Key Insights

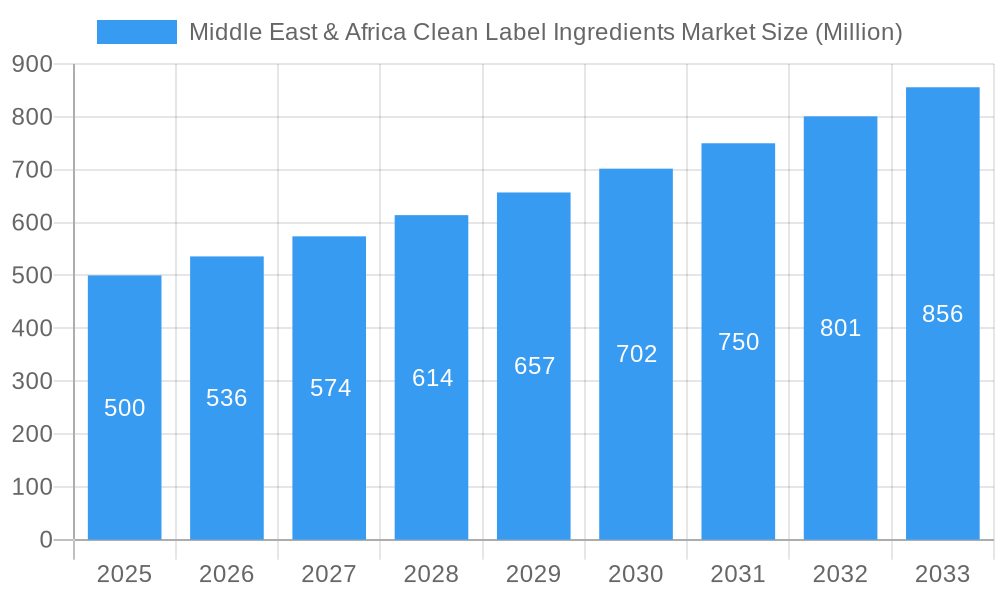

The Middle East & Africa (MEA) Clean Label Ingredients Market is poised for robust expansion, projected to reach an estimated XX million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.34% from 2019 to 2033. This dynamic growth is primarily propelled by a confluence of escalating consumer demand for transparently sourced, minimally processed food and beverage ingredients, and increasing regulatory emphasis on product safety and authenticity across the region. Consumers are actively seeking alternatives to artificial additives, preservatives, and synthetic colors and flavors, driving manufacturers to reformulate their products with clean label solutions. Key market drivers include a rising health-conscious population, a burgeoning middle class with higher disposable incomes, and growing awareness regarding the potential health impacts of conventional food processing. The demand for natural sweeteners, colors derived from fruits and vegetables, and plant-based proteins is particularly noteworthy, reflecting a broader shift towards natural and sustainable consumption patterns.

Middle East & Africa Clean Label Ingredients Market Market Size (In Million)

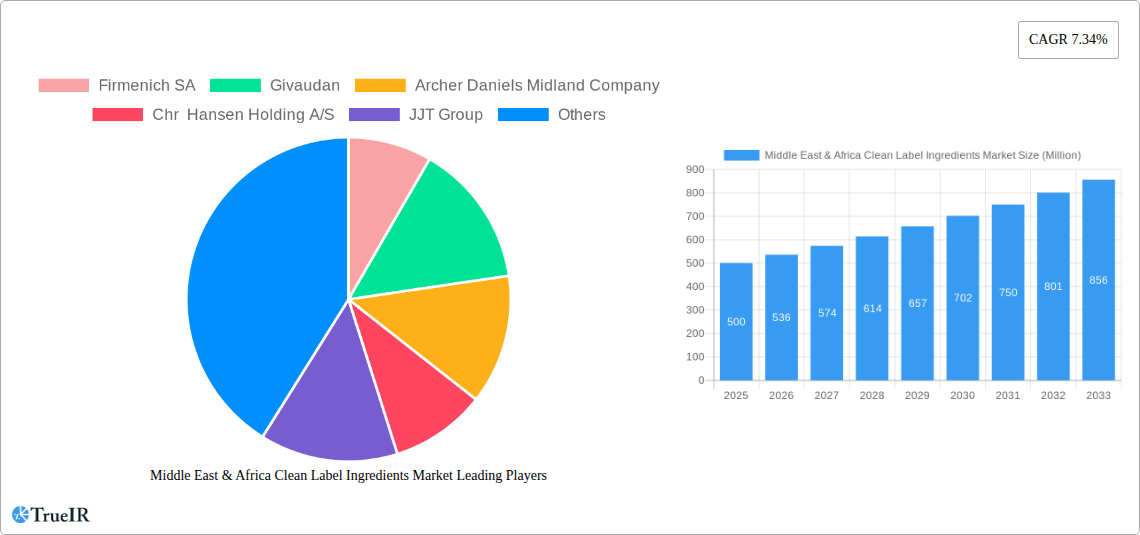

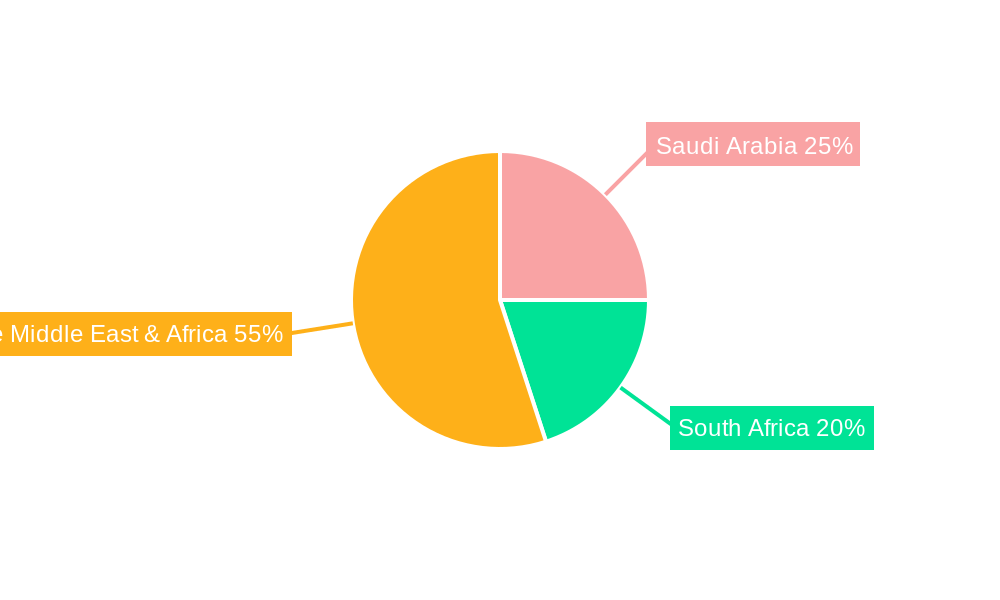

The market segmentation paints a clear picture of opportunities. In terms of Type, Color, Flavor, and Starch and Sweetener segments are anticipated to lead the growth trajectory, fueled by their widespread application in various food and beverage categories. The application segment is dominated by Beverages and Bakery & Confectionery, reflecting their significant role in daily consumer diets and the continuous innovation within these sectors to meet clean label demands. Processed foods also present a substantial opportunity as manufacturers actively seek to enhance their product profiles. Geographically, Saudi Arabia, South Africa, and the Rest of the Middle East & Africa are all expected to contribute significantly to the market's expansion. Saudi Arabia, with its rapidly modernizing food industry and affluent consumer base, is a key market. South Africa, as a diverse and developing economy, is also witnessing increasing adoption of clean label products. The market's restraints, while present, are largely manageable. These may include the higher cost of sourcing natural ingredients compared to synthetic alternatives and potential supply chain challenges for certain niche ingredients. However, the overwhelming consumer pull and the long-term benefits of aligning with clean label trends are expected to outweigh these limitations. The competitive landscape features prominent global players such as Firmenich SA, Givaudan, and Cargill Inc., alongside regional specialists, all vying for market share through product innovation, strategic partnerships, and capacity expansions to cater to the evolving MEA market.

Middle East & Africa Clean Label Ingredients Market Company Market Share

Here's a comprehensive, SEO-optimized report description for the Middle East & Africa Clean Label Ingredients Market, designed for immediate use and maximum impact.

Report Title: Middle East & Africa Clean Label Ingredients Market: Growth Trends, Opportunities, and Competitive Analysis 2025-2033

Report Description:

This in-depth market intelligence report provides a strategic overview of the Middle East & Africa (MEA) Clean Label Ingredients Market. Uncover critical insights into market size, segmentation, key trends, and future projections, empowering businesses to navigate this rapidly evolving landscape. With a focus on natural ingredients, transparency, and health-conscious consumption, the MEA region presents significant growth opportunities for clean label solutions. Our analysis covers the historical period from 2019-2024, with a base year of 2025 and a forecast period extending to 2033, offering a robust understanding of market dynamics.

Middle East & Africa Clean Label Ingredients Market Market Structure & Competitive Landscape

The Middle East & Africa Clean Label Ingredients Market is characterized by a moderately concentrated structure, with key global players actively expanding their presence and local manufacturers focusing on niche segments. Innovation drivers are primarily fueled by increasing consumer demand for natural, minimally processed ingredients and stricter regulatory frameworks promoting healthier food options. Regulatory impacts are significant, with governments in countries like Saudi Arabia and South Africa introducing policies that favor clean label ingredients. Product substitutes are abundant, ranging from traditional synthetic additives to emerging plant-based alternatives. End-user segmentation reveals a strong focus on the food and beverage industry, with significant traction in processed foods and dairy. Mergers and acquisitions (M&A) trends indicate strategic consolidation and technology acquisition, with an estimated XX number of M&A deals recorded during the historical period, aimed at expanding product portfolios and market reach. Key competitive advantages lie in product authenticity, sourcing transparency, and technological innovation in ingredient extraction and formulation.

Middle East & Africa Clean Label Ingredients Market Market Trends & Opportunities

The Middle East & Africa Clean Label Ingredients Market is poised for substantial growth, driven by a confluence of evolving consumer preferences, technological advancements, and supportive regulatory environments. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. A significant trend is the escalating consumer awareness regarding the adverse health effects of artificial ingredients, preservatives, and synthetic colors, leading to a premiumization of products that offer transparent and understandable ingredient lists. This shift is compelling food and beverage manufacturers across the region to reformulate their products, thereby boosting the demand for clean label alternatives.

Technological shifts are playing a pivotal role, with advancements in extraction, purification, and stabilization techniques enabling the development of high-performing natural ingredients that can match or exceed the functionality of synthetic counterparts. For instance, innovations in plant-based colorants and natural preservatives are gaining significant traction. Consumer preferences are increasingly leaning towards recognizable, natural sources, such as fruit and vegetable extracts for colors, natural enzymes for texture, and fermentation-based ingredients for preservation and flavor enhancement. This is creating a fertile ground for ingredient suppliers who can offer authentic, traceable, and sustainably sourced options.

Competitive dynamics are intensifying, with both multinational corporations and regional players vying for market share. Companies are investing in R&D to develop innovative clean label solutions and expanding their distribution networks to cater to the diverse needs of the MEA market. Strategic partnerships and collaborations are becoming common as companies seek to leverage each other's expertise and market access. The increasing penetration of clean label products in mainstream food categories, beyond niche markets, signifies a maturing consumer base and a broader acceptance of these ingredients. The growth in processed foods and beverages, coupled with a rising middle class in countries like Saudi Arabia and South Africa, further amplifies the market's potential. The report forecasts the market size to reach USD XX Billion by 2033, a significant increase from USD XX Billion in 2025, underscoring the immense opportunities for stakeholders in this dynamic sector.

Dominant Markets & Segments in Middle East & Africa Clean Label Ingredients Market

The Middle East & Africa Clean Label Ingredients Market exhibits distinct dominance across several segments, driven by specific consumer behaviors, industry structures, and economic factors.

Dominant Geography:

- Rest of the Middle East & Africa: This broad geographical segment, encompassing a multitude of developing economies beyond Saudi Arabia and South Africa, is emerging as a significant growth engine. Rapid urbanization, increasing disposable incomes, and a growing awareness of health and wellness trends are contributing to a surge in demand for cleaner food options. Government initiatives aimed at boosting domestic food production and attracting foreign investment are also fostering a conducive environment for clean label ingredient adoption. The sheer diversity of consumer preferences within this segment presents both challenges and opportunities for ingredient manufacturers.

Dominant Type Segments:

- Flavor: The Flavor segment is a leading contributor to the MEA clean label ingredients market. Consumers across the region have a strong affinity for authentic and natural taste profiles. The increasing demand for processed foods, snacks, and beverages that mimic traditional or exotic flavors without artificial enhancers is driving the adoption of natural flavor extracts derived from fruits, spices, and herbs. Manufacturers are actively seeking natural flavor solutions to meet this demand, leading to substantial market penetration.

- Color: The Color segment also holds significant market share. Driven by concerns over synthetic food dyes, consumers are actively seeking products colored with natural sources like carotenoids, anthocyanins, and chlorophyll. Regulatory pressures in some MEA countries are also mandating the use of natural colorants in specific food categories. This segment is experiencing robust growth as food and beverage manufacturers strive for visually appealing products with transparent ingredient labels.

Dominant Application Segments:

- Beverage: The Beverage sector is the largest application segment for clean label ingredients in the MEA. This is largely due to the high consumption rates of juices, carbonated drinks, dairy beverages, and functional drinks. Consumers are increasingly scrutinizing ingredient lists for artificial sweeteners, colors, and preservatives in their beverages, pushing manufacturers towards natural alternatives.

- Bakery and Confectionery: This segment is another major consumer of clean label ingredients. The demand for baked goods and confectionery products with natural sweeteners, colors derived from fruits and vegetables, and clean-label leavening agents is on the rise. The trend towards artisanal and premium bakery products further accentuates the need for high-quality, natural ingredients.

Key Growth Drivers:

- Rising Health Consciousness: A growing awareness of health and wellness issues is a primary driver across all segments, pushing consumers towards products perceived as healthier and more natural.

- Government Regulations and Standards: Stricter regulations concerning artificial additives in food and beverages in key MEA markets are compelling manufacturers to adopt clean label alternatives.

- Urbanization and Changing Lifestyles: Rapid urbanization leads to increased consumption of processed foods and beverages, creating a larger market for ingredients that meet evolving consumer expectations.

- Demand for Transparency: Consumers' desire to know what they are eating is fueling demand for ingredients with simple, recognizable names and traceable origins.

Middle East & Africa Clean Label Ingredients Market Product Analysis

Product innovation in the MEA Clean Label Ingredients Market is characterized by a strong emphasis on natural sourcing, enhanced functionality, and improved shelf-life. Key advancements include the development of natural colorants derived from abundant local fruits and vegetables, offering vibrant hues without artificial synthesis. Natural preservatives, such as those from plant extracts and fermentation processes, are gaining traction for their efficacy and consumer appeal. Furthermore, there's a growing focus on starch and sweetener alternatives derived from natural sources, catering to the demand for reduced sugar and cleaner ingredient profiles. These innovations provide competitive advantages by addressing specific consumer concerns and enabling product differentiation in a crowded marketplace.

Key Drivers, Barriers & Challenges in Middle East & Africa Clean Label Ingredients Market

Key Drivers:

The Middle East & Africa Clean Label Ingredients Market is propelled by several powerful drivers. Foremost is the burgeoning consumer demand for healthier, natural, and transparently sourced food products, fueled by increased health consciousness and a growing middle class with higher disposable incomes. Regulatory shifts in key markets, such as Saudi Arabia and South Africa, are increasingly favoring cleaner ingredient profiles, mandating the reduction or elimination of artificial additives. Technological advancements in natural ingredient extraction and preservation are making clean label solutions more viable and cost-effective for manufacturers. The expansion of the processed food and beverage industry across the region, coupled with the adoption of international food standards, further bolsters the demand for clean label ingredients.

Barriers & Challenges:

Despite the positive growth trajectory, the market faces significant barriers. Higher production costs associated with natural ingredients compared to synthetic alternatives can be a restraint, particularly for smaller manufacturers. Supply chain complexities and the need for consistent sourcing of raw materials across diverse geographies present logistical challenges. Regulatory fragmentation across different MEA countries, with varying standards and approval processes, can create hurdles for market entry and product standardization. Consumer education and awareness gaps in certain segments of the population may also limit the immediate uptake of clean label products. Intense competitive pressure from established synthetic ingredient providers and the need for significant investment in R&D to develop novel clean label solutions are also critical challenges.

Growth Drivers in the Middle East & Africa Clean Label Ingredients Market Market

Key drivers fueling the Middle East & Africa Clean Label Ingredients Market include the pervasive trend of growing consumer health consciousness, leading to a preference for recognizable and naturally derived ingredients. This is complemented by favorable government initiatives and evolving food safety regulations in countries like Saudi Arabia and South Africa, which are actively encouraging the use of cleaner food additives. Technological advancements in ingredient processing and extraction techniques are making natural alternatives more efficient and cost-effective, thereby widening their applicability. Furthermore, the rapid expansion of the food and beverage industry, particularly in segments like processed foods and beverages, creates a significant demand for ingredients that align with consumer expectations for naturalness and transparency.

Challenges Impacting Middle East & Africa Clean Label Ingredients Market Growth

Challenges impacting the Middle East & Africa Clean Label Ingredients Market growth are multifaceted. Cost competitiveness remains a significant barrier, as natural ingredients often have higher production costs than their synthetic counterparts, impacting price-sensitive markets. Supply chain disruptions and the lack of standardized sourcing for natural raw materials across the vast MEA region can lead to inconsistencies in quality and availability. Complex and fragmented regulatory frameworks across different countries within the MEA can hinder widespread adoption and increase compliance burdens. Limited consumer awareness and education in certain demographics regarding the benefits of clean label ingredients can slow down demand. Finally, intense competition and the need for substantial investment in research and development to innovate and scale up production further pose challenges for market participants.

Key Players Shaping the Middle East & Africa Clean Label Ingredients Market Market

- Firmenich SA

- Givaudan

- Archer Daniels Midland Company

- Chr Hansen Holding A/S

- JJT Group

- D D Williamson & Co

- Sensient Colors LLC

- Cargill Inc

- Bell Flavors & Fragrances GmbH

- GNT Group B V

Significant Middle East & Africa Clean Label Ingredients Market Industry Milestones

- 2023/05: Givaudan launches a new range of natural flavor solutions for dairy applications, responding to growing demand in the MEA region.

- 2023/09: Chr. Hansen Holding A/S expands its partnership with a major Saudi Arabian food manufacturer to supply natural color and enzyme solutions.

- 2024/01: Archer Daniels Midland Company announces an investment in expanding its natural sweetener production capacity in North Africa to cater to regional demand.

- 2024/03: Sensient Colors LLC introduces a new line of fruit and vegetable-based colors specifically formulated for the Middle Eastern climate and taste preferences.

- 2024/07: The South African government proposes new regulations to encourage the use of natural preservatives in processed foods.

Future Outlook for Middle East & Africa Clean Label Ingredients Market Market

The future outlook for the Middle East & Africa Clean Label Ingredients Market is exceptionally promising, driven by sustained consumer demand for healthier and more transparent food options. Strategic opportunities lie in leveraging emerging trends such as plant-based diets and functional foods, which further enhance the appeal of natural ingredients. Manufacturers are expected to invest heavily in innovation, focusing on developing cost-effective and high-performance clean label solutions tailored to regional palates and regulatory requirements. The ongoing expansion of the food processing sector across the MEA, coupled with increasing disposable incomes, will continue to fuel market growth. Key players are likely to pursue strategic partnerships and acquisitions to strengthen their market position and product portfolios, ensuring robust expansion in the coming years.

Middle East & Africa Clean Label Ingredients Market Segmentation

-

1. Type

- 1.1. Color

- 1.2. Flavor

- 1.3. Starch and Sweetener

- 1.4. Preservative

- 1.5. Other Types

-

2. Application

- 2.1. Beverage

- 2.2. Bakery and Confectionery

- 2.3. Sauces and Condiments

- 2.4. Dairy and Frozen Dessert

- 2.5. Processed foods

- 2.6. Other Applications

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. Rest of the Middle East & Africa

Middle East & Africa Clean Label Ingredients Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of the Middle East

Middle East & Africa Clean Label Ingredients Market Regional Market Share

Geographic Coverage of Middle East & Africa Clean Label Ingredients Market

Middle East & Africa Clean Label Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Fitness and Increasing Intake of Plant-based Protein; Increase in Consumer Inclination Towards Meat Substitutes

- 3.3. Market Restrains

- 3.3.1. Gluten-Intolerance Among the Population Hindering the Market

- 3.4. Market Trends

- 3.4.1. Processed Foods are Likely to Foster the Market Growth in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Color

- 5.1.2. Flavor

- 5.1.3. Starch and Sweetener

- 5.1.4. Preservative

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.2. Bakery and Confectionery

- 5.2.3. Sauces and Condiments

- 5.2.4. Dairy and Frozen Dessert

- 5.2.5. Processed foods

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. Rest of the Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Rest of the Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Color

- 6.1.2. Flavor

- 6.1.3. Starch and Sweetener

- 6.1.4. Preservative

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Beverage

- 6.2.2. Bakery and Confectionery

- 6.2.3. Sauces and Condiments

- 6.2.4. Dairy and Frozen Dessert

- 6.2.5. Processed foods

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. Rest of the Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South Africa Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Color

- 7.1.2. Flavor

- 7.1.3. Starch and Sweetener

- 7.1.4. Preservative

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Beverage

- 7.2.2. Bakery and Confectionery

- 7.2.3. Sauces and Condiments

- 7.2.4. Dairy and Frozen Dessert

- 7.2.5. Processed foods

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. Rest of the Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of the Middle East Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Color

- 8.1.2. Flavor

- 8.1.3. Starch and Sweetener

- 8.1.4. Preservative

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Beverage

- 8.2.2. Bakery and Confectionery

- 8.2.3. Sauces and Condiments

- 8.2.4. Dairy and Frozen Dessert

- 8.2.5. Processed foods

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. Rest of the Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Africa Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 10. Sudan Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 11. Uganda Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 12. Tanzania Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 13. Kenya Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 14. Rest of Africa Middle East & Africa Clean Label Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Firmenich SA

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Givaudan

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Archer Daniels Midland Company

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Chr Hansen Holding A/S

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 JJT Group

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 D D Williamson & Co

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Sensient Colors LLC

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Cargill Inc

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Bell Flavors & Fragrances GmbH

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 GNT Group B V *List Not Exhaustive

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Firmenich SA

List of Figures

- Figure 1: Middle East & Africa Clean Label Ingredients Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa Clean Label Ingredients Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 3: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 5: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 7: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 9: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 11: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: South Africa Middle East & Africa Clean Label Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: South Africa Middle East & Africa Clean Label Ingredients Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Sudan Middle East & Africa Clean Label Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sudan Middle East & Africa Clean Label Ingredients Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Uganda Middle East & Africa Clean Label Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Uganda Middle East & Africa Clean Label Ingredients Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Tanzania Middle East & Africa Clean Label Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Tanzania Middle East & Africa Clean Label Ingredients Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Kenya Middle East & Africa Clean Label Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Kenya Middle East & Africa Clean Label Ingredients Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Rest of Africa Middle East & Africa Clean Label Ingredients Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Africa Middle East & Africa Clean Label Ingredients Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 35: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 37: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 43: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Middle East & Africa Clean Label Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Middle East & Africa Clean Label Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Clean Label Ingredients Market?

The projected CAGR is approximately 7.34%.

2. Which companies are prominent players in the Middle East & Africa Clean Label Ingredients Market?

Key companies in the market include Firmenich SA, Givaudan, Archer Daniels Midland Company, Chr Hansen Holding A/S, JJT Group, D D Williamson & Co, Sensient Colors LLC, Cargill Inc, Bell Flavors & Fragrances GmbH, GNT Group B V *List Not Exhaustive.

3. What are the main segments of the Middle East & Africa Clean Label Ingredients Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Fitness and Increasing Intake of Plant-based Protein; Increase in Consumer Inclination Towards Meat Substitutes.

6. What are the notable trends driving market growth?

Processed Foods are Likely to Foster the Market Growth in the Region.

7. Are there any restraints impacting market growth?

Gluten-Intolerance Among the Population Hindering the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Clean Label Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Clean Label Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Clean Label Ingredients Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Clean Label Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence