market

Key growth drivers for the South America Compound Chocolate Market are multifaceted. Economic growth and rising disposable incomes in key nations like Brazil and Argentina directly fuel consumer spending on confectionery and bakery products, where compound chocolate is a staple. Technological advancements in oil processing and emulsification are enabling the creation of higher-quality compound chocolates with improved texture and mouthfeel, mirroring the desirable attributes of traditional chocolate. Furthermore, a favorable regulatory environment for food manufacturing and product innovation, coupled with increasing demand for cost-effective ingredients in a price-sensitive market, are significant catalysts. The growing trend of convenience foods and ready-to-eat snacks also plays a crucial role, with compound chocolate being an ideal ingredient for such applications.

Challenges Impacting South America Compound Chocolate Market Growth

Challenges impacting the South America Compound Chocolate Market growth are primarily centered around supply chain vulnerabilities and price volatility of key raw materials, particularly vegetable oils. Fluctuations in global commodity markets can significantly impact the cost of production. Stringent and varied food safety regulations across different countries within South America necessitate complex compliance strategies for manufacturers, potentially increasing operational costs and hindering cross-border trade. Intense competition from both established international brands and a multitude of local players leads to significant pricing pressures, challenging profit margins. Additionally, while consumer perception is evolving, there remains a segment of consumers who view compound chocolate as a less premium alternative to couverture chocolate, thus limiting its adoption in ultra-premium applications.

Key Players Shaping the South America Compound Chocolate Market Market

- Cargill Incorporated

- Aalst Chocolate Pte Ltd

- Santa Barbara Chocolate

- Unigra

- Sephra

- Blommer Chocolate Company

- The Barry Callebaut Group

- Puratos NV

Significant South America Compound Chocolate Market Industry Milestones

- 2019: Launch of a new range of plant-based compound chocolates by a leading manufacturer, responding to growing vegan consumer demand.

- 2020: Increased investment in automation for compound chocolate production lines by several key players to improve efficiency and quality control amidst rising labor costs.

- 2021: Introduction of sustainable sourcing initiatives for key vegetable oil ingredients by major compound chocolate producers, aligning with growing environmental consciousness.

- 2022: Merger of two regional confectionery ingredient suppliers, consolidating market presence and expanding product offerings in key South American markets.

- 2023: Emergence of novel flavor combinations, incorporating exotic South American fruits, in popular compound chocolate applications, driven by consumer appetite for unique taste experiences.

- 2024: Significant increase in demand for sugar-free and low-sugar compound chocolates, driven by heightened health awareness and the growing prevalence of lifestyle-related diseases.

Future Outlook for South America Compound Chocolate Market Market

The future outlook for the South America Compound Chocolate Market is exceptionally bright, fueled by sustained economic development and evolving consumer preferences. Strategic opportunities lie in the continued innovation of healthier product variants, such as low-sugar, sugar-free, and plant-based compound chocolates, to capture the growing health-conscious demographic. Expansion into untapped rural and emerging urban markets through strengthened distribution networks and targeted marketing efforts will be crucial. Furthermore, manufacturers focusing on unique flavor profiles incorporating local ingredients and on improving the sustainability of their supply chains will likely gain a competitive edge. The increasing adoption of e-commerce presents a significant channel for direct-to-consumer sales and market penetration, promising continued robust growth.

South America Compound Chocolate Market Segmentation

-

1. Flavor

- 1.1. Dark

- 1.2. Milk

- 1.3. White

- 1.4. Other Flavors

-

2. Product

- 2.1. Chocolate Chips/Drops/Chunks

- 2.2. Chocolate Slab

- 2.3. Chocolate Coatings

- 2.4. Other Products

-

3. Application

- 3.1. Compound Chocolates

- 3.2. Bakery

- 3.3. Confectionery

- 3.4. Ice Cream and Frozen Desserts

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Compound Chocolate Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Compound Chocolate Market Regional Market Share

Geographic Coverage of South America Compound Chocolate Market

South America Compound Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Versatile Application of Compound Chocolate in Bakery & Confectionery Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Flavor

- 5.1.1. Dark

- 5.1.2. Milk

- 5.1.3. White

- 5.1.4. Other Flavors

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Chocolate Chips/Drops/Chunks

- 5.2.2. Chocolate Slab

- 5.2.3. Chocolate Coatings

- 5.2.4. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Compound Chocolates

- 5.3.2. Bakery

- 5.3.3. Confectionery

- 5.3.4. Ice Cream and Frozen Desserts

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Flavor

- 6. Brazil South America Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Flavor

- 6.1.1. Dark

- 6.1.2. Milk

- 6.1.3. White

- 6.1.4. Other Flavors

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Chocolate Chips/Drops/Chunks

- 6.2.2. Chocolate Slab

- 6.2.3. Chocolate Coatings

- 6.2.4. Other Products

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Compound Chocolates

- 6.3.2. Bakery

- 6.3.3. Confectionery

- 6.3.4. Ice Cream and Frozen Desserts

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Flavor

- 7. Argentina South America Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Flavor

- 7.1.1. Dark

- 7.1.2. Milk

- 7.1.3. White

- 7.1.4. Other Flavors

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Chocolate Chips/Drops/Chunks

- 7.2.2. Chocolate Slab

- 7.2.3. Chocolate Coatings

- 7.2.4. Other Products

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Compound Chocolates

- 7.3.2. Bakery

- 7.3.3. Confectionery

- 7.3.4. Ice Cream and Frozen Desserts

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Flavor

- 8. Rest of South America South America Compound Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Flavor

- 8.1.1. Dark

- 8.1.2. Milk

- 8.1.3. White

- 8.1.4. Other Flavors

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Chocolate Chips/Drops/Chunks

- 8.2.2. Chocolate Slab

- 8.2.3. Chocolate Coatings

- 8.2.4. Other Products

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Compound Chocolates

- 8.3.2. Bakery

- 8.3.3. Confectionery

- 8.3.4. Ice Cream and Frozen Desserts

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Flavor

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Cargill Incorporated

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Aalst Chocolate Pte Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Santa Barbara Chocolate

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Unigra*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Sephra

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Blommer Chocolate Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 The Barry Callebaut Group

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Puratos NV

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Cargill Incorporated

List of Figures

- Figure 1: South America Compound Chocolate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Compound Chocolate Market Share (%) by Company 2025

List of Tables

- Table 1: South America Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 2: South America Compound Chocolate Market Revenue billion Forecast, by Product 2020 & 2033

- Table 3: South America Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: South America Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: South America Compound Chocolate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South America Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 7: South America Compound Chocolate Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: South America Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: South America Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: South America Compound Chocolate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: South America Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 12: South America Compound Chocolate Market Revenue billion Forecast, by Product 2020 & 2033

- Table 13: South America Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: South America Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: South America Compound Chocolate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Compound Chocolate Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 17: South America Compound Chocolate Market Revenue billion Forecast, by Product 2020 & 2033

- Table 18: South America Compound Chocolate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: South America Compound Chocolate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: South America Compound Chocolate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Compound Chocolate Market?

The projected CAGR is approximately 5.64%.

2. Which companies are prominent players in the South America Compound Chocolate Market?

Key companies in the market include Cargill Incorporated, Aalst Chocolate Pte Ltd, Santa Barbara Chocolate, Unigra*List Not Exhaustive, Sephra, Blommer Chocolate Company, The Barry Callebaut Group, Puratos NV.

3. What are the main segments of the South America Compound Chocolate Market?

The market segments include Flavor, Product, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Versatile Application of Compound Chocolate in Bakery & Confectionery Segment.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Compound Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Compound Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Compound Chocolate Market?

To stay informed about further developments, trends, and reports in the South America Compound Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence