Key Insights

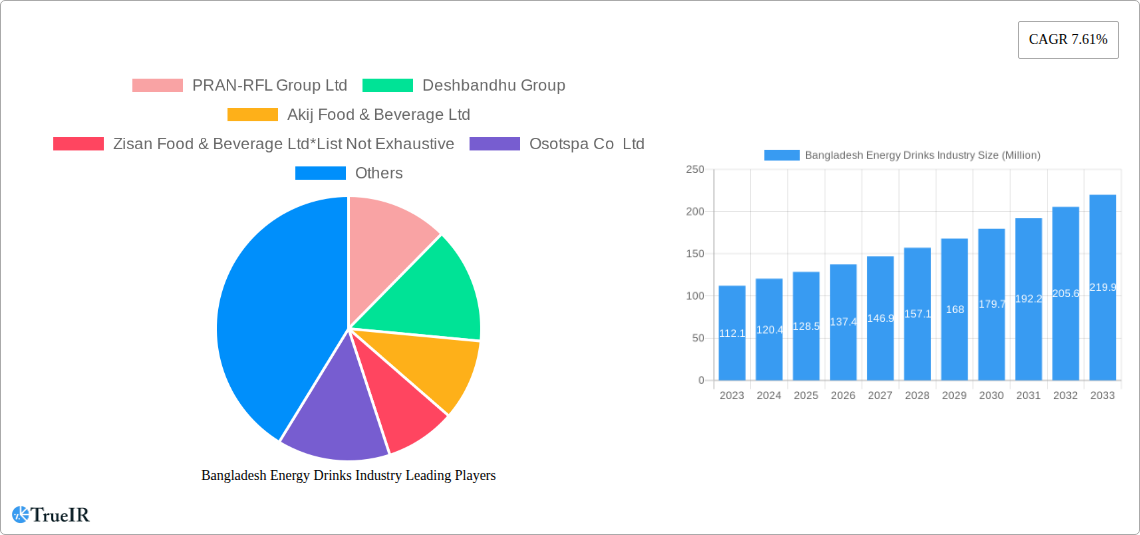

The Bangladesh energy drinks market is poised for substantial growth, with a projected market size of USD 128.5 million in 2025 and a robust Compound Annual Growth Rate (CAGR) of 7.61% expected to persist through 2033. This dynamic expansion is fueled by a confluence of factors, including increasing disposable incomes among the youth demographic, a growing health and wellness consciousness that is subtly shifting towards functional beverages, and the ever-present demand for quick energy boosts to combat busy lifestyles and demanding work schedules. The proliferation of distribution channels, particularly the burgeoning online retail sector and the continued dominance of supermarkets and hypermarkets, ensures widespread accessibility for these products. Furthermore, innovative product launches and aggressive marketing campaigns by both established players and emerging brands are continuously stimulating consumer interest and driving sales.

Bangladesh Energy Drinks Industry Market Size (In Million)

Despite this optimistic outlook, the market faces certain headwinds. Intense competition among a growing number of domestic and international players, coupled with increasing consumer awareness regarding the potential health implications of high sugar and caffeine content, presents significant challenges. Regulatory scrutiny concerning product ingredients and marketing practices could also impact future growth trajectories. However, the prevailing trend towards healthier formulations, such as sugar-free or natural ingredient-based energy drinks, is emerging as a key opportunity for manufacturers to mitigate these restraints and cater to a more health-conscious consumer base. The segmentation analysis reveals that while Cans and PET Bottles are the dominant packaging types, the strategic importance of Supermarkets/Hypermarkets and Online Stores as key distribution channels is undeniable in reaching the target audience effectively.

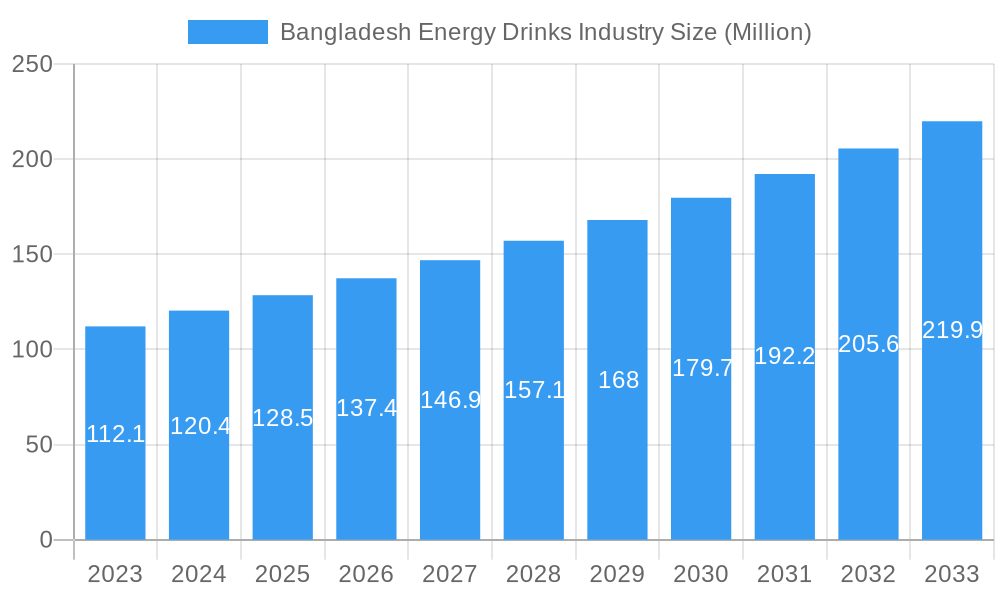

Bangladesh Energy Drinks Industry Company Market Share

This comprehensive report delves into the dynamic Bangladesh energy drinks industry, providing in-depth analysis and future projections from 2019 to 2033. Covering market structure, trends, opportunities, product analysis, and key players, this SEO-optimized report leverages high-volume keywords to deliver actionable insights for industry stakeholders. Our analysis is segmented by packaging type (Cans, PET Bottles) and distribution channels (Supermarket/Hypermarkets, Convenience/Grocery Stores, Online Stores, Others). The base year for our estimations is 2025, with a forecast period extending from 2025 to 2033, building upon historical data from 2019-2024.

Bangladesh Energy Drinks Industry Market Structure & Competitive Landscape

The Bangladesh energy drinks market is characterized by a moderate to high concentration, with a few dominant players holding significant market share. Innovation drivers are primarily focused on product formulation, appealing to evolving consumer preferences for enhanced energy, focus, and added nutritional benefits. Regulatory impacts, while not overtly restrictive, shape product labeling and marketing strategies. Product substitutes include traditional beverages and caffeinated food items, but specialized energy drinks maintain a distinct consumer base. End-user segmentation reveals strong demand from the youth demographic, students, and professionals seeking performance enhancement. Mergers and acquisitions (M&A) trends are nascent but are anticipated to grow as companies seek to consolidate market position and expand product portfolios. Current market concentration is estimated at a CR4 of approximately 70%, with ongoing strategic investments indicating potential for consolidation.

Bangladesh Energy Drinks Industry Market Trends & Opportunities

The Bangladesh energy drinks industry is poised for robust expansion, driven by a confluence of economic growth, increasing disposable incomes, and a burgeoning young population with an active lifestyle. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025-2033. Technological shifts are evident in product development, with a greater emphasis on natural ingredients, functional benefits beyond mere energy boost (e.g., stress relief, cognitive enhancement), and sustainable packaging solutions. Consumer preferences are evolving, moving beyond basic caffeine kick to demand sophisticated formulations catering to specific needs like pre-workout energy, mental alertness, and post-activity recovery. The competitive landscape is intensifying, with both local and international players vying for market dominance through aggressive marketing campaigns, product innovation, and strategic pricing. Opportunities lie in tapping into the growing online retail sector, developing niche energy drink variants for specific demographics and activities, and exploring export markets within the South Asian region. Market penetration rates are expected to rise significantly, particularly in urban and semi-urban areas, as accessibility and consumer awareness increase. The introduction of sugar-free and low-calorie options also presents a significant opportunity to capture health-conscious segments of the market.

Dominant Markets & Segments in Bangladesh Energy Drinks Industry

The Cans packaging segment is anticipated to dominate the Bangladesh energy drinks market, driven by consumer preference for convenience, portability, and superior shelf appeal. The ubiquitous presence of cans in convenience stores and supermarkets, coupled with their perceived premiumness by consumers, solidifies their leading position.

- Key Growth Drivers for Cans:

- Consumer Preference: Cans are widely perceived as the standard for energy drinks, offering an immediate visual appeal and a 'grab-and-go' experience.

- Retail Availability: Extensive stocking of canned energy drinks across all retail formats, from small neighborhood stores to large hypermarkets.

- Brand Image: Many leading global and local energy drink brands utilize cans as their primary packaging, reinforcing its association with the product category.

The Supermarket/Hypermarkets distribution channel is emerging as a significant contributor to market growth. These large retail formats offer wider product variety, promotional offers, and a more engaging shopping experience for consumers, contributing to increased sales volume.

- Key Growth Drivers for Supermarket/Hypermarkets:

- Product Assortment: Ability to stock a broader range of energy drink brands and SKUs, catering to diverse consumer tastes and preferences.

- Promotional Activities: Frequent in-store promotions, discounts, and bundle offers that attract price-sensitive consumers.

- Impulse Purchases: Strategic product placement near checkouts and high-traffic areas encourages impulse buys.

While Convenience/Grocery Stores have historically been strongholds, Online Stores are rapidly gaining traction, fueled by the digital transformation and the convenience of home delivery. This channel is crucial for reaching a younger, tech-savvy demographic and expanding geographical reach beyond physical store limitations. The Others category, encompassing on-premise sales in cafes, bars, and gyms, also contributes to market dynamics, especially among target user groups seeking immediate energy boosts.

Bangladesh Energy Drinks Industry Product Analysis

Product innovations in the Bangladesh energy drinks market are increasingly focused on functional benefits beyond basic energy. Manufacturers are incorporating vitamins, natural extracts, and lower sugar content to appeal to health-conscious consumers. Competitive advantages are being built on unique flavor profiles, sustained energy release, and improved cognitive function. Examples include formulations with double doses of Vitamin B12 for enhanced focus and the introduction of novel flavors like watermelon. These advancements cater to specific consumer needs and differentiate brands in a competitive landscape.

Key Drivers, Barriers & Challenges in Bangladesh Energy Drinks Industry

Key Drivers:

- Growing Youth Population: A substantial demographic actively seeking energy and performance enhancement.

- Increasing Disposable Income: Enables greater consumer spending on non-essential, lifestyle-enhancing products.

- Urbanization and Busy Lifestyles: Drives demand for quick energy solutions to combat fatigue and maintain productivity.

- Product Innovation: Introduction of new flavors, functional ingredients, and healthier alternatives caters to evolving consumer preferences.

Barriers & Challenges:

- Health Concerns: Growing awareness about sugar content and potential negative health effects of excessive consumption.

- Regulatory Scrutiny: Potential for increased regulation on marketing, labeling, and sugar content.

- Price Sensitivity: A significant portion of the market remains price-sensitive, impacting premium product adoption.

- Supply Chain Disruptions: Reliance on imported raw materials can lead to vulnerability to global supply chain issues.

- Intense Competition: Saturated market with established global and local players requires constant innovation and marketing investment. The estimated market value is approximately BDT 15.0 Billion.

Growth Drivers in the Bangladesh Energy Drinks Industry Market

The Bangladesh energy drinks industry's growth is propelled by several key factors. The expanding young demographic, comprising over 30% of the population, actively seeks products to enhance physical and mental performance, aligning perfectly with energy drink offerings. Rising disposable incomes, projected to grow by an average of 7.5% annually, translate into increased consumer spending power for lifestyle products. Furthermore, increasing urbanization and the demanding nature of modern work and study environments create a sustained demand for quick energy solutions. Technological advancements in formulation, leading to healthier and more functional energy drinks with added vitamins and natural ingredients, are attracting a wider consumer base, including those previously hesitant due to health concerns.

Challenges Impacting Bangladesh Energy Drinks Industry Growth

Despite promising growth, the Bangladesh energy drinks industry faces significant challenges. Growing public health concerns regarding sugar content and potential long-term health impacts of excessive consumption are leading to increased scrutiny and a demand for healthier alternatives. Regulatory bodies are also becoming more attentive, with potential for stricter advertising guidelines and ingredient disclosure mandates, impacting marketing strategies and product development costs. The highly competitive landscape, with established international brands and aggressive local players, necessitates continuous innovation and substantial marketing expenditure, creating barriers for new entrants. Supply chain vulnerabilities, particularly for imported ingredients, can lead to price volatility and availability issues, affecting production schedules and profit margins. The estimated total market value is projected to reach BDT 35.0 Billion by 2033.

Key Players Shaping the Bangladesh Energy Drinks Industry Market

- PRAN-RFL Group Ltd

- Deshbandhu Group

- Akij Food & Beverage Ltd

- Zisan Food & Beverage Ltd

- Osotspa Co Ltd

- Globe Soft Drinks & AST Beverage Ltd

- Red Bull GMBH

Significant Bangladesh Energy Drinks Industry Industry Milestones

- March 2022: Osotspa Public Company Limited released a newly formulated M-150 energy drink containing a double dose of Vitamin B12 to enhance energy and focus levels. This innovation aimed to tap into the growing demand for functional beverages with enhanced cognitive benefits.

- February 2022: Red Bull launched its new watermelon edition can in Bangladesh. The Red Bull Red Edition (Watermelon) was priced at INR 115 for 250 ml, indicating a strategic move to offer new flavor profiles and cater to evolving consumer tastes in the Bangladeshi market.

- October 2021: The Deshbandhu Group announced significant expansion plans with an investment of approximately BDT 8.0 billion. As part of this conglomerate, Deshbandhu Food and Beverage allocated BDT 2.0 billion, alongside investments in packaging and apparel, signaling a robust commitment to expanding its food and beverage segment, including energy drinks.

Future Outlook for Bangladesh Energy Drinks Industry Market

The future outlook for the Bangladesh energy drinks industry is exceptionally bright, driven by a young and aspirational population, increasing disposable incomes, and a growing awareness of functional beverages. Strategic opportunities lie in developing healthier, sugar-free, and natural variants to cater to evolving consumer preferences and address health concerns. Expansion into emerging online retail channels and partnerships with fitness centers and educational institutions will further boost market penetration. The industry is expected to witness continued product innovation, with a focus on unique flavors, added health benefits, and sustainable packaging, solidifying its growth trajectory towards an estimated market value of BDT 35.0 Billion by 2033.

Bangladesh Energy Drinks Industry Segmentation

-

1. Packaging Type

- 1.1. Cans

- 1.2. PET Bottles

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Stores

- 2.4. Others

Bangladesh Energy Drinks Industry Segmentation By Geography

- 1. Bangladesh

Bangladesh Energy Drinks Industry Regional Market Share

Geographic Coverage of Bangladesh Energy Drinks Industry

Bangladesh Energy Drinks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Strong Demand From Fitness-oriented Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Energy Drinks Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Cans

- 5.1.2. PET Bottles

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Stores

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PRAN-RFL Group Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deshbandhu Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Akij Food & Beverage Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zisan Food & Beverage Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Osotspa Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Globe Soft Drinks & AST Beverage Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Red Bull GMBH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 PRAN-RFL Group Ltd

List of Figures

- Figure 1: Bangladesh Energy Drinks Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Bangladesh Energy Drinks Industry Share (%) by Company 2025

List of Tables

- Table 1: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 2: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 5: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Energy Drinks Industry?

The projected CAGR is approximately 7.61%.

2. Which companies are prominent players in the Bangladesh Energy Drinks Industry?

Key companies in the market include PRAN-RFL Group Ltd, Deshbandhu Group, Akij Food & Beverage Ltd, Zisan Food & Beverage Ltd*List Not Exhaustive, Osotspa Co Ltd, Globe Soft Drinks & AST Beverage Ltd, Red Bull GMBH.

3. What are the main segments of the Bangladesh Energy Drinks Industry?

The market segments include Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 128.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Strong Demand From Fitness-oriented Consumers.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

In March 2022, The Osotspa Public Company Limited released a newly formulated M-150 energy drink containing a double dose of Vitamin B12 to enhance energy and focus levels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Energy Drinks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Energy Drinks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Energy Drinks Industry?

To stay informed about further developments, trends, and reports in the Bangladesh Energy Drinks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence