Key Insights

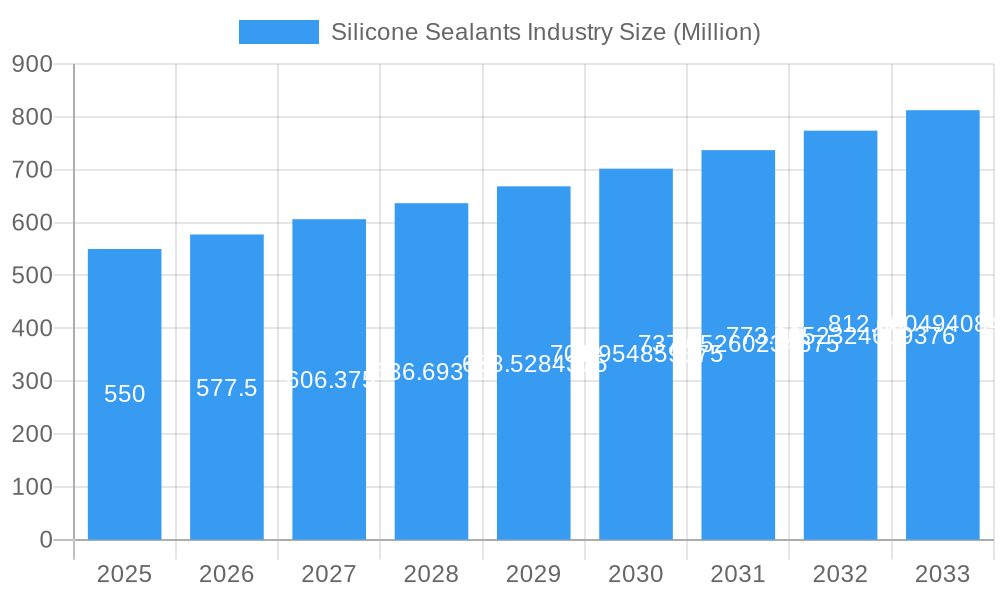

The global silicone sealants market is projected to reach a substantial size, driven by a Compound Annual Growth Rate (CAGR) of 5.00% from a base year of 2025 through to 2033. This robust growth signifies a healthy expansion, with the market value expected to be in the hundreds of millions, reflecting its critical role across diverse industrial applications. Key growth drivers include the escalating demand for durable, weather-resistant, and versatile sealing solutions in the booming construction sector, particularly for energy-efficient buildings and infrastructure development. The automotive industry's continuous innovation, including the shift towards electric vehicles which often require specialized sealing for battery packs and components, further fuels market expansion. Furthermore, the increasing adoption of advanced materials in aerospace for lightweighting and structural integrity, alongside the growing need for biocompatible and sterile sealants in healthcare for medical devices and facilities, contribute significantly to market momentum. Emerging economies in the Asia Pacific region, with their rapid industrialization and urbanization, are expected to be major contributors to this growth trajectory.

Silicone Sealants Industry Market Size (In Million)

The silicone sealants market is characterized by a dynamic competitive landscape, with prominent global players such as Henkel AG & Co KGaA, 3M, Dow, and Sika AG vying for market share. These companies are actively engaged in research and development to introduce innovative products with enhanced properties like improved adhesion, UV resistance, and flexibility. However, the market also faces certain restraints. Fluctuations in raw material prices, particularly silicone precursors, can impact profit margins and pricing strategies. Stringent environmental regulations concerning the production and disposal of certain chemical compounds used in sealant formulations might also pose challenges. Nevertheless, the overarching trend towards sustainable construction and manufacturing practices, coupled with ongoing technological advancements in silicone chemistry, is expected to propel the market forward, enabling it to overcome these hurdles and capitalize on emerging opportunities in niche applications and advanced material development.

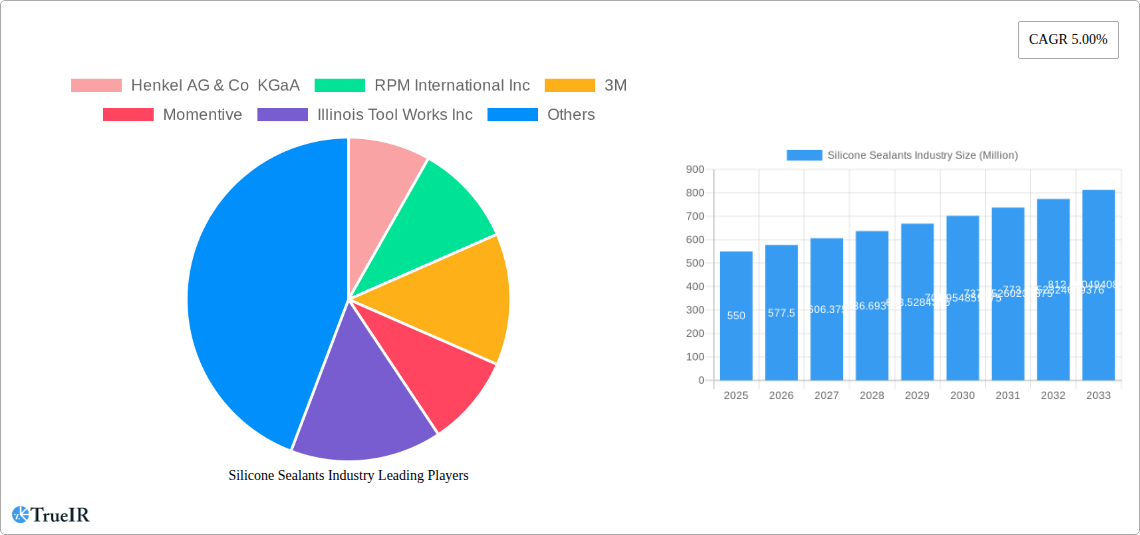

Silicone Sealants Industry Company Market Share

Unlocking Global Growth: Silicone Sealants Industry Market Analysis (2019–2033)

This comprehensive report delves into the dynamic silicone sealants market, a critical component across diverse industries. Driven by innovation and demand for high-performance sealing solutions, the market is projected for significant expansion. Our analysis spans the historical period (2019-2024), the base and estimated year (2025), and an extensive forecast period (2025-2033), providing deep insights into market dynamics, growth drivers, and future opportunities. We leverage high-volume keywords such as "silicone sealants," "adhesives," "construction sealants," "automotive sealants," "aerospace sealants," and "healthcare sealants" to ensure maximum SEO impact and reach for industry professionals.

Silicone Sealants Industry Market Structure & Competitive Landscape

The global silicone sealants market exhibits a moderately concentrated structure, with leading players like Henkel AG & Co KGaA, RPM International Inc, 3M, Momentive, Illinois Tool Works Inc, Arkema Group, Wacker Chemie AG, Dow, and H.B. Fuller Company holding significant market share. These established giants drive innovation through substantial R&D investments, focusing on developing advanced formulations for enhanced durability, flexibility, and environmental resistance. Regulatory impacts, particularly concerning VOC emissions and sustainability mandates, are increasingly shaping product development and market entry strategies. The threat of product substitutes, while present from other sealant chemistries, is mitigated by the superior performance characteristics of silicone-based products in demanding applications. End-user segmentation reveals Building and Construction as the dominant sector, followed by Automotive, Aerospace, and Healthcare. Merger and acquisition (M&A) trends are active, with strategic consolidations aimed at expanding geographical reach, product portfolios, and technological capabilities. Recent M&A activities have focused on acquiring niche technologies and expanding into high-growth emerging markets, contributing to market consolidation and enhanced competitive advantages for acquiring entities.

Silicone Sealants Industry Market Trends & Opportunities

The global silicone sealants market is on a robust growth trajectory, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This expansion is fueled by increasing demand from the building and construction sector, driven by infrastructure development projects, urbanization, and the need for energy-efficient buildings. The automotive industry's shift towards lightweighting and enhanced structural integrity, alongside stringent safety regulations, further boosts the adoption of high-performance silicone sealants for various applications, including windshield bonding and engine sealing. In the aerospace sector, the inherent properties of silicone sealants, such as their resistance to extreme temperatures and UV radiation, make them indispensable for aircraft assembly and maintenance. The healthcare industry is also witnessing growing demand for biocompatible and sterile silicone sealants for medical device manufacturing and pharmaceutical packaging.

Technological advancements are playing a pivotal role, with manufacturers focusing on developing low-VOC and sustainable silicone sealant formulations to meet evolving environmental regulations and consumer preferences. Innovations in self-healing, conductive, and UV-curable silicones are opening up new application avenues and offering enhanced performance. The competitive landscape is characterized by strategic partnerships, product differentiation, and a focus on geographical expansion. Opportunities abound for players who can offer customized solutions, adhere to stringent quality standards, and demonstrate a commitment to sustainability. Market penetration rates are high in developed economies, but emerging markets in Asia-Pacific and Latin America present significant untapped potential due to rapid industrialization and infrastructure growth. The increasing adoption of smart building technologies also creates demand for specialized silicone sealants that can integrate with these systems.

Dominant Markets & Segments in Silicone Sealants Industry

The Building and Construction segment unequivocally dominates the global silicone sealants market, driven by a confluence of robust infrastructure development, rapid urbanization, and an increasing emphasis on energy-efficient and sustainable building practices. This sector accounts for an estimated 55% of the total market value in 2025.

- Key Growth Drivers in Building and Construction:

- Infrastructure Investment: Government initiatives focused on upgrading existing infrastructure and building new residential and commercial spaces worldwide are a primary catalyst. This includes projects like bridges, tunnels, airports, and high-rise buildings, all requiring high-performance sealants for weatherproofing, structural integrity, and expansion joints.

- Energy Efficiency Mandates: Growing global awareness and regulatory pressure to reduce energy consumption in buildings are propelling the demand for advanced insulating and sealing solutions. Silicone sealants offer excellent thermal insulation properties, contributing to reduced energy bills and a smaller carbon footprint.

- Durability and Weather Resistance: The inherent ability of silicone sealants to withstand extreme temperatures, UV radiation, moisture, and chemical exposure makes them ideal for exterior applications, ensuring long-term structural integrity and aesthetic appeal of buildings.

- Aesthetic Versatility: Available in a wide range of colors and formulations, silicone sealants offer architects and builders flexibility in achieving desired visual outcomes, from clear seals to color-matched joints.

The Automotive sector emerges as the second-largest segment, with an estimated 20% market share in 2025. The increasing complexity of vehicle designs, the trend towards lightweighting, and the growing adoption of electric vehicles (EVs) necessitate advanced sealing solutions for battery packs, powertrains, and structural components.

The Aerospace segment, though smaller in volume, commands significant value due to the stringent performance requirements and high-cost applications. Silicone sealants are critical for sealing aircraft windows, fuselage seams, and engine components, demanding exceptional resistance to extreme temperatures and pressures.

The Healthcare sector, with an estimated 10% market share, showcases steady growth driven by the demand for biocompatible, medical-grade silicone sealants used in the manufacturing of medical devices, implants, and pharmaceutical packaging. Sterilizability and inertness are paramount in this segment.

"Other End-user Industries," encompassing sectors like electronics, industrial manufacturing, and consumer goods, represent the remaining market share, driven by specialized applications requiring the unique properties of silicone sealants.

Silicone Sealants Industry Product Analysis

Silicone sealants are characterized by their exceptional durability, flexibility, and resistance to extreme temperatures, UV radiation, and moisture. Recent product innovations focus on developing low-VOC formulations to meet environmental regulations and enhance sustainability. Advancements in self-healing silicone sealants offer extended service life and reduced maintenance needs. The competitive advantage of silicone sealants lies in their superior performance in demanding applications across aerospace, automotive, and construction, where other sealant types fall short. Applications range from weatherproofing in buildings and bonding windshields in vehicles to sealing critical components in electronics and medical devices.

Key Drivers, Barriers & Challenges in Silicone Sealants Industry

Key Drivers, Barriers & Challenges in Silicone Sealants Industry

Growth Drivers:

- Infrastructure Development: Global investments in construction and infrastructure projects are a primary catalyst, driving demand for durable and weather-resistant sealants.

- Technological Advancements: Innovations in low-VOC, high-performance, and specialty silicone sealants are expanding application possibilities.

- Automotive Evolution: The shift towards EVs and lightweighting in vehicles requires advanced sealing solutions for battery packs and structural components.

- Sustainability Focus: Increasing environmental consciousness and stricter regulations are favoring the use of more sustainable and energy-efficient building materials.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials, such as silicon metal and methanol, can impact profitability.

- Regulatory Landscape: Evolving environmental and health regulations can necessitate product reformulation and compliance costs.

- Competition from Substitutes: While silicone sealants offer superior performance, competition from other sealant chemistries and alternative joining methods exists.

- Supply Chain Disruptions: Global supply chain issues and logistical challenges can affect the availability and cost of finished products.

Growth Drivers in the Silicone Sealants Industry Market

The silicone sealants industry market is propelled by several key growth drivers. Infrastructure development worldwide, particularly in emerging economies, fuels substantial demand for durable and weather-resistant sealants in the building and construction sector. Technological advancements are a critical factor, with ongoing product innovations leading to the development of specialized silicone sealants offering enhanced properties like improved adhesion, UV resistance, and thermal stability. The automotive industry's transition towards electric vehicles and lightweight designs necessitates advanced sealing solutions for battery packs and structural components, creating new market opportunities. Furthermore, increasing global emphasis on sustainability and energy efficiency in buildings favors the adoption of high-performance silicone sealants that contribute to reduced energy consumption.

Challenges Impacting Silicone Sealants Industry Growth

Several challenges can impact the growth of the silicone sealants industry. Volatility in raw material prices, especially for key inputs like silicon metal, can significantly affect manufacturers' profitability and pricing strategies. The evolving regulatory landscape, encompassing environmental standards and health regulations, requires continuous adaptation and investment in compliance. Intense competition from alternative sealant chemistries and established players can also exert pressure on market share and pricing. Moreover, global supply chain disruptions and logistical hurdles can lead to material shortages and increased lead times, impacting production and timely delivery.

Key Players Shaping the Silicone Sealants Industry Market

- Henkel AG & Co KGaA

- RPM International Inc

- 3M

- Momentive

- Illinois Tool Works Inc

- Arkema Group

- Wacker Chemie AG

- Dow

- H.B. Fuller Company

- Guangzhou Jointas Chemical Co Ltd

- Soudal Holding N V

- Shin-Etsu Chemical Co Ltd

- MAPEI S.p.A.

- Sika AG

- Chengdu Guibao Science and Technology Co Ltd

Significant Silicone Sealants Industry Industry Milestones

- May 2022: ITW Performance Polymers announced a distribution partnership with PREMA SA in Poland for its Devcon brand, expanding its market reach in Europe.

- December 2021: Sika planned to establish a new technology center and manufacturing factory for high-quality adhesives and sealants in Pune, India, to cater to the growing demand from the transportation and construction industries with three new production lines.

- July 2021: RPM International Inc. procured a 178,000-square-foot chemical manufacturing facility in Texas. This facility, operated by RPM’s Tremco Construction Products Group, is designed to meet increasing customer demand and strengthen its supply chain.

Future Outlook for Silicone Sealants Industry Market

The future outlook for the silicone sealants industry is exceptionally bright, driven by persistent demand from core sectors and emerging opportunities. Continued investment in global infrastructure, coupled with a growing preference for sustainable and energy-efficient buildings, will solidify the dominance of the building and construction segment. The automotive industry's relentless pursuit of lightweighting and electrification will unlock new applications for advanced silicone sealants. Innovations in areas such as smart materials, self-healing technologies, and eco-friendly formulations will further enhance product differentiation and market penetration. Strategic collaborations, technological advancements, and a focus on emerging markets will be crucial for sustained growth and competitive advantage in the coming years. The market is poised for continued expansion, offering significant value to stakeholders across the entire supply chain.

Silicone Sealants Industry Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Healthcare

- 1.5. Other End-user Industries

Silicone Sealants Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

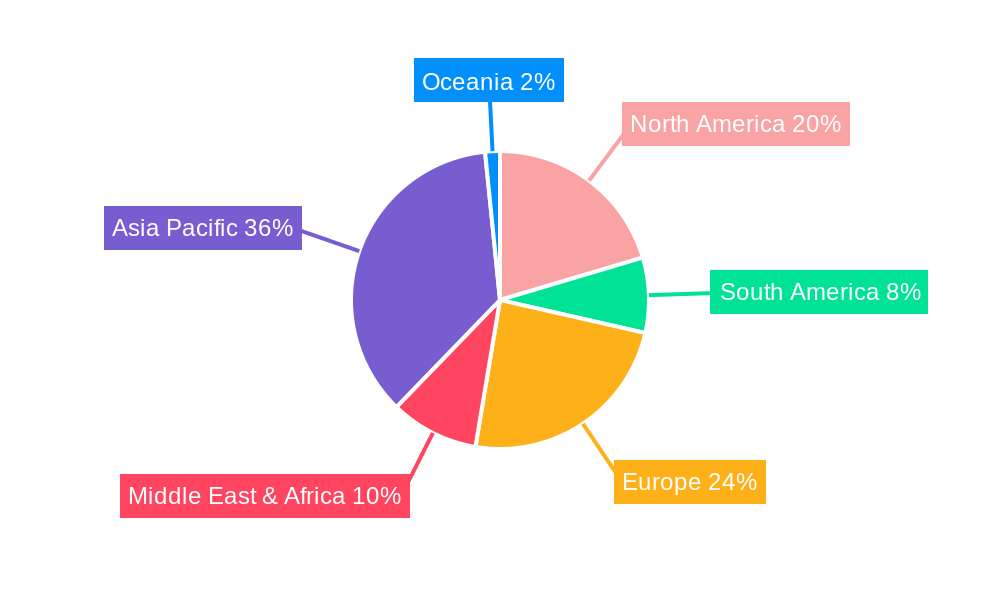

Silicone Sealants Industry Regional Market Share

Geographic Coverage of Silicone Sealants Industry

Silicone Sealants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand From Various End-user Industries; Superior Characteristics of Ceramic Textiles

- 3.3. Market Restrains

- 3.3.1. ; Stringent Environmental Regulations; Unfavourable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silicone Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Healthcare

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Silicone Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Aerospace

- 6.1.2. Automotive

- 6.1.3. Building and Construction

- 6.1.4. Healthcare

- 6.1.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Silicone Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Aerospace

- 7.1.2. Automotive

- 7.1.3. Building and Construction

- 7.1.4. Healthcare

- 7.1.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Silicone Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Aerospace

- 8.1.2. Automotive

- 8.1.3. Building and Construction

- 8.1.4. Healthcare

- 8.1.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Silicone Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Aerospace

- 9.1.2. Automotive

- 9.1.3. Building and Construction

- 9.1.4. Healthcare

- 9.1.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Silicone Sealants Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Aerospace

- 10.1.2. Automotive

- 10.1.3. Building and Construction

- 10.1.4. Healthcare

- 10.1.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RPM International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 3M

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Momentive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Illinois Tool Works Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arkema Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wacker Chemie A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dow

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 H B Fuller Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Guangzhou Jointas Chemical Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Soudal Holding N V

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shin-Etsu Chemical Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MAPEI S p A

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sika AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Chengdu Guibao Science and Technology Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Silicone Sealants Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Silicone Sealants Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 3: North America Silicone Sealants Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America Silicone Sealants Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Silicone Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Silicone Sealants Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 7: South America Silicone Sealants Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 8: South America Silicone Sealants Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Silicone Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Silicone Sealants Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 11: Europe Silicone Sealants Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe Silicone Sealants Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Silicone Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Silicone Sealants Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 15: Middle East & Africa Silicone Sealants Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Middle East & Africa Silicone Sealants Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Silicone Sealants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Silicone Sealants Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 19: Asia Pacific Silicone Sealants Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 20: Asia Pacific Silicone Sealants Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Silicone Sealants Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silicone Sealants Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 2: Global Silicone Sealants Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Silicone Sealants Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 4: Global Silicone Sealants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Silicone Sealants Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 9: Global Silicone Sealants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Silicone Sealants Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 14: Global Silicone Sealants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Silicone Sealants Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 25: Global Silicone Sealants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Silicone Sealants Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 33: Global Silicone Sealants Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Silicone Sealants Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silicone Sealants Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Silicone Sealants Industry?

Key companies in the market include Henkel AG & Co KGaA, RPM International Inc, 3M, Momentive, Illinois Tool Works Inc, Arkema Group, Wacker Chemie A, Dow, H B Fuller Company, Guangzhou Jointas Chemical Co Ltd, Soudal Holding N V, Shin-Etsu Chemical Co Ltd, MAPEI S p A, Sika AG, Chengdu Guibao Science and Technology Co Ltd.

3. What are the main segments of the Silicone Sealants Industry?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand From Various End-user Industries; Superior Characteristics of Ceramic Textiles.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Stringent Environmental Regulations; Unfavourable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

May 2022: ITW Performance Polymers announced a distribution partnership with PREMA SA in Poland for its Devcon brand.December 2021: Sika planned to establish a new technology center and manufacturing factory for high-quality adhesives and sealants in Pune, India. The company primarily manufactures products for the transportation and construction industries through its three new production lines.July 2021: RPM International Inc. procured a 178,000-square-foot chemical manufacturing facility in Texas to act as a manufacturing campus, owned and operated by RPM’s Tremco Construction Products Group, to meet customer demand and strengthen its supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silicone Sealants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silicone Sealants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silicone Sealants Industry?

To stay informed about further developments, trends, and reports in the Silicone Sealants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence