Key Insights

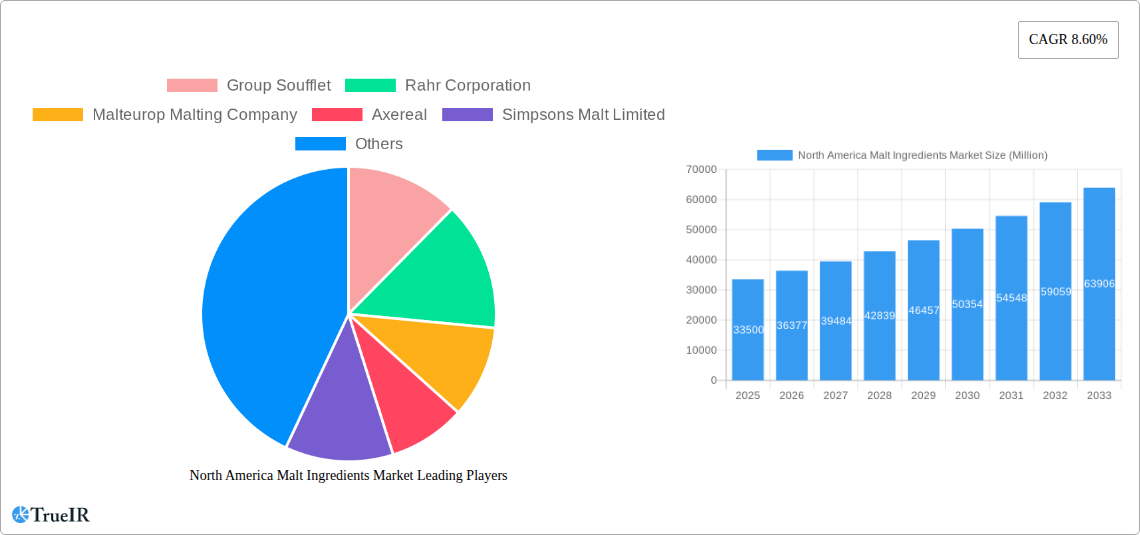

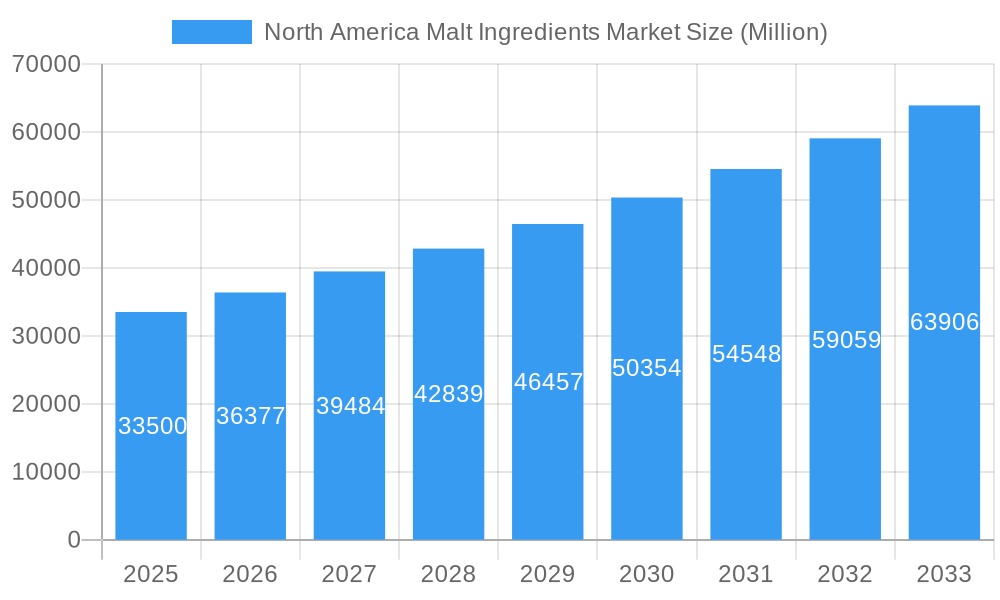

The North American malt ingredients market is poised for robust expansion, projected to reach a significant valuation driven by a compound annual growth rate (CAGR) of 8.60%. This dynamic growth is underpinned by the increasing demand for malt in its diverse applications, particularly within the beverage and food sectors. The market's current size, estimated at $33,500 million, signifies its substantial economic contribution and its integral role in various industrial processes. Key drivers fueling this expansion include the escalating consumer preference for premium and craft beverages, where malt is a foundational ingredient, and the growing adoption of malt-derived ingredients in functional foods and health-oriented products. Furthermore, advancements in malting technology and ingredient processing are leading to the development of specialized malt varieties, catering to niche market demands and encouraging innovation across the value chain. The United States, Canada, and Mexico represent key geographical markets within North America, each exhibiting unique consumption patterns and growth trajectories influenced by local culinary traditions and beverage industry trends.

North America Malt Ingredients Market Market Size (In Billion)

The market's upward trajectory is further supported by its versatile application spectrum, encompassing alcoholic and non-alcoholic beverages, food products, pharmaceuticals, and animal feed. While the beverage industry remains the primary consumer of malt ingredients, the expanding use in food processing, particularly in baking and confectionery, and the pharmaceutical sector for specific applications, are becoming increasingly significant growth contributors. Emerging trends such as the rise of plant-based diets, which often incorporate malted grains for texture and flavor enhancement, and the continued innovation in brewing and distilling techniques, are expected to sustain market momentum. Despite this optimistic outlook, potential restraints such as volatile raw material prices, particularly for barley and wheat, and increasing competition from alternative ingredients could present challenges. However, the inherent value and functional benefits of malt ingredients, coupled with ongoing research and development, are likely to outweigh these concerns, solidifying its position as a crucial component in the North American food and beverage landscape.

North America Malt Ingredients Market Company Market Share

North America Malt Ingredients Market: Comprehensive Analysis & Forecast (2019-2033)

Unlock unparalleled insights into the dynamic North American Malt Ingredients Market with this in-depth, SEO-optimized report. Discover current market structures, emerging trends, dominant segments, and future growth opportunities. This report leverages high-volume keywords to enhance search rankings and provide actionable intelligence for industry stakeholders.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

North America Malt Ingredients Market Market Structure & Competitive Landscape

The North America Malt Ingredients Market is characterized by a moderate to high level of concentration, with a significant presence of both multinational corporations and specialized ingredient suppliers. Key players like Cargill, Incorporated, AB InBev (Anheuser-Busch InBev), and GrainCorp Limited hold substantial market shares, driving consolidation through strategic acquisitions and mergers to expand their geographical reach and product portfolios. The market is fueled by innovation, with companies continuously investing in new technologies and production facilities to enhance efficiency and product quality. Regulatory landscapes, while generally supportive, can influence production standards and import/export dynamics. Product substitutes, such as alternative sweeteners and flavorings, pose a moderate threat, but the unique functional and sensory attributes of malt ingredients ensure their continued demand. End-user segmentation reveals a strong reliance on the alcoholic beverage sector, particularly the craft brewing revolution, followed by significant applications in food and non-alcoholic beverages. The competitive landscape is further shaped by the growing demand for specialty malts and sustainable sourcing practices.

- Market Concentration: Dominated by a few large players, with increasing activity in mergers and acquisitions.

- Innovation Drivers: Investment in new technologies, development of novel malt varieties, and focus on sustainability.

- Regulatory Impacts: Influence on production standards, food safety, and labeling requirements.

- Product Substitutes: Alternative sweeteners and flavor enhancers, though malt offers unique properties.

- End-User Segmentation: Alcoholic beverages (especially craft beer) lead, followed by food, non-alcoholic beverages, pharmaceuticals, and animal feed.

- M&A Trends: Acquisitions and mergers are key strategies for market consolidation and expansion.

North America Malt Ingredients Market Market Trends & Opportunities

The North America Malt Ingredients Market is experiencing robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and a thriving craft beverage industry. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.2% between 2025 and 2033, reaching an estimated value of over $7,500 million by the end of the forecast period. Technological shifts are playing a pivotal role, with manufacturers investing heavily in advanced malting processes that optimize enzyme activity, enhance flavor profiles, and improve nutrient extraction. This includes the adoption of precision fermentation techniques and novel kilning technologies. Consumer preferences are increasingly leaning towards natural, sustainably sourced ingredients, and products with unique flavor profiles. The burgeoning craft beer movement continues to be a significant demand driver, with craft breweries actively seeking specialty malt ingredients to differentiate their offerings and create innovative beer styles. This has led to a surge in demand for a wider variety of malt types, including caramel, chocolate, and roasted malts, catering to diverse brewing needs. Furthermore, the growing awareness of health and wellness is spurring innovation in non-alcoholic beverages and functional foods, creating new avenues for malt ingredient applications. Opportunities lie in developing malt-based ingredients for health-conscious consumers, such as those with enhanced nutritional profiles or lower glycemic indices. The pharmaceutical industry also presents a niche but growing segment, utilizing malt extracts as excipients and active ingredients. The ongoing expansion of the animal feed sector, driven by demand for high-quality animal nutrition, further bolsters the market. Strategic partnerships between malt suppliers and end-users, particularly craft breweries and food manufacturers, are becoming crucial for co-creating innovative products and ensuring a stable supply chain. The market penetration rates for malt ingredients are expected to deepen across various sectors as awareness of their versatility and benefits grows.

Dominant Markets & Segments in North America Malt Ingredients Market

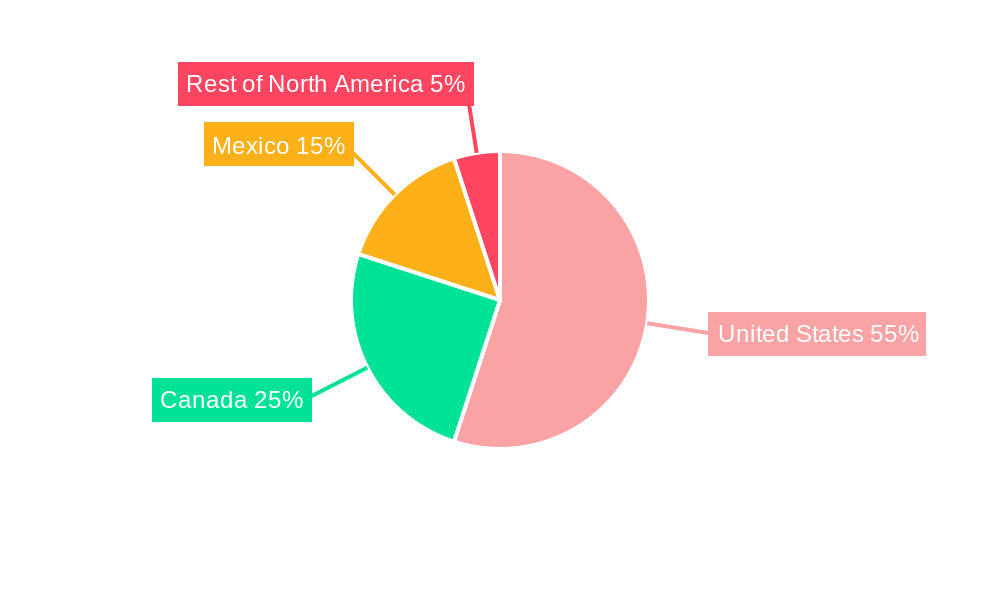

The United States stands as the dominant market within the North American Malt Ingredients landscape, accounting for an estimated 65% of the total market value in 2025, projected to reach over $4,800 million. This dominance is underpinned by a highly developed brewing industry, a burgeoning craft beverage scene, and a large consumer base with diverse food and beverage preferences. The country's extensive agricultural infrastructure, particularly for barley cultivation, further solidifies its leading position.

Source: Barley is overwhelmingly the dominant source of malt ingredients in North America, representing an estimated 80% of the market share in 2025, valued at over $6,000 million. This is primarily due to barley's ideal grain structure and enzymatic properties for malting, making it the foundational ingredient for most beers and many food products.

Application: Alcoholic Beverages continue to be the largest application segment, commanding an estimated 70% of the market in 2025, projected to exceed $5,200 million. The robust beer market, driven by both large-scale producers and the ever-expanding craft brewery sector, is the primary consumer. The demand for diverse malt profiles for lagers, ales, stouts, and specialty beers fuels this segment's growth.

- Key Growth Drivers (United States):

- Strong presence of major brewing companies and a vibrant craft beer culture.

- Extensive agricultural land for barley cultivation and advanced processing facilities.

- High consumer spending on alcoholic and non-alcoholic beverages, and processed foods.

- Supportive government policies related to agriculture and food production.

Canada and Mexico represent significant secondary markets, with Canada contributing an estimated 20% and Mexico 10% to the regional market share in 2025. Canada benefits from its own significant barley production and a well-established brewing industry. Mexico, while historically less focused on malt-based beverages, is witnessing growth in its beer sector and increasing adoption of malt ingredients in its expanding food processing industry. The "Rest of North America" segment, though smaller, is expected to witness gradual growth driven by niche applications and emerging markets.

Source: Wheat is the second-largest source, capturing an estimated 15% of the market share in 2025, valued at over $1,100 million. Wheat malt is crucial for specific beer styles, particularly those requiring lighter bodies and head retention, and is also used in certain food applications.

Other Sources, including rye and other grains, constitute a smaller but growing segment, estimated at 5% in 2025, valued at over $375 million. These are often utilized for specialty applications and to impart unique flavor profiles.

Application: Foods is the second-largest application, estimated at 15% in 2025, valued at over $1,100 million. Malt extracts and flours are used in a wide array of baked goods, cereals, confectionery, and savory products for flavor, color, and texture enhancement.

Non-alcoholic beverages represent an emerging segment with an estimated 7% market share in 2025, valued at over $525 million. Malt-based beverages, fortified drinks, and malted milk alternatives are gaining traction.

Pharmaceuticals and Animal Feed represent niche but stable segments, each accounting for an estimated 2% and 1% of the market share, respectively, in 2025. Malt is utilized in pharmaceutical formulations for its nutritional and medicinal properties, and in animal feed for its digestibility and nutrient content.

North America Malt Ingredients Market Product Analysis

The North America Malt Ingredients Market is characterized by a diverse and evolving product portfolio driven by technological advancements and shifting consumer demands. Key innovations revolve around developing malts with enhanced enzymatic activity, improved fermentability, and unique flavor profiles such as roasted, caramel, and chocolate malts. These advancements cater specifically to the demands of the craft brewing industry, allowing for greater creativity in beer production. Furthermore, the market is seeing a rise in specialty malt extracts and functional malt ingredients designed for food and beverage applications, offering natural sweetness, color, and nutritional benefits. Product development is increasingly focused on sustainability, with an emphasis on traceable sourcing and eco-friendly processing methods. This ensures that malt ingredients not only meet the functional and sensory requirements of diverse applications but also align with growing consumer concerns about environmental impact.

Key Drivers, Barriers & Challenges in North America Malt Ingredients Market

Key Drivers: The North American Malt Ingredients Market is propelled by several key factors. The booming craft beer industry is a significant growth engine, demanding a wider variety of specialty malts for unique flavor profiles. Technological advancements in malting processes enhance efficiency and product quality. Growing consumer preference for natural and sustainably sourced ingredients supports the market. Expansion in the food and beverage sector, particularly in areas like baked goods and non-alcoholic beverages, provides new application opportunities. Furthermore, increasing demand for high-quality animal feed ingredients contributes to market growth.

Barriers & Challenges: Despite robust growth, the market faces several challenges. Fluctuations in raw material prices, particularly barley, due to weather conditions and global supply chain disruptions, can impact profitability. Stringent regulations regarding food safety and labeling add to operational complexities. Intense competition among established players and the emergence of new entrants can lead to price pressures. The availability of alternative sweeteners and flavor enhancers in some food applications poses a competitive threat. Additionally, the carbon footprint associated with grain cultivation and processing is an increasing concern, necessitating investment in sustainable practices.

Growth Drivers in the North America Malt Ingredients Market Market

The North America Malt Ingredients Market is propelled by the ever-expanding craft beer sector, which consistently demands innovative and diverse malt profiles to create unique brews. Technological advancements in malting processes, including precision temperature control and enzyme optimization, are enhancing ingredient quality and efficiency, leading to growth. A strong consumer trend towards natural and sustainably sourced ingredients is driving demand for malt, perceived as a wholesome and traditional ingredient. Furthermore, the increasing use of malt extracts and derivatives in the food and beverage industry, for natural flavoring and coloring, and the steady growth in the animal feed sector for improved animal nutrition, are significant growth catalysts. Government policies supporting agricultural innovation and food processing also contribute positively.

Challenges Impacting North America Malt Ingredients Market Growth

The North America Malt Ingredients Market faces several hurdles that could impede growth. Volatility in the price and availability of key raw materials, especially barley, due to climate change and geopolitical factors, presents a significant challenge. Stringent regulatory requirements related to food safety, quality control, and traceability necessitate continuous investment in compliance. Intense competition among numerous suppliers, including large corporations and smaller specialty maltsters, can lead to price erosion and reduced profit margins. The development and adoption of alternative ingredients in certain food and beverage applications, although not direct substitutes for all malt functions, can also pose a competitive pressure. Supply chain disruptions, from farming to processing and distribution, can lead to increased costs and delays.

Key Players Shaping the North America Malt Ingredients Market Market

- Cargill, Incorporated

- AB InBev (Anheuser-Busch InBev)

- Group Soufflet

- Rahr Corporation

- Malteurop Malting Company

- Axereal

- Simpsons Malt Limited

- Muntons PLC

- GrainCorp Limited

- Briess Malt & Ingredients Co.

Significant North America Malt Ingredients Market Industry Milestones

- 2021: Cargill, Incorporated announces significant investment in new malting facilities in Canada to expand its North American capacity and cater to growing demand, particularly from the craft beverage sector.

- 2022: AB InBev (Anheuser-Busch InBev) collaborates with a leading agricultural research institute to develop new malt varieties with enhanced sustainability metrics and improved disease resistance, impacting future supply chains.

- 2022: Malteurop Malting Company acquires a smaller regional malt producer in the United States, consolidating its market share and expanding its geographical footprint.

- 2023: Strategic partnerships between Axereal and several prominent craft breweries across the US are formed to co-develop bespoke malt ingredients for limited-edition beer releases, highlighting market customization.

- 2023: Muntons PLC achieves significant sustainability certifications for its malting operations in North America, emphasizing reduced water usage and carbon emissions, influencing industry standards.

- 2024: Simpsons Malt Limited launches a new line of innovative malt flavors, including a smoked malt and a naturally sweet malt, designed to meet the evolving palates of brewers and food manufacturers.

- 2024: GrainCorp Limited announces strategic investments in advanced drying and storage technologies to improve the quality and shelf-life of malt ingredients, addressing supply chain resilience.

Future Outlook for North America Malt Ingredients Market Market

The North America Malt Ingredients Market is poised for continued strong growth, driven by persistent demand from the alcoholic and non-alcoholic beverage sectors, particularly the dynamic craft beer industry. Opportunities lie in further product innovation, focusing on health-beneficial malt ingredients, novel flavors, and improved functional properties for food applications. The increasing emphasis on sustainability will drive investment in eco-friendly production methods and certifications, creating a competitive advantage. Strategic partnerships between malt suppliers and end-users will deepen, fostering innovation and market penetration. The market is expected to witness continued consolidation through mergers and acquisitions, leading to a more streamlined competitive landscape. Growth catalysts include the expanding use of malt in emerging food categories and the potential for increased utilization in pharmaceutical and nutraceutical applications.

North America Malt Ingredients Market Segmentation

-

1. Source

- 1.1. Barley

- 1.2. Wheat

- 1.3. Other Sources

-

2. Application

- 2.1. Alcoholic beverages

- 2.2. Non-alcoholic beverages

- 2.3. Foods

- 2.4. Pharmaceuticals

- 2.5. Animal Feed

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Malt Ingredients Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Malt Ingredients Market Regional Market Share

Geographic Coverage of North America Malt Ingredients Market

North America Malt Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods

- 3.3. Market Restrains

- 3.3.1. Potential Side-effects of Yeast

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Craft Beer to Contribute Towards the Escalated Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Malt Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Barley

- 5.1.2. Wheat

- 5.1.3. Other Sources

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Alcoholic beverages

- 5.2.2. Non-alcoholic beverages

- 5.2.3. Foods

- 5.2.4. Pharmaceuticals

- 5.2.5. Animal Feed

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. United States North America Malt Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Barley

- 6.1.2. Wheat

- 6.1.3. Other Sources

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Alcoholic beverages

- 6.2.2. Non-alcoholic beverages

- 6.2.3. Foods

- 6.2.4. Pharmaceuticals

- 6.2.5. Animal Feed

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Canada North America Malt Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Barley

- 7.1.2. Wheat

- 7.1.3. Other Sources

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Alcoholic beverages

- 7.2.2. Non-alcoholic beverages

- 7.2.3. Foods

- 7.2.4. Pharmaceuticals

- 7.2.5. Animal Feed

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Mexico North America Malt Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Barley

- 8.1.2. Wheat

- 8.1.3. Other Sources

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Alcoholic beverages

- 8.2.2. Non-alcoholic beverages

- 8.2.3. Foods

- 8.2.4. Pharmaceuticals

- 8.2.5. Animal Feed

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Rest of North America North America Malt Ingredients Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Barley

- 9.1.2. Wheat

- 9.1.3. Other Sources

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Alcoholic beverages

- 9.2.2. Non-alcoholic beverages

- 9.2.3. Foods

- 9.2.4. Pharmaceuticals

- 9.2.5. Animal Feed

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Group Soufflet

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rahr Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Malteurop Malting Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Axereal

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Simpsons Malt Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Muntons PLC*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 GrainCorp Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cargill Incorporated

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Briess Malt & Ingredients Co.

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AB InBev (Anheuser-Busch InBev)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Group Soufflet

List of Figures

- Figure 1: North America Malt Ingredients Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Malt Ingredients Market Share (%) by Company 2025

List of Tables

- Table 1: North America Malt Ingredients Market Revenue Million Forecast, by Source 2020 & 2033

- Table 2: North America Malt Ingredients Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 3: North America Malt Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Malt Ingredients Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: North America Malt Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Malt Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: North America Malt Ingredients Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Malt Ingredients Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: North America Malt Ingredients Market Revenue Million Forecast, by Source 2020 & 2033

- Table 10: North America Malt Ingredients Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 11: North America Malt Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: North America Malt Ingredients Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: North America Malt Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: North America Malt Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: North America Malt Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Malt Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: North America Malt Ingredients Market Revenue Million Forecast, by Source 2020 & 2033

- Table 18: North America Malt Ingredients Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 19: North America Malt Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: North America Malt Ingredients Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: North America Malt Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North America Malt Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: North America Malt Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Malt Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: North America Malt Ingredients Market Revenue Million Forecast, by Source 2020 & 2033

- Table 26: North America Malt Ingredients Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 27: North America Malt Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: North America Malt Ingredients Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: North America Malt Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: North America Malt Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: North America Malt Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: North America Malt Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: North America Malt Ingredients Market Revenue Million Forecast, by Source 2020 & 2033

- Table 34: North America Malt Ingredients Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 35: North America Malt Ingredients Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: North America Malt Ingredients Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 37: North America Malt Ingredients Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: North America Malt Ingredients Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: North America Malt Ingredients Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: North America Malt Ingredients Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Malt Ingredients Market?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the North America Malt Ingredients Market?

Key companies in the market include Group Soufflet, Rahr Corporation, Malteurop Malting Company, Axereal, Simpsons Malt Limited, Muntons PLC*List Not Exhaustive, GrainCorp Limited , Cargill, Incorporated , Briess Malt & Ingredients Co. , AB InBev (Anheuser-Busch InBev).

3. What are the main segments of the North America Malt Ingredients Market?

The market segments include Source, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 33500 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods.

6. What are the notable trends driving market growth?

Growing Popularity of Craft Beer to Contribute Towards the Escalated Market Growth.

7. Are there any restraints impacting market growth?

Potential Side-effects of Yeast.

8. Can you provide examples of recent developments in the market?

Acquisitions and mergers to consolidate market share

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Malt Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Malt Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Malt Ingredients Market?

To stay informed about further developments, trends, and reports in the North America Malt Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence