Key Insights

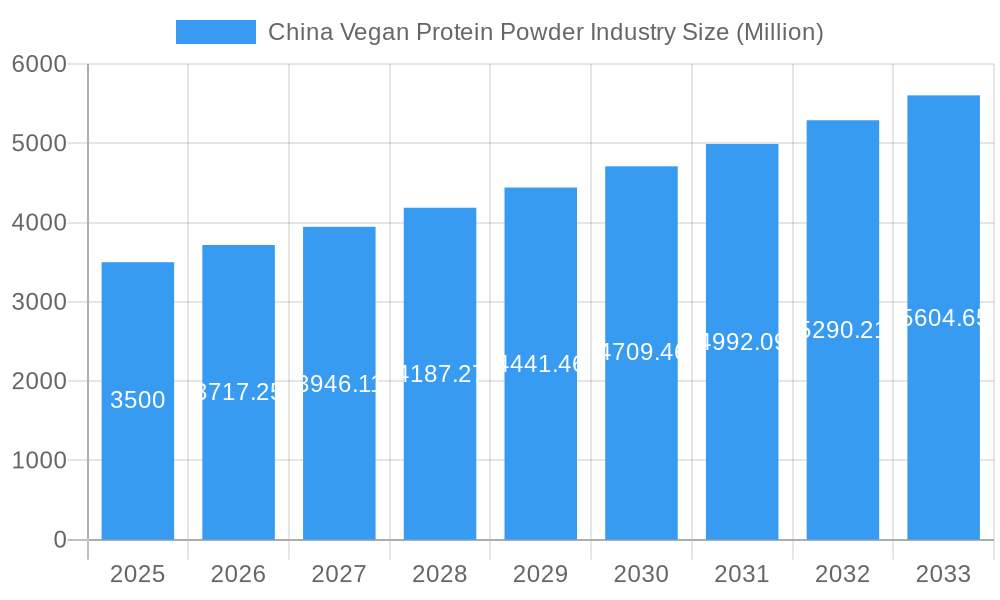

The China Vegan Protein Powder market is projected for significant expansion, with an estimated market size of $5.65 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 6.41% through 2033. This growth is driven by increasing consumer awareness of plant-based diet benefits, rising environmental sustainability concerns, and growing disposable incomes supporting premium nutritional product investments. The market features a diverse range of protein sources, with soy and pea protein currently leading due to their availability and cost-effectiveness. Emerging segments like hemp and algae protein are gaining traction through innovation and demand for novel, high-value ingredients. The "Food and Beverages" segment, encompassing bakery, dairy alternatives, and meat alternatives, is the largest end-user category, reflecting the integration of vegan protein powders into everyday consumables. An expanding middle class and a greater emphasis on preventive healthcare are key drivers.

China Vegan Protein Powder Industry Market Size (In Billion)

Evolving consumer preferences for natural and clean-label products are pushing manufacturers to offer protein powders with minimal additives and high nutritional profiles. Potential restraints include price sensitivity and the need for consumer education regarding plant-based protein efficacy. China's vast population and modernizing food industry create a fertile ground for vegan protein powder innovation and adoption. Key companies like Archer Daniels Midland Company and Wilmar International are strategically positioned to capitalize on this growth through extensive supply chains and product development. The forecast period indicates sustained demand across various applications, from dietary supplements to animal feed, underscoring the versatility and increasing acceptance of vegan protein sources.

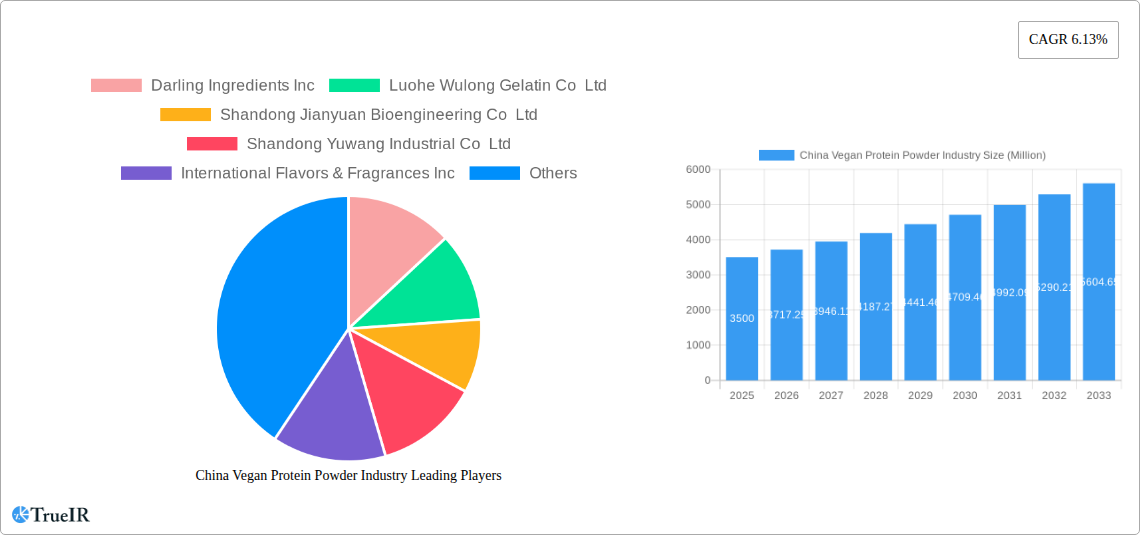

China Vegan Protein Powder Industry Company Market Share

This comprehensive report offers an in-depth analysis of the China Vegan Protein Powder Industry, covering market dynamics, growth trajectories, and competitive landscapes from 2019 to 2033. With a base and estimated year of 2025 and a forecast period of 2025–2033, the report provides invaluable insights. We dissect the market by source (Animal, Microbial, Plant) and end-user segments, including protein types and sub-end users. Leverage high-volume keywords such as "China vegan protein," "plant-based protein China," "protein powder market," and "food ingredients China" to enhance searchability and reach a broad industry audience.

China Vegan Protein Powder Industry Market Structure & Competitive Landscape

The China Vegan Protein Powder Industry exhibits a moderately concentrated market structure, characterized by the presence of both established global players and rapidly growing domestic enterprises. Innovation drivers are primarily centered on enhancing protein bioavailability, taste profiles, and sustainability credentials. Regulatory impacts, while evolving, are increasingly focused on food safety standards and labeling requirements, particularly for imported ingredients. Product substitutes are abundant, ranging from traditional animal-derived proteins to emerging novel protein sources. End-user segmentation reveals a dynamic shift, with significant growth anticipated in the Supplements and Food and Beverages sectors, driven by increasing health consciousness and dietary diversification. Mergers and acquisitions (M&A) trends indicate strategic consolidation and vertical integration as companies aim to secure supply chains and expand market reach. For instance, the concentration ratio for the top five players is estimated to be around 55-60%, with M&A volumes showing a steady increase of approximately 10-15% annually over the historical period.

China Vegan Protein Powder Industry Market Trends & Opportunities

The China Vegan Protein Powder Industry is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 18.5% from 2025 to 2033. This expansion is fueled by a confluence of evolving consumer preferences, significant technological advancements, and a burgeoning awareness of health and environmental sustainability. The market size is projected to reach over 8,000 million by 2025, driven by an increasing demand for protein alternatives to traditional animal sources, attributed to concerns over health implications, ethical considerations, and the environmental footprint of animal agriculture. Technological shifts are pivotal, with ongoing research and development focusing on novel extraction methods, improved protein formulation for better texture and flavor, and the development of less common but highly nutritious plant proteins. For example, advancements in processing technologies for pea protein and hemp protein have significantly enhanced their market appeal.

Consumer preferences are increasingly leaning towards plant-based diets, not just among vegetarians and vegans but also among flexitarians seeking healthier and more sustainable food choices. This demographic shift is a primary catalyst for the industry's growth. The penetration rate of vegan protein powders in the overall protein supplement market in China has already surpassed 25% and is expected to climb significantly. Furthermore, the integration of vegan protein powders into mainstream food and beverage products, such as dairy alternatives, baked goods, and meat substitutes, is creating new avenues for market penetration. The competitive dynamics are intensifying, with both domestic Chinese manufacturers and international corporations vying for market share. This competition spurs innovation, leading to a wider array of product offerings and more competitive pricing. Opportunities abound in niche segments like specialized sports nutrition, elderly nutrition, and the development of infant formulas with plant-based protein bases. The trend towards clean-label products, free from artificial additives and genetically modified ingredients, also presents a significant market opportunity for manufacturers who can meet these consumer demands.

Dominant Markets & Segments in China Vegan Protein Powder Industry

Within the China Vegan Protein Powder Industry, the Plant protein segment stands out as the dominant force, driven by evolving consumer preferences and a strong emphasis on health and sustainability. Among plant-based sources, Pea Protein and Soy Protein are leading the charge due to their high protein content, relatively low cost, and established production infrastructure in China. The Food and Beverages end-user segment is witnessing exponential growth, with particular traction in Dairy and Dairy Alternative Products and Meat/Poultry/Seafood and Meat Alternative Products. This is directly linked to the rising popularity of plant-based milk, yogurts, and meat substitutes, where vegan protein powders play a crucial role in enhancing nutritional value and texture.

The Supplements end-user segment, especially Sport/Performance Nutrition, also holds significant market share. Chinese consumers are increasingly investing in fitness and sports, driving demand for high-quality protein powders to support muscle recovery and growth. The Microbial protein segment, particularly Algae Protein, is an emerging area with substantial growth potential, driven by its sustainable cultivation and rich nutritional profile, though its market penetration is still in its nascent stages.

Key Growth Drivers in Dominant Segments:

Plant Protein:

- Consumer Awareness: Growing understanding of the health benefits of plant-based diets and the environmental impact of animal agriculture.

- Cost-Effectiveness: Relatively lower production costs compared to some animal proteins, making it accessible to a wider consumer base.

- Versatility: Ability to be incorporated into a wide range of food and beverage applications.

- Government Support: Policies encouraging the development and consumption of healthy and sustainable food options.

Food and Beverages (Dairy & Meat Alternatives):

- Dietary Trends: Rise of flexitarianism and veganism, leading to increased demand for plant-based alternatives.

- Product Innovation: Continuous development of new and improved plant-based products that mimic the taste and texture of traditional animal products.

- Health Concerns: Consumer aversion to lactose and cholesterol associated with dairy and meat products.

Supplements (Sport/Performance Nutrition):

- Fitness Culture: Growing popularity of gyms, sports, and active lifestyles among Chinese millennials and Gen Z.

- Health & Wellness Focus: Increased emphasis on personal health and the role of protein in fitness regimes.

- Availability: Wide distribution channels and increasing availability of specialized sports nutrition products.

The market dominance is further influenced by government policies promoting food security and agricultural innovation, which indirectly benefit the domestic production of plant-based proteins. Infrastructure development for processing and distribution also plays a vital role in ensuring the availability and affordability of these products across China.

China Vegan Protein Powder Industry Product Analysis

Product innovation in the China Vegan Protein Powder Industry is primarily focused on improving taste, texture, and nutritional completeness. Key advancements include the development of allergen-free formulations, enhanced solubility for smoother beverages, and the blending of different plant proteins to achieve a more balanced amino acid profile, rivaling that of animal proteins. Competitive advantages are being carved out through proprietary extraction technologies that preserve the natural benefits of ingredients and reduce processing impurities. Applications are rapidly expanding beyond traditional supplements to include functional foods, fortified beverages, and specialized nutritional products for infants and the elderly. This trend signifies a market shift towards integrating vegan protein powders into daily dietary staples.

Key Drivers, Barriers & Challenges in China Vegan Protein Powder Industry

Key Drivers:

- Technological Advancements: Improved extraction and processing techniques are enhancing the quality and appeal of plant-based proteins.

- Economic Factors: Growing disposable incomes allow consumers to invest in premium health and wellness products, including vegan protein powders.

- Policy Support: Government initiatives promoting healthy eating and sustainable agriculture are creating a favorable market environment.

Key Barriers & Challenges:

- Supply Chain Volatility: Dependence on agricultural outputs can lead to price fluctuations and availability issues.

- Regulatory Hurdles: Navigating complex food safety regulations and labeling standards, particularly for novel ingredients.

- Competitive Pressures: Intense competition from both established and emerging players, as well as from traditional animal-based protein sources.

- Consumer Perception: Overcoming lingering perceptions of taste inferiority or incomplete nutrition compared to animal proteins requires ongoing education and product refinement. The estimated cost increase due to these challenges could range from 5-10%.

Growth Drivers in the China Vegan Protein Powder Industry Market

The China Vegan Protein Powder Industry is propelled by a confluence of powerful growth drivers. Technologically, advancements in plant protein extraction and processing are yielding products with improved taste, texture, and digestibility, making them more appealing to a wider consumer base. Economically, rising disposable incomes and a growing middle class are fueling demand for premium health and wellness products, with plant-based protein powders increasingly seen as a healthy lifestyle choice. Policy-wise, the Chinese government's focus on food security, public health, and environmental sustainability creates a supportive ecosystem for the vegan protein industry. Initiatives promoting the reduction of meat consumption and the development of alternative proteins further bolster market expansion.

Challenges Impacting China Vegan Protein Powder Industry Growth

Several challenges can impact the growth trajectory of the China Vegan Protein Powder Industry. Regulatory complexities surrounding novel ingredients and food safety standards can create barriers to market entry and product development. Supply chain issues, including the variability of agricultural yields and the potential for price volatility of raw materials, pose significant operational risks. Competitive pressures from both domestic and international companies, as well as the enduring consumer preference for traditional animal proteins, necessitate continuous innovation and marketing efforts. For example, sourcing specific high-quality plant protein ingredients can face price fluctuations of up to 15-20% year-on-year.

Key Players Shaping the China Vegan Protein Powder Industry Market

- Darling Ingredients Inc.

- Luohe Wulong Gelatin Co Ltd

- Shandong Jianyuan Bioengineering Co Ltd

- Shandong Yuwang Industrial Co Ltd

- International Flavors & Fragrances Inc.

- Linxia Huaan Biological Products Co Ltd

- Wilmar International Ltd.

- Archer Daniels Midland Company

- Gansu Hua'an Biotechnology Group

- Fonterra Co-operative Group Limited

- Foodchem International Corporation

- FUJI OIL HOLDINGS INC.

Significant China Vegan Protein Powder Industry Industry Milestones

- July 2021: Fuji Oil Holdings Inc.'s Dutch subsidiary invested in UNOVIS NCAP II Fund, a major fund specializing in food technologies, aiming to leverage its plant-based food material processing expertise for global sustainability initiatives.

- May 2021: Darling Ingredients Inc. announced the expansion of its Rousselot brand's purified, pharmaceutical-grade, modified gelatins with the launch of X-Pure® GelDAT – Gelatin Desaminotyrosine.

- March 2021: Darling Ingredients entered a joint venture with Intrexon Corporation for the industrial-scale production of non-pathogenic black soldier fly (BSF) larvae, positioning it as a novel protein source for animal feed.

Future Outlook for China Vegan Protein Powder Industry Market

The future outlook for the China Vegan Protein Powder Industry is exceptionally promising, driven by sustained growth catalysts. Strategic opportunities lie in expanding product applications into functional foods, specialized nutritional products for aging populations, and infant nutrition. The industry is expected to witness further innovation in protein sources, processing technologies, and formulation to address taste and texture challenges. Market potential is immense, with increasing consumer adoption of plant-based diets and a growing global emphasis on sustainable protein sources creating a robust demand environment for vegan protein powders in China. The market is projected to continue its upward trajectory, exceeding 15,000 million by the end of the forecast period.

China Vegan Protein Powder Industry Segmentation

-

1. Source

-

1.1. Animal

-

1.1.1. By Protein Type

- 1.1.1.1. Casein and Caseinates

- 1.1.1.2. Collagen

- 1.1.1.3. Egg Protein

- 1.1.1.4. Gelatin

- 1.1.1.5. Insect Protein

- 1.1.1.6. Milk Protein

- 1.1.1.7. Whey Protein

- 1.1.1.8. Other Animal Protein

-

1.1.1. By Protein Type

-

1.2. Microbial

- 1.2.1. Algae Protein

- 1.2.2. Mycoprotein

-

1.3. Plant

- 1.3.1. Hemp Protein

- 1.3.2. Pea Protein

- 1.3.3. Potato Protein

- 1.3.4. Rice Protein

- 1.3.5. Soy Protein

- 1.3.6. Wheat Protein

- 1.3.7. Other Plant Protein

-

1.1. Animal

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

China Vegan Protein Powder Industry Segmentation By Geography

- 1. China

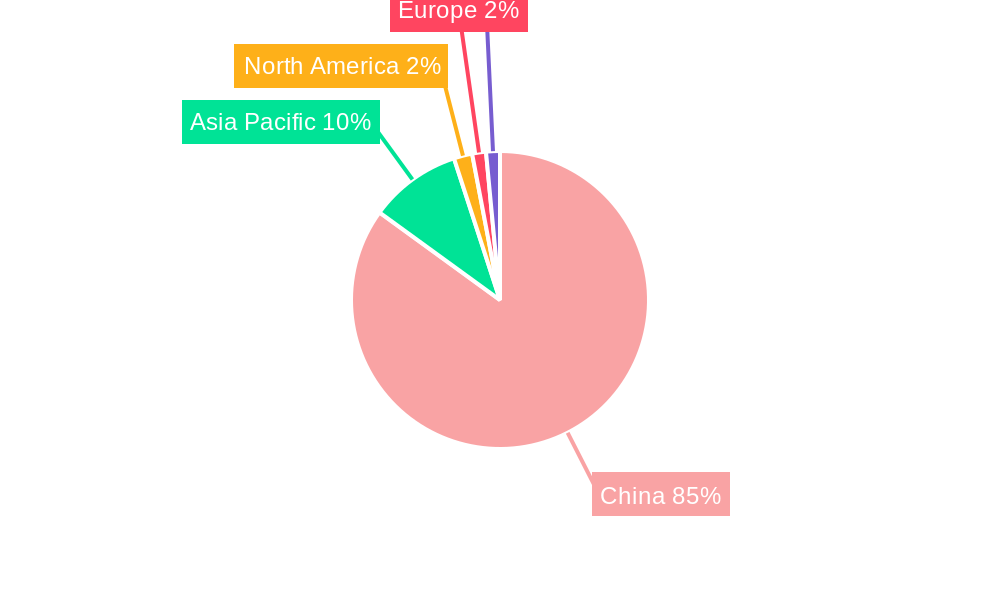

China Vegan Protein Powder Industry Regional Market Share

Geographic Coverage of China Vegan Protein Powder Industry

China Vegan Protein Powder Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Vegan Protein Powder Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal

- 5.1.1.1. By Protein Type

- 5.1.1.1.1. Casein and Caseinates

- 5.1.1.1.2. Collagen

- 5.1.1.1.3. Egg Protein

- 5.1.1.1.4. Gelatin

- 5.1.1.1.5. Insect Protein

- 5.1.1.1.6. Milk Protein

- 5.1.1.1.7. Whey Protein

- 5.1.1.1.8. Other Animal Protein

- 5.1.1.1. By Protein Type

- 5.1.2. Microbial

- 5.1.2.1. Algae Protein

- 5.1.2.2. Mycoprotein

- 5.1.3. Plant

- 5.1.3.1. Hemp Protein

- 5.1.3.2. Pea Protein

- 5.1.3.3. Potato Protein

- 5.1.3.4. Rice Protein

- 5.1.3.5. Soy Protein

- 5.1.3.6. Wheat Protein

- 5.1.3.7. Other Plant Protein

- 5.1.1. Animal

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Darling Ingredients Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Luohe Wulong Gelatin Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shandong Jianyuan Bioengineering Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shandong Yuwang Industrial Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Flavors & Fragrances Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Linxia Huaan Biological Products Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wilmar International Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Archer Daniels Midland Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gansu Hua'an Biotechnology Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fonterra Co-operative Group Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Foodchem International Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 FUJI OIL HOLDINGS INC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: China Vegan Protein Powder Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Vegan Protein Powder Industry Share (%) by Company 2025

List of Tables

- Table 1: China Vegan Protein Powder Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 2: China Vegan Protein Powder Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: China Vegan Protein Powder Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Vegan Protein Powder Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 5: China Vegan Protein Powder Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: China Vegan Protein Powder Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Vegan Protein Powder Industry?

The projected CAGR is approximately 6.41%.

2. Which companies are prominent players in the China Vegan Protein Powder Industry?

Key companies in the market include Darling Ingredients Inc, Luohe Wulong Gelatin Co Ltd, Shandong Jianyuan Bioengineering Co Ltd, Shandong Yuwang Industrial Co Ltd, International Flavors & Fragrances Inc, Linxia Huaan Biological Products Co Ltd, Wilmar International Lt, Archer Daniels Midland Company, Gansu Hua'an Biotechnology Group, Fonterra Co-operative Group Limited, Foodchem International Corporation, FUJI OIL HOLDINGS INC.

3. What are the main segments of the China Vegan Protein Powder Industry?

The market segments include Source, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.65 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

July 2021: Fuji Oil Holdings Inc.'s Dutch subsidiary invested in UNOVIS NCAP II Fund, which is a major fund specializing in food technologies. Fuji Oil Group aims to contribute to a sustainable society using its processing technologies of plant-based food materials to tackle the issues faced by customers worldwide.May 2021: Darling Ingredients Inc. announced that its Rousselot brand expanded its range of purified, pharmaceutical-grade, modified gelatins with the launch of X-Pure® GelDAT – Gelatin Desaminotyrosine.March 2021: Darling Ingredients entered a joint venture with Intrexon Corporation for industrial-scale production of non-pathogenic black soldier fly (BSF) larvae for use as a protein source in animal feed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Vegan Protein Powder Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Vegan Protein Powder Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Vegan Protein Powder Industry?

To stay informed about further developments, trends, and reports in the China Vegan Protein Powder Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence