Key Insights

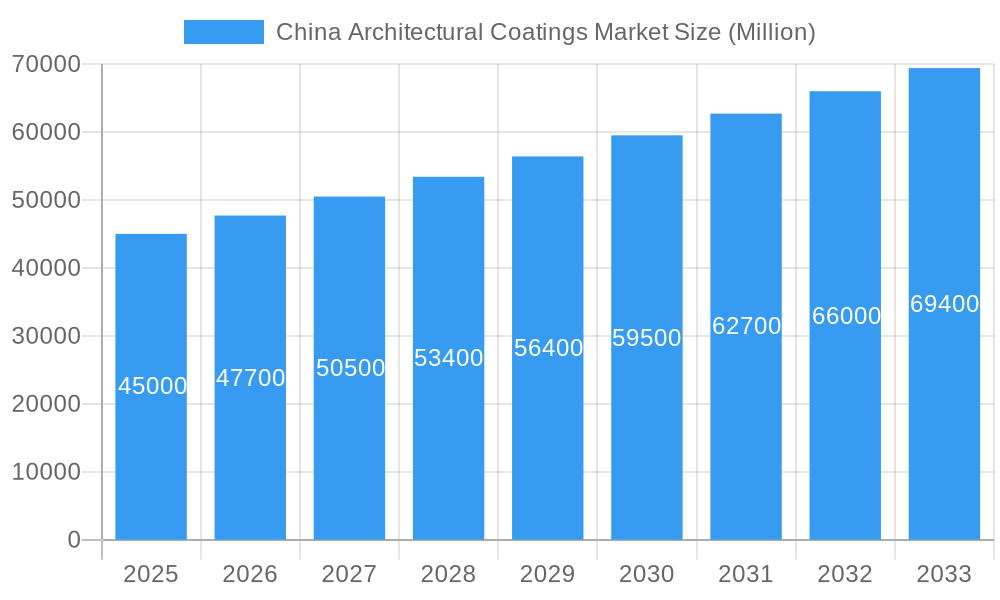

The China Architectural Coatings Market is poised for robust expansion, projected to exceed a market size of approximately USD 45,000 million by 2025, with a Compound Annual Growth Rate (CAGR) surpassing 5.00% throughout the forecast period of 2025-2033. This significant growth is primarily fueled by a confluence of dynamic market drivers, including rapid urbanization, escalating infrastructure development, and a burgeoning middle class with an increasing disposable income, leading to higher demand for aesthetically pleasing and protective building finishes. Furthermore, a heightened focus on sustainable construction practices and the demand for low-VOC (Volatile Organic Compound) and eco-friendly coatings are shaping product development and consumer preferences. The market is also witnessing a technological shift, with waterborne coatings gaining substantial traction due to environmental regulations and growing consumer awareness regarding health and safety.

China Architectural Coatings Market Market Size (In Billion)

The market's segmentation reveals diverse opportunities. In terms of sub-end users, the Commercial segment, encompassing office buildings, retail spaces, and hospitality venues, is expected to drive significant demand, mirroring the ongoing expansion of China's service sector. The Residential segment also remains a strong contributor, fueled by new housing construction and an increasing trend of home renovations and upgrades. Technologically, the dominance of waterborne coatings is expected to strengthen, while solventborne coatings will continue to cater to specific applications where performance requirements necessitate their use. Resin types like Acrylic, Epoxy, and Polyurethane are likely to see increased adoption due to their durability, versatility, and aesthetic properties, catering to both functional and decorative demands in architectural applications. Key industry players like AkzoNobel N.V., PPG Industries Inc., Nippon Paint Holdings Co. Ltd., and Kansai Paint Co. Ltd. are actively investing in R&D and expanding their production capacities to capture this burgeoning market.

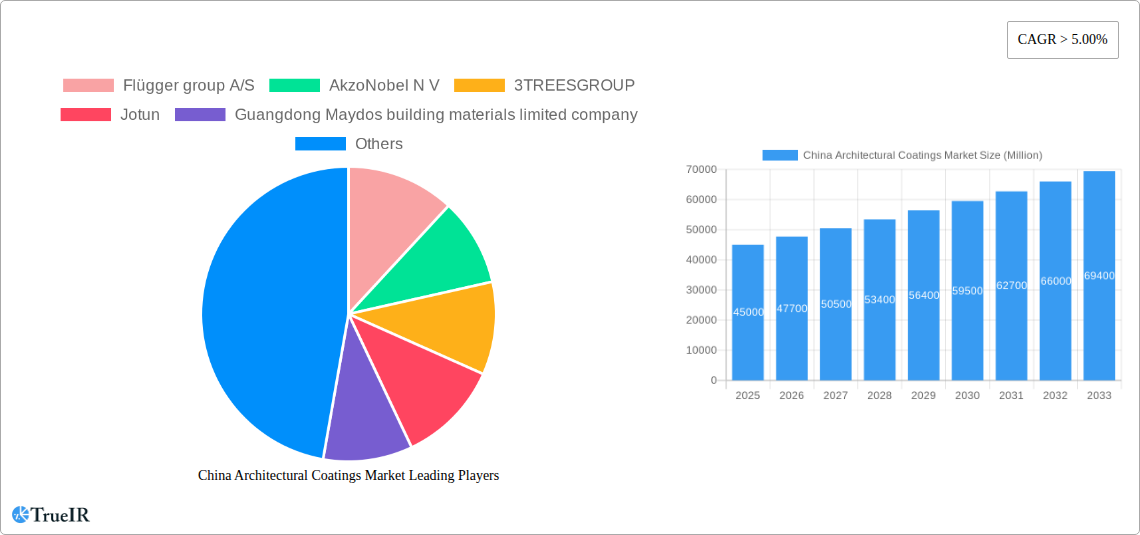

China Architectural Coatings Market Company Market Share

This in-depth report provides a strategic analysis of the China Architectural Coatings Market, offering a detailed forecast and critical insights into its dynamic evolution. Covering the study period from 2019 to 2033, with a base year of 2025, this report leverages high-volume keywords to maximize SEO visibility and reach key industry stakeholders. Understand the market's trajectory, competitive landscape, technological advancements, and growth opportunities within one of the world's largest construction and renovation markets.

China Architectural Coatings Market Market Structure & Competitive Landscape

The China Architectural Coatings Market exhibits a moderately consolidated structure, with a blend of established multinational corporations and rapidly growing domestic players. Innovation serves as a primary driver, fueled by increasing demand for sustainable, high-performance, and aesthetically pleasing coatings. Regulatory impacts, particularly concerning environmental standards and VOC emissions, are progressively shaping product development and manufacturing processes. The threat of product substitutes, such as wallpapers and alternative cladding materials, remains a consideration, though the inherent versatility and protective qualities of architectural coatings maintain their market dominance. End-user segmentation, broadly categorized into Commercial and Residential sectors, reveals distinct purchasing behaviors and product preferences. Mergers and acquisitions (M&A) are a significant trend, with companies actively consolidating their market positions and expanding their product portfolios. For instance, PPG Industries Inc.'s acquisition of Tikkurila in 2021 demonstrates a strategic move to bolster its presence in key regions, including China. The market's competitive intensity is further heightened by strategic partnerships and R&D collaborations, aimed at developing next-generation coating solutions.

China Architectural Coatings Market Market Trends & Opportunities

The China Architectural Coatings Market is poised for substantial expansion, projected to reach XXX Million by 2033. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). A significant trend is the increasing demand for waterborne architectural coatings, driven by stringent environmental regulations and a growing consumer preference for eco-friendly and low-VOC products. This shift represents a major opportunity for manufacturers investing in sustainable technologies. The burgeoning urbanisation and ongoing infrastructure development projects across China continue to fuel demand for both interior and exterior architectural coatings. Furthermore, the rising disposable income and evolving consumer aspirations are leading to a greater emphasis on premium and decorative coatings, offering opportunities for product differentiation and value-added solutions.

Technological advancements are playing a pivotal role, with the development of coatings offering enhanced durability, weather resistance, and specific functionalities such as anti-bacterial, self-cleaning, and thermal insulation properties. The Residential segment, driven by new home construction and extensive renovation activities, is expected to remain the largest end-user market. The Commercial segment, encompassing offices, retail spaces, hospitality, and healthcare facilities, also presents considerable growth potential, particularly with the focus on modern building aesthetics and energy efficiency.

Key opportunities lie in the development and promotion of energy-saving coatings that align with China's dual carbon goals. Manufacturers that can offer innovative solutions that reduce building energy consumption will gain a significant competitive edge. The digital transformation within the industry, including online sales channels and advanced color matching technologies, is also creating new avenues for market penetration and customer engagement. The increasing adoption of smart home technologies further opens doors for functional coatings integrated with these systems. Understanding and adapting to these evolving trends will be crucial for sustained success in this vibrant market.

Dominant Markets & Segments in China Architectural Coatings Market

The China Architectural Coatings Market is characterized by distinct regional dominance and segment leadership, driven by a confluence of economic, demographic, and policy factors. The Residential segment consistently commands the largest share of the market, propelled by ongoing urbanization and a substantial backlog of new housing construction and existing property renovations. This dominance is further amplified by government initiatives aimed at improving housing standards and promoting urban renewal projects.

Within the technology segment, Waterborne architectural coatings are rapidly gaining traction and are projected to witness the highest growth. This surge is primarily attributable to increasingly stringent environmental regulations aimed at reducing volatile organic compound (VOC) emissions, a key driver for the adoption of eco-friendly alternatives over traditional Solventborne formulations.

In terms of resin types, Acrylic based architectural coatings represent a significant and dominant segment. Their versatility, durability, excellent weather resistance, and cost-effectiveness make them suitable for a wide range of applications, from interior walls to exterior facades. While Epoxy coatings are prevalent in industrial and heavy-duty applications within the architectural sphere (e.g., garage floors, high-traffic areas), and Polyurethane offers superior durability and chemical resistance, Acrylics maintain a broader market appeal for general architectural use.

The East China region, with its high population density, robust economic activity, and advanced infrastructure, typically emerges as the dominant geographical market. This region benefits from substantial construction volumes, higher disposable incomes, and a greater propensity for adopting new and advanced coating technologies.

Key growth drivers within these dominant segments include:

- Infrastructure Development: Continued government investment in public infrastructure, including schools, hospitals, and transportation hubs, necessitates large-scale application of architectural coatings.

- Urbanization & Housing Demand: The ongoing migration of rural populations to urban centers fuels demand for new residential construction.

- Green Building Initiatives: Growing awareness and policy support for sustainable construction practices directly favor the uptake of waterborne and low-VOC coatings.

- Renovation & Retrofitting: The aging building stock in many urban areas presents a significant opportunity for renovation and retrofitting projects, requiring extensive coating applications.

- Consumer Affluence & Aesthetics: Increasing consumer disposable income leads to a greater demand for aesthetically pleasing and high-quality decorative coatings, driving innovation in color palettes and finishes.

- Technological Advancements: Innovations in coating formulations offering enhanced durability, functionality (e.g., thermal insulation, air purification), and ease of application further stimulate market demand.

The interplay of these factors solidifies the dominance of the Residential segment, Waterborne technology, Acrylic resins, and the East China region, creating a favorable landscape for market players to capitalize on.

China Architectural Coatings Market Product Analysis

The China Architectural Coatings Market is witnessing a surge in product innovation centered on sustainability, enhanced functionality, and improved aesthetics. Manufacturers are increasingly focusing on developing waterborne coatings with reduced VOC content, aligning with stringent environmental regulations and growing consumer demand for healthier living spaces. Innovations include coatings with enhanced durability, superior weather resistance, and specialized properties such as anti-bacterial, anti-mold, and self-cleaning capabilities. The integration of advanced resin technologies, including modified acrylics and polyurethanes, allows for superior performance characteristics, such as improved adhesion, flexibility, and scratch resistance. These advancements cater to diverse applications, from interior decorative paints to protective exterior finishes, offering competitive advantages through superior performance, environmental compliance, and aesthetic appeal.

Key Drivers, Barriers & Challenges in China Architectural Coatings Market

Key Drivers:

- Robust Infrastructure Development: Continued government investment in urban development, housing, and public facilities fuels demand for architectural coatings.

- Urbanization and Growing Middle Class: Increased disposable income and a rising middle class drive demand for higher quality and aesthetically pleasing coatings in both new constructions and renovations.

- Environmental Regulations: Stringent government policies promoting eco-friendly and low-VOC coatings are a significant catalyst for the adoption of waterborne and sustainable technologies.

- Technological Advancements: Innovations in coating formulations offering enhanced durability, functionality (e.g., thermal insulation, air purification), and ease of application are driving market growth.

Barriers & Challenges:

- Intense Competition and Price Sensitivity: The market is highly competitive, with numerous players leading to price pressures and challenges for smaller manufacturers.

- Supply Chain Disruptions: Volatility in raw material prices and potential disruptions in the global supply chain can impact production costs and availability.

- Regulatory Compliance Costs: Adhering to evolving environmental standards and product certifications can incur significant compliance costs for manufacturers.

- Counterfeit Products: The prevalence of counterfeit and lower-quality products can undermine market integrity and erode consumer trust in genuine brands.

- Skilled Labor Shortage: A shortage of skilled applicators can impact the quality of finished projects and potentially slow down the adoption of advanced coating systems.

Growth Drivers in the China Architectural Coatings Market Market

The China Architectural Coatings Market is propelled by a confluence of powerful growth drivers. Foremost is the relentless pace of urbanization and ongoing infrastructure expansion, creating a consistent demand for building materials, including high-quality coatings. Government policies championing green building and environmental protection are a significant catalyst, driving the adoption of waterborne coatings and low-VOC formulations. Technological advancements in resin development and application techniques are enabling the creation of more durable, functional, and aesthetically appealing coatings. Furthermore, rising consumer affluence and a growing awareness of interior design and building aesthetics are leading to increased expenditure on premium and decorative paints, particularly in the Residential segment. The retrofitting and renovation market also presents a substantial opportunity, as older buildings are updated to meet modern standards.

Challenges Impacting China Architectural Coatings Market Growth

Despite its robust growth trajectory, the China Architectural Coatings Market faces several critical challenges. Intense market competition, characterized by a large number of domestic and international players, often leads to significant price wars, squeezing profit margins. Fluctuations in the prices of key raw materials, such as titanium dioxide and acrylic monomers, can unpredictably impact production costs and the overall profitability of manufacturers. Navigating a complex and evolving regulatory landscape, particularly concerning environmental standards and product certifications, requires continuous investment and adaptation. Furthermore, ensuring consistent quality control across a vast distribution network and combating the proliferation of counterfeit products remain persistent concerns that can erode market trust and consumer confidence. The need for skilled applicators also presents a challenge, as improper application can compromise the performance and longevity of coatings, leading to customer dissatisfaction.

Key Players Shaping the China Architectural Coatings Market Market

- Flügger group A/S

- AkzoNobel N V

- 3TREESGROUP

- Jotun

- Guangdong Maydos building materials limited company

- The China Paint Mfg Co (1932) Ltd

- SKK(S) Pte Ltd

- DAI NIPPON TORYO CO LTD

- CARPOLY

- PPG Industries Inc

- Nippon Paint Holdings Co Ltd

- Axalta Coating Systems

- Hempel A/S

- Foshan Caboli Painting Material Co Ltd

- Kansai Paint Co Ltd

Significant China Architectural Coatings Market Industry Milestones

- April 2022: Nippon Paint Holdings Co., Ltd. formed a strategic partnership with the Sichuan Academy of Construction Sciences, cooperating in multiple fields to promote the high-quality development of the coating industry.

- January 2022: Nippon Paint Holdings Co., Ltd. proposed new solutions focusing on dual carbon goals and reducing building energy consumption.

- October 2021: PPG completed the acquisition of Tikkurila, a Nordic paint company, in June 2021. This acquisition is expected to aid PPG in growing its Architectural Coatings business in EMEA and China within the Nordic region.

Future Outlook for China Architectural Coatings Market Market

The future outlook for the China Architectural Coatings Market is exceptionally promising, driven by sustained economic growth, urbanization, and a growing emphasis on sustainability and technological innovation. Strategic opportunities abound for companies that can adeptly navigate the evolving regulatory landscape and capitalize on the increasing demand for eco-friendly, high-performance coatings. The market's potential is further bolstered by the ongoing renovation and retrofitting of existing infrastructure, as well as the continuous development of smart and energy-efficient buildings. Investments in research and development, focusing on next-generation coatings with advanced functionalities and digital integration, will be crucial for market leaders. Collaborative efforts, strategic partnerships, and targeted acquisitions will continue to shape the competitive dynamics, positioning the market for robust and sustained growth in the coming years.

China Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

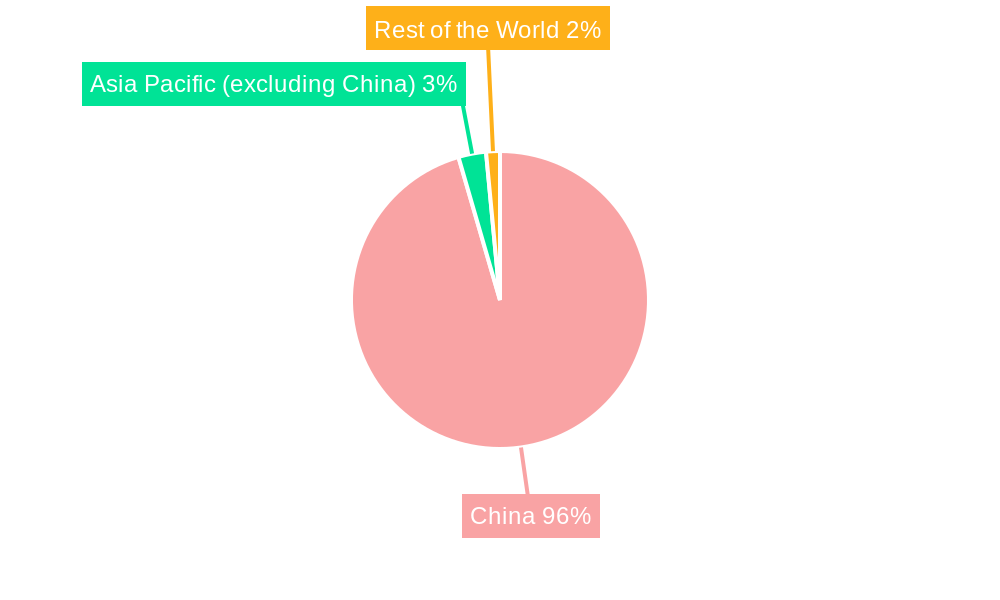

China Architectural Coatings Market Segmentation By Geography

- 1. China

China Architectural Coatings Market Regional Market Share

Geographic Coverage of China Architectural Coatings Market

China Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations on VOCs Released on Flooring; Other Restraints

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Architectural Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Flügger group A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AkzoNobel N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3TREESGROUP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Guangdong Maydos building materials limited company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The China Paint Mfg Co (1932) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SKK(S) Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DAI NIPPON TORYO CO LTD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CARPOLY

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PPG Industries Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nippon Paint Holdings Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Axalta Coating Systems

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hempel A/S

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Foshan Caboli Painting Material Co Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kansai Paint Co Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Flügger group A/S

List of Figures

- Figure 1: China Architectural Coatings Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Architectural Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: China Architectural Coatings Market Revenue undefined Forecast, by Sub End User 2020 & 2033

- Table 2: China Architectural Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: China Architectural Coatings Market Revenue undefined Forecast, by Resin 2020 & 2033

- Table 4: China Architectural Coatings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: China Architectural Coatings Market Revenue undefined Forecast, by Sub End User 2020 & 2033

- Table 6: China Architectural Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 7: China Architectural Coatings Market Revenue undefined Forecast, by Resin 2020 & 2033

- Table 8: China Architectural Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Architectural Coatings Market?

The projected CAGR is approximately 9.97%.

2. Which companies are prominent players in the China Architectural Coatings Market?

Key companies in the market include Flügger group A/S, AkzoNobel N V, 3TREESGROUP, Jotun, Guangdong Maydos building materials limited company, The China Paint Mfg Co (1932) Ltd, SKK(S) Pte Ltd, DAI NIPPON TORYO CO LTD, CARPOLY, PPG Industries Inc, Nippon Paint Holdings Co Ltd, Axalta Coating Systems, Hempel A/S, Foshan Caboli Painting Material Co Ltd, Kansai Paint Co Ltd.

3. What are the main segments of the China Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food and Beverage Industry.

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

Stringent Regulations on VOCs Released on Flooring; Other Restraints.

8. Can you provide examples of recent developments in the market?

April 2022: Nippon Paint Holdings Co., Ltd. has formed a strategic partnership with the Sichuan Academy of Construction Sciences, cooperating in multiple fields to promote the high-quality development of the coating industry.January 2022: Nippon Paint Holdings Co., Ltd. proposes new solutions for focusing on dual carbon goals and reducing building energy consumption.October 2021: PPG completed the acquisition of Tikkurila a Nordic paint company in June 2021. This acquisition will help PPG grow its Architectural coatings business in EMEA and China in the Nordic region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the China Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence