Key Insights

The North American Vitamin C supplements market is projected for significant expansion, expected to reach a market size of $64.06 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 7.3%. This growth is primarily attributed to heightened consumer awareness of Vitamin C's health benefits, including immune support and antioxidant properties, especially in light of global health concerns. Increasing adoption of preventive healthcare and a focus on wellness among North American consumers are further stimulating demand. Product innovation, featuring diverse formats like gummies and powders, caters to evolving preferences beyond traditional capsules. E-commerce expansion and a greater emphasis on preventive health are also key growth catalysts.

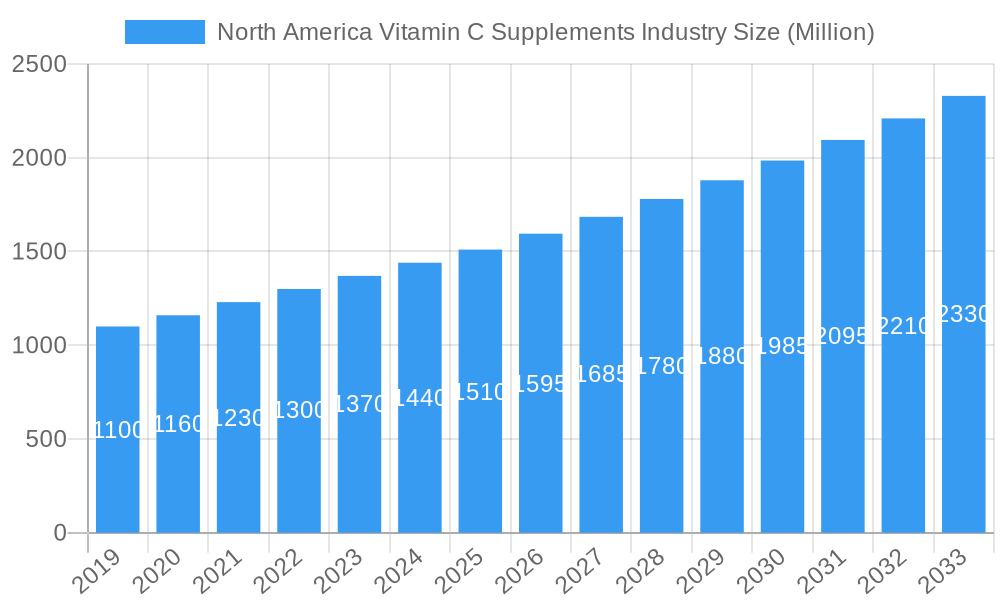

North America Vitamin C Supplements Industry Market Size (In Billion)

Key market drivers include rising health consciousness, demand for immune-boosting products, and the recognition of Vitamin C's role in skin health and collagen synthesis. Emerging trends involve enhanced bioavailability formulations and the incorporation of Vitamin C into functional foods and beverages. However, market growth may be moderated by consumer price sensitivity, potential product category saturation, and the availability of Vitamin C through natural dietary sources. Stringent regulatory frameworks for supplement claims and manufacturing practices also pose ongoing challenges. Nevertheless, robust underlying demand, fueled by a growing focus on holistic well-being and preventive healthcare, will support sustained expansion in the North American Vitamin C supplements market.

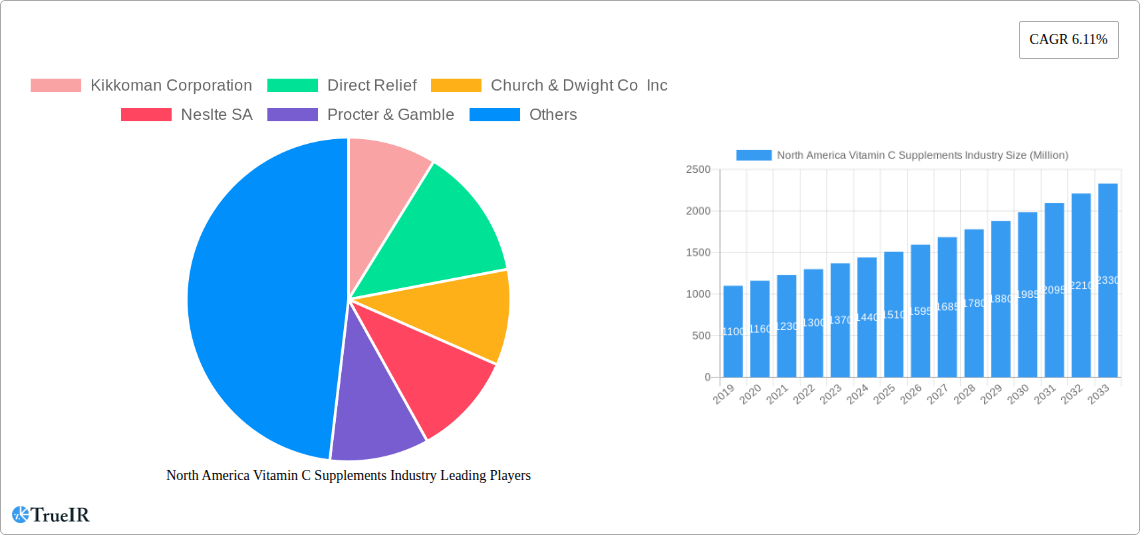

North America Vitamin C Supplements Industry Company Market Share

North America Vitamin C Supplements Industry Market Structure & Competitive Landscape

The North America Vitamin C supplements market exhibits a moderately consolidated structure, with key players like Kikkoman Corporation, Direct Relief, Church & Dwight Co Inc, Nestle SA, Procter & Gamble, Bayer AG, Otsuka Holdings Co Ltd (Nature Made), NATURELO Premium Supplements Inc, and Amway Corp holding significant market share. Innovation is a primary driver, with companies continuously investing in research and development to introduce novel formulations, enhance bioavailability, and cater to evolving consumer demands for natural and sustainably sourced ingredients. Regulatory impacts from bodies like the FDA play a crucial role, influencing product claims, manufacturing standards, and ingredient approvals, thus shaping market entry and competition.

The threat of product substitutes, while present from general health foods and fortified beverages, remains relatively low for dedicated Vitamin C supplements due to their targeted efficacy and convenience. End-user segmentation is diverse, encompassing health-conscious individuals, athletes, elderly populations, and those seeking immune support. Mergers and acquisitions (M&A) trends are observed as companies aim to expand their product portfolios, gain market access, and leverage synergistic capabilities. For instance, recent M&A activity in the broader dietary supplement space indicates a continued interest in consolidating market presence and acquiring innovative technologies. The market concentration ratio, estimated to be around 60-70% for the top five players, underscores the competitive intensity while still allowing for significant growth opportunities for niche and emerging brands.

North America Vitamin C Supplements Industry Market Trends & Opportunities

The North America Vitamin C supplements market is poised for robust expansion, driven by a growing awareness of the health benefits associated with Vitamin C, including its antioxidant properties, immune-boosting capabilities, and role in collagen synthesis. The market size for Vitamin C supplements in North America, valued at an estimated $3.5 Million in 2025, is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% over the forecast period of 2025–2033. This significant growth is fueled by several underlying trends.

Technological advancements are revolutionizing the production and delivery of Vitamin C supplements. Innovations in encapsulation techniques, such as liposomal delivery, are enhancing bioavailability and absorption, leading to more effective products. Furthermore, the development of sustained-release formulations is offering consumers more convenient dosing schedules and consistent nutrient delivery throughout the day. These technological shifts are not only improving product efficacy but also creating new market niches and competitive advantages for companies that invest in cutting-edge research.

Consumer preferences are increasingly leaning towards natural, organic, and plant-based ingredients. The demand for Vitamin C derived from natural sources like acerola cherries and rose hips is on the rise, reflecting a broader trend towards clean label products. Consumers are also seeking supplements that are free from artificial additives, preservatives, and GMOs. This preference for natural products is driving innovation in sourcing and manufacturing processes, pushing companies to adopt more sustainable and ethical practices. The convenience factor also plays a vital role, with a growing preference for easily digestible forms like gummies and powders, especially among younger demographics.

The competitive dynamics within the market are characterized by a blend of established global brands and agile, niche players. Major corporations like Nestle SA, Procter & Gamble, and Bayer AG leverage their extensive distribution networks and brand recognition, while smaller, specialized companies are differentiating themselves through product innovation, targeted marketing, and a focus on specific consumer needs, such as athletic performance or immune support during seasonal changes. The rise of e-commerce has democratized market access, enabling smaller brands to reach a wider audience and compete effectively with larger players. Increased focus on preventative healthcare and well-being post-pandemic has further accelerated market penetration rates, with an estimated 35% of the North American population now regularly consuming Vitamin C supplements. Emerging opportunities lie in the development of personalized nutrition solutions, functional foods and beverages fortified with Vitamin C, and the expansion into underserved demographics.

Dominant Markets & Segments in North America Vitamin C Supplements Industry

The North America Vitamin C supplements market exhibits dominance across several key segments, driven by distinct consumer behaviors and market dynamics.

Dominant Region: North America, encompassing the United States and Canada, represents the largest and most mature market for Vitamin C supplements. This dominance is attributed to a highly developed healthcare infrastructure, widespread consumer awareness of health and wellness, and a higher disposable income, enabling greater spending on health-related products. Government initiatives promoting preventative healthcare and a proactive approach to well-being further bolster market penetration.

Dominant Country: The United States stands as the paramount market within North America. Its large population, coupled with a strong emphasis on dietary supplements for general health, immune support, and anti-aging, fuels substantial demand. The presence of leading supplement manufacturers and retailers in the US also contributes to its market leadership.

Dominant Segment - Type: Within the "Type" segment, Vitamins naturally hold the leading position, with Vitamin C being a standalone and primary component in a vast array of formulations. However, the Minerals segment, particularly calcium and iron supplements, is also experiencing significant growth due to widespread awareness of deficiencies and their impact on overall health. The "Others" category, encompassing various botanical extracts and specialized nutrient blends, is also gaining traction as consumers seek comprehensive wellness solutions.

Dominant Segment - Form: The Capsules form continues to be a dominant choice for Vitamin C supplements due to its ease of consumption, accurate dosage control, and perceived efficacy. However, the Gummy segment is witnessing rapid expansion, especially among children and adults seeking a more palatable and chewable alternative. Powder forms are also popular, offering versatility for mixing into beverages and smoothies, catering to a health-conscious demographic that prioritizes customization.

Dominant Segment - Distribution Channel: Online Retail Stores have emerged as the fastest-growing and a highly dominant distribution channel. The convenience of home delivery, wider product selection, competitive pricing, and accessibility to consumer reviews makes e-commerce a preferred platform for a significant portion of the population. Hypermarket/Supermarket channels also maintain strong market presence due to their widespread accessibility and the ability to purchase supplements alongside other household essentials. Pharmacy/Drug Stores remain crucial for consumers seeking immediate availability and pharmacist recommendations, particularly for specific health needs. Direct Selling channels, while smaller in overall market share, cater to a loyal customer base through personalized interactions and multi-level marketing strategies.

North America Vitamin C Supplements Industry Product Analysis

Product innovations in the North America Vitamin C supplements industry are focused on enhancing efficacy, consumer appeal, and market differentiation. Companies are introducing novel formulations such as liposomal Vitamin C for improved bioavailability and sustained-release capsules for prolonged nutrient delivery. The demand for natural and organic sources, like acerola cherry and rosehip extracts, is driving product development with a focus on clean labels and minimal processing. These advancements cater to growing consumer interest in preventative health and immune support, offering competitive advantages through superior absorption rates and a commitment to natural ingredients.

Key Drivers, Barriers & Challenges in North America Vitamin C Supplements Industry

Key Drivers: The North America Vitamin C supplements industry is propelled by a confluence of factors including increasing consumer health consciousness, a growing demand for immune support products, and rising awareness of Vitamin C's antioxidant benefits. Technological advancements in bioavailability enhancement and product formulations, alongside government initiatives promoting dietary health, further fuel market growth. The aging population's increased focus on well-being and the preventative healthcare trend post-pandemic are significant growth catalysts.

Barriers & Challenges: Key challenges impacting growth include stringent regulatory frameworks governing supplement claims and manufacturing, which can increase compliance costs and product development timelines. Supply chain disruptions, particularly for natural raw ingredients, can lead to price volatility and availability issues. Intense market competition, with a proliferation of brands and product types, creates pressure on pricing and market share. Consumer confusion regarding optimal dosages and product efficacy also presents a barrier to consistent market penetration.

Growth Drivers in the North America Vitamin C Supplements Industry Market

The North America Vitamin C supplements market is experiencing robust growth driven by heightened consumer awareness regarding the immune-boosting and antioxidant properties of Vitamin C. A significant surge in demand for preventative health solutions, particularly in the wake of global health events, has accelerated market penetration. Technological advancements in supplement formulation, such as enhanced bioavailability and novel delivery systems (e.g., liposomal Vitamin C), are creating more effective and appealing products. The aging demographic's increasing focus on maintaining overall health and well-being, coupled with rising disposable incomes and a growing preference for natural and organic ingredients, further underpin this growth trajectory.

Challenges Impacting North America Vitamin C Supplements Industry Growth

Several challenges temper the otherwise optimistic growth outlook for the North America Vitamin C supplements industry. Navigating the complex and evolving regulatory landscape, including FDA guidelines on labeling and efficacy claims, can be a significant hurdle for manufacturers. Supply chain volatility, particularly concerning the sourcing of raw Vitamin C and other natural ingredients, poses risks of price fluctuations and potential shortages. The highly competitive market environment, characterized by a large number of established and emerging players, intensifies price pressures and necessitates continuous product innovation and marketing investment to maintain market share. Consumer skepticism regarding the efficacy of supplements and potential misinformation also present a barrier to sustained growth.

Key Players Shaping the North America Vitamin C Supplements Industry Market

- Kikkoman Corporation

- Direct Relief

- Church & Dwight Co Inc

- Nestle SA

- Procter & Gamble

- Bayer AG

- Otsuka Holdings Co Ltd (Nature Made)

- NATURELO Premium Supplements Inc

- Amway Corp

Significant North America Vitamin C Supplements Industry Industry Milestones

- 2019: Increased consumer interest in immune health supplements due to prevalent seasonal illnesses.

- 2020: Surge in demand for Vitamin C supplements driven by global health concerns and heightened awareness of immune support.

- 2021: Launch of new liposomal Vitamin C formulations promising enhanced bioavailability.

- 2022: Growing emphasis on natural and organic Vitamin C sources, leading to product diversification.

- 2023: Increased investment in e-commerce platforms for direct-to-consumer sales by supplement brands.

- 2024: Continued innovation in gummy and chewable Vitamin C forms to cater to wider demographics.

Future Outlook for North America Vitamin C Supplements Industry Market

The future outlook for the North America Vitamin C supplements industry is highly promising, driven by sustained consumer demand for health and wellness products. Key growth catalysts include ongoing innovation in product formulations for improved efficacy and convenience, a continued focus on natural and sustainably sourced ingredients, and the expanding role of e-commerce in market access. Strategic opportunities lie in the development of personalized nutrition solutions tailored to individual needs and the integration of Vitamin C into functional foods and beverages. The aging population and a growing emphasis on preventative healthcare will continue to fuel market expansion, positioning Vitamin C supplements as an essential component of a healthy lifestyle.

North America Vitamin C Supplements Industry Segmentation

-

1. Type

- 1.1. Vitamins

- 1.2. Minerals (Calcium, Iron, and others)

- 1.3. Essential Fatty Acids

- 1.4. Others

-

2. Form

- 2.1. Capsules

- 2.2. Powder

- 2.3. Gummy

-

3. Distribution Channel

- 3.1. Hypermarket/Supermarket

- 3.2. Online Retail Stores

- 3.3. Direct Selling

- 3.4. Pharmacy/Drug Store

- 3.5. Others

North America Vitamin C Supplements Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

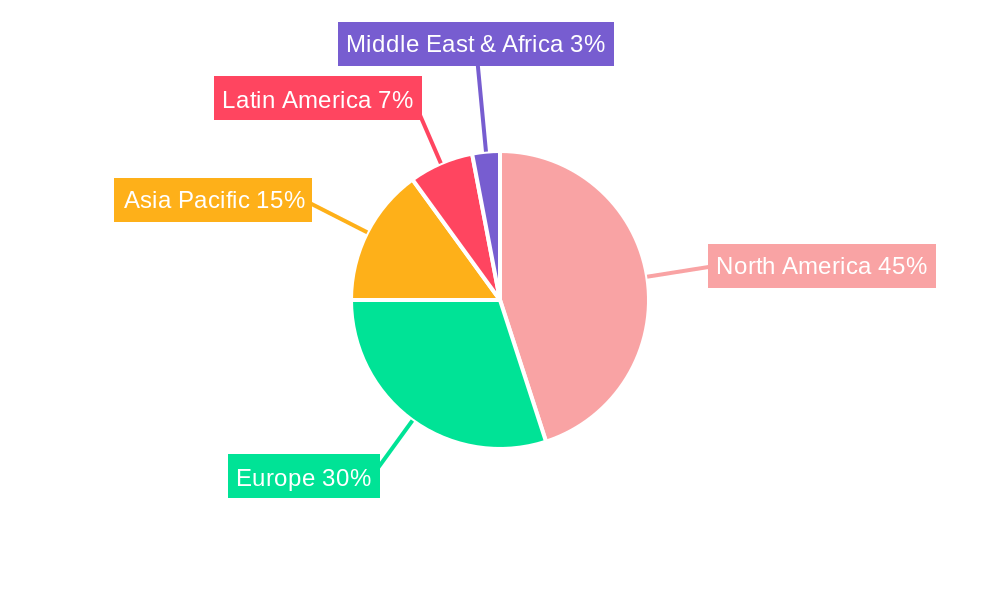

North America Vitamin C Supplements Industry Regional Market Share

Geographic Coverage of North America Vitamin C Supplements Industry

North America Vitamin C Supplements Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Consumption for Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vitamin C Supplements Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamins

- 5.1.2. Minerals (Calcium, Iron, and others)

- 5.1.3. Essential Fatty Acids

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Capsules

- 5.2.2. Powder

- 5.2.3. Gummy

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarket/Supermarket

- 5.3.2. Online Retail Stores

- 5.3.3. Direct Selling

- 5.3.4. Pharmacy/Drug Store

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kikkoman Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Direct Relief

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Church & Dwight Co Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Neslte SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Procter & Gamble

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bayer AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Otsuka Holdings Co Ltd (Nature Made)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NATURELO Premium Supplements Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amway Corp *List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kikkoman Corporation

List of Figures

- Figure 1: North America Vitamin C Supplements Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Vitamin C Supplements Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Vitamin C Supplements Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Vitamin C Supplements Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 3: North America Vitamin C Supplements Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Vitamin C Supplements Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Vitamin C Supplements Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Vitamin C Supplements Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 7: North America Vitamin C Supplements Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: North America Vitamin C Supplements Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Vitamin C Supplements Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Vitamin C Supplements Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Vitamin C Supplements Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vitamin C Supplements Industry?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the North America Vitamin C Supplements Industry?

Key companies in the market include Kikkoman Corporation, Direct Relief, Church & Dwight Co Inc, Neslte SA, Procter & Gamble, Bayer AG, Otsuka Holdings Co Ltd (Nature Made), NATURELO Premium Supplements Inc, Amway Corp *List Not Exhaustive.

3. What are the main segments of the North America Vitamin C Supplements Industry?

The market segments include Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.06 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Consumption for Dietary Supplements.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vitamin C Supplements Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vitamin C Supplements Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vitamin C Supplements Industry?

To stay informed about further developments, trends, and reports in the North America Vitamin C Supplements Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence