Key Insights

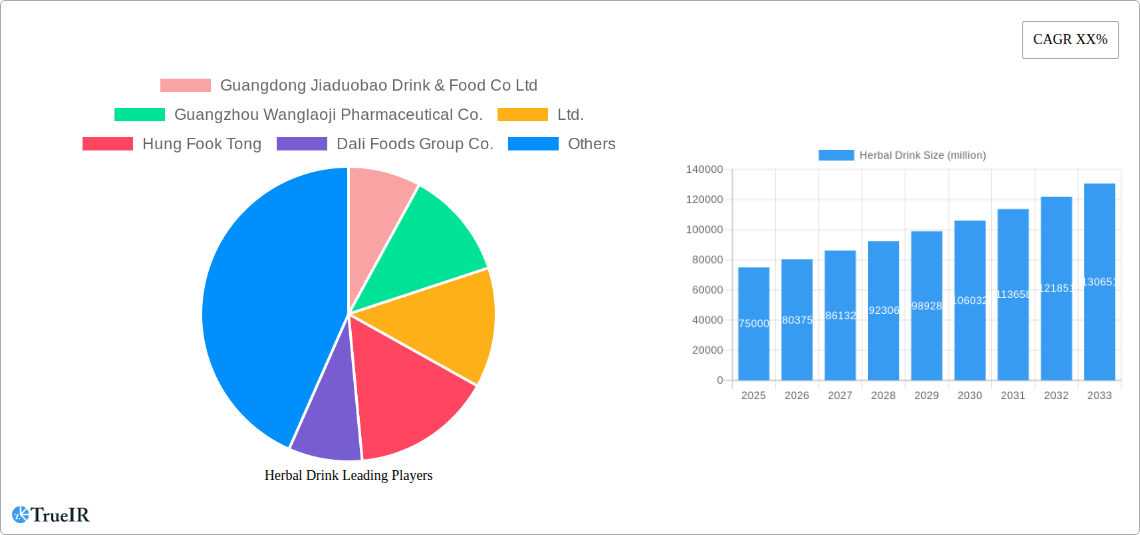

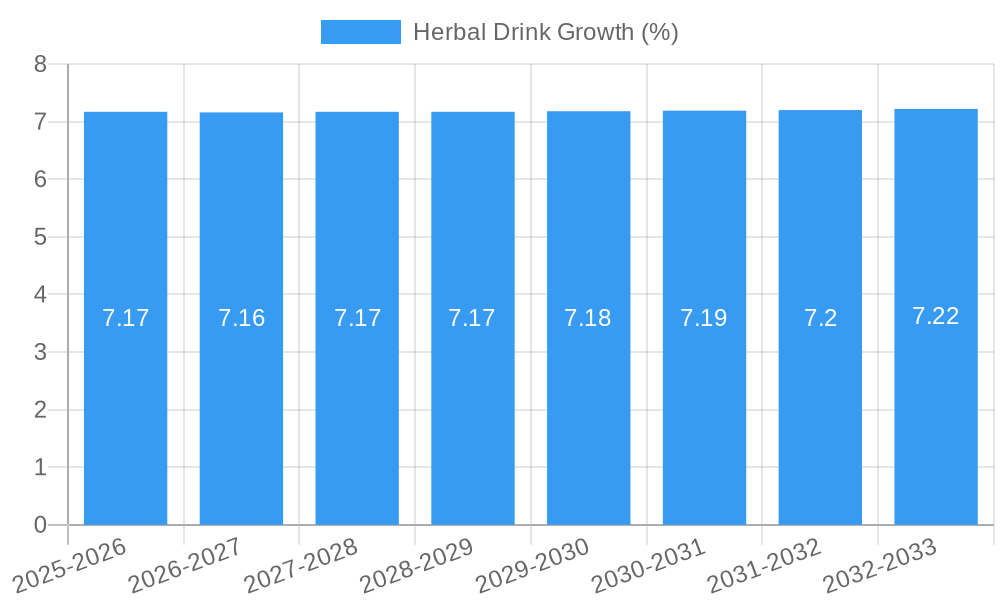

The global Herbal Drink market is poised for significant expansion, projected to reach an estimated market size of approximately $75 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% expected throughout the forecast period of 2025-2033. This substantial growth is fueled by a confluence of evolving consumer preferences and a growing awareness of health and wellness. Consumers are increasingly seeking natural and functional beverages that offer a healthier alternative to traditional sodas and sugary drinks. This shift is driven by rising concerns about lifestyle diseases, an increased emphasis on preventive healthcare, and a general desire for products that contribute to overall well-being. The market's dynamic nature is further underscored by the diverse range of ingredients, including popular options like ginger, mint, and chamomile, which cater to a wide spectrum of health benefits, from digestive support to stress relief and immune system enhancement. The appeal of these natural ingredients resonates strongly with a health-conscious global populace.

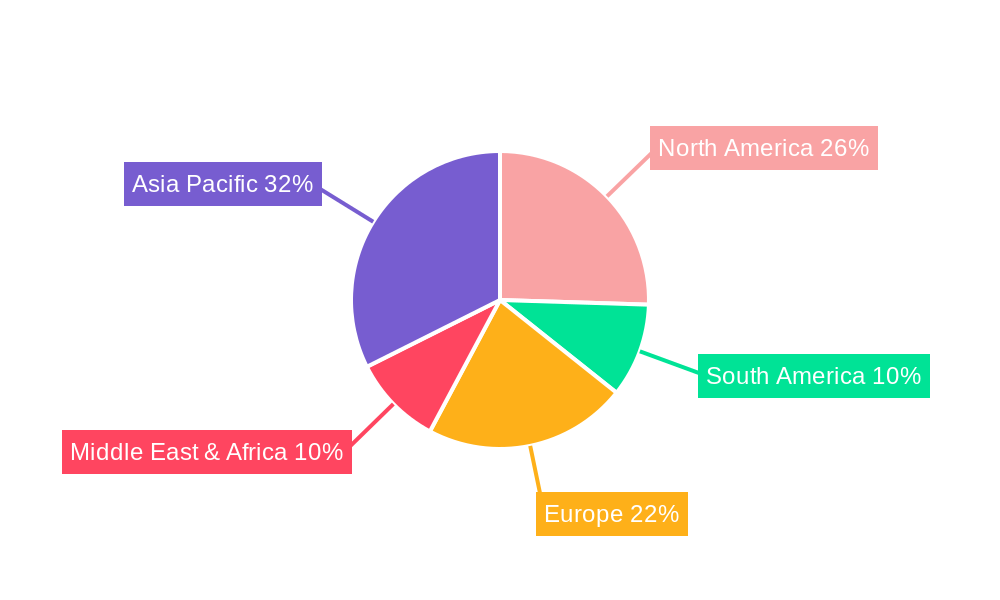

The market's expansion is strategically supported by key market drivers such as the growing demand for convenient and ready-to-drink (RTD) formats, making herbal drinks accessible for busy lifestyles. Furthermore, innovative product development, including the introduction of novel flavor combinations and functional benefits, plays a crucial role in attracting new consumers and retaining existing ones. The retail landscape, characterized by a strong presence in supermarkets and online sales channels, facilitates widespread accessibility. While the market enjoys a positive trajectory, certain restraints, such as the presence of established players in the beverage industry and the potential for fluctuating raw material prices, warrant careful strategic planning. However, the overarching trend towards natural, healthy, and functional beverages, coupled with continuous innovation, positions the Herbal Drink market for sustained and impressive growth in the coming years, with significant opportunities in regions like Asia Pacific and North America.

Herbal Drink Market Structure & Competitive Landscape

The global herbal drink market is characterized by a dynamic and evolving competitive landscape, with an estimated market concentration ratio of approximately 65% among the top five players. Innovation remains a crucial driver, with companies investing heavily in research and development to create novel formulations and leverage emerging herbal ingredients. Regulatory frameworks, particularly concerning ingredient sourcing, labeling, and health claims, significantly influence market entry and product development. Product substitutes, such as traditional teas, juices, and functional beverages, present ongoing competition, pushing herbal drink manufacturers to emphasize unique health benefits and premium positioning. End-user segmentation reveals a growing demand from health-conscious consumers and those seeking natural alternatives to conventional beverages. Mergers and acquisition (M&A) activity, estimated at over 50 million USD in deal value over the past five years, indicates a trend towards consolidation and strategic expansion within the industry.

- Key Market Dynamics:

- Increasing consumer preference for natural and functional beverages.

- Growing awareness of the health benefits associated with various herbs.

- Evolving regulatory landscapes impacting product approvals and claims.

- Intense competition from established beverage giants and emerging niche players.

- Strategic M&A activities to enhance market share and product portfolios.

Herbal Drink Market Trends & Opportunities

The global herbal drink market is projected to experience robust growth, with an estimated market size of over 500 million USD in 2025, expanding at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This expansion is fueled by a confluence of factors, including a burgeoning consumer awareness regarding health and wellness, a discernible shift towards natural and plant-based products, and an increasing demand for beverages offering specific functional benefits. Technological advancements in extraction, processing, and packaging are enabling manufacturers to produce a wider array of high-quality herbal drinks, enhancing their shelf life and appealing to a broader consumer base. The digital revolution has also played a pivotal role, with online sales channels experiencing exponential growth, allowing for wider product distribution and direct consumer engagement. Supermarkets and convenience stores continue to be significant distribution points, catering to impulse purchases and everyday consumption needs. The competitive dynamics are intensifying, with established players continuously innovating and smaller, agile companies carving out niche markets through unique ingredient combinations and targeted marketing strategies. Opportunities abound for companies that can effectively address evolving consumer preferences for personalized nutrition, sustainable sourcing, and ethically produced products. The premiumization trend is also evident, with consumers willing to pay more for scientifically backed formulations and superior taste profiles.

Dominant Markets & Segments in Herbal Drink

The herbal drink market exhibits distinct regional and segment-based dominance. North America and Europe currently represent the leading regional markets, driven by high disposable incomes, a strong culture of health consciousness, and well-established distribution networks. Within these regions, the Supermarket segment is a dominant application channel, accounting for an estimated 45% of sales, owing to its extensive reach and ability to cater to diverse consumer needs. The Online Sales segment is rapidly gaining traction, projected to capture over 30% of the market by 2033, propelled by the convenience it offers and the growing popularity of e-commerce for grocery and beverage purchases.

Among the types of herbal drinks, Ginger and Mint variants hold significant market share, estimated at over 20% each, owing to their widely recognized digestive and refreshing properties. Chamomile is also a strong contender, particularly within the wellness and relaxation beverage categories, with an estimated market share of 15%. The "Others" category, encompassing unique blends and less common herbs, is also showing promising growth, indicating consumer openness to novel flavor profiles and health benefits.

- Key Growth Drivers in Dominant Markets:

- North America & Europe: High consumer spending power, strong wellness trends, efficient retail infrastructure.

- Asia-Pacific: Rapidly growing middle class, increasing health awareness, expanding distribution networks.

- Dominant Application Segments:

- Supermarket: Broad accessibility, wide product variety, convenient purchasing.

- Online Sales: Growing e-commerce penetration, convenience, direct-to-consumer models.

- Convenience Store: Impulse purchases, grab-and-go consumption.

- Dominant Product Types:

- Ginger: Digestive benefits, natural immunity support, versatile flavor.

- Mint: Refreshing properties, digestive aid, widespread appeal.

- Chamomile: Calming and relaxation properties, sleep support.

- Perilla: Emerging popularity for its antioxidant and anti-inflammatory properties.

Herbal Drink Product Analysis

Product innovation in the herbal drink market centers on leveraging the inherent functional benefits of herbs to address specific consumer needs. Key advancements include the development of enhanced extraction techniques to maximize the bioavailability of active compounds, leading to more potent and effective formulations. Consumers are increasingly seeking beverages that offer tangible health advantages, such as stress relief, improved digestion, immune support, and cognitive enhancement. Competitive advantages are being forged through unique ingredient combinations, scientifically validated claims, and appealing flavor profiles that balance natural taste with consumer preferences. Technological advancements in shelf-stable packaging also contribute to wider market reach and reduced waste.

Key Drivers, Barriers & Challenges in Herbal Drink

Key Drivers:

- Rising Health Consciousness: A global surge in consumer awareness regarding the importance of natural ingredients and preventative health measures is a primary market propeller.

- Demand for Natural and Organic Products: The growing preference for beverages free from artificial additives and preservatives directly benefits the herbal drink sector.

- Functional Beverage Trend: Consumers are actively seeking drinks that offer specific health benefits beyond basic hydration, such as improved sleep or enhanced energy.

- Technological Advancements: Innovations in ingredient processing, extraction, and formulation enhance product efficacy and appeal.

- Expanding Distribution Channels: The growth of e-commerce and modern retail formats makes herbal drinks more accessible.

Barriers & Challenges:

- Regulatory Hurdles: Navigating complex and varying regulations regarding health claims, ingredient sourcing, and product labeling across different regions can be challenging.

- Supply Chain Volatility: Ensuring a consistent and sustainable supply of high-quality herbs, subject to agricultural yields and climate conditions, poses a significant risk.

- Consumer Education: Educating consumers about the specific benefits and efficacy of less familiar herbs requires significant marketing investment.

- Competition from Established Beverages: Competing with the vast marketing budgets and established distribution networks of traditional beverage giants presents a constant challenge.

- Perceived Taste Profile: Some consumers may associate herbal drinks with less appealing or acquired tastes, requiring innovative flavor development.

Growth Drivers in the Herbal Drink Market

The herbal drink market is propelled by a confluence of powerful growth drivers. Increasing consumer demand for natural and organic products is a paramount factor, as individuals actively seek alternatives to artificial ingredients. This is closely followed by a surge in health and wellness awareness, with consumers increasingly prioritizing beverages that offer specific functional benefits, such as immune support, stress reduction, and digestive health. Technological advancements in extraction and formulation are enabling manufacturers to create more potent and appealing products. Furthermore, the expansion of e-commerce and modern retail channels provides greater accessibility to a wider consumer base. Government initiatives promoting healthy lifestyles and the growing adoption of plant-based diets also contribute significantly to market expansion.

Challenges Impacting Herbal Drink Growth

Despite its promising growth trajectory, the herbal drink market faces several significant challenges. Navigating complex and inconsistent regulatory frameworks across different countries regarding ingredient claims and product approvals is a persistent hurdle. Ensuring a stable and sustainable supply chain for various herbs, which can be subject to agricultural uncertainties and climate variations, remains a critical concern. Intense competition from established beverage giants with substantial marketing budgets and distribution networks presents a formidable obstacle. Furthermore, educating consumers about the nuanced benefits of diverse herbal ingredients and overcoming potential taste preferences for conventional beverages requires sustained marketing efforts and investment in product development.

Key Players Shaping the Herbal Drink Market

- Guangdong Jiaduobao Drink & Food Co Ltd

- Guangzhou Wanglaoji Pharmaceutical Co.,Ltd.

- Hung Fook Tong

- Dali Foods Group Co.,Ltd.

- MyDrink

- Keliff's

- Organico

- Herbal Natural Drink

- CH'I Herbal Drinks Co.

- New Concept Product Co.,Ltd (NCP)

- Adagio Teas

- King's Hawaiian

- Unilever

- Dilmah Tea

- ITO EN

- Tata Global Beverages (TGB)

Significant Herbal Drink Industry Milestones

- 2019: Launch of novel functional herbal drink formulations targeting cognitive enhancement.

- 2020: Increased investment in sustainable sourcing practices by major players due to growing environmental awareness.

- 2021: Significant rise in online sales of herbal drinks, accelerated by global health concerns.

- 2022: Introduction of innovative plant-based herbal drink blends offering unique flavor profiles and health benefits.

- 2023: Strategic acquisitions by larger beverage companies aimed at expanding their herbal drink portfolios.

- 2024: Growing consumer interest in adaptogenic herbs for stress management and overall well-being, leading to product development in this niche.

Future Outlook for Herbal Drink Market

The future outlook for the herbal drink market is exceptionally bright, driven by sustained consumer demand for natural, healthy, and functional beverages. Strategic opportunities lie in continued product innovation, focusing on scientifically validated health benefits and appealing flavor profiles. The expansion of e-commerce and direct-to-consumer models will be crucial for reaching a wider audience and fostering brand loyalty. Companies that prioritize sustainable sourcing, transparent ingredient labeling, and ethical production practices will likely gain a competitive edge. Emerging markets, with their rapidly growing middle classes and increasing health consciousness, represent significant untapped potential for market expansion. The market is poised for continued growth, offering substantial opportunities for both established players and agile newcomers.

Herbal Drink Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Supermarket

- 1.3. Convenience Store

- 1.4. Others

-

2. Types

- 2.1. Perilla

- 2.2. Ginger

- 2.3. Mint

- 2.4. Lavender

- 2.5. Chamomile

- 2.6. Others

Herbal Drink Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Herbal Drink REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Herbal Drink Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Supermarket

- 5.1.3. Convenience Store

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Perilla

- 5.2.2. Ginger

- 5.2.3. Mint

- 5.2.4. Lavender

- 5.2.5. Chamomile

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Herbal Drink Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Supermarket

- 6.1.3. Convenience Store

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Perilla

- 6.2.2. Ginger

- 6.2.3. Mint

- 6.2.4. Lavender

- 6.2.5. Chamomile

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Herbal Drink Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Supermarket

- 7.1.3. Convenience Store

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Perilla

- 7.2.2. Ginger

- 7.2.3. Mint

- 7.2.4. Lavender

- 7.2.5. Chamomile

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Herbal Drink Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Supermarket

- 8.1.3. Convenience Store

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Perilla

- 8.2.2. Ginger

- 8.2.3. Mint

- 8.2.4. Lavender

- 8.2.5. Chamomile

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Herbal Drink Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Supermarket

- 9.1.3. Convenience Store

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Perilla

- 9.2.2. Ginger

- 9.2.3. Mint

- 9.2.4. Lavender

- 9.2.5. Chamomile

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Herbal Drink Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Supermarket

- 10.1.3. Convenience Store

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Perilla

- 10.2.2. Ginger

- 10.2.3. Mint

- 10.2.4. Lavender

- 10.2.5. Chamomile

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Guangdong Jiaduobao Drink & Food Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Guangzhou Wanglaoji Pharmaceutical Co.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ltd.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hung Fook Tong

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dali Foods Group Co.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MyDrink

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Keliff's

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Organico

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Herbal Natural Drink

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CH'I Herbal Drinks Co.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 New Concept Product Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ltd (NCP)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Adagio Teas

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 King's Hawaiian

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Unilever

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Dilmah Tea

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ITO EN

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Tata Global Beverages (TGB)

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Guangdong Jiaduobao Drink & Food Co Ltd

List of Figures

- Figure 1: Global Herbal Drink Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Herbal Drink Revenue (million), by Application 2024 & 2032

- Figure 3: North America Herbal Drink Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Herbal Drink Revenue (million), by Types 2024 & 2032

- Figure 5: North America Herbal Drink Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Herbal Drink Revenue (million), by Country 2024 & 2032

- Figure 7: North America Herbal Drink Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Herbal Drink Revenue (million), by Application 2024 & 2032

- Figure 9: South America Herbal Drink Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Herbal Drink Revenue (million), by Types 2024 & 2032

- Figure 11: South America Herbal Drink Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Herbal Drink Revenue (million), by Country 2024 & 2032

- Figure 13: South America Herbal Drink Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Herbal Drink Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Herbal Drink Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Herbal Drink Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Herbal Drink Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Herbal Drink Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Herbal Drink Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Herbal Drink Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Herbal Drink Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Herbal Drink Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Herbal Drink Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Herbal Drink Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Herbal Drink Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Herbal Drink Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Herbal Drink Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Herbal Drink Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Herbal Drink Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Herbal Drink Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Herbal Drink Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Herbal Drink Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Herbal Drink Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Herbal Drink Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Herbal Drink Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Herbal Drink Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Herbal Drink Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Herbal Drink Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Herbal Drink Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Herbal Drink Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Herbal Drink Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Herbal Drink Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Herbal Drink Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Herbal Drink Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Herbal Drink Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Herbal Drink Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Herbal Drink Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Herbal Drink Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Herbal Drink Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Herbal Drink Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Herbal Drink Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Herbal Drink?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Herbal Drink?

Key companies in the market include Guangdong Jiaduobao Drink & Food Co Ltd, Guangzhou Wanglaoji Pharmaceutical Co., Ltd., Hung Fook Tong, Dali Foods Group Co., Ltd., MyDrink, Keliff's, Organico, Herbal Natural Drink, CH'I Herbal Drinks Co., New Concept Product Co., Ltd (NCP), Adagio Teas, King's Hawaiian, Unilever, Dilmah Tea, ITO EN, Tata Global Beverages (TGB).

3. What are the main segments of the Herbal Drink?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Herbal Drink," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Herbal Drink report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Herbal Drink?

To stay informed about further developments, trends, and reports in the Herbal Drink, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence