Key Insights

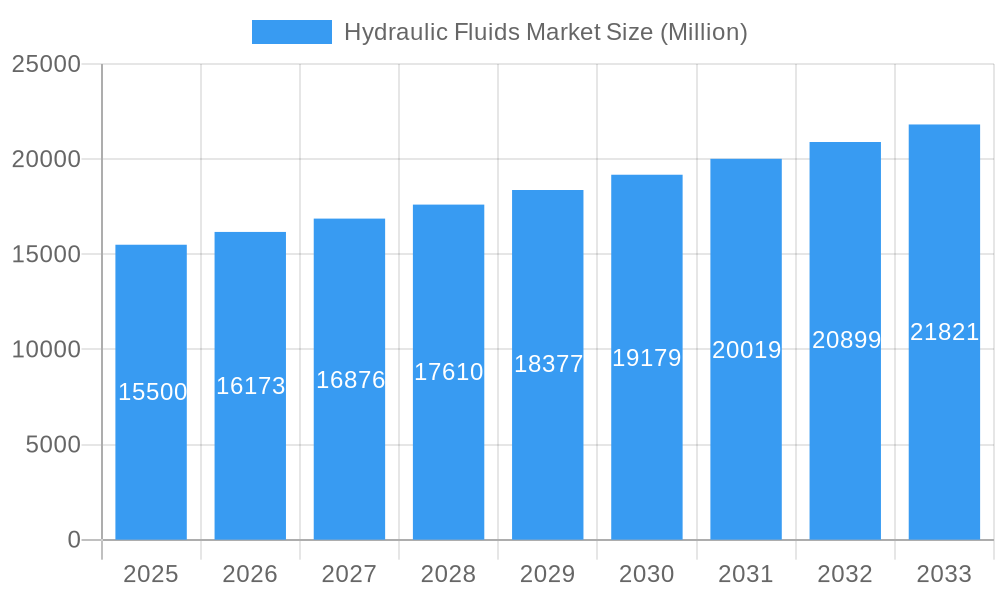

The global Hydraulic Fluids Market is projected to reach USD 1484.4 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.1% through 2033. Growth is driven by escalating demand from key sectors, notably automotive, due to increased vehicle production and the adoption of advanced hydraulic systems. The 'Other Transportation' segment (marine, aerospace, rail) also contributes significantly as fleets modernize. Infrastructure development worldwide fuels demand for heavy equipment and, consequently, high-performance hydraulic fluids. Innovations in fluid formulations, emphasizing biodegradability, thermal stability, and superior lubrication, are key growth catalysts, supporting compliance with environmental regulations and performance standards.

Hydraulic Fluids Market Market Size (In Billion)

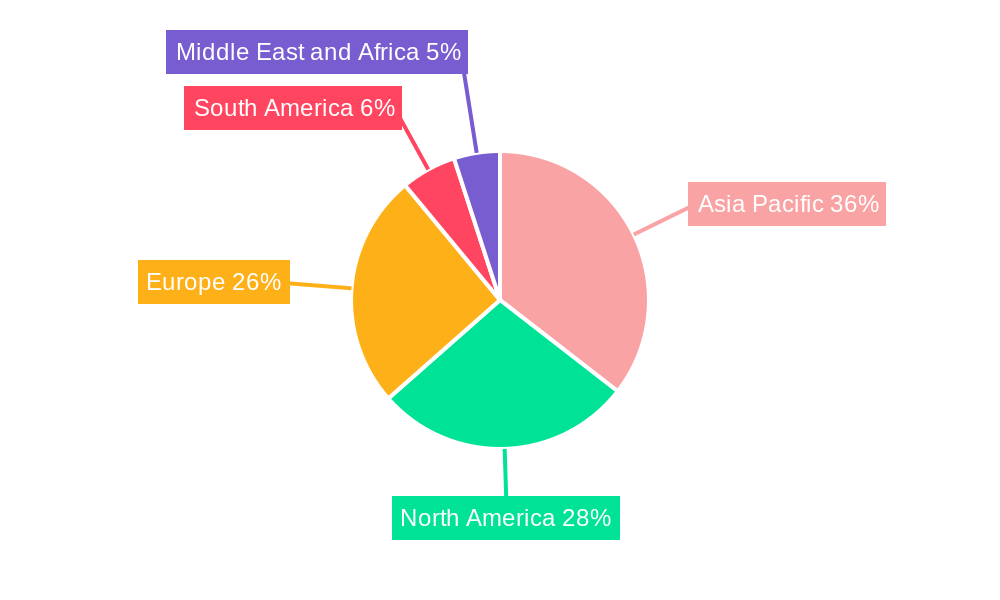

Market challenges include raw material price volatility, impacting profit margins and pricing. Increasing environmental scrutiny and the push for sustainable alternatives present restraints for traditional mineral-oil-based fluids. The industry is actively investing in R&D for bio-based and synthetic hydraulic fluids offering comparable or superior performance with reduced environmental impact. Leading market players, including BP PLC, Chevron Corporation, China National Petroleum Corporation, and Exxon Mobil Corporation, focus on innovation, geographic expansion, and strategic acquisitions to enhance market share. The Asia Pacific region, particularly China and India, is expected to lead market growth due to rapid industrialization and a robust manufacturing base.

Hydraulic Fluids Market Company Market Share

This comprehensive report provides an SEO-optimized analysis of the global Hydraulic Fluids Market, utilizing high-volume keywords for enhanced search visibility and delivering critical insights. The report covers the 2019–2033 study period, with 2025 as the base year and 2025–2033 as the forecast period, offering a detailed examination of market structure, trends, opportunities, and key players.

Hydraulic Fluids Market Market Structure & Competitive Landscape

The hydraulic fluids market exhibits a moderately consolidated structure, with a few key players holding significant market share. Innovation drivers are primarily centered around developing environmentally friendly hydraulic fluids, enhancing performance under extreme conditions, and extending fluid longevity. Regulatory impacts, particularly those concerning environmental protection and biodegradability, are shaping product development and market entry strategies. Product substitutes, such as synthetic lubricants and water-based fluids, pose a competitive challenge, necessitating continuous product differentiation.

- Market Concentration: Dominated by a mix of major oil and gas corporations and specialized lubricant manufacturers.

- Innovation Drivers:

- Development of biodegradable and eco-friendly hydraulic fluids.

- Enhancement of thermal stability and wear protection.

- Formulation of fire-resistant hydraulic fluids for specific applications.

- Regulatory Impacts: Increasing stringency of environmental regulations (e.g., REACH, biodegradability standards) driving demand for sustainable alternatives.

- Product Substitutes: Synthetic lubricants, water-based fluids, and bio-lubricants.

- End-User Segmentation: Automotive, Other Transportation, Heavy Equipment, Food and Beverage, and Other Enterprises are key segments.

- M&A Trends: Strategic acquisitions and partnerships aimed at expanding product portfolios, geographic reach, and technological capabilities. For instance, M&A activities in the broader lubricant sector, impacting hydraulic fluid suppliers, have been in the range of hundreds of millions of dollars annually.

Hydraulic Fluids Market Market Trends & Opportunities

The global hydraulic fluids market is poised for robust growth, driven by escalating demand across diverse industrial sectors and a paradigm shift towards high-performance and sustainable fluid solutions. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033, reaching an estimated value of over $15 Billion by 2033. This growth trajectory is fueled by significant investments in infrastructure development, particularly in emerging economies, which directly translate to increased demand for heavy equipment and, consequently, hydraulic fluids. The automotive sector continues to be a major consumer, with advancements in vehicle technology necessitating specialized hydraulic fluids for braking systems, power steering, and suspension.

Technological shifts are playing a pivotal role, with a growing emphasis on the development of advanced hydraulic fluids that offer superior lubrication, extended service life, and improved energy efficiency. The trend towards digitalization and automation in manufacturing processes also necessitates hydraulic systems that operate reliably under demanding conditions, thereby driving the demand for premium hydraulic fluids. Consumer preferences are increasingly leaning towards products with a lower environmental footprint. This has spurred significant R&D efforts by manufacturers to develop bio-based and biodegradable hydraulic fluids that meet stringent environmental regulations without compromising performance. The competitive dynamics within the market are characterized by intense competition among established global players and emerging regional manufacturers. Strategic alliances, product innovation, and aggressive market penetration strategies are common tactics employed by companies to gain a competitive edge.

Opportunities abound in niche markets and specialized applications. The growing adoption of robotics and advanced automation in industries such as food and beverage, pharmaceuticals, and aerospace presents a lucrative avenue for high-performance, specialized hydraulic fluids. Furthermore, the increasing awareness and enforcement of environmental regulations globally are creating a significant opportunity for manufacturers offering eco-friendly hydraulic fluid solutions. The circular economy initiatives and the drive for fluid recycling and re-refining also present emerging opportunities for value creation and market differentiation. The market penetration rates for bio-based hydraulic fluids are expected to increase significantly as environmental consciousness and regulatory pressures intensify, creating a substantial market opening for sustainable alternatives.

Dominant Markets & Segments in Hydraulic Fluids Market

The Heavy Equipment end-user industry stands as the dominant segment within the global hydraulic fluids market, exhibiting the highest demand and growth potential. This dominance is intricately linked to the robust global construction and mining sectors, which are experiencing significant expansion driven by urbanization, infrastructure development projects, and resource extraction activities. The sheer volume of heavy machinery, including excavators, loaders, bulldozers, and cranes, employed in these industries necessitates a continuous and substantial supply of high-performance hydraulic fluids to ensure optimal operation and longevity.

- Leading Region: Asia Pacific is anticipated to lead the hydraulic fluids market, fueled by rapid industrialization, extensive infrastructure projects in countries like China and India, and a burgeoning manufacturing base.

- Dominant End-User Industry:

- Heavy Equipment: This segment accounts for the largest market share due to its critical role in construction, mining, agriculture, and material handling. Growth drivers include government investments in infrastructure, increasing global population leading to demand for food (driving agricultural mechanization), and resource exploration.

- Key Growth Drivers for Heavy Equipment:

- Infrastructure Spending: Global governments are investing heavily in roads, bridges, public transportation, and utilities, driving demand for construction machinery.

- Mining Sector Expansion: Increased demand for minerals and metals, particularly for renewable energy technologies, is boosting mining operations and the need for hydraulic fluids.

- Agricultural Modernization: Mechanization in agriculture to improve efficiency and output directly correlates with the usage of hydraulic systems in tractors and other farm machinery.

- Urbanization: The continuous growth of cities worldwide necessitates ongoing construction and infrastructure maintenance, underpinning the demand for heavy equipment.

- Detailed Analysis of Market Dominance (Heavy Equipment): The operational intensity of heavy equipment, often subjected to extreme temperatures, high pressures, and abrasive environments, mandates the use of robust hydraulic fluids that offer superior wear protection, thermal stability, and oxidative resistance. Manufacturers are increasingly developing specialized hydraulic fluid formulations tailored to the specific demands of different types of heavy machinery and operating conditions, further solidifying this segment's dominance. The lifecycle cost of equipment is a significant consideration, and the selection of high-quality hydraulic fluids that prevent premature wear and system failures is paramount for end-users in this sector.

Hydraulic Fluids Market Product Analysis

Product innovation in the hydraulic fluids market is heavily focused on enhancing performance characteristics and environmental compatibility. This includes the development of high-viscosity index fluids for wider operating temperature ranges, improved anti-wear additives for extending equipment life, and advanced formulations for fire resistance in critical applications. The integration of nano-additives and synthetic base oils is enabling the creation of hydraulic fluids that offer superior lubrication, reduced friction, and extended drain intervals, providing a competitive advantage to manufacturers and greater value to end-users.

Key Drivers, Barriers & Challenges in Hydraulic Fluids Market

Key Drivers:

- Industrial Growth: Expansion in manufacturing, construction, and transportation sectors drives demand for hydraulic systems and fluids.

- Technological Advancements: Development of high-performance, energy-efficient, and environmentally friendly hydraulic fluids.

- Infrastructure Development: Significant global investments in infrastructure projects necessitate heavy machinery operations.

- Environmental Regulations: Growing stringency of regulations promoting biodegradable and low-toxicity fluids.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of base oils and additives can impact production costs and profitability.

- Counterfeit Products: The presence of substandard or counterfeit hydraulic fluids poses a threat to product quality and brand reputation.

- Harsh Operating Conditions: Extreme temperatures and pressures in certain applications can limit the effectiveness of conventional hydraulic fluids.

- Supply Chain Disruptions: Geopolitical events and logistical challenges can affect the availability and delivery of hydraulic fluids.

Growth Drivers in the Hydraulic Fluids Market Market

The hydraulic fluids market is propelled by several key growth drivers. Technological innovation is paramount, with the development of advanced formulations offering superior performance, extended fluid life, and enhanced energy efficiency. Economic factors, such as robust infrastructure development projects globally and the growth of the manufacturing sector, significantly increase the demand for hydraulic systems and fluids. Regulatory landscapes, particularly those encouraging the adoption of environmentally friendly and biodegradable hydraulic fluids, are creating substantial growth opportunities. The increasing mechanization in agriculture to boost food production is also a significant driver, as is the expansion of mining operations for various raw materials.

Challenges Impacting Hydraulic Fluids Market Growth

Several challenges can impact the growth of the hydraulic fluids market. The volatility of crude oil prices directly affects the cost of base oils, a key component of hydraulic fluids, leading to potential price fluctuations and impacting profitability. Supply chain complexities, especially in the wake of global events, can disrupt the availability of raw materials and finished products. Regulatory complexities surrounding environmental compliance and the disposal of used hydraulic fluids can also pose a hurdle for manufacturers and end-users alike. Furthermore, intense competition within the market, including the presence of numerous regional players and the threat of product substitution by alternative lubrication technologies, necessitates continuous innovation and competitive pricing strategies.

Key Players Shaping the Hydraulic Fluids Market Market

- BP PLC

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- Croda International PLC

- Eni SpA

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- LUKOIL

- Petromin

- PETRONAS Lubricants International

- Phillips 66 Company

- Repsol

- Royal Dutch Shell PLC

- Total

- Valvoline LLC

Significant Hydraulic Fluids Market Industry Milestones

- 2019: Increased focus on biodegradable hydraulic fluids due to growing environmental concerns and regulations.

- 2020: Emergence of advanced additive technologies for improved wear protection and extended fluid life.

- 2021: Major players began investing in R&D for synthetic and semi-synthetic hydraulic fluid formulations for high-performance applications.

- 2022: Launch of hydraulic fluids with enhanced thermal stability for extreme temperature operations.

- 2023: Companies started exploring bio-based feedstock for hydraulic fluid production to meet sustainability goals.

- 2024: Development of smart hydraulic fluids with self-healing properties and condition monitoring capabilities initiated.

Future Outlook for Hydraulic Fluids Market Market

The future outlook for the hydraulic fluids market is highly promising, driven by a confluence of technological advancements and expanding industrial applications. The increasing demand for high-performance, energy-efficient, and environmentally sustainable hydraulic fluids will continue to shape market dynamics. Strategic opportunities lie in the development of advanced bio-based and biodegradable formulations, catering to the growing preference for eco-friendly solutions and stringent environmental regulations. The ongoing industrialization in emerging economies, coupled with significant investments in infrastructure and the automotive sector, will sustain robust demand. Furthermore, the integration of smart technologies and the potential for developing 'condition-based' hydraulic fluids present exciting avenues for future growth and market differentiation.

Hydraulic Fluids Market Segmentation

-

1. End-user Industry

- 1.1. Automotive

- 1.2. Other Transportation

- 1.3. Heavy Equipment

- 1.4. Food and Beverage

- 1.5. Other En

Hydraulic Fluids Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Hydraulic Fluids Market Regional Market Share

Geographic Coverage of Hydraulic Fluids Market

Hydraulic Fluids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Industrial Sector in Asia-Pacific and Middle-East and Africa; The Rise in Production of Crude Oil; Increased Use of Hydraulic Fluid in Various Industries Including Construction

- 3.3. Market Restrains

- 3.3.1. Growth of Industrial Sector in Asia-Pacific and Middle-East and Africa; The Rise in Production of Crude Oil; Increased Use of Hydraulic Fluid in Various Industries Including Construction

- 3.4. Market Trends

- 3.4.1. Decline in Automotive Industry to Impact the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hydraulic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Automotive

- 5.1.2. Other Transportation

- 5.1.3. Heavy Equipment

- 5.1.4. Food and Beverage

- 5.1.5. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Hydraulic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Automotive

- 6.1.2. Other Transportation

- 6.1.3. Heavy Equipment

- 6.1.4. Food and Beverage

- 6.1.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Hydraulic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Automotive

- 7.1.2. Other Transportation

- 7.1.3. Heavy Equipment

- 7.1.4. Food and Beverage

- 7.1.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Hydraulic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Automotive

- 8.1.2. Other Transportation

- 8.1.3. Heavy Equipment

- 8.1.4. Food and Beverage

- 8.1.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Hydraulic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Automotive

- 9.1.2. Other Transportation

- 9.1.3. Heavy Equipment

- 9.1.4. Food and Beverage

- 9.1.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Hydraulic Fluids Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Automotive

- 10.1.2. Other Transportation

- 10.1.3. Heavy Equipment

- 10.1.4. Food and Beverage

- 10.1.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BP PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chevron Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China National Petroleum Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Petroleum & Chemical Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Croda International PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eni SpA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Exxon Mobil Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FUCHS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gazprom Neft PJSC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LUKOIL

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Petromin

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PETRONAS Lubricants International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Phillips 66 Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Repsol

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Royal Dutch Shell PLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Total

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Valvoline LLC*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 BP PLC

List of Figures

- Figure 1: Global Hydraulic Fluids Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Hydraulic Fluids Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Hydraulic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Hydraulic Fluids Market Revenue (million), by Country 2025 & 2033

- Figure 5: Asia Pacific Hydraulic Fluids Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Hydraulic Fluids Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 7: North America Hydraulic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Hydraulic Fluids Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Hydraulic Fluids Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Hydraulic Fluids Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 11: Europe Hydraulic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Hydraulic Fluids Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Hydraulic Fluids Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Hydraulic Fluids Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 15: South America Hydraulic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Hydraulic Fluids Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America Hydraulic Fluids Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Hydraulic Fluids Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa Hydraulic Fluids Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa Hydraulic Fluids Market Revenue (million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Hydraulic Fluids Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hydraulic Fluids Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Hydraulic Fluids Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Hydraulic Fluids Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Hydraulic Fluids Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: China Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: India Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Japan Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Hydraulic Fluids Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Hydraulic Fluids Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: United States Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Canada Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Global Hydraulic Fluids Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Hydraulic Fluids Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Germany Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: France Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Hydraulic Fluids Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Hydraulic Fluids Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Brazil Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global Hydraulic Fluids Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Hydraulic Fluids Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Hydraulic Fluids Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydraulic Fluids Market?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the Hydraulic Fluids Market?

Key companies in the market include BP PLC, Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Croda International PLC, Eni SpA, Exxon Mobil Corporation, FUCHS, Gazprom Neft PJSC, LUKOIL, Petromin, PETRONAS Lubricants International, Phillips 66 Company, Repsol, Royal Dutch Shell PLC, Total, Valvoline LLC*List Not Exhaustive.

3. What are the main segments of the Hydraulic Fluids Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1484.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Industrial Sector in Asia-Pacific and Middle-East and Africa; The Rise in Production of Crude Oil; Increased Use of Hydraulic Fluid in Various Industries Including Construction.

6. What are the notable trends driving market growth?

Decline in Automotive Industry to Impact the Market.

7. Are there any restraints impacting market growth?

Growth of Industrial Sector in Asia-Pacific and Middle-East and Africa; The Rise in Production of Crude Oil; Increased Use of Hydraulic Fluid in Various Industries Including Construction.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are being covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hydraulic Fluids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hydraulic Fluids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hydraulic Fluids Market?

To stay informed about further developments, trends, and reports in the Hydraulic Fluids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence