Key Insights

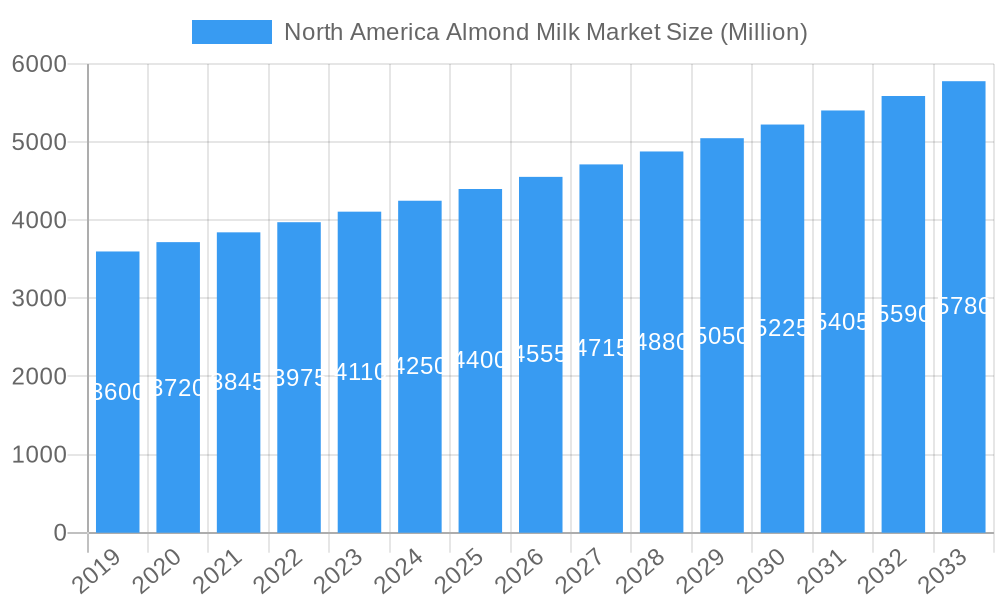

The North America almond milk market is projected to experience substantial growth, reaching an estimated $30.19 billion by 2025, with continued expansion anticipated through 2033. This robust growth, driven by a compound annual growth rate (CAGR) of 3.74%, is attributed to increasing consumer preference for healthier, plant-based alternatives, rising lactose intolerance, and heightened awareness of almond milk's environmental advantages over traditional dairy. Evolving consumer demand for functional beverages and innovative product offerings, including flavored and fortified varieties, further propel market dynamism. Retailers are strategically prioritizing the Off-Trade distribution channel, with online retail and supermarkets expected to dominate due to convenience and extensive product availability. A discernible trend towards premium and organic almond milk options caters to a discerning consumer segment seeking superior quality.

North America Almond Milk Market Market Size (In Billion)

Sustained innovation and strategic market initiatives by key players such as Danone SA, Califia Farms LLC, and Blue Diamond Growers underpin the North America almond milk market's growth trajectory. These companies are expanding product lines and investing in marketing to highlight almond milk's nutritional and environmental benefits. Key market restraints include the higher price point of almond milk compared to conventional dairy milk and concerns regarding water usage in almond cultivation, which may influence regional growth. Despite these challenges, the market outlook remains highly positive. Expansion into emerging Off-Trade sub-distribution channels like warehouse clubs and gas stations, alongside the continued strength of the On-Trade sector (restaurants, cafes), indicates a diversified and resilient market. North America, comprising the United States, Canada, and Mexico, is expected to maintain its position as the leading region, reflecting established consumer adoption and sustained demand for plant-based beverages.

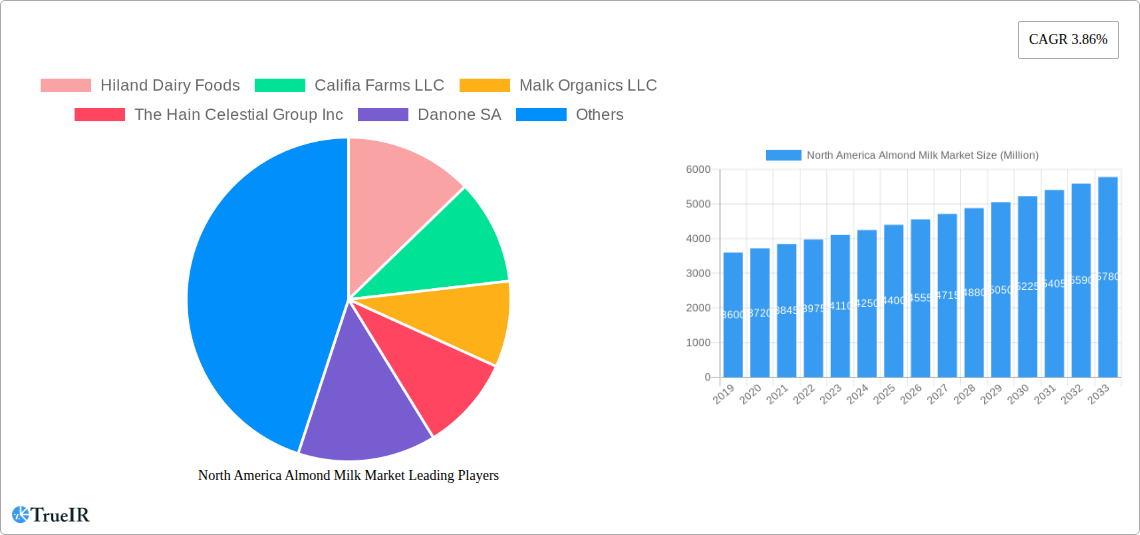

North America Almond Milk Market Company Market Share

This report provides a dynamic, SEO-optimized overview of the North America Almond Milk Market, incorporating high-volume keywords and structured for clarity and insightful analysis.

North America Almond Milk Market Market Structure & Competitive Landscape

The North America almond milk market exhibits a moderately concentrated structure, with a blend of large multinational corporations and specialized niche players vying for market share. Innovation is a significant driver, fueled by continuous product development focused on flavor profiles, nutritional enhancements, and improved textures to cater to evolving consumer demands for plant-based alternatives. Regulatory impacts, while generally supportive of food and beverage industries, can influence labeling requirements and ingredient sourcing, necessitating proactive compliance from market participants. Product substitutes, including other plant-based milks (soy, oat, cashew) and traditional dairy milk, present ongoing competitive pressure, pushing almond milk manufacturers to emphasize unique selling propositions. End-user segmentation is increasingly sophisticated, with distinct offerings tailored for consumers seeking low-calorie options, those with lactose intolerance, and a growing vegan demographic. Mergers and acquisitions (M&A) trends are expected to continue as larger companies seek to expand their plant-based portfolios and gain access to innovative brands or production capabilities. For instance, historical M&A activity has consolidated market share, with an estimated volume of 5-8 significant transactions in the past five years, impacting market concentration ratios, which are estimated to be around 45-55% for the top 5 players.

North America Almond Milk Market Market Trends & Opportunities

The North America almond milk market is poised for robust growth, driven by an escalating consumer preference for healthier, sustainable, and dairy-free alternatives. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% to 9.0% during the forecast period of 2025–2033, with the market size anticipated to reach an estimated value of USD 7,500 Million by 2033, up from an estimated USD 4,200 Million in the base year of 2025. Technological advancements are playing a pivotal role, with innovations in processing techniques leading to enhanced shelf life, improved taste profiles, and reduced water usage during almond cultivation and milk production. These advancements are crucial for maintaining competitiveness and addressing environmental concerns associated with almond farming. Consumer preferences are increasingly shifting towards unsweetened varieties and those fortified with essential nutrients like calcium and Vitamin D, reflecting a growing awareness of health and wellness. The demand for almond milk in convenient formats, such as single-serve cartons and ready-to-drink beverages, is also on the rise, catering to the on-the-go lifestyles of modern consumers. Competitive dynamics are intensifying, with established brands expanding their product lines and new entrants focusing on niche markets and premium offerings. The rise of online retail channels has democratized access to almond milk products, allowing smaller brands to reach a wider audience and challenging traditional brick-and-mortar distribution networks. Furthermore, a growing interest in ethical sourcing and sustainable production practices is influencing purchasing decisions, creating opportunities for brands that can demonstrate a commitment to environmental responsibility. The increasing adoption of almond milk in the foodservice industry, including cafes and restaurants, for use in coffee beverages and other culinary applications, represents another significant avenue for market expansion. The market penetration rate for plant-based milks is estimated to be around 15-20% in the North American region, with almond milk holding a dominant share within this segment, expected to grow further.

Dominant Markets & Segments in North America Almond Milk Market

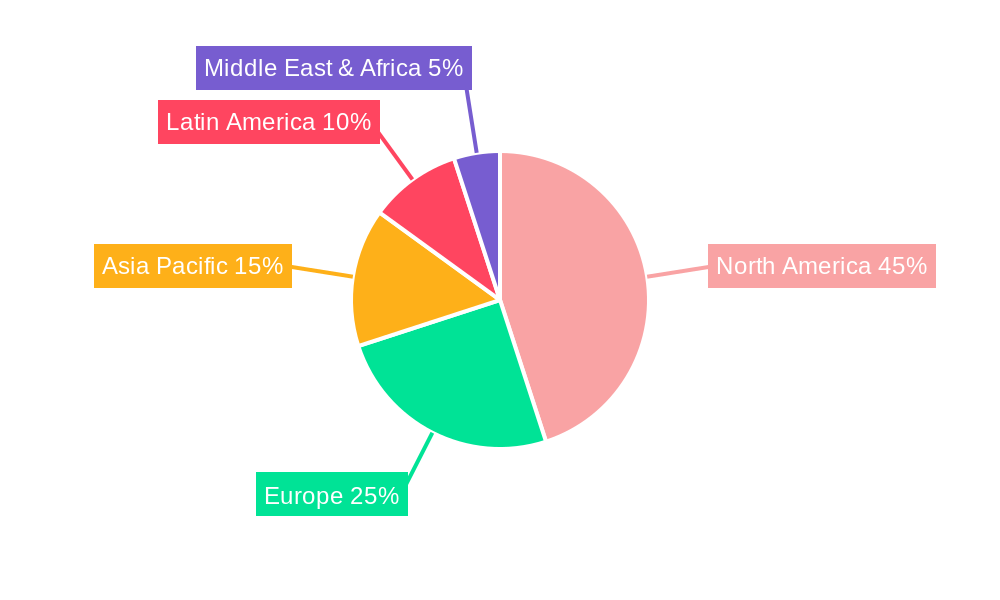

The North America almond milk market is significantly dominated by the Off-Trade distribution channel, which accounts for an estimated 85-90% of total market sales. Within the Off-Trade segment, Supermarkets and Hypermarkets emerge as the largest sub-distribution channel, driven by their extensive product availability, promotional activities, and widespread consumer reach, contributing approximately 40-45% of the total off-trade sales. Online Retail is experiencing rapid growth and is projected to capture a substantial market share, estimated at 25-30%, owing to the convenience, wider product selection, and competitive pricing offered to consumers, particularly younger demographics. Convenience Stores and Specialist Retailers also play a vital role, catering to immediate consumption needs and niche consumer groups, collectively holding around 15-20% of the off-trade market. The "Others" category, including Warehouse Clubs and Gas Stations, contributes the remaining 5-10%, serving specific consumer needs for bulk purchases or impulse buys. The On-Trade segment, encompassing foodservice establishments like cafes, restaurants, and hotels, represents a smaller but growing portion of the market, estimated at 10-15%, driven by the increasing popularity of plant-based milk in coffee beverages and culinary applications. Regionally, the United States holds the dominant market share in North America, estimated at over 70%, due to its large population, higher disposable incomes, and established consumer acceptance of plant-based diets. Canada follows, with an estimated 20-25% market share, also showing strong growth trends. Mexico, while a smaller market, is exhibiting significant upward potential due to increasing awareness and adoption of plant-based alternatives. Key growth drivers for market dominance in these regions include robust distribution infrastructure, supportive government policies promoting healthy eating, and proactive marketing campaigns by key players. The increasing prevalence of lactose intolerance and growing health consciousness among consumers are also significant factors propelling the growth of almond milk across these dominant markets and segments.

North America Almond Milk Market Product Analysis

Product innovations in the North America almond milk market are primarily centered on enhancing taste, nutritional profiles, and texture. Manufacturers are developing new formulations that mimic the creaminess of dairy milk, catering to consumers seeking a familiar mouthfeel. Key advancements include the introduction of unsweetened variants with minimal calories, and fortified options enriched with calcium, Vitamin D, and other essential vitamins and minerals to meet diverse dietary needs. Competitive advantages are being forged through unique ingredient blends, such as the use of multiple almond varieties for a richer flavor, and the development of barista-edition almond milks designed for optimal frothing in coffee beverages. These technological advancements not only meet market demands but also differentiate brands in a crowded marketplace.

Key Drivers, Barriers & Challenges in North America Almond Milk Market

The North America almond milk market is propelled by several key drivers, including the increasing consumer demand for plant-based and dairy-free alternatives, driven by health consciousness, ethical concerns, and environmental sustainability. Technological advancements in production processes that improve taste, texture, and shelf-life also significantly contribute to market growth. Economic factors such as rising disposable incomes and the growing vegan population further bolster demand.

However, the market faces several barriers and challenges. The environmental impact of almond cultivation, particularly its high water footprint, poses a significant challenge, attracting scrutiny and driving innovation in water-efficient farming practices. Supply chain volatility, including fluctuations in almond crop yields and pricing, can impact production costs and product availability. Regulatory hurdles related to labeling standards and potential "dairy-free" claims also require careful navigation by manufacturers. Competitive pressures from other plant-based milk alternatives, such as oat and soy milk, continue to intensify, demanding constant product differentiation and marketing efforts. The estimated impact of water scarcity concerns on future almond milk production could lead to a price increase of 5-10% in the coming years if not adequately addressed.

Growth Drivers in the North America Almond Milk Market Market

Key growth drivers in the North America almond milk market are intrinsically linked to evolving consumer lifestyles and heightened awareness of health and environmental issues. The escalating prevalence of lactose intolerance and dairy allergies continues to be a primary catalyst, creating a sustained demand for lactose-free alternatives. Furthermore, the burgeoning vegan and flexitarian population, driven by ethical and health considerations, significantly expands the addressable market. Technological advancements in processing are enabling the development of almond milk with improved taste profiles, creamier textures, and enhanced nutritional fortification, making it a more appealing substitute for dairy milk. Government initiatives promoting healthy eating habits and the availability of plant-based food options also indirectly support market expansion.

Challenges Impacting North America Almond Milk Market Growth

Challenges impacting North America almond milk market growth are multifaceted. The significant water consumption associated with almond cultivation is a growing concern, leading to increased scrutiny from environmental groups and consumers, potentially affecting brand perception and regulatory landscapes. Supply chain disruptions, including unpredictable almond harvests due to weather patterns and agricultural challenges, can lead to price volatility and impact product availability. Intense competition from other plant-based milk alternatives, such as oat milk and soy milk, which are gaining popularity for their distinct flavor profiles and perceived sustainability benefits, poses a constant threat. Furthermore, the cost of almond milk often remains higher than traditional dairy milk, presenting a barrier for price-sensitive consumers. Regulatory complexities surrounding product labeling and marketing claims can also pose challenges for market players.

Key Players Shaping the North America Almond Milk Market Market

- Hiland Dairy Foods

- Califia Farms LLC

- Malk Organics LLC

- The Hain Celestial Group Inc

- Danone SA

- Blue Diamond Growers

- Elmhurst Milked LLC

- Campbell Soup Company

- Agrifoods International Cooperative Ltd

- SunOpta Inc

Significant North America Almond Milk Market Industry Milestones

- October 2022: SunOpta Inc. completed the first phase of a USD 100 million sterile alternative milk plant in Midlothian to manufacture sustainable milk and food products. This expansion signifies a commitment to increasing production capacity and potentially incorporating almond milk into their sustainable offerings.

- April 2022: Califia Farms launched the Unsweetened Almond Barista Blend, which contains calcium and vitamin D. This product innovation directly addresses consumer demand for healthier, functional beverage options and caters to the professional foodservice sector.

- January 2022: Danone North America introduced a new addition to its almond milk portfolio named Silk Extra Creamy Almondmilk, featuring a blend of three types of almonds. This launch highlights product differentiation through ingredient innovation and aims to capture a segment of consumers seeking a richer, more indulgent almond milk experience.

Future Outlook for North America Almond Milk Market Market

The future outlook for the North America almond milk market remains exceptionally positive, characterized by sustained growth and strategic expansion opportunities. The persistent consumer shift towards healthier, plant-based diets, coupled with an increasing awareness of the environmental impact of traditional dairy, will continue to fuel demand. Innovations in product formulations, focusing on enhanced nutritional content, unique flavor profiles, and improved texture, will be crucial for maintaining competitive advantage. The expansion of distribution channels, particularly the burgeoning online retail sector and the growing adoption in the foodservice industry, will unlock new avenues for market penetration. Investments in sustainable almond cultivation practices and efficient production technologies will be key to addressing environmental concerns and ensuring long-term market viability. Strategic partnerships and potential mergers and acquisitions are also anticipated as companies seek to broaden their product portfolios and consolidate their market positions in this dynamic and evolving industry. The market is expected to witness continued innovation in ready-to-drink formats and specialized product lines catering to specific dietary needs and lifestyle preferences.

North America Almond Milk Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

-

1.1.1. By Sub Distribution Channels

- 1.1.1.1. Convenience Stores

- 1.1.1.2. Online Retail

- 1.1.1.3. Specialist Retailers

- 1.1.1.4. Supermarkets and Hypermarkets

- 1.1.1.5. Others (Warehouse clubs, gas stations, etc.)

-

1.1.1. By Sub Distribution Channels

- 1.2. On-Trade

-

1.1. Off-Trade

North America Almond Milk Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Almond Milk Market Regional Market Share

Geographic Coverage of North America Almond Milk Market

North America Almond Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Milk Production is Leading to Innovation in Dairy Industry

- 3.3. Market Restrains

- 3.3.1. Competition from Other Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Almond Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. By Sub Distribution Channels

- 5.1.1.1.1. Convenience Stores

- 5.1.1.1.2. Online Retail

- 5.1.1.1.3. Specialist Retailers

- 5.1.1.1.4. Supermarkets and Hypermarkets

- 5.1.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.1.1.1. By Sub Distribution Channels

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hiland Dairy Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Califia Farms LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Malk Organics LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Hain Celestial Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blue Diamond Growers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elmhurst Milked LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Campbell Soup Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agrifoods International Cooperative Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SunOpta Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hiland Dairy Foods

List of Figures

- Figure 1: North America Almond Milk Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Almond Milk Market Share (%) by Company 2025

List of Tables

- Table 1: North America Almond Milk Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 2: North America Almond Milk Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Almond Milk Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Almond Milk Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Almond Milk Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Almond Milk Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Almond Milk Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Almond Milk Market?

The projected CAGR is approximately 3.74%.

2. Which companies are prominent players in the North America Almond Milk Market?

Key companies in the market include Hiland Dairy Foods, Califia Farms LLC, Malk Organics LLC, The Hain Celestial Group Inc, Danone SA, Blue Diamond Growers, Elmhurst Milked LLC, Campbell Soup Company, Agrifoods International Cooperative Ltd, SunOpta Inc.

3. What are the main segments of the North America Almond Milk Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Milk Production is Leading to Innovation in Dairy Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Other Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: SunOpta Inc. completed the first phase of a USD 100 million sterile alternative milk plant in Midlothian to manufacture sustainable milk and food products.April 2022: Califia Farms launched the Unsweetened Almond Barista Blend, which contains calcium and vitamin D.January 2022: Danone North America introduced a new addition to its almond milk portfolio named Silk Extra Creamy Almondmilk, featuring a blend of three types of almonds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Almond Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Almond Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Almond Milk Market?

To stay informed about further developments, trends, and reports in the North America Almond Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence