Key Insights

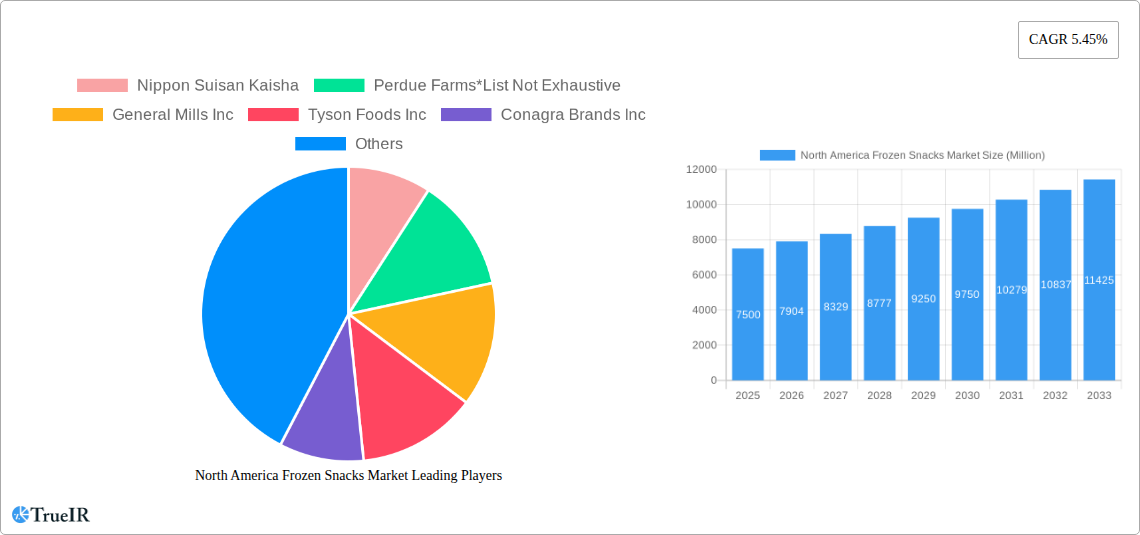

The North America Frozen Snacks Market is poised for robust growth, projected to reach a substantial market size of approximately $7,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 5.45% through 2033. This expansion is primarily fueled by evolving consumer lifestyles, characterized by an increasing demand for convenience and on-the-go food options. The busy schedules and preference for quick meal solutions are driving the adoption of frozen snacks across all demographics. Furthermore, innovations in product formulations, including healthier ingredient options and diverse flavor profiles, are significantly contributing to market expansion. The rising popularity of plant-based and meat-alternative frozen snacks, aligning with growing health and environmental consciousness, is a key trend. This segment is witnessing considerable investment and product development, attracting a wider consumer base.

North America Frozen Snacks Market Market Size (In Billion)

The market's trajectory is further supported by widespread availability through various distribution channels. Hypermarkets and supermarkets remain dominant, offering a broad selection, while the rapid growth of online retail stores is transforming consumer purchasing habits, providing enhanced accessibility and convenience. Convenience stores are also playing a crucial role in catering to immediate snacking needs. Key players like General Mills Inc., Tyson Foods Inc., and McCain Foods Limited are actively engaged in product innovation and strategic expansions to capture market share. While the market demonstrates strong growth, potential restraints include fluctuating raw material prices and increasing consumer concerns regarding the nutritional content of processed frozen foods. However, the ongoing emphasis on product quality, taste, and healthier alternatives is expected to mitigate these challenges and sustain the market's upward momentum.

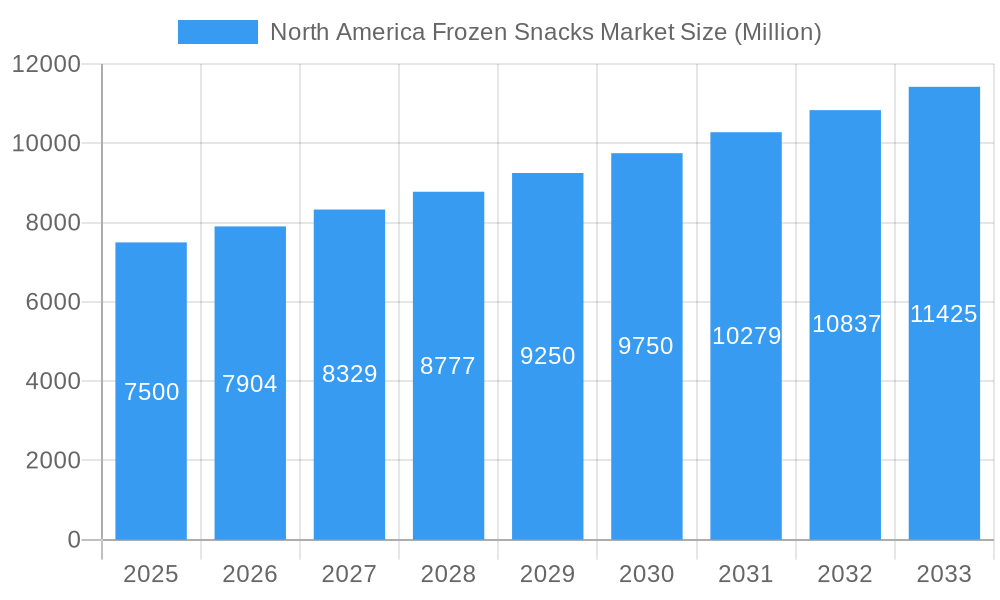

North America Frozen Snacks Market Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the North America Frozen Snacks Market. Leveraging high-volume keywords, this report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand market dynamics, emerging trends, and future growth opportunities. The study encompasses a comprehensive review from 2019 to 2033, with a base year of 2025, providing detailed forecasts and historical performance analysis.

North America Frozen Snacks Market Market Structure & Competitive Landscape

The North America frozen snacks market exhibits a moderate to high degree of concentration, with key players like General Mills Inc., Tyson Foods Inc., Conagra Brands Inc., The Kraft Heinz Company, and McCain Foods Limited holding significant market shares. The competitive landscape is characterized by continuous innovation, driven by evolving consumer preferences for healthier, convenient, and diverse snack options. Regulatory impacts, primarily concerning food safety standards and labeling requirements, play a crucial role in shaping market strategies. The availability of readily accessible product substitutes, such as fresh snacks and refrigerated ready-to-eat meals, necessitates constant product differentiation and value addition. End-user segmentation reveals a strong demand from households, food service establishments, and institutional buyers. Mergers and acquisitions (M&A) are a notable trend, with companies strategically acquiring smaller players or complementary businesses to expand their product portfolios, market reach, and technological capabilities. For instance, recent M&A activities in the broader food industry suggest a potential for consolidation within the frozen snacks segment, aimed at enhancing operational efficiencies and securing a larger market footprint. The market concentration ratio is estimated to be around 60-70%, indicating a competitive yet consolidated environment.

North America Frozen Snacks Market Market Trends & Opportunities

The North America frozen snacks market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033. This expansion is fueled by a confluence of evolving consumer lifestyles, increasing disposable incomes, and a growing demand for convenient, ready-to-eat food options. The COVID-19 pandemic significantly accelerated the adoption of frozen foods, as consumers sought to minimize grocery store visits and stock up on pantry staples. This trend continues to influence purchasing habits, with a sustained preference for frozen snacks due to their extended shelf life and ease of preparation. Technological advancements in freezing and packaging technologies are enabling manufacturers to offer a wider variety of frozen snacks with improved texture, taste, and nutritional profiles, thus catering to niche dietary requirements like plant-based and gluten-free options.

Consumer preferences are shifting towards healthier alternatives, with a growing demand for frozen snacks made with natural ingredients, lower sodium content, and reduced unhealthy fats. This presents a significant opportunity for manufacturers to innovate and develop a new generation of frozen snacks that align with health and wellness trends. The rise of online retail channels has further democratized access to frozen snacks, enabling consumers to purchase their preferred brands with convenience and speed. This shift necessitates a strong online presence and efficient cold chain logistics for manufacturers and distributors.

Furthermore, the growing influence of social media and online food bloggers is shaping consumer perceptions and driving demand for innovative and visually appealing frozen snacks. The foodservice sector, including restaurants, cafes, and catering services, is also a key driver of growth, as they increasingly incorporate frozen snacks into their menus to offer variety and convenience to their customers. The market penetration rate for frozen snacks is expected to rise steadily, driven by increased product availability and consumer awareness. The overall market size is projected to reach several tens of billions of dollars by 2033, underscoring the significant economic potential within this segment.

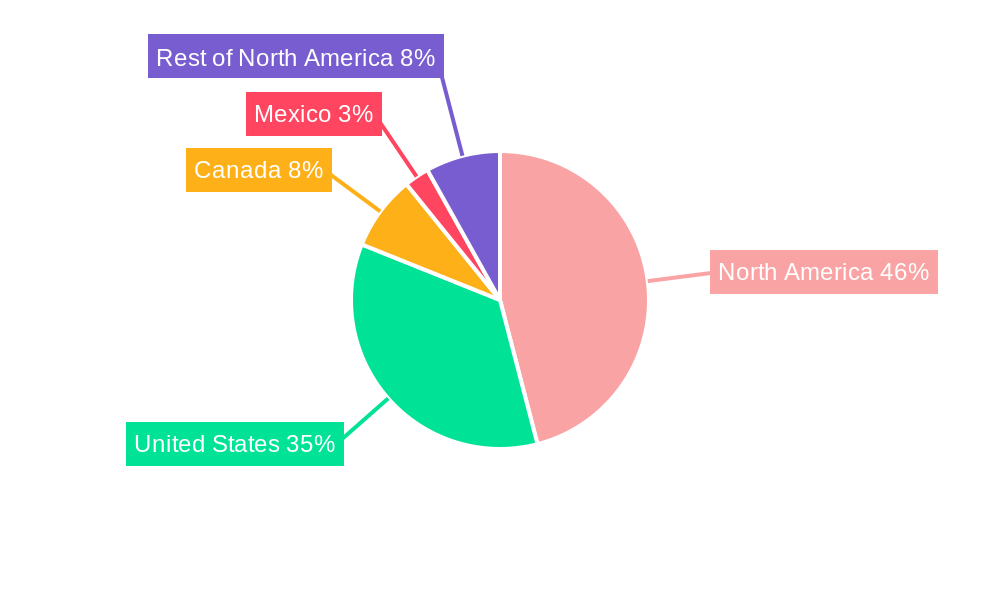

Dominant Markets & Segments in North America Frozen Snacks Market

The United States unequivocally dominates the North America frozen snacks market, accounting for a substantial majority of sales and consumption. This dominance is attributable to its large population, high disposable income, and deeply ingrained consumer habits favoring convenience foods. Within the United States, the Hypermarket/Supermarket distribution channel commands the largest market share, offering consumers a wide selection of frozen snacks and the convenience of one-stop shopping. The increasing adoption of online grocery shopping, however, is rapidly propelling Online Retail Stores to a significant and growing position within the distribution landscape.

From a product perspective, Potato-based Snacks consistently hold the largest segment share, driven by the enduring popularity of frozen fries, hash browns, and other potato-based appetizers. However, significant growth is observed in the Meat- and Seafood-based Snacks segment, fueled by innovations in plant-based alternatives and the demand for convenient protein sources. Fruit-based Snacks are also carving out a notable niche, catering to health-conscious consumers and the growing demand for convenient fruit options.

Key growth drivers for dominance in the United States include:

- Robust Retail Infrastructure: Extensive network of supermarkets, hypermarkets, and convenience stores facilitating widespread product availability.

- High Consumer Spending Power: Greater disposable income allows for discretionary spending on premium and convenience-oriented food products.

- Established Foodservice Sector: Large restaurant and catering industries consistently procure frozen snacks for menu diversification and operational efficiency.

- Growing Health and Wellness Consciousness: Increasing demand for healthier frozen snack options, spurring product innovation.

Canada and Mexico represent significant secondary markets, with their respective frozen snacks markets exhibiting steady growth. Canada's market mirrors some of the US trends, with a strong reliance on hypermarkets/supermarkets and a growing interest in healthier options. Mexico's market, while traditionally driven by different culinary preferences, is increasingly embracing frozen snacks as convenience becomes a more significant factor in household food purchasing decisions. The "Rest of North America," though smaller in aggregate, comprises emerging markets with potential for future growth as economic development and urbanization accelerate.

North America Frozen Snacks Market Product Analysis

Product innovation in the North America frozen snacks market is intensely focused on catering to evolving consumer demands for health, convenience, and taste. Manufacturers are increasingly developing plant-based and vegan frozen snack options, addressing the growing vegan and flexitarian populations. Innovations in texture and flavor encapsulation technology are enhancing the appeal of frozen snacks, ensuring they retain their desirable qualities after thawing and reheating. Gluten-free and allergen-friendly formulations are also gaining traction, broadening the market appeal. The competitive advantage lies in offering unique flavor profiles, recognizable brand endorsements, and convenient packaging solutions that cater to single-serving or family-sized consumption.

Key Drivers, Barriers & Challenges in North America Frozen Snacks Market

Key Drivers:

- Convenience and Time-Saving: The primary driver is the unparalleled convenience frozen snacks offer busy consumers.

- Extended Shelf Life: Reduced food waste and the ability to stock up are significant economic benefits.

- Product Innovation: Development of healthier, plant-based, and gourmet options is attracting new consumer segments.

- Growing Foodservice Demand: Restaurants and institutions increasingly rely on frozen snacks for menu variety and operational efficiency.

- E-commerce Growth: Online platforms provide broader accessibility and convenient purchasing options.

Barriers & Challenges:

- Supply Chain Disruptions: Maintaining the cold chain integrity from production to consumption can be challenging, leading to potential spoilage and increased costs.

- Consumer Health Concerns: Perceptions of frozen foods being less healthy than fresh alternatives persist for some consumer groups.

- Competition from Fresh Alternatives: The availability of numerous fresh snack options creates a competitive pressure.

- Energy Costs: The energy-intensive nature of freezing and cold storage operations can lead to significant operational expenses.

- Regulatory Compliance: Adhering to stringent food safety regulations and labeling requirements across different regions can be complex.

Growth Drivers in the North America Frozen Snacks Market Market

Growth in the North America frozen snacks market is propelled by escalating consumer demand for convenience and time-saving food solutions. The prolonged shelf life of frozen snacks contributes significantly to reduced food waste and enhanced inventory management for both consumers and businesses. Technological advancements in freezing and packaging are enabling manufacturers to offer a wider array of products with improved taste, texture, and nutritional content, including plant-based and gluten-free options. The expanding foodservice sector, encompassing restaurants and catering services, continues to be a robust growth engine, seeking diverse and easy-to-prepare snack items. Furthermore, the burgeoning e-commerce landscape is significantly enhancing product accessibility and distribution, driving market penetration. Economic factors such as rising disposable incomes in key demographics also support increased spending on premium and convenient frozen snack products.

Challenges Impacting North America Frozen Snacks Market Growth

The North America frozen snacks market faces several significant challenges that could impede its growth trajectory. Maintaining a consistent and unbroken cold chain from manufacturing facilities to the point of sale remains a critical logistical hurdle, susceptible to disruptions and increased operational costs. Consumer perceptions regarding the healthfulness of frozen foods, despite ongoing product innovations, continue to present a barrier for some health-conscious segments. The intense competition from a wide variety of fresh snack alternatives necessitates continuous product differentiation and marketing efforts. Energy costs associated with the freezing and refrigeration processes are substantial and can fluctuate, impacting profitability. Moreover, navigating complex and evolving food safety regulations and labeling requirements across different jurisdictions adds layers of operational and compliance challenges for manufacturers and distributors.

Key Players Shaping the North America Frozen Snacks Market Market

- Nippon Suisan Kaisha

- Perdue Farms

- General Mills Inc.

- Tyson Foods Inc.

- Conagra Brands Inc.

- The Kraft Heinz Company

- McCain Foods Limited

- J D Irving Limited

Significant North America Frozen Snacks Market Industry Milestones

- 2019: Increased investment in plant-based frozen snack development and launches.

- 2020: Surge in demand for frozen snacks driven by pandemic-induced at-home consumption trends.

- 2021: Expansion of online retail channels and direct-to-consumer (DTC) models for frozen snack delivery.

- 2022: Focus on sustainable packaging solutions and reduced environmental impact for frozen food products.

- 2023: Introduction of innovative flavor profiles and international cuisine-inspired frozen snacks.

- 2024: Growing emphasis on functional frozen snacks with added health benefits (e.g., probiotics, added vitamins).

Future Outlook for North America Frozen Snacks Market Market

The future outlook for the North America frozen snacks market remains exceptionally promising, driven by an ongoing confluence of consumer demand for convenience, innovative product development, and expanding distribution channels. Manufacturers are expected to continue prioritizing health-conscious options, including plant-based, low-calorie, and high-protein formulations, to capture a larger market share. The integration of smart technologies in packaging and supply chain management will enhance efficiency and reduce waste. The continued growth of e-commerce and the potential for further consolidation through strategic M&A activities will shape a dynamic competitive landscape. Anticipated advancements in freezing technologies will ensure superior product quality and diversity, solidifying the frozen snacks market's position as a resilient and expanding segment within the broader food industry.

North America Frozen Snacks Market Segmentation

-

1. Type

- 1.1. Fruit-based Snacks

- 1.2. Potato-based Snacks

- 1.3. Meat- and Seafood-based Snacks

- 1.4. Others

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Frozen Snacks Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Frozen Snacks Market Regional Market Share

Geographic Coverage of North America Frozen Snacks Market

North America Frozen Snacks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Supermarkets Emerged as a Prominent Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fruit-based Snacks

- 5.1.2. Potato-based Snacks

- 5.1.3. Meat- and Seafood-based Snacks

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fruit-based Snacks

- 6.1.2. Potato-based Snacks

- 6.1.3. Meat- and Seafood-based Snacks

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarket/Supermarket

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fruit-based Snacks

- 7.1.2. Potato-based Snacks

- 7.1.3. Meat- and Seafood-based Snacks

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarket/Supermarket

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fruit-based Snacks

- 8.1.2. Potato-based Snacks

- 8.1.3. Meat- and Seafood-based Snacks

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarket/Supermarket

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Frozen Snacks Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fruit-based Snacks

- 9.1.2. Potato-based Snacks

- 9.1.3. Meat- and Seafood-based Snacks

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarket/Supermarket

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nippon Suisan Kaisha

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Perdue Farms*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Mills Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Tyson Foods Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Conagra Brands Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Kraft Heinz Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 McCain Foods Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 J D Irving Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Nippon Suisan Kaisha

List of Figures

- Figure 1: North America Frozen Snacks Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Frozen Snacks Market Share (%) by Company 2025

List of Tables

- Table 1: North America Frozen Snacks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Frozen Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Frozen Snacks Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Frozen Snacks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Frozen Snacks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: North America Frozen Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Frozen Snacks Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Frozen Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Frozen Snacks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Frozen Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Frozen Snacks Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Frozen Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Frozen Snacks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: North America Frozen Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Frozen Snacks Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Frozen Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Frozen Snacks Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: North America Frozen Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Frozen Snacks Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Frozen Snacks Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Frozen Snacks Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the North America Frozen Snacks Market?

Key companies in the market include Nippon Suisan Kaisha, Perdue Farms*List Not Exhaustive, General Mills Inc, Tyson Foods Inc, Conagra Brands Inc, The Kraft Heinz Company, McCain Foods Limited, J D Irving Limited.

3. What are the main segments of the North America Frozen Snacks Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Convenient Snacking Options; Increase in Demand for New and Innovative Flavored Meat Snacks.

6. What are the notable trends driving market growth?

Supermarkets Emerged as a Prominent Segment.

7. Are there any restraints impacting market growth?

Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Frozen Snacks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Frozen Snacks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Frozen Snacks Market?

To stay informed about further developments, trends, and reports in the North America Frozen Snacks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence