Key Insights

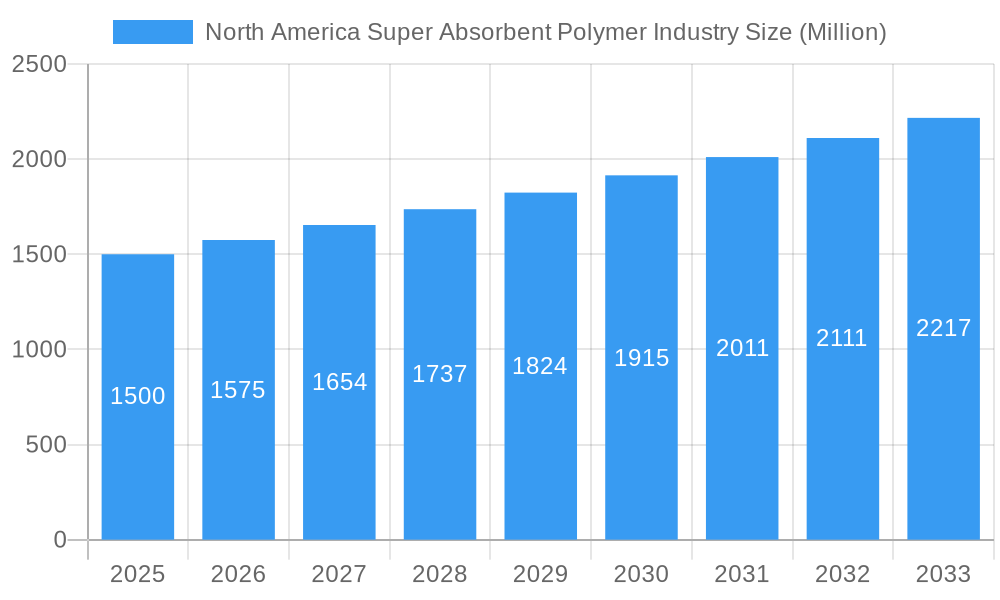

The North American Super Absorbent Polymer (SAP) market is projected for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 6.4%. The market size was valued at $9.77 billion in the base year 2025 and is expected to expand significantly through the forecast period. This growth is largely driven by the increasing demand for disposable hygiene products, including baby diapers, adult incontinence products, and feminine hygiene items. Rising disposable incomes and an aging population in key markets like the United States and Canada are boosting consumer preference for advanced hygiene solutions, thereby increasing SAP consumption. Additionally, emerging applications in agriculture, such as soil conditioning and water retention, are contributing to market diversification.

North America Super Absorbent Polymer Industry Market Size (In Billion)

The Polyacrylamide and Acrylic Acid-based SAP segments are anticipated to spearhead innovation and market adoption due to their superior absorption properties and cost-efficiency. However, the market confronts challenges such as volatile raw material prices, particularly for acrylic acid, impacting manufacturer profit margins. Environmental considerations surrounding SAP disposal and the development of biodegradable alternatives also present strategic hurdles. Nevertheless, continuous research and development focused on enhancing SAP performance, biodegradability, and exploring novel applications are expected to counteract these restraints. Leading companies are investing in technological advancements and production capacity expansion to meet escalating demand and maintain competitive advantage. The influence of markets like the United States and Canada will remain pivotal in shaping the North American SAP landscape.

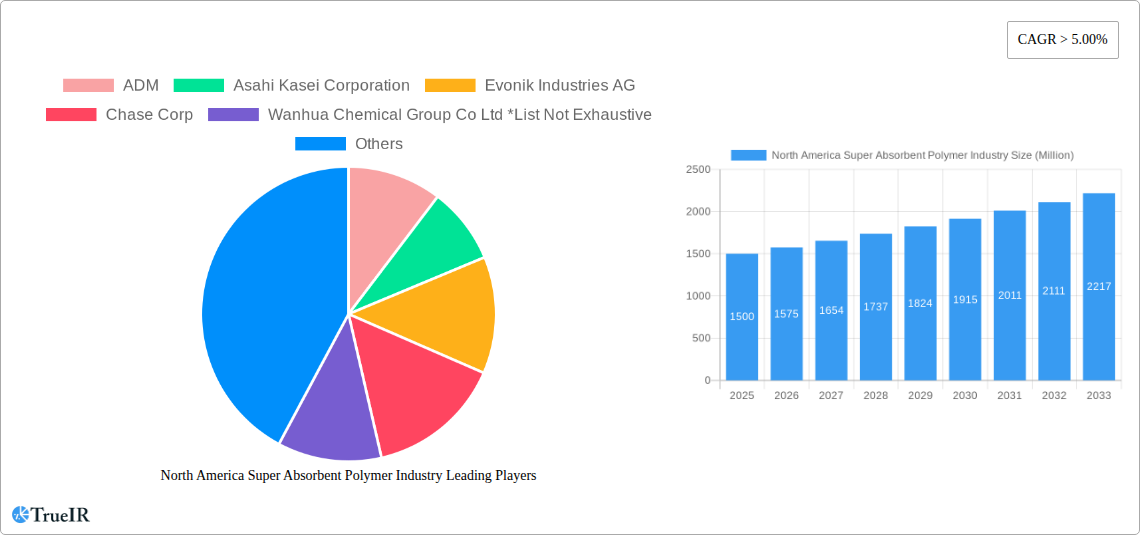

North America Super Absorbent Polymer Industry Company Market Share

North America Super Absorbent Polymer Industry Market Structure & Competitive Landscape

The North American Super Absorbent Polymer (SAP) market is characterized by a moderate to high level of concentration, with a few key players dominating production and innovation. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year, and a forecast period extending from 2025 to 2033, building upon historical data from 2019 to 2024. Acrylic acid-based SAPs constitute the largest product segment, driven by their superior absorbency and cost-effectiveness in high-volume applications like baby diapers and adult incontinence products. Innovation drivers are primarily focused on enhancing SAP performance, such as increased absorption capacity, faster absorption rates, and improved retention under pressure. Regulatory impacts, particularly concerning environmental sustainability and biodegradability of SAPs, are becoming increasingly significant, pushing manufacturers towards greener alternatives. Product substitutes, while present, are largely less efficient or more expensive, limiting their widespread adoption in core applications. End-user segmentation reveals a strong reliance on the baby diapers segment, followed by adult incontinence products and feminine hygiene applications. The agriculture support segment, though smaller, shows promising growth potential. Merger and acquisition (M&A) trends indicate a strategic consolidation among larger players to expand market share, gain technological expertise, and secure raw material supply chains. M&A volumes are projected to be in the hundreds of millions of dollars annually during the forecast period as companies seek to strengthen their competitive positions.

North America Super Absorbent Polymer Industry Market Trends & Opportunities

The North America Super Absorbent Polymer (SAP) industry is poised for substantial market size growth, projected to reach an estimated value of xx Million USD in 2025, with a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is fueled by a confluence of demographic shifts, evolving consumer preferences, and technological advancements. The aging population across the United States, Canada, and Mexico is a primary driver, directly increasing demand for adult incontinence products, a segment projected to experience a CAGR of xx%. Similarly, sustained birth rates in certain demographics continue to support the dominant baby diapers segment, which currently accounts for over 60% of the total SAP market in North America.

Technological shifts are also playing a pivotal role. Manufacturers are heavily investing in research and development to create bio-based and biodegradable SAPs, responding to growing environmental consciousness and regulatory pressures. This trend presents a significant opportunity for companies that can successfully commercialize sustainable SAP solutions, potentially capturing a market share of xx% in niche applications by 2033. Furthermore, advancements in SAP particle design and cross-linking technologies are leading to products with enhanced absorbency, faster wicking capabilities, and superior gel strength, translating into thinner, more comfortable, and higher-performing end-user products.

Consumer preferences are evolving beyond basic functionality. There's an increasing demand for SAP-infused products that offer enhanced comfort, discretion, and skin-friendliness, particularly in personal care applications. This is driving innovation in SAP formulations and manufacturing processes. The agriculture support segment, while currently smaller, represents a significant untapped opportunity. The increasing adoption of water-saving agricultural practices and the need for improved soil moisture retention in arid regions of the United States and Mexico are expected to drive demand for SAPs in this sector, with a projected CAGR of xx%. The feminine hygiene segment is also expected to see steady growth, driven by product innovation and increased awareness.

Competitive dynamics remain intense, with established players like BASF SE, Evonik Industries AG, and Asahi Kasei Corporation continuously vying for market share through product differentiation, strategic partnerships, and capacity expansions. The United States is expected to maintain its position as the largest geographical market due to its substantial population and high disposable income, followed by Mexico, which is experiencing rapid growth in its manufacturing sector and a rising middle class. Canada also contributes significantly to the market demand. Opportunities lie in developing specialized SAPs for niche applications such as medical uses and advanced textiles, further diversifying the revenue streams for SAP manufacturers. The overall outlook suggests a healthy and growing market, with ample scope for innovation and strategic expansion.

Dominant Markets & Segments in North America Super Absorbent Polymer Industry

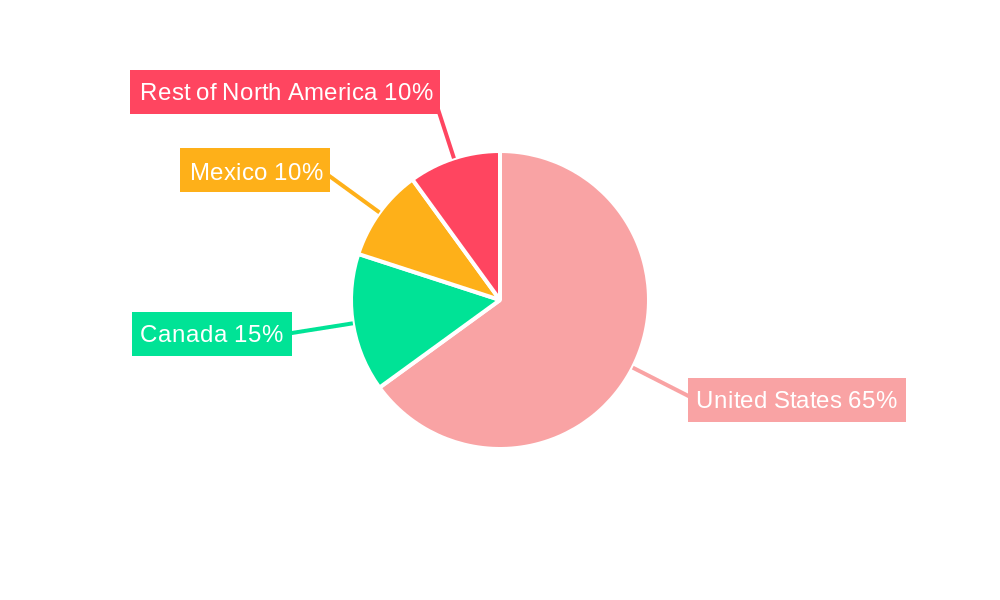

The North American Super Absorbent Polymer (SAP) industry exhibits distinct dominance across its geographical, product, and application segments, with the United States firmly established as the leading market.

Geographical Dominance:

- United States: The United States accounts for an estimated xx% of the North American SAP market value in 2025. This dominance is driven by its large and aging population, leading to high demand for baby diapers and adult incontinence products. The country's advanced healthcare infrastructure also supports the use of SAPs in medical applications. Significant investments in R&D and manufacturing by global SAP giants further solidify its leadership. The Rest of North America, primarily encompassing developed economies with similar demographic trends, also presents substantial demand.

- Mexico: While currently smaller in absolute value, Mexico is projected to exhibit the highest growth rate, with a CAGR of xx% during the forecast period. This rapid expansion is attributed to a growing population, increasing disposable incomes, and the country's expanding manufacturing base for hygiene products, serving both domestic and export markets. Policies supporting domestic manufacturing and infrastructure development are key growth enablers.

- Canada: Canada represents a stable and mature market, driven by its developed economy and an aging demographic. Its market share is consistent, with demand closely mirroring that of the United States but on a smaller scale.

Product Type Dominance:

- Acrylic Acid Based: This segment is the undisputed leader, comprising over xx% of the total SAP market in North America. Its dominance stems from its cost-effectiveness and superior performance in high-volume applications. Key growth drivers include its widespread use in disposable hygiene products and ongoing advancements in polymerization techniques that enhance its absorbency and retention properties.

- Polyacrylamide: While a smaller segment, Polyacrylamide SAPs are gaining traction in niche applications like water treatment and specialized agriculture due to their unique properties, such as higher gel strength and stability in certain environments.

- Other Product Types: This category includes emerging SAPs with biodegradable or specialized functionalities, representing a segment with high future growth potential as sustainability becomes a more critical factor.

Application Dominance:

- Baby Diapers: This segment is the largest and most mature, accounting for approximately xx% of the total SAP market in 2025. Sustained birth rates and increased disposable incomes in key regions drive consistent demand. Innovation in this segment focuses on thinner, more absorbent, and skin-friendly diapers.

- Adult Incontinence Products: Driven by the aging global population, this segment is experiencing robust growth and is projected to maintain a CAGR of xx%. Governments and healthcare providers are increasingly recognizing the importance of quality incontinence care, boosting demand.

- Feminine Hygiene: This segment offers steady growth, fueled by product innovation and increased consumer awareness of advanced hygiene solutions.

- Agriculture Support: While a smaller segment currently, Agriculture Support is poised for significant expansion, driven by the need for water conservation, improved soil health, and increased crop yields, particularly in drought-prone regions of the United States and Mexico. The adoption of smart farming technologies and sustainable agricultural practices are key growth catalysts.

The interplay of these dominant segments highlights the mature nature of the hygiene product market, while simultaneously pointing towards significant growth opportunities in agriculture and emerging bio-based SAP technologies.

North America Super Absorbent Polymer Industry Product Analysis

The North American Super Absorbent Polymer (SAP) market is characterized by continuous product innovation focused on enhancing absorbency, retention under pressure, and biodegradability. Acrylic acid-based SAPs remain the dominant product type, benefiting from advanced polymerization techniques that improve gel strength and absorption rates. These innovations directly translate into thinner, more efficient baby diapers and adult incontinence products. Emerging bio-based and biodegradable SAPs represent a significant area of development, driven by environmental regulations and growing consumer demand for sustainable solutions. Companies are exploring novel raw materials and synthesis methods to achieve competitive performance while reducing environmental impact. The competitive advantage in this product segment increasingly lies in the ability to balance cost-effectiveness with enhanced functionality and eco-friendliness, catering to a discerning market seeking both performance and sustainability.

Key Drivers, Barriers & Challenges in North America Super Absorbent Polymer Industry

Key Drivers:

- Demographic Shifts: An aging population in North America significantly boosts demand for adult incontinence products. Sustained birth rates in certain demographics continue to drive the baby diaper market.

- Technological Advancements: Innovations in SAP production, such as enhanced absorption capacity, faster wicking, and improved biodegradability, create demand for higher-performing products.

- Growing Environmental Awareness: Increasing consumer and regulatory pressure for sustainable products is driving the development and adoption of bio-based and biodegradable SAPs.

- Rising Disposable Incomes: In regions like Mexico, increasing disposable incomes translate to higher consumption of premium hygiene products.

- Agricultural Innovations: The need for water conservation and improved soil management in agriculture presents a growing opportunity for specialized SAPs.

Key Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials, such as acrylic acid derived from crude oil, can impact production costs and profitability.

- Regulatory Hurdles: Evolving environmental regulations regarding biodegradability and chemical composition can necessitate costly product reformulation and re-certification.

- Competition from Substitutes: While high-performance, some traditional absorbent materials or competing technologies could emerge as substitutes in specific, less demanding applications.

- Supply Chain Disruptions: Geopolitical events, natural disasters, or logistical challenges can disrupt the supply of raw materials and the distribution of finished SAPs, impacting market stability.

- Capital Intensity: Significant investment is required for state-of-the-art SAP manufacturing facilities, posing a barrier to entry for new players and requiring continuous capital expenditure for existing ones.

Growth Drivers in the North America Super Absorbent Polymer Industry Market

The North American Super Absorbent Polymer (SAP) market's growth is propelled by several key factors. The aging demographic across the United States, Canada, and Mexico is a primary driver, directly increasing the demand for adult incontinence products. Simultaneously, consistent birth rates in various populations continue to fuel the robust baby diaper market. Technological advancements in SAP manufacturing are leading to products with enhanced absorbency, faster wicking, and improved retention under pressure, enabling the creation of thinner and more comfortable end-use products. Furthermore, a significant and growing driver is the increasing focus on environmental sustainability, which is spurring the development and adoption of bio-based and biodegradable SAPs. This trend is supported by evolving consumer preferences and stringent regulatory frameworks. In countries like Mexico, rising disposable incomes and a growing middle class are contributing to increased consumption of hygiene products. The agriculture sector also presents a burgeoning opportunity, driven by the global emphasis on water conservation and the need for improved soil moisture retention.

Challenges Impacting North America Super Absorbent Polymer Industry Growth

Despite promising growth, the North America Super Absorbent Polymer (SAP) industry faces several significant challenges. Volatility in the prices of key raw materials, particularly acrylic acid, which is often derived from crude oil, poses a continuous threat to production costs and profit margins. Navigating a complex and evolving regulatory landscape, especially concerning environmental standards, biodegradability, and chemical safety, can necessitate substantial investments in research, development, and compliance. Supply chain vulnerabilities, exacerbated by global events, can lead to disruptions in raw material procurement and product distribution, impacting market stability and delivery timelines. Moreover, the capital-intensive nature of SAP manufacturing requires substantial upfront investment and ongoing expenditure for upgrades and expansions, acting as a potential barrier for new entrants and a continuous financial consideration for established players. Intense competition within the market also pressures companies to innovate constantly and maintain competitive pricing, while the threat of emerging substitute materials in specific applications requires ongoing vigilance and product differentiation.

Key Players Shaping the North America Super Absorbent Polymer Industry Market

- ADM

- Asahi Kasei Corporation

- Evonik Industries AG

- Chase Corp

- Wanhua Chemical Group Co Ltd

- BASF SE

- LG Chem

- Kao Corporation

- SONGWON

Significant North America Super Absorbent Polymer Industry Industry Milestones

- 2019: Increased investment in R&D for biodegradable SAPs by major chemical companies.

- 2020: Supply chain disruptions due to the global pandemic highlight the need for resilient raw material sourcing.

- 2021: Launch of new, high-absorbency SAP grades for adult incontinence products by leading manufacturers.

- 2022: Growing regulatory focus on PFAS-free absorbent materials in the United States and Canada.

- 2023: Strategic partnerships formed between SAP producers and hygiene product manufacturers to develop innovative, sustainable solutions.

- 2024: Continued expansion of manufacturing capacity by key players to meet rising global demand.

Future Outlook for North America Super Absorbent Polymer Industry Market

The future outlook for the North America Super Absorbent Polymer (SAP) industry is exceptionally positive, characterized by sustained growth driven by demographic trends and a strong push towards sustainability. The increasing demand for adult incontinence products due to an aging population will remain a core growth catalyst. Simultaneously, advancements in bio-based and biodegradable SAPs will unlock new market opportunities and cater to evolving consumer and regulatory preferences. Innovations aimed at enhancing SAP performance, such as improved moisture management and skin-friendliness, will continue to drive product development in the hygiene sector. The agriculture support segment is poised for significant expansion, offering a crucial role in water-efficient farming practices. Companies that successfully balance innovation, cost-effectiveness, and environmental responsibility are set to capture substantial market share and lead the industry into a more sustainable and high-performing future. The market is expected to witness continued strategic investments and product diversification to meet these evolving demands.

North America Super Absorbent Polymer Industry Segmentation

-

1. Product Type

- 1.1. Polyacrylamide

- 1.2. Acrylic Acid Based

- 1.3. Other Product Types

-

2. Application

- 2.1. Baby Diapers

- 2.2. Adult Incontinence Products

- 2.3. Feminine Hygiene

- 2.4. Agriculture Support

- 2.5. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Super Absorbent Polymer Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Super Absorbent Polymer Industry Regional Market Share

Geographic Coverage of North America Super Absorbent Polymer Industry

North America Super Absorbent Polymer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Hygiene Awareness; Growing Infant and Aging Population

- 3.3. Market Restrains

- 3.3.1. ; High Raw Material Cost and Availability of Raw Material; Other Restraints

- 3.4. Market Trends

- 3.4.1. Baby Diaper - A Huge Market Potential

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Polyacrylamide

- 5.1.2. Acrylic Acid Based

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Baby Diapers

- 5.2.2. Adult Incontinence Products

- 5.2.3. Feminine Hygiene

- 5.2.4. Agriculture Support

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Polyacrylamide

- 6.1.2. Acrylic Acid Based

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Baby Diapers

- 6.2.2. Adult Incontinence Products

- 6.2.3. Feminine Hygiene

- 6.2.4. Agriculture Support

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Polyacrylamide

- 7.1.2. Acrylic Acid Based

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Baby Diapers

- 7.2.2. Adult Incontinence Products

- 7.2.3. Feminine Hygiene

- 7.2.4. Agriculture Support

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Polyacrylamide

- 8.1.2. Acrylic Acid Based

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Baby Diapers

- 8.2.2. Adult Incontinence Products

- 8.2.3. Feminine Hygiene

- 8.2.4. Agriculture Support

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Super Absorbent Polymer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Polyacrylamide

- 9.1.2. Acrylic Acid Based

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Baby Diapers

- 9.2.2. Adult Incontinence Products

- 9.2.3. Feminine Hygiene

- 9.2.4. Agriculture Support

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ADM

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Asahi Kasei Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Evonik Industries AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Chase Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Wanhua Chemical Group Co Ltd *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BASF SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 LG Chem

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kao Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SONGWON

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 ADM

List of Figures

- Figure 1: North America Super Absorbent Polymer Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Super Absorbent Polymer Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Super Absorbent Polymer Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Super Absorbent Polymer Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the North America Super Absorbent Polymer Industry?

Key companies in the market include ADM, Asahi Kasei Corporation, Evonik Industries AG, Chase Corp, Wanhua Chemical Group Co Ltd *List Not Exhaustive, BASF SE, LG Chem, Kao Corporation, SONGWON.

3. What are the main segments of the North America Super Absorbent Polymer Industry?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Hygiene Awareness; Growing Infant and Aging Population.

6. What are the notable trends driving market growth?

Baby Diaper - A Huge Market Potential.

7. Are there any restraints impacting market growth?

; High Raw Material Cost and Availability of Raw Material; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Super Absorbent Polymer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Super Absorbent Polymer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Super Absorbent Polymer Industry?

To stay informed about further developments, trends, and reports in the North America Super Absorbent Polymer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence