Key Insights

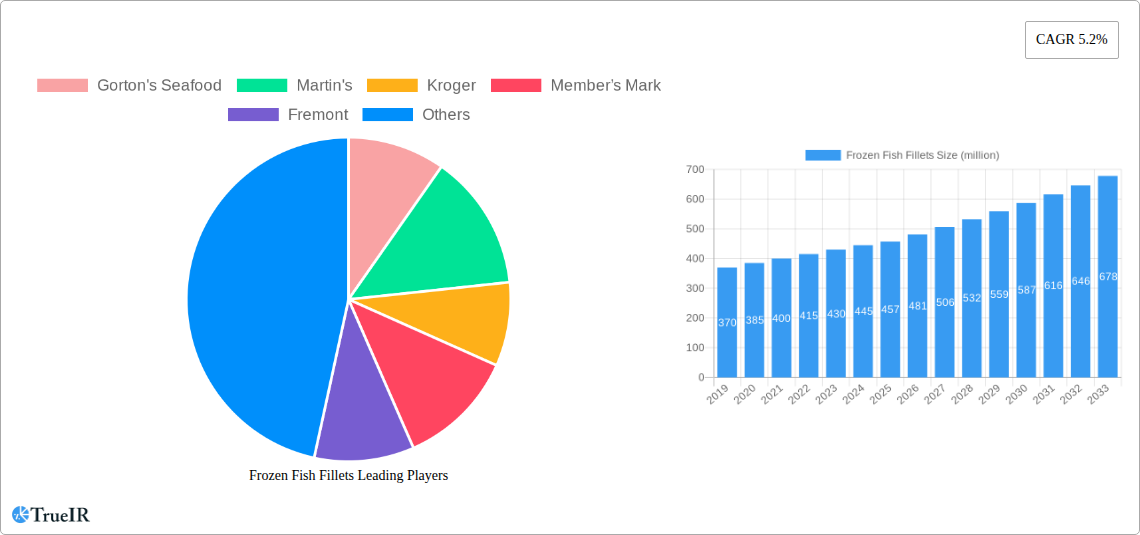

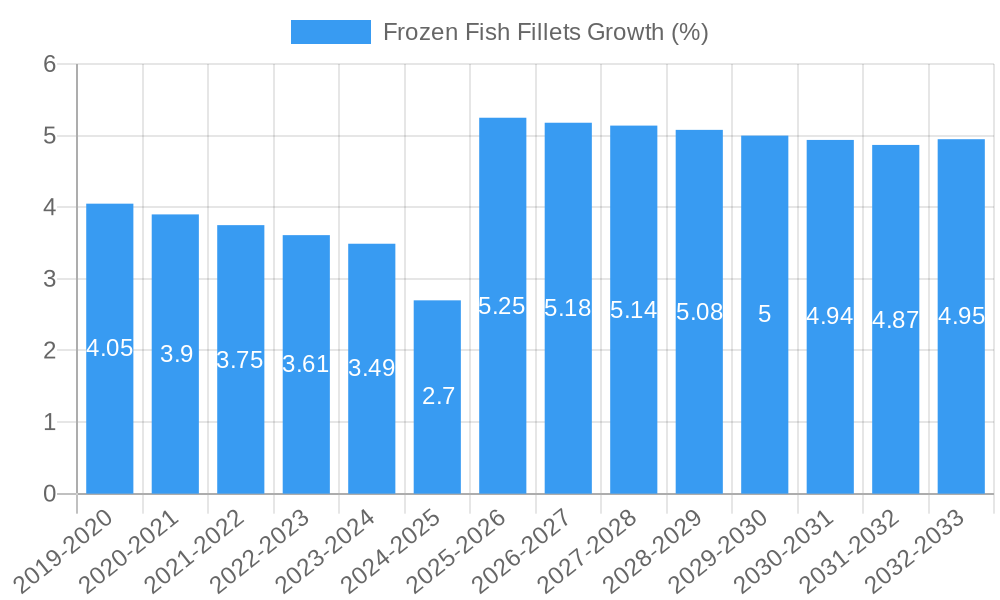

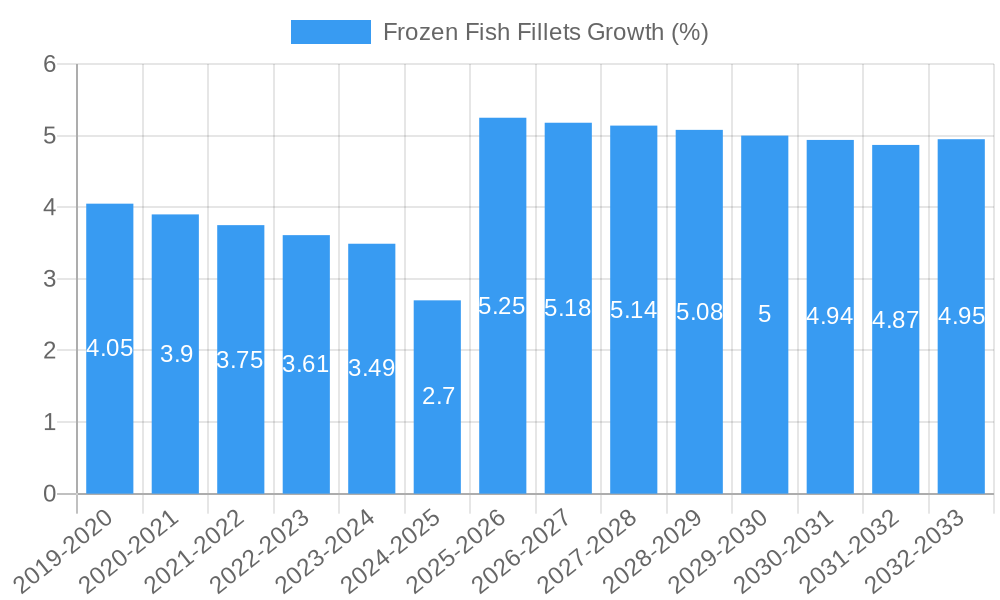

The global Frozen Fish Fillets market is poised for significant expansion, projected to reach a valuation of \$457 million by 2025, driven by a consistent Compound Annual Growth Rate (CAGR) of 5.2% throughout the forecast period extending to 2033. This robust growth is fueled by several key factors, including the increasing consumer preference for convenient and ready-to-cook food options, coupled with rising global demand for protein-rich diets. The extended shelf life and consistent quality of frozen fish fillets make them an attractive choice for both retail and food service sectors, especially in regions with developing cold chain infrastructure. Furthermore, advancements in freezing technologies are preserving the nutritional value and taste of fish fillets, mitigating concerns about quality degradation often associated with frozen products. The market's expansion is also supported by strategic product innovations, such as the introduction of sustainably sourced and value-added fillets, catering to evolving consumer consciousness and dietary preferences.

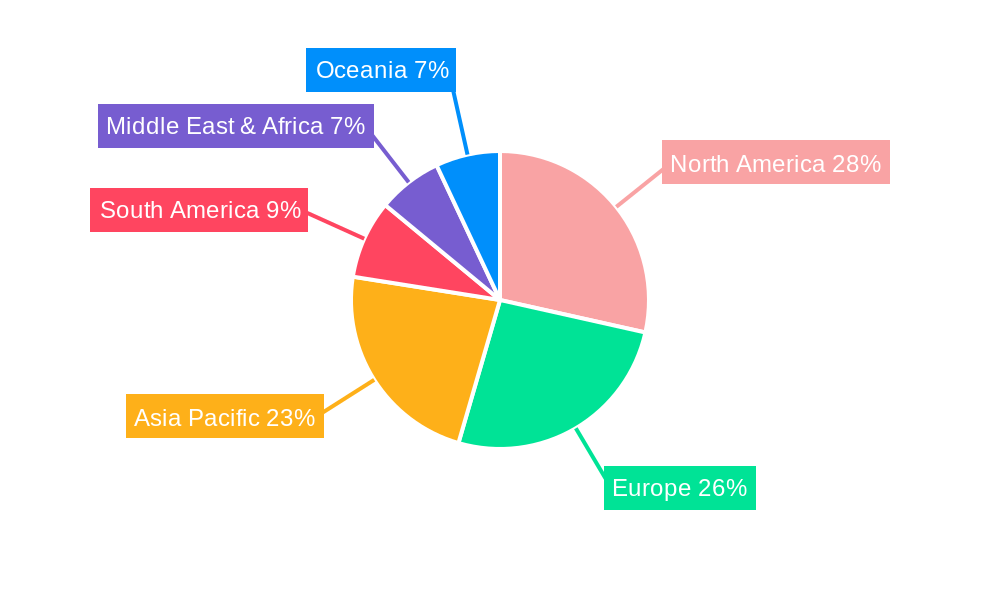

The market segmentation reveals a dynamic landscape, with Super/Hyper Stores and Online Stores emerging as dominant distribution channels, reflecting shifts in consumer purchasing habits. The demand for both Wild Fish and Farmed Fish fillets remains strong, though an increasing emphasis on sustainable aquaculture practices is expected to bolster the farmed fish segment. Geographically, Asia Pacific, led by China and India, is anticipated to exhibit the fastest growth due to a burgeoning middle class, increasing disposable incomes, and a growing adoption of Western dietary patterns. North America and Europe, while mature markets, continue to represent substantial market share owing to established seafood consumption habits and strong retail penetration. Restraints such as fluctuating raw material prices and concerns regarding the environmental impact of overfishing are being addressed through initiatives promoting responsible sourcing and sustainable aquaculture, which are crucial for the long-term health of the frozen fish fillets industry.

Frozen Fish Fillets Market Report: Unlocking Growth & Navigating Trends

This comprehensive Frozen Fish Fillets Market Report provides an in-depth analysis of the global industry, covering market structure, trends, dominant segments, product innovations, key drivers, challenges, and a future outlook. Leveraging high-volume keywords such as "frozen seafood," "fish products," "seafood market analysis," "frozen food trends," and "aquaculture market," this report is designed for industry professionals seeking strategic insights and actionable intelligence for the period of 2019–2033, with a base year of 2025.

Frozen Fish Fillets Market Structure & Competitive Landscape

The global frozen fish fillets market exhibits a moderately concentrated structure, with leading players like Gorton's Seafood, Young’s, and Anjoy Food Group holding significant market share. Innovation drivers are primarily focused on product diversification, premiumization, and sustainable sourcing practices. Regulatory impacts, particularly concerning food safety standards and fishing quotas, play a crucial role in shaping market entry and operational strategies. Product substitutes, including fresh fish and other protein sources, pose a constant competitive pressure. End-user segmentation reveals a strong reliance on retail channels, with Super/Hyper Stores and Online Stores emerging as dominant distribution points. Mergers and acquisitions (M&A) activity, estimated at an average of 50 million USD annually over the historical period, remains a key strategy for market consolidation and expansion, as evidenced by recent transactions involving mid-tier players. The market concentration ratio (CR4) stands at approximately 45% in the base year 2025, indicating a competitive yet consolidated landscape.

Frozen Fish Fillets Market Trends & Opportunities

The frozen fish fillets market is poised for robust growth, projected to expand from an estimated xx million USD in 2025 to xx million USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.8%. Technological shifts are driving innovations in freezing techniques, such as cryogenic freezing, which significantly enhances product quality and shelf life, thereby reducing spoilage and waste. Consumer preferences are increasingly leaning towards convenience, health-conscious options, and sustainably sourced seafood. This trend presents a significant opportunity for companies offering pre-portioned, individually frozen fillets, as well as those with traceable and eco-certified supply chains. The burgeoning online retail sector, with an estimated market penetration rate of 35% in 2025, offers a direct-to-consumer channel for frozen fish fillets, enabling wider reach and personalized marketing. Competitive dynamics are characterized by intense price competition in the mass market segment, while premiumization and value-added products are driving higher profit margins for specialized players. The increasing adoption of smart packaging technologies and cold chain logistics further optimizes product integrity and customer satisfaction. Furthermore, the growing demand for diverse fish species, beyond traditional cod and haddock, presents an opportunity for market players to diversify their product portfolios and cater to niche consumer tastes. The rising disposable incomes in emerging economies are also contributing to an increased demand for convenient and protein-rich food options, including frozen fish fillets. The global market size for frozen fish fillets is estimated to be xx million USD in 2025, with a projected value of xx million USD by 2033.

Dominant Markets & Segments in Frozen Fish Fillets

Super/Hyper Stores currently dominate the distribution landscape for frozen fish fillets, accounting for an estimated 45% of market sales in 2025. This dominance is driven by their extensive reach, widespread consumer accessibility, and the ability to offer a wide variety of brands and product types under one roof. The growth in this segment is supported by increasing urbanization and the proliferation of large retail formats.

- Key Growth Drivers for Super/Hyper Stores:

- Convenience and One-Stop Shopping: Consumers prefer purchasing a broad range of groceries, including frozen items, during single shopping trips.

- Promotional Activities: Retailers frequently engage in price promotions and bundle deals, attracting price-sensitive consumers.

- Cold Chain Infrastructure: Super/hyper stores possess robust cold chain logistics to maintain product freshness and quality.

Online Stores are rapidly emerging as a significant channel, projected to capture around 30% of the market by 2033, up from an estimated 20% in 2025. This growth is fueled by the increasing adoption of e-commerce, the convenience of home delivery, and the expanding reach of online grocers.

- Key Growth Drivers for Online Stores:

- Growing E-commerce Penetration: Increased internet access and smartphone usage facilitate online purchasing.

- Delivery Services: Efficient last-mile delivery networks ensure timely and intact product arrival.

- Niche Market Access: Online platforms allow specialized seafood providers to reach a broader customer base.

Grocery stores, including independent and smaller chain outlets, represent a substantial segment, estimated to hold 25% of the market share in 2025. They cater to local communities and offer a more personalized shopping experience.

- Key Growth Drivers for Grocery Stores:

- Local Community Engagement: Strong ties with local consumers and understanding of regional preferences.

- Freshness Perception: Some consumers perceive grocery store frozen sections as offering fresher alternatives due to frequent stocking.

Department Stores, while not a primary channel for frozen fish fillets, contribute a minor but growing segment, particularly through their in-house premium food sections.

The Farmed Fish segment is experiencing accelerated growth, projected to account for over 60% of the total market by 2033, driven by the need for sustainable and consistent supply chains to meet growing global demand.

- Key Growth Drivers for Farmed Fish:

- Controlled Environment: Aquaculture allows for predictable yields and consistent quality, mitigating the risks associated with wild fishing.

- Sustainability Initiatives: Responsible aquaculture practices are gaining traction, addressing environmental concerns.

- Cost-Effectiveness: Farmed fish can often be produced more economically, leading to competitive pricing.

Wild Fish, while historically dominant, faces challenges from overfishing and supply volatility. However, premium wild-caught varieties continue to command strong consumer loyalty.

Frozen Fish Fillets Product Analysis

Product innovations in frozen fish fillets are focused on enhancing consumer convenience, nutritional value, and taste profiles. This includes the development of ready-to-cook options, marinated fillets, and those fortified with omega-3 fatty acids. Technological advancements in IQF (Individually Quick Freezing) technology ensure optimal texture and prevent clumping, while advanced packaging solutions extend shelf life and maintain product integrity. Competitive advantages are being built through sustainable sourcing certifications, unique flavor infusions, and a commitment to transparency in the supply chain, appealing to health-conscious and ethically-minded consumers.

Key Drivers, Barriers & Challenges in Frozen Fish Fillets

Key Drivers, Barriers & Challenges in Frozen Fish Fillets

Key Drivers: The frozen fish fillets market is propelled by several key factors. Increasing global demand for protein-rich foods, driven by population growth and rising disposable incomes, is a primary catalyst. Technological advancements in freezing and processing techniques, such as IQF and blast freezing, are enhancing product quality and extending shelf life, making frozen options more appealing. Growing consumer preference for convenience and ready-to-cook meals further fuels demand. Regulatory support for sustainable aquaculture practices and traceability initiatives are also encouraging market expansion.

Barriers & Challenges: Despite the positive outlook, the market faces significant challenges. Fluctuations in raw material prices due to climate change, overfishing, and seasonal availability can impact supply chain stability and profitability. Stringent food safety regulations and evolving labeling requirements across different regions necessitate continuous compliance and investment. Intense competition, particularly from fresh seafood and alternative protein sources, leads to price pressures. Consumer perception regarding the quality of frozen versus fresh fish, though diminishing, remains a challenge. Supply chain disruptions, such as transportation bottlenecks and rising energy costs, can also impede growth. The cost of maintaining an efficient cold chain across the entire distribution network represents a significant operational hurdle.

Growth Drivers in the Frozen Fish Fillets Market

Growth in the frozen fish fillets market is significantly driven by evolving consumer lifestyles, emphasizing convenience and healthy eating habits. The rising global population and increasing disposable incomes, especially in emerging economies, are creating a larger consumer base for affordable and accessible protein sources like frozen fish. Technological advancements in freezing and packaging are crucial, ensuring the retention of nutritional value and the sensory appeal of the product, thereby bridging the gap between fresh and frozen options. Furthermore, a growing emphasis on sustainable seafood sourcing and ethical fishing practices is boosting demand for certified frozen fish products, appealing to environmentally conscious consumers. Government initiatives promoting seafood consumption and aquaculture development also contribute to market expansion.

Challenges Impacting Frozen Fish Fillets Growth

The frozen fish fillets market faces several significant challenges. Volatile raw material availability and pricing, influenced by climate change, overfishing, and geopolitical factors, can disrupt supply chains and impact profitability. Stringent and evolving food safety regulations and labeling requirements across international markets necessitate constant adaptation and compliance, increasing operational costs. Intense competition from both other frozen protein sources and the growing fresh seafood market exerts considerable price pressure. Consumer perception regarding the quality and freshness of frozen fish, while improving, can still be a limiting factor in certain markets. Additionally, maintaining a robust and efficient cold chain infrastructure throughout the distribution network requires substantial investment and poses logistical complexities, especially in remote or developing regions.

Key Players Shaping the Frozen Fish Fillets Market

- Gorton's Seafood

- Martin's

- Kroger

- Member’s Mark

- Fremont

- Young’s

- Pacific Seafood

- Trader Joe's

- Van de Kamp's

- Gardein

- Mrs. Paul's

- Anjoy Food Group

- Pan Asia

- Cock Brand

- DoDo Fishball

- Cheong Lee

- Choripdong

Significant Frozen Fish Fillets Industry Milestones

- 2019: Increased adoption of IQF (Individually Quick Freezing) technology by major manufacturers, leading to improved product quality and shelf life.

- 2020: Surge in online grocery sales due to the COVID-19 pandemic, significantly boosting demand for frozen fish fillets through e-commerce channels.

- 2021: Growing consumer awareness and demand for sustainable seafood, leading to an increase in certifications like MSC (Marine Stewardship Council) and ASC (Aquaculture Stewardship Council) for frozen fish products.

- 2022: Advancements in traceability technologies, utilizing blockchain, to provide greater transparency in the frozen fish supply chain.

- 2023: Expansion of value-added frozen fish fillet offerings, including pre-marinated and seasoned options, catering to consumer demand for convenience and variety.

- 2024: Increased investment in aquaculture research and development to improve farming efficiency and sustainability, impacting the supply of farmed fish fillets.

Future Outlook for Frozen Fish Fillets Market

The future outlook for the frozen fish fillets market is exceptionally promising, driven by a confluence of enduring consumer trends and ongoing industry innovations. The persistent demand for convenient, healthy, and protein-rich food options will continue to underpin market growth. Significant opportunities lie in further developing value-added products, such as ready-to-cook meals and plant-based fish alternatives, to cater to evolving dietary preferences. Expansion into emerging markets, where urbanization and disposable incomes are on the rise, presents substantial growth potential. Investments in sustainable aquaculture and advanced freezing technologies will be critical for market leaders to enhance product quality, reduce environmental impact, and ensure a stable supply chain, positioning the frozen fish fillets market for sustained expansion and profitability through 2033.

Frozen Fish Fillets Segmentation

-

1. Application

- 1.1. Super/ Hyper Stores

- 1.2. Department Stores

- 1.3. Grocery

- 1.4. Online Stores

-

2. Type

- 2.1. Wild Fish

- 2.2. Farmed Fish

Frozen Fish Fillets Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Frozen Fish Fillets REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Frozen Fish Fillets Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Super/ Hyper Stores

- 5.1.2. Department Stores

- 5.1.3. Grocery

- 5.1.4. Online Stores

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Wild Fish

- 5.2.2. Farmed Fish

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Frozen Fish Fillets Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Super/ Hyper Stores

- 6.1.2. Department Stores

- 6.1.3. Grocery

- 6.1.4. Online Stores

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Wild Fish

- 6.2.2. Farmed Fish

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Frozen Fish Fillets Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Super/ Hyper Stores

- 7.1.2. Department Stores

- 7.1.3. Grocery

- 7.1.4. Online Stores

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Wild Fish

- 7.2.2. Farmed Fish

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Frozen Fish Fillets Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Super/ Hyper Stores

- 8.1.2. Department Stores

- 8.1.3. Grocery

- 8.1.4. Online Stores

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Wild Fish

- 8.2.2. Farmed Fish

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Frozen Fish Fillets Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Super/ Hyper Stores

- 9.1.2. Department Stores

- 9.1.3. Grocery

- 9.1.4. Online Stores

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Wild Fish

- 9.2.2. Farmed Fish

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Frozen Fish Fillets Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Super/ Hyper Stores

- 10.1.2. Department Stores

- 10.1.3. Grocery

- 10.1.4. Online Stores

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Wild Fish

- 10.2.2. Farmed Fish

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Gorton's Seafood

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Martin's

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kroger

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Member’s Mark

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fremont

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Young’s

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pacific Seafood

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trader Joe's

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Van de Kamp's

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gardein

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mrs. Paul's

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Anjoy Food Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Pan Asia

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Cock Brand

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DoDo Fishball

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Cheong Lee

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Choripdong

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Gorton's Seafood

List of Figures

- Figure 1: Global Frozen Fish Fillets Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Frozen Fish Fillets Revenue (million), by Application 2024 & 2032

- Figure 3: North America Frozen Fish Fillets Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Frozen Fish Fillets Revenue (million), by Type 2024 & 2032

- Figure 5: North America Frozen Fish Fillets Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Frozen Fish Fillets Revenue (million), by Country 2024 & 2032

- Figure 7: North America Frozen Fish Fillets Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Frozen Fish Fillets Revenue (million), by Application 2024 & 2032

- Figure 9: South America Frozen Fish Fillets Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Frozen Fish Fillets Revenue (million), by Type 2024 & 2032

- Figure 11: South America Frozen Fish Fillets Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Frozen Fish Fillets Revenue (million), by Country 2024 & 2032

- Figure 13: South America Frozen Fish Fillets Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Frozen Fish Fillets Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Frozen Fish Fillets Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Frozen Fish Fillets Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Frozen Fish Fillets Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Frozen Fish Fillets Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Frozen Fish Fillets Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Frozen Fish Fillets Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Frozen Fish Fillets Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Frozen Fish Fillets Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Frozen Fish Fillets Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Frozen Fish Fillets Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Frozen Fish Fillets Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Frozen Fish Fillets Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Frozen Fish Fillets Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Frozen Fish Fillets Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Frozen Fish Fillets Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Frozen Fish Fillets Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Frozen Fish Fillets Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Frozen Fish Fillets Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Frozen Fish Fillets Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Frozen Fish Fillets Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Frozen Fish Fillets Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Frozen Fish Fillets Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Frozen Fish Fillets Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Frozen Fish Fillets Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Frozen Fish Fillets Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Frozen Fish Fillets Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Frozen Fish Fillets Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Frozen Fish Fillets Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Frozen Fish Fillets Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Frozen Fish Fillets Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Frozen Fish Fillets Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Frozen Fish Fillets Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Frozen Fish Fillets Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Frozen Fish Fillets Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Frozen Fish Fillets Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Frozen Fish Fillets Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Frozen Fish Fillets Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Frozen Fish Fillets?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Frozen Fish Fillets?

Key companies in the market include Gorton's Seafood, Martin's, Kroger, Member’s Mark, Fremont, Young’s, Pacific Seafood, Trader Joe's, Van de Kamp's, Gardein, Mrs. Paul's, Anjoy Food Group, Pan Asia, Cock Brand, DoDo Fishball, Cheong Lee, Choripdong.

3. What are the main segments of the Frozen Fish Fillets?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 457 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Frozen Fish Fillets," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Frozen Fish Fillets report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Frozen Fish Fillets?

To stay informed about further developments, trends, and reports in the Frozen Fish Fillets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence