Key Insights

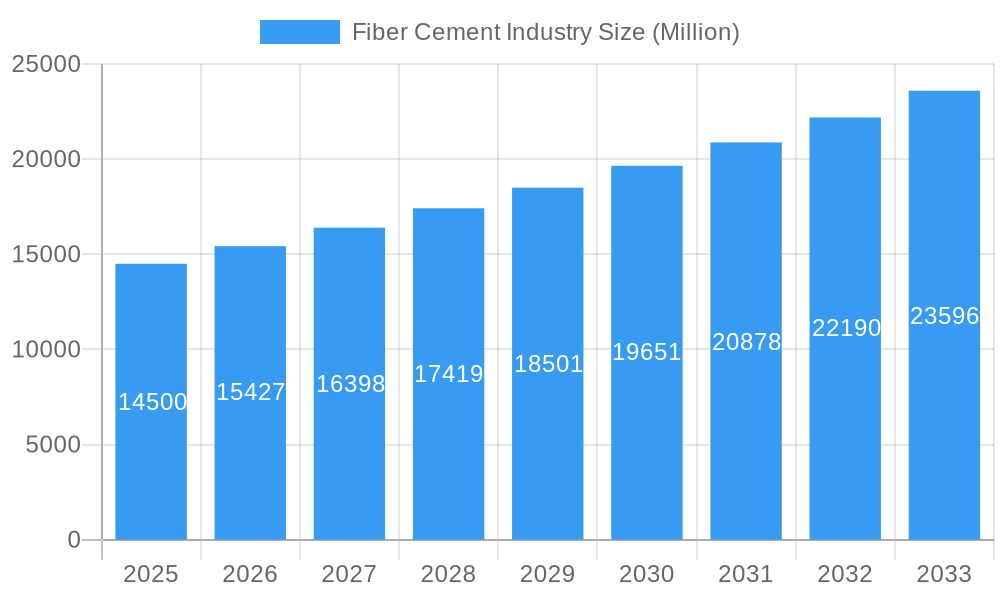

The global Fiber Cement Industry is poised for robust expansion, projected to reach a substantial market size of approximately $14,500 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This dynamic growth is fueled by a confluence of escalating construction activities across residential, commercial, and infrastructure sectors, particularly in rapidly developing economies. The inherent advantages of fiber cement, including its durability, fire resistance, termite-proof nature, low maintenance requirements, and aesthetic versatility, are increasingly recognized by builders and homeowners alike. The rising demand for sustainable and long-lasting building materials further bolsters market penetration. Key growth drivers include urbanization, government initiatives promoting affordable housing, and the growing preference for modern architectural designs that leverage the material's adaptability. Emerging economies in Asia Pacific and Middle East & Africa are expected to be significant contributors to this growth trajectory, driven by substantial infrastructure development and increasing disposable incomes.

Fiber Cement Industry Market Size (In Billion)

The market is segmented across diverse end-use sectors, with Commercial and Infrastructure applications demonstrating substantial demand, followed closely by Residential construction. Within applications, Siding, Roofing, and Cladding represent dominant segments, showcasing the material's widespread adoption in building exteriors. While the industry benefits from strong market fundamentals, certain restraints such as the availability and cost of raw materials, coupled with established preferences for traditional materials in some mature markets, present challenges. However, continuous innovation in product formulations and manufacturing processes is addressing these concerns. Key players like James Hardie Building Products Inc., Etex Group, and Saint-Gobain are actively investing in research and development, expanding their product portfolios, and strengthening their global distribution networks to capitalize on the burgeoning market opportunities. The forecast period is expected to witness increased competition and strategic collaborations aimed at enhancing market share and driving technological advancements in fiber cement solutions.

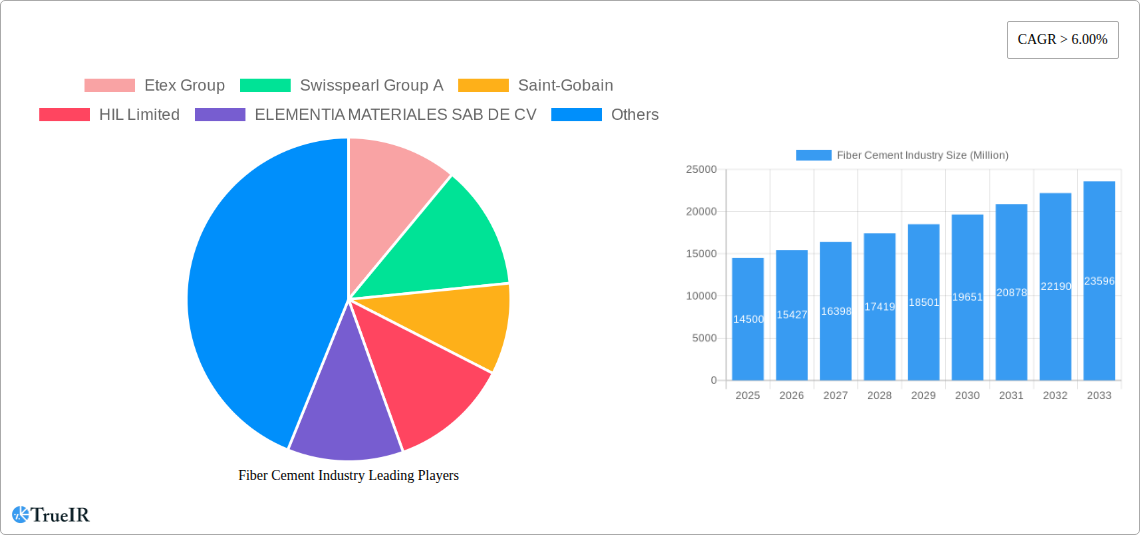

Fiber Cement Industry Company Market Share

This comprehensive Fiber Cement Industry Report delves into the evolving global market, providing in-depth analysis and strategic insights for stakeholders. With a study period from 2019 to 2033, base and estimated year of 2025, and a robust forecast period of 2025–2033, this report covers historical trends from 2019–2024 to deliver a complete market narrative. Leveraging high-volume keywords such as "fiber cement siding," "fiber cement boards," "construction materials," and "building products," this analysis is meticulously crafted for optimal search engine visibility and to engage a wide spectrum of industry professionals.

The report provides granular detail across key end-use sectors including Commercial, Industrial and Institutional, Infrastructure, and Residential, and analyzes dominant applications such as Cladding, Molding and Trimming, Roofing, Siding, and Other Applications. Expect to find quantitative data, including market size projections estimated in the multi-million dollar range, and qualitative insights into competitive strategies, technological advancements, and regulatory landscapes.

Fiber Cement Industry Market Structure & Competitive Landscape

The fiber cement industry exhibits a moderately concentrated market structure, characterized by the presence of several major global players alongside a robust network of regional manufacturers. Innovation drivers are primarily focused on enhancing product durability, sustainability, and aesthetic versatility, catering to the growing demand for eco-friendly and low-maintenance building materials. Regulatory impacts, while varying by region, are increasingly influenced by building codes that favor fire-resistant and weather-resistant materials, indirectly boosting fiber cement adoption. Product substitutes, such as vinyl siding, wood, and stucco, face stiff competition from fiber cement's superior performance characteristics. End-user segmentation reveals a strong reliance on the Residential sector, closely followed by Commercial and Institutional applications, with Infrastructure projects showing significant growth potential. Mergers and acquisitions (M&A) trends are evident as companies seek to expand their geographical reach, product portfolios, and supply chain efficiencies. For instance, the acquisition of Hume Cemboard Industries Sdn Bhd by Saint-Gobain in June 2023 highlights this consolidation. The market is projected to see an M&A volume of approximately $500 Million over the forecast period, reflecting strategic consolidation and market expansion efforts. Concentration ratios indicate that the top five players hold a substantial market share, estimated at around 60%.

Fiber Cement Industry Market Trends & Opportunities

The global fiber cement market is poised for significant expansion, projected to reach a valuation exceeding $25,000 Million by 2033. This robust growth is driven by an escalating demand for durable, low-maintenance, and aesthetically versatile building materials across residential, commercial, and industrial sectors. Technological shifts are continuously refining fiber cement formulations, leading to improved performance characteristics such as enhanced fire resistance, moisture tolerance, and insulation properties. The increasing consumer preference for sustainable building solutions further fuels market penetration, as fiber cement products often boast a lower environmental footprint compared to traditional materials, with many offerings now incorporating recycled content. The market penetration rate for fiber cement in new residential construction is steadily rising, estimated to reach 15% by 2028.

Competitive dynamics are intensifying, with manufacturers focusing on product differentiation through innovative designs, textures, and color palettes that mimic natural materials like wood and stone. The development of advanced manufacturing techniques is also contributing to cost efficiencies, making fiber cement more competitive. Opportunities abound in emerging economies where rapid urbanization and infrastructure development are creating substantial demand for high-quality building materials. Furthermore, the growing trend towards prefabricated and modular construction presents a significant avenue for growth, as fiber cement boards are well-suited for these building systems. The CAGR for the fiber cement industry is projected at approximately 6.5% during the forecast period. The market is also witnessing a surge in demand for fiber cement in retrofitting and renovation projects, driven by the need for durable and weather-resistant upgrades. Strategic partnerships, such as the one between James Hardie Building Products Inc. and D.R. Horton, Inc., are crucial for expanding market reach and securing large-scale supply contracts. The adoption of digital technologies in distribution and sales is another emerging trend, enhancing customer accessibility and service.

Dominant Markets & Segments in Fiber Cement Industry

The Fiber Cement Industry is experiencing robust growth across various regions and applications, with distinct segments demonstrating leadership. The Residential end-use sector remains a primary driver of market dominance, accounting for an estimated 45% of the total market share. This is propelled by a continuous demand for durable, low-maintenance, and aesthetically pleasing building materials for new home construction and renovations.

- Key Growth Drivers in Residential:

- Increasing disposable incomes and urbanization leading to new housing development.

- Consumer preference for long-lasting and weather-resistant exterior materials.

- Growing popularity of modern architectural designs requiring versatile cladding solutions.

The Application segment of Siding is the most dominant, capturing an estimated 35% of the market. Fiber cement siding offers superior durability, resistance to pests and rot, and a wide range of styles, making it a preferred choice for exterior finishes.

- Key Growth Drivers in Siding Application:

- Excellent fire resistance and ability to withstand harsh weather conditions.

- Low maintenance requirements compared to traditional wood or vinyl siding.

- Advancements in manufacturing allowing for realistic wood-grain finishes.

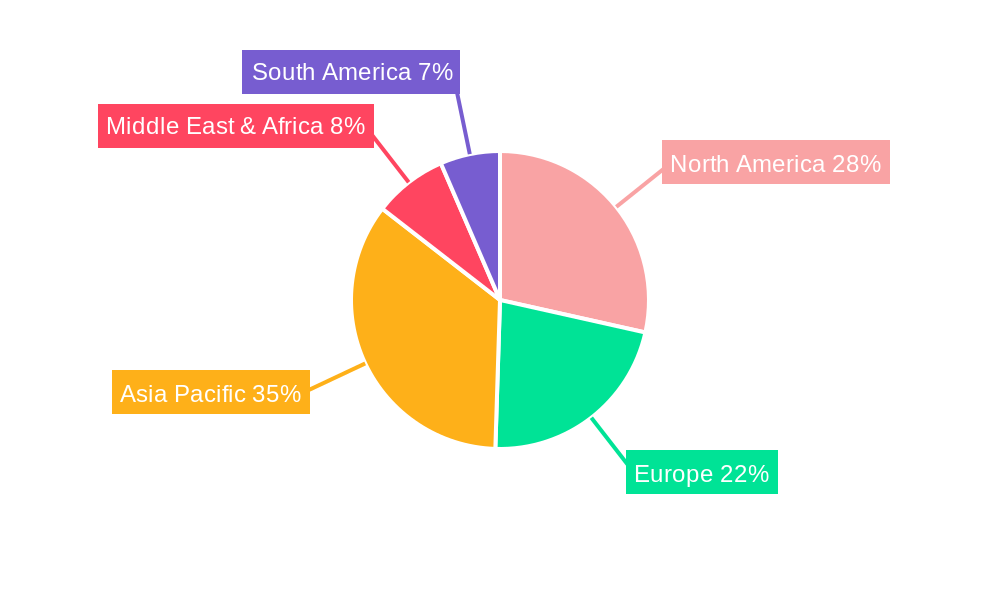

Geographically, North America is expected to continue its dominance, contributing approximately 30% to the global market revenue. This leadership is attributed to the region's established construction industry, strong demand for sustainable building materials, and the presence of major manufacturers like James Hardie Building Products Inc. and the expansion of distribution partnerships, such as the one between BlueLinx Holdings Inc. and Allura USA.

- Key Growth Drivers in North America:

- Stringent building codes favoring fire-resistant and durable materials.

- High levels of investment in residential and commercial construction projects.

- Growing awareness and adoption of sustainable building practices.

The Commercial, Industrial and Institutional end-use sector is also a significant contributor, with an estimated 25% market share, driven by the need for durable and fire-resistant materials in non-residential buildings. Cladding as an application is gaining prominence in this sector, accounting for roughly 20% of the market.

- Key Growth Drivers in Commercial, Industrial & Institutional:

- Demand for long-lasting and low-maintenance materials in high-traffic areas.

- Increased focus on building aesthetics and facade design.

- Projects requiring robust fire safety and weather protection.

The Infrastructure segment, while currently smaller in share (estimated 10%), presents substantial future growth opportunities, particularly for applications in public works and large-scale construction projects requiring long-term durability and resilience.

Fiber Cement Industry Product Analysis

Fiber cement products are distinguished by their superior composition of cellulose fibers, Portland cement, sand, and water, offering an exceptional blend of strength, durability, and aesthetic versatility. Key product innovations focus on enhanced fire resistance, superior moisture and pest resistance, and a wide array of finishes that mimic natural materials like wood and stone, significantly expanding their application in cladding, siding, and roofing. Competitive advantages lie in their longevity, low maintenance requirements, and resistance to warping, cracking, and fading, making them a cost-effective and sustainable choice for Residential and Commercial construction. Technological advancements continue to drive the development of lighter, easier-to-install fiber cement products, further solidifying their market position.

Key Drivers, Barriers & Challenges in Fiber Cement Industry

The Fiber Cement Industry is propelled by several key drivers, including a growing global demand for durable and low-maintenance building materials, increasing awareness of sustainability and eco-friendly construction practices, and stringent building codes that favor fire-resistant materials. Technological advancements in manufacturing processes and product formulations are enhancing performance and reducing costs. For instance, the increasing use of recycled materials in fiber cement production aligns with sustainability goals. The Residential construction boom in emerging economies and the continuous need for renovation and retrofitting in developed regions are also significant growth catalysts.

However, the industry faces notable barriers and challenges. Fluctuations in raw material prices, particularly for cement and cellulose fibers, can impact production costs and profitability. Supply chain disruptions and logistics complexities can also affect product availability and lead times. Intense competition from alternative materials like vinyl and engineered wood, often at lower price points, poses a constant threat. Regulatory hurdles related to building codes and environmental standards, though often beneficial, can also present compliance challenges for manufacturers. For example, the cost of compliance with evolving emission standards can add to operational expenses. Market penetration in certain price-sensitive segments remains a challenge, despite the superior long-term value proposition of fiber cement.

Growth Drivers in the Fiber Cement Industry Market

Key growth drivers for the fiber cement market stem from the increasing demand for durable, low-maintenance building materials, particularly in the Residential and Commercial sectors. Technological advancements are leading to improved product performance, such as enhanced fire and moisture resistance, making fiber cement a preferred choice in diverse climates. The global push towards sustainable construction practices, with fiber cement offering a more environmentally friendly alternative to some traditional materials, also fuels growth. Furthermore, supportive government policies and building codes that prioritize safety and longevity indirectly boost the adoption of fiber cement products. The ongoing urbanization in developing economies is creating a substantial need for reliable construction materials.

Challenges Impacting Fiber Cement Industry Growth

Challenges impacting the growth of the fiber cement industry include the volatility in raw material prices, especially cement and cellulose fibers, which can affect manufacturing costs and profit margins. Supply chain complexities and potential disruptions can also lead to delays and increased logistical expenses. Intense competition from alternative building materials, such as vinyl, wood composites, and engineered wood, often perceived as more cost-effective in the short term, presents a significant hurdle. Regulatory landscapes, while often favoring fiber cement, can also introduce compliance costs and complexities. Furthermore, educating builders and consumers about the long-term value and benefits of fiber cement over cheaper alternatives remains an ongoing effort. The energy-intensive nature of cement production also presents a challenge in meeting stringent environmental targets.

Key Players Shaping the Fiber Cement Industry Market

- Etex Group

- Swisspearl Group A

- Saint-Gobain

- HIL Limited

- ELEMENTIA MATERIALES SAB DE CV

- NICHIHA Co Ltd

- James Hardie Building Products Inc.

- SHERA Public Company Limited

- SCG

- CSR Limited

Significant Fiber Cement Industry Industry Milestones

- October 2023: James Hardie Building Products Inc. partnered with D.R. Horton, Inc., the largest homebuilder in the United States, to provide premier quality and innovative fiber cement solutions to home construction across the United States. This partnership is expected to significantly boost fiber cement adoption in new residential builds.

- June 2023: Saint-Gobain has entered into a definitive agreement to acquire Hume Cemboard Industries Sdn Bhd (HCBI), a manufacturer of fiber cement boards for façades, partitions, and ceilings, to expand its growth by enriching its range of solutions for light and sustainable construction in Malaysia. This acquisition strengthens Saint-Gobain's presence in the Asian market.

- April 2023: BlueLinx Holdings Inc., a leading wholesale distributor of building products in the United States, and Allura USA, a subsidiary of Elementia Materiales, announced the expansion of their distribution partnership to maintain growth in the highly competitive landscape of fiber cement siding, trim, and accessories. This move enhances market accessibility and distribution reach for Allura USA products.

Future Outlook for Fiber Cement Industry Market

The future outlook for the fiber cement industry is exceptionally promising, driven by a confluence of factors that position it for sustained growth. The increasing global emphasis on sustainable and resilient building practices will continue to favor fiber cement’s durability, longevity, and lower environmental impact compared to some conventional materials. Ongoing advancements in manufacturing technologies are expected to yield more cost-effective and versatile fiber cement products, broadening their appeal across various market segments, from high-end residential developments to large-scale infrastructure projects. Strategic collaborations, such as the recent partnership between James Hardie and D.R. Horton, will be crucial in securing market share and driving adoption. Emerging economies, with their burgeoning construction sectors, represent significant untapped potential, while developed markets will continue to see demand fueled by renovation and retrofitting trends. The industry is well-positioned to capitalize on the global shift towards lighter, stronger, and more sustainable construction solutions.

Fiber Cement Industry Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Application

- 2.1. Cladding

- 2.2. Molding and Trimming

- 2.3. Roofing

- 2.4. Siding

- 2.5. Other Applications

Fiber Cement Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fiber Cement Industry Regional Market Share

Geographic Coverage of Fiber Cement Industry

Fiber Cement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food & Beverages Industry

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations on VOCs Released from Industrial Floorings

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fiber Cement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cladding

- 5.2.2. Molding and Trimming

- 5.2.3. Roofing

- 5.2.4. Siding

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. North America Fiber Cement Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6.1.1. Commercial

- 6.1.2. Industrial and Institutional

- 6.1.3. Infrastructure

- 6.1.4. Residential

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cladding

- 6.2.2. Molding and Trimming

- 6.2.3. Roofing

- 6.2.4. Siding

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by End Use Sector

- 7. South America Fiber Cement Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End Use Sector

- 7.1.1. Commercial

- 7.1.2. Industrial and Institutional

- 7.1.3. Infrastructure

- 7.1.4. Residential

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cladding

- 7.2.2. Molding and Trimming

- 7.2.3. Roofing

- 7.2.4. Siding

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by End Use Sector

- 8. Europe Fiber Cement Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End Use Sector

- 8.1.1. Commercial

- 8.1.2. Industrial and Institutional

- 8.1.3. Infrastructure

- 8.1.4. Residential

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cladding

- 8.2.2. Molding and Trimming

- 8.2.3. Roofing

- 8.2.4. Siding

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by End Use Sector

- 9. Middle East & Africa Fiber Cement Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End Use Sector

- 9.1.1. Commercial

- 9.1.2. Industrial and Institutional

- 9.1.3. Infrastructure

- 9.1.4. Residential

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Cladding

- 9.2.2. Molding and Trimming

- 9.2.3. Roofing

- 9.2.4. Siding

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by End Use Sector

- 10. Asia Pacific Fiber Cement Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End Use Sector

- 10.1.1. Commercial

- 10.1.2. Industrial and Institutional

- 10.1.3. Infrastructure

- 10.1.4. Residential

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Cladding

- 10.2.2. Molding and Trimming

- 10.2.3. Roofing

- 10.2.4. Siding

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by End Use Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Etex Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Swisspearl Group A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Saint-Gobain

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HIL Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ELEMENTIA MATERIALES SAB DE CV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NICHIHA Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 James Hardie Building Products Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SHERA Public Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SCG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CSR Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Etex Group

List of Figures

- Figure 1: Global Fiber Cement Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fiber Cement Industry Revenue (Million), by End Use Sector 2025 & 2033

- Figure 3: North America Fiber Cement Industry Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 4: North America Fiber Cement Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Fiber Cement Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Fiber Cement Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Fiber Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Fiber Cement Industry Revenue (Million), by End Use Sector 2025 & 2033

- Figure 9: South America Fiber Cement Industry Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 10: South America Fiber Cement Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: South America Fiber Cement Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America Fiber Cement Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Fiber Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Fiber Cement Industry Revenue (Million), by End Use Sector 2025 & 2033

- Figure 15: Europe Fiber Cement Industry Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 16: Europe Fiber Cement Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Fiber Cement Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Fiber Cement Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Fiber Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Fiber Cement Industry Revenue (Million), by End Use Sector 2025 & 2033

- Figure 21: Middle East & Africa Fiber Cement Industry Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 22: Middle East & Africa Fiber Cement Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East & Africa Fiber Cement Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa Fiber Cement Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Fiber Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Fiber Cement Industry Revenue (Million), by End Use Sector 2025 & 2033

- Figure 27: Asia Pacific Fiber Cement Industry Revenue Share (%), by End Use Sector 2025 & 2033

- Figure 28: Asia Pacific Fiber Cement Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific Fiber Cement Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Fiber Cement Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Fiber Cement Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fiber Cement Industry Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 2: Global Fiber Cement Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Fiber Cement Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Fiber Cement Industry Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 5: Global Fiber Cement Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Fiber Cement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Fiber Cement Industry Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 11: Global Fiber Cement Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Fiber Cement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Fiber Cement Industry Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 17: Global Fiber Cement Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Fiber Cement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Fiber Cement Industry Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 29: Global Fiber Cement Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Fiber Cement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Fiber Cement Industry Revenue Million Forecast, by End Use Sector 2020 & 2033

- Table 38: Global Fiber Cement Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global Fiber Cement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Fiber Cement Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fiber Cement Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Fiber Cement Industry?

Key companies in the market include Etex Group, Swisspearl Group A, Saint-Gobain, HIL Limited, ELEMENTIA MATERIALES SAB DE CV, NICHIHA Co Ltd, James Hardie Building Products Inc, SHERA Public Company Limited, SCG, CSR Limited.

3. What are the main segments of the Fiber Cement Industry?

The market segments include End Use Sector, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about the Advantages of Industrial Flooring; Increasing Demand from the Food & Beverages Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent Regulations on VOCs Released from Industrial Floorings.

8. Can you provide examples of recent developments in the market?

October 2023: James Hardie Building Products Inc. partnered with D.R. Horton, Inc., the largest homebuilder in the United States, to provide premier quality and innovative fiber cement solutions to home construction across the United States.June 2023: Saint-Gobain has entered into a definitive agreement to acquire Hume Cemboard Industries Sdn Bhd (HCBI), a manufacturer of fiber cement boards for façades, partitions, and ceilings, to expand its growth by enriching its range of solutions for light and sustainable construction in Malaysia.April 2023: BlueLinx Holdings Inc., a leading wholesale distributor of building products in the United States, and Allura USA, a subsidiary of Elementia Materiales, announced the expansion of their distribution partnership to maintain growth in the highly competitive landscape of fiber cement siding, trim, and accessories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fiber Cement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fiber Cement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fiber Cement Industry?

To stay informed about further developments, trends, and reports in the Fiber Cement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence