Key Insights

The United States Hemp Protein Market is poised for substantial growth, with an estimated market size projected to reach 26.07 million by 2025. This robust expansion is driven by a Compound Annual Growth Rate (CAGR) of 4.42. Key growth factors include escalating consumer preference for plant-based protein alternatives, influenced by health consciousness, evolving dietary trends, and increasing awareness of hemp's environmental sustainability. The Food & Beverage sector, particularly bakery and snacks, significantly contributes, integrating hemp protein for its nutritional and functional benefits. The Supplements segment, including specialized nutrition for seniors, medical applications, and sports performance, also represents a significant market driver, capitalizing on hemp protein's rich amino acid profile and digestibility.

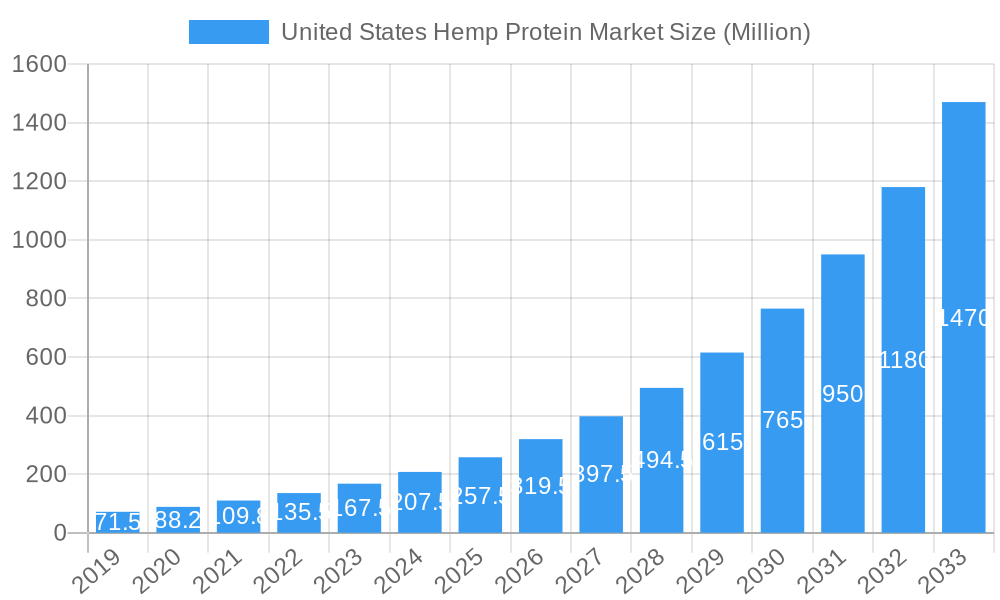

United States Hemp Protein Market Market Size (In Million)

Emerging trends shaping the market include the growing demand for organic and non-GMO certified hemp protein products. Advancements in processing technologies are enhancing texture and flavor profiles, expanding hemp protein's versatility across diverse applications. While these factors foster sustained market growth, potential restraints include fluctuations in raw material availability and pricing, alongside evolving regulatory frameworks for hemp-derived products. Despite these challenges, the persistent demand for healthy, sustainable, and effective protein sources continues to propel the United States Hemp Protein Market. Key industry players include Cooke Inc., Bioway (Xi'An) Organic Ingredients Co Ltd, and Martin Bauer Group.

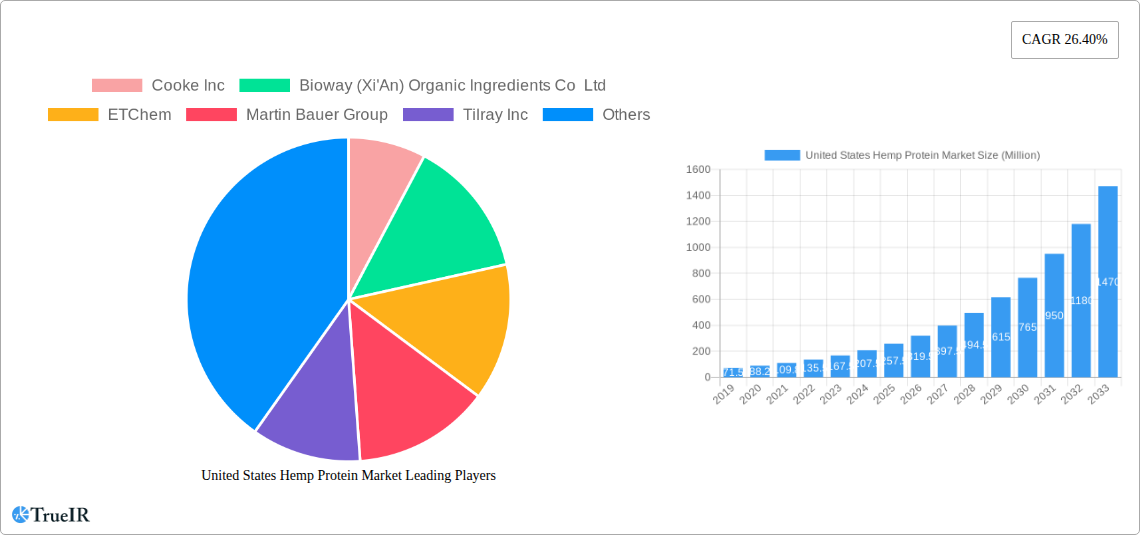

United States Hemp Protein Market Company Market Share

United States Hemp Protein Market: Comprehensive Analysis and Growth Projections (2019-2033)

This comprehensive report offers a dynamic and SEO-optimized analysis of the United States Hemp Protein Market. Utilizing high-volume keywords such as "hemp protein powder," "US hemp market," "plant-based protein," and "nutritional supplements," the report aims to improve search engine rankings and engage industry stakeholders, including manufacturers, distributors, investors, and researchers. The analysis covers the market from 2019 to 2033, with a detailed examination of the 2025 base year and a forecast period from 2025 to 2033.

United States Hemp Protein Market Market Structure & Competitive Landscape

The United States hemp protein market exhibits a moderately concentrated structure, characterized by a blend of established players and emerging innovators. Key companies such as Cooke Inc, Bioway (Xi'An) Organic Ingredients Co Ltd, ETChem, Martin Bauer Group, Tilray Inc, Axiom Foods Inc, A Costantino & C SpA, Green Source Organics, and Foodcom SA are actively competing. Innovation drivers include advancements in extraction technologies, product formulation for enhanced taste and solubility, and the development of novel hemp varieties with superior protein content and functional properties. Regulatory shifts, particularly the increasing clarity surrounding hemp cultivation and processing under federal and state laws, have significantly impacted market accessibility and product development. Product substitutes, primarily soy protein, pea protein, and whey protein, present ongoing competitive pressure, necessitating differentiation through unique selling propositions like organic sourcing, sustainability, and superior nutritional profiles. The end-user segmentation reveals robust demand across the food and beverages sector, particularly in bakery and snacks, and a significant uptake within the supplements industry, encompassing elderly nutrition, medical nutrition, and sport/performance nutrition. Mergers and acquisitions (M&A) activity, as seen with Tilray's acquisitions, plays a crucial role in consolidating market share and expanding product portfolios. For instance, the acquisition of Manitoba Harvest by Tilray signifies a strategic move to leverage established distribution networks and brand recognition. Concentration ratios are estimated to be within the XX% range for the top five players. M&A volumes are projected to grow by approximately XX% annually during the forecast period.

United States Hemp Protein Market Market Trends & Opportunities

The United States hemp protein market is experiencing robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and a growing awareness of the health and environmental benefits of plant-based proteins. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, reaching an estimated XX Million USD by the end of the forecast period. This significant expansion is fueled by an increasing demand for clean-label products, a heightened focus on sustainable sourcing, and a growing recognition of hemp protein's comprehensive amino acid profile and potential health benefits, including its rich omega-3 and omega-6 fatty acid content and digestibility. Technological shifts are central to this growth, with ongoing innovation in hemp cultivation techniques to improve yields and protein concentration, alongside advancements in processing and extraction methods that enhance product purity, texture, and flavor, addressing historical taste concerns associated with hemp protein. Opportunities abound for companies that can effectively capitalize on these trends. The "sports nutrition" segment, for example, continues to be a major growth engine, with athletes increasingly opting for plant-based protein sources for muscle recovery and performance enhancement. Similarly, the "food and beverages" segment offers substantial potential, with hemp protein being incorporated into a wider array of products, from plant-based milk alternatives and yogurts to protein bars and baked goods. Market penetration rates for hemp protein are steadily increasing, projected to reach XX% of the overall plant-based protein market by 2033. The growing adoption of hemp protein in mainstream consumer products, beyond niche health food stores, indicates a significant shift in consumer behavior. Furthermore, the development of functional hemp protein ingredients with specific applications, such as improved emulsification or binding properties, presents further avenues for market expansion and value creation. The industry's ability to meet demand while maintaining strict quality control and sustainable practices will be critical for sustained growth.

Dominant Markets & Segments in United States Hemp Protein Market

The United States hemp protein market is characterized by several dominant regions and segments, each contributing significantly to its overall growth trajectory. Within the End User category, the Food and Beverages segment, particularly Bakery and Snacks, is a powerhouse. The increasing consumer preference for convenient, healthy, and plant-based food options is driving substantial demand for hemp protein as an ingredient. In bakery products, hemp protein is being incorporated into breads, muffins, and cookies to boost their nutritional value and appeal to health-conscious consumers. Similarly, the snacks sector is witnessing a surge in protein bars, energy bites, and crisps fortified with hemp protein, capitalizing on its sustained energy release properties. The market dominance in this segment is underpinned by:

- Growing Health Consciousness: Consumers are actively seeking out ingredients that offer added nutritional benefits.

- Product Diversification: Manufacturers are innovating with novel product formulations that incorporate hemp protein seamlessly.

- Clean Label Trend: Hemp protein's natural and recognizable ingredient profile aligns perfectly with the demand for clean-label foods.

Concurrently, the Supplements segment, encompassing Elderly Nutrition and Medical Nutrition and Sport/Performance Nutrition, is another critical area of dominance. The increasing aging population and a greater focus on preventative healthcare are fueling demand for nutritional supplements designed for seniors, where hemp protein's digestibility and nutrient density are highly valued. In medical nutrition, it serves as a valuable protein source for individuals with specific dietary needs or recovery requirements. The Sport/Performance Nutrition sub-segment, however, remains a primary growth driver within supplements.

- Athlete Adoption: Athletes across various disciplines are increasingly turning to plant-based protein for muscle repair, recovery, and overall performance enhancement.

- Digestibility and Allergy Concerns: Hemp protein's hypoallergenic nature and ease of digestion make it an attractive alternative to dairy-based proteins for athletes prone to sensitivities.

- Nutritional Completeness: Its balanced amino acid profile, including essential branched-chain amino acids (BCAAs), appeals to those seeking optimal muscle synthesis.

Regionally, while the entire United States is a significant market, states with progressive agricultural policies and a strong emphasis on sustainable farming practices, such as Colorado, Oregon, and Kentucky, are emerging as leading hubs for hemp cultivation and processing, indirectly influencing the protein market's supply chain and innovation.

United States Hemp Protein Market Product Analysis

Product innovation in the United States hemp protein market is centered on enhancing consumer appeal and functionality. Manufacturers are focusing on developing hemp protein isolates and concentrates with higher protein percentages, reduced fiber content, and improved taste profiles to overcome historical palatability challenges. Technological advancements in cold-pressing and gentle extraction methods are crucial in preserving the integrity of the protein and its associated nutrients, such as omega fatty acids and antioxidants. Competitive advantages are being carved out through organic certifications, non-GMO labeling, and transparent sourcing practices that resonate with health-conscious consumers. The market is also witnessing the development of specialized hemp protein blends tailored for specific applications, such as faster absorption for post-workout recovery or sustained energy release for endurance athletes.

Key Drivers, Barriers & Challenges in United States Hemp Protein Market

The United States hemp protein market is propelled by several key drivers. Technologically, advancements in hemp cultivation and extraction are yielding higher quality and more palatable products. Economically, the growing consumer demand for plant-based and sustainable protein sources is a significant market mover. Policy-driven factors, including the Farm Bill's legalization of industrial hemp, have opened up agricultural opportunities and supply chains. The increasing awareness of hemp protein's nutritional completeness and hypoallergenic properties further fuels demand.

However, the market faces significant challenges and restraints. Supply chain issues, including inconsistencies in crop yields and quality due to weather or pest infestations, can impact availability and pricing. Regulatory hurdles, despite the Farm Bill, can still exist at state levels and regarding specific product claims. Competitive pressures from established plant-based proteins like soy and pea, as well as conventional animal-based proteins, necessitate continuous innovation and marketing efforts. The estimated impact of these challenges on market growth is approximately XX% reduction in potential CAGR if not addressed effectively.

Growth Drivers in the United States Hemp Protein Market Market

Key drivers fueling the United States hemp protein market growth include a burgeoning consumer preference for plant-based diets and a heightened awareness of the health benefits associated with hemp. Technological innovations in hemp cultivation and extraction processes are leading to improved product quality, taste, and bioavailability, making hemp protein more appealing to a wider audience. Economic factors such as the declining cost of production and increasing availability of hemp biomass are also contributing to market expansion. Furthermore, supportive government policies and increasing investments in research and development for hemp-derived products are creating a favorable environment for growth.

Challenges Impacting United States Hemp Protein Market Growth

Challenges impacting United States hemp protein market growth are multifaceted. Regulatory complexities at both federal and state levels, although improving, can still present hurdles in terms of production, processing, and labeling requirements. Supply chain vulnerabilities, including the potential for crop damage, pest issues, and logistical bottlenecks, can lead to price volatility and inconsistent product availability. Intense competitive pressure from well-established plant-based protein sources like soy and pea protein, which often have lower price points and wider market penetration, also poses a significant challenge. Consumer perception and education regarding the benefits and quality of hemp protein also remain an ongoing area requiring attention to overcome historical misconceptions.

Key Players Shaping the United States Hemp Protein Market Market

- Cooke Inc

- Bioway (Xi'An) Organic Ingredients Co Ltd

- ETChem

- Martin Bauer Group

- Tilray Inc

- Axiom Foods Inc

- A Costantino & C SpA

- Green Source Organics

- Foodcom SA

Significant United States Hemp Protein Market Industry Milestones

- July 2021: Tilray Brands Inc.'s subsidiary Manitoba Harvest announced a new research partnership to drive innovation in hemp and pea protein with a consortium of industry leaders through Protein Industries Canada to develop new hemp and pea varieties with increased protein content, differential starch content, and improved texture.

- December 2019: Privateer Holdings Inc. merged with Tilray Brands Inc., a global pioneer in cannabis research, cultivation, production, and distribution.

- February 2019: Tilray acquired Manitoba Harvest from Compass Group Diversified Holdings LLC. Manitoba Harvest is one of the largest hemp food manufacturers and distributes a broad-based portfolio of hemp-based products. It is the parent company of Hemp Oil Canada.

Future Outlook for United States Hemp Protein Market Market

The future outlook for the United States hemp protein market is exceptionally bright, poised for sustained expansion and innovation. Growth catalysts include the continued evolution of consumer demand for sustainable, plant-based, and functional foods and supplements. Strategic opportunities lie in further product diversification, catering to specific dietary needs and lifestyle trends, such as keto-friendly or allergen-free formulations. Advancements in processing technology are expected to enhance product quality and affordability, driving wider market adoption. Increased investment in R&D will likely unlock new applications and health benefits of hemp protein, solidifying its position as a premium ingredient in the global health and wellness landscape. The market potential is estimated to reach XX Million USD by 2033.

United States Hemp Protein Market Segmentation

-

1. End User

-

1.1. Food and Beverages

-

1.1.1. By Sub End User

- 1.1.1.1. Bakery

- 1.1.1.2. Snacks

-

1.1.1. By Sub End User

-

1.2. Supplements

- 1.2.1. Elderly Nutrition and Medical Nutrition

- 1.2.2. Sport/Performance Nutrition

-

1.1. Food and Beverages

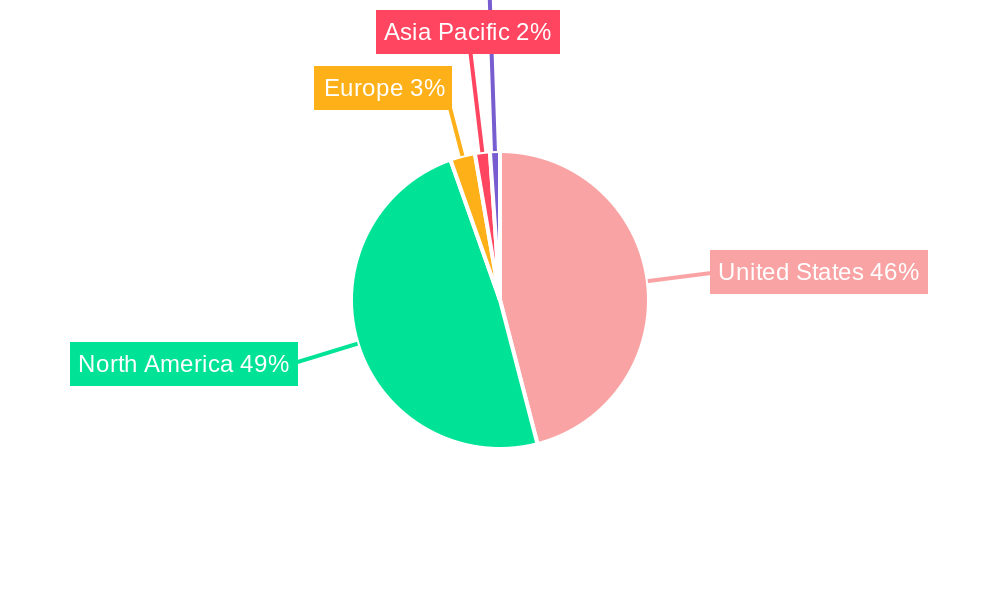

United States Hemp Protein Market Segmentation By Geography

- 1. United States

United States Hemp Protein Market Regional Market Share

Geographic Coverage of United States Hemp Protein Market

United States Hemp Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hemp Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Food and Beverages

- 5.1.1.1. By Sub End User

- 5.1.1.1.1. Bakery

- 5.1.1.1.2. Snacks

- 5.1.1.1. By Sub End User

- 5.1.2. Supplements

- 5.1.2.1. Elderly Nutrition and Medical Nutrition

- 5.1.2.2. Sport/Performance Nutrition

- 5.1.1. Food and Beverages

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cooke Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bioway (Xi'An) Organic Ingredients Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ETChem

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Martin Bauer Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tilray Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axiom Foods Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 A Costantino & C SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Green Source Organics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Foodcom SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cooke Inc

List of Figures

- Figure 1: United States Hemp Protein Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United States Hemp Protein Market Share (%) by Company 2025

List of Tables

- Table 1: United States Hemp Protein Market Revenue million Forecast, by End User 2020 & 2033

- Table 2: United States Hemp Protein Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: United States Hemp Protein Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: United States Hemp Protein Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hemp Protein Market?

The projected CAGR is approximately 4.42%.

2. Which companies are prominent players in the United States Hemp Protein Market?

Key companies in the market include Cooke Inc, Bioway (Xi'An) Organic Ingredients Co Ltd, ETChem, Martin Bauer Group, Tilray Inc, Axiom Foods Inc, A Costantino & C SpA, Green Source Organics, Foodcom SA.

3. What are the main segments of the United States Hemp Protein Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.07 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

July 2021: Tilray Brands Inc.'s subsidiary Manitoba Harvest announced a new research partnership to drive innovation in hemp and pea protein with a consortium of industry leaders through Protein Industries Canada to develop new hemp and pea varieties with increased protein content, differential starch content, and improved texture.December 2019: Privateer Holdings Inc. merged with Tilray Brands Inc., a global pioneer in cannabis research, cultivation, production, and distribution.February 2019: Tilray acquired Manitoba Harvest from Compass Group Diversified Holdings LLC. Manitoba Harvest is one of the largest hemp food manufacturers and distributes a broad-based portfolio of hemp-based products. It is the parent company of Hemp Oil Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hemp Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hemp Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hemp Protein Market?

To stay informed about further developments, trends, and reports in the United States Hemp Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence