Key Insights

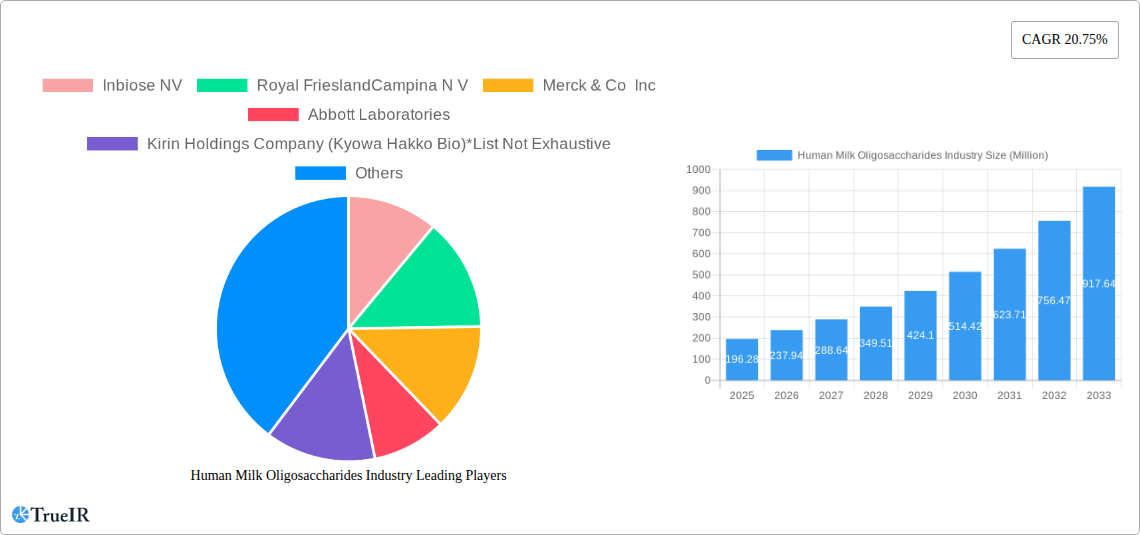

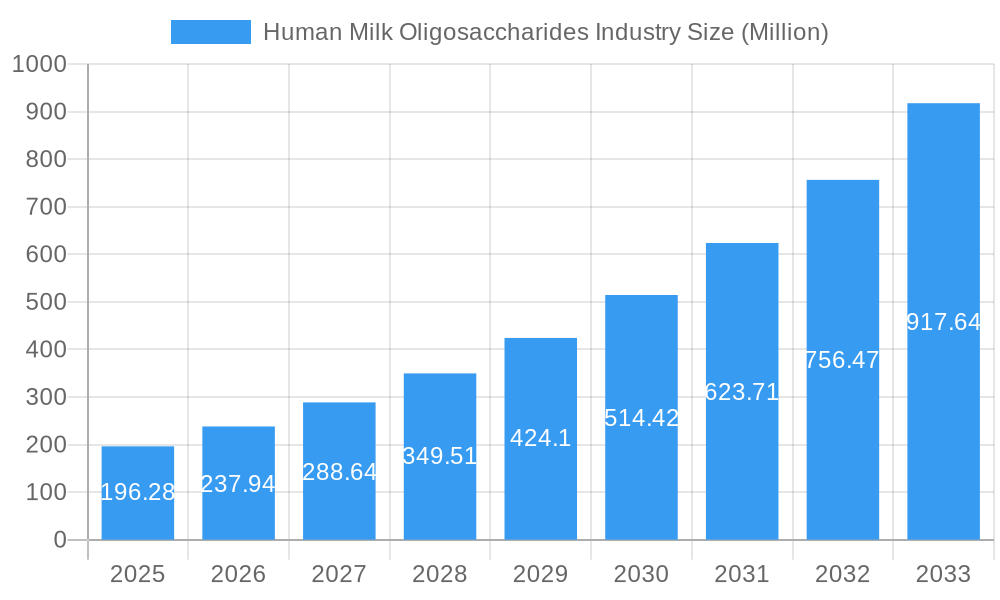

The Human Milk Oligosaccharides (HMOs) market is experiencing robust expansion, projected to reach USD 196.28 million in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 20.75% through 2033. This significant growth is primarily propelled by increasing consumer awareness regarding the health benefits of HMOs, particularly for infant gut health and immune development. The rising demand for premium infant nutrition products, coupled with advancements in research and development leading to novel applications of HMOs in dietary supplements and functional foods, are key drivers. The infant formula segment is expected to dominate the market, fueled by a global surge in birth rates and a growing preference for breast milk alternatives that mimic the nutritional and immunological advantages of human milk. Furthermore, the increasing prevalence of digestive disorders and a growing focus on preventative healthcare are creating new avenues for HMOs in the dietary supplement and functional food and beverage sectors, catering to a broader consumer base beyond infants.

Human Milk Oligosaccharides Industry Market Size (In Million)

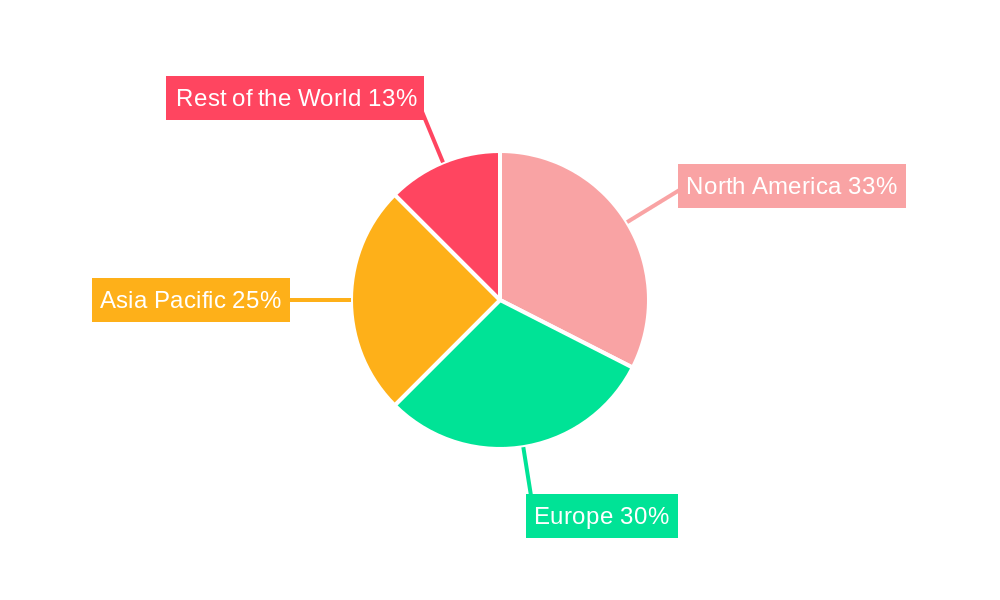

Despite the optimistic growth trajectory, the market faces certain restraints. The high cost of production for synthetic HMOs and regulatory hurdles associated with new product approvals in different regions can pose challenges. However, ongoing technological innovations in manufacturing processes are aimed at reducing production costs and improving scalability, which are expected to mitigate these restraints. Geographically, North America and Europe are anticipated to lead the market, owing to high disposable incomes, advanced healthcare infrastructure, and a well-established consumer base for health and wellness products. The Asia Pacific region, driven by rapidly developing economies like China and India, is poised for substantial growth due to increasing disposable incomes and a growing middle class with a higher propensity to spend on premium infant care and health products. Key players are actively investing in research and expansion strategies to capture market share and address the escalating demand for these vital oligosaccharides.

Human Milk Oligosaccharides Industry Company Market Share

Human Milk Oligosaccharides Industry: Market Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Human Milk Oligosaccharides (HMOs) industry, providing in-depth analysis and forecasts from 2019 to 2033, with a base year of 2025. Leveraging high-volume keywords such as "human milk oligosaccharides market," "HMO applications," "infant formula prebiotics," and "nutraceutical ingredients," this report is optimized for search engines and tailored for industry professionals seeking actionable insights. We cover market structure, trends, dominant segments, product innovations, key drivers, challenges, leading players, significant milestones, and the future outlook.

Human Milk Oligosaccharides Industry Market Structure & Competitive Landscape

The Human Milk Oligosaccharides (HMOs) market is characterized by a growing, yet moderately concentrated, competitive landscape. Innovation is a key driver, with significant investments in research and development by leading players to discover and synthesize novel HMO structures and optimize production processes. Regulatory impacts are substantial, as approvals from bodies like the US FDA and EFSA are crucial for market entry, particularly in infant formula applications. Product substitutes, primarily other prebiotics and probiotics, exist but HMOs offer unique, naturally derived benefits. End-user segmentation is dominated by infant formula manufacturers, with growing interest from the dietary supplements and functional food and beverage sectors. Mergers and acquisitions (M&A) trends are on the rise as companies seek to expand their portfolios and market reach. Anticipated M&A volumes in the coming forecast period are estimated to exceed $500 Million, indicating consolidation and strategic partnerships.

Human Milk Oligosaccharides Industry Market Trends & Opportunities

The global Human Milk Oligosaccharides (HMOs) market is experiencing robust growth, driven by increasing scientific understanding of their profound health benefits and rising consumer demand for science-backed nutritional products. The market size is projected to reach an estimated $1,500 Million by 2025 and is forecasted to grow at a Compound Annual Growth Rate (CAGR) of approximately 18% from 2025 to 2033. Technological shifts in manufacturing processes, including advancements in fermentation and enzymatic synthesis, are enabling more cost-effective and scalable production of various HMO types, such as 2'-fucosyllactose (2'-FL) and lacto-N-neotetraose (LNnT). These technological innovations are crucial for meeting the growing demand from infant nutrition, where HMOs are increasingly recognized for their role in promoting gut health, immune development, and cognitive function in infants.

Consumer preferences are shifting towards natural and functional ingredients, positioning HMOs as a premium ingredient in infant formula and a promising addition to dietary supplements and functional foods targeting gut health and immune support. Competitive dynamics are intensifying, with established players investing heavily in R&D and new market entrants emerging. The market penetration rate for HMOs in developed infant formula markets is estimated to be around 40% and is expected to rise significantly as more brands incorporate these beneficial oligosaccharides. Opportunities abound for companies focusing on cost-effective production, novel HMO formulations, and expanding applications beyond infant nutrition. The rise of personalized nutrition further presents a unique avenue for HMOs, catering to specific health needs.

Dominant Markets & Segments in Human Milk Oligosaccharides Industry

The Infant Formula segment stands as the undisputed dominant market within the Human Milk Oligosaccharides (HMOs) industry, capturing an estimated 75% of the total market share in 2025. This dominance is fueled by extensive scientific research validating the benefits of HMOs in mimicking the composition of human breast milk, crucial for infant gut microbiota development and immune system maturation.

- Key Growth Drivers in Infant Formula:

- Rising Birth Rates & Increased Demand for Premium Infant Nutrition: Globally, a consistent rise in birth rates, particularly in emerging economies, coupled with parents' increasing willingness to invest in premium, scientifically advanced infant formulas, propels HMO demand.

- Scientific Endorsement & Regulatory Approvals: The growing body of scientific evidence supporting HMO benefits, alongside favorable regulatory approvals in key markets like the US, Europe, and Australia, significantly enhances market acceptance.

- Brand Differentiation & Marketing: Manufacturers leverage the inclusion of HMOs as a key differentiator in their product marketing, appealing to health-conscious parents seeking optimal infant development.

The Dietary Supplements segment represents the second-largest market, projected to hold approximately 15% of the market share by 2025. This segment is experiencing rapid growth due to increasing consumer awareness of gut health and immunity as integral components of overall well-being, extending beyond infancy.

- Key Growth Drivers in Dietary Supplements:

- Growing Health Consciousness: A broader societal trend towards preventative health and wellness drives demand for functional ingredients like HMOs that support a healthy gut microbiome.

- Expanding Research Beyond Infancy: Emerging research into the benefits of HMOs for adult gut health, immune modulation, and even cognitive function is opening new avenues for supplement formulations.

- Convenience and Accessibility: Dietary supplements offer a convenient way for individuals of all ages to incorporate HMOs into their daily routines.

The Functional Food and Beverage segment, though smaller with an estimated 10% market share in 2025, is exhibiting significant growth potential. This segment is expected to witness a CAGR of over 20% in the forecast period.

- Key Growth Drivers in Functional Food and Beverage:

- Product Innovation: Food and beverage manufacturers are actively exploring the integration of HMOs into a variety of products, including yogurts, cereals, and beverages, to enhance their health propositions.

- Targeted Health Claims: The potential for functional foods and beverages to make specific health claims related to gut health and immunity, supported by HMOs, is a strong market driver.

- Evolving Consumer Lifestyles: Busy lifestyles and a desire for convenient nutritional solutions make functional foods and beverages an attractive option for consumers seeking health benefits.

Human Milk Oligosaccharides Industry Product Analysis

The Human Milk Oligosaccharides (HMOs) industry is witnessing rapid product innovation driven by advancements in biotechnology and a deeper understanding of the diverse functionalities of various HMO structures. Key innovations focus on the efficient and scalable synthesis of specific HMOs like 2'-fucosyllactose (2'-FL), lacto-N-neotetraose (LNnT), and 3'-sialyllactose (3'-SL), which offer distinct benefits for gut health and immune development. These advanced production methods, including enzymatic synthesis and microbial fermentation, enhance purity and reduce production costs, making HMOs more accessible for commercial applications. Competitive advantages lie in the ability to produce high-purity, well-characterized HMO ingredients that meet stringent regulatory standards for use in infant formula, dietary supplements, and functional foods.

Key Drivers, Barriers & Challenges in Human Milk Oligosaccharides Industry

Key Drivers:

- Technological Advancements: Innovations in fermentation and enzymatic synthesis are enabling cost-effective, large-scale production of diverse HMOs.

- Growing Scientific Evidence: A substantial body of research validates the health benefits of HMOs for gut health, immune function, and cognitive development, particularly in infants.

- Increasing Consumer Demand for Natural and Functional Ingredients: Consumers are actively seeking out ingredients that offer tangible health benefits, positioning HMOs as a desirable addition to food and supplement products.

- Regulatory Approvals and Support: Favorable regulatory assessments and approvals from key health authorities globally are crucial for market access and consumer confidence.

Barriers & Challenges:

- High Production Costs: Despite advancements, the production of certain complex HMOs remains expensive, impacting affordability and widespread adoption.

- Regulatory Hurdles: Navigating complex and varying regulatory landscapes across different regions can be a significant challenge for market entry and expansion.

- Supply Chain Complexity: Ensuring a consistent and high-quality supply of raw materials and finished HMO products can be intricate, requiring robust supply chain management.

- Competition from Existing Prebiotics: Established prebiotics like inulin and FOS offer alternative solutions, necessitating strong differentiation and clear communication of HMO benefits. The projected market for other prebiotics exceeds $8,000 Million, presenting significant competition.

Growth Drivers in the Human Milk Oligosaccharides Industry Market

The Human Milk Oligosaccharides (HMOs) market is propelled by a confluence of powerful growth drivers. Technological advancements in bioprocessing, particularly in microbial fermentation and enzymatic synthesis, are significantly improving production efficiency and reducing costs, making a wider range of HMOs commercially viable. The ever-expanding body of scientific research consistently unveils new health benefits of HMOs, reinforcing their value proposition for infant nutrition, gut health, and immune modulation. This growing scientific validation, coupled with increasing consumer awareness of the importance of gut health and natural ingredients, creates robust demand. Favorable regulatory approvals in key global markets are also critical enablers, fostering trust and facilitating market penetration, especially in the highly regulated infant formula sector.

Challenges Impacting Human Milk Oligosaccharides Industry Growth

Despite its promising trajectory, the Human Milk Oligosaccharides (HMOs) industry faces several significant challenges. The high cost of production for certain complex HMOs remains a primary barrier, impacting pricing strategies and accessibility for some market segments. Navigating the intricate and often disparate regulatory frameworks across different countries presents a considerable hurdle for global market expansion. Furthermore, establishing and maintaining robust and reliable supply chains for raw materials and finished products can be complex, susceptible to disruptions. Competitive pressures from established prebiotic ingredients, which have a longer history in the market and often lower price points, necessitate continuous innovation and clear communication of the unique advantages offered by HMOs.

Key Players Shaping the Human Milk Oligosaccharides Industry Market

- Inbiose NV

- Royal FrieslandCampina N V

- Merck & Co Inc

- Abbott Laboratories

- Kirin Holdings Company (Kyowa Hakko Bio)

- Chr Hansen Holding A/S

- BASF SE

- Koninklijke DSM N V

- International Flavors & Fragrances Inc (DuPont)

- ZuChem Inc

- Glycosyn LLC

Significant Human Milk Oligosaccharides Industry Industry Milestones

- November 2022: Kyowa Hakko Bio Co. Ltd (Kyowa Hakko Bio), a subsidiary of Kirin Holdings Company, Limited (Kirin Holdings), completed a production facility for human milk oligosaccharides (HMOs) at its Thai subsidiary, Thai Kyowa Biotechnologies Co, Ltd., enhancing global production capacity.

- October 2022: FrieslandCampina's 2'-fucosyllactose trademarked Aequival received approval from Australia's and New Zealand's authorities for use in infant milk formula. The company is also on track to expand its human milk oligosaccharide (HMO) portfolio with the launch of Lacto-N-tetraose (LNT), 3-fucosyllactose (3-FL), 3'-Sialyllactose (3'-SL), and 6-Sialyllactose (6-SL), further diversifying the market offering.

- March 2021: BASF announced that PREBILAC, BASF's brand of 2'-FL, had received approval from Australia's Therapeutic Goods Administration (TGA), marking it as the first and only 2'-FL ingredient to achieve TGA approval as a prebiotic ingredient, strengthening its position in the Australian market.

Future Outlook for Human Milk Oligosaccharides Industry Market

The future outlook for the Human Milk Oligosaccharides (HMOs) market is exceptionally bright, poised for sustained high growth and innovation. Continued investment in research and development will undoubtedly uncover further health benefits of HMOs, expanding their applications beyond infant nutrition into adult health, medical nutrition, and even animal feed. Advancements in manufacturing technologies will drive down production costs, making HMOs more accessible and competitive. Strategic partnerships and potential mergers and acquisitions will likely shape the competitive landscape, consolidating expertise and market reach. The increasing global demand for natural, science-backed functional ingredients ensures that HMOs will remain at the forefront of innovation in the nutraceutical and food industries, with market expansion expected to exceed $10,000 Million by 2033.

Human Milk Oligosaccharides Industry Segmentation

-

1. Application

- 1.1. Infant Formula

- 1.2. Dietary Supplements

- 1.3. Functional Food and Beverage

Human Milk Oligosaccharides Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. United Kingdom

- 2.4. France

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Human Milk Oligosaccharides Industry Regional Market Share

Geographic Coverage of Human Milk Oligosaccharides Industry

Human Milk Oligosaccharides Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Health Benefits Associated with Tocotrienol; Escalating Demand for Anti-Aging Products Containing Tocotrienol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Increasing Awareness About The Health Benefits Associated With HMO

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Human Milk Oligosaccharides Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Infant Formula

- 5.1.2. Dietary Supplements

- 5.1.3. Functional Food and Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Human Milk Oligosaccharides Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Infant Formula

- 6.1.2. Dietary Supplements

- 6.1.3. Functional Food and Beverage

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Human Milk Oligosaccharides Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Infant Formula

- 7.1.2. Dietary Supplements

- 7.1.3. Functional Food and Beverage

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Human Milk Oligosaccharides Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Infant Formula

- 8.1.2. Dietary Supplements

- 8.1.3. Functional Food and Beverage

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Human Milk Oligosaccharides Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Infant Formula

- 9.1.2. Dietary Supplements

- 9.1.3. Functional Food and Beverage

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Inbiose NV

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Royal FrieslandCampina N V

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Merck & Co Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Abbott Laboratories

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kirin Holdings Company (Kyowa Hakko Bio)*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chr Hansen Holding A/S

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Koninklijke DSM N V

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 International Flavors & Fragrances Inc (DuPont)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ZuChem Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Glycosyn LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Inbiose NV

List of Figures

- Figure 1: Global Human Milk Oligosaccharides Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Human Milk Oligosaccharides Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Human Milk Oligosaccharides Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Human Milk Oligosaccharides Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Human Milk Oligosaccharides Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Human Milk Oligosaccharides Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Human Milk Oligosaccharides Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Human Milk Oligosaccharides Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Human Milk Oligosaccharides Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Human Milk Oligosaccharides Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Human Milk Oligosaccharides Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Human Milk Oligosaccharides Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Human Milk Oligosaccharides Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Human Milk Oligosaccharides Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Rest of the World Human Milk Oligosaccharides Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Human Milk Oligosaccharides Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Human Milk Oligosaccharides Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Germany Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Spain Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Human Milk Oligosaccharides Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: South America Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Middle East and Africa Human Milk Oligosaccharides Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Human Milk Oligosaccharides Industry?

The projected CAGR is approximately 20.75%.

2. Which companies are prominent players in the Human Milk Oligosaccharides Industry?

Key companies in the market include Inbiose NV, Royal FrieslandCampina N V, Merck & Co Inc, Abbott Laboratories, Kirin Holdings Company (Kyowa Hakko Bio)*List Not Exhaustive, Chr Hansen Holding A/S, BASF SE, Koninklijke DSM N V, International Flavors & Fragrances Inc (DuPont), ZuChem Inc, Glycosyn LLC.

3. What are the main segments of the Human Milk Oligosaccharides Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 196.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Health Benefits Associated with Tocotrienol; Escalating Demand for Anti-Aging Products Containing Tocotrienol.

6. What are the notable trends driving market growth?

Increasing Awareness About The Health Benefits Associated With HMO.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

In November 2022, Kyowa Hakko Bio Co. Ltd (Kyowa Hakko Bio), a subsidiary of Kirin Holdings Company, Limited (Kirin Holdings), completed a production facility for human milk oligosaccharides (HMOs) at its Thai subsidiary, Thai Kyowa Biotechnologies Co, Ltd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Human Milk Oligosaccharides Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Human Milk Oligosaccharides Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Human Milk Oligosaccharides Industry?

To stay informed about further developments, trends, and reports in the Human Milk Oligosaccharides Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence