Key Insights

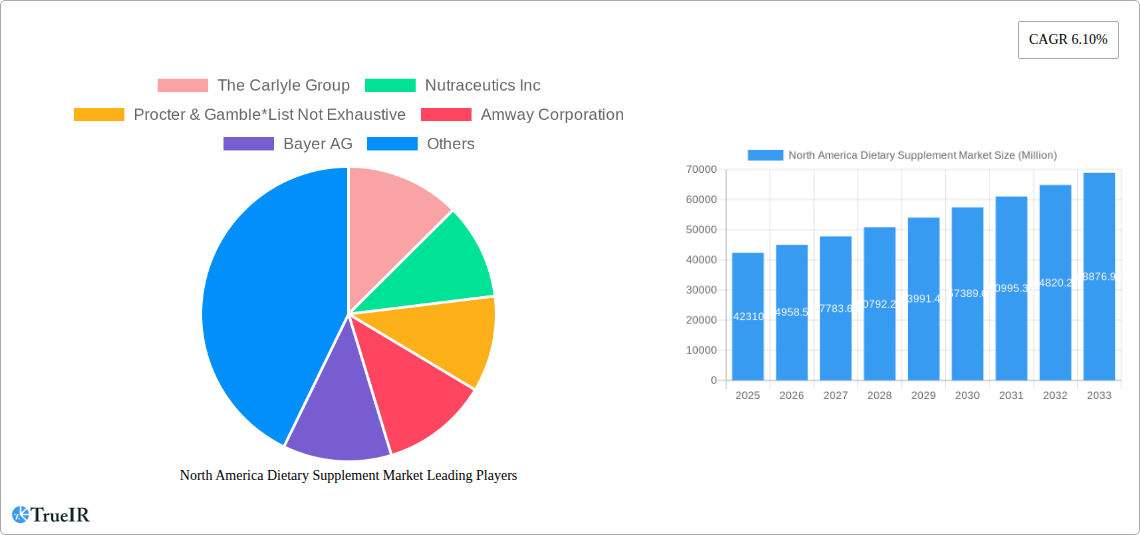

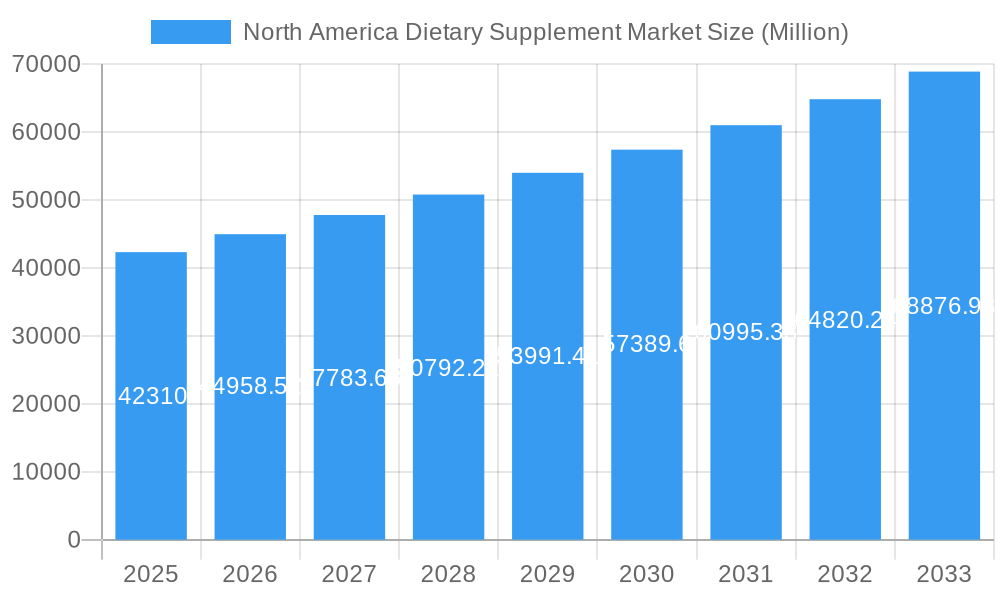

The North American dietary supplement market, valued at $42.31 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This expansion is driven by several key factors. Increasing health consciousness among consumers, coupled with a rising prevalence of chronic diseases like diabetes and heart disease, fuels demand for supplements to support overall well-being and address specific health concerns. The market's growth is further propelled by the increasing availability of diverse product formats, including convenient gummies and powders, catering to varied consumer preferences. Furthermore, the rise of e-commerce platforms has expanded distribution channels, making supplements more accessible to a wider consumer base. The market is segmented by product type (Vitamins & Minerals, Proteins & Amino Acids, Fatty Acids, Herbal Supplements, Enzymes, Other), form (Tablets, Capsules, Powder, Gummies, Other), and distribution channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail Stores, Other). Key players like The Carlyle Group, Nutraceutics Inc., Procter & Gamble, Amway Corporation, and others are actively shaping the market landscape through innovation and strategic acquisitions.

North America Dietary Supplement Market Market Size (In Billion)

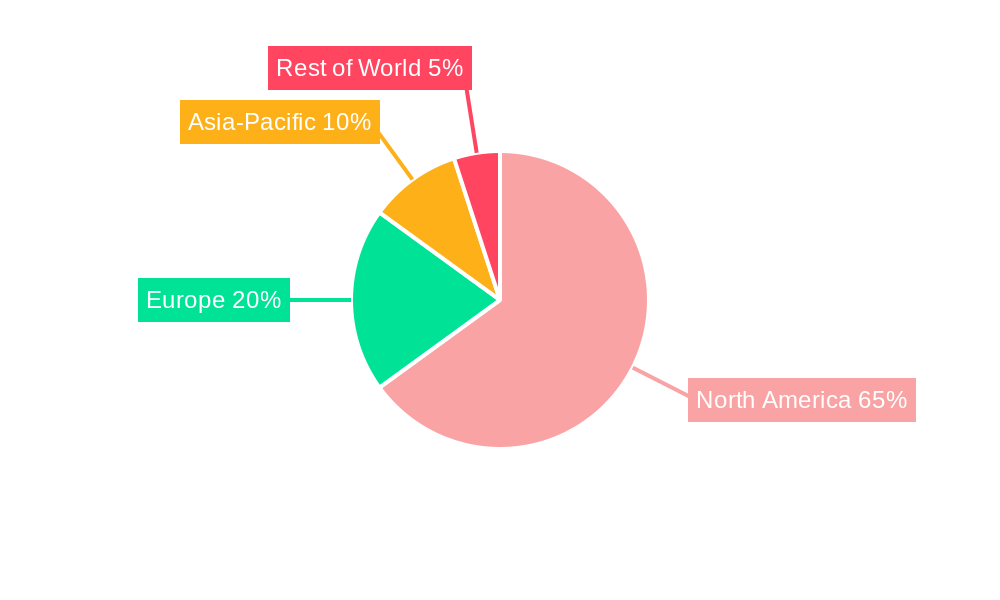

Within the North American region, the United States constitutes the largest market segment, followed by Canada and Mexico. Growth in this region is influenced by factors such as increased disposable income, rising awareness of preventative healthcare, and a strong regulatory framework ensuring product quality and safety. However, challenges remain, including concerns about product efficacy and safety regulations, and the potential for misleading marketing claims. The market is expected to witness increasing demand for specialized supplements targeting specific demographics, such as sports nutrition supplements and supplements catering to age-related health needs. This dynamic landscape necessitates continuous innovation and adaptation from market players to capitalize on the growth opportunities presented by this expanding sector.

North America Dietary Supplement Market Company Market Share

North America Dietary Supplement Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America dietary supplement market, offering valuable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market size, growth drivers, competitive dynamics, and future trends. The market is segmented by product type, form, and distribution channel, providing a granular understanding of market performance across various segments. Key players such as The Carlyle Group, Nutraceutics Inc, Procter & Gamble, Amway Corporation, Bayer AG, Glanbia PLC, Forest Remedies, Herbalife Nutrition, Abbott, and NOW Food are analyzed in detail.

North America Dietary Supplement Market Structure & Competitive Landscape

The North America dietary supplement market is characterized by a moderately concentrated structure, with a few large multinational corporations and numerous smaller players vying for market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is a crucial driver, with companies constantly introducing new products and formulations to cater to evolving consumer preferences and health trends. Regulatory scrutiny, including FDA guidelines and labeling requirements, significantly impacts market operations. Product substitutes, such as functional foods and fortified beverages, pose a competitive threat. The market is segmented based on end-users (e.g., age groups, health conditions), and M&A activity is relatively high, driven by the pursuit of economies of scale and technological advancements. The volume of M&A transactions in 2023 was approximately xx. Future market consolidation is anticipated, with large players aiming to dominate through acquisitions and expansion.

North America Dietary Supplement Market Market Trends & Opportunities

The North America dietary supplement market is experiencing robust growth, driven by increasing health awareness, rising disposable incomes, and expanding product offerings. The market size in 2024 was estimated at $xx Million and is projected to reach $xx Million by 2033, with a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as personalized nutrition and targeted supplement formulations, are transforming the market. Consumer preferences are shifting towards natural, organic, and sustainably sourced supplements. The market penetration rate for online retail channels continues to rise, driven by the convenience and accessibility of e-commerce platforms. The competitive landscape is dynamic, with companies focusing on product innovation, brand building, and strategic partnerships to enhance their market position.

Dominant Markets & Segments in North America Dietary Supplement Market

The United States remains the dominant market within North America, owing to its large population, high healthcare expenditure, and strong consumer demand for dietary supplements. Within the product type segment, vitamins and minerals hold the largest market share, followed by herbal supplements and protein and amino acids. The capsule and tablet forms dominate the market due to their convenience and ease of consumption. Supermarkets and hypermarkets are the primary distribution channels, followed by pharmacies and online retailers.

- Key Growth Drivers:

- Increasing health consciousness and preventative healthcare trends.

- Rising disposable incomes, enabling consumers to invest in health and wellness.

- Growing prevalence of chronic diseases, driving demand for nutritional support.

- Favorable regulatory environment, encouraging product innovation and market growth.

North America Dietary Supplement Market Product Analysis

The dietary supplement market showcases continuous product innovation, focusing on enhanced bioavailability, targeted formulations, and functional benefits. Advanced delivery systems like liposomal encapsulation and improved ingredient extraction methods are key technological advancements. Products are tailored to specific demographics and health needs, encompassing sports nutrition, immune support, cognitive enhancement, and weight management. Competitive advantages are often derived from unique formulations, proprietary ingredients, and strong brand recognition.

Key Drivers, Barriers & Challenges in North America Dietary Supplement Market

Key Drivers: The market is propelled by increasing health awareness, aging population, rising disposable incomes, and technological advancements in supplement formulation and delivery. Government initiatives promoting healthy lifestyles and rising consumer demand for convenient, effective products further bolster market growth.

Challenges: Stricter regulatory requirements, fluctuations in raw material prices, and intense competition are major hurdles. Supply chain disruptions and counterfeiting issues also pose significant threats to market stability and growth. The high cost of research and development for new products acts as a further challenge for smaller companies.

Growth Drivers in the North America Dietary Supplement Market Market

The market is driven by increasing health consciousness amongst consumers, the prevalence of chronic diseases demanding nutritional support, rising disposable incomes, and advancements in product formulation and delivery systems. Government initiatives supporting healthy lifestyles further fuel market growth.

Challenges Impacting North America Dietary Supplement Market Growth

Regulatory hurdles, including stringent labeling requirements and manufacturing standards, significantly impact market growth. Supply chain vulnerabilities, like raw material price fluctuations and potential disruptions, pose challenges. Intense competition and the high cost of research and development for new products constrain market expansion for some players.

Key Players Shaping the North America Dietary Supplement Market Market

- The Carlyle Group

- Nutraceutics Inc

- Procter & Gamble

- Amway Corporation

- Bayer AG

- Glanbia PLC

- Forest Remedies

- Herbalife Nutrition

- Abbott

- NOW Food

Significant North America Dietary Supplement Market Industry Milestones

- January 2024: Amway's Nutrilite brand emphasizes regenerative agriculture to ensure botanical supply and partners with farmers.

- January 2024: Chobani launches Chobani Creations Greek Yogurt, highlighting protein, calcium, probiotics, and amino acids.

- February 2024: Medella Springs Healthcare introduces AddiVance, a stimulant-free supplement for focus and impulse control, manufactured in FDA-registered facilities.

Future Outlook for North America Dietary Supplement Market Market

The North America dietary supplement market is poised for sustained growth, fueled by increasing health consciousness, technological innovations, and expanding product categories. Strategic partnerships, personalized nutrition solutions, and the continued rise of e-commerce will present significant opportunities for market expansion. The market is expected to experience a period of consolidation, with larger players potentially acquiring smaller competitors to achieve economies of scale and market dominance.

North America Dietary Supplement Market Segmentation

-

1. Product Type

- 1.1. Vitamins and Minerals

- 1.2. Proteins and Amino Acids

- 1.3. Fatty Acids

- 1.4. Herbal Supplements

- 1.5. Enzymes

- 1.6. Other Product Types

-

2. Form

- 2.1. Tablets

- 2.2. Capsules

- 2.3. Powder

- 2.4. Gummies

- 2.5. Other Forms

-

3. Distribution Channel

- 3.1. Supermarkets/hypermarkets

- 3.2. Pharmacies/drug Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Dietary Supplement Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Dietary Supplement Market Regional Market Share

Geographic Coverage of North America Dietary Supplement Market

North America Dietary Supplement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Increasing Focus on Maintaining Health and Well-Being

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Vitamins and Minerals

- 5.1.2. Proteins and Amino Acids

- 5.1.3. Fatty Acids

- 5.1.4. Herbal Supplements

- 5.1.5. Enzymes

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Tablets

- 5.2.2. Capsules

- 5.2.3. Powder

- 5.2.4. Gummies

- 5.2.5. Other Forms

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/hypermarkets

- 5.3.2. Pharmacies/drug Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Vitamins and Minerals

- 6.1.2. Proteins and Amino Acids

- 6.1.3. Fatty Acids

- 6.1.4. Herbal Supplements

- 6.1.5. Enzymes

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Tablets

- 6.2.2. Capsules

- 6.2.3. Powder

- 6.2.4. Gummies

- 6.2.5. Other Forms

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/hypermarkets

- 6.3.2. Pharmacies/drug Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Vitamins and Minerals

- 7.1.2. Proteins and Amino Acids

- 7.1.3. Fatty Acids

- 7.1.4. Herbal Supplements

- 7.1.5. Enzymes

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Tablets

- 7.2.2. Capsules

- 7.2.3. Powder

- 7.2.4. Gummies

- 7.2.5. Other Forms

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/hypermarkets

- 7.3.2. Pharmacies/drug Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Vitamins and Minerals

- 8.1.2. Proteins and Amino Acids

- 8.1.3. Fatty Acids

- 8.1.4. Herbal Supplements

- 8.1.5. Enzymes

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Tablets

- 8.2.2. Capsules

- 8.2.3. Powder

- 8.2.4. Gummies

- 8.2.5. Other Forms

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/hypermarkets

- 8.3.2. Pharmacies/drug Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Vitamins and Minerals

- 9.1.2. Proteins and Amino Acids

- 9.1.3. Fatty Acids

- 9.1.4. Herbal Supplements

- 9.1.5. Enzymes

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Tablets

- 9.2.2. Capsules

- 9.2.3. Powder

- 9.2.4. Gummies

- 9.2.5. Other Forms

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/hypermarkets

- 9.3.2. Pharmacies/drug Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Carlyle Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nutraceutics Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Procter & Gamble*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Amway Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bayer AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Glanbia PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Forest Remedies

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Herbalife Nutrition

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Abbott

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 NOW Food

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 The Carlyle Group

List of Figures

- Figure 1: North America Dietary Supplement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Dietary Supplement Market Share (%) by Company 2025

List of Tables

- Table 1: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 3: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Dietary Supplement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 8: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 13: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 18: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: North America Dietary Supplement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: North America Dietary Supplement Market Revenue Million Forecast, by Form 2020 & 2033

- Table 23: North America Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: North America Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: North America Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Dietary Supplement Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the North America Dietary Supplement Market?

Key companies in the market include The Carlyle Group, Nutraceutics Inc, Procter & Gamble*List Not Exhaustive, Amway Corporation, Bayer AG, Glanbia PLC, Forest Remedies, Herbalife Nutrition, Abbott, NOW Food.

3. What are the main segments of the North America Dietary Supplement Market?

The market segments include Product Type , Form , Distribution Channel , Geography .

4. Can you provide details about the market size?

The market size is estimated to be USD 42.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Increasing Focus on Maintaining Health and Well-Being.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

February 2024: Medella Springs Healthcare launched AddiVance, a stimulant-free dietary supplement to address common nutritional imbalances in individuals experiencing a lack of focus and impulsive behavior. The company claimed that the product is designed using high-quality ingredients, sourced at cGMP facilities, tested, and manufactured at FDA-registered facilities in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Dietary Supplement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Dietary Supplement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Dietary Supplement Market?

To stay informed about further developments, trends, and reports in the North America Dietary Supplement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence