Key Insights

The European Starch Derivatives Market is projected for substantial growth, driven by escalating demand for modified starches and glucose syrups across diverse industries. With an estimated market size of $62.55 billion in 2025, the market is forecast to expand at a Compound Annual Growth Rate (CAGR) of 3.7% through 2033. This expansion is primarily propelled by the food and beverage sector, where starch derivatives serve as essential thickeners, stabilizers, and sweeteners. The paper industry's adoption for enhanced strength and coating, alongside emerging pharmaceutical applications in drug delivery and excipients, further fuels this upward trajectory. Growing consumer preference for natural and clean-label ingredients also favors starch derivatives over synthetic alternatives, presenting a significant market opportunity. Leading players, including Cargill, Tereos SCA, and Ingredion, are actively investing in research and development and expanding production capacities to meet this increasing demand, reinforcing Europe's critical role in the global starch derivatives market.

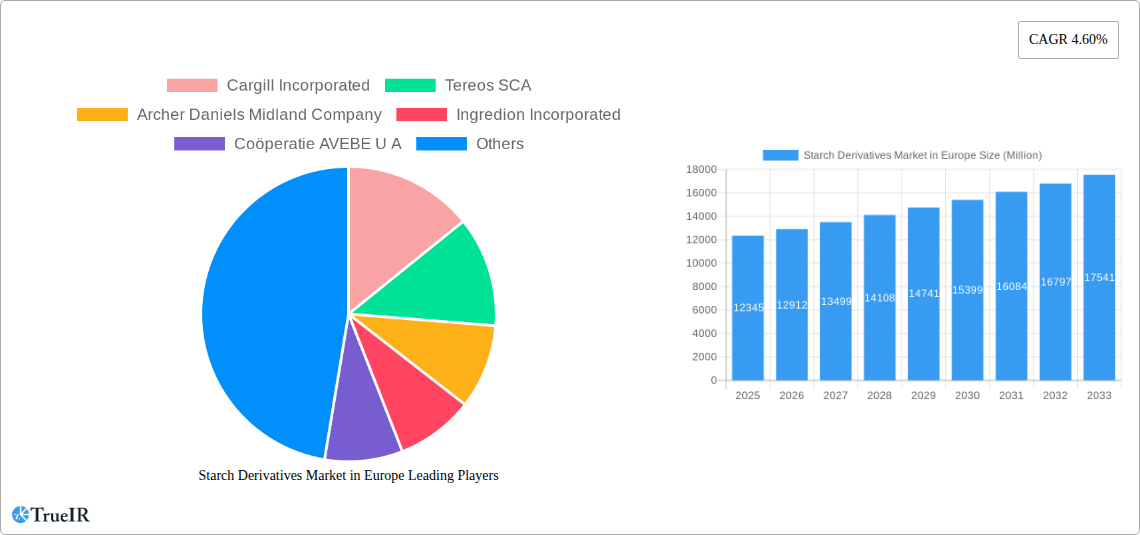

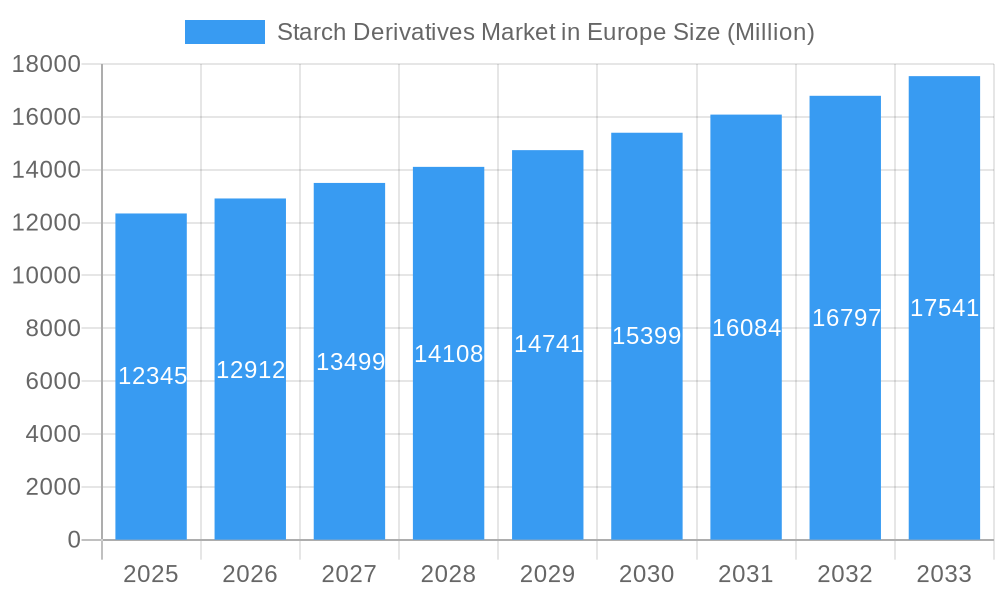

Starch Derivatives Market in Europe Market Size (In Billion)

While the market outlook is positive, potential restraints may influence its full realization. Volatile raw material prices, particularly for corn and wheat, can affect manufacturer profit margins. Stringent European regulations for food additives and processing aids, though ensuring safety, introduce complexities and compliance costs. However, the inherent versatility and cost-effectiveness of starch derivatives in numerous applications, combined with continuous innovation in specialized derivatives with enhanced functionalities, are expected to surmount these challenges. The market's dynamism is further defined by an increasing focus on sustainable sourcing and production methods, aligning with Europe's environmental objectives. As industries continue to prioritize efficient and functional ingredients, the European starch derivatives market is well-positioned for sustained expansion and innovation.

Starch Derivatives Market in Europe Company Market Share

Starch Derivatives Market in Europe: Comprehensive Market Analysis and Forecast (2019-2033)

This report offers an in-depth analysis of the dynamic Starch Derivatives Market in Europe, providing crucial insights for stakeholders navigating this evolving sector. We delve into market structure, competitive landscapes, key trends, dominant segments, product innovations, and the multifaceted drivers and challenges shaping the industry's future. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report equips you with the data and strategic intelligence needed to capitalize on emerging opportunities.

Starch Derivatives Market in Europe Market Structure & Competitive Landscape

The European starch derivatives market exhibits a moderate to high level of concentration, with a few key players dominating significant market share. Major companies such as Cargill Incorporated, Tereos SCA, Archer Daniels Midland Company, Ingredion Incorporated, Coöperatie AVEBE U A, and Sacchetto S p A are instrumental in driving innovation and shaping market dynamics. The competitive landscape is characterized by ongoing investments in research and development to enhance product functionalities and develop novel applications, particularly within the food and beverage sector, a primary consumer of starch derivatives. Regulatory frameworks, including those pertaining to food safety and sustainability, play a pivotal role in shaping market entry and product development strategies. The presence of robust substitute products, such as synthetic polymers and other natural thickeners, necessitates continuous innovation and cost-effectiveness from starch derivative manufacturers. End-user segmentation, spanning food and beverage, feed, paper industry, pharmaceutical industry, bioethanol, cosmetics, and other industrial applications, highlights the diverse demand drivers across Europe. Mergers and acquisitions (M&A) activity, while not as frenetic as in some other industries, is a strategic tool employed by larger entities to consolidate market presence, acquire new technologies, and expand their product portfolios. For instance, recent M&A volumes have hovered around xx Million euros annually, indicating strategic consolidations rather than widespread market consolidation.

Starch Derivatives Market in Europe Market Trends & Opportunities

The starch derivatives market in Europe is poised for robust growth, driven by escalating demand for natural and sustainable ingredients across various industries. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033, reaching an estimated value of over xx Million Euros by the end of the forecast period. This growth is underpinned by a confluence of factors, including evolving consumer preferences for clean-label products, a rising awareness of the environmental impact of synthetic ingredients, and the inherent versatility of starch derivatives. Technological advancements are continuously enhancing the functionalities of starch derivatives, leading to their adoption in sophisticated applications. For example, modified starches are being engineered to offer superior texture, stability, and shelf-life in processed foods, while cyclodextrins are finding new applications in encapsulation and drug delivery systems within the pharmaceutical industry. The increasing demand for convenience foods and beverages in Europe directly fuels the market for glucose syrups and maltodextrins, used extensively as sweeteners, thickeners, and texturizers. Furthermore, the bioethanol industry's reliance on starch-based feedstocks for renewable energy production presents a significant growth opportunity, particularly in countries with strong biofuel mandates. The paper industry's demand for modified starches as binders and coatings continues to be a stable contributor to market growth. The competitive dynamics are intensifying, with companies focusing on product differentiation, supply chain optimization, and strategic partnerships to secure market share. The opportunity for market penetration lies in developing novel starch derivatives with tailored functionalities for niche applications and in expanding the use of sustainable sourcing and production methods to align with European green initiatives. The increasing focus on circular economy principles also presents an opportunity for valorizing by-products from starch processing. The European Green Deal and similar environmental policies are creating a fertile ground for bio-based materials like starch derivatives.

Dominant Markets & Segments in Starch Derivatives Market in Europe

The Starch Derivatives Market in Europe is characterized by the dominance of specific regions and product segments, driven by distinct industrial and consumer trends.

Leading Region: Germany emerges as a dominant market within Europe for starch derivatives. This leadership is attributed to its robust industrial base, particularly in the food and beverage, pharmaceutical, and paper industries, coupled with significant investments in R&D and a strong emphasis on sustainable production practices.

Dominant Type Segment:

- Modified Starch: This segment holds the largest market share due to its wide array of functionalities, including thickening, binding, emulsifying, and stabilizing properties. Its extensive use in the food and beverage industry for products like sauces, baked goods, and dairy items is a key growth driver.

- Glucose Syrups: Essential for confectionery, baked goods, and beverages, glucose syrups remain a high-volume segment, driven by the demand for sweeteners and texturizers.

Dominant Source Segment:

- Corn: Corn-derived starch and its derivatives are the most prevalent in the European market, owing to its widespread cultivation, efficient processing technologies, and cost-effectiveness.

- Wheat: Wheat is another significant source, particularly in regions with strong agricultural production, contributing substantially to both food and industrial applications.

Dominant Application Segment:

- Food and Beverage: This segment is the largest consumer of starch derivatives, accounting for an estimated xx% of the total market. The demand for processed foods, convenience meals, and specialized dietary products significantly influences this segment's growth.

- Paper Industry: Modified starches are crucial for improving paper strength, printability, and surface characteristics, making this a consistently important application.

- Feed Industry: Starch derivatives serve as digestible carbohydrates and binders in animal feed, contributing to animal nutrition and feed pellet integrity.

Key Growth Drivers in Dominant Segments:

- Technological Advancements: Continuous innovation in modifying starch properties to meet specific functional requirements in food processing, pharmaceuticals, and other industrial applications.

- Consumer Demand for Natural Ingredients: The increasing preference for clean-label products and natural alternatives to synthetic additives is a significant catalyst for starch derivatives.

- Government Policies and Regulations: Favorable policies promoting the use of bio-based materials and renewable resources, alongside stringent food safety regulations, indirectly support the demand for compliant starch derivatives.

- Infrastructure Development: Investments in modern processing facilities and logistics networks across key European countries facilitate efficient production and distribution.

Starch Derivatives Market in Europe Product Analysis

The European starch derivatives market is characterized by continuous product innovation, driven by the pursuit of enhanced functionalities and expanded application portfolios. Modified starches, in particular, are witnessing significant advancements, offering tailored viscosity, stability, and texture profiles for diverse food and beverage applications, from dairy alternatives to gluten-free products. Cyclodextrins are gaining traction in the pharmaceutical sector for their encapsulation capabilities, improving drug solubility and bioavailability. The development of specialized starch hydrolysates for specific nutritional and functional benefits is also a key trend. Competitive advantages are being carved out through the development of sustainable production processes, the use of diverse and regionally sourced raw materials, and the ability to offer customized solutions to meet the evolving needs of industries such as cosmetics, paper, and bioethanol.

Key Drivers, Barriers & Challenges in Starch Derivatives Market in Europe

Key Drivers:

- Growing Demand for Natural and Sustainable Ingredients: A paramount driver is the increasing consumer and industry preference for bio-based, renewable, and environmentally friendly ingredients over synthetic alternatives, aligning with Europe's sustainability agenda.

- Versatility and Functionality: The inherent versatility of starch derivatives allows them to be modified to perform a wide range of functions – thickening, binding, stabilizing, texturizing – making them indispensable across numerous applications.

- Advancements in Biotechnology and Processing: Continuous innovation in enzyme technology and processing techniques enables the development of novel starch derivatives with enhanced properties and cost-effectiveness.

- Expansion of the Food and Beverage Industry: The growing demand for processed foods, convenience meals, and specialized dietary products in Europe directly fuels the consumption of starch derivatives as functional ingredients.

Barriers & Challenges:

- Price Volatility of Raw Materials: Fluctuations in the prices of agricultural commodities like corn, wheat, and potatoes, due to weather conditions, geopolitical factors, and market speculation, can impact the profitability of starch derivative manufacturers.

- Regulatory Compliance: Navigating complex and evolving food safety, labeling, and environmental regulations across different European countries can be challenging and costly, requiring significant investment in compliance.

- Competition from Substitutes: The market faces competition from other natural and synthetic thickeners, sweeteners, and texturizers, necessitating continuous product innovation and cost optimization.

- Supply Chain Disruptions: Global and regional supply chain vulnerabilities, exacerbated by events like pandemics or trade disputes, can affect the availability and cost of raw materials and the efficient distribution of finished products.

Growth Drivers in the Starch Derivatives Market in Europe Market

The Starch Derivatives Market in Europe is propelled by several key factors. Technologically, ongoing innovations in enzymatic modifications and processing techniques are creating starch derivatives with highly specific functionalities, catering to niche applications in food, pharmaceuticals, and cosmetics. Economically, the rising disposable incomes and evolving consumer lifestyles in Europe are driving demand for processed foods and beverages, where starch derivatives are essential ingredients. Regulatory tailwinds, such as the European Union's emphasis on bio-based products and sustainable sourcing, further encourage the adoption of starch derivatives as environmentally friendly alternatives. The bioethanol sector's growth also presents a substantial avenue for starch utilization.

Challenges Impacting Starch Derivatives Market in Europe Growth

Several challenges can impact the growth trajectory of the Starch Derivatives Market in Europe. Regulatory complexities, including differing standards for food additives and labeling requirements across member states, can hinder market access and increase compliance costs. Supply chain issues, stemming from agricultural yield variability, logistical bottlenecks, and global trade dynamics, can lead to price volatility and availability concerns for raw materials like corn and wheat. Competitive pressures from alternative ingredients, both natural and synthetic, necessitate continuous innovation and cost-competitiveness from starch derivative producers. Furthermore, the increasing scrutiny on the environmental impact of agricultural practices and processing methods requires a commitment to sustainable production and resource management.

Key Players Shaping the Starch Derivatives Market in Europe Market

- Cargill Incorporated

- Tereos SCA

- Archer Daniels Midland Company

- Ingredion Incorporated

- Coöperatie AVEBE U A

- Sacchetto S p A

Significant Starch Derivatives Market in Europe Industry Milestones

- 2022: Launch of novel biodegradable modified starches for packaging applications, responding to increasing demand for sustainable materials.

- 2021: Significant investment by major players in R&D for functional starch derivatives targeting the plant-based food sector.

- 2020: Increased adoption of glucose syrups and maltodextrins in the confectionery and bakery sectors due to shifting consumer snacking habits.

- 2019: Introduction of new enzymatic hydrolysis techniques to produce specialized starch derivatives with improved nutritional profiles for the feed industry.

Future Outlook for Starch Derivatives Market in Europe Market

The future outlook for the Starch Derivatives Market in Europe is highly promising, driven by a persistent global trend towards natural, sustainable, and functional ingredients. Strategic opportunities lie in the continued development of advanced modified starches for the food industry, particularly in areas like texture enhancement, fat replacement, and gluten-free formulations. The pharmaceutical and cosmetics sectors are expected to witness increased demand for specialized starch derivatives, such as cyclodextrins and dextrins, for their unique properties in drug delivery, formulation stabilization, and personal care products. Furthermore, the growing emphasis on the circular economy and bioeconomy within Europe will likely spur innovation in utilizing starch derivatives for bio-based materials and renewable energy production, presenting significant long-term growth catalysts.

Starch Derivatives Market in Europe Segmentation

-

1. Type

- 1.1. Maltodextrin

- 1.2. Cyclodextrin

- 1.3. Glucose Syrups

- 1.4. Hydrolysates

- 1.5. Modified Starch

- 1.6. Others

-

2. Source

- 2.1. Corn

- 2.2. Wheat

- 2.3. Cassava

- 2.4. Potato

- 2.5. Other Sources

-

3. Application

- 3.1. Food and Beverage

- 3.2. Feed

- 3.3. Paper Industry

- 3.4. Pharmaceutical Industry

- 3.5. Bioethanol

- 3.6. Cosmetics

- 3.7. Other Industrial Applications

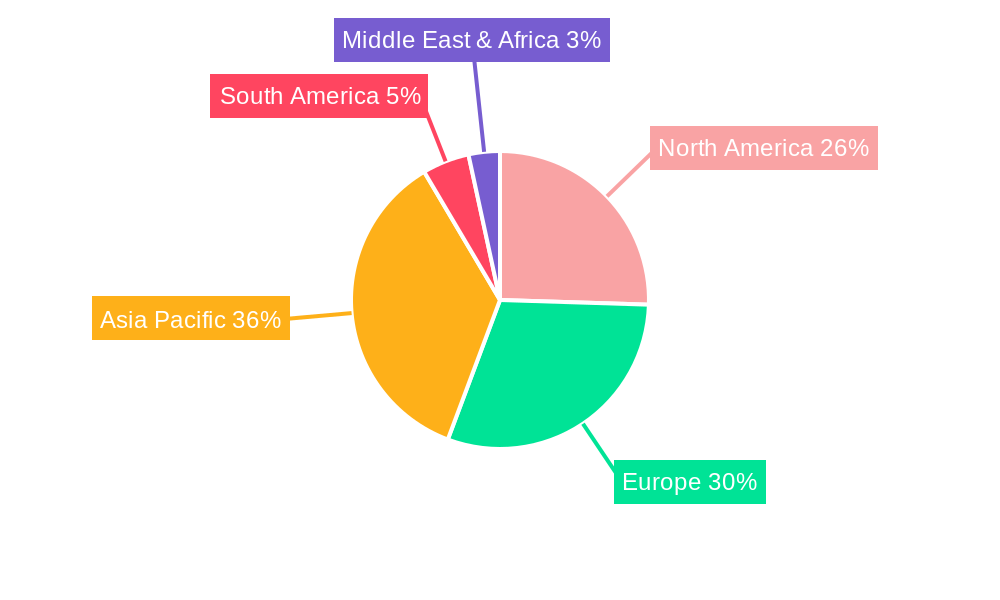

Starch Derivatives Market in Europe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Starch Derivatives Market in Europe Regional Market Share

Geographic Coverage of Starch Derivatives Market in Europe

Starch Derivatives Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Acquisitive Demand of Starch Derivatives in Food & Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Starch Derivatives Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Maltodextrin

- 5.1.2. Cyclodextrin

- 5.1.3. Glucose Syrups

- 5.1.4. Hydrolysates

- 5.1.5. Modified Starch

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Corn

- 5.2.2. Wheat

- 5.2.3. Cassava

- 5.2.4. Potato

- 5.2.5. Other Sources

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverage

- 5.3.2. Feed

- 5.3.3. Paper Industry

- 5.3.4. Pharmaceutical Industry

- 5.3.5. Bioethanol

- 5.3.6. Cosmetics

- 5.3.7. Other Industrial Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Starch Derivatives Market in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Maltodextrin

- 6.1.2. Cyclodextrin

- 6.1.3. Glucose Syrups

- 6.1.4. Hydrolysates

- 6.1.5. Modified Starch

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Source

- 6.2.1. Corn

- 6.2.2. Wheat

- 6.2.3. Cassava

- 6.2.4. Potato

- 6.2.5. Other Sources

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food and Beverage

- 6.3.2. Feed

- 6.3.3. Paper Industry

- 6.3.4. Pharmaceutical Industry

- 6.3.5. Bioethanol

- 6.3.6. Cosmetics

- 6.3.7. Other Industrial Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Starch Derivatives Market in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Maltodextrin

- 7.1.2. Cyclodextrin

- 7.1.3. Glucose Syrups

- 7.1.4. Hydrolysates

- 7.1.5. Modified Starch

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Source

- 7.2.1. Corn

- 7.2.2. Wheat

- 7.2.3. Cassava

- 7.2.4. Potato

- 7.2.5. Other Sources

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food and Beverage

- 7.3.2. Feed

- 7.3.3. Paper Industry

- 7.3.4. Pharmaceutical Industry

- 7.3.5. Bioethanol

- 7.3.6. Cosmetics

- 7.3.7. Other Industrial Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Starch Derivatives Market in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Maltodextrin

- 8.1.2. Cyclodextrin

- 8.1.3. Glucose Syrups

- 8.1.4. Hydrolysates

- 8.1.5. Modified Starch

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Source

- 8.2.1. Corn

- 8.2.2. Wheat

- 8.2.3. Cassava

- 8.2.4. Potato

- 8.2.5. Other Sources

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food and Beverage

- 8.3.2. Feed

- 8.3.3. Paper Industry

- 8.3.4. Pharmaceutical Industry

- 8.3.5. Bioethanol

- 8.3.6. Cosmetics

- 8.3.7. Other Industrial Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Starch Derivatives Market in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Maltodextrin

- 9.1.2. Cyclodextrin

- 9.1.3. Glucose Syrups

- 9.1.4. Hydrolysates

- 9.1.5. Modified Starch

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Source

- 9.2.1. Corn

- 9.2.2. Wheat

- 9.2.3. Cassava

- 9.2.4. Potato

- 9.2.5. Other Sources

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Food and Beverage

- 9.3.2. Feed

- 9.3.3. Paper Industry

- 9.3.4. Pharmaceutical Industry

- 9.3.5. Bioethanol

- 9.3.6. Cosmetics

- 9.3.7. Other Industrial Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Starch Derivatives Market in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Maltodextrin

- 10.1.2. Cyclodextrin

- 10.1.3. Glucose Syrups

- 10.1.4. Hydrolysates

- 10.1.5. Modified Starch

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Source

- 10.2.1. Corn

- 10.2.2. Wheat

- 10.2.3. Cassava

- 10.2.4. Potato

- 10.2.5. Other Sources

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Food and Beverage

- 10.3.2. Feed

- 10.3.3. Paper Industry

- 10.3.4. Pharmaceutical Industry

- 10.3.5. Bioethanol

- 10.3.6. Cosmetics

- 10.3.7. Other Industrial Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tereos SCA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Archer Daniels Midland Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ingredion Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coöperatie AVEBE U A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sacchetto S p A *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Starch Derivatives Market in Europe Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Starch Derivatives Market in Europe Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Starch Derivatives Market in Europe Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Starch Derivatives Market in Europe Revenue (billion), by Source 2025 & 2033

- Figure 5: North America Starch Derivatives Market in Europe Revenue Share (%), by Source 2025 & 2033

- Figure 6: North America Starch Derivatives Market in Europe Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Starch Derivatives Market in Europe Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Starch Derivatives Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Starch Derivatives Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Starch Derivatives Market in Europe Revenue (billion), by Type 2025 & 2033

- Figure 11: South America Starch Derivatives Market in Europe Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Starch Derivatives Market in Europe Revenue (billion), by Source 2025 & 2033

- Figure 13: South America Starch Derivatives Market in Europe Revenue Share (%), by Source 2025 & 2033

- Figure 14: South America Starch Derivatives Market in Europe Revenue (billion), by Application 2025 & 2033

- Figure 15: South America Starch Derivatives Market in Europe Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Starch Derivatives Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Starch Derivatives Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Starch Derivatives Market in Europe Revenue (billion), by Type 2025 & 2033

- Figure 19: Europe Starch Derivatives Market in Europe Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Starch Derivatives Market in Europe Revenue (billion), by Source 2025 & 2033

- Figure 21: Europe Starch Derivatives Market in Europe Revenue Share (%), by Source 2025 & 2033

- Figure 22: Europe Starch Derivatives Market in Europe Revenue (billion), by Application 2025 & 2033

- Figure 23: Europe Starch Derivatives Market in Europe Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Starch Derivatives Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Starch Derivatives Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Starch Derivatives Market in Europe Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East & Africa Starch Derivatives Market in Europe Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Starch Derivatives Market in Europe Revenue (billion), by Source 2025 & 2033

- Figure 29: Middle East & Africa Starch Derivatives Market in Europe Revenue Share (%), by Source 2025 & 2033

- Figure 30: Middle East & Africa Starch Derivatives Market in Europe Revenue (billion), by Application 2025 & 2033

- Figure 31: Middle East & Africa Starch Derivatives Market in Europe Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa Starch Derivatives Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Starch Derivatives Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Starch Derivatives Market in Europe Revenue (billion), by Type 2025 & 2033

- Figure 35: Asia Pacific Starch Derivatives Market in Europe Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Starch Derivatives Market in Europe Revenue (billion), by Source 2025 & 2033

- Figure 37: Asia Pacific Starch Derivatives Market in Europe Revenue Share (%), by Source 2025 & 2033

- Figure 38: Asia Pacific Starch Derivatives Market in Europe Revenue (billion), by Application 2025 & 2033

- Figure 39: Asia Pacific Starch Derivatives Market in Europe Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific Starch Derivatives Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Starch Derivatives Market in Europe Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Source 2020 & 2033

- Table 3: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Source 2020 & 2033

- Table 7: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Source 2020 & 2033

- Table 14: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Source 2020 & 2033

- Table 21: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Source 2020 & 2033

- Table 34: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 35: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Type 2020 & 2033

- Table 43: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Source 2020 & 2033

- Table 44: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Application 2020 & 2033

- Table 45: Global Starch Derivatives Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Starch Derivatives Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Starch Derivatives Market in Europe?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Starch Derivatives Market in Europe?

Key companies in the market include Cargill Incorporated, Tereos SCA, Archer Daniels Midland Company, Ingredion Incorporated, Coöperatie AVEBE U A, Sacchetto S p A *List Not Exhaustive.

3. What are the main segments of the Starch Derivatives Market in Europe?

The market segments include Type, Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 62.55 billion as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Acquisitive Demand of Starch Derivatives in Food & Beverage Industry.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Starch Derivatives Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Starch Derivatives Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Starch Derivatives Market in Europe?

To stay informed about further developments, trends, and reports in the Starch Derivatives Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence