Key Insights

The China Monosodium Glutamate (MSG) market is projected to reach $5.92 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.47% from 2025 to 2033. This growth is propelled by substantial demand across key applications, including noodles, soups, broth, processed meats, and seasonings. Increased consumer preference for convenient, flavorful food options, supported by rising disposable incomes in China, is a significant market driver. MSG's consistent utility as a flavor enhancer in both domestic and food service sectors continues to solidify its market position. Innovations in production technology are also contributing, enhancing efficiency and product quality to meet evolving consumer expectations for natural and premium ingredients.

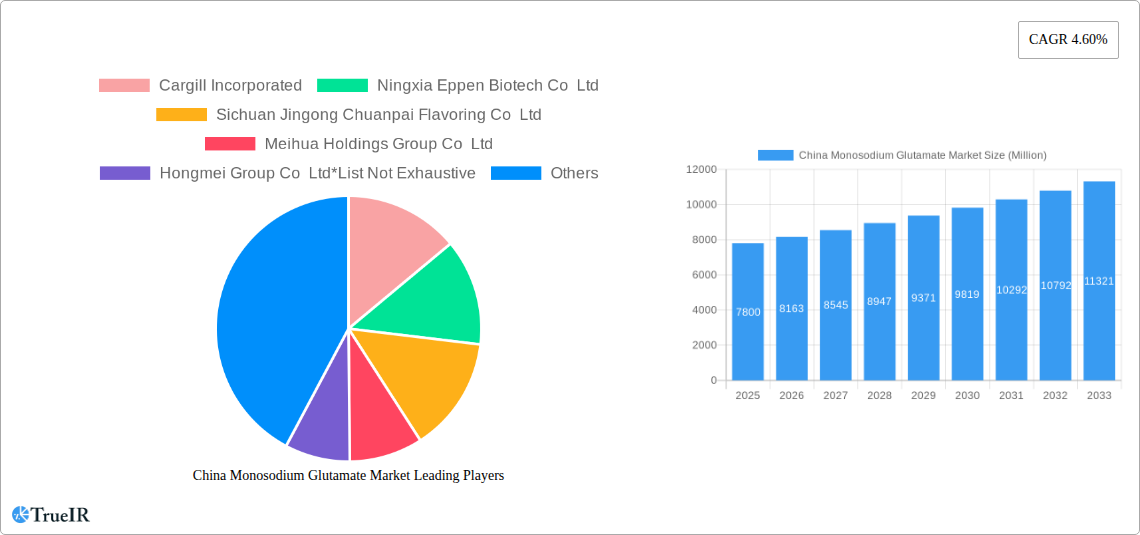

China Monosodium Glutamate Market Market Size (In Billion)

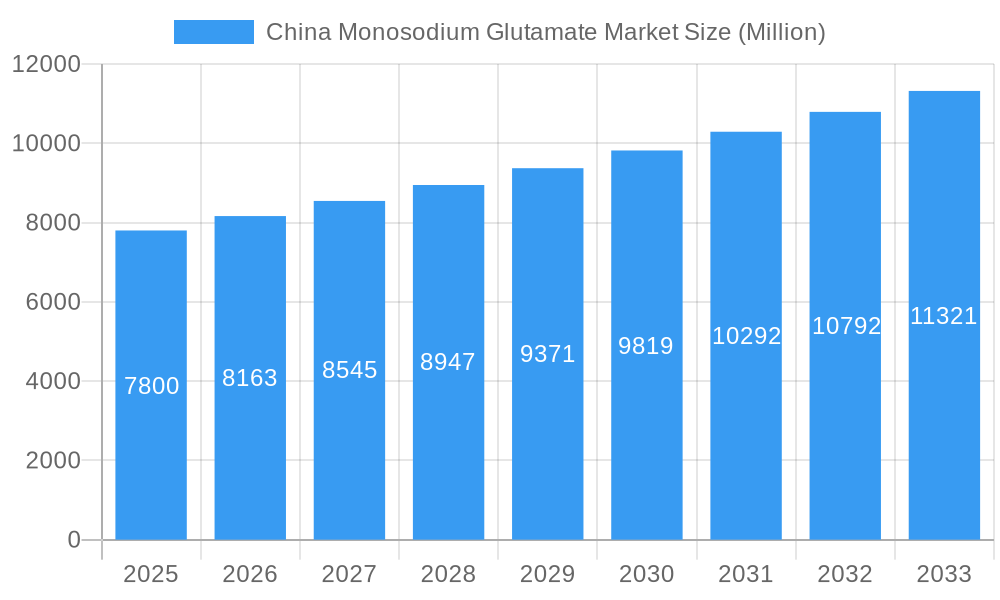

While the market outlook is positive, potential challenges include consumer health perceptions regarding MSG consumption, which can spur demand for MSG-free alternatives. Evolving regulatory frameworks and food labeling standards also warrant attention. Nevertheless, MSG's cost-effectiveness and efficacy as a flavor enhancer are expected to mitigate these restraints, particularly within China's price-sensitive market. The competitive landscape is dominated by key players such as Cargill Incorporated, Ningxia Eppen Biotech Co Ltd, and Meihua Holdings Group Co Ltd, suggesting continued innovation and market consolidation. Strategic market penetration and efficient production processes will be crucial for companies to capitalize on the sustained demand for MSG in China.

China Monosodium Glutamate Market Company Market Share

China Monosodium Glutamate (MSG) Market Analysis: Trends, Opportunities, and Key Players (2019-2033)

This comprehensive report provides critical insights into the China Monosodium Glutamate (MSG) market, covering the historical period (2019-2024), base year (2025), and a detailed forecast (2025-2033). It analyzes market dynamics, growth drivers, competitive intelligence, and future projections, targeting stakeholders, investors, and industry professionals. Optimized for high-volume SEO keywords such as "China MSG market," "monosodium glutamate industry," "flavor enhancer market China," and "food additives China," this report enhances search visibility for actionable market intelligence.

China Monosodium Glutamate Market Market Structure & Competitive Landscape

The China Monosodium Glutamate (MSG) market is characterized by a moderately concentrated structure, with a few large players dominating a significant market share. This concentration is driven by economies of scale in production, established distribution networks, and brand recognition. Innovation in processing technology, yield improvement, and exploration of novel applications are key drivers shaping the competitive landscape. Regulatory impacts, primarily focused on food safety standards and labeling requirements, play a crucial role in market entry and operational compliance. Product substitutes, such as yeast extract and other savory flavorings, present a competitive challenge, necessitating continuous product development and differentiation. End-user segmentation, particularly the increasing demand from the processed food industry, influences strategic investments and market positioning. Merger and acquisition (M&A) trends, though not as prevalent as in some other sectors, are observed as companies seek to consolidate market share, acquire new technologies, or expand their product portfolios. For instance, the market has witnessed strategic alliances and capacity expansions aimed at capturing a larger share of the burgeoning food processing sector. The concentration ratio is estimated to be around 60% for the top five players. M&A activities in the past five years have involved approximately 15-20 significant transactions, including vertical integrations and acquisitions of smaller specialized MSG producers.

China Monosodium Glutamate Market Market Trends & Opportunities

The China Monosodium Glutamate (MSG) market is poised for sustained growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 5.2% between 2025 and 2033. This expansion is fueled by several interconnected trends. The burgeoning Chinese middle class, with its increasing disposable income and evolving dietary habits, is driving higher consumption of processed and convenience foods, where MSG is a widely used flavor enhancer. The noodles, soups, and broth segment, in particular, continues to be a dominant application, benefiting from the convenience and taste profiles offered by MSG-infused products. Furthermore, the meat products sector also presents significant growth opportunities as processed meat consumption rises. Technological advancements in fermentation processes and purification techniques are leading to improved product quality, higher yields, and more cost-effective production, further stimulating market growth. The development of specialized MSG products catering to specific culinary needs and consumer preferences is also a notable trend. The "umami" taste, scientifically recognized as the fifth basic taste, is gaining greater consumer awareness, which inherently benefits MSG, the most recognized source of this taste. The market penetration rate of MSG in households and food manufacturing facilities remains high, indicating a mature yet still growing demand. Opportunities also lie in expanding export markets, leveraging China's competitive production costs and established supply chains. The integration of MSG into new food categories and the development of cleaner label alternatives or fortified MSG products could unlock further market potential. The increasing focus on food safety and quality control by both consumers and regulatory bodies presents an opportunity for manufacturers adhering to stringent standards to gain a competitive edge. The shift towards more refined and specialized food ingredients also presents an avenue for innovation within the MSG market. The estimated market size for China's MSG market is projected to reach approximately ¥120,000 Million by 2033.

Dominant Markets & Segments in China Monosodium Glutamate Market

The Noodles, Soups, and Broth segment stands as the most dominant force within the China Monosodium Glutamate (MSG) market. This dominance is attributed to the deeply ingrained consumption habits in China, where instant noodles, ready-to-eat soups, and broths are staples for convenience and affordability. The sheer volume of production and consumption in this category directly translates to a significant demand for MSG as a primary flavor enhancer. Key growth drivers in this segment include:

- Ubiquitous Consumer Access: The widespread availability of instant noodle and soup products across all retail channels, from hypermarkets to small convenience stores, ensures continuous demand.

- Affordability and Value Perception: MSG contributes to creating a desirable taste profile at a low cost, making these food products highly appealing to a broad demographic, especially price-sensitive consumers.

- Cultural Affinity: Traditional Chinese cuisine emphasizes rich, savory flavors, and MSG effectively replicates and enhances these taste experiences, aligning well with cultural preferences.

- Product Innovation: Manufacturers continuously innovate by introducing new flavors and formulations within the noodle and soup categories, often relying on MSG to deliver consistent and appealing taste.

Beyond the dominant noodle and soup segment, Meat Products represent another substantial and growing application for MSG. The processed meat industry, including sausages, processed poultry, and other meat preparations, increasingly utilizes MSG to enhance palatability, mask off-flavors, and improve overall sensory appeal. The growing demand for convenient, ready-to-cook meat products further propels this segment.

The Seasonings and Dressings category also exhibits steady growth, driven by the increasing popularity of home cooking and the demand for ready-to-use flavor solutions. MSG is a critical component in many spice blends, marinades, and savory dressings, contributing to their characteristic taste.

Other Applications, encompassing a diverse range of food products such as snacks, baked goods, and processed vegetables, represent a smaller but expanding market share. As food manufacturers explore new ways to enhance flavor profiles across an ever-wider array of products, the demand for MSG in these niche applications is expected to see gradual growth. Overall, the dominance of the noodle, soup, and broth segment, coupled with strong performance in meat products and a steady contribution from seasonings and dressings, underpins the robust growth trajectory of the China MSG market.

China Monosodium Glutamate Market Product Analysis

The China Monosodium Glutamate (MSG) market is characterized by a focus on product purity, particle size control, and cost-effectiveness. Technological advancements in fermentation and crystallization processes have led to the production of high-purity MSG, meeting stringent food safety standards. Competitive advantages stem from efficient production chains that translate into competitive pricing, a crucial factor in the price-sensitive Chinese market. Manufacturers are also exploring granulated and fine-powdered forms of MSG to cater to specific application needs, offering improved solubility and ease of use in various food formulations. Innovations are also emerging in the development of MSG derivatives or fortified products to address evolving consumer perceptions and dietary trends, albeit at an early stage.

Key Drivers, Barriers & Challenges in China Monosodium Glutamate Market

The China Monosodium Glutamate (MSG) market is propelled by the increasing demand for convenient and processed foods, driven by urbanization and a growing middle class. Economic prosperity directly correlates with higher consumption of MSG-infused products. Technological advancements in fermentation, leading to improved efficiency and lower production costs, are significant drivers. Favorable government policies supporting the food processing industry indirectly boost MSG demand.

However, the market faces significant challenges. Negative consumer perceptions and the persistent "anti-MSG" sentiment in some demographics create a barrier. Stringent food safety regulations and evolving quality control standards require continuous investment in compliance. Intense competition among domestic and international players can lead to price wars and reduced profit margins. Supply chain disruptions, including raw material price volatility and logistics, pose a constant threat. Regulatory hurdles for new product introductions and stringent import/export regulations also present challenges. The market is also susceptible to fluctuations in global agricultural commodity prices, which impact the cost of raw materials for MSG production.

Growth Drivers in the China Monosodium Glutamate Market Market

Key growth drivers in the China Monosodium Glutamate (MSG) market include the expanding processed food industry, fueled by a growing urban population and rising disposable incomes. The convenience food trend, encompassing instant noodles, ready-to-eat meals, and savory snacks, directly increases MSG consumption. Technological advancements in fermentation processes are enhancing production efficiency and reducing costs, making MSG more competitive. Government support for the agricultural and food processing sectors, including subsidies and investment incentives, further bolsters market expansion. The increasing awareness and acceptance of the "umami" taste profile, which MSG effectively delivers, are also contributing to sustained demand.

Challenges Impacting China Monosodium Glutamate Market Growth

Challenges impacting China Monosodium Glutamate (MSG) market growth primarily revolve around evolving consumer perceptions and health consciousness. Negative publicity and misinterpretations regarding MSG's health effects continue to be a significant barrier in certain consumer segments, leading to demand for "MSG-free" products. Stringent and evolving food safety regulations necessitate continuous investment in compliance and quality assurance. Intense competition within the domestic market can lead to price pressures and impact profitability. Fluctuations in the prices of agricultural raw materials, such as corn and tapioca, directly affect production costs. Furthermore, supply chain vulnerabilities, including logistics and transportation, can impact timely delivery and overall market efficiency.

Key Players Shaping the China Monosodium Glutamate Market Market

- Cargill Incorporated

- Ningxia Eppen Biotech Co Ltd

- Sichuan Jingong Chuanpai Flavoring Co Ltd

- Meihua Holdings Group Co Ltd

- Hongmei Group Co Ltd

- COFCO

- Fufeng Group Shandong

- Shandong Qilu Bio-Technology Group Co Ltd

Significant China Monosodium Glutamate Market Industry Milestones

- 2019: Increased focus on quality certifications and international food safety standards among major Chinese MSG manufacturers.

- 2020: Impact of COVID-19 on supply chains and logistics, leading to temporary production adjustments and increased domestic demand for certain food products.

- 2021: Growing consumer awareness regarding "umami" taste and its role in culinary applications.

- 2022: Continued investment in advanced fermentation technologies to improve yield and reduce environmental impact.

- 2023: Expansion of export markets and diversification of product applications beyond traditional food items.

- 2024: Intensified focus on sustainable production practices and traceability within the MSG industry.

Future Outlook for China Monosodium Glutamate Market Market

The future outlook for the China Monosodium Glutamate (MSG) market remains positive, driven by enduring demand from the processed food industry and the growing acceptance of the umami taste. Opportunities lie in leveraging technological innovations for more efficient and sustainable production, as well as in developing specialized MSG products for niche applications. The market is expected to witness further consolidation and strategic partnerships as key players aim to enhance their competitive positions. Addressing negative consumer perceptions through transparent communication and educational initiatives will be crucial for sustained growth. The market is projected to continue its upward trajectory, with an estimated market value of approximately ¥120,000 Million by 2033.

China Monosodium Glutamate Market Segmentation

-

1. Application

- 1.1. Noodles, Soups, and Broth

- 1.2. Meat Products

- 1.3. Seasonings and Dressings

- 1.4. Other Applications

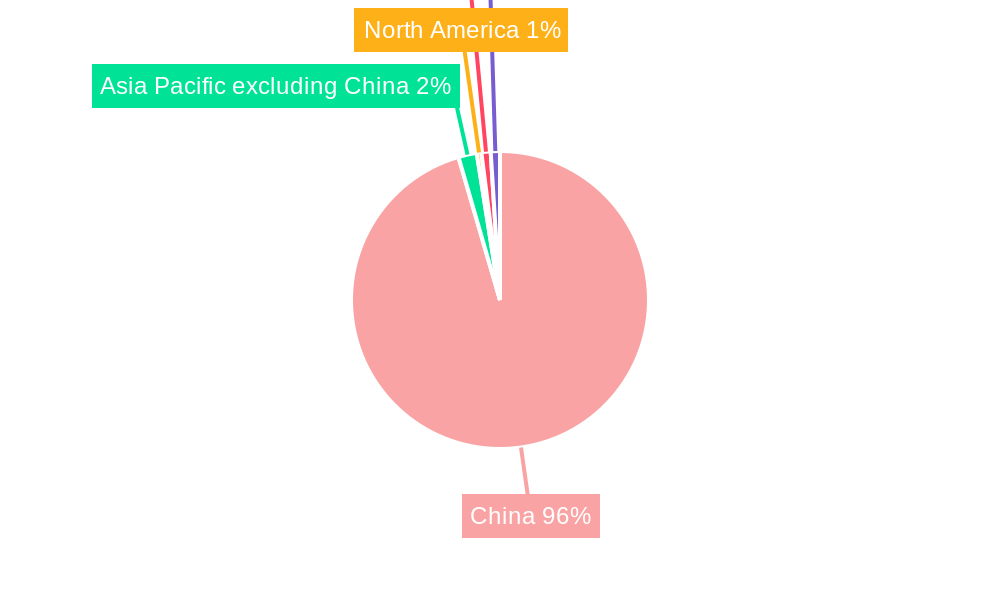

China Monosodium Glutamate Market Segmentation By Geography

- 1. China

China Monosodium Glutamate Market Regional Market Share

Geographic Coverage of China Monosodium Glutamate Market

China Monosodium Glutamate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Growing Demand of Processed Foods in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Monosodium Glutamate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Noodles, Soups, and Broth

- 5.1.2. Meat Products

- 5.1.3. Seasonings and Dressings

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ningxia Eppen Biotech Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sichuan Jingong Chuanpai Flavoring Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Meihua Holdings Group Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hongmei Group Co Ltd*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 COFCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fufeng Group Shandong

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shandong Qilu Bio-Technology Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: China Monosodium Glutamate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Monosodium Glutamate Market Share (%) by Company 2025

List of Tables

- Table 1: China Monosodium Glutamate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: China Monosodium Glutamate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: China Monosodium Glutamate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: China Monosodium Glutamate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Monosodium Glutamate Market?

The projected CAGR is approximately 4.47%.

2. Which companies are prominent players in the China Monosodium Glutamate Market?

Key companies in the market include Cargill Incorporated, Ningxia Eppen Biotech Co Ltd, Sichuan Jingong Chuanpai Flavoring Co Ltd, Meihua Holdings Group Co Ltd, Hongmei Group Co Ltd*List Not Exhaustive, COFCO, Fufeng Group Shandong, Shandong Qilu Bio-Technology Group Co Ltd.

3. What are the main segments of the China Monosodium Glutamate Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Growing Demand of Processed Foods in the Country.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Monosodium Glutamate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Monosodium Glutamate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Monosodium Glutamate Market?

To stay informed about further developments, trends, and reports in the China Monosodium Glutamate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence