Key Insights

The French Food Hydrocolloids Market is projected for robust expansion, driven by increasing consumer preference for processed foods, healthier formulations, and innovative product development. Anticipated to reach $5032 million by 2024, the market demonstrates a Compound Annual Growth Rate (CAGR) of 6.6%. Key growth catalysts include the escalating popularity of dairy and frozen products, where hydrocolloids like gelatin and pectin enhance texture and stability. The bakery sector also significantly contributes, utilizing hydrocolloids for improved dough characteristics and extended shelf life. Emerging trends favor clean-label ingredients and natural alternatives, boosting demand for plant-based hydrocolloids such as pectin and xanthan gum, aligning with evolving consumer wellness and sustainability values.

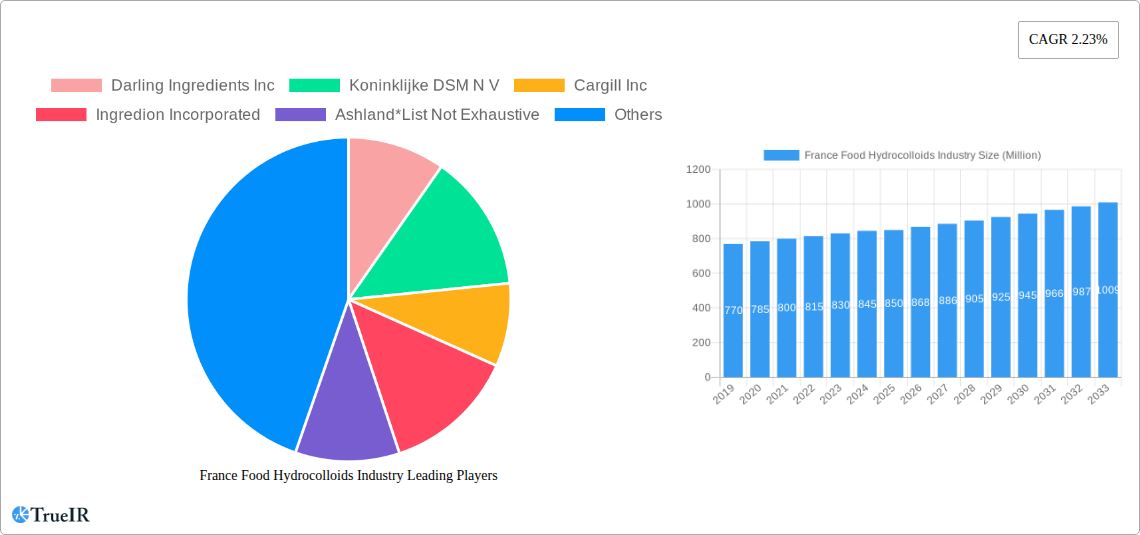

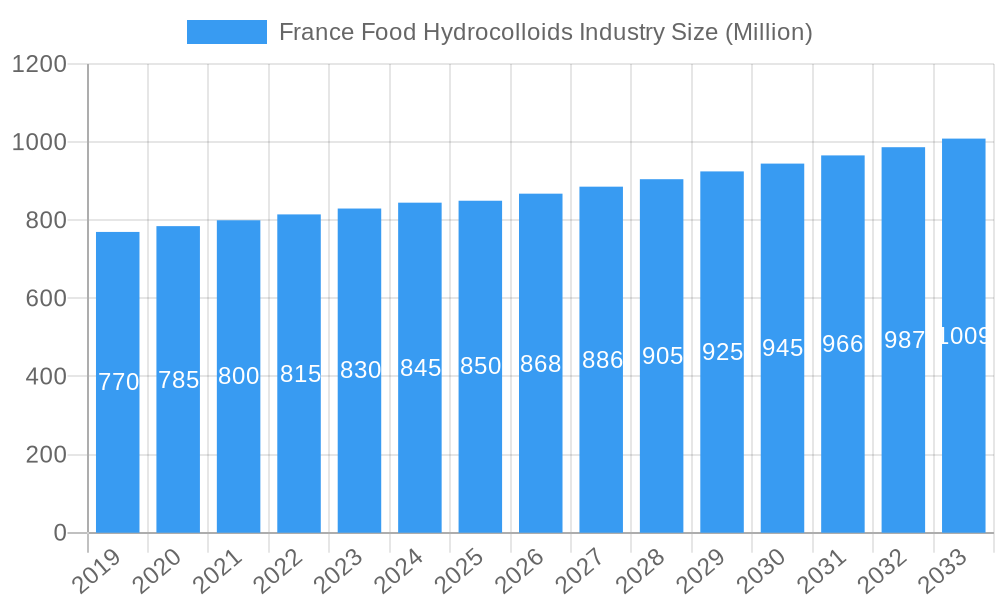

France Food Hydrocolloids Industry Market Size (In Billion)

Challenges in the French market include raw material price volatility, particularly for gelatin, impacting manufacturing costs. Stringent regulations on food additives and labeling also necessitate continuous compliance. Nevertheless, significant opportunities exist in product innovation and expanded applications within confectionery and beverage sectors for novel textures and improved stability. Leading companies are investing in research and development to introduce advanced functionalities and sustainable sourcing, shaping the market's future. A focus on high-quality ingredients and customized solutions will be critical for sustained market leadership.

France Food Hydrocolloids Industry Company Market Share

This report offers an in-depth analysis of the France Food Hydrocolloids Market from 2019 to 2033, with the base year at 2024 and a forecast period of 2024–2033. It examines market dynamics, trends, opportunities, and the competitive landscape, utilizing optimized SEO keywords for high discoverability and providing actionable insights for stakeholders in the food hydrocolloids industry.

France Food Hydrocolloids Industry Market Structure & Competitive Landscape

The France food hydrocolloids market exhibits a moderately concentrated structure, with key players like Darling Ingredients Inc, Koninklijke DSM N V, Cargill Inc, Ingredion Incorporated, and Ashland holding significant market shares. While Rousselot and CP Kelco U S Inc are also notable contributors, the market is characterized by ongoing innovation and strategic alliances. Drivers of innovation include the demand for clean-label ingredients, enhanced product texture, and extended shelf-life solutions. Regulatory impacts, particularly those concerning food safety and labeling, play a crucial role in shaping product development and market entry strategies. The threat of product substitutes, while present from novel ingredients and processing techniques, remains manageable given the established functionalities of hydrocolloids. End-user segmentation is diverse, spanning dairy and frozen products, bakery, beverages, confectionery, and meat and seafood applications. Mergers and acquisitions (M&A) trends are observed, with companies seeking to expand their product portfolios and geographical reach. Over the historical period (2019–2024), approximately $500 Million in M&A deals were recorded, signaling a dynamic consolidation phase within the industry. The market is characterized by a competitive intensity driven by product differentiation and cost-efficiency.

France Food Hydrocolloids Industry Market Trends & Opportunities

The France food hydrocolloids market is poised for robust growth, with an estimated market size expected to reach $1.5 Billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period (2025–2033). This expansion is fueled by evolving consumer preferences, a growing demand for processed and convenience foods, and the increasing application of hydrocolloids as functional ingredients. Technological advancements are leading to the development of novel hydrocolloid formulations with improved stability, solubility, and synergistic effects. The "clean label" trend continues to influence product development, driving demand for natural and plant-based hydrocolloids. Opportunities lie in tapping into emerging applications within the plant-based food sector, functional beverages, and specialized confectionery. The penetration rate of hydrocolloids in dairy and frozen products is already high, but innovation in texture modification and fat replacement presents further growth avenues. In the bakery segment, hydrocolloids are crucial for moisture retention and improving crumb structure, with ongoing research into extending shelf life without compromising sensory attributes. The beverage industry is witnessing a surge in demand for texturizing and stabilizing agents, particularly in ready-to-drink (RTD) options and plant-based milk alternatives. Confectionery products benefit from hydrocolloids for gelling, texture enhancement, and controlled release of flavors. The meat and seafood sector is utilizing hydrocolloids for binding, moisture retention, and improving the texture of processed products. The Oils and Fats segment is exploring hydrocolloids for emulsification and stabilization. Overall, the market is characterized by a steady upward trajectory, driven by both established applications and the exploration of new frontiers.

Dominant Markets & Segments in France Food Hydrocolloids Industry

Within the France food hydrocolloids industry, the Dairy and Frozen Products segment is a dominant force, projected to account for 35% of the market share by 2025. This dominance is driven by the widespread use of hydrocolloids for texture modification, stabilization, and mouthfeel enhancement in products such as yogurts, ice creams, cheeses, and frozen desserts. The Bakery segment also holds a significant position, representing approximately 20% of the market, where hydrocolloids contribute to dough conditioning, moisture retention, and extended shelf life in breads, pastries, and cakes.

The Type segmentation reveals a strong demand for Gelatin Gum, holding an estimated 30% market share, owing to its gelling and emulsifying properties, particularly in confectionery and dairy. Pectin, with its natural origin and gelling capabilities, is expected to capture 25% of the market, driven by its extensive use in jams, jellies, and fruit preparations. Xanthan Gum follows closely at 20%, valued for its thickening and stabilizing properties across a wide range of applications, especially in gluten-free products and beverages. Other Types, including carrageenan, alginates, and cellulose derivatives, collectively represent the remaining 25%, each serving niche but important functionalities.

In terms of Application, the leading segment, Dairy and Frozen Products, is driven by the demand for premium textures and shelf-stable formulations. Key growth drivers include consumer desire for convenience, the rise of plant-based dairy alternatives, and advancements in freezing technologies that require effective stabilizers. The Beverages segment, holding an estimated 15% market share, is experiencing growth due to its use in enhancing mouthfeel, suspending particles, and providing viscosity in juices, RTD teas, and nutritional drinks. Confectionery is another substantial segment at 18%, where hydrocolloids are essential for creating desired textures in gummies, candies, and chocolates. The Meat and Seafood Products segment, accounting for 12%, benefits from hydrocolloids for improving texture, binding, and moisture retention in processed meats and surimi. Oils and Fats (5%) utilize hydrocolloids for emulsification and stabilization, while Other Applications (10%) encompass a diverse range of uses including dressings, sauces, and pharmaceutical applications.

France Food Hydrocolloids Industry Product Analysis

The France food hydrocolloids industry is witnessing continuous product innovation focused on enhancing functionality, natural sourcing, and synergistic effects. Manufacturers are developing specialized hydrocolloid blends tailored for specific applications, offering improved texturizing, emulsifying, and stabilizing capabilities. For instance, new pectin formulations are emerging with lower sugar requirements, aligning with health-conscious consumer demands. Similarly, advancements in xanthan gum production are yielding variants with superior viscosity profiles and heat stability. The competitive advantage for key players lies in their ability to offer customized solutions, demonstrate clear technological superiority, and provide comprehensive technical support to food manufacturers seeking to meet evolving market needs and regulatory standards.

Key Drivers, Barriers & Challenges in France Food Hydrocolloids Industry

Key drivers propelling the France food hydrocolloids industry include the escalating consumer demand for processed and convenience foods, necessitating texture enhancement and shelf-life extension. The growing popularity of plant-based diets is a significant catalyst, increasing the need for functional ingredients like hydrocolloids to replicate the mouthfeel and texture of traditional animal-based products. Furthermore, advancements in food processing technologies and a focus on clean-label ingredients are spurring innovation and market growth. Government initiatives promoting food safety and quality standards also indirectly support the adoption of high-performance hydrocolloids.

Challenges impacting France food hydrocolloids industry growth include the volatility of raw material prices, which can affect production costs and market pricing. Stringent regulatory frameworks surrounding food additives, although ensuring safety, can also present compliance hurdles and lengthen product development cycles. Supply chain disruptions, exacerbated by geopolitical events and climate change, pose a risk to the consistent availability of key raw materials. Intense competition among established players and the emergence of new market entrants also pressure profit margins.

Growth Drivers in the France Food Hydrocolloids Industry Market

Key growth drivers in the France food hydrocolloids industry market are multifaceted. Technologically, the development of novel hydrocolloid blends with enhanced functionalities, such as improved thermal stability and synergistic texturizing effects, is a significant catalyst. Economically, the rising disposable incomes and increased consumption of convenience foods across France directly fuel demand. Regulatory drivers, such as evolving food labeling laws and a push for healthier ingredients, are also creating opportunities for natural and plant-derived hydrocolloids. The growing trend towards functional foods, where hydrocolloids contribute to texture and nutrient delivery, further underpins market expansion.

Challenges Impacting France Food Hydrocolloids Industry Growth

Challenges impacting France food hydrocolloids industry growth are primarily centered around supply chain complexities and raw material dependency. Fluctuations in the availability and pricing of natural sources like seaweed, pectin-rich fruits, and animal by-products can lead to significant cost pressures. Regulatory scrutiny and the ever-evolving landscape of food additive approvals in France and the EU require continuous adaptation and investment in compliance. Furthermore, the increasing consumer preference for "free-from" labels and a perceived aversion to chemical additives can pose a perception challenge for some hydrocolloids, necessitating clear communication of their benefits and safety profiles. Competitive pressures from both established giants and agile niche players demand constant innovation and cost optimization.

Key Players Shaping the France Food Hydrocolloids Industry Market

- Darling Ingredients Inc

- Koninklijke DSM N V

- Cargill Inc

- Ingredion Incorporated

- Ashland

- Rousselot

- CP Kelco U S Inc

Significant France Food Hydrocolloids Industry Industry Milestones

- 2019: Launch of a new range of plant-based emulsifiers by CP Kelco, catering to the growing vegan market.

- 2020: DSM acquires DuPont's culture and enzyme business, strengthening its position in food ingredients.

- 2021: Cargill invests in expanding its pectin production capacity in Europe to meet rising demand.

- 2022: Ingredion announces a strategic partnership to develop innovative hydrocolloid solutions for the bakery sector.

- 2023: Ashland introduces a new line of natural stabilizers for dairy alternatives, enhancing texture and mouthfeel.

- 2024: Rousselot unveils a collagen peptide ingredient with added health benefits for functional foods.

Future Outlook for France Food Hydrocolloids Industry Market

The future outlook for the France food hydrocolloids industry is highly promising, driven by sustained consumer demand for improved food textures, shelf stability, and the ever-expanding plant-based food sector. Strategic opportunities lie in further developing sustainable and traceable sourcing of raw materials, investing in R&D for novel functionalities, and expanding into emerging applications like personalized nutrition and high-protein products. The market is expected to witness continued innovation in clean-label solutions and synergistic hydrocolloid blends, ensuring its continued growth and relevance in the French food landscape.

France Food Hydrocolloids Industry Segmentation

-

1. Type

- 1.1. Gelatin Gum

- 1.2. Pectin

- 1.3. Xanthan Gum

- 1.4. Other Types

-

2. Application

- 2.1. Dairy and Frozen Products

- 2.2. Bakery

- 2.3. Beverages

- 2.4. Confectionery

- 2.5. Meat and Seafood Products

- 2.6. Oils and Fats

- 2.7. Other Applications

France Food Hydrocolloids Industry Segmentation By Geography

- 1. France

France Food Hydrocolloids Industry Regional Market Share

Geographic Coverage of France Food Hydrocolloids Industry

France Food Hydrocolloids Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation

- 3.3. Market Restrains

- 3.3.1. ; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition

- 3.4. Market Trends

- 3.4.1. Confectionery holds a Prominent Share in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Food Hydrocolloids Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gelatin Gum

- 5.1.2. Pectin

- 5.1.3. Xanthan Gum

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy and Frozen Products

- 5.2.2. Bakery

- 5.2.3. Beverages

- 5.2.4. Confectionery

- 5.2.5. Meat and Seafood Products

- 5.2.6. Oils and Fats

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Darling Ingredients Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Koninklijke DSM N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cargill Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ingredion Incorporated

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ashland*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rousselot

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CP Kelco U S Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: France Food Hydrocolloids Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: France Food Hydrocolloids Industry Share (%) by Company 2025

List of Tables

- Table 1: France Food Hydrocolloids Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: France Food Hydrocolloids Industry Revenue million Forecast, by Application 2020 & 2033

- Table 3: France Food Hydrocolloids Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: France Food Hydrocolloids Industry Revenue million Forecast, by Type 2020 & 2033

- Table 5: France Food Hydrocolloids Industry Revenue million Forecast, by Application 2020 & 2033

- Table 6: France Food Hydrocolloids Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Food Hydrocolloids Industry?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the France Food Hydrocolloids Industry?

Key companies in the market include Darling Ingredients Inc, Koninklijke DSM N V, Cargill Inc, Ingredion Incorporated, Ashland*List Not Exhaustive, Rousselot, CP Kelco U S Inc.

3. What are the main segments of the France Food Hydrocolloids Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5032 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Low-Calorie Food; Increasing Product Innovation.

6. What are the notable trends driving market growth?

Confectionery holds a Prominent Share in the Market Studied.

7. Are there any restraints impacting market growth?

; Threat of New Entrants; Bargaining Power of Buyers/Consumers; Bargaining Power of Suppliers; Threat of Substitute Products; Degree Of Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Food Hydrocolloids Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Food Hydrocolloids Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Food Hydrocolloids Industry?

To stay informed about further developments, trends, and reports in the France Food Hydrocolloids Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence