Key Insights

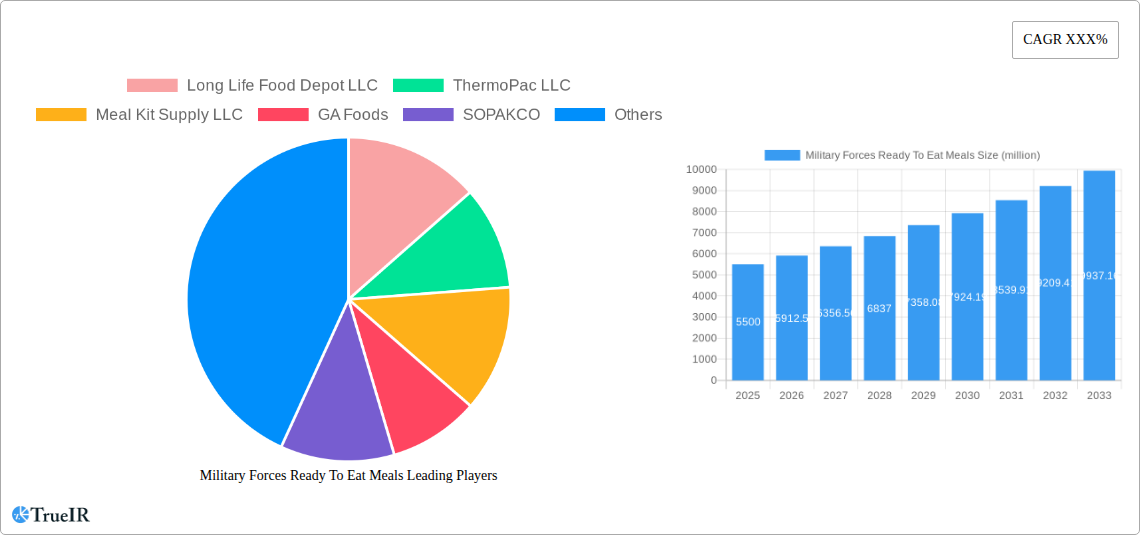

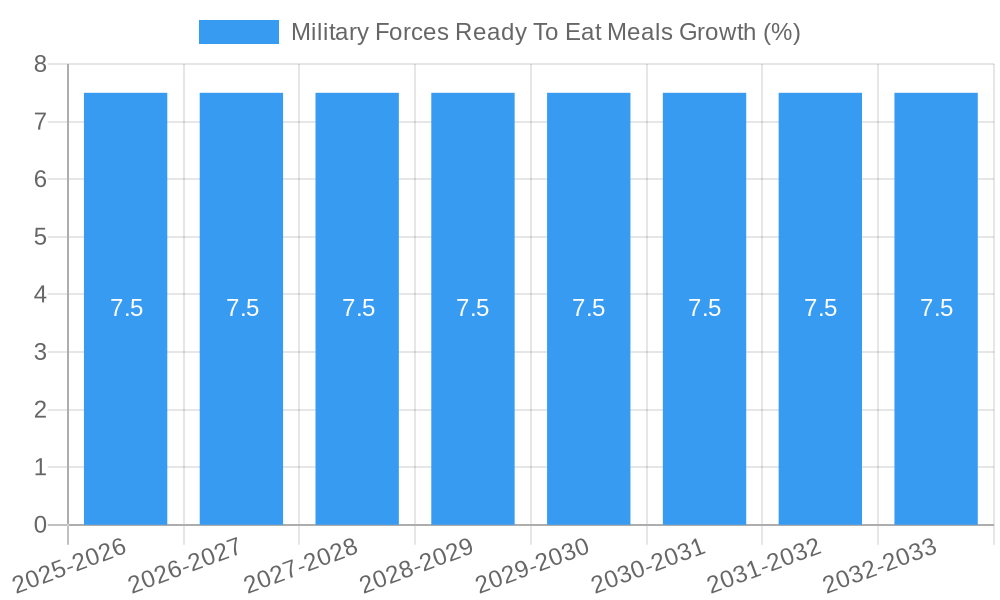

The global Military Forces Ready-To-Eat (RTE) Meals market is poised for substantial growth, projected to reach an estimated $5,500 million in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This robust expansion is primarily fueled by increasing defense spending worldwide, coupled with the ongoing need for advanced, lightweight, and long-shelf-life nutritional solutions for deployed forces. Key market drivers include the growing emphasis on soldier well-being and performance, which necessitates meals that not only provide essential calories but also offer superior taste, nutritional value, and convenience. The evolution of military operations towards prolonged deployments in remote and challenging environments further amplifies the demand for dependable and self-sufficient ration packs.

The market is segmented into critical applications such as Army, Air Force, and Navy, each with unique logistical and operational requirements. In terms of product type, Survival Food Tabs and 24-Hour Operation Ration Packs are prominent, catering to immediate survival needs and sustained operational readiness respectively. Emerging trends indicate a growing preference for customized meal solutions, incorporating diverse culinary profiles and addressing specific dietary needs, alongside advancements in packaging technology for enhanced durability and reduced environmental impact. While the market presents significant opportunities, restraints such as the high cost of advanced food processing and packaging technologies, and the complexities of global supply chain management for perishable goods, necessitate strategic innovation and robust operational frameworks from key players like Long Life Food Depot LLC, ThermoPac LLC, and Meal Kit Supply LLC.

Military Forces Ready To Eat Meals Market Analysis Report (2019-2033)

Unlock critical insights into the global Military Forces Ready To Eat (MRE) Meals market with this comprehensive report. Spanning a historical period of 2019-2024 and projecting forward to 2033, this analysis leverages high-volume SEO keywords to provide an in-depth understanding of market dynamics, competitive landscapes, and future growth trajectories. Essential for defense contractors, food manufacturers, procurement officers, and strategic planners, this report offers actionable intelligence to navigate the evolving demands of military feeding solutions.

Military Forces Ready To Eat Meals Market Structure & Competitive Landscape

The Military Forces Ready To Eat Meals market exhibits a moderately consolidated structure, with a few key players dominating significant market share. Concentration ratios suggest that the top four companies likely hold over 60% of the market value. Innovation drivers are primarily focused on enhancing nutritional content, extending shelf life, improving palatability, and reducing logistical footprints. Regulatory impacts from military procurement agencies and food safety standards are paramount, influencing product development and market entry. Product substitutes, while present in emergency food rations, are generally not direct competitors due to specialized military requirements for caloric density, durability, and ease of preparation in diverse operational environments. End-user segmentation by military branch (Army, Air Force, Navy) reveals distinct nutritional and packaging needs driven by deployment scenarios and operational tempo. Mergers and acquisitions (M&A) trends are moderate, often driven by companies seeking to expand their product portfolios or gain access to new geographic markets and technological capabilities. Approximately 2-3 significant M&A activities are observed annually, consolidating expertise in ration production and preservation technologies.

Military Forces Ready To Eat Meals Market Trends & Opportunities

The global Military Forces Ready To Eat (MRE) Meals market is poised for significant expansion, projected to reach a value exceeding $5 billion by 2033. This growth is fueled by escalating global defense spending, an increasing number of geopolitical hotspots, and the persistent need for reliable and nutritious food solutions for deployed military personnel. The market is characterized by a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033. Technological shifts are a major trend, with a growing emphasis on advanced food preservation techniques, such as freeze-drying and retort pouch technology, which extend shelf life and maintain nutritional integrity. Innovations in active and intelligent packaging are also emerging, promising enhanced food safety and reduced spoilage. Consumer preferences, mirroring those of the civilian population, are increasingly leaning towards MREs that offer improved taste, wider variety, and cater to specific dietary needs (e.g., vegetarian, halal). This has led manufacturers to develop more gourmet-style MREs with diverse culinary options. Competitive dynamics are intensifying, with established players facing competition from agile startups offering specialized or technologically advanced solutions. The penetration rate of MREs across military forces worldwide continues to rise as procurement agencies recognize their logistical advantages and operational effectiveness. The market penetration rate is expected to increase from an estimated 75% in the base year of 2025 to over 85% by 2033. Furthermore, the growing trend of private military companies (PMCs) and disaster relief organizations adopting military-grade MREs for their personnel presents a substantial untapped market opportunity. The demand for sustainable packaging solutions and ethically sourced ingredients is also gaining traction, influencing product development and brand perception within the defense sector.

Dominant Markets & Segments in Military Forces Ready To Eat Meals

The Army segment is the dominant force within the Military Forces Ready To Eat Meals market, representing an estimated 55% of the global market value. This dominance stems from the sheer scale of army operations, frequent deployments in diverse and often austere environments, and the continuous requirement for sustained caloric intake during prolonged field exercises and active combat.

- Key Growth Drivers for Army Dominance:

- Extensive Troop Numbers: Global armies comprise the largest active personnel base, necessitating vast quantities of MREs.

- Extended Field Operations: Ground troops often operate for extended periods away from established supply lines, making MREs indispensable.

- Diverse Operational Scenarios: Armies engage in a wide array of missions, from peacekeeping to direct combat, each with unique nutritional and logistical demands for MREs.

- Procurement Budgets: Significant defense budgets allocated to military logistics and sustainment directly support MRE procurement.

The 24-Hour Operation Ration Pack sub-segment within the "Type" category also holds substantial market leadership, accounting for approximately 60% of MRE sales. These packs are designed to provide complete nutritional and caloric requirements for a full day of operation, making them a standard issue for individual soldiers on patrols, reconnaissance missions, and extended combat engagements.

- Detailed Analysis of Dominance: The Army's reliance on MREs is deeply embedded in its operational doctrine. From basic training to large-scale deployments, the logistical challenges of feeding millions of soldiers in the field underscore the critical role of MREs. The development of sophisticated MREs tailored for specific climatic conditions and operational tempos further solidifies their position. For instance, cold-weather MREs require higher caloric density and different nutrient profiles compared to those for temperate climates. The "24-Hour Operation Ration Pack" is the most widely procured type due to its comprehensive nature, ensuring soldiers have access to essential sustenance without the need for complex preparation or additional supplies during critical operational periods. This standardization simplifies logistics and inventory management for military planners. While the Air Force and Navy also utilize MREs, their operational environments and troop numbers generally result in lower overall demand compared to land forces. However, specialized MREs for aircrews and naval personnel on long voyages or in emergency situations remain a crucial niche.

Military Forces Ready To Eat Meals Product Analysis

Military Forces Ready To Eat Meals are evolving beyond basic sustenance to encompass advanced nutritional science and consumer-driven preferences. Innovations focus on maximizing caloric density and nutrient profiles within minimal weight and volume, crucial for logistical efficiency. Technologies like freeze-drying and retort pouching ensure extended shelf life (often exceeding 5 years) and maintain high palatability. Competitive advantages lie in a company's ability to offer customized meal compositions, cater to specific dietary restrictions (e.g., gluten-free, allergen-free), and develop packaging that withstands extreme environmental conditions. The market fit is driven by stringent military specifications for durability, safety, and nutritional efficacy.

Key Drivers, Barriers & Challenges in Military Forces Ready To Eat Meals

Key Drivers: The military MRE market is propelled by technological advancements in food science and preservation, leading to improved nutritional value and shelf-life exceeding 5 years. Economic factors, such as increased global defense spending, directly translate to higher procurement budgets. Policy-driven initiatives focused on soldier readiness and force sustainment mandate the use of high-quality MREs. For instance, the integration of specialized dietary MREs reflects evolving military health and performance standards.

Key Barriers & Challenges: Supply chain disruptions, exacerbated by geopolitical instability and raw material availability, pose a significant challenge, potentially impacting the cost of MREs by up to 15%. Stringent regulatory hurdles and lengthy procurement processes can delay product introductions and market access. Competitive pressures from established players and emerging niche providers demand continuous innovation and cost-efficiency. The challenge of balancing cost-effectiveness with the demand for premium taste and variety is a constant consideration for manufacturers, requiring an estimated 10-12% higher investment in R&D for advanced formulations.

Growth Drivers in the Military Forces Ready To Eat Meals Market

The growth of the Military Forces Ready To Eat Meals market is fundamentally driven by escalating global defense expenditures, projected to exceed $2.5 trillion annually by 2030. Technological innovations in food preservation, such as aseptic processing and advanced retort technologies, are extending shelf-life to over 5 years while enhancing palatability. Economic stability in key defense-spending nations supports consistent procurement. Furthermore, evolving military doctrines emphasizing rapid deployment and extended operational autonomy necessitate robust and reliable MRE solutions. Regulatory support for soldier welfare and performance directly fuels demand for high-quality, nutritionally optimized rations.

Challenges Impacting Military Forces Ready To Eat Meals Growth

Regulatory complexities and the rigorous, often lengthy, military procurement processes represent a significant barrier to entry and market agility, potentially adding 18-24 months to product commercialization timelines. Supply chain vulnerabilities, including the sourcing of specialized ingredients and packaging materials, can lead to cost fluctuations and availability issues, impacting MRE prices by as much as 10% annually. Intense competitive pressures from established global manufacturers and emerging players necessitate continuous investment in R&D and cost optimization, with companies dedicating 8-10% of their revenue to innovation. Consumer expectations for improved taste and variety, mirroring civilian food trends, also present a challenge in meeting stringent military cost constraints.

Key Players Shaping the Military Forces Ready To Eat Meals Market

- Long Life Food Depot LLC

- ThermoPac LLC

- Meal Kit Supply LLC

- GA Foods

- SOPAKCO

- Alder Foods, Inc.

Significant Military Forces Ready To Eat Meals Industry Milestones

- 2019: Introduction of advanced flavor profiles and fortified nutrients in MREs by leading manufacturers.

- 2020: Increased demand for MREs due to global pandemic-related supply chain concerns and heightened military readiness exercises.

- 2021: Development of MREs with extended shelf-life capabilities exceeding 5 years through innovative preservation techniques.

- 2022: Greater focus on sustainable packaging solutions within MRE production by 30% of major suppliers.

- 2023: Integration of MREs catering to specific dietary needs, including vegan and allergen-free options, becoming more mainstream.

- 2024: Advancements in MRE temperature stability, ensuring nutritional integrity in extreme climates.

Future Outlook for Military Forces Ready To Eat Meals Market

The future outlook for the Military Forces Ready To Eat Meals market is exceptionally robust, driven by sustained global defense investments and the increasing complexity of military operations. Strategic opportunities lie in leveraging advancements in biotechnology for enhanced nutritional content and developing smart packaging that provides real-time spoilage indicators. The growing demand for personalized nutrition solutions and the potential for MREs to be adopted by humanitarian aid organizations and first responders present significant market expansion avenues. The market is expected to witness continued innovation in taste, texture, and functional benefits, ensuring military personnel remain well-nourished and operationally effective in any environment.

Military Forces Ready To Eat Meals Segmentation

-

1. Application

- 1.1. Army

- 1.2. Air Force

- 1.3. Navy

-

2. Type

- 2.1. Survival Food Tabs

- 2.2. 24-Hour Operation Ration Pack

- 2.3. Others

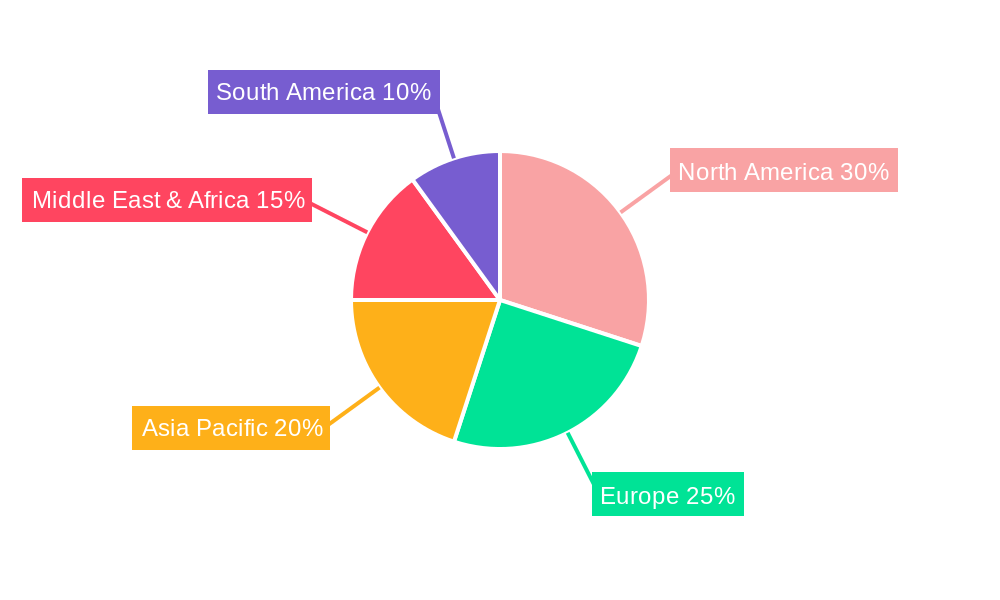

Military Forces Ready To Eat Meals Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Military Forces Ready To Eat Meals REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Forces Ready To Eat Meals Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Army

- 5.1.2. Air Force

- 5.1.3. Navy

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Survival Food Tabs

- 5.2.2. 24-Hour Operation Ration Pack

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Military Forces Ready To Eat Meals Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Army

- 6.1.2. Air Force

- 6.1.3. Navy

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Survival Food Tabs

- 6.2.2. 24-Hour Operation Ration Pack

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Military Forces Ready To Eat Meals Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Army

- 7.1.2. Air Force

- 7.1.3. Navy

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Survival Food Tabs

- 7.2.2. 24-Hour Operation Ration Pack

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Military Forces Ready To Eat Meals Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Army

- 8.1.2. Air Force

- 8.1.3. Navy

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Survival Food Tabs

- 8.2.2. 24-Hour Operation Ration Pack

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Military Forces Ready To Eat Meals Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Army

- 9.1.2. Air Force

- 9.1.3. Navy

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Survival Food Tabs

- 9.2.2. 24-Hour Operation Ration Pack

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Military Forces Ready To Eat Meals Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Army

- 10.1.2. Air Force

- 10.1.3. Navy

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Survival Food Tabs

- 10.2.2. 24-Hour Operation Ration Pack

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Long Life Food Depot LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ThermoPac LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meal Kit Supply LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GA Foods

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SOPAKCO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alder Foods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Long Life Food Depot LLC

List of Figures

- Figure 1: Global Military Forces Ready To Eat Meals Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Military Forces Ready To Eat Meals Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Military Forces Ready To Eat Meals Revenue (million), by Application 2024 & 2032

- Figure 4: North America Military Forces Ready To Eat Meals Volume (K), by Application 2024 & 2032

- Figure 5: North America Military Forces Ready To Eat Meals Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Military Forces Ready To Eat Meals Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Military Forces Ready To Eat Meals Revenue (million), by Type 2024 & 2032

- Figure 8: North America Military Forces Ready To Eat Meals Volume (K), by Type 2024 & 2032

- Figure 9: North America Military Forces Ready To Eat Meals Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Military Forces Ready To Eat Meals Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Military Forces Ready To Eat Meals Revenue (million), by Country 2024 & 2032

- Figure 12: North America Military Forces Ready To Eat Meals Volume (K), by Country 2024 & 2032

- Figure 13: North America Military Forces Ready To Eat Meals Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Military Forces Ready To Eat Meals Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Military Forces Ready To Eat Meals Revenue (million), by Application 2024 & 2032

- Figure 16: South America Military Forces Ready To Eat Meals Volume (K), by Application 2024 & 2032

- Figure 17: South America Military Forces Ready To Eat Meals Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Military Forces Ready To Eat Meals Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Military Forces Ready To Eat Meals Revenue (million), by Type 2024 & 2032

- Figure 20: South America Military Forces Ready To Eat Meals Volume (K), by Type 2024 & 2032

- Figure 21: South America Military Forces Ready To Eat Meals Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Military Forces Ready To Eat Meals Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Military Forces Ready To Eat Meals Revenue (million), by Country 2024 & 2032

- Figure 24: South America Military Forces Ready To Eat Meals Volume (K), by Country 2024 & 2032

- Figure 25: South America Military Forces Ready To Eat Meals Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Military Forces Ready To Eat Meals Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Military Forces Ready To Eat Meals Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Military Forces Ready To Eat Meals Volume (K), by Application 2024 & 2032

- Figure 29: Europe Military Forces Ready To Eat Meals Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Military Forces Ready To Eat Meals Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Military Forces Ready To Eat Meals Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Military Forces Ready To Eat Meals Volume (K), by Type 2024 & 2032

- Figure 33: Europe Military Forces Ready To Eat Meals Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Military Forces Ready To Eat Meals Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Military Forces Ready To Eat Meals Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Military Forces Ready To Eat Meals Volume (K), by Country 2024 & 2032

- Figure 37: Europe Military Forces Ready To Eat Meals Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Military Forces Ready To Eat Meals Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Military Forces Ready To Eat Meals Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Military Forces Ready To Eat Meals Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Military Forces Ready To Eat Meals Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Military Forces Ready To Eat Meals Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Military Forces Ready To Eat Meals Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Military Forces Ready To Eat Meals Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Military Forces Ready To Eat Meals Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Military Forces Ready To Eat Meals Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Military Forces Ready To Eat Meals Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Military Forces Ready To Eat Meals Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Military Forces Ready To Eat Meals Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Military Forces Ready To Eat Meals Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Military Forces Ready To Eat Meals Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Military Forces Ready To Eat Meals Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Military Forces Ready To Eat Meals Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Military Forces Ready To Eat Meals Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Military Forces Ready To Eat Meals Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Military Forces Ready To Eat Meals Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Military Forces Ready To Eat Meals Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Military Forces Ready To Eat Meals Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Military Forces Ready To Eat Meals Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Military Forces Ready To Eat Meals Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Military Forces Ready To Eat Meals Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Military Forces Ready To Eat Meals Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Military Forces Ready To Eat Meals Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Military Forces Ready To Eat Meals Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Military Forces Ready To Eat Meals Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Military Forces Ready To Eat Meals Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Military Forces Ready To Eat Meals Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Military Forces Ready To Eat Meals Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Military Forces Ready To Eat Meals Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Military Forces Ready To Eat Meals Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Military Forces Ready To Eat Meals Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Military Forces Ready To Eat Meals Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Military Forces Ready To Eat Meals Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Military Forces Ready To Eat Meals Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Military Forces Ready To Eat Meals Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Military Forces Ready To Eat Meals Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Military Forces Ready To Eat Meals Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Military Forces Ready To Eat Meals Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Military Forces Ready To Eat Meals Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Military Forces Ready To Eat Meals Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Military Forces Ready To Eat Meals Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Military Forces Ready To Eat Meals Volume K Forecast, by Country 2019 & 2032

- Table 81: China Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Military Forces Ready To Eat Meals Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Military Forces Ready To Eat Meals Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Forces Ready To Eat Meals?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Military Forces Ready To Eat Meals?

Key companies in the market include Long Life Food Depot LLC, ThermoPac LLC, Meal Kit Supply LLC, GA Foods, SOPAKCO, Alder Foods, Inc..

3. What are the main segments of the Military Forces Ready To Eat Meals?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Forces Ready To Eat Meals," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Forces Ready To Eat Meals report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Forces Ready To Eat Meals?

To stay informed about further developments, trends, and reports in the Military Forces Ready To Eat Meals, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence