Key Insights

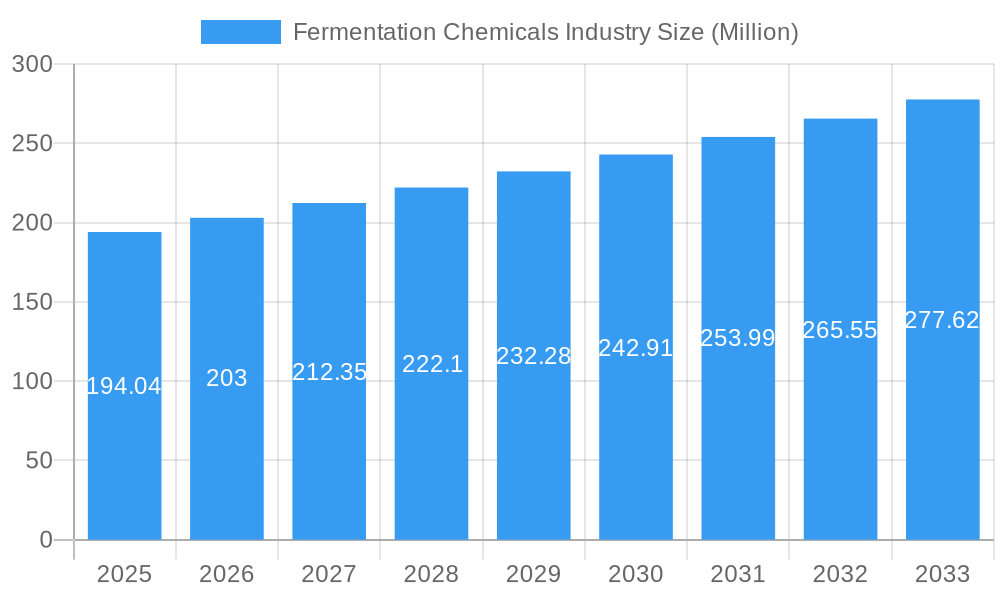

The global fermentation chemicals market is poised for robust expansion, projected to reach an estimated USD 194.04 million with a Compound Annual Growth Rate (CAGR) of 4.60% during the study period of 2019-2033. This growth is fundamentally driven by the increasing demand for sustainable and bio-based chemicals across various industries, moving away from traditional petrochemical-based alternatives. The versatility of fermentation processes allows for the production of a wide array of chemicals, including alcohols, organic acids, and enzymes, which are integral to sectors like food and beverage, pharmaceuticals, and industrial manufacturing. The rising consumer preference for natural and ethically sourced products further fuels the adoption of fermented ingredients, creating significant opportunities for market participants. Furthermore, advancements in biotechnology and bioprocessing techniques are enhancing the efficiency and cost-effectiveness of fermentation, enabling the production of higher-value products and expanding the market's reach.

Fermentation Chemicals Industry Market Size (In Million)

The market's trajectory is further shaped by critical trends such as the growing application of fermentation in the production of biofuels, bioplastics, and specialty chemicals, contributing to a circular economy. Innovations in microbial strain development and process optimization are enhancing yields and reducing production costs, making fermented chemicals more competitive. However, the market also faces certain restraints. These include the initial high capital investment required for setting up fermentation facilities, the complex regulatory landscape governing the use of bio-based products in certain applications, and the potential for supply chain disruptions. Despite these challenges, the overarching demand for eco-friendly solutions and the continuous innovation within the industry are expected to propel the fermentation chemicals market forward, with Asia Pacific anticipated to be a significant growth engine due to its expanding industrial base and increasing investments in biotechnology.

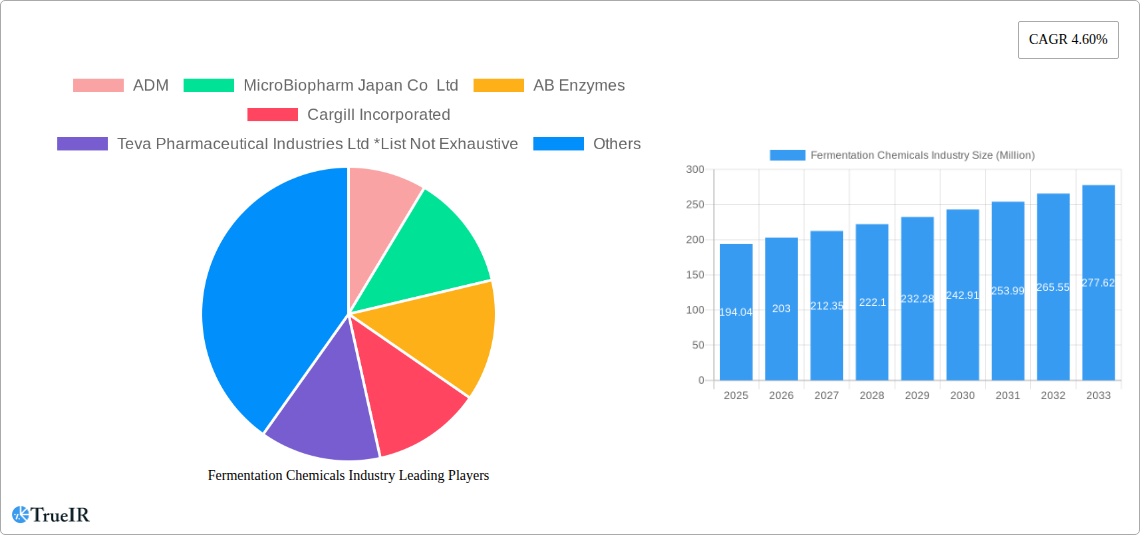

Fermentation Chemicals Industry Company Market Share

Here's a dynamic, SEO-optimized report description for the Fermentation Chemicals Industry, meticulously crafted for clarity, engagement, and maximum search visibility.

Fermentation Chemicals Industry Market Structure & Competitive Landscape

The global fermentation chemicals market, valued at an estimated $XX Million in 2025, exhibits a moderately concentrated structure, with key players like ADM, Cargill Incorporated, Novozymes, and BASF SE holding significant market share. Innovation is a primary driver, fueled by substantial R&D investments aimed at developing more efficient and sustainable fermentation processes and novel bio-based chemical solutions. Regulatory frameworks, particularly concerning food safety, environmental impact, and biosecurity, play a crucial role in shaping market entry and product development. The threat of product substitutes, while present from petrochemical alternatives, is diminishing with the growing demand for bio-based and sustainable products. End-user segmentation is diverse, spanning industrial, food and beverage, pharmaceutical and nutritional, and plastics & fibers applications, each with unique growth trajectories and demand patterns. Mergers and acquisitions (M&A) activity, with an estimated XX M&A deals in the historical period (2019-2024) valued at approximately $XX Million, continues to be a strategic tool for market consolidation, technology acquisition, and expanded geographical reach. This section will delve into the competitive intensity, strategic alliances, and the evolving landscape of market leadership.

Fermentation Chemicals Industry Market Trends & Opportunities

The fermentation chemicals industry is poised for robust expansion, projecting a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This significant growth is underpinned by a confluence of escalating demand for sustainable and bio-based alternatives across a multitude of sectors, coupled with continuous technological advancements in bioprocessing and synthetic biology. Market penetration rates for fermentation-derived products are steadily increasing as companies invest heavily in research and development, leading to the optimization of yields, reduction of production costs, and the expansion of product portfolios.

Technological shifts are paramount, with innovations in areas like metabolic engineering, CRISPR-Cas9 gene editing, and advanced downstream processing techniques enabling the production of higher-value chemicals with greater efficiency. This enables the fermentation of complex molecules and the exploration of entirely new bio-based chemical pathways. Consumer preferences are increasingly gravitating towards natural, biodegradable, and ethically produced goods, directly boosting the demand for fermentation-derived ingredients in food and beverage, personal care, and pharmaceutical applications.

The competitive dynamics are evolving, with established chemical giants like BASF SE, DSM, and Evonik Industries AG expanding their bio-based offerings, while specialized biotechnology firms such as Novozymes, Chr. Hansen Holding A/S, and AB Enzymes are at the forefront of enzyme and microbial solution development. Strategic collaborations between ingredient manufacturers, end-product producers, and research institutions are becoming more prevalent, fostering innovation and accelerating market adoption. The growing emphasis on circular economy principles and the reduction of carbon footprints further amplifies the opportunities for fermentation chemicals as viable, eco-friendly substitutes for traditional petrochemicals. This report meticulously examines these overarching trends, alongside specific opportunities within emerging markets and niche applications, providing a comprehensive overview of the industry's forward trajectory.

Dominant Markets & Segments in Fermentation Chemicals Industry

The Food and Beverage segment stands out as a dominant force within the global fermentation chemicals market, driven by an insatiable consumer appetite for natural flavors, colors, preservatives, and nutritional ingredients. This segment is projected to account for a substantial XX% of the market share in 2025, with a projected CAGR of XX% during the forecast period. Key growth drivers include the rising demand for clean-label products, the expansion of the global processed food industry, and the increasing adoption of fermentation-derived sweeteners and thickeners. Companies like ADM, Cargill Incorporated, and Ajinomoto Co., Inc. are key players, offering a wide array of ingredients that enhance taste, texture, and shelf-life in various food and beverage applications.

Within Product Types, Enzymes represent a crucial and rapidly growing segment, estimated at $XX Million in 2025, with a CAGR of XX%. Enzymes are indispensable in numerous industrial processes, including baking, brewing, textile manufacturing, and detergent formulation, offering enhanced efficiency and sustainability. Novozymes, AB Enzymes, and DSM are leaders in this domain, continuously innovating to develop novel enzymes with improved specificity and performance.

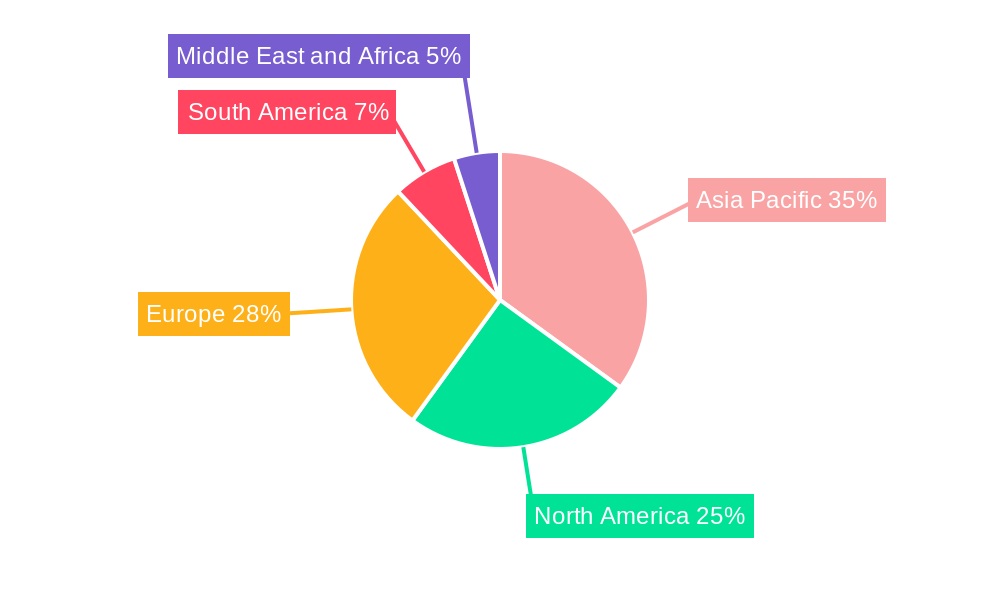

Geographically, North America and Europe currently dominate the fermentation chemicals market, collectively holding an estimated XX% market share in 2025. This dominance is attributed to well-established industrial infrastructure, significant R&D investments, supportive government policies promoting bio-based industries, and a high consumer awareness of sustainable products. The United States and Germany are particularly strong markets, benefiting from advanced technological capabilities and robust demand from key end-use industries. However, the Asia-Pacific region is exhibiting the fastest growth, projected to witness a CAGR of XX%, fueled by rapid industrialization, a burgeoning middle class, and increasing investments in biotechnology and sustainable manufacturing.

The Industrial application segment also holds significant sway, driven by the production of bio-based solvents, polymers, and other chemical intermediates. The Pharmaceutical and Nutritional segment, while smaller, is characterized by high-value products and stringent quality requirements, with fermentation playing a pivotal role in the production of antibiotics, vitamins, and amino acids.

Fermentation Chemicals Industry Product Analysis

Product innovation within the fermentation chemicals industry is characterized by a relentless pursuit of enhanced efficiency, sustainability, and novel functionalities. Companies are leveraging advanced genetic engineering and metabolic pathway optimization to develop higher-yielding strains of microorganisms and more potent enzymes. For instance, the development of enzymes for specific industrial applications, such as those used in biofuel production or the synthesis of biodegradable plastics, offers significant competitive advantages. The application of fermentation to produce organic acids like lactic acid and citric acid continues to expand, finding new uses in food preservation, biodegradable polymers, and industrial cleaning agents. Alcohols, a traditional output of fermentation, are witnessing innovation in the production of higher-purity grades and novel bio-alcohols with diverse industrial applications.

Key Drivers, Barriers & Challenges in Fermentation Chemicals Industry

Key Drivers: The fermentation chemicals market is propelled by several significant forces. Growing environmental concerns and a global push towards sustainability are driving demand for bio-based alternatives to petrochemicals, fostering innovation in green chemistry. Technological advancements in synthetic biology, metabolic engineering, and downstream processing are enabling more efficient and cost-effective production of a wider range of fermentation chemicals. Supportive government policies and incentives, aimed at promoting renewable resources and reducing carbon footprints, further accelerate market growth. The increasing consumer preference for natural, organic, and healthier products also fuels demand, particularly in the food, beverage, and pharmaceutical sectors.

Barriers & Challenges: Despite the positive outlook, the industry faces considerable challenges. High initial investment costs for setting up fermentation facilities and scaling up production remain a significant barrier. Stringent regulatory approvals, especially for food and pharmaceutical applications, can lead to lengthy development timelines and increased costs. Fluctuations in the cost and availability of raw materials, such as agricultural feedstocks, can impact production economics. Furthermore, competition from established petrochemical alternatives, often with lower production costs, poses a continuous challenge. Supply chain complexities and the need for specialized expertise in bioprocessing also contribute to market hurdles.

Growth Drivers in the Fermentation Chemicals Industry Market

The fermentation chemicals industry is experiencing robust growth driven by an overarching shift towards sustainability and bio-based solutions. Technological advancements in genetic engineering and enzyme technology are enabling the efficient production of a wider array of chemicals, from biofuels to specialized ingredients. Supportive government policies, including grants and tax incentives for bio-based manufacturing, are actively stimulating investment and innovation. The escalating consumer demand for natural, healthy, and environmentally friendly products, especially in the food, beverage, and pharmaceutical sectors, is a critical catalyst. For instance, the demand for bio-based plastics derived from fermented sugars is projected to surge. The ongoing R&D into novel bio-production platforms is continuously expanding the potential applications and market reach of fermentation chemicals.

Challenges Impacting Fermentation Chemicals Industry Growth

Several factors present significant challenges to the growth of the fermentation chemicals industry. The high capital expenditure required for establishing and scaling up fermentation facilities is a considerable barrier to entry and expansion. Stringent regulatory landscapes across different regions, particularly for food-grade and pharmaceutical-grade products, can lead to prolonged approval processes and increased development costs. Fluctuations in the availability and pricing of agricultural feedstocks, the primary raw materials for many fermentation processes, can impact production costs and profitability. Additionally, competition from cost-effective petrochemical alternatives, especially for bulk chemicals, remains a persistent challenge. Ensuring the consistent quality and supply chain reliability of bio-based products also requires robust infrastructure and stringent quality control measures.

Key Players Shaping the Fermentation Chemicals Industry Market

- ADM

- MicroBiopharm Japan Co Ltd

- AB Enzymes

- Cargill Incorporated

- Teva Pharmaceutical Industries Ltd

- BioVectra

- Novozymes

- Evonik Industries AG

- Ajinomoto Co Inc

- Chr Hansen Holding A/S

- BASF SE

- Biocon

- DSM

- Novasep

- Lonza

Significant Fermentation Chemicals Industry Industry Milestones

- 2019: Launch of novel enzyme cocktail for enhanced biofuel production, significantly increasing yields.

- 2020: Major pharmaceutical company acquires a biotechnology firm specializing in microbial fermentation for antibiotic production, signaling industry consolidation.

- 2021: Development of a breakthrough fermentation process for bio-based succinic acid, opening new avenues for biodegradable plastics.

- 2022: Introduction of a new generation of organic acids with improved shelf-life and functional properties for the food industry.

- 2023: Government initiatives in several key regions announced to boost investment in bio-refineries and bio-based chemical production.

- 2024: Significant advancements in CRISPR-based strain engineering leading to higher yields and reduced production costs for key fermentation chemicals.

Future Outlook for Fermentation Chemicals Industry Market

The future of the fermentation chemicals industry is exceptionally promising, driven by an accelerating global imperative for sustainability and the continuous evolution of biotechnological capabilities. Strategic opportunities lie in the expanding applications of fermentation-derived products in emerging sectors such as advanced biofuels, bioplastics, and novel therapeutic agents. Continued investment in R&D for novel bioprocesses and strain development will unlock new chemical pathways and enhance production efficiencies. The increasing demand for high-value specialty chemicals produced through fermentation presents significant market potential. Furthermore, favorable government policies and a growing consumer preference for eco-friendly products will solidify the industry's growth trajectory, making it a cornerstone of the future bioeconomy.

Fermentation Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Alcohols

- 1.2. Organic Acids

- 1.3. Enzymes

- 1.4. Other Product Types

-

2. Application

- 2.1. Industrial

- 2.2. Food and Beverage

- 2.3. Pharmaceutical and Nutritional

- 2.4. Plastics and Fibers

- 2.5. Other Applications

Fermentation Chemicals Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Fermentation Chemicals Industry Regional Market Share

Geographic Coverage of Fermentation Chemicals Industry

Fermentation Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Methanol and Ethanol Industry; Increasing Demand from the Pharmaceutical Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost Due to the Complexity Involved in the Manufacturing Process; Other Restraints

- 3.4. Market Trends

- 3.4.1. Food and Beverage Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Alcohols

- 5.1.2. Organic Acids

- 5.1.3. Enzymes

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Food and Beverage

- 5.2.3. Pharmaceutical and Nutritional

- 5.2.4. Plastics and Fibers

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Alcohols

- 6.1.2. Organic Acids

- 6.1.3. Enzymes

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial

- 6.2.2. Food and Beverage

- 6.2.3. Pharmaceutical and Nutritional

- 6.2.4. Plastics and Fibers

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Alcohols

- 7.1.2. Organic Acids

- 7.1.3. Enzymes

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial

- 7.2.2. Food and Beverage

- 7.2.3. Pharmaceutical and Nutritional

- 7.2.4. Plastics and Fibers

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Alcohols

- 8.1.2. Organic Acids

- 8.1.3. Enzymes

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial

- 8.2.2. Food and Beverage

- 8.2.3. Pharmaceutical and Nutritional

- 8.2.4. Plastics and Fibers

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Alcohols

- 9.1.2. Organic Acids

- 9.1.3. Enzymes

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Industrial

- 9.2.2. Food and Beverage

- 9.2.3. Pharmaceutical and Nutritional

- 9.2.4. Plastics and Fibers

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Fermentation Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Alcohols

- 10.1.2. Organic Acids

- 10.1.3. Enzymes

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Industrial

- 10.2.2. Food and Beverage

- 10.2.3. Pharmaceutical and Nutritional

- 10.2.4. Plastics and Fibers

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ADM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MicroBiopharm Japan Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AB Enzymes

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cargill Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teva Pharmaceutical Industries Ltd *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BioVectra

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Novozymes

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evonik Industries AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ajinomoto Co Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chr Hansen Holding A/S

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BASF SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Biocon

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 DSM

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Novasep

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Lonza

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 ADM

List of Figures

- Figure 1: Global Fermentation Chemicals Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: North America Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Fermentation Chemicals Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Fermentation Chemicals Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Fermentation Chemicals Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Fermentation Chemicals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Fermentation Chemicals Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Fermentation Chemicals Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Fermentation Chemicals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Canada Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Germany Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 28: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Fermentation Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Fermentation Chemicals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Fermentation Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Fermentation Chemicals Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fermentation Chemicals Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Fermentation Chemicals Industry?

Key companies in the market include ADM, MicroBiopharm Japan Co Ltd, AB Enzymes, Cargill Incorporated, Teva Pharmaceutical Industries Ltd *List Not Exhaustive, BioVectra, Novozymes, Evonik Industries AG, Ajinomoto Co Inc, Chr Hansen Holding A/S, BASF SE, Biocon, DSM, Novasep, Lonza.

3. What are the main segments of the Fermentation Chemicals Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 194.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Methanol and Ethanol Industry; Increasing Demand from the Pharmaceutical Industry; Other Drivers.

6. What are the notable trends driving market growth?

Food and Beverage Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

High Cost Due to the Complexity Involved in the Manufacturing Process; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fermentation Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fermentation Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fermentation Chemicals Industry?

To stay informed about further developments, trends, and reports in the Fermentation Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence