Key Insights

The France water enhancer market is projected for significant expansion, forecast to reach $1.25 billion by 2033, exhibiting a robust compound annual growth rate (CAGR) of 10.2% from a base year of 2021. This growth is propelled by escalating consumer demand for healthier beverage options and convenient, personalized hydration solutions. Water enhancers, offering a low-calorie, flavorful method to increase water consumption, resonate strongly with health-conscious French consumers. This trend is further amplified by rising disposable incomes and increased awareness of hydration's health benefits, driving sales across diverse retail channels. Market dynamics are also shaped by novel product introductions, emphasizing natural ingredients and functional benefits to appeal to consumers seeking both taste and wellness.

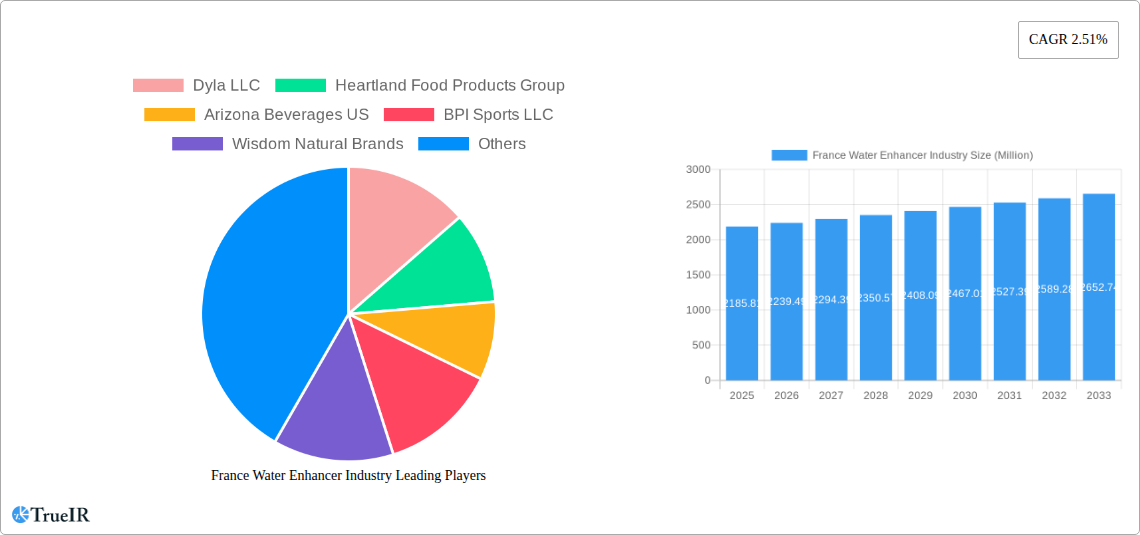

France Water Enhancer Industry Market Size (In Billion)

Key growth catalysts include the expanding adoption of e-commerce for grocery purchases, enhancing consumer access to a broad spectrum of water enhancer products. Hypermarkets and supermarkets remain vital retail venues, offering prominent placement and promotional avenues for manufacturers. Conversely, potential market restraints encompass volatile raw material costs, intense competition from established and new brands, and a rising consumer preference for minimally processed beverages, which may moderate the uptake of highly formulated enhancers. Notwithstanding these factors, the overall outlook for the France water enhancer market is optimistic, sustained by ongoing innovation, robust consumer demand for healthier alternatives, and evolving retail strategies.

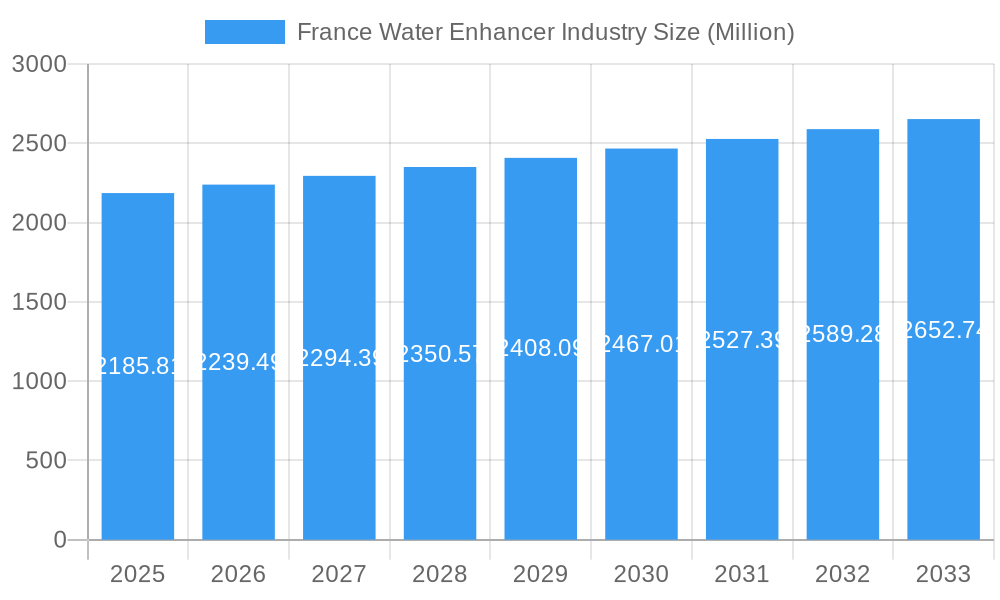

France Water Enhancer Industry Company Market Share

France Water Enhancer Industry: Comprehensive Market Analysis & Growth Forecast (2019–2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the France Water Enhancer Market. Leveraging high-volume keywords such as "France water enhancer market size," "water enhancer trends France," and "functional beverage market France," this report is designed to attract industry professionals, investors, and market strategists. We offer critical insights into market structure, competitive landscape, trends, opportunities, dominant segments, product innovations, key drivers, challenges, and a forward-looking outlook, all meticulously structured for clarity and actionable intelligence. The study encompasses a comprehensive historical period from 2019 to 2024, with the base year set for 2025 and an extensive forecast period extending to 2033.

France Water Enhancer Industry Market Structure & Competitive Landscape

The France water enhancer market exhibits a moderate to high concentration, with key players like Dyla LLC, Heartland Food Products Group, Arizona Beverages US, BPI Sports LLC, and Wisdom Natural Brands holding significant shares. Innovation is primarily driven by the demand for healthier beverage options, with a surge in sugar-free, natural ingredient, and functional benefit-infused water enhancers. Regulatory impacts are increasingly focused on clear labeling of ingredients and nutritional information, influencing product development and marketing strategies. Product substitutes include flavored waters, juices, and other functional beverages, necessitating continuous differentiation by water enhancer manufacturers. End-user segmentation reveals a strong preference for functional benefits such as hydration, energy, and relaxation, alongside taste preferences. Merger and acquisition (M&A) activities, while not exceptionally high, are strategic, focusing on consolidating market presence or acquiring innovative technologies, with an estimated two to three significant M&A deals annually within the broader beverage enhancer space in Europe impacting France. The market concentration ratio for the top three players is estimated to be around 45%.

France Water Enhancer Industry Market Trends & Opportunities

The France water enhancer market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period of 2025–2033. This expansion is fueled by a confluence of evolving consumer preferences and technological advancements. The increasing health consciousness among French consumers, particularly millennials and Gen Z, is a primary driver. There is a discernible shift away from sugary beverages towards healthier alternatives, positioning water enhancers as an attractive option for customizable hydration with added benefits. The market size in the base year of 2025 is estimated to be around €150 Million.

Technological shifts are playing a crucial role, with innovations in flavoring agents, natural sweeteners, and encapsulation technologies enabling the development of more appealing and functional products. The demand for natural and organic ingredients is on the rise, prompting manufacturers to invest in research and development for plant-based formulations and ethically sourced components. Furthermore, the integration of functional ingredients such as vitamins, minerals, electrolytes, and adaptogens is creating new product categories and attracting a wider consumer base seeking specific health outcomes, from improved immunity to enhanced cognitive function.

Consumer preferences are increasingly leaning towards convenience and personalization. Water enhancers, in their compact and easy-to-use formats, perfectly cater to the on-the-go lifestyle prevalent in France. Online channels are emerging as a dominant distribution force, offering wider product selection and personalized recommendations, contributing to an estimated 30% market penetration rate for water enhancers through e-commerce platforms. The competitive dynamics are intensifying, with both established beverage giants and agile startups vying for market share. This competition fosters innovation and drives down prices, making water enhancers more accessible to a broader demographic. Opportunities lie in developing niche products catering to specific dietary needs (e.g., keto-friendly, vegan), expanding into untapped distribution channels, and leveraging digital marketing to build brand loyalty and educate consumers about the benefits of water enhancers. The overall market volume is projected to reach over 1.2 Billion Units by 2033.

Dominant Markets & Segments in France Water Enhancer Industry

The Online Channels segment is emerging as a dominant force within the France water enhancer market, driven by evolving consumer shopping habits and the inherent convenience it offers. This segment is projected to capture an increasing market share, estimated to grow by 15% annually over the forecast period.

- Online Channels: The rapid adoption of e-commerce platforms in France, coupled with the accessibility and vast product variety offered online, makes it a primary destination for water enhancer purchases. Consumers benefit from competitive pricing, user reviews, and direct-to-consumer options, fostering significant growth. The ease of purchasing niche and specialty water enhancers online further bolsters its dominance. The market size for online distribution is expected to reach €70 Million by 2025.

- Hypermarkets/Supermarkets: While traditionally strong, hypermarkets and supermarkets are facing increased competition from online channels. However, their extensive reach and ability to offer impulse purchases and bulk discounts ensure their continued relevance. Strategic product placement and promotional activities will be key to maintaining their market share. Key growth drivers in this segment include increased store traffic for essential goods and the growing demand for health-focused beverages in mainstream retail. This segment is estimated to hold a 35% market share.

- Convenience Stores: Convenience stores cater to immediate needs and on-the-go consumption. Their role is crucial for impulse buys and reaching consumers who prioritize immediate availability. Expansion of smaller, portable packaging options and targeted promotions can enhance growth in this segment. The demand for quick refreshment solutions is a key driver.

- Other Distribution Channels: This category encompasses specialized health food stores, pharmacies, and direct-to-consumer subscription services. These channels often target specific consumer groups seeking premium or specialized products. Growth here is driven by niche market penetration and the increasing consumer interest in personalized health solutions.

France Water Enhancer Industry Product Analysis

Product innovation in the France water enhancer industry centers on natural ingredients, functional benefits, and diverse flavor profiles. Companies are focusing on creating sugar-free, low-calorie options infused with vitamins, electrolytes, and adaptogens to cater to the growing health and wellness trend. Competitive advantages are being forged through unique flavor combinations, extended shelf-life formulations, and eco-friendly packaging. The market fit is increasingly being achieved by aligning products with specific consumer needs, such as post-workout recovery, enhanced focus, or stress reduction. Technological advancements in flavor encapsulation and natural preservation techniques are crucial for sustained market competitiveness.

Key Drivers, Barriers & Challenges in France Water Enhancer Industry

Key Drivers: The France water enhancer market is propelled by a strong emphasis on health and wellness, with consumers actively seeking low-sugar, low-calorie beverage alternatives. The growing demand for natural ingredients and functional benefits (e.g., vitamins, electrolytes) is a significant catalyst. Technological advancements in flavoring and formulation are enabling more appealing and diverse product offerings. Furthermore, the convenience and portability of water enhancers align perfectly with the on-the-go lifestyles prevalent in France.

Barriers & Challenges: Despite robust growth, the industry faces challenges. Stricter regulations regarding health claims and ingredient transparency can impact marketing and product development. Intense competition from established beverage categories and emerging substitutes necessitates continuous innovation and competitive pricing strategies. Supply chain complexities and the sourcing of natural ingredients can also pose logistical hurdles. Consumer education remains crucial to differentiate water enhancers from artificial flavored drinks and to highlight their specific health benefits, with an estimated 10-15% of the target consumer base requiring ongoing education.

Growth Drivers in the France Water Enhancer Industry Market

Key growth drivers in the France water enhancer industry are deeply rooted in the evolving consumer landscape. The increasing health consciousness among the French population is a primary catalyst, leading to a significant demand for low-sugar and calorie-free beverage options. This aligns perfectly with the core offering of water enhancers. Furthermore, the growing trend towards functional beverages, incorporating vitamins, minerals, electrolytes, and herbal extracts for specific health benefits like energy, focus, or relaxation, presents a substantial opportunity. Technological advancements in natural flavoring and sweetener technologies are enabling the creation of more palatable and diverse product portfolios, expanding consumer appeal.

Challenges Impacting France Water Enhancer Industry Growth

Several challenges can impede the growth trajectory of the France water enhancer industry. Regulatory complexities surrounding health claims and ingredient disclosures can necessitate extensive product reformulation and compliance efforts. Supply chain disruptions, particularly in sourcing natural and premium ingredients, can impact product availability and cost. Intense competition from established soft drink manufacturers and the burgeoning market for flavored waters and ready-to-drink functional beverages also pose a significant threat. Consumer perception and the need for effective education campaigns to differentiate water enhancers from less healthy alternatives remain a constant challenge, potentially limiting market penetration to an estimated 60% of the addressable market.

Key Players Shaping the France Water Enhancer Industry Market

- Dyla LLC

- Heartland Food Products Group

- Arizona Beverages US

- BPI Sports LLC

- Wisdom Natural Brands

Significant France Water Enhancer Industry Industry Milestones

- 2019: Increased consumer interest in plant-based and natural ingredients gains momentum, influencing product development in the water enhancer sector.

- 2020: The COVID-19 pandemic accelerates the adoption of online grocery shopping and direct-to-consumer delivery models, significantly boosting online sales for water enhancers.

- 2021: Launch of several new product lines featuring functional benefits like enhanced immunity and cognitive support, reflecting evolving consumer health priorities.

- 2022: Growing awareness of sugar's negative health impacts drives further demand for sugar-free and low-calorie alternatives, benefiting water enhancer sales.

- 2023: Introduction of sustainable and eco-friendly packaging solutions by key players, aligning with increasing consumer demand for environmentally conscious products. Estimated market share gain for sustainable products at 5%.

- 2024: Intensified focus on personalized nutrition and customized beverage experiences, paving the way for innovative, adaptable water enhancer formulations.

Future Outlook for France Water Enhancer Industry Market

The future outlook for the France water enhancer industry is exceptionally promising, driven by continued consumer demand for healthy, convenient, and functional beverage solutions. Strategic opportunities lie in expanding product lines to cater to niche dietary needs and specific health goals, further leveraging online channels for direct consumer engagement and personalized marketing. Innovations in natural ingredients and sustainable packaging will be crucial for maintaining brand loyalty and market relevance. The market is projected to witness sustained growth, with an estimated market size reaching €300 Million by 2033, indicating a significant expansion in market penetration and consumer adoption.

France Water Enhancer Industry Segmentation

-

1. Distribution Channel

- 1.1. Hypermarkets/Supermarkets

- 1.2. Convenience Stores

- 1.3. Online Channels

- 1.4. Other Distribution Channels

France Water Enhancer Industry Segmentation By Geography

- 1. France

France Water Enhancer Industry Regional Market Share

Geographic Coverage of France Water Enhancer Industry

France Water Enhancer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Lower Immunity and Lagging Health May Surge the Future Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Hypermarkets/Supermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Online Channels

- 5.1.4. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Germany France Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 7. France France Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 8. Italy France Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom France Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands France Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 11. Rest of Europe France Water Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dyla LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Heartland Food Products Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Arizona Beverages US

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BPI Sports LLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Wisdom Natural Brands

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.1 Dyla LLC

List of Figures

- Figure 1: France Water Enhancer Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Water Enhancer Industry Share (%) by Company 2025

List of Tables

- Table 1: France Water Enhancer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 2: France Water Enhancer Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: France Water Enhancer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Water Enhancer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Germany France Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: France France Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Italy France Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: United Kingdom France Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Netherlands France Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of Europe France Water Enhancer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Water Enhancer Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: France Water Enhancer Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Water Enhancer Industry?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the France Water Enhancer Industry?

Key companies in the market include Dyla LLC, Heartland Food Products Group, Arizona Beverages US, BPI Sports LLC, Wisdom Natural Brands.

3. What are the main segments of the France Water Enhancer Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Lower Immunity and Lagging Health May Surge the Future Demand.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Water Enhancer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Water Enhancer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Water Enhancer Industry?

To stay informed about further developments, trends, and reports in the France Water Enhancer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence