Key Insights

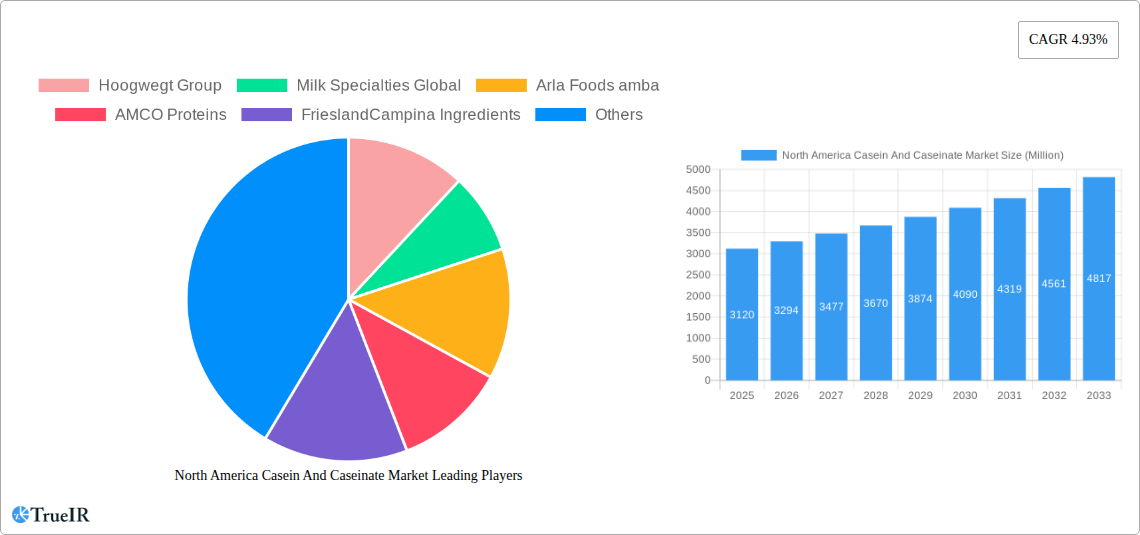

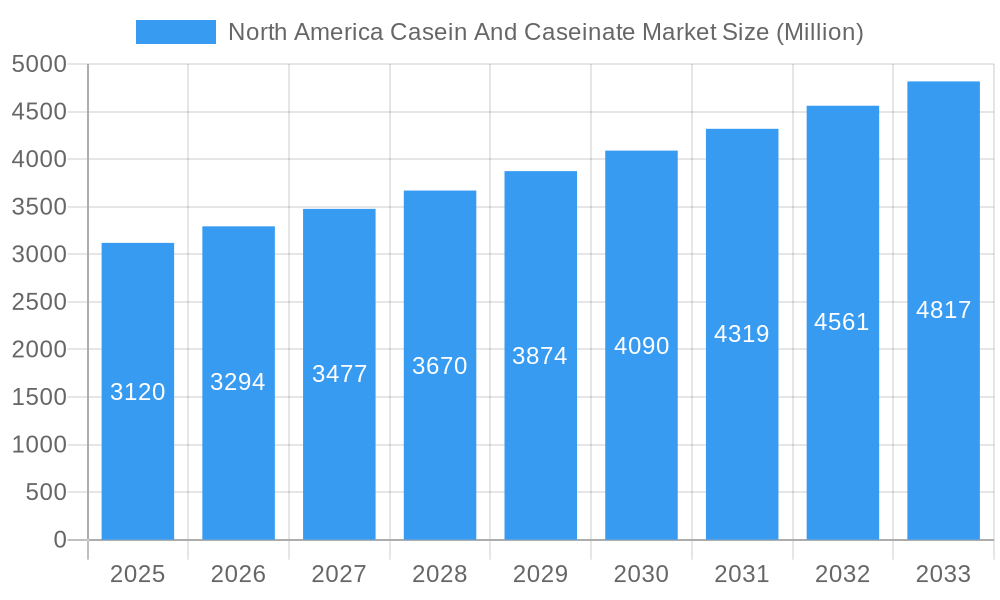

The North America Casein and Caseinate Market is poised for robust growth, driven by increasing demand across diverse applications. Valued at $3.12 billion in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.5% through 2033. This upward trajectory is primarily fueled by the expanding animal feed industry, which utilizes casein and caseinates for their high protein content and nutritional benefits, supporting animal health and productivity. Simultaneously, the personal care and cosmetics sector is witnessing a growing preference for natural and protein-rich ingredients, boosting demand for casein-based formulations. In the food and beverages industry, the versatility of caseinates is evident, with significant applications in bakery, confectionery, dairy and dairy alternative products, ready-to-eat/ready-to-cook meals, and snacks, where they act as emulsifiers, stabilizers, and texturizers, enhancing product quality and consumer appeal. The burgeoning supplements market, encompassing baby food and infant formula, elderly nutrition, medical nutrition, and sport/performance nutrition, further bolsters market expansion, as caseinates are recognized for their slow-digesting protein properties, beneficial for sustained nutrient release.

North America Casein And Caseinate Market Market Size (In Billion)

The market's growth is further supported by key industry players such as Hoogwegt Group, FrieslandCampina Ingredients, and Glanbia PLC, who are actively involved in innovation and expanding their product portfolios. Emerging trends include the development of specialized caseinates for niche applications and a focus on sustainable sourcing and production methods. While the market demonstrates strong growth potential, certain restraints exist. Fluctuations in raw milk prices, which are directly linked to the availability and cost of casein, can impact market dynamics. Furthermore, the increasing availability of alternative protein sources in certain applications might pose a competitive challenge. However, the inherent nutritional advantages and functional properties of casein and caseinates are expected to sustain their demand across the North American region, with the United States, Canada, and Mexico forming the core of this dynamic market.

North America Casein And Caseinate Market Company Market Share

North America Casein and Caseinate Market: Comprehensive Industry Analysis & Forecast 2025-2033

This in-depth report offers a panoramic view of the North American Casein and Caseinate market, providing critical insights into its structure, trends, opportunities, and competitive landscape. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves deep into market dynamics, end-user segments, and prevailing industry developments. Understand the evolving demand for high-quality protein ingredients driven by health and wellness trends, the burgeoning functional food sector, and the animal nutrition industry.

North America Casein And Caseinate Market Market Structure & Competitive Landscape

The North American Casein and Caseinate market is characterized by a moderately concentrated structure, with a few key players dominating a significant portion of the market share. Innovation drivers are primarily focused on developing specialized caseinates with enhanced functional properties, such as improved solubility, emulsification, and heat stability, catering to the evolving needs of the food and beverage, supplement, and animal feed industries. Regulatory impacts, particularly concerning food safety standards and labeling requirements for dairy derivatives, play a crucial role in shaping market entry and product development strategies. Product substitutes, including plant-based proteins and other animal-derived proteins, present a competitive challenge, necessitating continuous product differentiation and value addition by casein and caseinate manufacturers. The end-user segmentation analysis highlights the significant contribution of the food and beverage sector, followed by supplements and animal feed. Mergers and acquisitions (M&A) trends indicate strategic consolidation and expansion efforts by leading companies to enhance their product portfolios, market reach, and operational efficiencies. Over the historical period (2019-2024), M&A activities have seen an estimated volume of xx billion USD.

North America Casein And Caseinate Market Market Trends & Opportunities

The North American Casein and Caseinate market is poised for robust expansion, driven by a confluence of factors that are reshaping consumer preferences and industrial applications. The market size is projected to grow at an impressive Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033, reaching an estimated xx billion USD by 2033. This significant growth trajectory is underpinned by a strong and sustained demand for high-quality protein ingredients, fueled by increasing health consciousness and a growing emphasis on dietary protein intake across all age groups. The functional food and beverage sector, in particular, is a major growth engine, with consumers actively seeking products that offer enhanced nutritional benefits and specific health advantages. Casein and caseinates, with their excellent nutritional profiles and versatile functional properties, are ideally positioned to meet these demands.

Technological shifts are playing a pivotal role, with ongoing advancements in processing techniques leading to the development of novel casein and caseinate derivatives with superior functional attributes. These innovations are enabling wider applications in areas such as low-lactose products, specialized infant formulas, and high-performance sports nutrition products. Furthermore, the integration of advanced manufacturing processes is improving efficiency and sustainability within the supply chain.

Consumer preferences are evolving towards cleaner labels and natural ingredients, which benefits casein and caseinates derived from natural dairy sources. The rising popularity of dairy-alternative products, while presenting some competition, also creates opportunities for casein and caseinates to be incorporated into hybrid formulations or to serve as a benchmark for protein quality. The competitive dynamics within the market are intensifying, prompting companies to focus on product differentiation, strategic partnerships, and vertical integration to secure market share and profitability. Market penetration rates are expected to increase significantly as new applications and consumer awareness expand. The demand for specialty caseinates with tailored functionalities, such as enhanced emulsification for processed meats or improved texture in bakery products, is a key trend. The growing trend of personalized nutrition also presents a considerable opportunity, with investments in research and development aimed at creating customized protein solutions.

Dominant Markets & Segments in North America Casein And Caseinate Market

The North American Casein and Caseinate market exhibits distinct patterns of dominance across various regions and end-user segments, driven by specific economic, demographic, and policy factors. The United States consistently emerges as the leading market due to its large consumer base, advanced food processing infrastructure, and high disposable incomes. Canada and Mexico also contribute significantly, albeit to a lesser extent, with their own unique market dynamics influencing demand.

Within the End-User segmentation, the Food and Beverages segment is the most dominant, encompassing a vast array of sub-segments.

- Dairy and Dairy Alternative Products: This remains a cornerstone, with casein and caseinates crucial for producing cheese, yogurt, ice cream, and increasingly, for fortifying plant-based milk alternatives to enhance their protein content and texture.

- Bakery: Caseinates improve dough stability, crumb structure, and shelf-life in bread and baked goods.

- Confectionery: They act as emulsifiers and stabilizers in chocolates and candies, contributing to a smoother mouthfeel.

- RTE/RTC Food Products (Ready-to-Eat/Ready-to-Cook): Their functional properties are vital for enhancing texture, binding, and moisture retention in processed meals, soups, and sauces.

- Snacks: The demand for protein-enriched snacks, including crackers and extruded snacks, is a significant growth area.

The Supplements segment is another powerful driver of market growth.

- Baby Food and Infant Formula: Casein and its derivatives are fundamental components of infant formulas, providing essential amino acids for infant development. Strict regulatory oversight ensures high quality and safety standards.

- Sport/Performance Nutrition: The surging popularity of sports and fitness has led to an exponential rise in demand for protein powders, bars, and beverages, where caseinates offer slow-digesting protein benefits.

- Elderly Nutrition and Medical Nutrition: For aging populations and individuals with specific medical conditions, casein-based nutritional supplements are crucial for maintaining muscle mass and overall health.

The Animal Feed segment, while historically significant, is witnessing shifts.

- Young Animal Feed: Casein is a vital protein source for young animals, particularly calves and piglets, due to its high digestibility and nutrient profile.

- Specialty Animal Nutrition: There is growing interest in tailored protein solutions for livestock to optimize growth and health.

Key growth drivers across these dominant segments include increasing consumer awareness regarding the health benefits of protein, the rising demand for functional and fortified foods, and advancements in product formulations catering to specific dietary needs and preferences. Government policies promoting healthy eating habits and support for the dairy industry also play a supportive role.

North America Casein And Caseinate Market Product Analysis

The North American Casein and Caseinate market is witnessing significant product innovation, driven by the demand for enhanced functionalities and specialized applications. Key product innovations include the development of highly soluble caseinates for beverages, acid-stable caseinates for acidic food systems, and micellar casein for slow-release protein supplements. These advancements cater to specific end-user needs, offering competitive advantages such as improved texture, emulsification, and nutritional profiling. The competitive landscape favors products with proven efficacy, clean label credentials, and sustainable sourcing, allowing manufacturers to capture premium market segments.

Key Drivers, Barriers & Challenges in North America Casein And Caseinate Market

The North American Casein and Caseinate market is propelled by several key drivers, including the escalating global demand for high-protein food products driven by increasing health and wellness consciousness, particularly among younger demographics and athletes. The versatile functional properties of casein and caseinates, such as emulsification, water binding, and foam stabilization, make them indispensable ingredients in a wide array of food and beverage applications. Furthermore, the growing demand for specialized nutritional products, including infant formulas, medical nutrition, and sports supplements, provides substantial growth opportunities. Technological advancements in processing and extraction techniques are leading to the development of specialized caseinates with tailored functionalities, further expanding their market reach.

However, the market also faces significant barriers and challenges. Fluctuations in raw milk prices and availability, influenced by agricultural policies and climate conditions, can impact production costs and supply chain stability. Stringent regulatory frameworks governing food safety, labeling, and import/export procedures in different North American countries can pose compliance challenges for manufacturers. The competitive pressure from alternative protein sources, including plant-based proteins, necessitates continuous innovation and cost optimization. Supply chain disruptions, as experienced in recent years, can also affect the timely delivery of products and raw materials.

Growth Drivers in the North America Casein And Caseinate Market Market

The North American Casein and Caseinate market is experiencing robust growth, primarily fueled by the escalating global demand for high-protein food products. This trend is underpinned by increasing health and wellness consciousness across all demographics, with consumers actively seeking ingredients that support muscle health, satiety, and overall well-being. The versatile functional properties of casein and caseinates, such as their excellent emulsifying, water-binding, and foaming capabilities, make them indispensable in a wide array of food and beverage applications, including dairy products, bakery goods, and processed foods. Furthermore, the burgeoning sports nutrition and medical nutrition sectors are significant growth drivers, as caseinates offer slow-digesting protein benefits crucial for muscle recovery and specialized dietary needs. Technological advancements in processing and extraction are enabling the development of tailored caseinates with enhanced functionalities, further expanding their application scope and market penetration. Supportive government initiatives promoting dairy consumption and nutritional awareness also contribute to market expansion.

Challenges Impacting North America Casein And Caseinate Market Growth

Despite its strong growth potential, the North American Casein and Caseinate market faces several challenges that could impact its trajectory. Regulatory complexities and evolving food safety standards across the United States, Canada, and Mexico can create hurdles for market entry and product compliance, demanding significant investment in quality control and documentation. Supply chain vulnerabilities, including potential disruptions in raw milk availability due to agricultural factors or geopolitical events, can lead to price volatility and affect production schedules. Competitive pressures from the rapidly expanding plant-based protein sector necessitate continuous innovation and value proposition refinement to maintain market share. Additionally, consumer perceptions regarding dairy products, influenced by environmental concerns and dietary trends, can also pose a challenge, requiring proactive communication and marketing efforts to highlight the sustainability and nutritional benefits of casein and caseinates.

Key Players Shaping the North America Casein And Caseinate Market Market

- Hoogwegt Group

- Milk Specialties Global

- Arla Foods amba

- AMCO Proteins

- FrieslandCampina Ingredients

- Tatua Co-operative Dairy Company Ltd

- Kerry Group PLC

- Farbest-Tallman Foods Corporation

- Fonterra Co-operative Group Limited

- Glanbia PLC

Significant North America Casein And Caseinate Market Industry Milestones

- July 2023: Fonterra made a significant investment of USD 10 million in the United States to support the development of microbiome-based personalized nutrition solutions. The recipient of this investment was Pendulum Therapeutics, a leading U.S. biotechnology company dedicated to advancing microbiome-targeted therapeutics with a focus on restoring metabolic health.

- January 2022: Hoogwegt and Royal A-ware established a long-term, strategic partnership aimed at marketing and distributing milk powders and creams produced by Royal A-ware. This alliance was strategically designed to enhance the core operations of both companies.

- August 2021: Milk Specialties Global completed the acquisition of the Kay's Processing facility in Minnesota, United States, spanning an impressive 96,000 square feet. Additionally, they acquired the renowned Kay's Naturals brand, known for its high-protein and gluten-free snack products. As part of this acquisition, the 11th facility within the company's portfolio was renamed the Milk Specialties Global Clara City Facility.

Future Outlook for North America Casein And Caseinate Market Market

The future outlook for the North American Casein and Caseinate market remains exceptionally bright, characterized by sustained growth and evolving opportunities. Key growth catalysts include the continuous rise in demand for protein-fortified foods and beverages, driven by increasing health and wellness trends and an aging population seeking nutritional support. Innovations in functional ingredients will unlock new applications in the rapidly expanding personalized nutrition and medical food sectors. Strategic partnerships and acquisitions are expected to shape the competitive landscape, fostering market consolidation and expanding global reach. The market's ability to adapt to evolving consumer preferences for clean labels and sustainable sourcing will be crucial for long-term success. Overall, the North American Casein and Caseinate market is poised for continued expansion, offering significant strategic opportunities for stakeholders who can leverage product innovation and address dynamic consumer demands.

North America Casein And Caseinate Market Segmentation

-

1. End-User

- 1.1. Animal Feed

- 1.2. Personal Care and Cosmetics

-

1.3. Food and Beverages

- 1.3.1. Bakery

- 1.3.2. Confectionery

- 1.3.3. Dairy and Dairy Alternative Products

- 1.3.4. RTE/RTC Food Products

- 1.3.5. Snacks

-

1.4. Supplements

- 1.4.1. Baby Food and Infant Formula

- 1.4.2. Elderly Nutrition and Medical Nutrition

- 1.4.3. Sport/Performance Nutrition

North America Casein And Caseinate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Casein And Caseinate Market Regional Market Share

Geographic Coverage of North America Casein And Caseinate Market

North America Casein And Caseinate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. High Competition From Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. Rising Consumer Awareness about Health and Fitness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Casein And Caseinate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Animal Feed

- 5.1.2. Personal Care and Cosmetics

- 5.1.3. Food and Beverages

- 5.1.3.1. Bakery

- 5.1.3.2. Confectionery

- 5.1.3.3. Dairy and Dairy Alternative Products

- 5.1.3.4. RTE/RTC Food Products

- 5.1.3.5. Snacks

- 5.1.4. Supplements

- 5.1.4.1. Baby Food and Infant Formula

- 5.1.4.2. Elderly Nutrition and Medical Nutrition

- 5.1.4.3. Sport/Performance Nutrition

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hoogwegt Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Milk Specialties Global

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arla Foods amba

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AMCO Proteins

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FrieslandCampina Ingredients

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tatua Co-operative Dairy Company Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kerry Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Farbest-Tallman Foods Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fonterra Co-operative Group Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Glanbia PLC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hoogwegt Group

List of Figures

- Figure 1: North America Casein And Caseinate Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Casein And Caseinate Market Share (%) by Company 2025

List of Tables

- Table 1: North America Casein And Caseinate Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 2: North America Casein And Caseinate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: North America Casein And Caseinate Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: North America Casein And Caseinate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States North America Casein And Caseinate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Casein And Caseinate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Casein And Caseinate Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Casein And Caseinate Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the North America Casein And Caseinate Market?

Key companies in the market include Hoogwegt Group, Milk Specialties Global, Arla Foods amba, AMCO Proteins, FrieslandCampina Ingredients, Tatua Co-operative Dairy Company Ltd, Kerry Group PLC, Farbest-Tallman Foods Corporation, Fonterra Co-operative Group Limited, Glanbia PLC*List Not Exhaustive.

3. What are the main segments of the North America Casein And Caseinate Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry.

6. What are the notable trends driving market growth?

Rising Consumer Awareness about Health and Fitness.

7. Are there any restraints impacting market growth?

High Competition From Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

July 2023: Fonterra made a significant investment of USD 10 million in the United States to support the development of microbiome-based personalized nutrition solutions. The recipient of this investment was Pendulum Therapeutics, a leading U.S. biotechnology company dedicated to advancing microbiome-targeted therapeutics with a focus on restoring metabolic health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Casein And Caseinate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Casein And Caseinate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Casein And Caseinate Market?

To stay informed about further developments, trends, and reports in the North America Casein And Caseinate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence