Key Insights

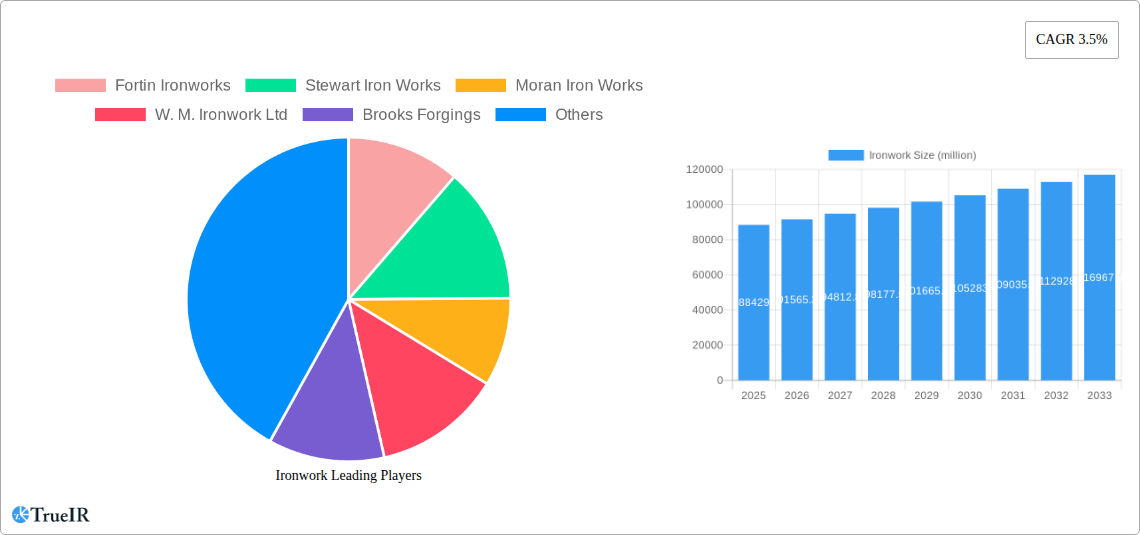

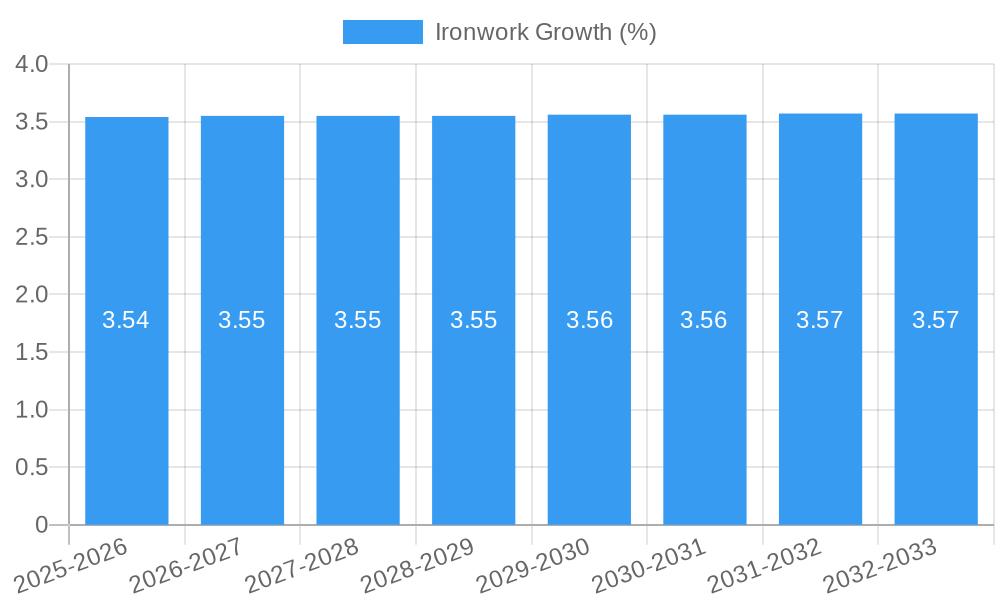

The global Ironwork market is poised for steady expansion, projected to reach approximately USD 88,429 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of 3.5% from 2019 to 2033. This sustained growth is underpinned by a confluence of factors, primarily the enduring demand for decorative and functional iron elements across various sectors. The industrial application of ironwork, encompassing structural components, machinery parts, and heavy-duty fittings, forms a significant pillar of market demand. Simultaneously, the commercial sector, with its growing reliance on bespoke iron fixtures for businesses, restaurants, and public spaces, contributes substantially. Furthermore, the household segment, characterized by a consistent appetite for aesthetic iron features such as gates, railings, balconies, and furniture, continues to be a robust driver. The inherent durability, aesthetic versatility, and timeless appeal of ironwork ensure its continued relevance in both traditional and contemporary designs.

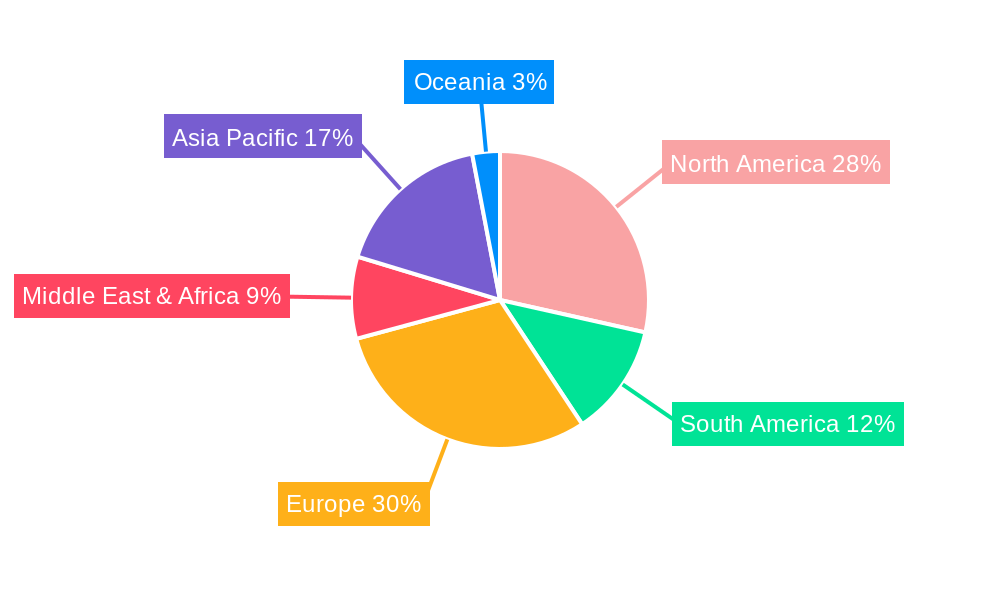

The market is further segmented by type, with wrought iron and cast iron representing key production methods. Wrought iron, known for its malleability and ability to be shaped into intricate designs, caters to premium applications and decorative elements. Cast iron, offering strength and cost-effectiveness, finds extensive use in industrial components and more utilitarian applications. Key players like Fortin Ironworks, Stewart Iron Works, and Moran Iron Works are instrumental in shaping market dynamics through innovation and extensive product portfolios. Emerging trends suggest a growing emphasis on sustainable production practices and the integration of smart technologies in ironwork manufacturing. While the market exhibits strong growth potential, factors such as fluctuating raw material costs and the availability of alternative materials could present moderate challenges to sustained, accelerated expansion in specific niches. The Asia Pacific region is anticipated to emerge as a significant growth hub, owing to rapid industrialization and increasing disposable incomes.

Ironwork Market Research Report: Comprehensive Analysis & Forecast (2019-2033)

This in-depth Ironwork Market research report offers a dynamic and SEO-optimized overview of the global ironwork industry, leveraging high-volume keywords to enhance search rankings and engage industry audiences. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides critical insights into market structure, trends, opportunities, dominant segments, product analysis, key drivers, challenges, influential players, significant milestones, and future outlook. We delve into market sizes estimated to reach several million and growth rates, offering a valuable resource for manufacturers, suppliers, investors, and stakeholders in the industrial, commercial, and household ironwork sectors, encompassing both wrought iron and cast iron applications.

Ironwork Market Structure & Competitive Landscape

The global ironwork market exhibits a moderately fragmented structure, with a concentration ratio estimated at XX% among the top five players. Innovation remains a key driver, with advancements in fabrication techniques and aesthetic design continuously shaping product offerings. Regulatory impacts, while generally supportive of safety and environmental standards, can introduce compliance costs. The threat of product substitutes, particularly in certain decorative and structural applications, is present but often mitigated by the inherent durability and aesthetic appeal of iron. End-user segmentation across industrial, commercial, and household sectors reveals distinct demand patterns and application needs. Mergers and acquisitions (M&A) activity, with hundreds of millions in reported deal values historically, indicates ongoing consolidation and strategic expansion within the industry. Key strategies observed include vertical integration and the acquisition of complementary technologies and market shares.

- Market Concentration: Estimated XX% for top 5 players.

- Innovation Drivers: Advanced fabrication, aesthetic design, material science.

- Regulatory Impacts: Safety standards, environmental compliance, building codes.

- Product Substitutes: Aluminum, stainless steel, composite materials.

- End-User Segments: Industrial, Commercial, Household.

- M&A Activity: Historical deal values in hundreds of millions.

Ironwork Market Trends & Opportunities

The ironwork market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033, with an estimated market size reaching tens of millions by the end of the forecast period. This robust expansion is fueled by a confluence of factors, including increasing global urbanization, a surge in infrastructure development projects, and a growing demand for aesthetically pleasing and durable architectural elements. Technological shifts are playing a pivotal role, with advancements in automated welding, CNC machining, and advanced finishing techniques enhancing efficiency, precision, and the complexity of designs achievable. Consumer preferences are evolving, with a discernible trend towards bespoke and artisanal ironwork, particularly in the residential sector, as homeowners seek unique and high-quality additions to their properties. Furthermore, the commercial sector is witnessing a renewed appreciation for the timeless appeal and structural integrity of iron in both new constructions and renovations, from decorative facades to robust industrial frameworks. The competitive dynamics are characterized by a mix of established giants and agile niche players, each vying for market share through product differentiation, cost leadership, and superior customer service. Opportunities abound in the development of sustainable ironwork solutions, the integration of smart technologies for enhanced functionality, and the expansion into emerging markets with nascent infrastructure needs. The penetration rate of specialized ironwork products is expected to rise significantly as awareness of their benefits and aesthetic potential grows.

Dominant Markets & Segments in Ironwork

The Industrial application segment is currently the most dominant force in the global ironwork market, driven by substantial investments in infrastructure, manufacturing facilities, and heavy engineering projects worldwide. This dominance is underscored by the critical role ironwork plays in structural components, machinery, and plant construction, where strength, durability, and reliability are paramount. The Commercial segment is emerging as a significant growth engine, propelled by the construction of new commercial buildings, the renovation of existing retail spaces, hotels, and public institutions, and a rising demand for decorative and functional ironwork in architectural designs, such as balconies, railings, and signage. The Household segment, while smaller in overall market value compared to industrial applications, presents strong growth potential, fueled by the increasing disposable income, a desire for enhanced home aesthetics, and a preference for durable and customizable home features like gates, fences, and interior decorative pieces.

In terms of Type, Wrought Iron continues to hold a significant market share due to its inherent strength, malleability, and the timeless, artisanal appeal it offers. It is highly sought after for decorative applications, custom gates, railings, and furniture, where intricate designs and a classic aesthetic are desired. Cast Iron, known for its rigidity, durability, and ability to be molded into complex shapes, remains crucial for industrial components, machine parts, cookware, and certain architectural elements like manhole covers and decorative columns.

- Leading Region: Asia-Pacific, due to rapid industrialization and infrastructure development.

- Dominant Application Segment: Industrial, driven by manufacturing and infrastructure projects.

- High-Growth Application Segment: Commercial, fueled by urban development and renovations.

- Key Type in Decorative Applications: Wrought Iron, prized for its aesthetic appeal and artisanal quality.

- Key Type in Industrial Applications: Cast Iron, valued for its strength and moldability.

Ironwork Product Analysis

Product innovation in the ironwork market is increasingly focused on enhancing durability, corrosion resistance, and aesthetic appeal through advanced material treatments and fabrication techniques. Smart integration, such as automated gates with security features, represents a growing area of application. Competitive advantages are derived from bespoke design capabilities, efficient manufacturing processes, and specialized finishes that cater to specific end-user needs in industrial, commercial, and household settings for both wrought and cast iron products.

Key Drivers, Barriers & Challenges in Ironwork

The ironwork market is propelled by significant growth drivers including robust global infrastructure development, the ongoing need for durable construction materials, and a rising demand for aesthetically pleasing and customizable architectural elements across industrial, commercial, and household sectors. Technological advancements in fabrication and finishing are further enhancing product capabilities.

However, the industry faces key challenges. Fluctuations in raw material prices, particularly iron ore and steel, can impact manufacturing costs and profitability. Stringent environmental regulations regarding emissions and waste disposal can necessitate significant investments in compliance technologies. Furthermore, the availability of skilled labor for specialized fabrication and installation remains a concern, and intense competition, both domestically and internationally, puts pressure on pricing and margins. Supply chain disruptions, as witnessed in recent years, can also pose significant risks.

Growth Drivers in the Ironwork Market

Key growth drivers in the ironwork market are multifaceted. The sustained global investment in infrastructure, encompassing transportation networks, energy facilities, and public utilities, creates a consistent demand for robust iron components. Furthermore, the accelerating pace of urbanization and commercial development directly translates into increased construction of buildings, retail spaces, and public amenities, all of which require significant ironwork. Technological advancements, such as automated manufacturing processes and innovative surface treatments, are not only improving production efficiency but also enabling the creation of more complex and aesthetically refined ironwork, catering to evolving consumer preferences for customization and design. The inherent durability and longevity of ironwork materials also contribute to their sustained appeal.

Challenges Impacting Ironwork Growth

Several challenges can impede the growth of the ironwork market. Volatility in the prices of raw materials like iron ore and scrap metal directly affects production costs and profit margins, creating economic uncertainty for manufacturers. Increasingly stringent environmental regulations globally necessitate investments in cleaner production technologies and waste management, adding to operational expenses. The persistent shortage of skilled labor, particularly for intricate fabrication, welding, and installation, poses a significant constraint on production capacity and the ability to undertake complex projects. Moreover, intense competition from both established players and emerging low-cost manufacturers can lead to price wars and reduced profitability, particularly in commoditized product segments. Supply chain vulnerabilities, from sourcing raw materials to logistics and distribution, also present ongoing risks.

Key Players Shaping the Ironwork Market

- Fortin Ironworks

- Stewart Iron Works

- Moran Iron Works

- W. M. Ironwork Ltd

- Brooks Forgings

- TOKUSHU KINZOKU EXCEL

- FUJITA Iron Works

- tar Iron Works, Inc.

Significant Ironwork Industry Milestones

- 2019-2023: Increased adoption of CNC machinery leading to enhanced precision in metal fabrication.

- 2020: Emergence of advanced anti-corrosion coatings significantly extending the lifespan of ironwork.

- 2021: Growth in demand for smart ironwork solutions, including automated gates and security features.

- 2022: Major infrastructure projects in emerging economies boosted demand for industrial ironwork.

- 2023: Focus on sustainable manufacturing practices and recycling initiatives within the iron industry.

Future Outlook for Ironwork Market

The future outlook for the ironwork market is overwhelmingly positive, driven by persistent global infrastructure development and a renaissance in architectural aesthetics. Strategic opportunities lie in the integration of smart technologies, the development of sustainable and eco-friendly ironwork solutions, and expansion into burgeoning markets. The continuous evolution of design trends, coupled with advancements in fabrication and finishing, will ensure ironwork remains a preferred choice for both functional and decorative applications across industrial, commercial, and household sectors, with market value projected to reach tens of millions.

Ironwork Segmentation

-

1. Application

- 1.1. Industrial

- 1.2. Commercial

- 1.3. Household

-

2. Type

- 2.1. Wrought Iron

- 2.2. Cast Iron

Ironwork Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ironwork REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ironwork Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial

- 5.1.2. Commercial

- 5.1.3. Household

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Wrought Iron

- 5.2.2. Cast Iron

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ironwork Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industrial

- 6.1.2. Commercial

- 6.1.3. Household

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Wrought Iron

- 6.2.2. Cast Iron

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ironwork Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industrial

- 7.1.2. Commercial

- 7.1.3. Household

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Wrought Iron

- 7.2.2. Cast Iron

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ironwork Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industrial

- 8.1.2. Commercial

- 8.1.3. Household

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Wrought Iron

- 8.2.2. Cast Iron

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ironwork Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industrial

- 9.1.2. Commercial

- 9.1.3. Household

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Wrought Iron

- 9.2.2. Cast Iron

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ironwork Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industrial

- 10.1.2. Commercial

- 10.1.3. Household

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Wrought Iron

- 10.2.2. Cast Iron

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Fortin Ironworks

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stewart Iron Works

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Moran Iron Works

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 W. M. Ironwork Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Brooks Forgings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TOKUSHU KINZOKU EXCEL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FUJITA Iron Works

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 tar Iron Works Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Fortin Ironworks

List of Figures

- Figure 1: Global Ironwork Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ironwork Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ironwork Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ironwork Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ironwork Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ironwork Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ironwork Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ironwork Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ironwork Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ironwork Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ironwork Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ironwork Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ironwork Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ironwork Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ironwork Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ironwork Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ironwork Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ironwork Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ironwork Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ironwork Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ironwork Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ironwork Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ironwork Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ironwork Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ironwork Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ironwork Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ironwork Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ironwork Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ironwork Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ironwork Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ironwork Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ironwork Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ironwork Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ironwork Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ironwork Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ironwork Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ironwork Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ironwork Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ironwork Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ironwork Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ironwork Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ironwork Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ironwork Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ironwork Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ironwork Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ironwork Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ironwork Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ironwork Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ironwork Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ironwork Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ironwork Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ironwork Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ironwork?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Ironwork?

Key companies in the market include Fortin Ironworks, Stewart Iron Works, Moran Iron Works, W. M. Ironwork Ltd, Brooks Forgings, TOKUSHU KINZOKU EXCEL, FUJITA Iron Works, tar Iron Works, Inc..

3. What are the main segments of the Ironwork?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 884290 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ironwork," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ironwork report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ironwork?

To stay informed about further developments, trends, and reports in the Ironwork, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence