Key Insights

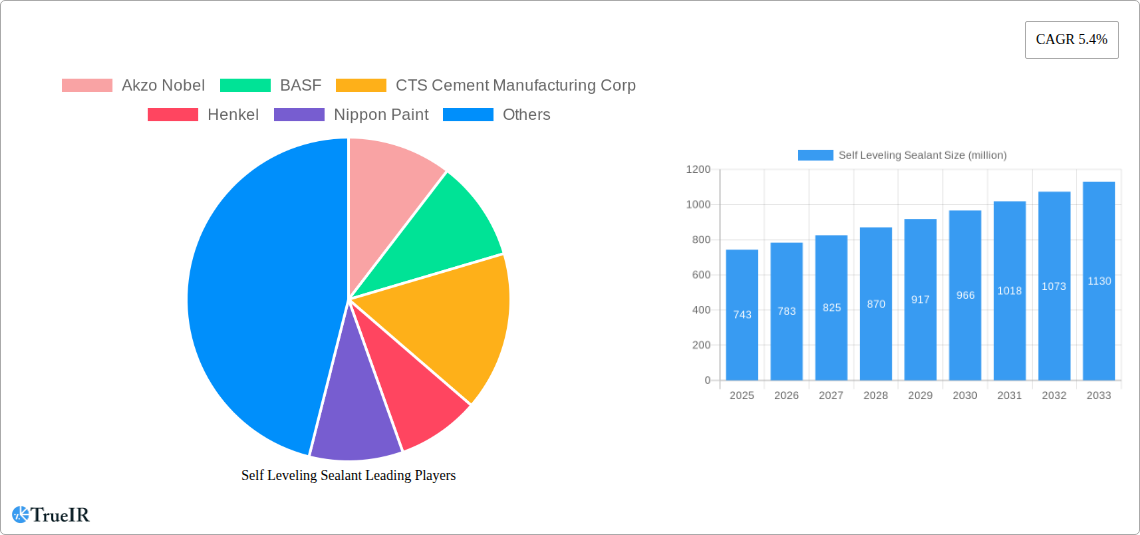

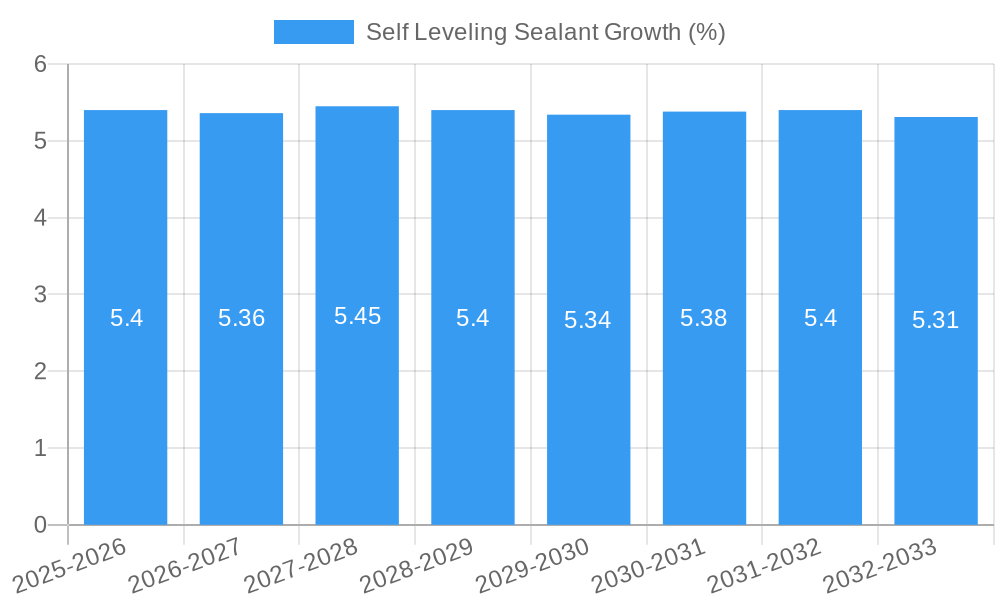

The global Self-Leveling Sealant market is poised for robust growth, projected to reach a significant market size by the end of the study period. Driven by increasing construction activities and a growing demand for durable, high-performance sealing solutions across residential and commercial sectors, the market is expected to expand at a Compound Annual Growth Rate (CAGR) of 5.4% from 2025 to 2033. The inherent properties of self-leveling sealants, such as ease of application, superior gap-filling capabilities, and long-term performance, make them indispensable in modern construction and renovation projects. Key applications include creating seamless finishes in flooring, preventing water ingress in expansion joints, and providing sound dampening. The residential segment, fueled by new home construction and extensive renovation projects, is a primary growth engine. Simultaneously, the commercial sector, encompassing large-scale infrastructure, retail spaces, and office buildings, presents substantial opportunities due to the need for reliable and aesthetically pleasing sealing solutions.

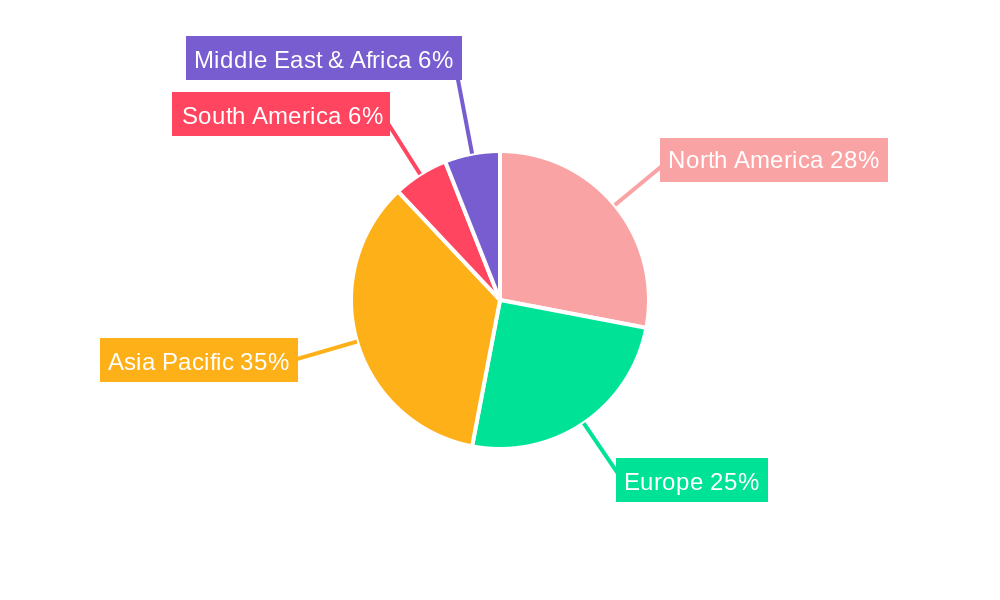

The market's expansion is further bolstered by advancements in material science, leading to the development of innovative polyurethane and epoxy resin-based sealants that offer enhanced durability, flexibility, and adhesion. These advancements cater to evolving industry requirements for specialized applications. However, the market also faces certain restraints, including the relatively higher cost compared to conventional sealants and the need for precise surface preparation to ensure optimal performance. Geographically, Asia Pacific is anticipated to emerge as a dominant region, driven by rapid urbanization and significant infrastructure development in countries like China and India. North America and Europe are also expected to maintain a strong market presence, supported by stringent building codes and a mature construction industry prioritizing quality and longevity. Emerging economies in the Middle East and Africa present untapped potential for future growth as construction sectors mature.

Self Leveling Sealant Market Structure & Competitive Landscape

The global self-leveling sealant market, projected to reach millions in value by 2033, is characterized by a moderately fragmented structure. Leading players like Akzo Nobel, BASF, CTS Cement Manufacturing Corp, Henkel, Nippon Paint, Novalink, PPG, QUIKRETE, Sherwin-Williams, Sika, TCC Materials, 3M hold significant market shares. Innovation is a key driver, with companies investing millions in R&D for advanced formulations offering enhanced durability, faster curing times, and superior adhesion across diverse substrates. Regulatory impacts, primarily concerning environmental standards and VOC emissions, are increasingly shaping product development, pushing manufacturers towards greener solutions. Product substitutes, such as traditional sealants and caulks, exist but often lack the self-leveling property, a critical differentiator. End-user segmentation sees strong demand from Residential and Commercial applications, driven by new construction and renovation projects valued at millions annually. Mergers and acquisitions (M&A) activity, valued at millions over the historical period, has played a role in market consolidation, with notable transactions focused on expanding geographical reach and acquiring complementary technologies. The concentration ratio for the top 5 players is estimated at xx%, indicating room for further market evolution.

Self Leveling Sealant Market Trends & Opportunities

The self-leveling sealant market is poised for robust expansion, driven by sustained demand from the construction industry and advancements in material science. The global market size is estimated to reach millions by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period of 2025–2033. This growth is underpinned by a rising trend in infrastructure development across both developed and emerging economies, where these sealants are crucial for ensuring watertight and durable joints in flooring, tiling, and concrete applications. Technological shifts are also playing a pivotal role. Manufacturers are actively developing advanced formulations incorporating nanotechnology for enhanced performance, improved crack resistance, and extended lifespan, catering to the growing preference for high-performance building materials. The market penetration rate in key regions is expected to climb as awareness of the benefits of self-leveling sealants, such as ease of application and superior finish, increases among contractors and DIY enthusiasts. Consumer preferences are leaning towards sustainable and low-VOC (Volatile Organic Compound) products, creating significant opportunities for companies that can offer eco-friendly solutions. The Commercial segment, in particular, is witnessing substantial growth due to the increasing number of large-scale construction projects, including commercial complexes, healthcare facilities, and educational institutions, where stringent performance requirements necessitate the use of advanced sealing solutions. The Residential segment also contributes significantly, fueled by ongoing renovation activities and new housing construction, with homeowners increasingly seeking durable and aesthetically pleasing solutions. The Others segment, encompassing industrial applications and specialized infrastructure projects, is also showing promising growth, driven by unique performance demands. The competitive dynamics are characterized by ongoing product innovation, strategic partnerships, and price competition, pushing market players to constantly refine their offerings. The study period from 2019 to 2033, with a base year of 2025, provides a comprehensive view of historical trends and future projections. The estimated year of 2025 further solidifies the current market standing. The historical period of 2019–2024 showcases a steady upward trajectory, laying the foundation for the projected future growth. The increasing urbanization and a surge in the construction of high-rise buildings are creating further demand for specialized sealants that can accommodate the dynamic structural movements of such constructions, a niche where self-leveling sealants excel. Furthermore, the growing focus on building energy efficiency is driving the adoption of sealants that contribute to improved insulation and reduced air leakage, areas where advanced self-leveling formulations can offer significant advantages. The market is also observing a trend towards customized solutions, with manufacturers developing specialized products for specific applications and environmental conditions, thereby expanding the market's addressable scope.

Dominant Markets & Segments in Self Leveling Sealant

The global self-leveling sealant market's dominance is clearly defined by regional strengths and segment preferences. North America, particularly the United States, emerges as the leading region, driven by its mature construction industry, extensive infrastructure development, and high adoption rate of advanced building materials. The country's robust Commercial construction sector, characterized by the development of skyscrapers, shopping malls, and industrial facilities valued at over millions annually, consistently fuels demand for high-performance sealants. Government initiatives promoting green building practices and energy efficiency further bolster the market.

Key Growth Drivers in Dominant Regions/Countries:

- Infrastructure Investment: Significant government spending on roads, bridges, and public utilities, amounting to millions in 2025, directly translates to demand for durable sealing solutions.

- Renovation and Retrofitting: A substantial market exists for upgrading existing structures, with homeowners and businesses investing millions in improvements that often include flooring and joint sealing.

- Technological Adoption: The widespread acceptance and implementation of advanced construction techniques and materials, including self-leveling sealants, are pivotal.

The Commercial application segment stands as the most dominant segment, accounting for an estimated xx% of the global market share. This is attributed to the sheer scale of commercial projects, the stringent performance requirements in these environments, and the substantial investments involved, which often exceed millions per project.

Dominant Segments & Their Growth Catalysts:

- Commercial Applications:

- Growth Drivers: Increased construction of retail spaces, office buildings, hospitals, and educational institutions. Emphasis on durability, aesthetic finish, and long-term performance in high-traffic areas. Investments in commercial real estate are in the millions.

- Market Penetration: Expected to reach xx% by 2033.

- Residential Applications:

- Growth Drivers: Ongoing new home construction and a burgeoning renovation market. Rising disposable incomes leading to investments in home improvements. Growing demand for aesthetically pleasing and low-maintenance flooring solutions. The Residential construction market is valued at millions.

- Market Penetration: Expected to reach xx% by 2033.

- Others (Industrial & Specialized):

- Growth Drivers: Demand from specialized industrial floors (e.g., food processing, pharmaceutical), repair of existing infrastructure, and niche construction projects requiring specific sealant properties. The value of specialized construction projects can be in the millions.

- Market Penetration: Expected to reach xx% by 2033.

In terms of product type, Polyurethane Component based self-leveling sealants hold a significant market share, favored for their flexibility, abrasion resistance, and excellent adhesion to a variety of substrates. These are widely used in both Residential and Commercial applications valued at millions. The Epoxy Resin Component segment is also substantial, particularly in industrial settings where high chemical resistance and strength are paramount, with associated project values in the millions. The Others category, encompassing silicone-based and hybrid formulations, is gaining traction due to its adaptability and specialized properties. The market for these specialized sealants is also valued in the millions.

Self Leveling Sealant Product Analysis

Self-leveling sealants are witnessing significant product innovation, with manufacturers focusing on enhanced performance characteristics and ease of application. Advancements include faster curing times, improved UV resistance, and superior adhesion to a wider range of building materials, crucial for projects valued in the millions. The development of low-VOC and eco-friendly formulations addresses growing environmental concerns. These products offer competitive advantages through their ability to create smooth, seamless finishes, reduce labor costs, and provide long-lasting protection against moisture and chemical ingress. The market fit is strong for applications requiring a perfect aesthetic and structural integrity, from expansive commercial floors to residential kitchens and bathrooms, with significant market potential in the millions.

Key Drivers, Barriers & Challenges in Self Leveling Sealant

Key Drivers:

- Robust Construction Activity: Continued growth in global construction, particularly in infrastructure and commercial development, valued at millions, fuels demand.

- Technological Advancements: Development of faster-curing, more durable, and eco-friendly formulations attracts wider adoption.

- Increasing Demand for Aesthetics and Performance: Consumers and specifiers are seeking seamless, durable, and visually appealing sealing solutions.

- Government Initiatives: Favorable regulations and incentives promoting energy-efficient and sustainable building practices.

Barriers & Challenges:

- High Initial Cost: Compared to traditional sealants, self-leveling variants can have a higher upfront cost, impacting adoption in price-sensitive markets.

- Supply Chain Disruptions: Global supply chain volatilities can affect the availability and cost of raw materials, with potential impacts on production valued in the millions.

- Skilled Labor Requirements: Proper application requires some degree of expertise, and a shortage of skilled applicators can pose a challenge.

- Competition from Substitutes: While offering unique benefits, competition from conventional sealants and caulks persists, particularly in less demanding applications. The market value of competing products is in the millions.

- Regulatory Hurdles: Evolving environmental regulations in different regions can necessitate costly product reformulation and compliance testing, adding to operational expenses.

Growth Drivers in the Self Leveling Sealant Market

The self-leveling sealant market's growth is primarily propelled by the unyielding expansion of the global construction sector, with ongoing infrastructure projects and commercial developments contributing millions in investment. Technological innovation remains a significant catalyst, with manufacturers continuously introducing advanced formulations that offer superior performance characteristics such as faster curing times, enhanced durability, and improved environmental profiles. The increasing consumer and specifier demand for high-quality finishes and long-lasting sealing solutions further fuels market penetration. Supportive government policies, particularly those advocating for green building standards and energy efficiency, create a favorable regulatory environment for advanced sealant solutions.

Challenges Impacting Self Leveling Sealant Growth

Despite its promising trajectory, the self-leveling sealant market faces several significant challenges. Regulatory complexities, particularly concerning VOC emissions and product safety standards in different jurisdictions, can necessitate costly product reformulation and compliance efforts, impacting market entry and expansion. Persistent supply chain issues, exacerbated by global economic fluctuations and geopolitical events, can disrupt the availability and increase the cost of essential raw materials, potentially affecting production volumes worth millions. Intense competitive pressures from both established players and emerging manufacturers, coupled with the ongoing availability of lower-cost traditional sealants, can lead to price wars and reduced profit margins, especially in price-sensitive segments. The requirement for specialized application techniques can also limit adoption in regions with a scarcity of skilled labor.

Key Players Shaping the Self Leveling Sealant Market

- Akzo Nobel

- BASF

- CTS Cement Manufacturing Corp

- Henkel

- Nippon Paint

- Novalink

- PPG

- QUIKRETE

- Sherwin-Williams

- Sika

- TCC Materials

- 3M

Significant Self Leveling Sealant Industry Milestones

- 2019: Introduction of advanced low-VOC polyurethane self-leveling sealants, addressing growing environmental regulations.

- 2020: Major players invest millions in R&D for faster-curing epoxy resin-based sealants for industrial applications.

- 2021: Several mergers and acquisitions consolidate market share, with deals valued in the millions, focusing on expanding product portfolios.

- 2022: Launch of a new generation of hybrid self-leveling sealants offering enhanced flexibility and adhesion to diverse substrates.

- 2023: Increased adoption of self-leveling sealants in residential renovation projects driven by DIY trends and aesthetic preferences.

- 2024: Development of nanotech-enhanced self-leveling sealants with superior wear resistance and longevity, targeting high-traffic commercial spaces.

Future Outlook for Self Leveling Sealant Market

- 2019: Introduction of advanced low-VOC polyurethane self-leveling sealants, addressing growing environmental regulations.

- 2020: Major players invest millions in R&D for faster-curing epoxy resin-based sealants for industrial applications.

- 2021: Several mergers and acquisitions consolidate market share, with deals valued in the millions, focusing on expanding product portfolios.

- 2022: Launch of a new generation of hybrid self-leveling sealants offering enhanced flexibility and adhesion to diverse substrates.

- 2023: Increased adoption of self-leveling sealants in residential renovation projects driven by DIY trends and aesthetic preferences.

- 2024: Development of nanotech-enhanced self-leveling sealants with superior wear resistance and longevity, targeting high-traffic commercial spaces.

Future Outlook for Self Leveling Sealant Market

The future outlook for the self-leveling sealant market is exceptionally bright, propelled by continued global construction growth and an unwavering focus on performance and sustainability. Strategic opportunities lie in the development of smart sealants with integrated sensor capabilities and the expansion of product lines catering to niche industrial applications. The growing demand for sustainable building materials will drive innovation in bio-based and recycled content sealants. Increased investment in emerging economies, coupled with the rising adoption of advanced construction technologies, presents significant potential for market expansion, with the market value projected to reach millions by 2033.

Self Leveling Sealant Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Others

-

2. Type

- 2.1. Polyurethane Component

- 2.2. Epoxy Resin Component

- 2.3. Others

Self Leveling Sealant Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Self Leveling Sealant REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self Leveling Sealant Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Polyurethane Component

- 5.2.2. Epoxy Resin Component

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Self Leveling Sealant Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Polyurethane Component

- 6.2.2. Epoxy Resin Component

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Self Leveling Sealant Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Polyurethane Component

- 7.2.2. Epoxy Resin Component

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Self Leveling Sealant Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Polyurethane Component

- 8.2.2. Epoxy Resin Component

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Self Leveling Sealant Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Polyurethane Component

- 9.2.2. Epoxy Resin Component

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Self Leveling Sealant Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Polyurethane Component

- 10.2.2. Epoxy Resin Component

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Akzo Nobel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASF

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CTS Cement Manufacturing Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Henkel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nippon Paint

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Novalink

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PPG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 QUIKRETE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sherwin-Williams

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sika

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TCC Materials

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 3M

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Akzo Nobel

List of Figures

- Figure 1: Global Self Leveling Sealant Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Self Leveling Sealant Revenue (million), by Application 2024 & 2032

- Figure 3: North America Self Leveling Sealant Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Self Leveling Sealant Revenue (million), by Type 2024 & 2032

- Figure 5: North America Self Leveling Sealant Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Self Leveling Sealant Revenue (million), by Country 2024 & 2032

- Figure 7: North America Self Leveling Sealant Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Self Leveling Sealant Revenue (million), by Application 2024 & 2032

- Figure 9: South America Self Leveling Sealant Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Self Leveling Sealant Revenue (million), by Type 2024 & 2032

- Figure 11: South America Self Leveling Sealant Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Self Leveling Sealant Revenue (million), by Country 2024 & 2032

- Figure 13: South America Self Leveling Sealant Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Self Leveling Sealant Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Self Leveling Sealant Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Self Leveling Sealant Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Self Leveling Sealant Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Self Leveling Sealant Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Self Leveling Sealant Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Self Leveling Sealant Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Self Leveling Sealant Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Self Leveling Sealant Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Self Leveling Sealant Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Self Leveling Sealant Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Self Leveling Sealant Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Self Leveling Sealant Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Self Leveling Sealant Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Self Leveling Sealant Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Self Leveling Sealant Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Self Leveling Sealant Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Self Leveling Sealant Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Self Leveling Sealant Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Self Leveling Sealant Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Self Leveling Sealant Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Self Leveling Sealant Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Self Leveling Sealant Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Self Leveling Sealant Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Self Leveling Sealant Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Self Leveling Sealant Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Self Leveling Sealant Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Self Leveling Sealant Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Self Leveling Sealant Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Self Leveling Sealant Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Self Leveling Sealant Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Self Leveling Sealant Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Self Leveling Sealant Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Self Leveling Sealant Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Self Leveling Sealant Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Self Leveling Sealant Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Self Leveling Sealant Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Self Leveling Sealant Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self Leveling Sealant?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Self Leveling Sealant?

Key companies in the market include Akzo Nobel, BASF, CTS Cement Manufacturing Corp, Henkel, Nippon Paint, Novalink, PPG, QUIKRETE, Sherwin-Williams, Sika, TCC Materials, 3M.

3. What are the main segments of the Self Leveling Sealant?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 743 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self Leveling Sealant," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self Leveling Sealant report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self Leveling Sealant?

To stay informed about further developments, trends, and reports in the Self Leveling Sealant, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence